Market Overview

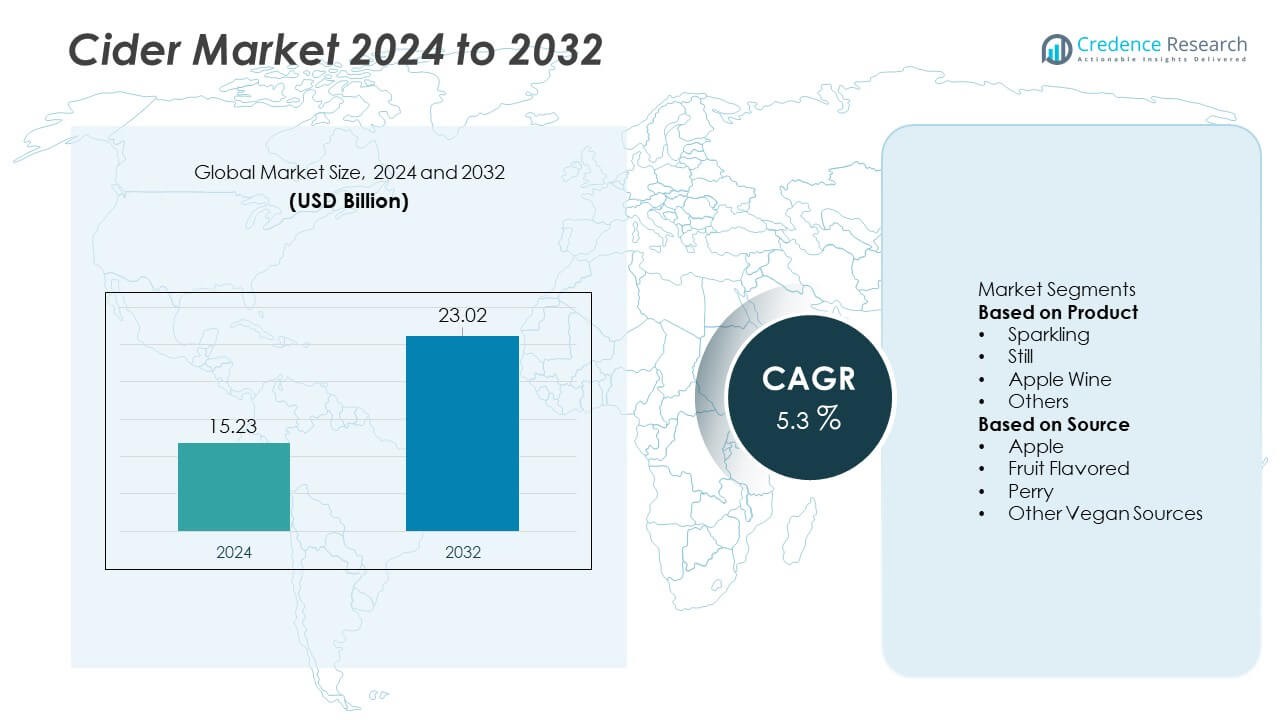

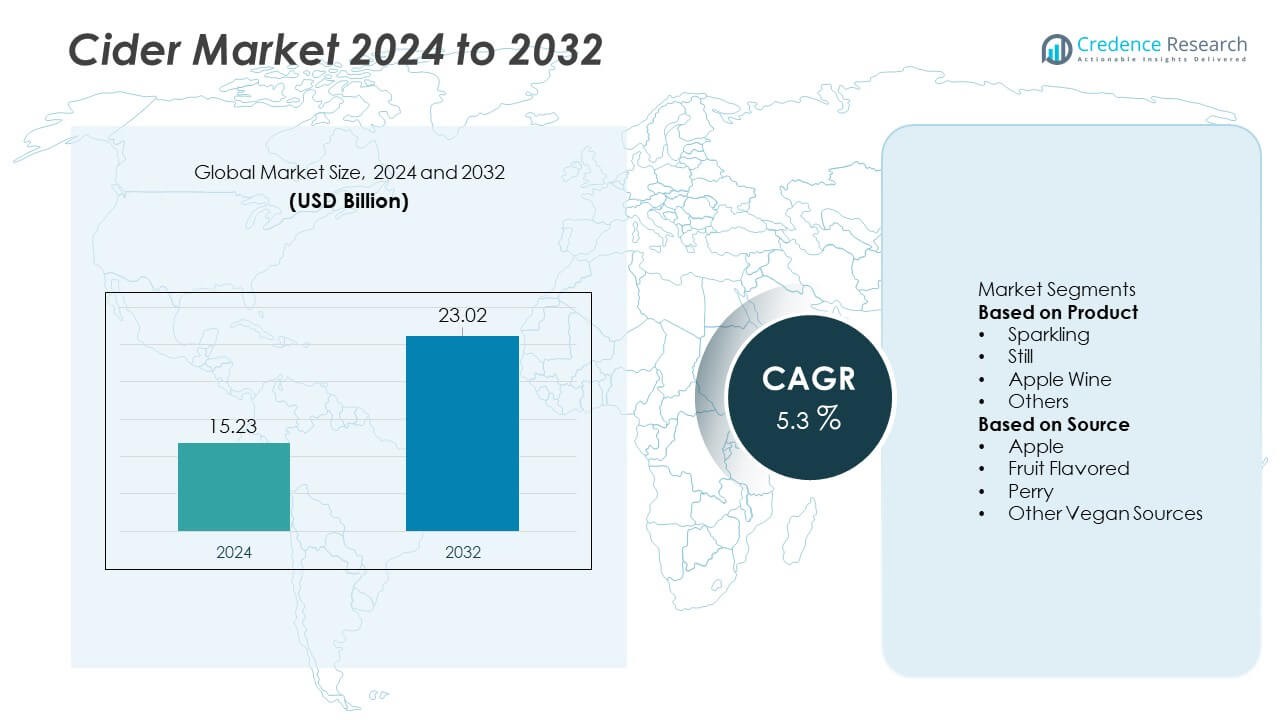

The Cider Market was valued at USD 15.23 billion in 2024 and is projected to reach USD 23.02 billion by 2032. The market is set to grow at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cider Market Size 2024 |

USD 15.23 Billion |

| Cider Market, CAGR |

5.3% |

| Cider Market Size 2032 |

USD 23.02 Billion |

Top players in the Cider market include Thatchers Cider, AB InBev, Halewood Sales, The Boston Beer Company, Heineken N.V., Aston Manor, KOPPARBERGS BRYGGERI AB, C&C Group PLC, Carlsberg Breweries A/S, and Diageo. These companies strengthen their positions through wide product portfolios, strong distribution networks, and continuous innovation in flavors and packaging. Europe leads the global market with a 41% share, supported by deep-rooted cider traditions and strong consumption across pubs and retail channels. North America follows with a 34% share, driven by rising craft cider production and increasing demand for flavored, low-alcohol beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 15.23 billion in 2024 and will grow at a CAGR of 5.3 %, driven by steady global demand for flavored alcoholic drinks.

- Sparkling cider leads the product segment with a 46 % share, supported by strong consumer interest in carbonated, low-alcohol beverages across bars, restaurants, and retail outlets.

- Key trends include rising demand for fruit-flavored blends, craft production, and organic or vegan cider variants, strengthening premium product adoption among younger consumers.

- Leading players such as Thatchers Cider, AB InBev, Heineken N.V., and KOPPARBERGS BRYGGERI AB drive competition through flavor innovation, sustainable sourcing, and expanded distribution, while high production and raw material costs act as restraints.

