Market Overview:

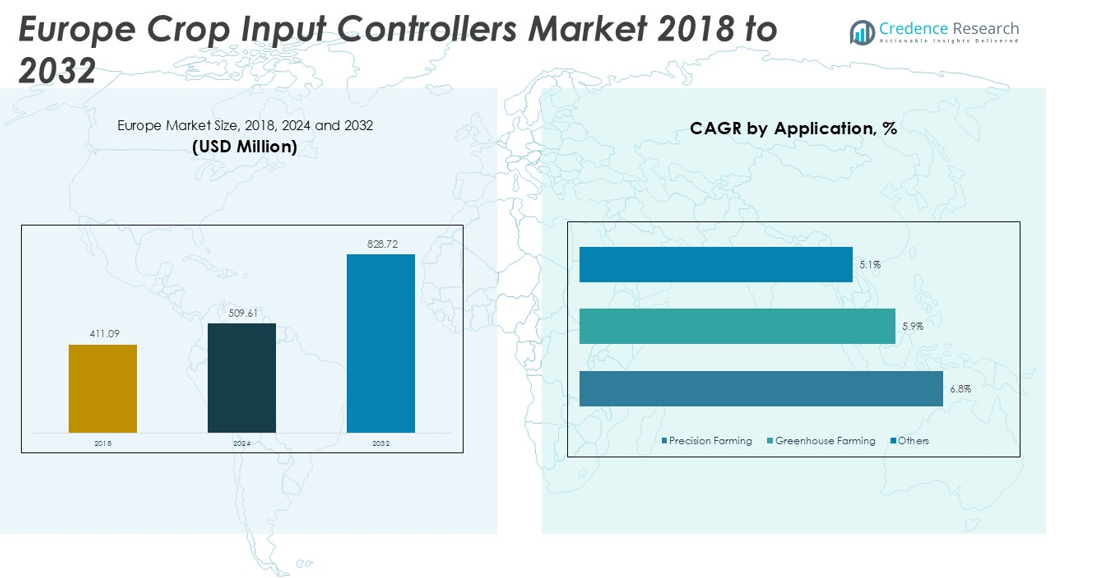

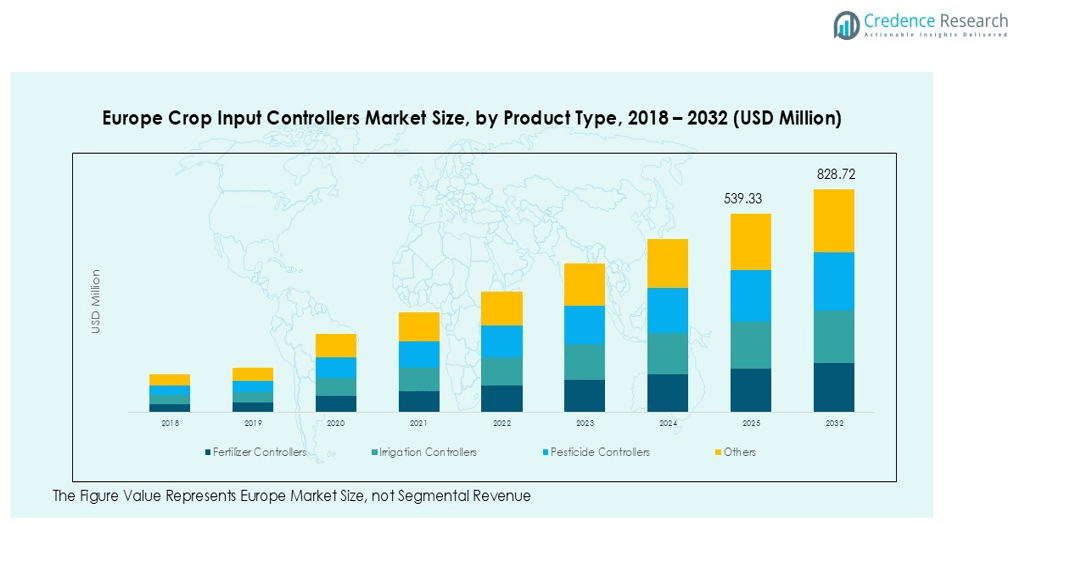

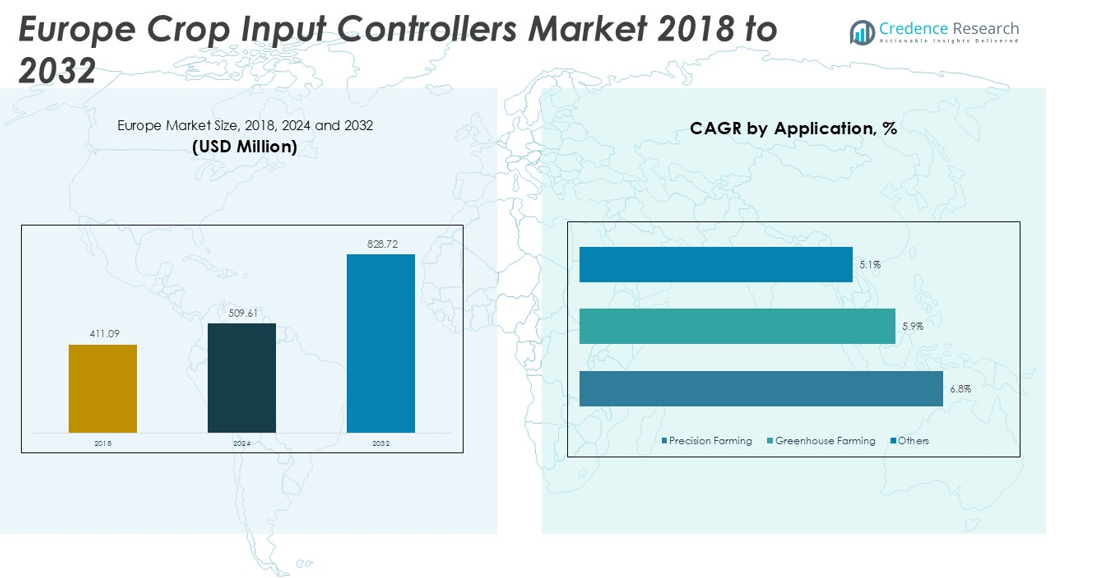

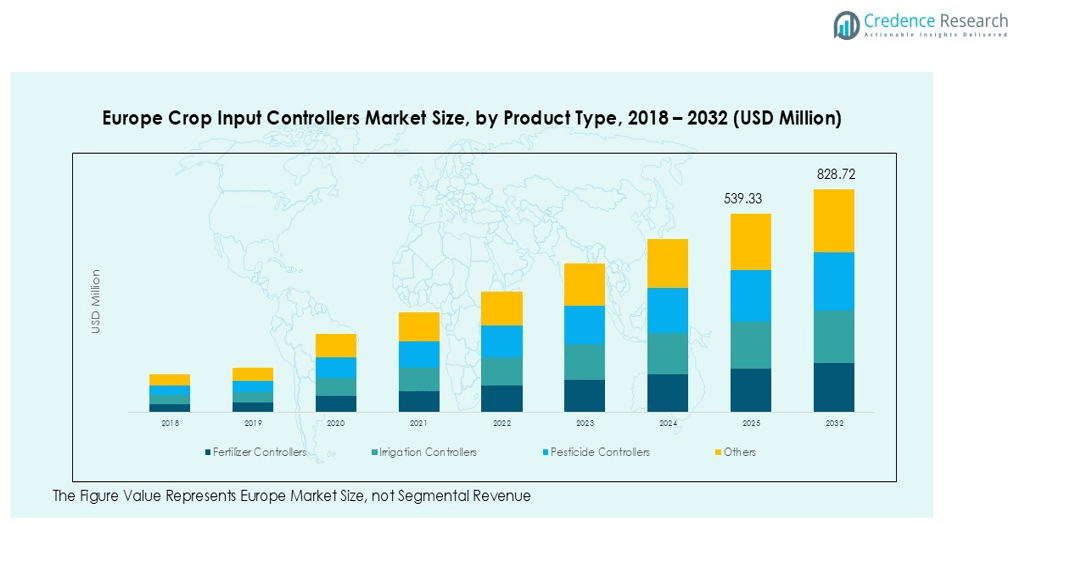

The Europe Crop Input Controllers Market size was valued at USD 411.09 million in 2018 to USD 509.61 million in 2024 and is anticipated to reach USD 828.72 million by 2032, at a CAGR of 5.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Crop Input Controllers Market Size 2024 |

