Market Overview

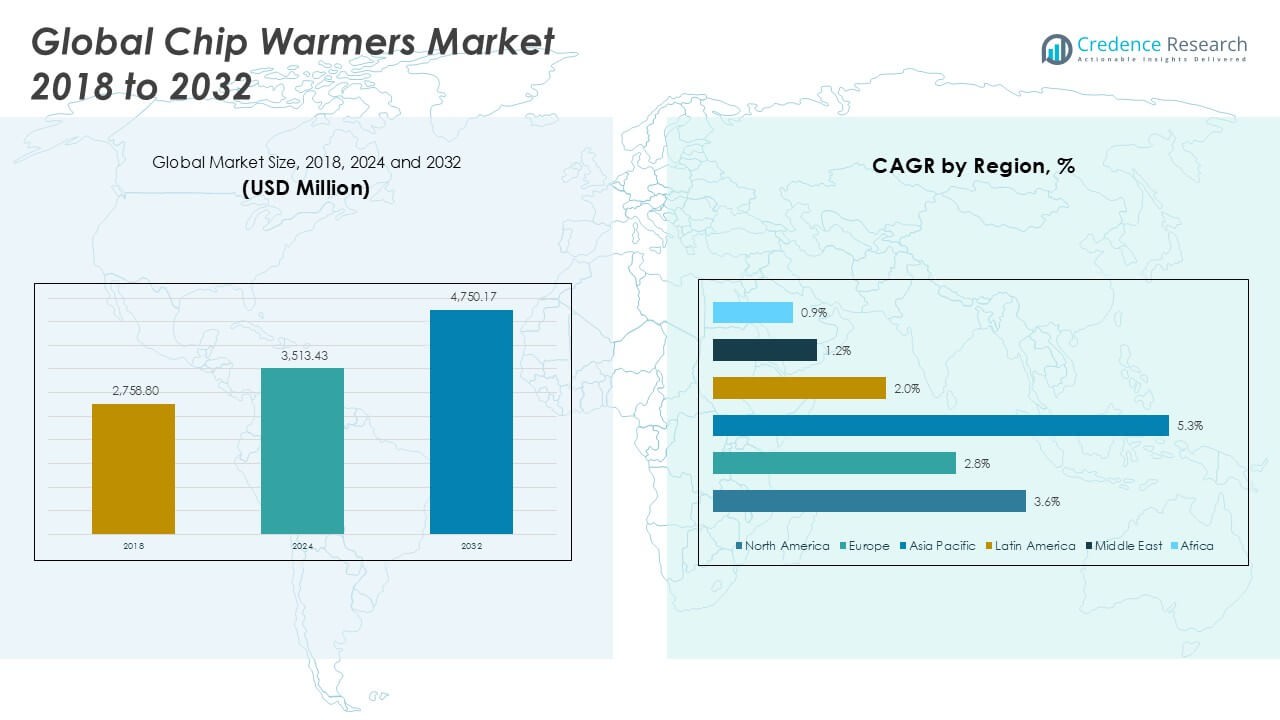

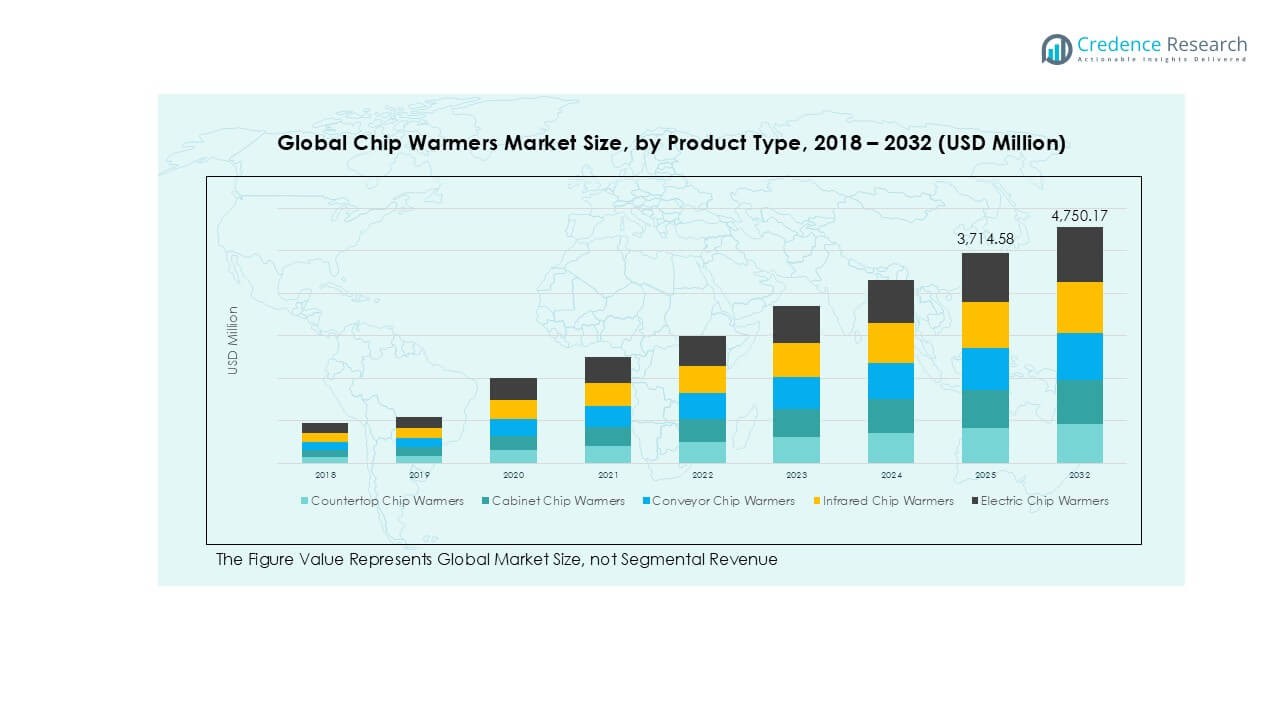

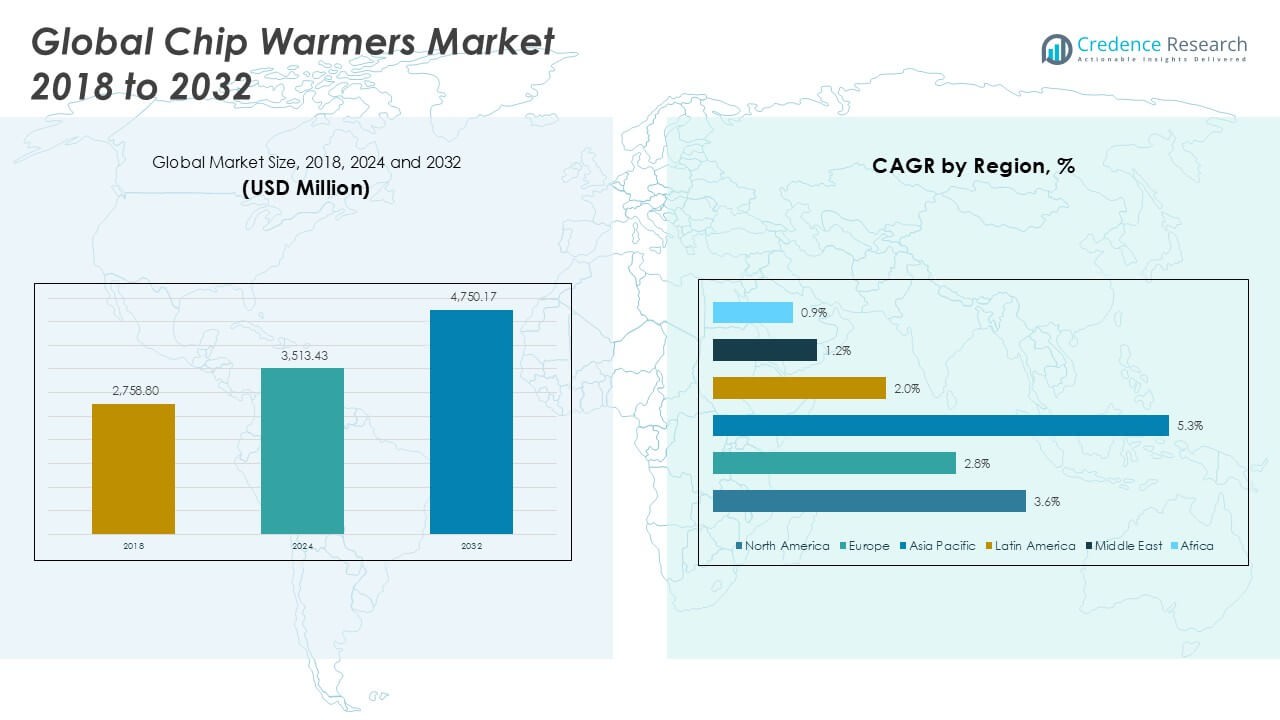

