Market Overview:

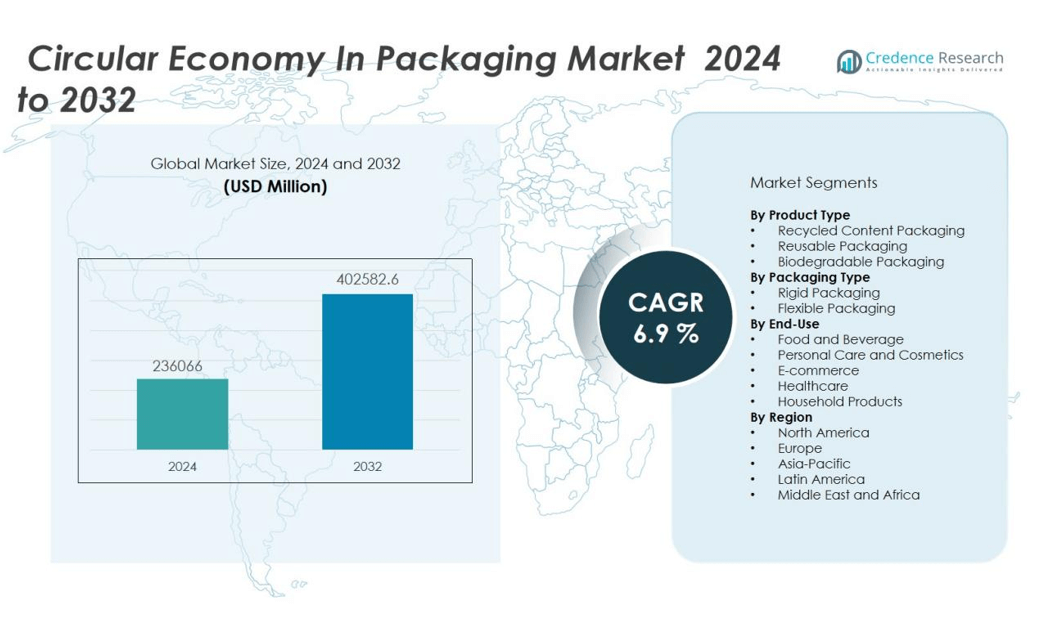

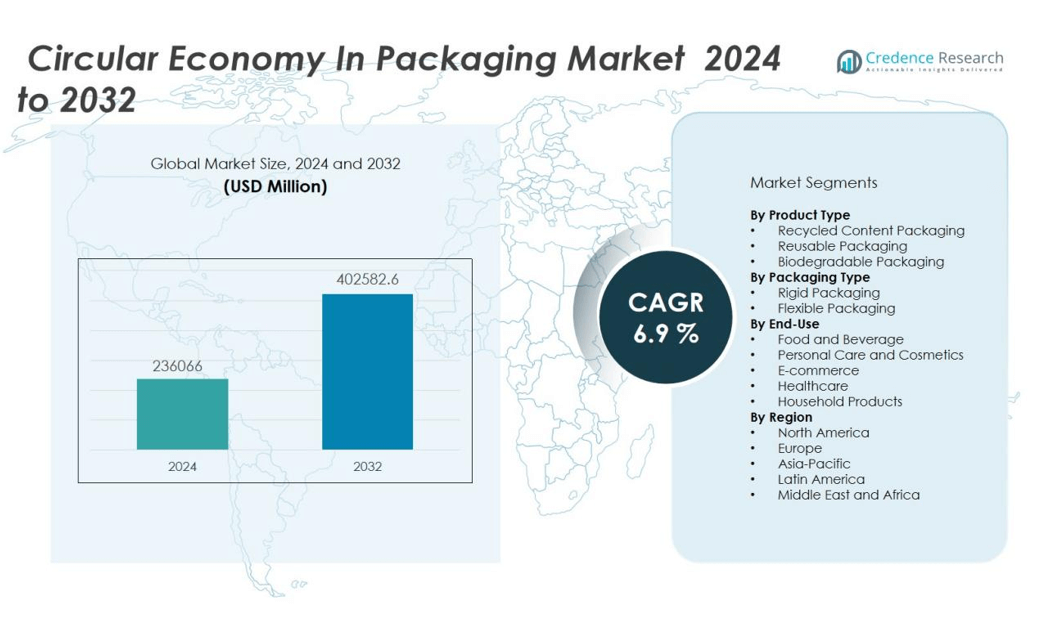

The circular economy in packaging market size was valued at USD 236066 million in 2024 and is anticipated to reach USD 402582.6 million by 2032, at a CAGR of 6.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circular Economy in Packaging Market Size 2024 |

