Market Overview

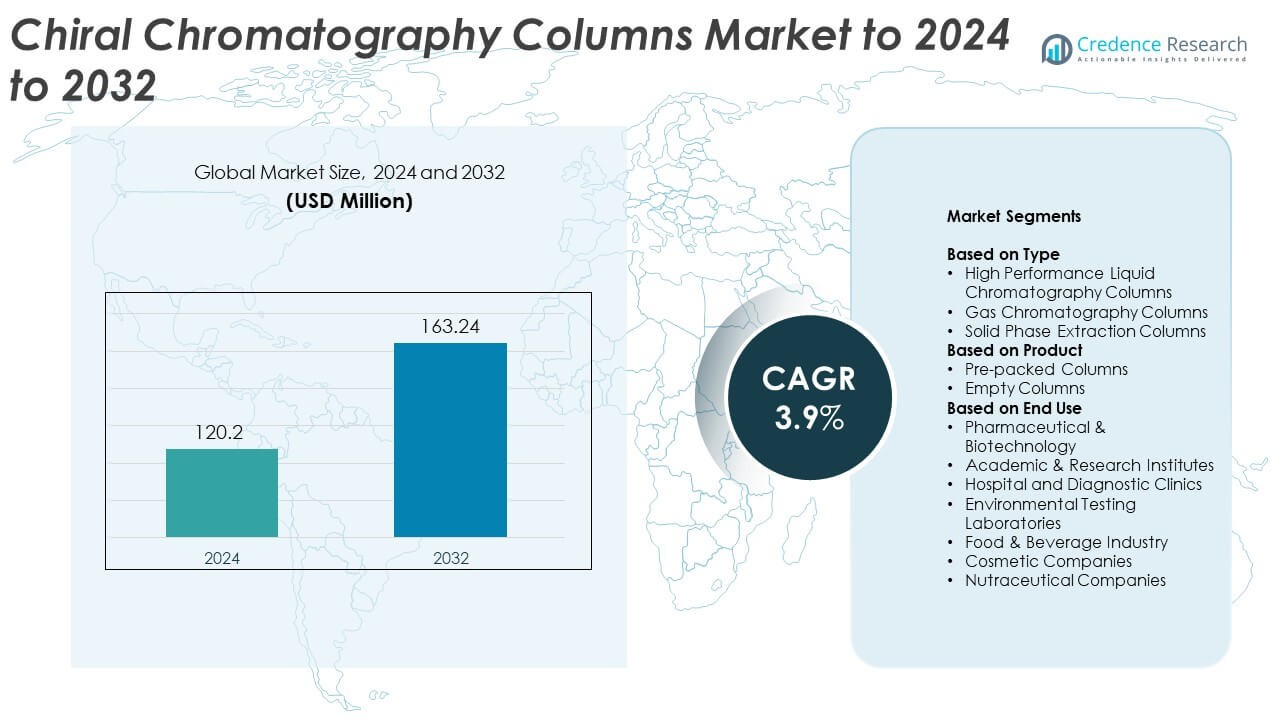

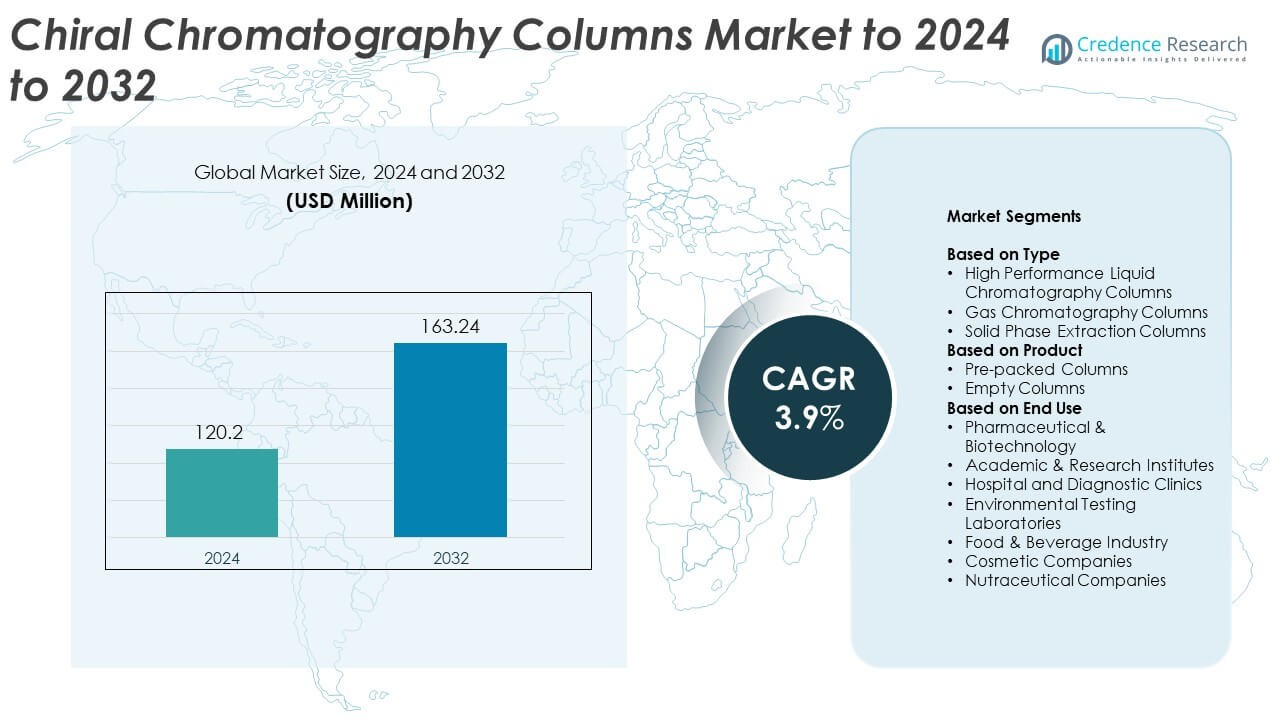

Chiral Chromatography Columns Market size was valued USD 120.2 million in 2024 and is anticipated to reach USD 163.24 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chiral Chromatography Columns Market Size 2024 |

USD 120.2 Million |

| Chiral Chromatography Columns Market, CAGR |

3.9% |

| Chiral Chromatography Columns Market Size 2032 |

USD 163.24 Million |

The chiral chromatography columns market is shaped by major players such as Shimadzu Corporation, Waters Corporation, Danaher, Daicel Corporation, Thermo Fisher Scientific, Bio-Rad Laboratories, Perkin Elmer, GE Healthcare, Cytiva, and Merck & Co., Inc. These companies strengthen their presence through advanced chiral stationary phase technologies, wider product portfolios, and strong global distribution networks. North America led the market in 2024 with 38% share due to extensive pharmaceutical research and strict regulatory requirements. Europe followed with 30% share, supported by strong life sciences infrastructure, while Asia Pacific accounted for 22%, driven by rapid expansion in generics, biosimilars, and analytical testing capabilities.

Market Insights

- The chiral chromatography columns market reached USD 120.2 million in 2024 and will approach USD 163.24 million by 2032 at a 3.9% CAGR, supported by expanding analytical applications.

- Strong demand for enantiomeric purity testing in pharmaceuticals drives market growth, as drug developers increase use of high-resolution columns in discovery, formulation, and quality-control workflows.

- Advancements in chiral stationary phases, automation-ready UHPLC formats, and high-throughput screening trends support wider adoption across commercial labs and research institutes.

- The competitive landscape includes major global providers offering broader CSP portfolios and application support, with the HPLC column segment leading at about 67% share in 2024.