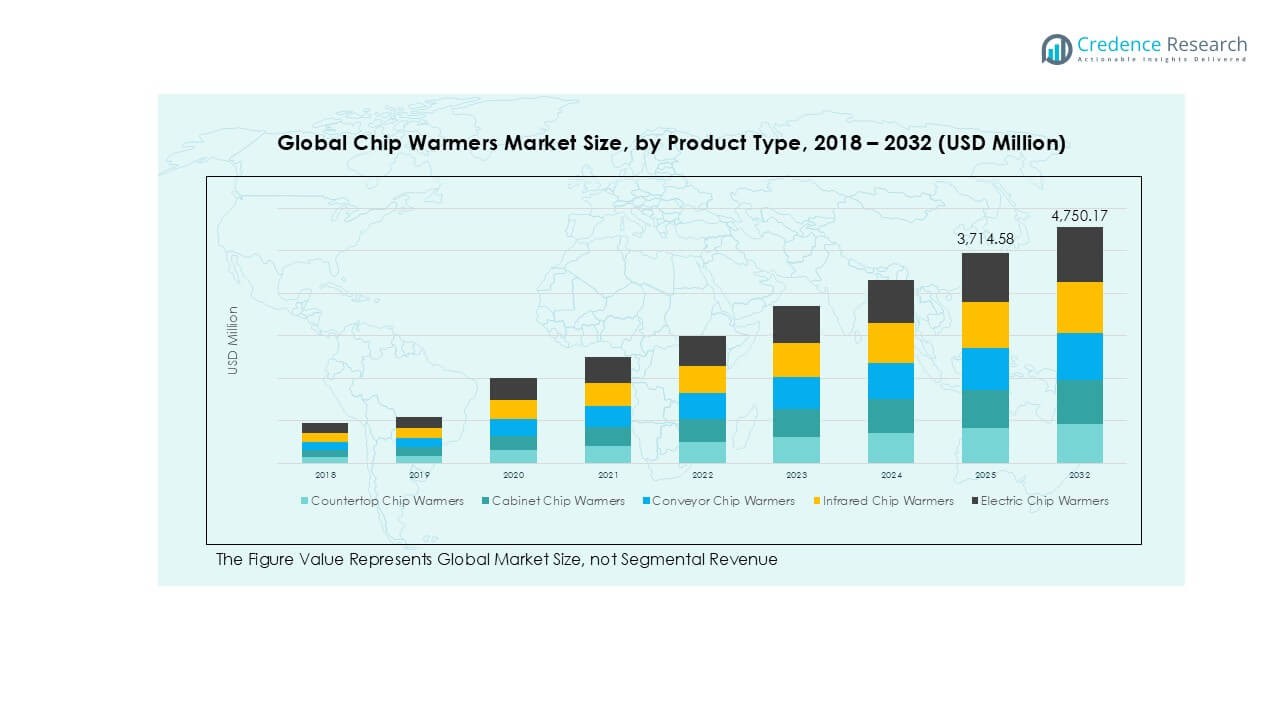

The Global Chip Warmers Market size was valued at USD 2,758.80 million in 2018, growing to USD 3,513.43 million in 2024, and is anticipated to reach USD 4,750.17 million by 2032, at a CAGR of 3.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chip Warmers Market Size 2024 |