USD 236066 million |

| Circular Economy in Packaging Market, CAGR |

6.9% |

| Circular Economy in Packaging Market Size 2032 |

USD 402582.6 million |

Several key drivers are fueling market growth. Regulatory frameworks such as the EU Circular Economy Action Plan, extended producer responsibility (EPR) policies, and single-use plastic bans are prompting companies to redesign packaging with a lifecycle approach. Companies are investing in recyclable mono-materials, refillable packaging, closed-loop logistics, and bio-based polymers to minimize environmental impact and improve circularity performance. Brand owners across food, personal care, and e-commerce sectors are launching returnable packaging models, zero-waste packaging lines, and smart packaging technologies to enhance traceability and drive consumer engagement. Innovation in chemical and mechanical recycling, packaging-as-a-service models, and digital watermarking further supports scalable circular solutions. Rising investor interest in circular economy initiatives also provides capital flow for green packaging innovation.

Regionally, Europe dominates the circular economy in packaging market due to early regulatory adoption, strong waste management infrastructure, and industry-wide circular economy targets. Countries like Germany, France, and the Netherlands lead in terms of recycled content mandates and corporate circularity initiatives, supported by key players such as Ball Corporation, Sealed Air Corporation, Crown Holdings, Inc., Greif, Inc., WestRock Company, and Constantia Flexibles. North America is advancing through voluntary commitments and sustainability investments by major brands, while Asia Pacific is emerging rapidly, driven by urbanization, regulatory reforms, and growing awareness. China, Japan, and India are key markets where circular packaging solutions are gaining traction amid efforts to reduce landfill waste and stimulate green innovation.

Market Insights:

- The market was valued at USD 236,066 million in 2024 and is projected to reach USD 402,582.6 million by 2032, driven by rising sustainability regulations and consumer demand.

- Regulatory initiatives such as the EU Circular Economy Action Plan and EPR schemes are reshaping packaging strategies across industries.

- Companies invest in recyclable mono-materials, refillable formats, and bio-based polymers to minimize environmental impact and boost circularity.

- Smart packaging, chemical recycling, and packaging-as-a-service models are creating scalable and traceable circular solutions.

- Europe leads the market with 41% share due to advanced infrastructure and strict regulatory mandates, with key countries including Germany, France, and the Netherlands.

- Inconsistent recycling infrastructure and high costs of sustainable materials limit adoption across developing regions and small businesses.

- North America and Asia Pacific show strong momentum, with brands and governments in China, India, and the U.S. driving green packaging innovation and policy-led reform.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Regulatory Mandates and Government Policies Push Circular Transformation:

Government initiatives and environmental regulations are key forces driving the circular economy in packaging market. Policies such as the European Union’s Circular Economy Action Plan and Extended Producer Responsibility (EPR) schemes require manufacturers to take accountability for post-consumer waste. These mandates encourage companies to redesign packaging using recyclable or compostable materials and to invest in waste collection systems. Bans on single-use plastics across regions are accelerating the transition to reusable and recyclable formats. Compliance with these policies is not optional, placing pressure on both large corporations and SMEs to adopt circular practices. The regulatory push is reshaping supply chains and product development strategies in the global packaging industry.

- For instance, Unilever has eliminated more than 100,000 tonnes of plastic packaging since its public commitment to reduce plastics, and is now targeting no more than 350,000 tonnes of virgin plastic packaging annually by 2025.

Corporate ESG Goals and Sustainability Targets Influence Strategic Shifts:

Companies are aligning their packaging strategies with environmental, social, and governance (ESG) goals. Large FMCG brands and retailers are setting public targets to reduce packaging waste and increase the use of recycled content. These initiatives are driving demand for circular packaging systems that support reuse, refill, and recovery. The circular economy in packaging market benefits from this shift as firms compete to meet consumer and investor expectations. Businesses now prioritize design for disassembly, material traceability, and waste elimination throughout the packaging lifecycle. These internal targets often go beyond compliance, encouraging innovation and supplier collaboration.

