Market Overview

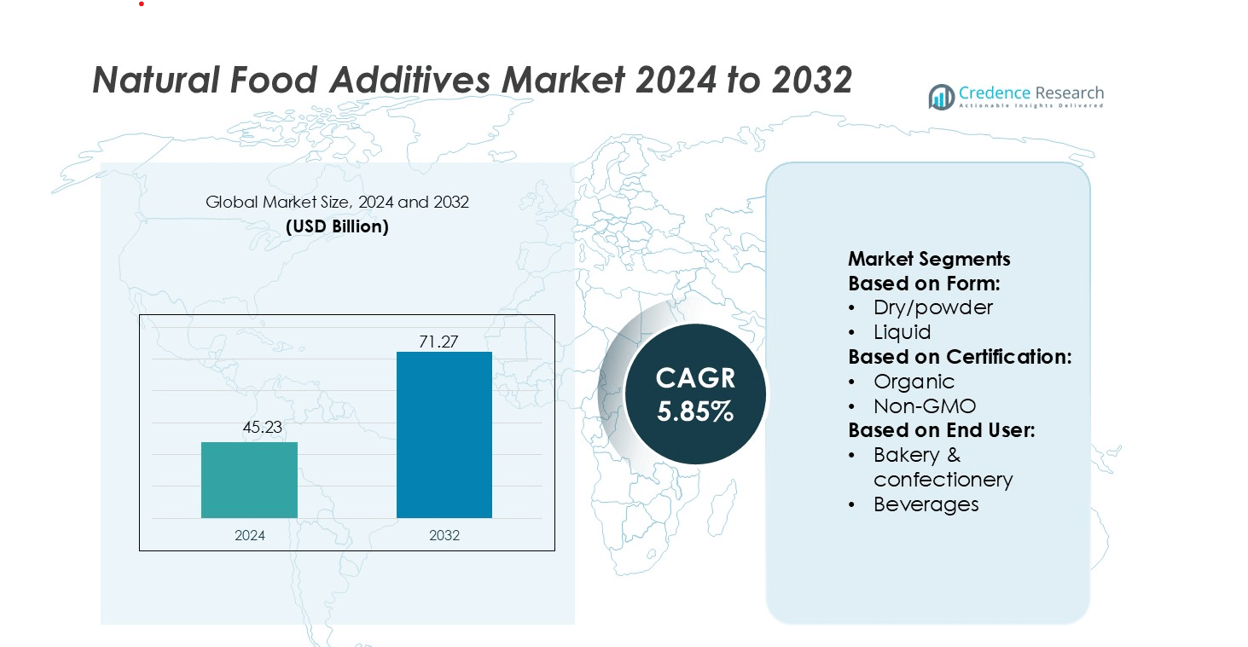

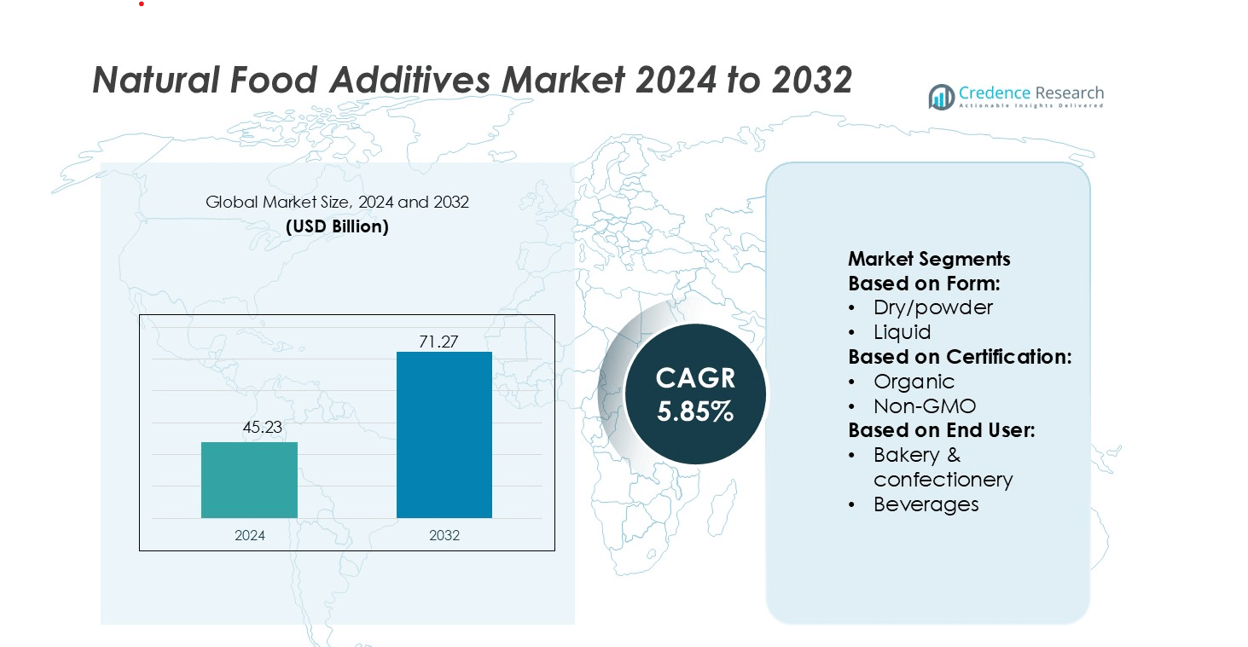

Natural Food Additives Market size was valued USD 45.23 billion in 2024 and is anticipated to reach USD 71.27 billion by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Food Additives Market Size 2024 |

USD 45.23 billion |

| Natural Food Additives Market, CAGR |

5.85% |

| Natural Food Additives Market Size 2032 |

USD 71.27 billion |

The natural food additives market include Givaudan, DSM, BASF SE, Ajinomoto Co., Inc., ADM, International Flavors & Fragrances Inc. (IFF), Cargill, Incorporated, Ingredion Incorporated, Biospringer and Tate & Lyle Plc. These firms invest significantly in innovation, sustainable sourcing and global expansion to secure leadership in ingredient development and clean‑label solutions. Geographically, the leading region is North America, which holds about 30% of the global natural food additives market share. Strong regulatory frameworks, high consumer demand for natural ingredients and large processed food sectors underpin North America’s dominance.

Market Insights

- The natural food additives market size was valued at USD 45.23 billion in 2024 and is projected to reach USD 71.27 billion by 2032, growing at a CAGR of 5.85% during the forecast period.

- North America leads the market with a 30% share, driven by strong regulatory standards, high consumer awareness, and extensive processed food industries, followed by Asia Pacific and Europe with significant growth potential.