USD 3,513.43 Million |

| Chip Warmers Market, CAGR |

3.58% |

| Chip Warmers Market Size 2032 |

USD 4,750.17 Million |

The global chip warmers market is shaped by key players such as Heat Technologies, Inc., Anets, Star Manufacturing International, APW Wyott, Hatco Corporation, Vollrath Company, Alto-Shaam, Nemco Food Equipment, Baston-Cooke Corporation, and Delfield Company, who compete through product innovation and strong distribution networks. North America emerged as the leading region in 2024, accounting for 43.5% of global market share, supported by a high concentration of quick service restaurants and advanced food service infrastructure. Europe followed with 27.7% share, driven by a mature hospitality industry and regulatory focus on energy-efficient equipment. Asia Pacific, with 19.9% share, remains the fastest-growing market due to rapid urbanization and QSR expansion. These regions, together with strong company portfolios and technological advancements, define the competitive dynamics of the global chip warmers industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global chip warmers market was valued at USD 3,513.43 million in 2024 and is projected to reach USD 4,750.17 million by 2032, registering a CAGR of 3.58% during the forecast period.

- Rising adoption in quick service restaurants, which accounted for over 45% of demand in 2024, remains a primary growth driver as these outlets focus on efficiency, consistency, and food safety.

- Infrared heating dominated the technology segment with more than 40% share in 2024, supported by faster warming, energy efficiency, and broader use across catering and hospitality.

- The market is moderately consolidated with key players such as Heat Technologies, Hatco Corporation, Vollrath Company, and Alto-Shaam investing in energy-efficient designs and expanding distribution through dealers and online channels.

- North America led with 43.5% share in 2024, followed by Europe at 27.7%, while Asia Pacific held 19.9% and is expected to record the fastest CAGR of 5.3%.

Market Segmentation Analysis:

