Market Overview

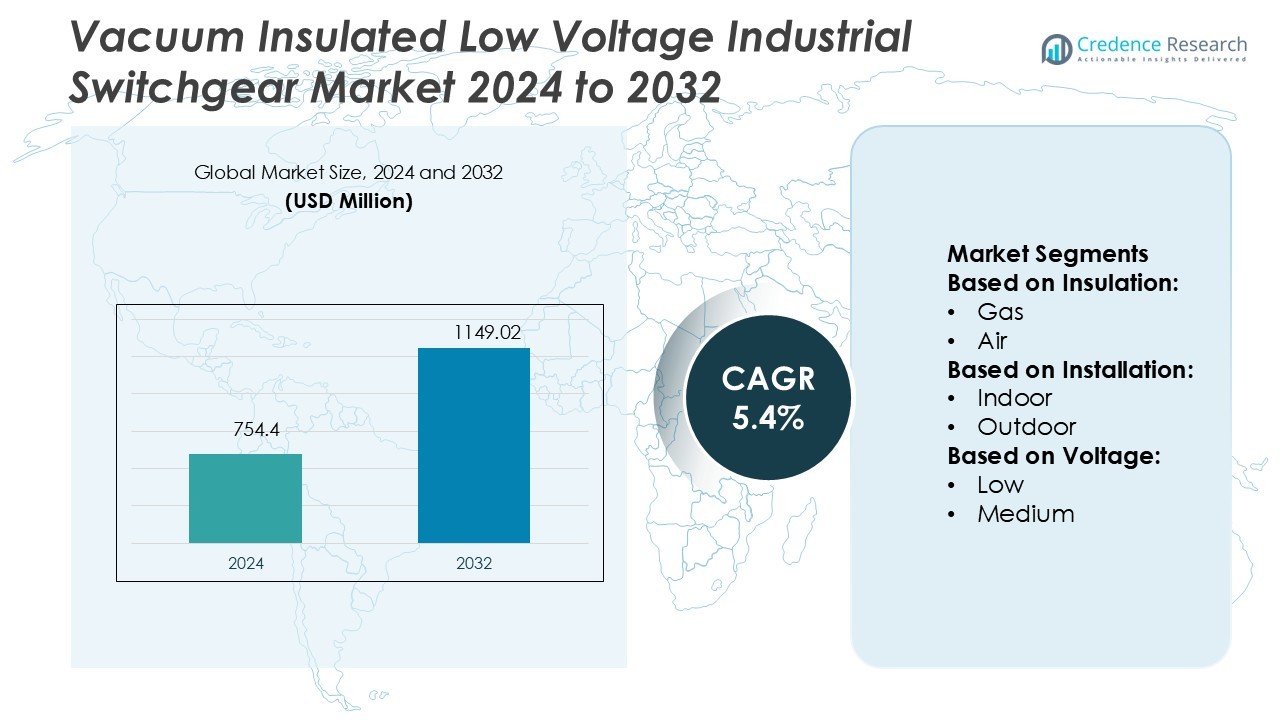

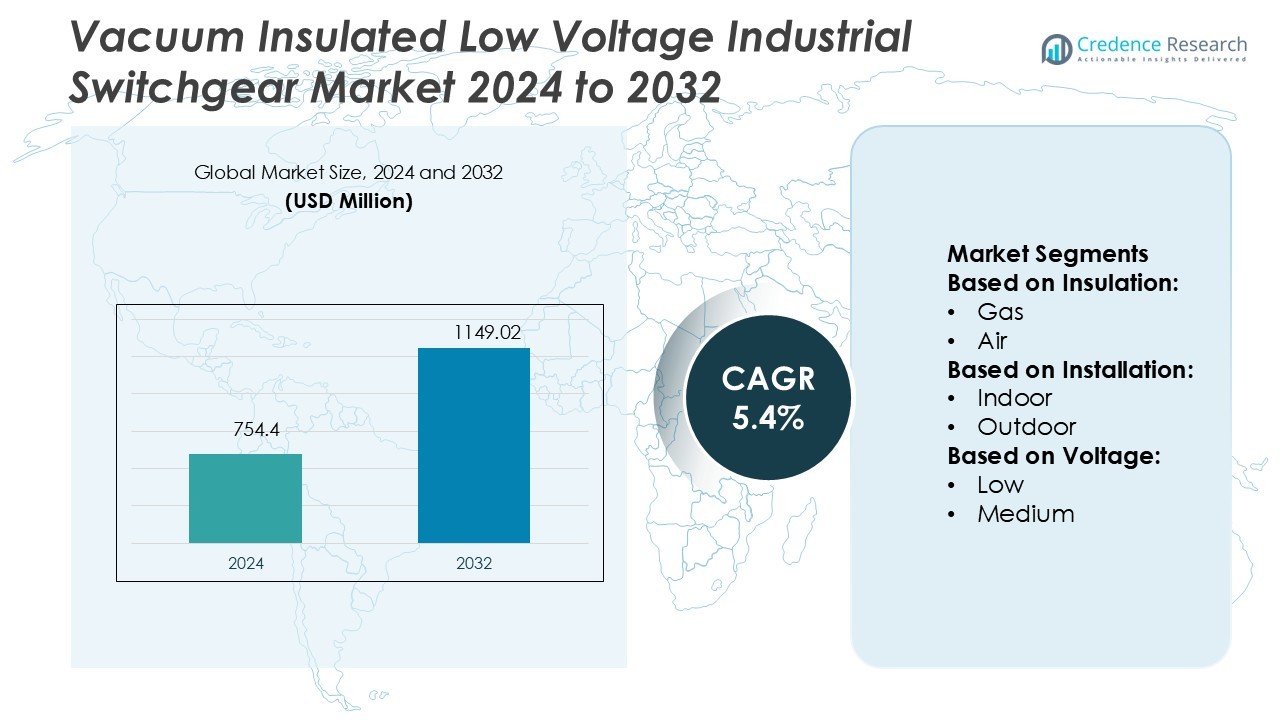

Vacuum Insulated Low Voltage Industrial Switchgear Market size was valued USD 754.4 million in 2024 and is anticipated to reach USD 1149.02 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Insulated Low Voltage Industrial Switchgear Market Size 2024 |

USD 754.4 Million |

| Vacuum Insulated Low Voltage Industrial Switchgear Market, CAGR |

5.4% |

| Vacuum Insulated Low Voltage Industrial Switchgear Market Size 2032 |

USD 1149.02 Million |

The Vacuum Insulated Low Voltage Industrial Switchgear Market is shaped by prominent players including Fuji Electric, CG Power and Industrial Solutions, Eaton, Bharat Heavy Electricals, Hitachi, General Electric, ABB, Hyosung Heavy Industries, HD Hyundai Electric, and E + I Engineering. These companies strengthen their positions through advanced product development, integration of digital monitoring, and expansion into renewable energy applications. Their strategies focus on improving reliability, efficiency, and safety while aligning with sustainability goals. Regionally, Asia-Pacific leads the market with a 29% share, driven by rapid industrialization, infrastructure expansion, and strong government investments in smart grids and renewable power projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vacuum Insulated Low Voltage Industrial Switchgear Market was valued at USD 754.4 million in 2024 and will reach USD 1149.02 million by 2032, growing at a CAGR of 5.4%.

- Growth is driven by rising demand for reliable power distribution, sustainability initiatives, and increasing adoption in renewable energy projects such as solar and wind.

- A major trend is the integration of digital monitoring, IoT connectivity, and automation, enabling predictive maintenance and enhanced operational efficiency across industrial and commercial facilities.

- Competitive dynamics are shaped by leading players like ABB, Eaton, Hitachi, and Fuji Electric, who focus on innovation, grid modernization, and expansion in emerging economies to strengthen their positions.

- Asia-Pacific dominates with a 29% share, supported by industrialization and smart grid investments, while the vacuum insulation segment leads by insulation type due to its reliability, safety, and low maintenance advantages in power distribution networks.

