Market Overview

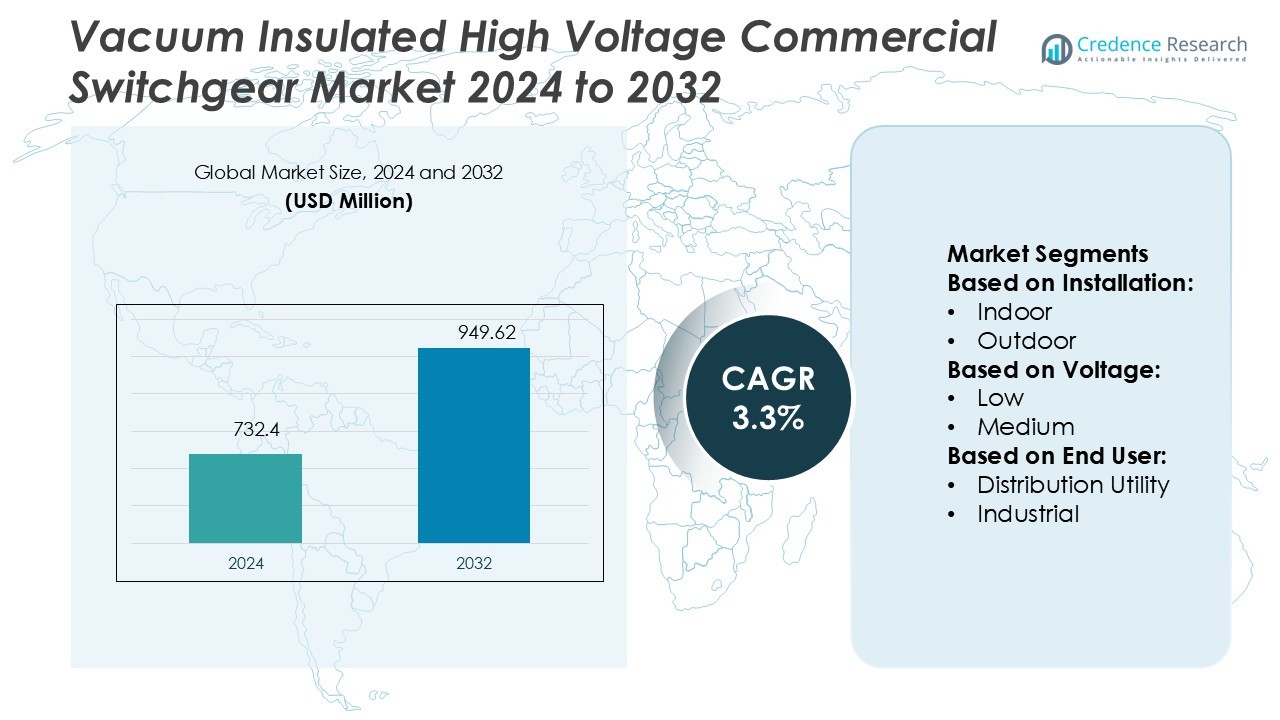

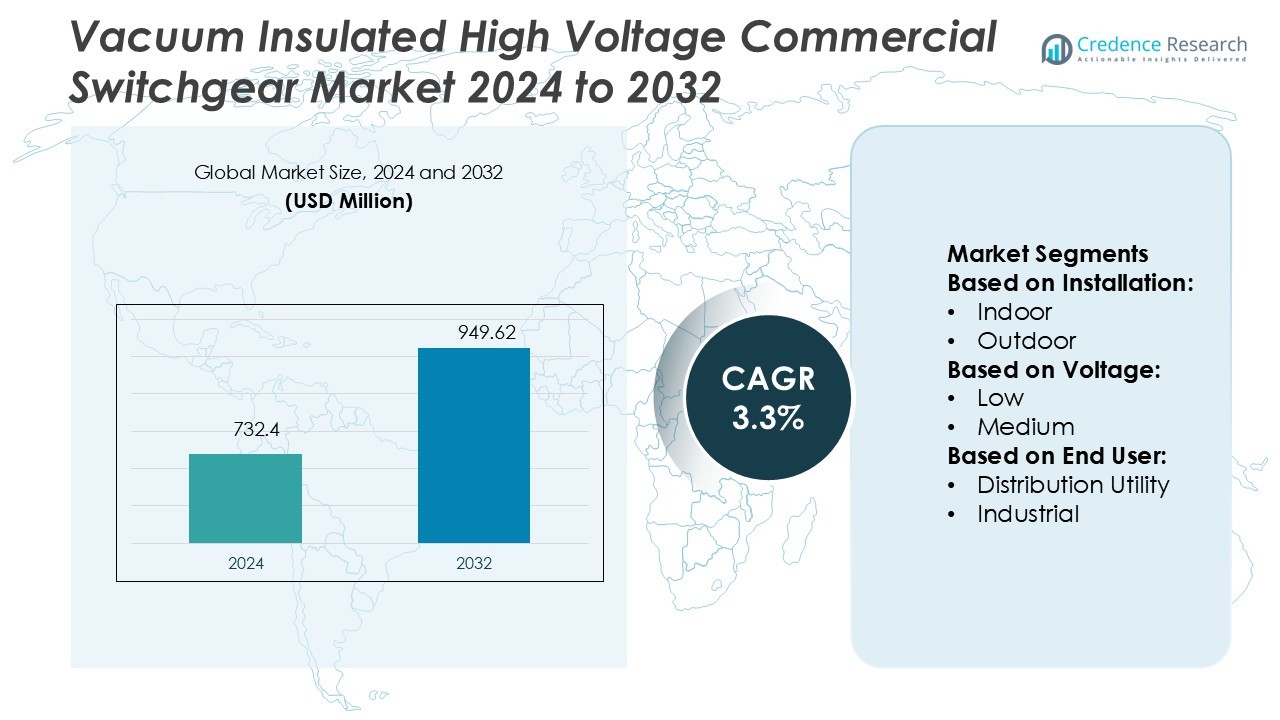

Vacuum Insulated High Voltage Commercial Switchgear Market size was valued USD 732.4 million in 2024 and is anticipated to reach USD 949.62 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Insulated High Voltage Commercial Switchgear Market Size 2024 |

USD 732.4 Million |

| Vacuum Insulated High Voltage Commercial Switchgear Market, CAGR |

3.3% |

| Vacuum Insulated High Voltage Commercial Switchgear Market Size 2032 |

USD 949.62 Million |

The Vacuum Insulated High Voltage Commercial Switchgear Market is driven by leading players such as ABB, Hitachi, Eaton, General Electric, Fuji Electric, HD Hyundai Electric, Hyosung Heavy Industries, Bharat Heavy Electricals, CG Power and Commercial Solutions, and E + I Engineering. These companies focus on developing SF₆-free technologies, integrating digital monitoring systems, and delivering compact, reliable solutions for diverse applications. Europe emerges as the leading region, holding a 32% market share, supported by strict environmental regulations, renewable integration targets, and continuous grid modernization. Strong utility investments and industrial demand reinforce Europe’s dominance in this market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vacuum Insulated High Voltage Commercial Switchgear Market was valued at USD 732.4 million in 2024 and will reach USD 949.62 million by 2032, registering a CAGR of 3.3%.

- Growth is driven by rising demand for compact, safe, and eco-friendly systems, with utilities and commercial complexes adopting vacuum insulated technology to enhance reliability and efficiency.

- A key trend is the shift toward SF₆-free switchgear and integration of digital monitoring systems, enabling real-time fault detection, predictive maintenance, and smart grid compatibility.

- The competitive landscape is shaped by players such as ABB, Hitachi, Eaton, General Electric, Fuji Electric, and others, focusing on sustainability, product innovation, and strategic collaborations, though high installation costs remain a restraint.

- Europe leads with a 32% share, followed by Asia-Pacific at 30% and North America at 28%, while the indoor installation segment dominates with 58% share due to suitability in urban and high-density environments.