- For instance, Procter & Gamble eliminated 545 metric tons of plastic annually by moving Gillette and Venus shave care products to recyclable carton packaging, and its hair care brands launched reusable 100% aluminum bottles with refill pouches using 60% less plastic.

Consumer Awareness and Ethical Preferences Guide Market Adoption:

Eco-conscious consumers are influencing packaging decisions across industries. Rising awareness of plastic pollution and environmental degradation is prompting buyers to favor sustainable packaging solutions. Brands that fail to meet sustainability expectations face reputational risks and reduced customer loyalty. The market responds to these pressures by offering products in recyclable or biodegradable formats with minimal environmental impact. Clear labeling and transparency in sourcing enhance consumer trust and brand differentiation. It is this consumer-led demand that reinforces circular models and validates market investment.

Technological Advancements Support Scalable Circular Packaging Solutions:

Innovations in material science, digital technologies, and recycling systems are enabling circular packaging at scale. Companies are deploying chemical recycling, AI-powered sorting, and smart packaging to improve resource efficiency and recovery. Automation and digital tracking enhance transparency and traceability across the value chain. These tools reduce contamination, optimize material usage, and enable new business models such as packaging-as-a-service. The circular economy in packaging market grows with each breakthrough that makes sustainable solutions more viable and cost-effective. It depends on technology to overcome legacy limitations and enable high-performing, low-impact packaging systems.

Market Trends:

Widespread Shift Toward Reusable, Refillable, and Returnable Packaging Models:

Companies are rapidly moving away from single-use formats toward packaging designed for multiple life cycles. Reusable containers, refill stations, and returnable systems are gaining traction across food, beverage, and personal care sectors. Brands such as Unilever and Nestlé are piloting refill programs to reduce packaging waste and improve customer retention. These models reduce material consumption while enhancing brand engagement and loyalty. The circular economy in packaging market reflects this transition, supported by infrastructure investments and collaborative supply chain models. It evolves to support consumer-friendly reuse systems that align with sustainability and convenience.

- For instance, GSK Consumer Healthcare committed to making more than 1billion toothpaste tubes fully recyclable annually by 2025 across its Sensodyne, parodontax, and Aquafresh brands.

Growth of Bio-Based, Mono-Material, and Smart Packaging Technologies:

Material innovation is shaping the next generation of circular packaging. Companies are adopting mono-material structures that improve recyclability and reduce contamination during waste processing. Bio-based polymers, such as PLA and PHA, offer compostable alternatives to petroleum-based plastics. Smart packaging integrates digital watermarks and RFID tags to improve sorting accuracy and track packaging through the circular supply chain. It enables transparency, enhances recycling efficiency, and supports reverse logistics. These trends reinforce the shift toward a regenerative packaging system where materials retain value across uses.

- For instance, Amcor’s AmPrima mono-material packaging enabled the packaging of 2 liters of product using just 15 grams of plastic in the refill pouch for Nana products, representing an exact, measured material use and direct advancement over traditional packaging.

Market Challenges Analysis:

Inconsistent Infrastructure and Recycling Standards Limit Material Recovery:

The lack of uniform recycling infrastructure across regions poses a major barrier to circularity. Differences in waste collection, sorting technologies, and recycling capabilities lead to inefficiencies and contamination. Brands designing circular packaging face challenges in ensuring end-of-life recovery due to these regional disparities. The circular economy in packaging market struggles when recyclability claims cannot be fulfilled at scale. It depends on reliable systems to close material loops, but fragmented infrastructure weakens this potential. Harmonized standards and investment in advanced recovery technologies remain critical gaps.

High Cost Structures and Limited Supply of Sustainable Materials:

Developing circular packaging often involves higher material and production costs than conventional options. Bio-based polymers, recycled content, and advanced labeling systems can increase overall packaging expenses. Small and medium enterprises face financial hurdles in adopting circular models without economies of scale. Limited availability of high-quality recycled materials also constrains implementation. It becomes difficult for manufacturers to meet both sustainability goals and price competitiveness. Market growth relies on innovation, policy support, and value chain collaboration to balance cost and performance.

