Market Overview

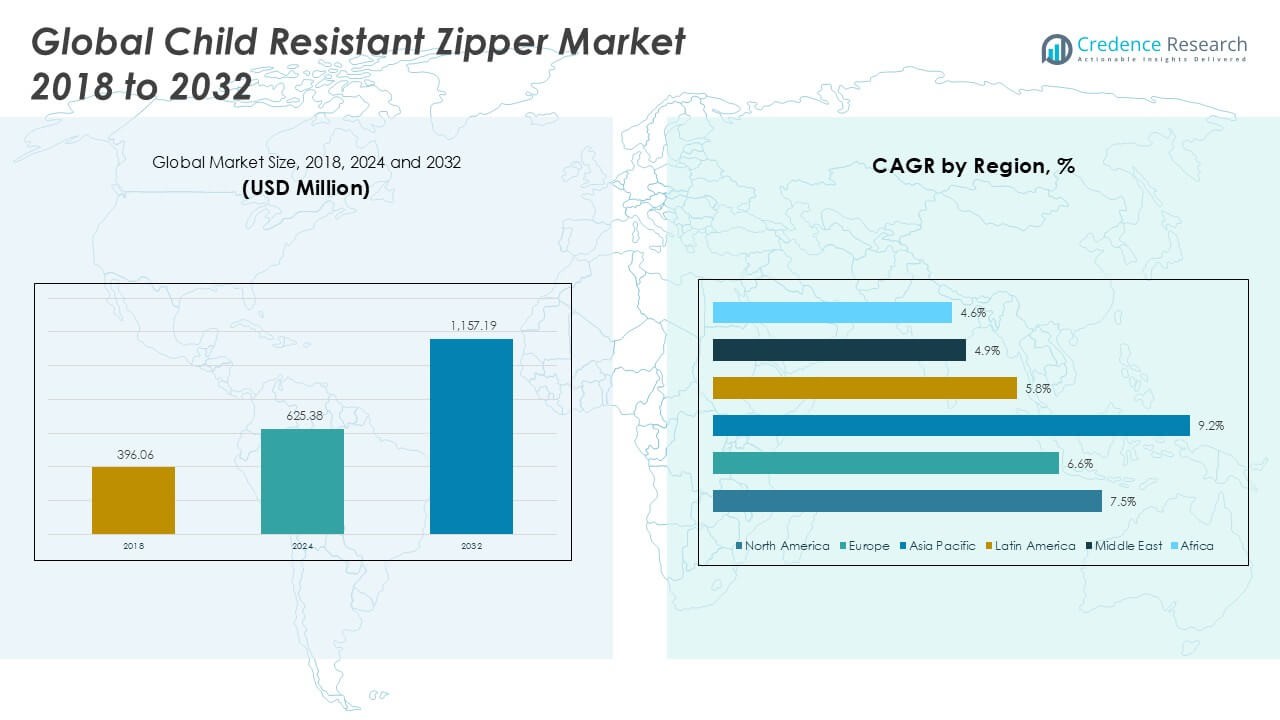

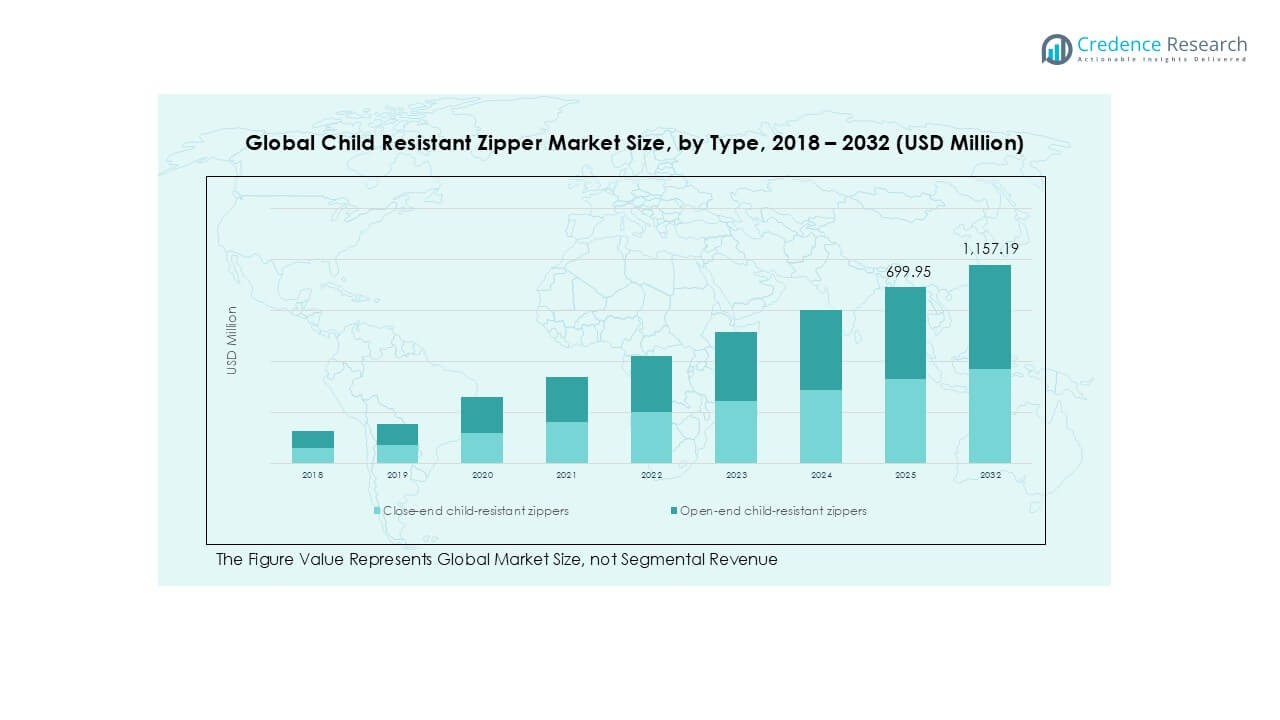

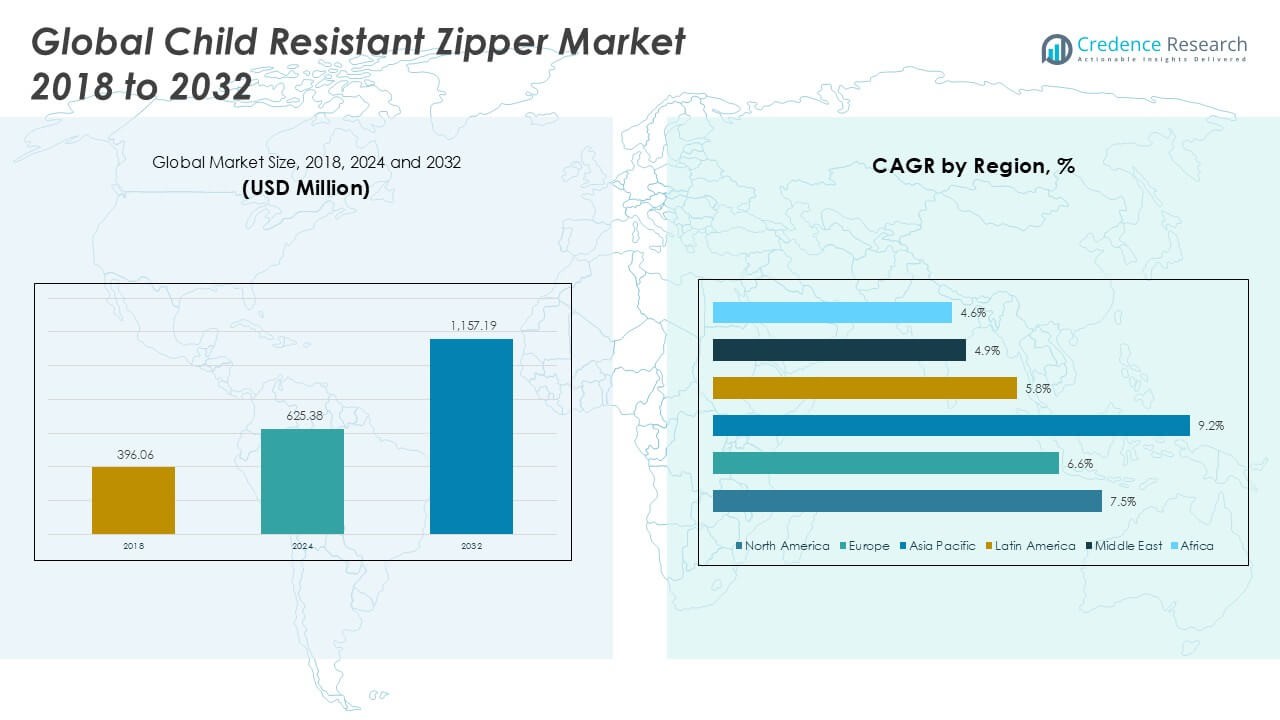

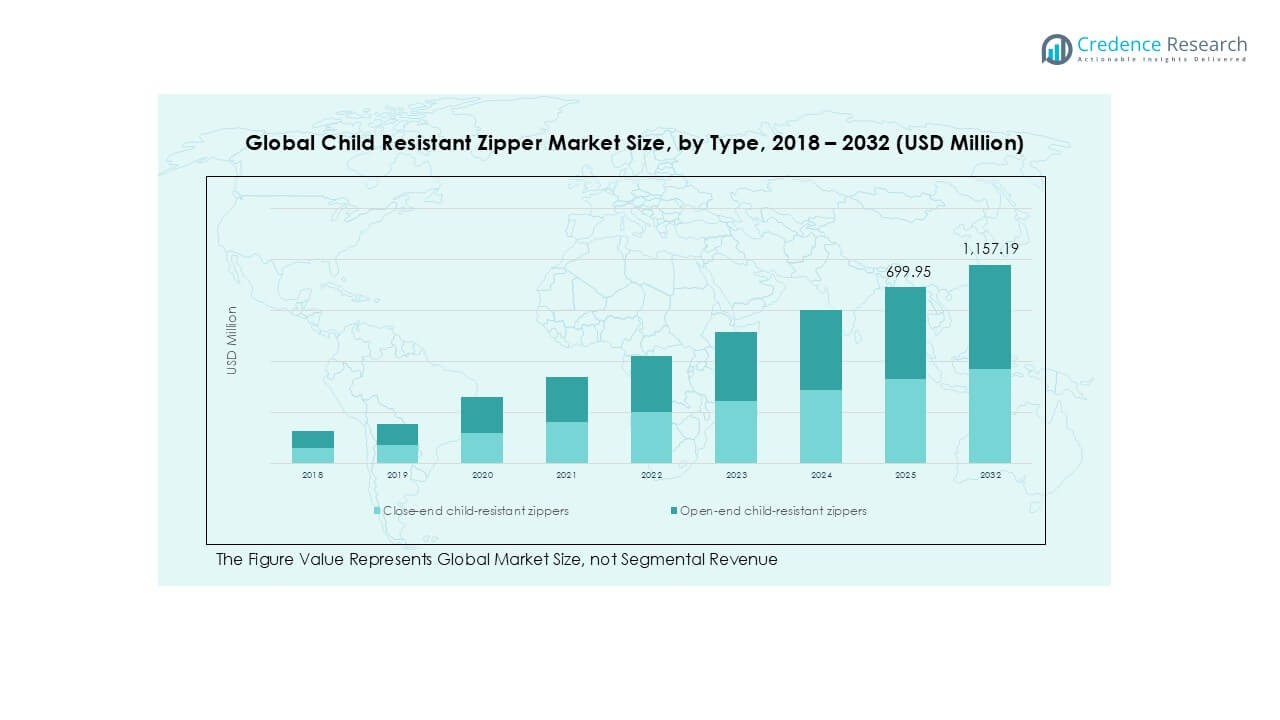

The Child Resistant Zipper market size was valued at USD 396.06 million in 2018, growing to USD 625.38 million in 2024, and is anticipated to reach USD 1,157.19 million by 2032, at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Child Resistant Zipper Market Size 2024 |

USD 625.38 Million |

| Child Resistant Zipper Market, CAGR |

7.45% |

| Child Resistant Zipper Market Size 2032 |

USD 1,157.19 Million |

The child-resistant zipper market is led by global packaging innovators such as Berry Global, Gerresheimer, AptarGroup, Mold-Rite Plastics, and Origin Pharma Packaging, alongside regional specialists including PauPack Bottles, O.Berk Company, Comar, CL Smith, and United Caps. These companies maintain competitiveness through compliance-driven product portfolios, R&D investments, and strategic partnerships with pharmaceutical and food packaging industries. Regionally, North America accounted for the largest share of 43.4% in 2024, driven by strict safety regulations and strong pharmaceutical demand. Europe followed with 27.5%, supported by regulatory frameworks and sustainability initiatives, while Asia Pacific held 20.2%, emerging as the fastest-growing market with a CAGR of 9.2%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Child Resistant Zipper market was valued at USD 625.38 million in 2024 and is projected to reach USD 1,157.19 million by 2032, growing at a CAGR of 7.45%.

