Market Overview:

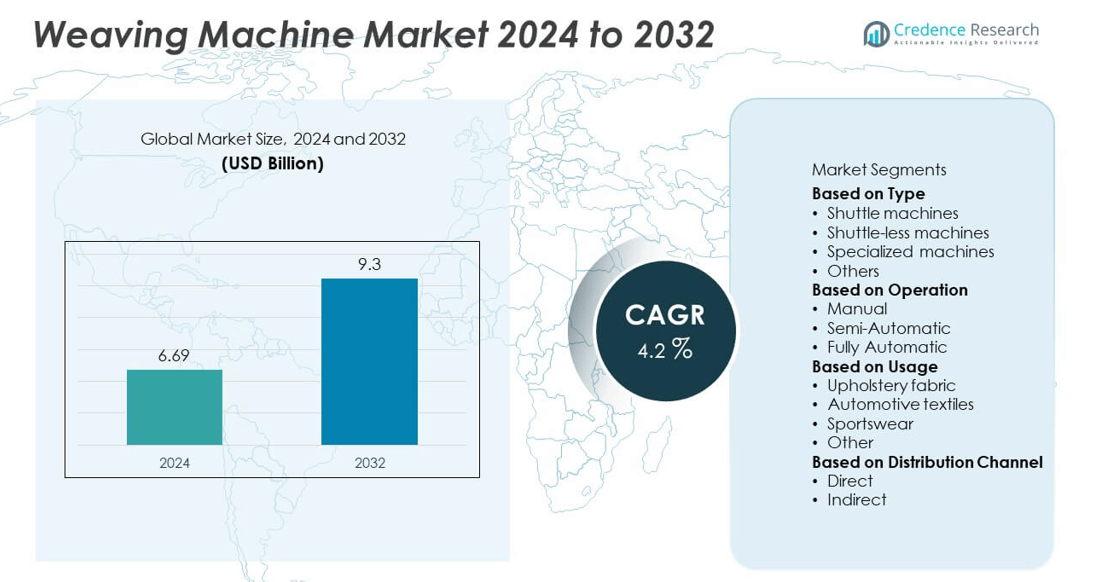

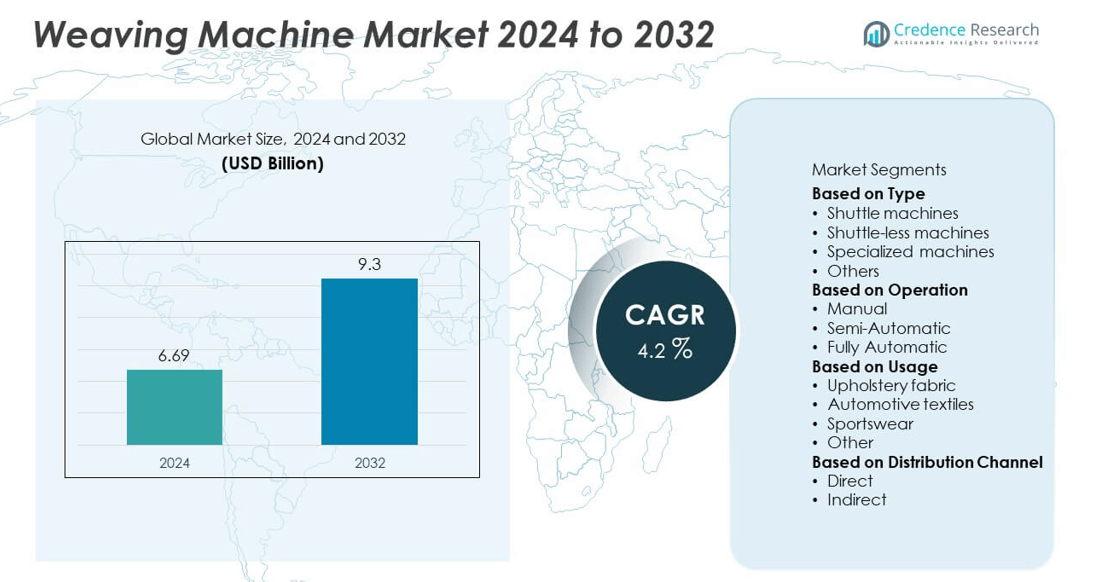

The weaving machine market was valued at USD 6.69 billion in 2024 and is projected to reach USD 9.3 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Weaving Machine Market Size 2024 |

