Market Overview:

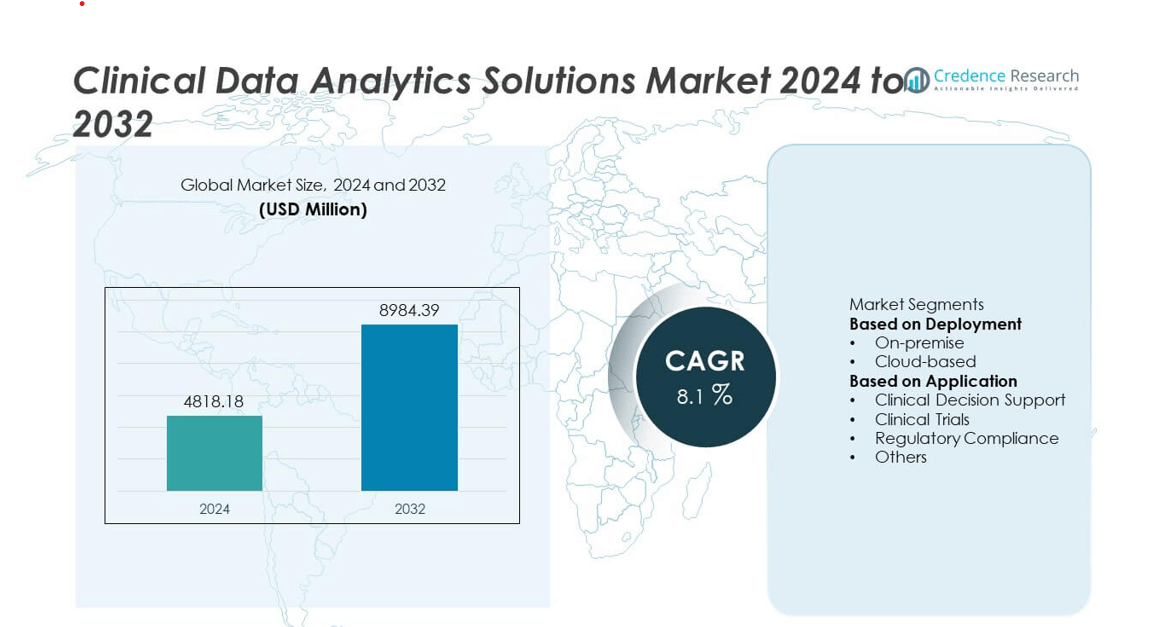

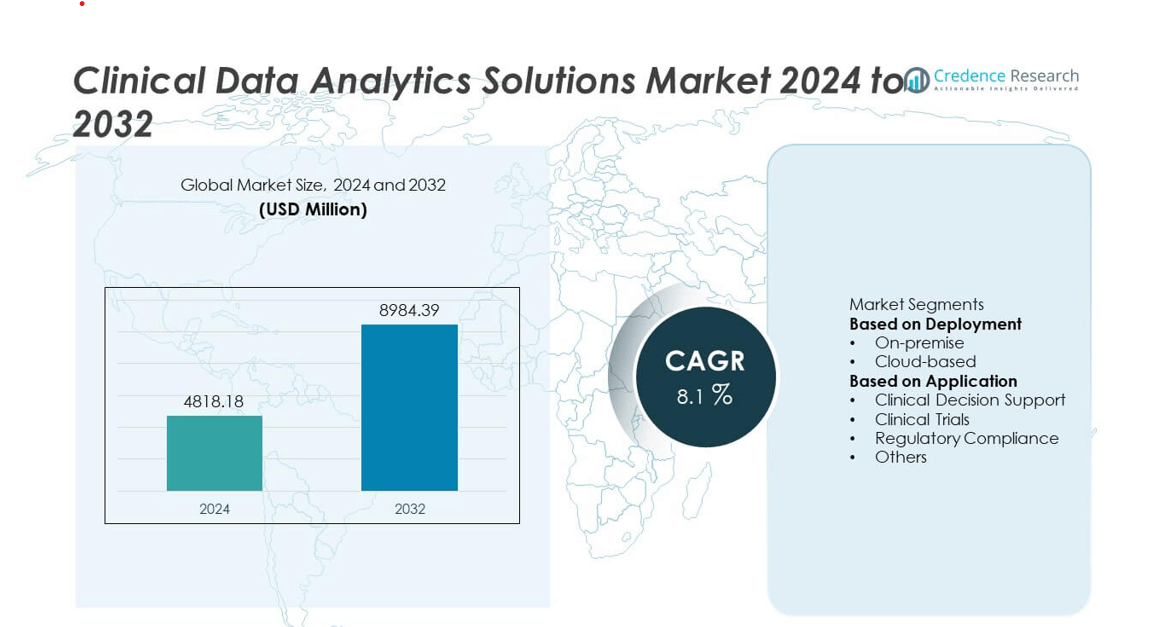

The Clinical Data Analytics Solutions Market was valued at USD 4818.18 million in 2024 and is projected to reach USD 8984.39 million by 2032, expanding at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Data Analytics Solutions Market Size 2024 |