- Rising regulatory requirements in pharmaceuticals and household chemicals are driving demand, with close-end child-resistant zippers leading the type segment at over 55% share in 2024.

- Key trends include the shift toward sustainable, recyclable zipper materials and the rapid adoption of e-commerce packaging solutions, boosting growth opportunities across industries.

- The market is moderately consolidated, with global players such as Berry Global, Gerresheimer, and AptarGroup competing alongside regional firms like Comar, O.Berk, and CL Smith, focusing on product innovation and compliance.

- Regionally, North America led with 43.4% share in 2024, followed by Europe at 27.5% and Asia Pacific at 20.2%, where the fastest growth is expected with a 9.2% CAGR, fueled by expanding food and pharmaceutical sectors.

Market Segmentation Analysis:

By Type

Close-end child-resistant zippers accounted for the dominant share of the market in 2024, holding more than 55% of total revenue. Their leadership is supported by widespread use in food, pharmaceuticals, and household chemical packaging where safety compliance is critical. Close-end variants offer enhanced sealing strength, preventing tampering and accidental access by children. Open-end child-resistant zippers, though growing steadily, serve niche applications where reclosable flexibility is prioritized. Rising consumer safety awareness and strict packaging regulations continue to drive the adoption of close-end formats across industries.

- For instance, Berry Global launched its Child-Resistant Zipper (CRZ), tested and certified to meet the standards required by regulators like the U.S. Consumer Product Safety Commission (CPSC). CPSC protocol specifies that at least 80% of children under 5 should not be able to open the packaging in the required time to be deemed child-resistant. Testing is conducted by third-party firms and involves panels of children aged 42-51 months and senior adults.

By Application

Food & beverage packaging represented the leading application segment, contributing over 40% of the market share in 2024. The growth is fueled by rising demand for resealable, tamper-evident packaging to ensure both child safety and product freshness. Pharmaceuticals also captured a significant portion of demand, driven by stringent regulations for child-resistant closures on medicines. Cosmetics, personal care, and household chemicals add further traction as manufacturers seek consumer-friendly safety features. Increasing emphasis on compliant packaging standards and consumer convenience sustains the dominance of food and beverage packaging.

- For instance, Amcor introduced its AmPrima certified child-resistant pouch, which is designed to be recyclable. While the original AmLite Ultra Recyclable pouch is focused on high-barrier and recyclable properties, the company’s AmPrima line features a third-party certified, child-resistant zipper.

By Distribution Channel

Direct industrial sales dominated the distribution landscape, capturing nearly 50% share of the market in 2024. This channel is preferred by large-scale food, pharmaceutical, and chemical manufacturers seeking bulk procurement and tailored packaging solutions. Retail outlets continue to serve smaller businesses and regional packaging firms, while online/e-commerce is expanding rapidly with growing demand from SMEs and private-label brands. The growth of digital sales platforms, combined with global supply chain integration, is enabling broader market access. Direct industrial sales remain dominant due to cost efficiency and secure supply partnerships.

Key Growth Drivers

Rising Safety Regulations in Packaging

Stringent government regulations across industries are a major growth driver for child-resistant zippers. Regulatory bodies such as the U.S. Consumer Product Safety Commission (CPSC) and the European Union mandate child-resistant packaging for pharmaceuticals, household chemicals, and certain food products. This legal pressure compels manufacturers to adopt compliant packaging solutions, boosting demand for zippers with enhanced locking and sealing mechanisms. Moreover, global alignment toward child safety standards is prompting industries such as FMCG and healthcare to transition to compliant formats. With regulations becoming stricter, demand for child-resistant zippers is set to expand across developed and emerging economies alike.

- For instance, AptarGroup’s child-resistant closures achieve compliance with international standards like ISO 8317 and U.S. regulations such as 16 CFR §1700.20. During testing with a panel of children, the closures must meet a minimum effectiveness rate. The specific performance can vary, but regulations require a high percentage of children, typically at least 80%, to be unable to open the packaging over the testing period.

