Market Overview:

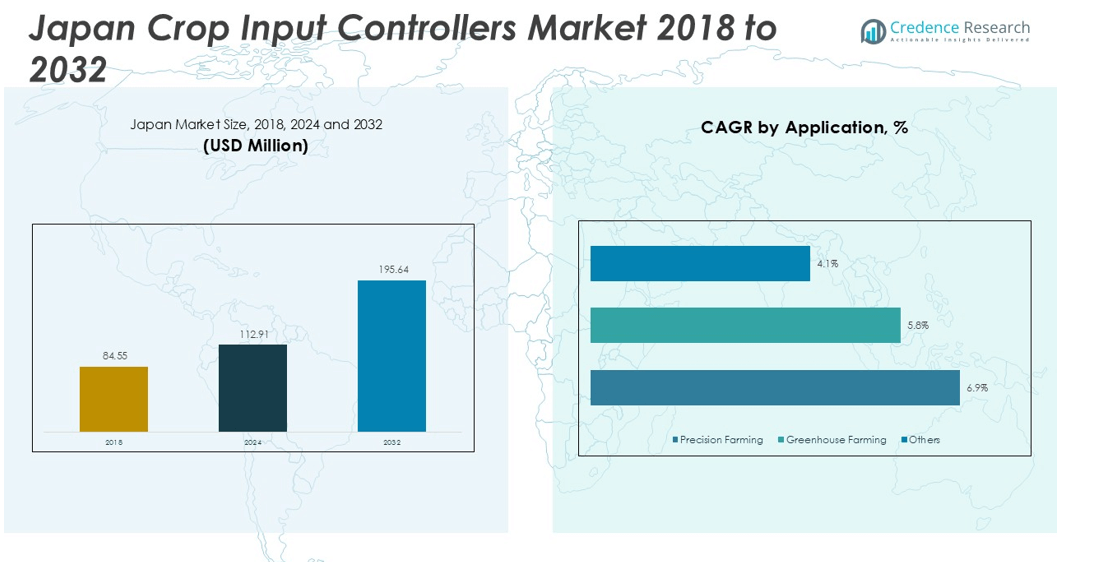

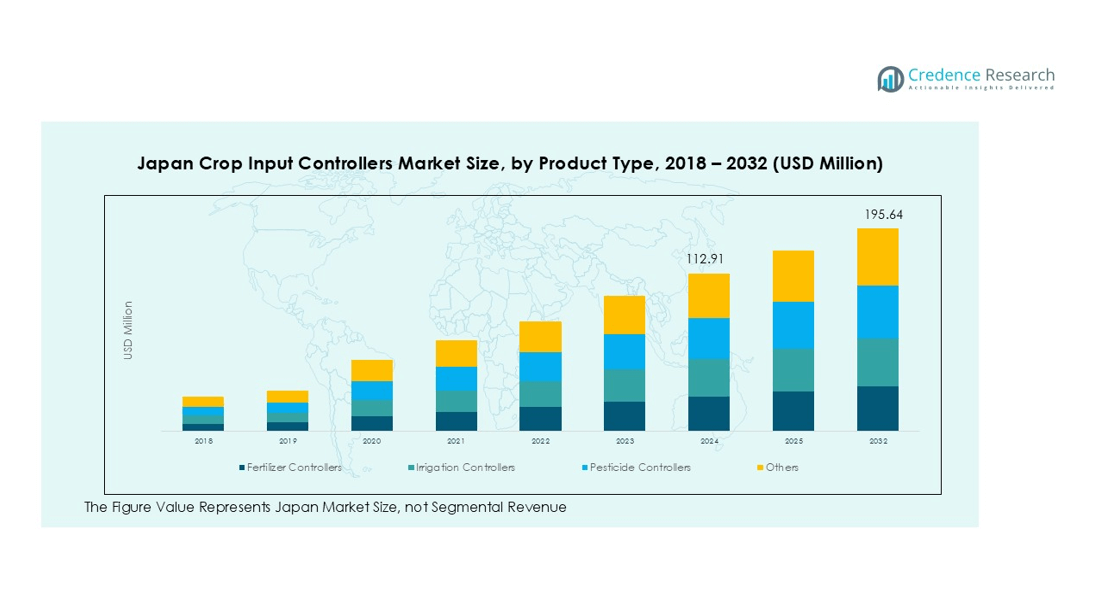

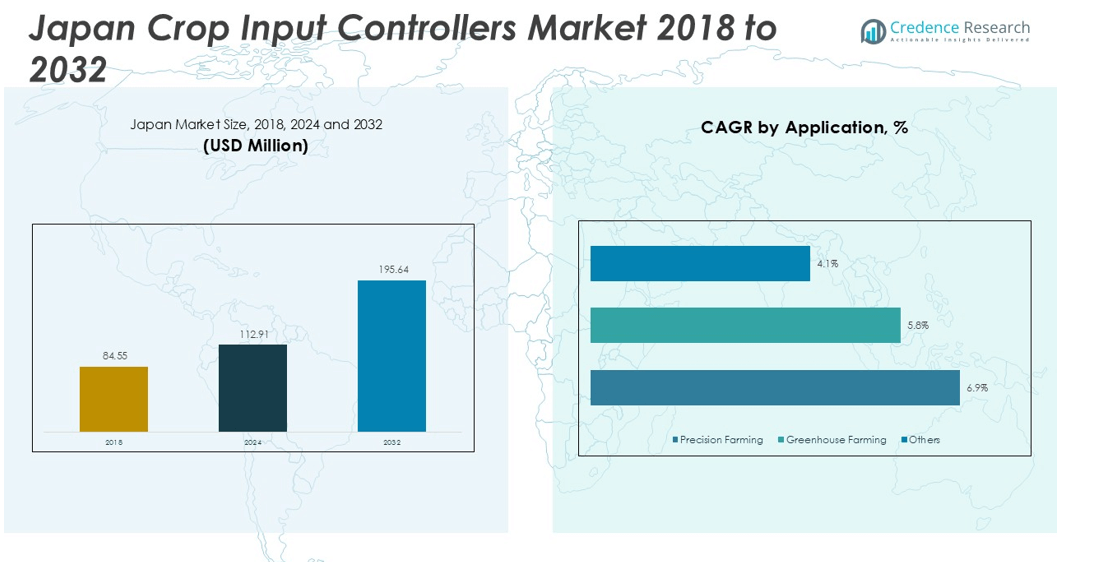

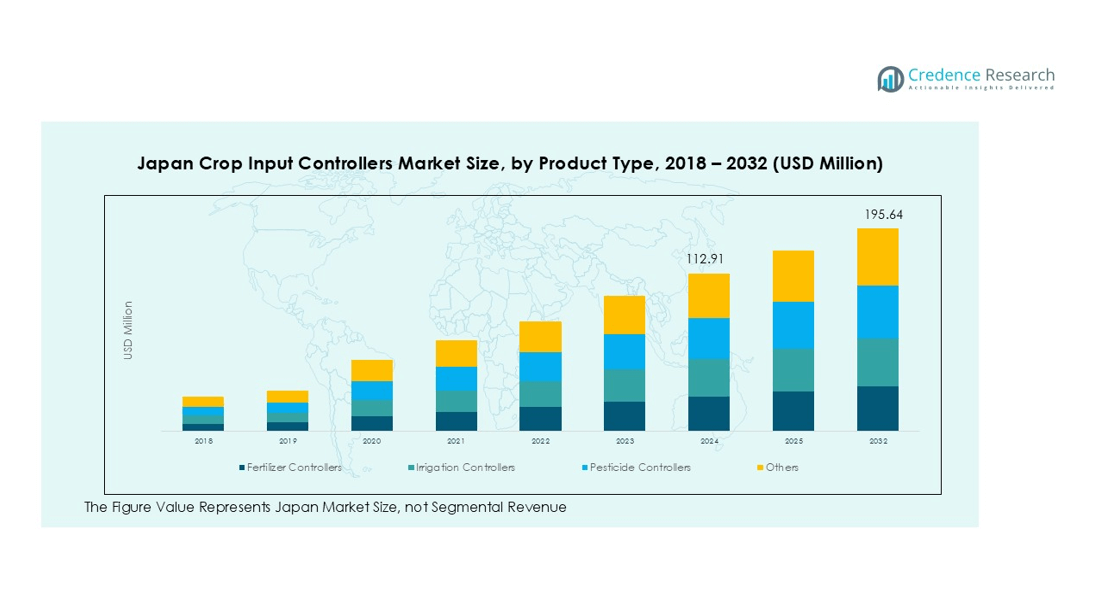

The Japan Crop Input Controllers size was valued at USD 84.55 million in 2018 to USD 112.91 million in 2024 and is anticipated to reach USD 195.64 million by 2032, at a CAGR of 7.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Crop Input Controllers Market Size 2024 |