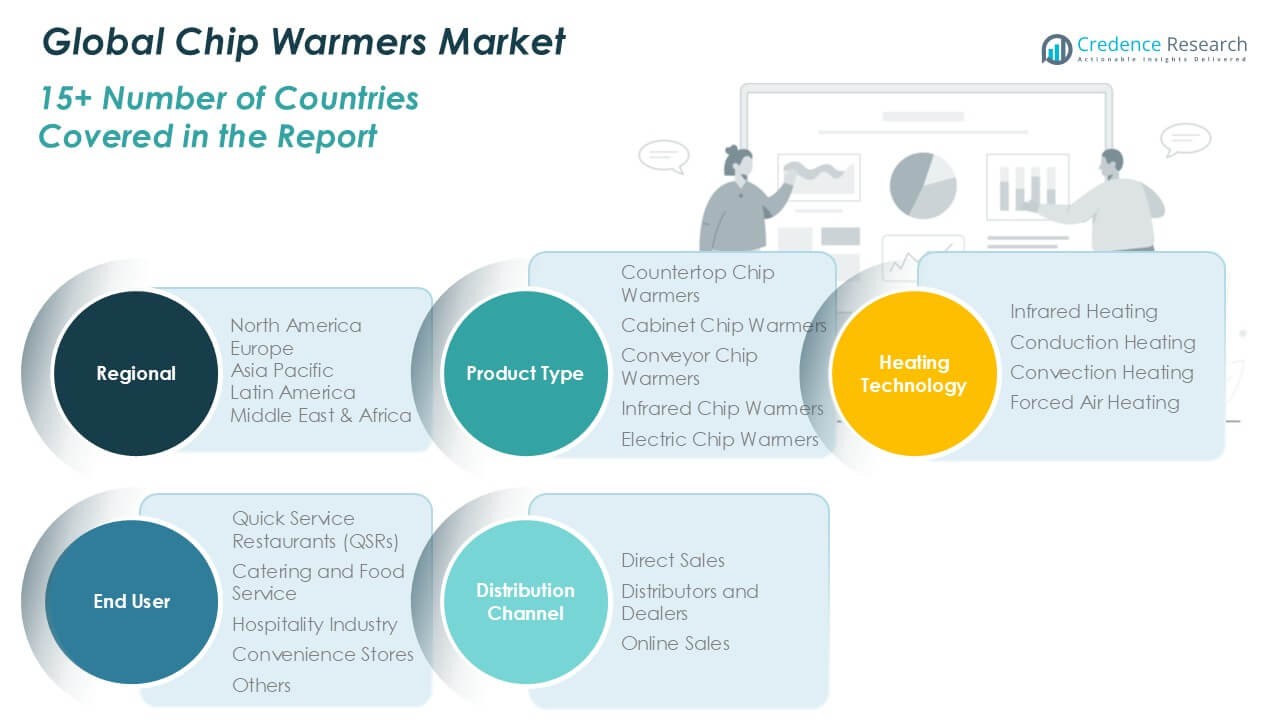

By Product Type

Countertop chip warmers dominated the market in 2024, accounting for over 35% share. Their dominance is driven by compact design, affordability, and widespread adoption in small- to mid-sized restaurants. Cabinet chip warmers follow closely, serving large-scale food outlets requiring higher storage capacity. Conveyor warmers are gaining popularity in high-volume quick service restaurants due to continuous warming efficiency. Infrared and electric warmers are expanding steadily, with electric models favored for energy efficiency and ease of installation. The demand for countertop units continues to rise with growth in fast-casual dining formats worldwide.

- For instance, the Hatco Glo-Ray® GRSDS countertop warmer is a type of short-term food holding equipment used in fast-casual and quick-service restaurants. It holds wrapped or boxed items at safe, warm serving temperatures. Its heated base and infrared top heat are designed to help maintain food quality during holding.

By Heating Technology

Infrared heating led the segment with more than 40% market share in 2024, supported by faster heat transfer and energy savings. The technology ensures even warming without drying food, making it a preferred choice in quick service and catering. Conduction heating is popular in traditional setups due to cost-effectiveness, while convection heating finds applications in larger warmers requiring uniform temperature distribution. Forced air heating is gradually expanding, particularly in modern conveyor systems, as it maintains consistent heat for extended operations. Infrared’s efficiency and adaptability keep it at the forefront of technological adoption.

- For instance, Hatco Corporation offers a variety of commercial food warming solutions, including both infrared warmers and convection-based chip warmers. While Hatco promotes the efficiency and performance of its products, the specific claims that their infrared chip warmers maintain a surface temperature of 160°F while using 20% less energy than convection units

By End User

Quick Service Restaurants (QSRs) held the largest share, exceeding 45% in 2024, fueled by high consumer traffic and rapid food delivery models. Chip warmers are vital in maintaining food quality during peak demand, especially in global fast-food chains. Catering and food service providers represent the second-largest segment, driven by large-scale event demand. The hospitality industry, including hotels and resorts, continues to adopt warmers to improve service standards. Convenience stores are expanding usage as hot snack sections grow, while niche users in institutional cafeterias and entertainment venues add further momentum to the market.

Key Growth Drivers

Rising Demand from Quick Service Restaurants (QSRs)

Quick Service Restaurants (QSRs) are the largest adopters of chip warmers, driving consistent revenue growth. The rapid expansion of global fast-food chains such as McDonald’s, KFC, and Burger King has significantly increased the demand for warming equipment that ensures food remains fresh and appetizing during peak hours. With QSR sales surpassing USD 1 trillion globally in 2024, chip warmers play a vital role in streamlining service efficiency and enhancing customer satisfaction. The push for faster turnaround times and consistency in food quality continues to accelerate adoption, making QSRs a primary growth engine for the market.

- For instance, Hatco supplied over 12,000 countertop chip warmers to McDonald s outlets worldwide in 2023, each unit capable of holding 25 lbs of chips with consistent 160°F temperatures.

Technological Advancements in Heating Systems

Innovations in heating technologies, including infrared and forced air systems, have greatly enhanced chip warmer efficiency. Infrared heating now accounts for more than 40% of the market share, owing to its ability to provide uniform heating while reducing energy consumption. Modern systems also feature smart temperature controls and energy-saving functions, meeting the operational needs of restaurants with lower running costs. These advancements not only improve performance but also align with the growing industry shift toward energy efficiency and sustainability. Continuous investment in R&D by leading manufacturers ensures steady technological improvements, reinforcing adoption across food service sectors.