Expanding Pharmaceutical and Healthcare Demand

The pharmaceutical sector heavily relies on child-resistant zippers to ensure safe storage and handling of medications. Rising consumption of over-the-counter drugs and increasing production of packaged medicines amplify the need for compliant resealable closures. In 2024, pharmaceuticals represented a strong application segment due to heightened consumer awareness of accidental poisoning risks among children. The aging global population and increasing chronic disease prevalence are also pushing pharmaceutical production, creating sustained demand for child-resistant packaging. As healthcare companies invest in innovative and compliant packaging solutions, the market for child-resistant zippers is poised for steady long-term growth.

- For instance, Comar developed the DoseGuard system for liquid medication bottles, featuring a patented, valved bottle adapter and oral syringe to ensure child-resistant dosing in compliance with Poison Prevention Packaging Act (PPPA) regulations..

Growth in Packaged Food and Household Products

The rising popularity of packaged and convenience foods is another major growth driver. Consumers prefer resealable, tamper-proof, and child-resistant packaging for snacks, beverages, and ready-to-eat items. Similarly, growing use of household chemicals, detergents, and cleaning supplies requires secure zipper closures to prevent child exposure. Food and beverage packaging already accounts for the largest application share, supported by growing urbanization and demand for convenience. Meanwhile, the household chemicals category is projected to expand at a robust pace due to increasing product penetration in emerging markets. This rising demand across both categories ensures sustained market expansion for child-resistant zippers.

Key Trends & Opportunities

Adoption of Sustainable and Eco-Friendly Packaging

Sustainability is shaping the child-resistant zipper market, creating opportunities for eco-friendly and recyclable zipper formats. Growing environmental concerns and regulatory pressure are encouraging manufacturers to replace traditional plastics with bio-based, compostable, or recyclable materials. Food and pharmaceutical companies are increasingly seeking packaging partners that can deliver safety compliance while reducing carbon footprints. This dual demand for child safety and sustainability is expected to redefine innovation in zipper materials. Companies that successfully balance compliance, performance, and sustainability are likely to gain strong competitive advantages and secure long-term growth opportunities.

- For instance, Amcor launched its AmLite Ultra Recyclable pouch, a metal-free, high-barrier laminate designed to be recycled in existing polyolefin recycling streams. To validate its real-world recyclability, the product was certified by the independent cyclos-HTP Institute.

Digitalization and Expansion of E-commerce Distribution

The rise of e-commerce channels is opening new growth avenues for child-resistant zipper manufacturers. Online retail platforms demand packaging solutions that combine durability, safety, and consumer convenience. Zippers that are tamper-evident, resealable, and easy to ship are gaining traction as consumers increasingly buy medicines, cosmetics, and household goods online. Additionally, digital sales channels allow smaller manufacturers and private-label brands to access global markets at lower costs. This creates opportunities for zipper producers to expand reach through partnerships with e-commerce packaging suppliers. The trend highlights the growing integration of digital retail with compliant packaging solutions.

Key Challenges

High Production Costs and Material Constraints

One of the major challenges for the child-resistant zipper market is the high cost of production. Developing zippers with enhanced safety features requires specialized materials, advanced molding techniques, and rigorous testing for compliance. These factors raise manufacturing expenses, making products more expensive compared to traditional zippers. Small and medium enterprises often find it difficult to adopt such costly packaging solutions, limiting market penetration. Additionally, raw material price fluctuations, especially in plastics and bio-based polymers, further add to production challenges. Managing costs while maintaining compliance remains a significant hurdle for the industry.

Balancing Safety with Consumer Convenience

While safety remains the priority, creating child-resistant zippers that are also convenient for adults is a persistent challenge. Complex opening mechanisms may frustrate elderly users or individuals with limited dexterity, leading to negative consumer experiences. This issue is particularly critical in pharmaceutical packaging, where ease of use must balance with child safety. Designing zippers that pass stringent safety tests while offering smooth operation for adults requires continuous R&D investment. Failure to achieve this balance may reduce consumer acceptance, limiting adoption across key applications. Addressing usability without compromising compliance is a central challenge for manufacturers.

Regional Analysis

North America

North America dominated the child-resistant zipper market in 2024, accounting for 43.4% share, with revenue rising from USD 173.65 million in 2018 to USD 271.36 million in 2024. The market is projected to reach USD 503.51 million by 2032, expanding at a CAGR of 7.5%. Strong regulatory frameworks, particularly in the U.S. for pharmaceutical and chemical packaging, drive adoption. The region’s mature packaged food and healthcare industries further support demand. Large-scale manufacturers continue to focus on compliance and innovation, making North America the most established regional market for child-resistant zippers.