USD 112.91 million |

| Japan Crop Input Controllers Market, CAGR |

7.11% |

| Japan Crop Input Controllers Market Size 2032 |

USD 195.64 million |

The key drivers for the market include the growing need for automation in agriculture to optimize the use of crop inputs like water, fertilizers, and pesticides. Additionally, advancements in sensor technologies, IoT, and AI contribute to better crop management and resource allocation. The Japanese government’s strong support for sustainable farming practices, along with funding and subsidies for smart farming, further accelerates market growth.

Regionally, Japan is a leader in adopting advanced agricultural technologies. The country’s agriculture sector faces challenges such as labor shortages and aging farmers, which has led to increased automation adoption. The government’s efforts to implement precision agriculture solutions through technological innovation and the promotion of sustainable farming practices are expected to fuel further market expansion in the coming years.

Market Insights:

- The Japan Crop Input Controllers Market is valued at USD 112.91 million in 2024, projected to reach USD 195.64 million by 2032, growing at a CAGR of 7.11%.

- Technological advancements in IoT, AI, and automation enable real-time crop input management, enhancing efficiency and reducing costs.

- Government initiatives, including subsidies and research funding, are driving the adoption of precision agriculture in Japan.

- The focus on environmental sustainability is pushing for more efficient management of resources like water, fertilizers, and pesticides.

- High initial investment and maintenance costs hinder the adoption of crop input controllers, particularly for small farms.

- Resistance to technological change among Japan’s aging farming population and skill gaps slow market growth.

- Rural areas present significant growth opportunities as targeted initiatives and government support foster technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Precision Agriculture

The Japan Crop Input Controllers Market is driven by the rising demand for precision agriculture solutions. With the need for optimized crop management and higher yields, farmers are turning to advanced technologies to monitor and control crop inputs such as water, fertilizers, and pesticides. These technologies help reduce input costs and enhance efficiency, making it a valuable tool for farmers seeking to improve productivity while managing resources effectively.

Technological Advancements in Automation and AI

Technological advancements, particularly in automation, AI, and IoT, play a key role in driving the Japan Crop Input Controllers Market. Automation enables farmers to monitor crop health and adjust input levels in real-time, enhancing decision-making capabilities. AI and IoT integration allow for precise data collection and analysis, further improving efficiency in farming operations. These innovations significantly contribute to the market’s growth by offering more accurate and timely solutions to manage agricultural resources.

- For instance, the ‘NoshoNavi1000’ smart rice production model integrates AI through a system composed of 3 distinct modules for data collection, analysis, and production management.

Government Support and Policies for Smart Farming

Government policies and incentives to promote smart farming in Japan are accelerating the adoption of crop input controllers. The Japanese government supports the use of modern technologies through funding, subsidies, and research initiatives aimed at enhancing agricultural productivity. This support encourages the adoption of crop input controllers, aligning with the country’s goal of fostering sustainable farming practices and addressing labor shortages in agriculture.

Sustainability and Environmental Concerns

Environmental sustainability concerns have become a major driver of the Japan Crop Input Controllers Market. As awareness of climate change and resource depletion grows, farmers are looking for ways to reduce waste and minimize their environmental footprint. Crop input controllers help achieve sustainable farming practices by precisely managing the use of water, fertilizers, and pesticides, thus reducing overuse and promoting eco-friendly practices.

- For instance, as part of a government initiative, the soil technology company Towing received a grant of JPY1.25 billion to develop a large-scale production process for high-performance biochar to improve soil health on farmland.