Market Segmentation Analysis:

By Insulation

The vacuum insulation sub-segment dominates the Vacuum Insulated Low Voltage Industrial Switchgear Market, holding the largest share. Its leadership stems from superior arc-quenching ability, longer operational life, and minimal maintenance compared to gas, air, and oil options. Industries adopt vacuum insulation for enhanced safety and reduced energy losses. Rising demand from manufacturing, power distribution, and industrial automation drives growth, as companies prioritize reliability and efficiency in electrical infrastructure. This segment continues to expand due to regulatory emphasis on sustainable and low-maintenance switchgear solutions.

- For instance, Fuji Electric offers a range of circuit breakers for different applications. For medium-voltage systems (3.6 to 36 kV), their V-series vacuum circuit breakers (including the HS-series) are known for stable performance, with some models offering a breaking capacity up to 63,000 A.

By Installation

Indoor switchgear leads the installation segment with the highest market share, driven by strong adoption in industrial facilities, commercial complexes, and data centers. Indoor installations ensure protection from environmental hazards, enhancing equipment reliability and reducing operational risks. Compact design and easy integration with existing infrastructure make them highly preferred in space-constrained applications. Rising urbanization and infrastructure development strengthen demand, while industries focus on improved safety and uninterrupted power supply. The shift toward automation and digitized monitoring further consolidates indoor switchgear as the dominant choice.

- For instance, CG Power and Industrial Solutions offers a range of medium-voltage vacuum switchgear, such as the Calix VCB (Vacuum Circuit Breaker) series. These systems are rated for voltage levels typically up to 36 kV and provide high fault tolerance and reliable performance in large-scale industrial plants.

By Voltage

The low voltage sub-segment holds the dominant share in the voltage category, supported by extensive application across industrial and commercial sectors. Low voltage switchgear is essential for power distribution, machinery protection, and automation processes, particularly in manufacturing plants and utilities. Growing deployment of renewable energy and industrial electrification enhances reliance on low voltage solutions. This dominance is reinforced by cost-effectiveness, easier installation, and compatibility with modern digital monitoring systems. As industries prioritize operational efficiency, the low voltage segment continues to lead with strong adoption worldwide.

Key Growth Drivers

Rising Demand for Reliable Power Distribution

Industries increasingly depend on continuous power supply to support manufacturing, automation, and data-driven operations. Vacuum insulated low voltage switchgear ensures stable distribution while reducing arc faults and downtime. Its adoption grows across sectors such as power utilities, oil and gas, and transportation, where safety and efficiency are critical. Expanding industrial electrification and smart grid projects further boost demand. The combination of operational reliability and protection against electrical failures positions vacuum insulated solutions as a preferred choice in modern industrial environments.

- For instance, Eaton introduced its xEnergy Main LV switchgear platform featuring modular designs that support main bus ratings up to 7,100 A. This platform includes optional advanced arc fault mitigation technologies, such as the ARCON® arc-fault protection system.

Expansion of Industrial and Commercial Infrastructure

Rapid urbanization and industrialization worldwide are driving the deployment of reliable electrical systems. Commercial complexes, hospitals, and data centers increasingly require low-maintenance switchgear to ensure operational continuity. Vacuum insulated switchgear delivers compact design, easy installation, and strong protection in indoor facilities. With governments investing in infrastructure development, demand continues to grow for safe and efficient low voltage distribution systems. These projects fuel the integration of advanced switchgear solutions, strengthening their market presence across both developed and emerging economies.

- For instance, BHEL manufactures and commissions Gas-Insulated Switchgear (GIS) systems for extra high-voltage applications, including substations with voltage levels such as 400 kV and 220 kV.

Shift Toward Energy Efficiency and Sustainability

Sustainability initiatives are accelerating the adoption of vacuum insulated switchgear, which reduces energy losses compared to conventional alternatives. Its long lifecycle and low maintenance requirements minimize environmental impact, aligning with corporate and regulatory green goals. Industries are replacing oil and air-insulated systems to achieve compliance with energy efficiency standards. Growth in renewable energy deployment also supports demand, as reliable switchgear is required to integrate distributed power sources. The push toward eco-friendly infrastructure positions vacuum insulated systems as a critical enabler of sustainable power management.