USD 6.69 billion |

| Weaving Machine Market, CAGR |

4.2% |

| Weaving Machine Market Size 2032 |

USD 9.3 billion |

The weaving machine market is led by major players including KARL MAYER, Picanol, Itema, Saurer Group, Dornier, Lohia Corp Limited, RIFA, Nisshinbo Industries, Laxmi Group, and Fong’s National Engineering. These companies dominate through advanced weaving technologies, automation integration, and strong service networks, catering to both apparel and technical textile industries. North America accounted for 20% share in 2024, supported by demand for high-quality technical textiles. Asia-Pacific led with 42% share, driven by large-scale textile manufacturing in China, India, and Southeast Asia. Europe held 28% share, supported by strong adoption of energy-efficient and digitally controlled weaving machines.

Market Insights

- The weaving machine market was valued at USD 6.69 billion in 2024 and is projected to reach USD 9.3 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

- Growth is driven by rising demand for advanced weaving machines with automation features and increasing production of technical textiles, sportswear, and automotive fabrics across global markets.

- Key trends include adoption of energy-efficient, digitally controlled machines and rising use of shuttle-less looms for high-speed, precision fabric manufacturing, boosting productivity and reducing downtime.

- The market is competitive with key players such as KARL MAYER, Picanol, Itema, and Saurer Group focusing on innovation, R&D, and strategic partnerships to expand their presence in emerging economies.

- Asia-Pacific led with 42% share in 2024, followed by Europe at 28% and North America at 20%; by type, shuttle-less machines dominated with over 50% share, driven by demand for faster and more efficient weaving operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Shuttle-less machines dominated the weaving machine market in 2024, holding over 65% share due to their higher productivity, reduced noise levels, and ability to produce superior fabric quality. Air-jet and rapier looms are widely used across large-scale textile manufacturing units, enabling faster output and minimal maintenance compared to traditional shuttle machines. Demand for shuttle-less technology is driven by the rising need for efficient, automated fabric production to meet global demand for apparel, technical textiles, and home furnishings. Specialized machines are gaining traction for niche applications like medical textiles and industrial fabrics.

- For instance, Kanoria-Africa Textile’s facility produced an average of 391 meters per loom daily using air-jet looms, which was significantly below its target production of 500 meters and achieved at a suboptimal 61% efficiency due to issues like yarn breakages and weaver performance.

By Operation

Fully automatic weaving machines accounted for more than 55% share in 2024, driven by the textile industry’s shift toward automation and Industry 4.0 adoption. These machines reduce labor dependency, improve precision, and deliver consistent output, making them highly preferred by large manufacturers. Semi-automatic machines follow in demand, particularly among mid-scale producers balancing cost and efficiency. Manual weaving machines retain use in small-scale, artisanal, and traditional textile clusters where craftsmanship and customization are prioritized. Rising labor costs and demand for high-speed production are expected to further boost adoption of fully automated systems.

- For instance, in India’s Ichalkaranji powerloom cluster, the introduction of four imported rapier looms has led to productivity gains beyond traditional plain looms, with enhanced production rates and lowered waste levels, supporting export-ready fabric quality.

By Usage

Upholstery fabric production led the market with over 40% share in 2024, supported by growing demand from furniture, home décor, and commercial interior applications. The rise of premium residential projects and hospitality sector investments is fueling consumption of high-quality woven upholstery materials. Automotive textiles are the second-largest segment, driven by the use of durable woven fabrics in seat covers, airbags, and interior components. Sportswear weaving applications are expanding, supported by rising demand for breathable, stretchable, and performance fabrics. Diversification into technical and industrial textiles is creating additional growth opportunities for machine manufacturers.

Market Overview

Rising Demand for Technical Textiles

Technical textiles are increasingly used in automotive, medical, industrial, and protective applications, driving demand for advanced weaving machines. Manufacturers are upgrading to shuttle-less and specialized looms to produce high-strength, precision fabrics. The growth of airbags, geotextiles, and filtration media production is expanding machine installations. Government programs encouraging local textile manufacturing and infrastructure investments are further boosting market growth, particularly in Asia-Pacific, which is a key hub for technical textile production.