Market Segmentation Analysis:

By Installation

Indoor installation holds the dominant share in the Vacuum Insulated High Voltage Commercial Switchgear Market, accounting for over 58% of total adoption. Its leadership stems from compact design, safety features, and suitability for urban and high-density commercial environments where space is limited. Industries and utilities prefer indoor systems for data centers, high-rise buildings, and industrial facilities, as they minimize exposure to weather-related risks and ensure continuous operations. Rising urbanization and demand for safe, reliable power distribution drive growth of this sub-segment.

- For instance, CG Power and Industrial Solutions offers a range of medium-voltage vacuum switchgear, such as the Calix VCB (Vacuum Circuit Breaker) series. These systems are rated for voltage levels typically up to 36 kV and provide high fault tolerance and reliable performance in large-scale industrial plants.

By Voltage

High voltage switchgear leads the segment with 46% market share, driven by large-scale transmission and distribution projects. The growth of renewable integration and grid modernization initiatives accelerates adoption, as utilities require robust systems to handle heavy loads. High voltage systems ensure efficient fault isolation and reliable long-distance power transmission. Demand is rising in industrial clusters, metropolitan transmission grids, and cross-border energy networks, where capacity requirements and safety standards are stringent. This sub-segment continues to benefit from infrastructure upgrades and investments in resilient power systems.

- For instance, Fuji Electric offers a range of circuit breakers for different applications. For medium-voltage systems (3.6 to 36 kV), their V-series vacuum circuit breakers (including the HS-series) are known for stable performance, with some models offering a breaking capacity up to 63,000 A.

By End-User

Transmission and distribution utilities dominate the market with a 51% share, supported by their crucial role in national grid reliability. These utilities adopt vacuum insulated switchgear to enhance operational safety, extend equipment lifespan, and reduce maintenance costs. Stringent regulatory standards and decarbonization targets further encourage investment in advanced switchgear for renewable integration and grid stability. Industrial and commercial users follow, driven by demand for reliable energy in manufacturing, healthcare, and residential complexes. However, utilities remain the largest growth driver, backed by ongoing grid expansion projects.

Key Growth Drivers

Rising Urbanization and Infrastructure Development

Rapid urbanization and expansion of commercial infrastructure are fueling demand for vacuum insulated high voltage commercial switchgear. High-rise buildings, data centers, metro stations, and industrial parks require compact, reliable, and safe power distribution systems. Vacuum insulation technology reduces fire risk and ensures uninterrupted supply in densely populated zones. Government-backed infrastructure projects and smart city initiatives further accelerate adoption. The growing need for space-efficient and maintenance-free equipment positions vacuum insulated switchgear as a preferred choice for both new installations and retrofitting projects.

- For instance, BHEL manufactures and commissions Gas-Insulated Switchgear (GIS) systems for extra high-voltage applications, including substations with voltage levels such as 400 kV and 220 kV.

Integration of Renewable Energy Sources

The increasing integration of renewable energy sources into transmission and distribution networks is a major growth driver. Solar and wind farms demand high-performance switchgear that can manage variable power loads while ensuring grid stability. Vacuum insulated switchgear supports efficient fault isolation and smooth power distribution, making it essential for renewable integration. Global renewable capacity expansion and decarbonization targets are creating strong opportunities for utilities to adopt advanced systems. This driver is reinforced by regulatory incentives and investments in sustainable energy infrastructure worldwide.

- For instance, Eaton introduced its xEnergy Main LV switchgear platform featuring modular designs that support main bus ratings up to 7,100 A. This platform includes optional advanced arc fault mitigation technologies, such as the ARCON® arc-fault protection system.

Focus on Safety and Reliability in Power Networks

Growing emphasis on operational safety and reliability in commercial and industrial facilities drives market growth. Vacuum insulated switchgear eliminates the use of SF₆ gas, addressing environmental concerns while reducing the risk of leakage and accidents. Enhanced arc-quenching properties improve system performance and extend service life. Utilities and industries are investing in systems that minimize downtime and maintenance, directly supporting productivity. Rising awareness of energy efficiency and stricter regulatory compliance standards further strengthen demand for advanced, eco-friendly, and high-reliability switchgear solutions.