Key Trends & Opportunities

Integration of Digital Monitoring and Automation

The market is witnessing growing adoption of digital sensors, IoT connectivity, and automation features within vacuum insulated switchgear. These technologies enable predictive maintenance, real-time monitoring, and fault detection, significantly reducing downtime. As industries transition toward smart factories and digitalized power systems, demand for switchgear with built-in intelligence continues to rise. This integration creates opportunities for manufacturers to deliver advanced, data-driven solutions that support operational efficiency and long-term cost savings.

- For instance, Hitachi Energy’s Relion® protection and control relays, integrated into its VD4 vacuum switchgear, enable extensive data collection via IEC 61850 digital communication.

Increasing Adoption in Renewable Energy Projects

Renewable energy integration presents a strong opportunity for vacuum insulated switchgear. Solar and wind farms require reliable, low-maintenance equipment for safe energy distribution. Vacuum technology ensures efficient switching while reducing environmental risks. With global renewable capacity expanding, investments in supporting infrastructure are rising. This trend accelerates the deployment of vacuum insulated systems in renewable plants, substations, and microgrids, making them essential in the shift toward sustainable energy.

- For instance, GE has advanced g³-based high voltage breakers and lines. Their dual-gas 420 kV gas-insulated line (GIL) can be supplied in either SF₆ or g³ form, with more than 15% lower gas mass and ≤ same footprint.

Key Challenges

High Initial Capital Investment

Despite long-term benefits, vacuum insulated switchgear involves higher upfront costs compared to conventional systems. Small and medium-sized enterprises often hesitate to adopt due to budget constraints. The need for specialized components and installation expertise further adds to the cost. While operational savings offset expenses over time, the initial financial barrier restricts adoption in cost-sensitive regions. Manufacturers face the challenge of balancing affordability with advanced performance to expand their market reach.

Limited Awareness in Emerging Markets

In several developing economies, awareness of vacuum insulated switchgear remains limited compared to traditional solutions. Decision-makers often prioritize lower-cost systems, overlooking long-term efficiency benefits. Inadequate training and lack of skilled technicians further slow adoption. This challenge is compounded by fragmented regulatory standards, which limit consistent deployment across markets. Overcoming these barriers requires focused education, technical training, and targeted marketing strategies to highlight the advantages of vacuum insulated low voltage switchgear.

Regional Analysis

North America

North America holds a significant 32% share in the Vacuum Insulated Low Voltage Industrial Switchgear Market, driven by strict safety regulations and modernization of aging power infrastructure. The U.S. leads adoption, with strong investments in industrial automation and data centers. Canada also supports growth through renewable energy projects, particularly wind and hydro. Demand is reinforced by utilities and oil and gas sectors focusing on reliable, efficient distribution systems. Rising integration of digital monitoring and IoT-enabled switchgear further boosts market penetration across industrial and commercial applications in the region.

Europe

Europe accounts for 27% of the Vacuum Insulated Low Voltage Industrial Switchgear Market, supported by robust regulations promoting energy efficiency and sustainability. Germany, France, and the UK dominate due to extensive industrial bases and ongoing grid modernization projects. The European Union’s decarbonization policies are accelerating the shift from conventional systems to vacuum-insulated technologies. Strong growth in renewable energy deployment and electrification of transportation also drive demand. Manufacturers in the region emphasize advanced, compact designs integrated with automation, ensuring steady adoption across utilities, manufacturing facilities, and commercial establishments.

Asia-Pacific

Asia-Pacific leads with a 29% market share, making it the fastest-growing region in the Vacuum Insulated Low Voltage Industrial Switchgear Market. China and India dominate, fueled by rapid industrialization, urbanization, and expansion of power infrastructure. Japan and South Korea contribute with high adoption in electronics, automotive, and advanced manufacturing. Rising investments in renewable energy projects, particularly solar and wind, support growth. The region also benefits from increasing government spending on smart grid development. Strong demand across commercial, residential, and industrial sectors ensures Asia-Pacific remains the key hub for future expansion.