- For instance, Nemco advertises that its infrared warmers can significantly extend chip holding time compared to conduction models, allowing food to be held at an optimum serving temperature.

Expansion of Food Service and Catering Industry

The global catering and institutional food service market is expanding rapidly, fueled by events, corporate dining, and hospitality demand. Chip warmers have become essential in catering services as they preserve food quality across large gatherings. In 2024, catering services contributed to more than 25% of chip warmer demand, with consistent growth expected as urbanization and disposable income increase. Hotels, resorts, and event catering companies prefer cabinet and conveyor chip warmers for large-scale operations. This rising adoption across diverse food service formats provides strong market momentum and establishes long-term opportunities for equipment suppliers worldwide.

Key Trends & Opportunities

Integration of Smart and Energy-Efficient Features

Manufacturers are increasingly introducing chip warmers with digital thermostats, automatic shut-off, and energy optimization systems. These features cater to growing regulatory and consumer pressure for greener solutions, as commercial kitchens seek to reduce energy costs. The trend aligns with broader adoption of smart kitchen equipment across the food service industry. Energy-efficient warmers not only lower operational expenses but also enhance compliance with sustainability standards, creating opportunities for product differentiation and premium offerings in developed markets.

- For instance, Alto-Shaam advertises its Vector® series ovens as energy-efficient due to features like independent cooking chambers and a waterless design.

Growth of Online Food Delivery and Convenience Stores

The rise of online food delivery platforms and expanding convenience store networks is creating new demand for chip warmers. Compact countertop warmers are particularly suited for convenience stores, while larger conveyor systems support bulk preparation for delivery kitchens. This evolving consumption model represents a significant opportunity for chip warmer manufacturers to target new retail and delivery-oriented customer segments.

Key Challenges

High Energy Consumption and Operational Costs

Despite technological improvements, chip warmers remain energy-intensive equipment. Small and mid-sized restaurants often face challenges in adopting large warmers due to higher electricity costs and space requirements. In regions with rising energy tariffs, operators are cautious about adding equipment that increases overhead expenses. Manufacturers face pressure to balance performance with cost-efficiency, pushing them to innovate energy-saving models without compromising output. This ongoing challenge may slow adoption in cost-sensitive markets unless addressed through sustainable product design.

Maintenance and Hygiene Concerns

Chip warmers require frequent cleaning and proper maintenance to ensure safe food handling. Failure to meet hygiene standards can lead to regulatory penalties and customer dissatisfaction. In high-volume environments such as QSRs and catering, improper cleaning can shorten equipment lifespan and compromise food quality. Regular upkeep adds to operational workload and costs, making some food operators hesitant to invest. This challenge underscores the need for user-friendly designs and durable materials that simplify cleaning and extend product life, reducing resistance among potential buyers.

Regional Analysis

North America

North America dominated the global chip warmers market in 2024 with a value of USD 1,527.67 million, representing the largest regional share. The market grew from USD 1,212.06 million in 2018 and is projected to reach USD 2,071.12 million by 2032, registering a CAGR of 3.6%. Growth is fueled by the strong presence of quick service restaurants, high consumer preference for fast food, and advanced food service infrastructure. Leading players in the U.S. and Canada are adopting energy-efficient warmers to reduce operational costs, keeping the region a frontrunner in global adoption.

Europe

Europe held the second-largest position in 2024, valued at USD 970.12 million, up from USD 789.97 million in 2018. The market is expected to reach USD 1,235.60 million by 2032, growing at a CAGR of 2.8%. Market expansion is supported by a well-established hospitality sector and rising demand for convenience food services. Countries such as Germany, the UK, and France are key adopters, with quick service chains and catering companies driving purchases. Sustainability initiatives and EU energy efficiency regulations are encouraging the adoption of advanced infrared and electric chip warmers across the region.