- Europe holds a 41 % share due to strong cultural consumption, followed by North America with 34 %, while apple-based cider dominates sourcing with a 58 % share, reflecting continued preference for traditional fermentation.

Market Segmentation Analysis:

By Product

Sparkling cider leads this segment with a 46% share, driven by strong consumer demand for refreshing, carbonated alcoholic drinks. The segment grows as younger buyers shift toward light, flavorful beverages with lower alcohol content. Still cider attracts traditional consumers who prefer smooth and mellow taste profiles. Apple wine holds steady interest due to its richer flavor, while the “others” category includes niche craft variants gaining traction in urban markets. Brands expand sparkling lines with new flavors to match evolving tastes. Growing availability in bars, restaurants, and retail stores further strengthens segment dominance.

- For instance, The Boston Beer Company invested significantly in its Pennsylvania brewery to handle increased demand for brands including Angry Orchard, and in a prior period completed efficiency projects and expanded capacity as part of its brewing strategy.

By Source

Apple-based cider dominates the market with a 58% share, supported by strong global preference for authentic apple fermentation and classic taste. Fruit-flavored variants grow quickly as consumers seek new blends made from berries, tropical fruits, and citrus. Perry appeals to niche drinkers who enjoy pear-based fermentation. “Other vegan sources” gain attention through plant-based trends and craft innovations. Apple sourcing benefits from established orchards and consistent supply. Rising interest in flavored beverages drives experimentation across brands. Broader retail penetration and premium packaging enhance visibility for all categories within this segment.

- For instance, Aston Manor sources more than 25,000 tonnes of British apples annually for its fermentation operations.