Market Opportunities:

Rising Demand for Circular Packaging Across Emerging Economies Creates Scalable Growth Potential:

Emerging markets present strong opportunities for the circular economy in packaging market. Rising urban populations, growing consumer awareness, and evolving environmental regulations are creating favorable conditions for circular packaging adoption. Governments in Asia, Latin America, and Africa are promoting waste reduction through incentives and plastic bans. Local brands are beginning to explore reusable and recyclable packaging formats to meet shifting preferences. It opens pathways for multinationals and packaging startups to enter untapped markets with scalable, sustainable solutions. Partnerships with local recyclers and infrastructure providers can accelerate implementation and ensure long-term market access.

Technological Innovation Enables Differentiation and New Business Models:

Advances in digital printing, AI-enabled waste sorting, and blockchain-based traceability offer packaging companies new value creation opportunities. Smart packaging can optimize logistics, extend shelf life, and enhance consumer engagement while supporting circular goals. Companies can use data from connected packaging to improve reverse logistics and material recovery. It allows them to launch new models such as subscription-based packaging-as-a-service or deposit-return schemes. The circular economy in packaging market benefits from these innovations, which align profitability with sustainability. Early adoption of emerging technologies will provide competitive advantage in a resource-constrained global market.

Market Segmentation Analysis:

By Product Type:

The circular economy in packaging market includes key product types such as recycled content packaging, reusable packaging, and biodegradable packaging. Recycled content packaging holds the largest share due to rising corporate commitments and recycled material mandates. Reusable packaging is gaining momentum across food service, e-commerce, and FMCG sectors where refill and return systems improve sustainability performance. Biodegradable packaging is expanding in regions with industrial composting infrastructure and is commonly applied to single-use items in food and beverage.

- For instance, Subaru of Indiana Automotive has implemented reusable packaging for 95% of direct ship parts in producing its vehicles, which prevented over 28,000 tons of cardboard from reaching landfills.

By Packaging:

Based on packaging type, the market is segmented into rigid and flexible packaging. Rigid packaging dominates due to its durability and high recovery rate, making it ideal for reuse and closed-loop logistics systems. Flexible packaging is evolving through mono-material innovations that improve its recyclability and reduce environmental impact. It supports lightweighting goals and appeals to cost-sensitive markets, especially in emerging economies. Both segments are transforming through design-for-recycling principles and material simplification.

- For instance, Amcor’s AmLite Ultra Recyclable flexible laminate achieves industry-leading performance with an oxygen barrier of less than 0.1 cc /m²/ day.

By End-Use:

Key end-use sectors include food and beverage, personal care and cosmetics, healthcare, household products, and e-commerce. The circular economy in packaging market sees highest adoption in food and beverage, where sustainability and regulatory pressure drive innovation in recyclable and reusable formats. Personal care and cosmetics brands focus on packaging aesthetics and refillability. E-commerce platforms adopt circular packaging to reduce waste in shipping and enhance brand value. It continues to expand across sectors seeking environmental impact reduction and regulatory compliance.

Segmentations:

By Product Type:

- Recycled Content Packaging

- Reusable Packaging

- Biodegradable Packaging

By Packaging:

- Rigid Packaging

- Flexible Packaging

By End-Use:

- Food and Beverage

- Personal Care and Cosmetics

- E-commerce

- Healthcare

- Household Products

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe accounts for 41% share of the circular economy in packaging market, driven by strict regulations and proactive industry adoption. Countries such as Germany, France, and the Netherlands enforce ambitious recycling targets and EPR schemes that promote circular design. The EU Green Deal and Circular Economy Action Plan set clear objectives, incentivizing companies to adopt recyclable, reusable, and compostable packaging formats. Multinational brands collaborate with local governments and NGOs to create closed-loop systems and improve consumer participation. It benefits from well-developed infrastructure for collection, sorting, and recycling. Strong public support and consistent policy enforcement continue to fuel innovation and investment across the region.

