Market Overview

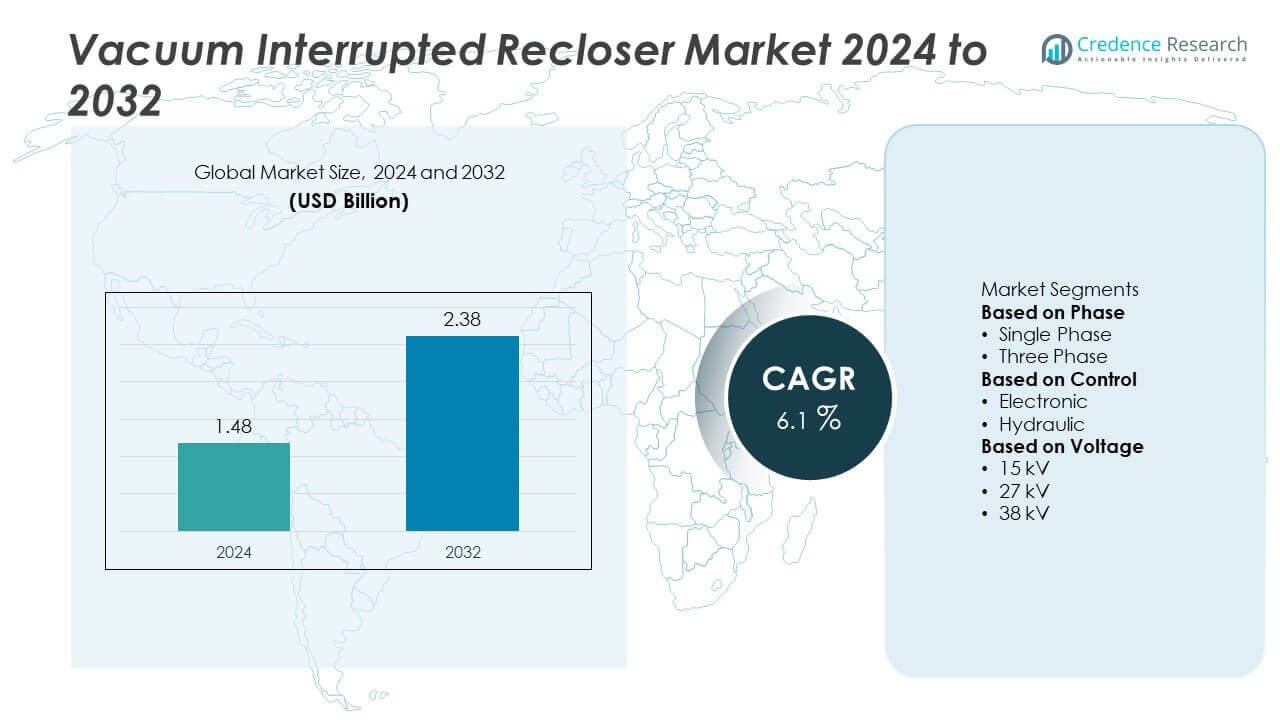

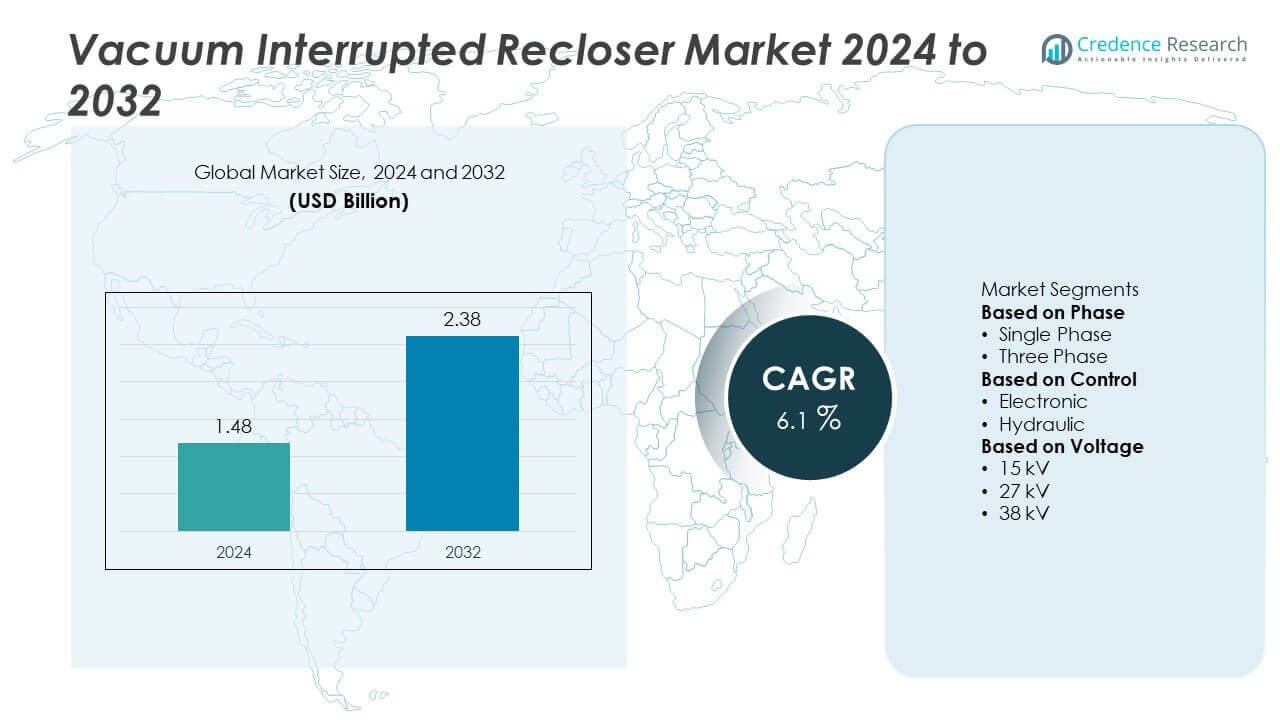

The vacuum interrupted recloser market was valued at USD 1.48 billion in 2024 and is projected to reach USD 2.38 billion by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Interrupted Recloser Market Size 2024 |

USD 1.48 Billion |

| Vacuum Interrupted Recloser Market, CAGR |

6.1% |

| Vacuum Interrupted Recloser Market Size 2032 |

USD 2.38 Billion |

The vacuum interrupted recloser market is driven by leading players including Rockwell Automation, Eaton, Hughes Power System, ENSTO, S&C Electric Company, Hubbell, ABB, NOJA Power, G&W Electric, and ARTECHE. These companies focus on advanced electronic reclosers, SCADA-enabled controls, and predictive maintenance solutions to meet rising grid reliability requirements. Asia-Pacific led the market with over 42% share in 2024, supported by large-scale grid modernization and renewable energy integration projects. North America accounted for 28% share, driven by smart grid deployment and storm-resilient infrastructure investments, while Europe held 20% share, fueled by renewable energy adoption and aging grid replacement initiatives.

Market Insights

Market Insights

- The vacuum interrupted recloser market was valued at USD 1.48 billion in 2024 and is projected to reach USD 2.38 billion by 2032, growing at a CAGR of 6.1% during the forecast period.

- Rising focus on grid reliability and automation drives demand, with three-phase reclosers holding over 65% share due to their suitability for medium-voltage distribution networks.

- Key trends include adoption of smart grid technologies, SCADA-enabled control systems, and IoT-based monitoring for predictive maintenance and faster fault response.

- Major players such as Rockwell Automation, Eaton, ABB, NOJA Power, and S&C Electric Company focus on product innovation, regional expansion, and partnerships to strengthen their market presence.