Key Growth Drivers

Rising Demand for Flavored and Low-Alcohol Beverages

Growing interest in flavored alcoholic drinks strengthens demand for cider across all age groups. Consumers prefer light, refreshing options that offer lower alcohol content compared with spirits and beer. Brands introduce fruit-infused blends and seasonal flavors to attract younger buyers. Rising preference for casual drinking occasions supports wider consumption in bars and retail stores. Health-conscious consumers also choose cider as a moderate alternative. Expanding availability of premium and craft variants reinforces steady growth. This shift toward diverse flavors and lighter drinks continues to fuel market expansion.

- For instance, Heineken N.V. expanded its Strongbow flavor line, which is mass-produced using modern methods, including apple concentrate and sugar, and is fermented in vats such as the Bulmers Strongbow vat, the world’s largest alcoholic container with a capacity of 6.8 million liters.

Expansion of Craft Cider Production and Premium Offerings

Craft cider makers boost market growth by offering unique blends, small-batch production, and premium ingredients. Consumers value authenticity, artisanal quality, and natural fermentation processes. Local orchards support craft producers with fresh apple supplies, enhancing regional identity. Premium ciders gain popularity in urban markets through distinctive flavors and specialty packaging. Restaurants and gourmet outlets promote craft labels for pairing menus. Growing tourism and tasting events strengthen consumer awareness. This rising craft movement increases product diversity and elevates cider’s position in the alcoholic beverage category.

- For instance, Diageo produces premium spirits and uses a variety of oak casks, including former bourbon casks and seasoned European oak/sherry casks, with maturation often lasting decades to achieve richer profiles

Growing Retail Penetration and Wider Distribution Networks

Retail chains expand shelf space for cider as demand rises across multiple flavor categories. Supermarkets, convenience stores, and online platforms provide extensive visibility for both mass and craft brands. Seasonal promotions encourage trial purchases, while subscription-based delivery supports recurring orders. Bars and restaurants diversify drink menus with sparkling and fruit-flavored ciders. Improved logistics enable producers to reach new markets quickly. Strong partnerships between producers and distributors ensure consistent supply. This widening distribution footprint directly supports sustained market growth.

Key Trends & Opportunities

Shift Toward Natural, Organic, and Vegan Cider Variants

Consumers increasingly seek clean-label, natural, and organic ingredients, encouraging producers to develop preservative-free and vegan-friendly ciders. Fruit-based formulations without artificial additives gain traction among health-conscious buyers. Brands explore organic apple sourcing and low-sugar recipes to meet rising wellness demand. Vegan ciders attract plant-based consumers, expanding reach across new customer groups. Certifications and transparent labeling improve trust and drive premium pricing. This trend creates strong opportunities for companies focusing on sustainable and natural production.

- For instance, beverage companies are upgrading their sugar-reduction technology, such as using flavor modulators, innovative sweetener blends, and advanced fermentation techniques, to deliver flavor stability in blends with significantly reduced sugar content.

Rising Popularity of Fruit-Flavored and Experimental Cider Blends

Fruit-flavored ciders grow as buyers seek bold, refreshing, and innovative taste profiles beyond traditional apple. Blends using berries, tropical fruits, citrus, and botanicals gain strong momentum. Limited-edition flavors support seasonal sales peaks. Craft producers experiment with barrel aging and mixed-fermentation techniques to attract premium drinkers. Younger consumers prefer adventurous flavors that pair well with social events. Global influence from flavored beverage trends increases demand for new varieties. This shift provides a significant opportunity for flavor innovation and portfolio expansion.

- For instance, the C&C Group is a major manufacturer and distributor of drinks, owning brands such as Bulmers and Magners cider, and has a small brewery on their Clonmel site.

Key Challenges

Fluctuating Raw Material Supply and Rising Production Costs

Apple harvest variability affects cider production, creating supply challenges for producers. Weather changes, pests, and seasonal inconsistencies impact yield and fruit quality. Craft producers face higher input costs due to reliance on fresh fruit and local orchards. Rising packaging and logistics expenses add pressure on margins. These cost fluctuations limit pricing flexibility in competitive markets. Producers must secure long-term sourcing agreements and invest in supply stability to maintain consistent product output.

Competition from Beer, Hard Seltzers, and Other Alcoholic Alternatives

Cider competes with fast-growing segments such as beer, hard seltzers, RTDs, and flavored alcoholic beverages. Aggressive marketing by large beverage brands increases competition for shelf space. Younger consumers often shift between categories, reducing long-term loyalty to cider. Price-sensitive buyers choose cheaper alcoholic options during economic slowdowns. Innovation in seltzers and cocktails diverts attention away from traditional cider. Producers must differentiate through flavor innovation, branding, and sustainability to protect market share.