Market Trends:

Growing Integration of IoT and AI for Real-Time Crop Management

A major trend shaping the Japan Crop Input Controllers Market is the growing integration of IoT and AI technologies. These innovations enable real-time monitoring of crop inputs such as water, fertilizers, and pesticides, enhancing the accuracy and efficiency of agricultural operations. IoT sensors collect data on soil moisture, temperature, and crop health, while AI algorithms process this data to offer actionable insights for optimal input management. This real-time decision-making capability improves crop yields and reduces waste, aligning with the increasing demand for precision agriculture in Japan. The seamless integration of these technologies into farming systems is transforming the way farmers manage their resources, making operations more cost-effective and sustainable.

- For instance, Kubota’s subsidiary Bloomfield Robotics utilizes AI-powered image analysis to give growers a consistent view of crop health and yield potential across thousands of plants, this technology allows for detailed crop assessment at a scale that would be impossible to achieve through manual monitoring.

Rising Adoption of Automated and Autonomous Farming Solutions

Another key trend in the Japan Crop Input Controllers Market is the increasing adoption of automated and autonomous farming solutions. These systems reduce the reliance on manual labor, which is especially crucial given Japan’s aging farming population. Automated crop input controllers offer the ability to manage inputs remotely, allowing farmers to monitor and adjust systems without being physically present. Autonomous equipment, such as drones and automated tractors, is being integrated with crop input controllers to optimize operations further. This trend is expected to continue as farmers seek ways to improve productivity while addressing labor shortages, making these technologies a crucial aspect of Japan’s future agricultural landscape.

- For instance, Yanmar’s Robot Tractor technology enables a single operator to manage the simultaneous operation of 2 tractors. This allows one person to perform the work of two, significantly improving labor efficiency.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary challenges faced by the Japan Crop Input Controllers Market is the high initial investment and ongoing maintenance costs associated with advanced technologies. These systems require substantial upfront capital for installation and integration, which can be a significant barrier for small and medium-sized farms. The maintenance and operation of crop input controllers also demand skilled labor, adding to the overall cost burden. Despite the long-term benefits of increased productivity and resource optimization, the high cost of adoption remains a concern for many farmers, limiting the widespread implementation of these systems.

Resistance to Technological Change and Skill Gaps

Another challenge in the Japan Crop Input Controllers Market is the resistance to technological change, especially among the older farming population. Many farmers are accustomed to traditional farming methods and may be hesitant to adopt new technologies. Additionally, there is a gap in technical expertise required to operate and maintain these advanced systems. The shortage of skilled professionals who can manage and troubleshoot these technologies further complicates adoption. While younger farmers are more open to new technologies, the need for proper training and education is critical to overcoming this barrier and ensuring the effective use of crop input controllers.

Market Opportunities:

Government Initiatives and Support for Smart Farming

A significant opportunity in the Japan Crop Input Controllers Market lies in the government’s continued initiatives to support smart farming. Japan’s government provides financial incentives and research funding to encourage the adoption of advanced agricultural technologies. These efforts aim to improve farm productivity, address labor shortages, and enhance sustainability. With government backing, farmers are increasingly encouraged to implement precision agriculture solutions. This support lowers the financial barriers to entry, enabling more farmers to access crop input controllers and reap the benefits of efficient resource management.

Expansion of Sustainable and Precision Farming Practices

Another key opportunity for the Japan Crop Input Controllers Market is the growing shift towards sustainable and precision farming practices. As environmental concerns increase, farmers are focusing on reducing resource wastage, such as excessive water and fertilizer use. Crop input controllers enable precise management, helping farmers meet sustainability goals while improving yields. This market is positioned for growth as more farmers adopt eco-friendly practices to minimize their environmental footprint. The growing demand for organic and sustainably produced crops also drives the need for advanced input management technologies, creating a favorable environment for the market’s expansion.