- Asia-Pacific led with over 42% share, followed by North America at 28% and Europe at 20%, while utility applications accounted for around 65% share, dominating demand across global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Phase

Three-phase vacuum interrupted reclosers dominated the market with over 65% share in 2024, driven by their ability to handle higher load currents and provide superior fault protection in medium-voltage distribution networks. These reclosers are widely used in industrial, commercial, and utility grids to maintain power continuity during transient faults. Single-phase reclosers held the remaining share, primarily deployed in rural distribution systems where loads are smaller and cost-effectiveness is crucial. Increasing investments in grid reliability and expansion of three-phase feeder lines are expected to sustain the growth of the three-phase segment.

- For instance, Eaton’s Cooper Power NOVA series three-phase vacuum reclosers produced in 2024 feature a rated continuous current of 630 A and short circuit current capacity of 12.5 kA symmetrical, supporting medium-voltage distribution networks up to 38 kV with maintenance-free vacuum interruption technology ensuring over 10,000 mechanical operations without maintenance.

By Control

Electronic control reclosers led the market with around 70% share in 2024, supported by their advanced fault detection, remote operation, and SCADA integration capabilities. Utilities prefer electronic reclosers for automated grid management and real-time monitoring, which improve outage response times and reduce maintenance costs. Hydraulic control reclosers accounted for a smaller share, being used in regions with limited automation requirements or where cost constraints are significant. The rising adoption of smart grid technologies and distribution automation projects continues to strengthen demand for electronically controlled reclosers.

- For instance, Hughes Power System’s ACR121 electronic control recloser integrates extra insulated 27kV epoxy bushings with silicone surface, built-in voltage sensors, and advanced protection relay functionalities, enabling low-latency fault detection and remote operation across distribution networks with up to four autoreclosing sequences per fault event.

By Voltage

The 27 kV voltage segment captured nearly 50% share in 2024, making it the largest contributor to the vacuum interrupted recloser market. These reclosers are extensively deployed in medium-voltage distribution systems for urban, suburban, and industrial applications. The 15 kV segment follows, serving rural and light distribution networks, while the 38 kV segment is used for heavy-duty applications in transmission and sub-transmission systems. Growing urbanization, rising electricity consumption, and utility focus on minimizing downtime are expected to drive continued demand for 27 kV reclosers during the forecast period.

Key Growth Drivers

Rising Focus on Grid Reliability

The growing need to improve grid reliability and minimize outage duration is a primary driver for the vacuum interrupted recloser market. Utilities are deploying reclosers to quickly isolate faults, restore service automatically, and reduce downtime in distribution networks. This helps improve SAIDI and SAIFI performance indices and meet regulatory reliability targets. The adoption of reclosers is further supported by increasing electricity demand and grid modernization programs, particularly in developing regions where power infrastructure upgrades are prioritized to ensure continuous and stable energy supply.

- For instance, ABB offers vacuum interrupted reclosers with rapid fault isolation technology, designed to significantly enhance grid reliability in industrial and utility power distribution networks.

Expansion of Distribution Automation Projects

Distribution automation initiatives are significantly boosting demand for smart reclosers with advanced control capabilities. Utilities are investing in SCADA-enabled and remotely operated reclosers to enhance fault detection and real-time monitoring. These solutions support self-healing grid systems that automatically reconfigure during faults, improving service continuity and reducing operational costs. The rising penetration of IoT and communication technologies in power systems further accelerates adoption, as utilities seek to build resilient and digitally connected distribution networks to meet future energy needs.

- For instance, Schneider Electric consistently implements smart grid solutions, including vacuum reclosers and integrated SCADA systems, in projects for utility partners across Europe and North America to improve grid resilience and reliability.

Integration of Renewable Energy Sources

The rapid integration of renewable energy sources into distribution networks is driving the need for reclosers to manage bidirectional power flows and fluctuating generation levels. Wind and solar power installations can introduce voltage fluctuations and transient faults, making reliable protection devices critical. Vacuum interrupted reclosers help isolate faults and maintain grid stability under these variable conditions. Supportive government policies and renewable energy targets worldwide are encouraging utilities to strengthen distribution infrastructure with advanced reclosers to ensure safe, efficient, and reliable power delivery.