North America :

North America holds 27% share of the circular economy in packaging market, with growth led by voluntary corporate sustainability goals and modernization of recycling systems. Major brands in the U.S. and Canada are setting ambitious circularity targets, investing in recycled content, and adopting smart packaging solutions. Governments support progress through tax incentives, plastic reduction legislation, and public-private partnerships to upgrade material recovery facilities. It shows steady growth as states implement bottle bills, zero-waste goals, and sustainable procurement policies. Consumer demand for transparent labeling and waste reduction reinforces business case for circular packaging. Infrastructure gaps remain, but collaborative efforts aim to close them.

Asia Pacific :

Asia Pacific holds 21% share of the circular economy in packaging market, with rapid expansion driven by population growth, urbanization, and evolving environmental policies. Countries like China, Japan, South Korea, and India are launching national waste management reforms and plastic reduction mandates. Local manufacturers are exploring recyclable and bio-based packaging to comply with regulations and meet export standards. It presents vast potential due to rising consumer awareness and demand for sustainable alternatives. Regional initiatives support investment in chemical recycling, eco-design, and circular business models. Public-private collaborations aim to build capacity and improve waste segregation and processing efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ball Corporation

- Sealed Air Corporation

- Crown Holdings, Inc.

- Greif, Inc.

- WestRock Company

- Constantia Flexibles

- Coveris Holdings S.A.

- Crown Holdings, Inc.

- WestRock Company

- DS Smith plc

Competitive Analysis:

The circular economy in packaging market features a competitive landscape shaped by global packaging leaders and innovation-driven firms. Key players include Ball Corporation, Sealed Air Corporation, Crown Holdings, Inc., Greif, Inc., WestRock Company, and Constantia Flexibles. These companies invest in recyclable materials, closed-loop systems, and sustainable design to meet growing regulatory and consumer demands. It reflects high competition based on material innovation, recycling capabilities, and end-to-end supply chain integration. Companies focus on partnerships, acquisitions, and R&D to expand their circular product portfolios and regional presence. Market participants also align offerings with ESG goals, positioning sustainability as a core differentiator. Competitive intensity continues to grow as emerging players enter with advanced biodegradable and reusable solutions.

Recent Developments:

- In January 2025, SIG entered into a partnership with the Ellen MacArthur Foundation to advance circular packaging systems, and through this collaboration, SIG is leveraging the Foundation’s expertise to minimize waste, enhance recyclability, and expand the use of renewable materials.

- In February 2024, BAE Systems completed its acquisition of Ball Aerospace from Ball Corporation, marking a significant shift in focus for Ball and expanding BAE’s space technology portfolio.

- In April 2024, Sealed Air, in partnership with Eastman, introduced a compostable CRYOVAC® brand overwrap tray for protein packaging, aligning with industry efforts to replace polystyrene foam trays

Market Concentration & Characteristics:

The circular economy in packaging market remains moderately concentrated, with a mix of global packaging giants, sustainability-focused startups, and regional material suppliers shaping its structure. Leading players such as Amcor, Mondi Group, and Tetra Pak dominate through established supply chains, strong R&D capabilities, and strategic partnerships focused on recyclable and reusable formats. It features high innovation intensity, with companies competing on material innovation, recyclability, and closed-loop systems. Regulatory compliance, traceability, and end-of-life recovery performance are key competitive differentiators. The market attracts continuous investment in bio-based polymers, mono-material solutions, and smart packaging. It also encourages collaboration across industries to build scalable circular ecosystems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Packaging, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Companies will expand scalable returnable packaging programs, integrating reuse across industries and driving long-term waste reduction.

- Material innovation will intensify with development of high-performance bio-based polymers and mono-material structures to enhance recyclability.

- Smart packaging adoption will grow through embedding digital markers and IoT-enabled tracking, improving transparency and reverse logistics.

- Collaboration across brand owners, waste management firms, and technology providers will support closed-loop systems and circular supply chains.

- Recycling infrastructure upgrades in developed and emerging regions will enable broader implementation of circular models.

- Governments will increase support through targeted incentives, recycled content mandates, and deposit-return legislation to accelerate change.

- New business models such as packaging-as-a-service and deposit schemes will attract consumers and reduce single-use dependency.

- Consumer preference for sustainable alternatives will strengthen demand for circular-packaging formats and brand accountability.

- Investment funds will flow into circular-first startups and green packaging innovation to support market transformation.

- Standardization of material labeling, recyclability metrics, and traceability frameworks will improve market confidence in circular solutions.