Market Segmentation Analysis:

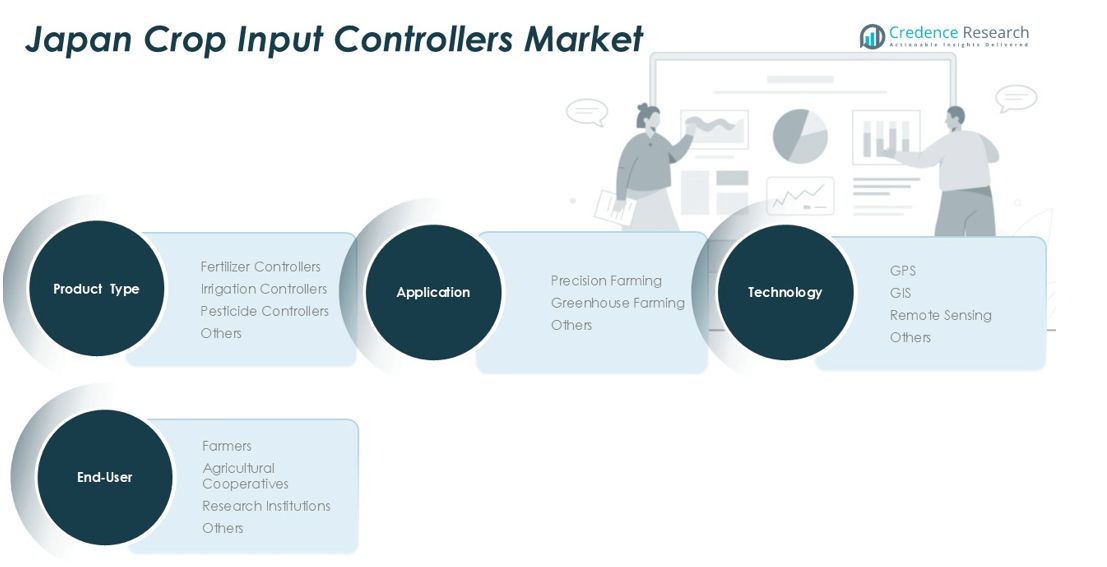

By Product Type

The Japan Crop Input Controllers Market is segmented into fertilizer controllers, irrigation controllers, pesticide controllers, and others. Fertilizer controllers lead the market, as they help manage nutrient applications efficiently, boosting crop yields while reducing excess fertilizer use. Irrigation controllers are gaining prominence due to the growing need for efficient water management, especially in light of sustainability concerns. Pesticide controllers are increasingly important for optimizing pesticide usage, minimizing waste, and ensuring environmentally friendly farming practices.

- For instance, Sumika Agrotech’s Sumisansui R-Wide irrigation tube is designed for efficient water distribution, with a single tube capable of irrigating a maximum width of 10 meters over a 100-meter length to ensure uniform coverage.

By Application

The primary applications for crop input controllers in Japan are precision farming and greenhouse farming. Precision farming dominates the market as it enables farmers to optimize resource allocation through real-time data analysis and automation. This method improves productivity and reduces waste, contributing to its widespread adoption. Greenhouse farming also holds a significant share, with crop input controllers being essential for maintaining controlled environments, improving crop output, and optimizing input usage in such settings.

- For instance, Kubota’s Smart Agri System (KSAS) shows the successful adoption of precision farming in Japan, with the data-driven management system being used by 28,000 farmers as of June 2024.

By Technology

The market is divided into GPS, GIS, remote sensing, and other technologies. GPS and GIS technologies are essential for mapping and monitoring crop inputs, enabling precise resource management. Remote sensing technologies further enhance the accuracy of crop input management by providing real-time data on crop health, soil conditions, and other vital metrics. These advanced technologies are critical for improving the effectiveness and efficiency of crop input controllers, supporting precision agriculture practices in Japan.

Segmentations:

By Product Type:

- Fertilizer Controllers

- Irrigation Controllers

- Pesticide Controllers

- Others

By Application:

- Precision Farming

- Greenhouse Farming

- Others

By Technology:

- GPS

- GIS

- Remote Sensing

- Others

By End-User:

- Farmers

- Agricultural Cooperatives

- Research Institutions

- Others

Regional Analysis:

Adoption of Precision Agriculture Technologies in Japan

The Japan Crop Input Controllers Market holds a significant share, with precision agriculture technologies contributing 30% to market growth. Japan’s advanced technological landscape has led to widespread adoption of smart farming solutions, enhancing efficiency and productivity. IoT, AI, and automation are increasingly integrated into farming operations, helping farmers optimize input management and reduce costs. This trend is expected to continue as Japan focuses on modernizing its agricultural sector while addressing challenges like labor shortages. The growing interest in precision farming also reflects Japan’s commitment to sustainable agricultural practices, driving further market expansion.