USD 4818.18 million |

| Clinical Data Analytics Solutions Market, CAGR |

8.1% |

| Clinical Data Analytics Solutions Market Size 2032 |

USD 8984.39 million |

The Clinical Data Analytics Solutions market is led by major players including Health Catalyst, BD, OSP, IQVIA, Dassault Systems, Optum Inc. (UnitedHealth Group), JMP Statistical Discovery LLC, eClinical Solutions LLC, Cognizant, and SAS Institute Inc. These companies dominate through advanced data analytics platforms integrating AI, cloud computing, and predictive modeling to enhance clinical efficiency and patient outcomes. North America held the largest share of 42.3% in 2024, supported by strong healthcare IT infrastructure and widespread adoption of data-driven healthcare solutions. Europe followed with 26.8%, while Asia-Pacific accounted for 24.9%, emerging as the fastest-growing region driven by increasing healthcare digitalization and research investments.

Market Insights

- The Clinical Data Analytics Solutions market was valued at USD 4818.18 million in 2024 and is projected to reach USD 8984.39 million by 2032, growing at a CAGR of 8.1% during the forecast period.

- Growing adoption of cloud-based analytics platforms and AI-driven insights is driving market expansion, enabling faster data interpretation and evidence-based clinical decisions.

- Key trends include integration of real-time analytics, predictive modeling, and interoperability with electronic health records to improve care coordination and regulatory compliance.

- The market is competitive with major players such as Health Catalyst, IQVIA, Optum Inc., and SAS Institute Inc. focusing on innovation, partnerships, and digital healthcare transformation.

- North America led the market with a 42.3% share in 2024, followed by Europe at 26.8% and Asia-Pacific at 24.9%, while the cloud-based segment held 61.3% share, driven by increasing demand for scalable and secure clinical data management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The cloud-based segment dominated the Clinical Data Analytics Solutions market in 2024, accounting for 61.3% of the total share. Its leadership stems from growing adoption of scalable, cost-efficient, and easily accessible cloud infrastructures in healthcare analytics. Cloud-based platforms enable real-time data sharing, remote collaboration, and integration with electronic health records (EHRs). They also facilitate AI and machine learning applications for predictive analysis. Increasing demand for interoperability, data security enhancements, and remote healthcare services continues to drive the shift from on-premise systems toward cloud-based solutions across hospitals and research institutions.

- For instance, Optum leverages its cloud-based platforms, including solutions within Optum Insight and the acquired Change Healthcare business, which collectively are capable of processing over 22 billion electronic transactions annually, including 15 billion transactions through the Change Healthcare platform alone.

By Application

Clinical decision support held the largest share of 44.7% in the Clinical Data Analytics Solutions market in 2024. The dominance is driven by the growing use of analytics for improving diagnosis accuracy, treatment planning, and patient safety. Advanced analytics tools help physicians derive actionable insights from large clinical datasets and real-time patient data. Integration with EHR systems and AI-enabled predictive algorithms enhances decision-making efficiency. Rising emphasis on evidence-based medicine and value-based healthcare further strengthens the adoption of data analytics platforms in clinical decision support applications globally.

- For instance, SAS Institute Inc. introduced its Viya 4 analytics engine. The system is a high-performance, cloud-native platform that works across hybrid environments. It employs embedded AI algorithms to enhance diagnostic predictions and automate medical data interpretation, improving clinical decision efficiency in hospitals and research networks.

Key Growth Drivers

Growing Demand for Data-Driven Clinical Decision-Making

The increasing need for evidence-based medical decisions is a key driver for the Clinical Data Analytics Solutions market. Healthcare providers are using data analytics to improve diagnosis accuracy, treatment effectiveness, and patient safety. Advanced algorithms and predictive models assist in identifying high-risk patients and optimizing resource allocation. The rise in chronic diseases and complex care demands reinforces the importance of real-time data interpretation. Hospitals and research institutions are adopting analytics-driven systems to enhance clinical outcomes and support value-based care delivery.