Key Trends & Opportunities

Shift Toward Eco-Friendly and SF₆-Free Solutions

A significant trend is the move toward SF₆-free switchgear as regulators tighten restrictions on greenhouse gas emissions. Vacuum insulated technology offers a sustainable alternative by eliminating the use of harmful gases. Manufacturers are actively investing in eco-friendly designs that align with global climate policies. This transition creates opportunities for companies to expand product portfolios and capture markets prioritizing sustainability. Adoption is gaining traction in Europe and North America, where environmental regulations are most stringent, and the trend is spreading across Asia-Pacific markets.

- For instance, GE has advanced g³-based high voltage breakers and lines. Their dual-gas 420 kV gas-insulated line (GIL) can be supplied in either SF₆ or g³ form, with more than 15% lower gas mass and ≤ same footprint.

Digitalization and Smart Monitoring Integration

The integration of digital monitoring systems, IoT connectivity, and predictive maintenance capabilities presents strong growth opportunities. Advanced sensors embedded in switchgear enable real-time fault detection, load monitoring, and remote control. These features enhance operational efficiency and reduce downtime in critical applications such as data centers and industrial facilities. As industries and utilities embrace smart grid technologies, the demand for switchgear with built-in intelligence continues to expand. Digitalization not only supports cost savings but also creates opportunities for differentiation among leading manufacturers.

- For instance, Hitachi Energy’s Relion® protection and control relays, integrated into its VD4 vacuum switchgear, enable extensive data collection via IEC 61850 digital communication.

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing increased investments in power infrastructure. Rapid industrialization, rising electricity demand, and government initiatives to modernize grids create significant opportunities for vacuum insulated switchgear adoption. These markets prefer solutions that combine cost efficiency with safety and reliability. Local partnerships and production facilities are expected to support wider penetration. The untapped potential in these regions offers manufacturers the chance to strengthen global footprints while meeting the growing need for advanced power distribution systems.

Key Challenges

High Initial Investment Costs

One of the main challenges in the market is the high upfront cost of vacuum insulated high voltage commercial switchgear. Advanced insulation technology, digital features, and compliance with environmental standards increase production costs, making these systems more expensive compared to conventional alternatives. For small and medium enterprises or cost-sensitive regions, the high capital requirement acts as a barrier to adoption. Manufacturers must focus on cost optimization and localized production to enhance affordability while maintaining quality and performance standards.

Complex Installation and Technical Expertise Requirements

The installation and operation of vacuum insulated switchgear demand specialized technical expertise and skilled workforce. Complex configurations, digital monitoring features, and integration with existing networks can pose challenges for utilities and industries with limited technical capabilities. Insufficient training and lack of skilled professionals in emerging markets may slow adoption rates. This challenge is particularly significant in regions where infrastructure modernization is still in early stages. Addressing it requires stronger after-sales support, training programs, and collaborative efforts between manufacturers and utilities.

Regional Analysis

North America

North America holds a 28% share in the Vacuum Insulated High Voltage Commercial Switchgear Market, driven by strong adoption across transmission utilities, industrial facilities, and data centers. The U.S. leads the region due to grid modernization programs, renewable integration, and growing demand for energy-efficient infrastructure. Strict regulatory frameworks on safety and emissions accelerate the shift toward SF₆-free solutions. Canada contributes with investments in clean energy and smart grid deployments. Increasing focus on reliability, safety, and sustainability ensures steady market growth, making the region a hub for advanced switchgear technologies.

Europe

Europe accounts for 32% of the market, making it the leading region for vacuum insulated high voltage commercial switchgear. Countries such as Germany, the U.K., and France spearhead adoption, supported by strict environmental regulations and renewable energy integration targets. The region benefits from early adoption of SF₆-free technologies and continuous grid modernization initiatives. Industrial sectors, including automotive and manufacturing, also contribute to demand for compact, safe switchgear. Strong investments in offshore wind and energy transition projects reinforce Europe’s dominant position, establishing it as a critical market for sustainable power distribution solutions.