- Regionally, North America held 38%, followed by Europe at 30%, while Asia Pacific accounted for 22%, supported by growing generics and biosimilar manufacturing and rising analytical testing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

High performance liquid chromatography columns dominated the type segment in 2024 with about 67% share due to their high resolution, broad compatibility with chiral stationary phases, and strong use in drug purity assessment. Pharmaceutical companies selected HPLC columns because they deliver accurate enantiomeric separation and support regulatory-driven analysis for APIs and complex intermediates. Gas chromatography columns grew in applications that require volatile chiral compound testing, while solid phase extraction columns advanced as labs adopted sample-clean-up workflows that improve accuracy and reduce analytical turnaround time.

- For instance, the Thermo Scientific/Daicel ChiralCel OD-H HPLC column uses 5 µm particle size, as published in its official column specifications.

By Product

Pre-packed columns led the product segment in 2024 with nearly 72% share, supported by rising demand for ready-to-use formats that reduce method development time. Researchers preferred pre-packed units because they ensure consistent packing density, reduce variability, and enhance reproducibility in chiral resolution studies. Empty columns maintained a smaller share and served specialized needs where labs customized stationary phases for niche compounds, process optimization, and advanced enantioselective method development.

- For instance, Agilent Technologies confirms that its InfinityLab Quick Connect fittings facilitate connections for high-pressure systems up to 1300 bar (approx. 18,850 psi).

By End Use

Pharmaceutical and biotechnology companies dominated the end-use segment in 2024 with around 58% share due to strict regulatory requirements for enantiomeric purity testing in drug discovery and manufacturing. These companies expanded use of chiral columns to support high-volume screening, impurity profiling, and quality-control programs. Academic and research institutes increased adoption for stereochemistry studies, while hospital labs, environmental testing units, and food and cosmetic industries used chiral analysis for contaminant detection, authenticity testing, and formulation compliance.

Key Growth Drivers

Rising demand for enantiomerically pure drugs

The demand for safer and more effective enantiomerically pure therapeutics increased the need for chiral chromatography columns across global pharmaceutical pipelines. Regulatory bodies require detailed enantiomeric purity data for APIs, forcing companies to expand high-resolution chiral screening during discovery and formulation stages. Growing small-molecule drug launches, combined with rising outsourcing of analytical testing, strengthened adoption in both R&D and commercial QC workflows. Increased focus on stereoselective drug behavior further supported investment in high-performance chiral stationary phases.

- For instance, Shimadzu’s Nexera UHPLC system is documented to operate at pressures up to 130 MPa with flow rates up to 3 mL/min, enabling high-pressure chiral analysis, as verified in the Nexera Series UHPLC System Specifications.

Expansion of biopharmaceutical and biotechnology research

Biopharmaceutical research programs expanded precision analysis for chiral intermediates and complex biologically derived molecules, strengthening demand for advanced chiral columns. Biotechnology companies adopted chiral separation tools to support metabolic pathway studies, enzyme activity profiling, and stereospecific reaction monitoring. This growth aligned with rising investments in synthetic biology and peptide-based therapeutics, increasing the analytical workload across global research centers. The shift toward data-driven quality systems also encouraged labs to upgrade chromatographic equipment to maintain higher accuracy and reproducibility.

- For instance, PerkinElmer states that its Clarus 690 GC platform offers oven temperature programming up to 450 °C and ramp rates up to 140 °C/min (in the 50–70 °C range with the fast heating option).

Growth in environmental, food, and forensic testing

Environmental and food testing laboratories increased use of chiral columns to detect chiral pesticides, pollutants, and flavor compounds where stereoisomer ratios influence toxicity or authenticity. Regulatory tightening around agrochemical residues and environmental monitoring created new demand for high-selectivity column formats. Forensic labs also adopted chiral chromatography for drug metabolite differentiation and stereospecific toxicology assessments. These expanding application areas widened the market footprint beyond pharma and biotechnology, making it a major growth driver in 2024.

Key Trends & Opportunities

Advancements in chiral stationary phase technology

Manufacturers invested in improved chiral stationary phases that offer higher selectivity, better stability, and broader solvent compatibility. New polysaccharide-based phases and immobilized CSP designs enabled faster method development and enhanced workflow efficiency in regulated labs. These technological improvements created strong opportunities for column replacement cycles and premium-grade column sales. Growth in short-format and high-throughput options also aligned with global demand for faster analytical turnaround times across research and quality-control environments.