Latin America

Latin America represents 5% of the Vacuum Insulated Low Voltage Industrial Switchgear Market, with Brazil and Mexico leading adoption. Growth is supported by expanding industrial bases, rising renewable energy projects, and modernization of grid infrastructure. Brazil’s focus on hydro and wind power integration creates opportunities for vacuum insulated systems, while Mexico emphasizes reliable low-voltage distribution in manufacturing and automotive sectors. Economic constraints and cost-sensitive buyers remain key challenges in the region. Nonetheless, ongoing urbanization and government-led electrification programs are expected to gradually increase adoption of advanced switchgear technologies.

Middle East & Africa

The Middle East & Africa region contributes 7% of the Vacuum Insulated Low Voltage Industrial Switchgear Market, supported by large-scale oil and gas projects and infrastructure development. The Gulf Cooperation Council (GCC) countries lead adoption, particularly Saudi Arabia and the UAE, which prioritize advanced distribution systems in industrial and commercial sectors. Africa’s demand is growing in urban centers with expanding construction and power distribution projects. However, limited awareness and high costs challenge faster penetration. Despite this, rising renewable energy projects, particularly solar, offer significant growth potential for vacuum insulated switchgear.

Market Segmentations:

By Insulation:

By Installation:

By Voltage:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Vacuum Insulated Low Voltage Industrial Switchgear Market features strong competition among key players such as Fuji Electric, CG Power and Industrial Solutions, Eaton, Bharat Heavy Electricals, Hitachi, General Electric, ABB, Hyosung Heavy Industries, HD Hyundai Electric, and E + I Engineering. The Vacuum Insulated Low Voltage Industrial Switchgear Market is highly competitive, driven by continuous advancements in technology, growing demand for sustainable solutions, and increasing investment in smart grid infrastructure. Companies in the sector emphasize innovation through digital monitoring, automation, and compact designs that improve efficiency and reliability. The market also benefits from rising adoption in renewable energy projects, manufacturing plants, and commercial facilities, where safety and low maintenance remain top priorities. Strategic collaborations, research and development initiatives, and regional expansion are key approaches used to strengthen market presence and address evolving industrial power distribution needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- CG Power and Industrial Solutions

- Eaton

- Bharat Heavy Electricals

- Hitachi

- General Electric

- ABB

- Hyosung Heavy Industries

- HD Hyundai Electric

- E + I Engineering

Recent Developments

- In March 2025, nVent Electric plc announced to enter into a definitive agreement to acquire the enclosures, switchgear, and bus systems businesses of Avail Infrastructure Solutions for an acquisition price of subject to customary adjustments.

- In August 2024, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage.

- In May 2024, L&T Switchgear, one of India’s leading electrical and automation brands and a pioneer in energy management, unveiled its new brand identity, ‘Lauritz Knudsen Electrical and Automation’. Announces plans to invest Rs 850 cr. over the next 3 years.

- In April 2024, Schneider Electric and Digital Realty launched a circular economy initiative at the Paris 5 (PAR5) data center. This partnership aims to extend the lifespan of critical systems at PAR5, including Schneider Electric’s low-voltage (LV) and low-voltage (MV) electrical equipment, switchgear, and UPS units

Report Coverage

The research report offers an in-depth analysis based on Insulation, Installation, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for reliable low-voltage power distribution.

- Adoption will increase in renewable energy projects requiring efficient and sustainable switchgear.

- Digital monitoring and IoT integration will enhance predictive maintenance and performance.

- Urbanization and infrastructure development will drive installations in commercial and industrial facilities.

- Regulatory focus on energy efficiency will support replacement of conventional systems.

- Compact and modular designs will gain traction in space-constrained applications.

- Industrial automation growth will boost demand for advanced low-voltage switchgear solutions.

- Emerging economies will create opportunities through electrification and industrial expansion.

- Long lifecycle and low maintenance benefits will strengthen preference for vacuum insulation.

- Global manufacturers will expand through innovation, partnerships, and regional diversification strategies.