Key Trends & Opportunities

Adoption of Smart Grid Technologies

The shift toward smart grid infrastructure presents major opportunities for vacuum interrupted reclosers with electronic controls. Utilities are seeking intelligent devices that integrate with digital platforms, provide real-time data, and support remote diagnostics. Advanced reclosers enable predictive maintenance and help reduce manual intervention, improving operational efficiency. Vendors are focusing on developing reclosers with IoT connectivity, enhanced fault analytics, and interoperability with distribution management systems. This trend is expected to drive significant growth as utilities accelerate investments in digital and automated distribution networks globally.

- For instance, Korea Electric Power Corporation (KEPCO) is actively integrating AI into its smart grid infrastructure, including the deployment of technologies like smart fault locators and systems for predictive maintenance and real-time fault analytics, aiming to enhance grid reliability and efficiency.

Rising Demand in Emerging Economies

Emerging economies are witnessing increased demand for reclosers due to rapid urbanization, industrialization, and rural electrification programs. Governments in Asia-Pacific, Latin America, and Africa are investing heavily in power distribution infrastructure to expand grid coverage and reduce technical losses. The opportunity lies in supplying cost-effective, robust, and easy-to-maintain reclosers suited for developing grid systems. Market players focusing on localized manufacturing and after-sales support will be better positioned to capture growth in these price-sensitive yet rapidly growing markets.

- For instance, ABB India supports grid modernization and rural electrification projects in underserved regions with its technologies. In 2024, the company saw a significant surge in demand for its products, driven by government initiatives and the expansion of data centers, reflecting its ongoing growth in the country.

Key Challenges

High Installation and Maintenance Costs

The high upfront cost of vacuum interrupted reclosers and the need for skilled installation can limit adoption, especially for small utilities and rural cooperatives. Ongoing maintenance, periodic testing, and control system upgrades add to lifecycle costs, putting pressure on budgets. These financial barriers may slow adoption in developing regions despite strong demand for grid reliability improvements. Manufacturers are working on modular and cost-efficient designs to lower the total cost of ownership and encourage wider deployment.

Technical Complexity and Cybersecurity Risks

Modern electronically controlled reclosers require advanced communication protocols and software integration, which can introduce technical complexity. Improper configuration or communication failures may lead to misoperations or delayed fault clearance. Additionally, as reclosers become more connected, they are exposed to cybersecurity risks that can compromise grid operations. Utilities must invest in training, secure communication systems, and periodic audits to mitigate these risks. Vendors are also focusing on developing cybersecurity-compliant solutions to address growing concerns in digital power infrastructure.

Regional Analysis

Asia-Pacific

Asia-Pacific led the vacuum interrupted recloser market with over 42% share in 2024, driven by large-scale grid modernization projects and rising electricity demand in China, India, and Southeast Asia. Government initiatives supporting rural electrification and industrialization are fueling installation of reclosers to improve power reliability. The region is also witnessing strong renewable energy integration, which increases the need for advanced fault protection devices. Investments in smart grid infrastructure, SCADA integration, and distribution automation programs further strengthen demand. Local manufacturing presence and supportive policy frameworks are helping reduce costs, making Asia-Pacific the fastest-growing market globally.

North America

North America accounted for around 28% share in 2024, supported by widespread adoption of smart grid technologies and strong focus on improving power reliability. The United States leads the region, with utilities deploying electronic vacuum reclosers to meet stringent outage performance standards. Integration of renewable energy sources, such as wind and solar, is driving the need for advanced protection devices to manage fluctuating power flows. Federal and state-level investments in grid resilience, storm hardening, and modernization projects are further boosting demand. Continuous digitalization of distribution networks is expected to keep North America a major contributor to market growth.