USD 509.61 million |

| Europe Crop Input Controllers Market, CAGR |

5.14% |

| Europe Crop Input Controllers Market Size 2032 |

USD 828.72 million |

The key drivers of market growth include the rising demand for precision agriculture solutions, aimed at enhancing farm productivity and minimizing resource wastage. The growing need for sustainable farming practices and government support for smart farming technologies also contribute significantly to market expansion. Furthermore, advancements in sensor technologies, artificial intelligence (AI), and IoT integration are enabling farmers to manage inputs more efficiently, leading to better crop yield and cost savings.

Regionally, the market is witnessing strong growth in countries such as the U.K., Germany, and France, where large-scale farming operations are increasingly adopting precision farming techniques. The push for sustainability and more efficient farming methods, along with a shift toward eco-friendly practices, is accelerating the demand for crop input controllers across these regions.

Market Insights:

- The Europe Crop Input Controllers market was valued at USD 509.61 million in 2024 and is expected to reach USD 828.72 million by 2032, growing at a CAGR of 5.14%.

- Precision agriculture and automation are key drivers, as farmers aim to enhance operational efficiency and reduce resource wastage.

- Government incentives supporting sustainable farming practices encourage the adoption of smart farming technologies, including crop input controllers, to optimize resource usage.

- Advancements in sensor technologies, artificial intelligence (AI), and IoT are enabling farmers to monitor and manage inputs more efficiently, resulting in improved crop yields and cost savings.

- The market is witnessing strong growth in Western Europe, with the U.K., Germany, and France leading the adoption of precision farming techniques.

- Eastern Europe is emerging as a growing market, with countries like Poland and Romania increasing the adoption of crop input controllers, aided by EU-funded initiatives.

- In Southern and Northern Europe, regions are seeing diverse adoption rates, with Northern Europe showing rapid growth driven by sustainability goals, while Southern Europe faces financial constraints but gradually integrates advanced technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Agriculture and Automation

The growing adoption of precision agriculture is a significant driver for the Europe Crop Input Controllers market. Farmers increasingly seek ways to enhance operational efficiency and productivity while minimizing costs and resource usage. Precision farming technologies, such as crop input controllers, provide real-time monitoring and data-driven insights for optimal input management. These technologies help reduce waste and ensure more sustainable farming practices, contributing to higher crop yields and reduced environmental impact.

- For instance, the collaboration between John Deere and BASF’s xarvio® Digital Farming Solutions helps farmers optimize crop production, field trials in Europe have shown that using their variable rate application maps provides an average benefit of €27 per hectare.

Government Support for Sustainable Farming Practices

European governments are prioritizing sustainable agriculture through policies and incentives that promote smart farming solutions. Initiatives aimed at reducing the environmental footprint of farming practices, such as reducing water and fertilizer usage, are driving the adoption of crop input controllers. The EU’s Common Agricultural Policy (CAP) and other regional support programs encourage farmers to integrate technology in their operations, further boosting the demand for advanced crop input controllers.

Technological Advancements in Sensor Technologies and AI Integration

Technological advancements in sensor technology and artificial intelligence (AI) have accelerated the growth of the Europe Crop Input Controllers market. Sensors enable real-time tracking of crop conditions, while AI algorithms optimize input applications, leading to increased efficiency. These innovations allow farmers to make more informed decisions regarding water usage, nutrient application, and pest control, significantly improving crop performance and reducing costs.

- For instance, Ecorobotix’s ARA smart sprayer uses AI and high-resolution cameras to identify and treat individual plants, this technology enables ultra-precise spraying, reducing the application area to a 6 cm x 6 cm minimum on a selected target.