Europe

Europe held the second-largest share of 27.5% in 2024, growing from USD 112.93 million in 2018 to USD 171.91 million in 2024. The market is expected to reach USD 299.59 million by 2032, at a CAGR of 6.6%. Stringent EU packaging safety standards, particularly under REACH and pharmaceutical directives, fuel steady growth. Food and beverage packaging continues to dominate applications, supported by consumer safety awareness. Regional players are also investing in sustainable zipper materials to comply with Europe’s circular economy goals, further shaping demand. This balance of safety and eco-friendly innovation sustains Europe’s strong position.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, holding 20.2% market share in 2024, up from USD 73.80 million in 2018 to USD 126.62 million in 2024. The market is projected to reach USD 266.29 million by 2032, advancing at a robust CAGR of 9.2%. Expanding pharmaceutical production, rising packaged food consumption, and increasing urbanization across China, India, and Southeast Asia are key growth drivers. Growing regulatory adoption of child-resistant packaging standards further strengthens the outlook. Asia Pacific’s cost-effective manufacturing base and rising e-commerce packaging needs are also propelling demand, positioning the region as the most dynamic market.

Latin America

Latin America accounted for 4.8% share in 2024, with revenues climbing from USD 19.15 million in 2018 to USD 29.86 million in 2024. The market is forecast to reach USD 49.06 million by 2032, registering a CAGR of 5.8%. Growing awareness of child safety in packaging, particularly in pharmaceuticals and household chemicals, is fueling regional demand. Brazil and Mexico remain the largest contributors, with their expanding FMCG and healthcare sectors. However, limited regulatory enforcement compared to developed markets slightly restrains growth. Still, rising investments in modern packaging solutions create steady opportunities for child-resistant zipper adoption.

Middle East

The Middle East child-resistant zipper market represented 2.3% of global share in 2024, rising from USD 9.99 million in 2018 to USD 14.28 million in 2024. It is projected to reach USD 21.79 million by 2032, growing at a CAGR of 4.9%. Demand is supported by rising pharmaceutical imports and packaged food consumption across GCC countries. However, adoption is limited by low local manufacturing capacity and moderate awareness of child-resistant packaging benefits. Increasing investments in healthcare infrastructure and expansion of retail supply chains are expected to create gradual growth opportunities for suppliers targeting the Middle Eastern market.

Africa

Africa contributed 1.8% share in 2024, expanding from USD 6.54 million in 2018 to USD 11.34 million in 2024. The market is expected to grow to USD 16.96 million by 2032, at a CAGR of 4.6%. Adoption is driven by growing demand for secure packaging in pharmaceuticals and household chemicals, especially in South Africa and Nigeria. However, weak regulatory frameworks and lower purchasing power limit large-scale adoption. Despite these challenges, the rise of regional manufacturing hubs and expansion of urban retail channels are expected to gradually boost demand for child-resistant zippers in African markets.