- For instance, IQVIA’s AI-enabled platforms and the broader Connected Intelligence framework leverage AI and machine learning to process over 100 billion healthcare records annually across more than 100 countries.

Expansion of Electronic Health Records (EHR) and Interoperability

Widespread implementation of electronic health records has created vast data repositories that drive analytics adoption. Clinical data analytics platforms integrate with EHR systems to analyze patient histories, medication outcomes, and population health trends. Enhanced interoperability among healthcare systems improves information exchange and operational efficiency. Governments and regulators are encouraging digital health frameworks that support interoperable data structures. This integration not only streamlines workflows but also promotes personalized care and efficient clinical decision-making.

- For instance, Health Catalyst’s Data Operating System (DOS™) integrates data from over 100 million patient records through over 200 source systems across hospitals.

Rising Investments in Artificial Intelligence and Machine Learning

Growing investments in AI and machine learning are transforming clinical data analytics. These technologies enable predictive modeling, automated data classification, and early disease detection. AI-driven tools analyze massive datasets from diverse sources to generate insights that support timely clinical interventions. Pharmaceutical companies are leveraging AI analytics for faster drug development and clinical trial optimization. The increasing focus on precision medicine and real-time patient monitoring continues to propel AI integration in healthcare analytics platforms globally.

Key Trends & Opportunities

Integration of Predictive Analytics for Proactive Healthcare

Predictive analytics is gaining traction as healthcare providers move toward proactive patient care. By analyzing historical and real-time data, predictive models identify potential health risks and treatment outcomes. Hospitals use these insights to reduce readmission rates and improve chronic disease management. The trend is further supported by advancements in big data technologies and cloud computing. This evolution is creating opportunities for vendors offering AI-enabled predictive healthcare analytics solutions.

- For instance, a machine learning algorithm, which has been associated with systems leveraging vast patient data, has been shown in real-world clinical use across a study of nine U.S. hospitals to achieve a 22.7% reduction in 30-day readmission rates and a 39.5% reduction in in-hospital mortality for severe sepsis patients.

Growing Adoption of Value-Based Care Models

The global shift toward value-based healthcare presents significant growth opportunities for analytics providers. Clinical data analytics solutions help healthcare organizations measure performance, track patient outcomes, and optimize cost efficiency. By linking financial incentives with care quality, value-based models encourage analytics adoption for continuous performance improvement. Healthcare systems in developed economies are increasingly deploying analytics tools to align operations with outcome-driven healthcare frameworks.

- For instance, Cerner (now Oracle Health) has a de-identified, multicenter database called Cerner Real-World Data™ (CRWD). As of December 2021, this database included information from 117 health systems in the United States and contained data from more than 100 million patients and over 1.5 billion clinical encounters.

Key Challenges

Data Privacy and Security Concerns

Data security remains a critical challenge in the Clinical Data Analytics Solutions market. Healthcare organizations handle sensitive patient information, making them prime targets for cyberattacks and data breaches. Ensuring compliance with regulations such as HIPAA and GDPR adds complexity to analytics deployment. Breaches can lead to financial losses and erosion of patient trust. Vendors are focusing on encryption, authentication, and secure data-sharing mechanisms, yet maintaining security across cloud and hybrid environments remains a major industry concern.

Integration Complexity and High Implementation Costs

Integrating analytics platforms with existing hospital systems poses technical and financial challenges. Legacy systems often lack interoperability, leading to data silos and delayed analytics deployment. Customizing solutions for different healthcare environments increases cost and complexity. Smaller institutions face additional barriers due to limited budgets and expertise. To overcome these hurdles, vendors are introducing modular and scalable platforms, but seamless integration and return on investment continue to be major obstacles for widespread adoption.

Regional Analysis

North America

North America dominated the Clinical Data Analytics Solutions market in 2024, holding a 41.2% share. The region’s leadership is supported by the strong presence of advanced healthcare infrastructure, electronic health record (EHR) adoption, and early implementation of AI-driven analytics. The United States leads in investments toward precision medicine, clinical research, and regulatory compliance frameworks. Major companies and research institutions are integrating data analytics to enhance patient outcomes and operational efficiency. Continuous government support for digital healthcare initiatives and data interoperability standards further strengthens North America’s position in the global market.

Europe

Europe accounted for 28.6% of the Clinical Data Analytics Solutions market in 2024, driven by the expansion of digital healthcare initiatives and strict regulatory frameworks such as GDPR. Countries like Germany, the United Kingdom, and France are leading adoption due to robust public health systems and government-backed investments in data-driven research. The focus on patient data security, value-based healthcare, and AI-enabled analytics supports steady growth across hospitals and clinical laboratories. Collaborative projects between healthcare providers and technology vendors are promoting interoperability and enhancing real-time clinical decision-making capabilities in the European region.