Shift Towards Eco-Friendly and Efficient Agricultural Practices

A growing emphasis on environmentally responsible farming practices is another key driver for the Europe Crop Input Controllers market. Consumers and regulatory bodies increasingly demand sustainable agricultural methods that reduce chemical use and resource wastage. Crop input controllers facilitate eco-friendly practices by ensuring that only the necessary inputs are used, thus contributing to sustainable farming while meeting consumer and regulatory expectations.

Market Trends:

Integration of Internet of Things (IoT) and Automation in Crop Input Controllers

The integration of Internet of Things (IoT) technology is becoming a key trend in the Europe Crop Input Controllers market. IoT enables real-time monitoring of crop conditions, allowing farmers to adjust inputs such as water, fertilizers, and pesticides dynamically. This integration supports more accurate, data-driven decisions, optimizing input usage and reducing waste. Smart sensors and connected devices enable automation, minimizing human intervention and improving operational efficiency. The use of IoT also enhances the traceability and transparency of farming practices, which aligns with the growing consumer demand for sustainable and ethically sourced agricultural products. As IoT continues to evolve, crop input controllers are becoming more advanced, offering more precise control over agricultural inputs.

- For instance, Pessl Instruments, an Austrian company, has successfully deployed more than 60,000 iMETOS systems worldwide.

Adoption of Artificial Intelligence (AI) for Predictive Analysis and Decision Making

Artificial Intelligence (AI) is gaining traction in the Europe Crop Input Controllers market as it enables predictive analytics for more accurate decision-making. AI-powered algorithms analyze large volumes of data from sensors to forecast crop needs, including water and nutrient requirements. By predicting future conditions and input needs, AI helps farmers manage resources more effectively, reducing costs and enhancing productivity. The growing interest in AI-driven solutions is a response to the need for precision in modern farming practices. As these technologies advance, the integration of AI in crop input controllers will continue to improve the efficiency, scalability, and sustainability of farming operations across Europe. The growing reliance on AI-powered tools reflects the industry’s shift toward data-driven farming, improving the overall effectiveness of crop input management.

- For instance, in 2025, BASF Digital Farming launched its xarvio® FIELD MANAGER platform to support wine and table grape cultivation across 4 European and Turkish markets.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary challenges facing the Europe Crop Input Controllers market is the high initial investment and maintenance costs associated with these systems. Small and medium-sized farms, in particular, find it difficult to afford advanced crop input controllers due to the significant upfront capital required. While the long-term benefits of these systems are evident, such as reduced resource wastage and higher productivity, the cost barrier remains a deterrent for widespread adoption. In addition to the initial investment, ongoing maintenance and system upgrades can be costly, further complicating the financial accessibility of these technologies for many farmers.

Lack of Technical Knowledge and Skilled Workforce

The adoption of crop input controllers in Europe is also hindered by the lack of technical knowledge and skilled personnel required to operate these advanced systems. Many farmers may struggle with the complexities of integrating and managing technology such as IoT-enabled devices and AI-powered algorithms. The need for specialized training in precision agriculture technologies limits the efficiency of system implementation and usage. This skills gap can lead to underutilization of crop input controllers, reducing their effectiveness and hindering market growth. Addressing this challenge requires better education and training programs for farmers to fully leverage the potential of these advanced technologies.

Market Opportunities:

Growth in Sustainable Farming Practices and Government Incentives

The increasing focus on sustainable farming practices presents significant opportunities for the Europe Crop Input Controllers market. Governments across Europe are offering financial incentives to farmers who adopt eco-friendly farming methods, which include precision agriculture technologies like crop input controllers. These technologies help farmers optimize the use of resources such as water, fertilizers, and pesticides, contributing to more sustainable production. With environmental regulations becoming stricter, there is a growing push for agricultural solutions that minimize waste and reduce environmental impact. Crop input controllers align well with these demands, offering farmers the tools to meet both regulatory requirements and consumer preferences for sustainably produced goods.

Expanding Use of Data-Driven Farming Solutions

There is a growing opportunity for the Europe Crop Input Controllers market driven by the increasing use of data-driven farming solutions. As the agriculture industry shifts towards more precise and informed decision-making, the demand for technologies that offer real-time data on soil health, crop conditions, and resource usage continues to rise. Crop input controllers are central to this shift, enabling farmers to make better-informed decisions and improve overall farm efficiency. As data analytics and AI integration advance, these systems are becoming more accessible and effective, further enhancing their appeal. This opens the door for broader adoption across various types of farms, including those previously reluctant to adopt such technologies.