Asia Pacific

Asia Pacific is the fastest-growing region, with a projected CAGR of 5.3% during the forecast period. The market expanded from USD 506.40 million in 2018 to USD 701.61 million in 2024, and it is forecast to reach USD 1,079.88 million by 2032. Rising urbanization, growing middle-class populations, and the rapid expansion of international and domestic fast-food chains are fueling demand. China, India, and Japan dominate the regional market, supported by the surge in online food delivery and quick service outlets. Strong growth momentum keeps Asia Pacific the most attractive market for future investments.

Latin America

Latin America contributed moderately to global revenues, reaching USD 164.28 million in 2024, compared with USD 130.62 million in 2018. The market is projected to grow at a CAGR of 2.0%, reaching USD 196.65 million by 2032. Expansion of regional quick service chains, coupled with rising consumer spending on ready-to-eat meals, is driving adoption. Brazil and Mexico represent key markets, benefiting from the gradual modernization of food service infrastructure. Although growth is slower than in Asia Pacific, the region offers opportunities for affordable and compact chip warmers tailored for small and mid-scale businesses.

Middle East

The Middle East market grew from USD 72.37 million in 2018 to USD 83.72 million in 2024 and is projected to reach USD 94.18 million by 2032 at a CAGR of 1.2%. The region holds a smaller share due to limited QSR penetration compared to developed markets. However, rising tourism and investments in the hospitality sector, especially in the UAE and Saudi Arabia, are creating niche opportunities. High-end hotels and resorts increasingly adopt chip warmers to enhance service efficiency, while catering firms serving large-scale events also contribute to steady demand.

Africa

Africa represented the smallest regional share, valued at USD 66.02 million in 2024, up from USD 47.37 million in 2018. The market is projected to reach USD 72.73 million by 2032, growing at a modest CAGR of 0.9%. Limited adoption is due to underdeveloped food service infrastructure and lower purchasing power. However, rising urbanization, expanding convenience store networks, and increasing penetration of global QSR brands are gradually boosting demand. South Africa leads regional adoption, supported by a growing hospitality industry, while other markets show slow but steady improvements in commercial kitchen equipment use.