- For instance, Daicel Chiral Technologies confirms that its immobilized CSP series, such as CHIRALPAK IA, uses 5 µm particles and is compatible with a wide range of solvents, including harsh ones like THF and dichloromethane (DCM).

Integration with automation and high-throughput workflows

Laboratories increasingly integrated chiral chromatography columns with automated sampling systems, UHPLC platforms, and high-throughput screening units. Automation reduced manual errors, improved reproducibility, and supported large compound libraries used in drug discovery. This trend created new opportunities for manufacturers to design columns optimized for robotic systems and rapid-cycling chromatographic workflows. The shift toward digital and automated laboratories strengthened future adoption, especially within CROs and large pharmaceutical R&D hubs.

- For instance, Bio-Rad lists its NGC Quest 10 chromatography system with flow rates ranging from 0.001 to 10 mL/min and a standard fraction collector capacity that varies by rack type (e.g., 96 tubes for 13 mm racks).

Expansion of chiral analysis in emerging markets

Emerging regions expanded pharmaceutical manufacturing and research capabilities, creating new opportunities for chiral column suppliers. Increased investment in generics, biosimilars, and academic research improved analytical infrastructure and raised demand for cost-effective chiral separation solutions. Government support for local drug development in Asia and Latin America further accelerated adoption. These growing markets presented long-term expansion potential for global vendors offering scalable and high-performance chiral technologies.

Key Challenges

High cost of advanced chiral columns and analytical systems

The cost of high-performance chiral columns and compatible instrumentation slowed adoption among smaller laboratories and academic centers. Premium chiral stationary phases require specialized manufacturing processes, which increases overall pricing. Limited budgets in public research institutions also restrict frequent column replacement despite high usage demand. This price sensitivity hampers broader market penetration and creates operational challenges for labs aiming to maintain strong analytical precision without exceeding spending limits.

Complex method development and limited analyst expertise

Chiral separations often require complex method optimization involving solvent systems, temperature control, and careful CSP selection. Many laboratories face skill gaps as fewer analysts possess deep stereochemistry expertise and hands-on experience in chiral method development. This complexity increases analysis time, reduces overall throughput, and raises the likelihood of inconsistent results. Limited training resources in developing regions further amplify this challenge, slowing wider adoption across new analytical facilities.

Regional Analysis

North America

North America held about 38% share in 2024 driven by strong pharmaceutical and biotechnology research activity across the United States and Canada. The region benefited from advanced analytical infrastructure, high regulatory compliance needs, and continuous investment in chiral purity testing for drug development. Contract research organizations expanded adoption of high-performance chiral columns to support outsourced analytical programs. Growing funding for academic research also strengthened demand for new chiral stationary phases. The mature presence of column manufacturers and distributors further supported steady regional expansion.

Europe

Europe accounted for roughly 30% share in 2024 supported by strong life sciences programs across Germany, the United Kingdom, France, and Switzerland. Strict regulatory frameworks encouraged widespread use of chiral columns in drug development, quality control, and clinical research. The region’s large network of chemical and environmental laboratories increased adoption for testing agrochemical residues and chiral pollutants. Universities and research institutes maintained significant demand due to extensive stereochemistry-focused studies. Expanding biopharma manufacturing also contributed to higher use of high-resolution chiral separation technologies.

Asia Pacific

Asia Pacific held nearly 22% share in 2024 and remained the fastest-growing region due to expanding pharmaceutical manufacturing in China, India, Japan, and South Korea. Increased investment in generics and biosimilar production raised the need for advanced enantiomeric analysis. Academic institutions improved analytical capabilities, driving higher adoption of chiral HPLC and GC column formats. Government support for R&D infrastructure and the rise of regional CROs further accelerated demand. Growing environmental testing requirements, especially for pesticide residue monitoring, reinforced wider use across commercial laboratories.