Asia-Pacific

Asia-Pacific captures 30% of the market, supported by rapid industrialization, urban expansion, and significant investments in transmission and distribution infrastructure. China dominates regional demand with extensive renewable capacity additions and large-scale grid upgrades. India, Japan, and South Korea contribute through industrial growth, smart city initiatives, and adoption of sustainable technologies. The need for compact, reliable, and cost-efficient systems in high-density urban environments drives strong demand. Government policies favoring electrification and renewable integration further strengthen growth prospects. With rising electricity consumption and modernization efforts, Asia-Pacific is positioned as the fastest-growing regional market.

Latin America

Latin America represents 6% of the market, with Brazil and Mexico leading regional demand. Growing industrialization, coupled with investments in renewable energy projects, creates opportunities for vacuum insulated switchgear adoption. Utilities in the region are modernizing distribution networks to improve reliability and reduce losses, which supports demand. The transition toward environmentally friendly and low-maintenance equipment also encourages adoption in commercial and industrial sectors. Although limited by high initial costs and slower technological penetration, increasing focus on infrastructure resilience and sustainability drives gradual market expansion in this region.

Middle East & Africa

The Middle East & Africa accounts for 4% of the market, driven by infrastructure development, industrial expansion, and renewable energy initiatives. Gulf countries, including Saudi Arabia and the UAE, invest heavily in modernizing grids to support large-scale commercial and industrial projects. Africa shows growing potential, supported by electrification programs and demand for reliable power distribution in urban centers. High investments in oil and gas, mining, and utility sectors also boost demand. While the region faces challenges from limited technical expertise, ongoing projects and renewable adoption fuel gradual growth in the switchgear market.

Market Segmentations:

By Installation:

By Voltage:

By End User:

- Distribution Utility

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Vacuum Insulated High Voltage Commercial Switchgear Market is shaped by key players including CG Power and Commercial Solutions, Fuji Electric, General Electric, E + I Engineering, Bharat Heavy Electricals, Eaton, Hitachi, HD Hyundai Electric, ABB, and Hyosung Heavy Industries. The Vacuum Insulated High Voltage Commercial Switchgear Market is highly competitive, characterized by continuous innovation, technological integration, and sustainability-driven advancements. Companies focus on developing SF₆-free solutions, integrating digital monitoring systems, and enhancing product reliability to meet global regulatory standards. The competitive environment is shaped by rising demand for compact, safe, and maintenance-free systems across utilities, industrial facilities, and commercial complexes. Strategic initiatives such as mergers, partnerships, and localized manufacturing are common to expand market reach and address regional demand. Emphasis on smart grid compatibility, renewable integration, and energy efficiency further defines the competitive dynamics of this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, JST Power Equipment launched the J20N™ Dry-Air Gas-Insulated Switchgear, rated at 38kV. This solution is recognized for its quick lead times, reliability, and advanced engineering.

- In August 2024, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage.

- In May 2024, L&T Switchgear, one of India’s leading electrical and automation brands and a pioneer in energy management, unveiled its new brand identity, ‘Lauritz Knudsen Electrical and Automation’. Announces plans to invest Rs 850 cr. over the next 3 years.

- In April 2024, Schneider Electric and Digital Realty launched a circular economy initiative at the Paris 5 (PAR5) data center. This partnership aims to extend the lifespan of critical systems at PAR5, including Schneider Electric’s high-voltage (LV) and high-voltage (MV) electrical equipment, switchgear, and UPS units.

Report Coverage

The research report offers an in-depth analysis based on Installation, Voltage, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for reliable power distribution systems.

- Adoption of SF₆-free switchgear will increase due to stricter environmental regulations.

- Digital monitoring and IoT integration will become standard features in new installations.

- Utilities will continue to drive demand with ongoing grid modernization projects.

- Data centers and commercial complexes will strengthen adoption in urban regions.

- Renewable energy integration will create consistent opportunities for high-voltage switchgear deployment.

- Emerging economies will offer strong growth potential through infrastructure development.

- Manufacturers will invest more in localized production to reduce costs and improve supply.

- Strategic collaborations will rise as companies seek to expand their global presence.

- Focus on safety, efficiency, and sustainability will remain the key market differentiators.