Regional Analysis

North America

North America holds a 34% share, driven by rising demand for flavored alcoholic beverages and strong adoption of craft cider. The U.S. leads consumption due to expanding taprooms, tasting events, and retail availability across supermarkets and specialty stores. Younger consumers prefer low-alcohol options, supporting steady growth of sparkling and fruit-flavored ciders. Local orchards strengthen supply for small producers, while premium brands expand presence in urban markets. Increasing interest in sustainable and organic beverages enhances category visibility. Strong distribution networks and rising on-premise sales continue to support regional market expansion.

Europe

Europe accounts for a 41% share, making it the largest regional market due to long-standing cider traditions in the U.K., France, and Spain. Strong cultural acceptance and widespread consumption in pubs, restaurants, and retail stores reinforce steady demand. Premium apple-based ciders remain popular, while flavored and low-sugar variants grow among younger consumers. Regional producers benefit from established orchards, supporting consistent supply. The rise of artisanal and dry cider styles helps expand the premium segment. Tourism and seasonal festivals further boost consumption, strengthening Europe’s leading position in the global cider market.

Asia Pacific

Asia Pacific holds a 17% share, driven by rising interest in fruit-based alcoholic drinks across China, Japan, Australia, and South Korea. Growing urbanization and exposure to Western drinking trends support cider adoption among younger consumers. Flavored and sparkling variants gain traction due to their light taste profiles. Retail expansion and online alcohol delivery platforms increase availability across urban centers. Craft producers in Australia and New Zealand boost regional production with premium blends. Rising disposable income and lifestyle shifts continue to strengthen cider demand across Asia Pacific markets.

Latin America

Latin America captures a 5% share, supported by emerging interest in flavored alcoholic beverages and rising consumption in Brazil, Mexico, and Chile. Younger consumers shift toward lighter, fruit-based drinks, creating demand for sparkling and fruit-flavored ciders. Retail penetration increases as supermarkets expand imported and premium alcoholic categories. Local craft producers experiment with tropical fruit blends to attract new users. Tourism in coastal regions boosts seasonal consumption. Although niche, the category grows steadily as consumers seek alternatives to beer and traditional spirits across the region.

Middle East & Africa

The Middle East & Africa region holds a 3% share, influenced by growing tourism, premium hospitality outlets, and rising acceptance of low-alcohol beverages in select markets. Countries such as South Africa and the UAE lead demand, supported by expanding retail channels and craft producers introducing premium blends. Non-alcoholic and low-alcohol ciders gain traction in markets with strict alcohol regulations. Fruit-flavored options appeal to younger consumers seeking refreshing alternatives. Hotel chains and beach resorts support rising consumption, gradually strengthening regional market presence.

Market Segmentations:

By Product

- Sparkling

- Still

- Apple Wine

- Others

By Source

- Apple

- Fruit Flavored

- Perry

- Other Vegan Sources

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes Thatchers Cider, AB InBev, Halewood Sales, The Boston Beer Company, Heineken N.V., Aston Manor, KOPPARBERGS BRYGGERI AB, C&C Group PLC, Carlsberg Breweries A/S, and Diageo as the major players shaping market growth. These companies strengthen their presence through diverse product portfolios, ranging from traditional apple-based ciders to fruit-flavored and premium craft variants. Leading brands invest in advanced fermentation techniques, sustainable sourcing, and innovative packaging to meet rising consumer expectations. Global players expand distribution through supermarkets, pubs, and online channels, ensuring strong regional penetration. Craft cider producers create competition by offering small-batch blends that attract premium consumers. Marketing campaigns, seasonal launches, and flavor experimentation help companies differentiate their offerings. Steady investment in brand visibility and product innovation continues to elevate competitiveness across global markets.

Key Player Analysis

Recent Developments

- In August 2024, C&C Group PLC struck a cooperation agreement with investment firm Engine Capital under which the company would appoint one new non-executive director from a short-list of nominees agreed upon with Engine Capital.

- In 2023, Anheuser‑Busch InBev sold the U.S. cider brand Virtue Cider to brewer Greg Hall, who plans to steer Virtue back to a craft-style, European-inspired cider focus.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cider will grow as consumers choose lighter and fruit-based alcoholic beverages.

- Craft cider producers will expand premium offerings with unique blends and natural ingredients.

- Flavored variants will gain traction as younger consumers seek diverse and refreshing taste profiles.

- Organic and vegan cider lines will rise as clean-label preferences strengthen worldwide.

- Online alcohol delivery platforms will boost accessibility and widen consumer reach.

- Hospitality and restaurant chains will increase cider listings to meet growing on-premise demand.

- Producers will adopt sustainable sourcing and packaging to appeal to eco-conscious buyers.

- Innovation in fermentation and aging techniques will enhance product quality and differentiation.

- Global brands will expand distribution networks to capture emerging markets.

- Seasonal and limited-edition flavors will drive repeat purchases and strengthen brand loyalty.