Latin America

Latin America captured close to 6% share in 2024 with growth driven by increased pharmaceutical production in Brazil and Mexico. Regional regulatory bodies introduced stricter quality standards, which encouraged greater use of chiral analysis for API purity validation. Academic and government laboratories expanded analytical investments, supporting demand for cost-effective chiral column formats. Environmental testing programs targeting pesticide residues and industrial pollutants also contributed to broader adoption. Despite slower infrastructure development than other regions, improving laboratory capabilities supported steady market expansion.

Middle East and Africa

The Middle East and Africa region held about 4% share in 2024 supported by rising investment in healthcare infrastructure and pharmaceutical manufacturing in Gulf countries and South Africa. Research institutes and diagnostic facilities increased adoption of advanced analytical tools, including chiral chromatography systems, to meet evolving testing standards. Growth in food safety programs and environmental monitoring created additional demand for reliable chiral separation solutions. Although market penetration remained moderate due to budget constraints, expanding research capabilities and government-led modernization supported gradual adoption across the region.

Market Segmentations:

By Type

- High Performance Liquid Chromatography Columns

- Gas Chromatography Columns

- Solid Phase Extraction Columns

By Product

- Pre-packed Columns

- Empty Columns

By End Use

- Pharmaceutical & Biotechnology

- Academic & Research Institutes

- Hospital and Diagnostic Clinics

- Environmental Testing Laboratories

- Food & Beverage Industry

- Cosmetic Companies

- Nutraceutical Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chiral chromatography columns market features leading global players such as Shimadzu Corporation, Waters Corporation, Danaher, Daicel Corporation, Thermo Fisher Scientific, Bio-Rad Laboratories, Perkin Elmer, GE Healthcare, Cytiva, and Merck & Co., Inc. These companies compete by expanding portfolios of high-performance chiral stationary phases and advanced HPLC and GC column formats tailored for drug discovery, quality control, and research laboratories. Vendors focus on developing columns with higher selectivity, stability, and method-development flexibility to support faster analytical workflows. Many manufacturers invest in automation-ready designs that integrate with UHPLC and high-throughput systems to meet rising demand from pharmaceutical and biotechnology sectors. Strategic initiatives include partnerships with CROs, expansion of global distribution networks, and localized support centers to strengthen customer reach. Companies also enhance technical support services, offering application guidance, method optimization tools, and training programs that help laboratories achieve consistent enantiomeric separation performance.

Key Player Analysis

- Shimadzu Corporation

- Waters Corporation

- Danaher

- Daicel Corporation

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories

- Perkin Elmer

- GE Healthcare

- Cytiva

- Merck & Co., Inc.

Recent Developments

- In 2024, Merck KGaA began construction of a €300 million Advanced Research Center at Darmstadt, emphasizing future advancements in analytical chromatography technologies, including chiral separation methods.

- In 2023, Daicel Chiral Technologies announced the availability of CHIRALPAK® IM-3. This 3µm version of its immobilized selector offers increased robustness and is optimized for analytical and supercritical fluid chromatography (SFC) applications.

- In 2023, Waters launched the XBridge Premier GTx BEH SEC columns, engineered for gene therapy applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth as pharma companies expand enantiomeric purity testing.

- Biotechnology research will drive higher adoption of advanced chiral stationary phases.

- Automation and high-throughput platforms will increase demand for UHPLC-compatible chiral columns.

- Environmental and food laboratories will widen use due to stricter residue and contaminant testing norms.

- Manufacturers will invest in next-generation polysaccharide-based and immobilized CSP technologies.

- CROs will expand chiral analysis services, boosting column consumption globally.

- Emerging markets will experience faster adoption as analytical infrastructure improves.

- Academic labs will increase usage through growing stereochemistry and metabolomics research.

- Digital and AI-supported method development will reduce complexity and support wider deployment.

- Sustainability initiatives will encourage development of longer-life and eco-friendly chiral column materials.