- For instance, Toyota Group company Toyota Industries Corporation is a major manufacturer of weaving machinery, including high-speed air-jet looms. These advanced, shuttle-less weaving machines are used globally for high-quality technical textiles, including the precise, strong fabrics required for airbags.

Automation and Industry 4.0 Adoption

Automation and digitalization are transforming the weaving industry. Fully automatic and IoT-enabled weaving machines are improving productivity, reducing defects, and enabling predictive maintenance. Industry 4.0 integration allows real-time data monitoring, faster production changeovers, and higher consistency, addressing labor shortages and rising quality requirements. This technological shift is helping manufacturers reduce operational costs and remain competitive in global textile supply chains while meeting the growing demand for customized and small-batch production runs.

- For instance, Picanol Group implemented its PicConnect online platform, which uses IoT technology for features like predictive maintenance and real-time alerts, at its facility in Belgium to help maximize machine uptime, improve operational efficiency, and boost overall productivity.

Growth in Apparel and Home Textile Production

Rising disposable incomes and changing lifestyle patterns are boosting demand for apparel, home furnishings, and upholstery textiles worldwide. Weaving machine manufacturers benefit as mills invest in higher capacity and modern equipment to meet surging demand. E-commerce and fast fashion trends are pushing textile producers to adopt machines with faster output and flexible operation. Emerging economies such as India and China are witnessing significant capacity expansions, making them major growth engines for the weaving machine market over the forecast period.

Key Trends & Opportunities

Shift Toward Energy-Efficient and Sustainable Machines

Manufacturers are introducing weaving machines that consume less power and use eco-friendly components to meet global sustainability targets. Energy-efficient air-jet and rapier looms help textile mills lower production costs and carbon footprints. This shift aligns with stricter energy regulations and growing demand from brands focusing on sustainable supply chains.

- For instance, Klüber Lubrication’s Klübersynth MEG 4 lubricant helped reduce energy consumption by up to 4% in high-load rapier weaving machines, contributing to lower operational costs and extended gear and machine life in large textile mills.

Digital Weaving and Design Customization

Digital weaving solutions and CAD-driven design software are enabling faster prototyping and small-batch production of premium fabrics. This trend supports customization and personalization in fashion, sportswear, and luxury home textiles. It creates opportunities for machine suppliers offering integrated software and hardware solutions to meet this rising demand.

- For instance, Picanol Group’s OptiMax-i Connect or Ultimax automated weaving machines integrate CAD software using its PicConnect digital platform, allowing for quick design adjustments and flexible batch sizes.

Key Challenges

High Capital and Maintenance Costs

Advanced weaving machines require significant investment, making adoption challenging for small and mid-sized textile firms. Maintenance and replacement of high-precision components further increase total cost of ownership. Limited financing options can slow modernization efforts in cost-sensitive regions.

Shortage of Skilled Operators

Operating modern weaving machines with automation and digital controls requires skilled technicians. A shortage of trained workers often leads to inefficiencies, underutilization, and production delays. Collaborations between OEMs and training institutes are needed to build a skilled workforce and maximize equipment efficiency.

Regional Analysis

North America

North America held 26% share of the weaving machine market in 2024, supported by demand for high-performance fabrics and technical textiles. The U.S. leads the region with strong investment in industrial textiles, airbags, and protective clothing production. Automation adoption is high, with mills focusing on upgrading to fully automatic and IoT-enabled weaving systems. The region benefits from advanced R&D capabilities and strong presence of textile machinery distributors. Growth is also driven by reshoring initiatives and sustainable textile production, creating opportunities for energy-efficient weaving solutions and smart manufacturing systems.

Europe

Europe accounted for 28% share in 2024, driven by demand for premium textiles and advanced weaving technology. Germany, Italy, and France lead production, focusing on high-quality apparel, home textiles, and industrial fabrics. European manufacturers are adopting energy-efficient weaving machines to comply with strict emission and sustainability regulations. The presence of leading machine makers and innovation hubs drives adoption of digital weaving technologies. Investments in luxury and technical textiles, combined with export demand, are fueling equipment upgrades, with the region maintaining strong focus on sustainable production and circular economy practices.