Market Segmentation Analysis:

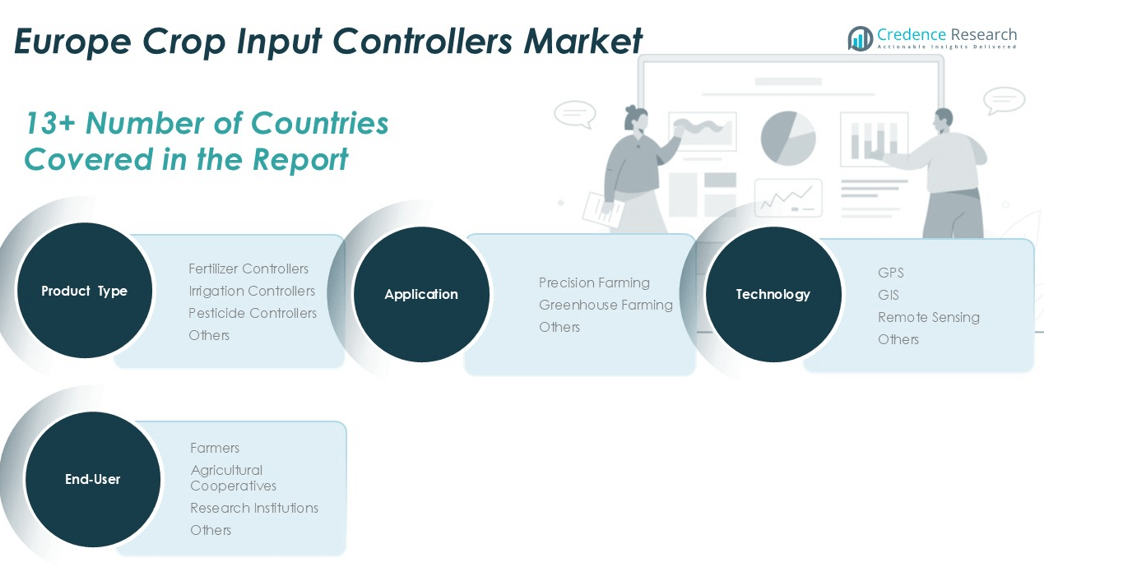

By Product Type

The Europe Crop Input Controllers market is primarily driven by fertilizer controllers, irrigation controllers, and pesticide controllers. Fertilizer controllers hold the largest market share, optimizing nutrient management and boosting crop yields. Irrigation controllers are gaining momentum due to their efficiency in water usage, particularly in regions with water scarcity. Pesticide controllers focus on minimizing pesticide application, reducing environmental impact while ensuring effective crop protection.

- For instance, Galcon’s FERTIGAL direct injection fertigation system can be configured with up to 8 fertilizer channels that are activated simultaneously for precise, synchronized nutrient delivery.

By Application

Precision farming and greenhouse farming are the major applications of crop input controllers. Precision farming is the dominant segment, enabling farmers to optimize resources and enhance crop productivity through real-time data and automation. Greenhouse farming is increasingly adopting crop input controllers to regulate environmental conditions, ensuring improved crop quality and higher yields, particularly in controlled environments.

- For instance, John Deere’s RTK guidance system used in its 8R series tractors provides precise pass-to-pass positioning accuracy of +/- 2.5 cm, enhancing the accuracy of field operations like planting and nutrient application.

By Technology

Key technologies driving the market include GPS, GIS, and remote sensing. GPS technology aids in precise field mapping and data collection, enhancing input application efficiency. GIS technology is crucial for spatial data analysis, optimizing resource distribution. Remote sensing technology enables real-time monitoring, helping farmers manage inputs more accurately. These technologies, when integrated into crop input controllers, enhance farming precision and resource efficiency.