Government Support and Policy Initiatives for Smart Farming

The Japan Crop Input Controllers Market has a 25% share, driven by government initiatives that support smart farming technologies. The Japanese government actively promotes precision agriculture through financial incentives, subsidies, and research funding for sustainable farming. These policies are instrumental in encouraging farmers to adopt modern agricultural solutions, reducing the financial burden of implementation. As these policies strengthen, more farmers are adopting crop input controllers to improve efficiency and resource management. Government support plays a vital role in increasing market penetration, especially in enhancing long-term agricultural sustainability.

Regional Challenges and Growth Opportunities in Rural Areas

Rural areas contribute to 20% of the Japan Crop Input Controllers Market, with significant growth opportunities despite facing challenges. The aging farming population and limited technical expertise in rural regions have slowed the adoption of advanced technologies. However, targeted initiatives, such as cost-effective solutions and educational programs, can help accelerate adoption. With continued government support, rural Japan offers substantial growth potential for the crop input controllers market. As rural areas modernize, the demand for these technologies is projected to rise significantly.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kubota Corporation

- CNH Industrial N.V.

- AGCO Corporation

- John Deere

- Trimble Inc.

- Topcon Positioning Systems, Inc.

- Raven Industries, Inc.

- Hexagon Agriculture

- Bayer CropScience AG

- Syngenta AG

- BASF SE

- Yara International ASA

Competitive Analysis:

The Japan Crop Input Controllers Market is highly competitive, with key players focusing on technological innovation and precision farming solutions. Major companies such as Kubota Corporation, CNH Industrial N.V., and AGCO Corporation lead the market by offering advanced controllers for fertilizer, irrigation, and pesticide management. These companies emphasize product differentiation through integration of GPS, GIS, and remote sensing technologies, which enhance the accuracy and efficiency of crop management. The market also sees competition from Trimble Inc. and Topcon Positioning Systems, Inc., which provide robust solutions for agricultural automation. Industry leaders like Bayer CropScience AG and Syngenta AG contribute to the market with integrated crop input management systems that align with sustainable farming practices. Competitive strategies include ongoing product development, strategic partnerships, and expanding product portfolios to address the increasing demand for efficient, eco-friendly farming solutions. The market remains dynamic, with companies striving to meet the evolving needs of Japan’s agricultural sector.

Recent Developments:

- In August 2025, Escorts Kubota, in partnership with Kubota Corporation, launched the new Kubota MU4201 tractor in India, marking the brand’s entry into the 41-44 HP category in the country.

- In February 2025, AGCO entered into a new strategic partnership with SDF, under which SDF will manufacture proprietary tractors with up to 85 horsepower for AGCO’s Massey Ferguson brand, with production starting in mid-2025.

- In May 2025, John Deere announced that its most powerful production tractor, the 9RX 830, would make its public debut at the Cereals 2025 event.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Technology and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Crop Input Controllers Market will continue to grow as precision agriculture becomes more integral to farming practices.

- Increasing demand for automation will drive further adoption of crop input controllers to optimize resource management in agriculture.

- Advancements in IoT and AI will enable more accurate and real-time data analysis, improving crop management and input control.

- The Japanese government will likely increase support for sustainable farming technologies, encouraging wider adoption of crop input controllers.

- Integration of new technologies, such as machine learning and advanced sensors, will enhance the functionality of crop input controllers.

- The focus on reducing environmental impact will further propel the adoption of smart farming solutions, improving sustainability.

- Rural areas in Japan will present growth opportunities, with targeted initiatives to help farmers adopt crop input controllers more effectively.

- The need for enhanced crop yields and resource optimization will push farmers to adopt more advanced and efficient crop input management solutions.

- Key players will continue innovating their products, offering customizable solutions to meet specific regional and crop needs.

- The market will likely see greater collaboration between technology providers and agricultural cooperatives, improving accessibility and support for farmers.