Asia-Pacific

Asia-Pacific captured 34% share of the global weaving machine market in 2024, making it the largest and fastest-growing region. China and India dominate with massive textile manufacturing bases, fueled by domestic consumption and export-oriented production. Government initiatives supporting modernization and subsidies for advanced machinery are boosting market growth. Rising demand for apparel, home furnishings, and industrial textiles is encouraging investment in shuttle-less and fully automatic looms. Rapid urbanization and expanding middle-class populations are strengthening textile consumption, positioning Asia-Pacific as the key growth engine for weaving machine manufacturers worldwide.

Latin America

Latin America held 7% share in 2024, with Brazil and Mexico leading textile production and machinery demand. The region’s growth is supported by rising exports of apparel and home textiles to North America and Europe. Manufacturers are gradually adopting automated weaving machines to improve competitiveness and meet international quality standards. Government programs promoting domestic textile production and foreign investment are contributing to steady market development. However, challenges such as economic fluctuations and limited financing options slightly restrain rapid adoption of high-cost advanced weaving technologies in this region.

Middle East & Africa

The Middle East & Africa region accounted for 5% share of the weaving machine market in 2024, with growth driven by investments in textile parks and industrial diversification. Countries such as Turkey, Egypt, and South Africa are leading adoption, focusing on domestic textile production and exports. The demand for weaving machines is increasing in sectors like upholstery, uniforms, and technical fabrics. Infrastructure development and government incentives are encouraging local textile manufacturing. However, the market faces challenges from limited skilled workforce and high import dependency, which creates opportunities for regional machinery suppliers and training initiatives.

Market Segmentations:

By Type

- Shuttle machines

- Shuttle-less machines

- Specialized machines

- Others

By Operation

- Manual

- Semi-Automatic

- Fully Automatic

By Usage

- Upholstery fabric

- Automotive textiles

- Sportswear

- Other

By Distribution Channel

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape of the weaving machine market is shaped by leading players such as KARL MAYER, RIFA, Lohia Corp Limited, Picanol, Nisshinbo Industries, Itema, Saurer Group, Dornier, Laxmi Group, and Fong’s National Engineering. These companies focus on developing high-performance weaving solutions with advanced automation and energy-efficient features to meet the growing demand for technical textiles, apparel fabrics, and industrial applications. Strategic initiatives include expanding manufacturing facilities, investing in R&D, and launching fully automated and digitalized weaving systems that enhance productivity and reduce downtime. Partnerships with textile manufacturers and integration of IoT-based monitoring systems are becoming common to offer predictive maintenance and improve machine efficiency. Competitive differentiation is driven by technology leadership, global distribution networks, and strong aftersales service. With rising demand from Asia-Pacific and Europe, market players are strengthening regional footprints to serve both mass-production textile hubs and premium segments seeking precision weaving and innovative fabric designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KARL MAYER

- RIFA

- Lohia Corp Limited

- Picanol

- Nisshinbo Industries

- Itema

- Saurer Group

- Dornier

- Laxmi Group

- Fong’s National Engineering

Recent Developments

- In February 2025, Karl Mayer launched its new 26 B batching device for special Raschel weaving machines, integrating KAMCOS® 2 control and improved safety features.

- In January 2025, Ekoten Textile (Turkey) invested in Karl Mayer tricot machines. The machines arrived in December 2024; production scheduled to begin in January 2025.

- In 2025, Karl Mayer showcased the HKS 3 M-ON warp knitting machine, the PROWARP automatic sectional warping machine, and the WEFTTRONIC II RS high-performance Raschel machine at Techtextil North Americ

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Usage, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for shuttle-less weaving machines will continue to rise for faster production speeds.

- Automation and digital controls will become standard features to enhance precision and efficiency.

- Adoption of weaving machines for technical textiles will expand in automotive and medical sectors.

- Energy-efficient machines will gain traction as manufacturers focus on sustainability goals.

- Integration of IoT and smart monitoring will improve predictive maintenance and reduce downtime.

- Asia-Pacific will remain the largest market, driven by rising textile exports and production capacity.

- European manufacturers will invest in premium, high-performance weaving technologies for niche fabrics.

- Partnerships between machine makers and textile producers will accelerate technology adoption.

- Growing demand for customized fabrics will encourage development of versatile, multi-purpose weaving machines.

- Emerging markets will witness higher machine installations as governments promote local textile manufacturing.