Europe

Europe captured around 20% share in 2024, driven by modernization of aging grid infrastructure and renewable energy integration initiatives. Countries like Germany, France, and the UK are deploying vacuum reclosers to enhance fault protection and meet strict grid reliability requirements. EU directives promoting smart grid deployment and cross-border interconnections are encouraging utilities to invest in advanced distribution automation equipment. Increasing electrification of transport and growth in distributed energy resources are further boosting adoption. The region is also emphasizing environmentally sustainable solutions, which drives preference for low-maintenance and long-life vacuum interruption technology.

Latin America

Latin America represented 6% share in 2024, supported by expanding power distribution networks in Brazil, Mexico, and Chile. Rising electricity consumption, industrial growth, and rural electrification projects are key demand drivers. Utilities are focusing on improving grid reliability and reducing technical losses, which increases recloser installations. International investments and public-private partnerships are modernizing distribution infrastructure, creating opportunities for cost-effective and robust recloser solutions. However, budget constraints and limited technical expertise in some areas remain challenges. Vendors offering localized service support and affordable electronic reclosers are well positioned to capitalize on the region’s growth potential.

Middle East & Africa

The Middle East & Africa held 4% share in 2024, with demand driven by growing electricity consumption, urbanization, and large-scale infrastructure projects. GCC countries are upgrading distribution networks to support industrial development and renewable integration, creating steady demand for medium-voltage reclosers. Africa is witnessing gradual adoption, particularly in South Africa and Egypt, where grid reinforcement and rural electrification initiatives are underway. Utility focus on reducing outages and improving network efficiency is boosting installations. Partnerships with local distributors and investment in training programs are crucial to accelerate market penetration and meet region-specific reliability requirements.

Market Segmentations:

By Phase

By Control

By Voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vacuum interrupted recloser market is shaped by key players such as Rockwell Automation, Eaton, Hughes Power System, ENSTO, S&C Electric Company, Hubbell, ABB, NOJA Power, G&W Electric, and ARTECHE. These companies compete by offering advanced reclosers with electronic controls, IoT connectivity, and SCADA integration to support smart grid modernization. Strategic initiatives include capacity expansion, technology partnerships, and the development of compact, low-maintenance designs suitable for diverse voltage applications. Players are also focusing on enhancing fault detection accuracy, improving communication capabilities, and providing predictive maintenance features. Emerging markets remain a major growth focus, with vendors strengthening regional distribution networks and after-sales service to capture new utility projects. Investment in R&D to deliver environmentally sustainable solutions and compliance with international reliability standards positions these players to address the growing global demand for grid resilience and renewable energy integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, NOJA Power commissioned OSM® reclosers for Saudi Aramco’s Jafurah gas development project.

- In 2025, Hubbell showcased advanced vacuum interrupter reclosers such as the LineDefender single-phase recloser, launched with enhanced lineworker safety features

- In July 2024, NOJA Power has introduced an updated product guide for its EcoLink fuse link-mounted reclosing circuit breaker, offering an alternative to traditional medium voltage fuses. The revised guide features startup times under different fault conditions, as well as a detailed ANSI protection feature diagram showcasing the capabilities of the NOJA Power EcoLink.

Report Coverage

The research report offers an in-depth analysis based on Phase, Control, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as utilities invest in grid modernization projects.

- Three-phase reclosers will continue to dominate due to their role in medium-voltage networks.

- Adoption of electronic controls and SCADA integration will rise with smart grid deployment.

- Renewable energy growth will increase demand for reclosers to manage bidirectional power flows.

- Utilities will focus on predictive maintenance and IoT-enabled monitoring for reliability improvement.

- Asia-Pacific will remain the largest and fastest-growing regional market.

- Manufacturers will develop compact, energy-efficient, and low-maintenance recloser designs.

- Investment in digitalization and automation will boost demand for remote-operated solutions.

- Strategic partnerships and local manufacturing will help address emerging market needs.

- Compliance with international grid reliability standards will drive product innovation and upgrades.

Market Insights

Market Insights