Asia-Pacific

Asia-Pacific held 22.9% of the Clinical Data Analytics Solutions market in 2024 and is projected to experience the fastest growth through 2032. The region’s expansion is fueled by increasing healthcare digitalization, government initiatives in data-driven medicine, and growing demand for predictive analytics in patient care. Countries such as China, India, Japan, and South Korea are investing heavily in healthcare IT infrastructure and AI integration. The rising prevalence of chronic diseases and the adoption of cloud-based analytics tools are further accelerating market growth. Asia-Pacific’s expanding clinical research ecosystem continues to attract global technology partnerships.

Latin America

Latin America captured 4.2% of the Clinical Data Analytics Solutions market in 2024, supported by growing healthcare modernization efforts and public health digitalization programs. Brazil and Mexico are leading adoption due to expanding hospital networks and increased investments in cloud-based data management. The region’s focus on improving clinical efficiency and patient care outcomes is driving demand for analytics tools. However, challenges such as data privacy concerns and limited technical expertise slow down adoption. Despite this, government-backed initiatives and partnerships with global IT providers are expected to sustain steady market development in the coming years.

Middle East & Africa

The Middle East & Africa accounted for 3.1% of the global Clinical Data Analytics Solutions market in 2024. The region’s growth is primarily driven by healthcare infrastructure development, growing hospital digitalization, and the adoption of AI-based analytics systems. Countries such as the UAE, Saudi Arabia, and South Africa are at the forefront of deploying data analytics solutions to enhance patient outcomes and resource management. Government investments in smart healthcare systems and clinical research are supporting market expansion. While limited data integration capabilities persist, rising digital transformation initiatives are strengthening the region’s growth potential.

Market Segmentations:

By Deployment

By Application

- Clinical Decision Support

- Clinical Trials

- Regulatory Compliance

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Clinical Data Analytics Solutions market is characterized by key players such as Health Catalyst, BD, OSP, IQVIA, Dassault Systems, Optum Inc. (UnitedHealth Group), JMP Statistical Discovery LLC, eClinical Solutions LLC, Cognizant, and SAS Institute Inc. These companies lead through advanced analytics platforms, AI-driven data integration, and clinical insights solutions that enhance patient outcomes and operational efficiency. Major vendors are investing in cloud-based tools and real-time analytics to support clinical trials, precision medicine, and regulatory compliance. Partnerships between technology firms and healthcare organizations are expanding data accessibility and interoperability. Continuous innovations in predictive modeling, machine learning, and data visualization are helping market leaders deliver actionable intelligence to healthcare providers. The competitive environment remains dynamic, with a focus on accelerating digital transformation in clinical workflows and improving evidence-based decision-making through secure, scalable, and high-performance analytics platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Health Catalyst

- BD

- OSP

- IQVIA

- Dassault Systems

- Optum, Inc. (UnitedHealth Group)

- JMP Statistical Discovery LLC

- eClinical Solutions LLC

- Cognizant

- SAS Institute Inc.

Recent Developments

- In August 2025, eClinical Solutions introduced an Integrated Data Review Plan (IDRP) capability within its elluminate Clinical Data Cloud® platform, enabling centralized digital review workflows.

- In July 2025, Dassault Systèmes (via its brand Medidata) announced that Medidata Clinical Data Studio, its AI-powered unified platform, had seen growing adoption across major biopharma companies.

- In April 2025, eClinical Solutions LLC published new research emphasizing risk-based strategies and expanded AI adoption among clinical trial leaders.

- In January 2023, IQVIA announced a co llaboration with Alibaba Cloud. This collaboration is anticipated to strengthen IQVIA’s geographical presence in China by better serving its customers

Report Coverage

The research report offers an in-depth analysis based on Deployment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare providers adopt data-driven decision-making tools.

- Cloud-based analytics platforms will dominate due to scalability and real-time data access.

- AI and machine learning will enhance predictive analytics for personalized patient care.

- Integration of analytics with EHRs will improve interoperability and workflow efficiency.

- Demand for regulatory compliance and audit-ready systems will increase across regions.

- Partnerships between healthcare institutions and analytics firms will strengthen innovation.

- Real-time data visualization will support faster clinical insights and reduced error rates.

- Investments in advanced analytics for clinical trials and drug discovery will rise.

- Asia-Pacific will experience strong growth with digital healthcare modernization.

- Continuous focus on patient outcome optimization will drive next-generation analytics adoption.