Segmentations:

By Product Type:

- Fertilizer Controllers

- Irrigation Controllers

- Pesticide Controllers

- Others

By Application:

- Precision Farming

- Greenhouse Farming

- Others

By Technology:

- GPS

- GIS

- Remote Sensing

- Others

By End-User:

- Farmers

- Agricultural Cooperatives

- Research Institutions

- Others

Regional Analysis:

Western Europe: Leading the Adoption of Smart Farming Solutions

Western Europe holds the largest share of the Europe Crop Input Controllers market, accounting for 42%. Countries such as the United Kingdom, Germany, and France lead the way in adopting precision farming technologies. The region’s well-established agricultural infrastructure and significant investments in technological advancements drive this growth. A focus on sustainability and regulatory compliance encourages farmers to adopt crop input controllers, optimizing resource usage and reducing waste. Government incentives and subsidies for sustainable farming further fuel the region’s growth. The demand for these technologies continues to rise as farmers seek improved crop yields and environmental sustainability.

Eastern Europe: Emerging Market for Precision Agriculture Technologies

Eastern Europe holds a smaller share of the Europe Crop Input Controllers market, with a contribution of 22%. Countries like Poland, Hungary, and Romania are beginning to embrace precision farming technologies. Although financial constraints and lower levels of technological adoption slow growth, government programs and EU-funded initiatives are driving adoption. As awareness of the benefits of crop input controllers increases, farmers are recognizing the value of these systems in enhancing productivity and reducing costs. Over the coming years, the market in Eastern Europe is expected to expand, driven by continued agricultural modernization.

Southern and Northern Europe: Diverse Adoption and Regional Growth

Southern and Northern Europe collectively account for 36% of the Europe Crop Input Controllers market share. In Northern Europe, countries like Sweden and Denmark are incorporating smart farming technologies, driven by sustainability concerns and government policies. Meanwhile, Southern Europe, including Spain and Italy, faces challenges such as financial constraints and traditional farming practices but is gradually adopting crop input controllers. EU support for agricultural innovation is helping to accelerate growth in both regions. As awareness grows, these areas are expected to see increasing integration of crop input controllers into their farming operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Crop Input Controllers market is highly competitive, with several key players leading innovation and technological advancements. Companies such as Trimble Inc., John Deere, and AGCO Corporation dominate the market, offering a wide range of precision farming solutions. These players are investing heavily in research and development to improve the efficiency and capabilities of crop input controllers, focusing on integrating IoT, AI, and sensor technologies. The market is also witnessing strong competition from companies like Kubota Corporation and Yara International ASA, which offer tailored solutions to address specific agricultural needs. Competitive strategies include expanding product portfolios, forming strategic partnerships, and enhancing customer support services. As the market grows, players are leveraging sustainable and eco-friendly farming solutions to align with consumer demand for environmentally responsible practices. To maintain market share, companies are focusing on improving the affordability and accessibility of their products for farmers across different regions.

Recent Developments:

- In August 2025, Trimble Inc. launched its Freight Marketplace in North America, with Procter & Gamble serving as the initial shipper customer.

- In November 2024, Raven Industries, Inc. became an official distributor for Razor Tracking, a provider of fleet telematics software.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Technology and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for precision agriculture solutions will continue to rise as farmers seek to improve productivity and reduce input costs.

- Advancements in AI, IoT, and sensor technologies will drive more efficient and data-driven crop management systems.

- Sustainable farming practices will become increasingly essential, with crop input controllers playing a key role in reducing waste and environmental impact.

- Governments across Europe will continue to offer incentives to encourage the adoption of smart farming technologies, further boosting market growth.

- Automation and real-time monitoring capabilities will become more prevalent, streamlining farm operations and enhancing resource management.

- As environmental regulations tighten, crop input controllers will be critical in helping farmers comply with sustainability standards.

- The integration of advanced technologies like remote sensing, GIS, and GPS will provide farmers with more precise and actionable data for input management.

- Smaller farms will increasingly adopt affordable, scalable crop input controllers as the technology becomes more accessible.

- Partnerships between technology providers and agricultural cooperatives will foster innovation and drive wider market penetration.

- The expansion of the market in Eastern and Southern Europe will continue as more farmers recognize the benefits of precision farming technologies.