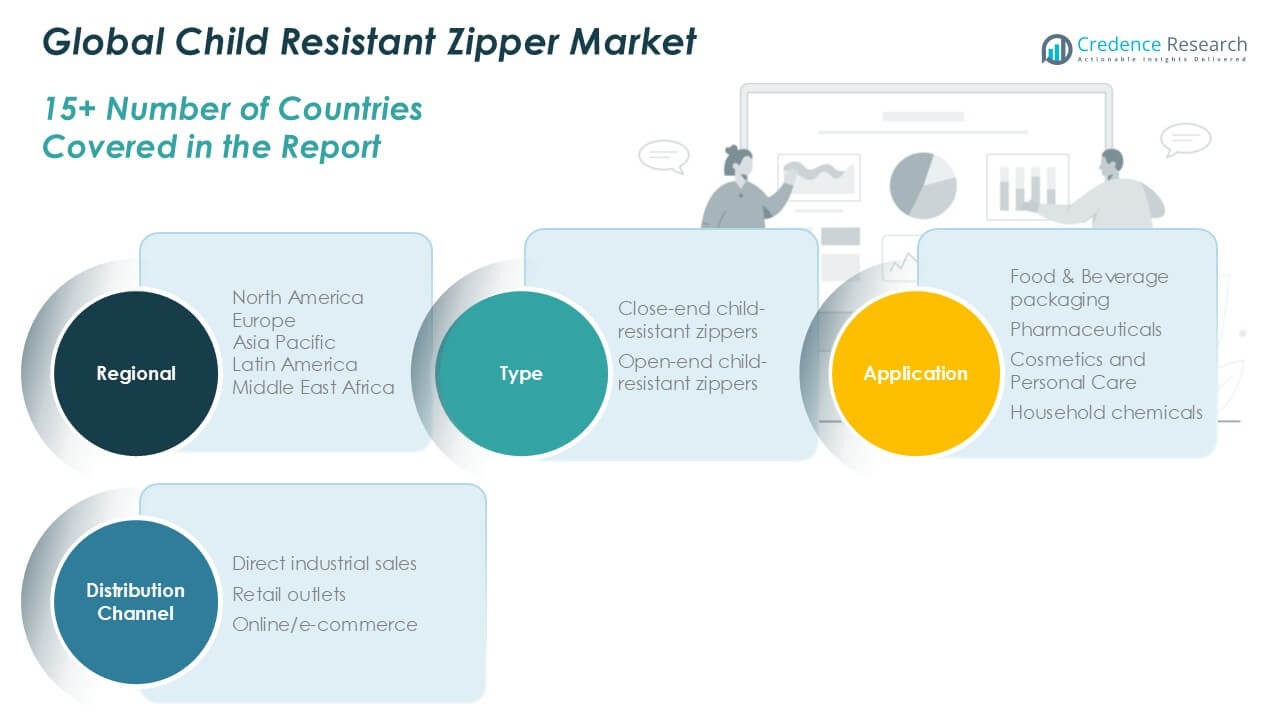

Market Segmentations:

By Type

- Close-end child-resistant zippers

- Open-end child-resistant zippers

By Application

- Food & Beverage packaging

- Pharmaceuticals

- Cosmetics and Personal Care

- Household chemicals

By Distribution Channel

- Direct industrial sales

- Retail outlets

- Online/e-commerce

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The child-resistant zipper market is moderately consolidated, with leading packaging companies competing through product innovation, compliance, and strategic partnerships. Major players such as Berry Global, Gerresheimer, AptarGroup, Mold-Rite Plastics, and Origin Pharma Packaging dominate the landscape due to their strong portfolios in pharmaceutical and consumer packaging. These firms invest heavily in R&D to design zippers that meet stringent regulatory standards while improving consumer convenience. Smaller players, including PauPack Bottles, O.Berk Company, Comar, CL Smith, and United Caps, strengthen regional presence by offering cost-effective and customizable solutions. Competition is intensifying as sustainability trends push companies to adopt recyclable and eco-friendly zipper materials. Strategic moves such as acquisitions, product launches, and partnerships with food and pharmaceutical brands define growth strategies. With rising safety regulations and demand across multiple industries, the market is expected to see further consolidation, where global leaders expand portfolios while niche players target specialized applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global

- Gerresheimer

- PauPack Bottles

- AptarGroup

- Origin Pharma Packaging

- Mold-Rite Plastics

- Comar

- Berk Company

- United Caps

- CL Smith

Recent Developments

- In 2025, Cmz zipper (wuxi) co. Ltd. is looking forward to expand through acquisition & mergers in order to expand its business overseas.

- In April 2025, Amcor finalized an all-stock combination with Berry Global, creating one of the most comprehensive packaging solutions companies globally. This merger enhances their capacity to deliver innovative, sustainable, and child-resistant packaging across healthcare and consumer markets.

- In March 2024, Aptar is constructing a new cleanroom and production line at its Congers, NY facility to increase manufacturing of CRP for nasal sprays, pumps, and dropper systems. The expansion, aimed for completion in early 2025, reinforces its position as a leading provider of child-resistant, senior-friendly closures.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by stricter global child safety regulations.

- Demand from the pharmaceutical sector will continue to dominate growth.

- Food and beverage packaging will remain the largest application segment.

- Household chemical packaging will gain traction in emerging economies.

- Asia Pacific will record the fastest growth due to rising urbanization and manufacturing.

- Sustainability will influence product innovation with recyclable and eco-friendly zipper materials.

- Direct industrial sales will remain the leading distribution channel.

- E-commerce packaging demand will accelerate adoption of tamper-evident zippers.

- Competitive intensity will increase as global leaders acquire niche players.

- Balancing safety with consumer convenience will remain a key industry challenge.