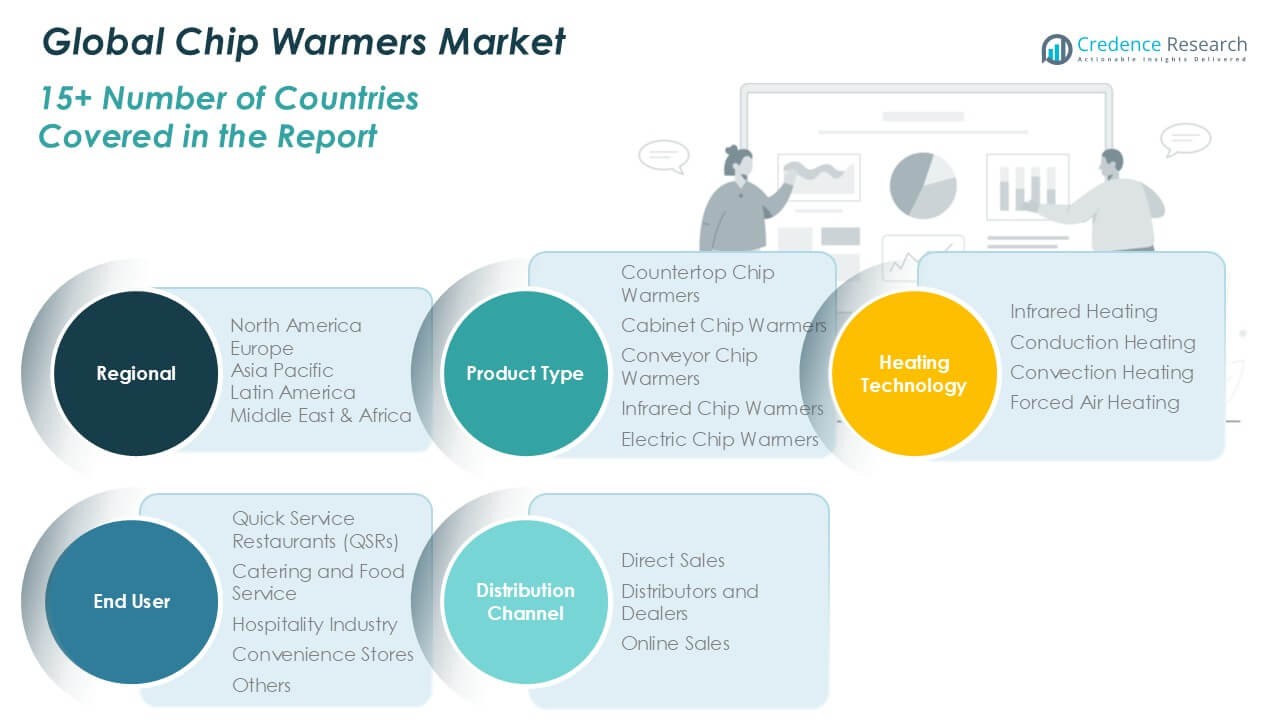

Market Segmentations:

By Product Type

- Countertop Chip Warmers

- Cabinet Chip Warmers

- Conveyor Chip Warmers

- Infrared Chip Warmers

- Electric Chip Warmers

By Heating Technology

- Infrared Heating

- Conduction Heating

- Convection Heating

- Forced Air Heating

By End User

- Quick Service Restaurants (QSRs)

- Catering and Food Service

- Hospitality Industry

- Convenience Stores

- Others

By Distribution Channel

- Direct Sales

- Distributors and Dealers

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global chip warmers market is moderately consolidated, with leading players focusing on product innovation, energy efficiency, and strategic partnerships to strengthen their positions. Key companies such as Heat Technologies, Inc., Anets, Star Manufacturing International, APW Wyott, Hatco Corporation, Vollrath Company, Alto-Shaam, Nemco Food Equipment, Baston-Cooke Corporation, and Delfield Company compete through diverse product portfolios catering to quick service restaurants, catering firms, and hospitality operators. Market leaders emphasize advanced heating technologies, including infrared and forced air systems, to enhance performance and reduce energy costs. Several players also invest in digital controls and sustainable designs to align with evolving food service trends. Regional expansion and distribution networks remain critical, with manufacturers leveraging dealer partnerships and online sales channels to reach small and mid-sized operators. Ongoing innovation, combined with after-sales services and strong brand reputation, enables established companies to maintain competitiveness while creating barriers for new entrants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heat Technologies, Inc.

- Anets

- Star Manufacturing International, Inc.

- APW Wyott

- Hatco Corporation

- Vollrath Company, LLC

- Alto-Shaam, Inc.

- Nemco Food Equipment

- Baston-Cooke Corporation

- Delfield Company

Recent Developments

- In July 2025, APW Wyott updated its Workline series with enhanced display warmers and countertop models featuring high-capacity insulated wells and digital control systems to maximize heat retention and ease of use.

- In Dec 2024, Hatco’s article “Speed & Flavor: High-Tech Equipment Powers Menu …” talks about their commercial Induction Warmers that direct up to 94% of the energy to food, improving energy use and reducing waste.

- In Aug 2024, Hatco blog post on “Innovative Equipment: How Chains Are Cooking Up Specialized Menus” mentions their Hatco/Suntec Snack System which allows swapping plates (waffles, paninis etc.), and highlights using induction warmers that maintain optimal serving temperature with high energy efficiency.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Heating Technology, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from quick service restaurants worldwide.

- Infrared heating technology will continue leading due to efficiency and energy-saving features.

- Asia Pacific will record the fastest growth, supported by urbanization and food service expansion.

- North America will maintain dominance, driven by strong QSR penetration and advanced infrastructure.

- Europe will grow steadily, influenced by sustainability regulations and hospitality sector adoption.

- Catering and institutional services will increasingly adopt cabinet and conveyor chip warmers.

- Compact countertop models will gain traction in convenience stores and small outlets.

- Manufacturers will focus on smart controls, automation, and digital integration for efficiency.

- Energy efficiency and hygiene-friendly designs will remain top priorities for product development.

- Competitive strategies will emphasize distribution partnerships, online sales channels, and regional market expansion.