- Key players such as Givaudan, DSM, BASF SE, Ajinomoto Co., ADM, IFF, Cargill, Ingredion, Biospringer, and Tate & Lyle Plc focus on innovation, sustainable sourcing, and global expansion to strengthen their competitive positions.

- Growing consumer preference for clean-label, plant-based, and organic products drives adoption across bakery, beverages, dairy, processed foods, and sauces segments.

- Market restraints include high production costs, supply chain challenges, and regulatory complexities in emerging regions, which may limit rapid expansion despite increasing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Dry or powder additives hold the dominant market share. Food and beverage manufacturers use powder forms for improved stability, controlled dosing, and longer shelf life. Powdered extracts, colors, flavors, and preservatives are easier to store and transport, reducing product loss. Dry formats blend well in bakery mixes, snacks, and processed foods, supporting large-scale production. Rising demand for clean-label ingredients in packaged foods drives adoption of dehydrated plant extracts and natural colorants.

- For instance, Givaudan developed a spray‑dried flavour particle in which the droplets had an average size of 3 μm to 15 μm and the surface oil level was specified at less than 0.3% by weight.

By Certification

Organic additives lead this segment with the highest market share. Consumers associate organic certification with safety, transparency, and pesticide-free sourcing. Food brands use certified organic flavors, sweeteners, and colors to improve label claims and strengthen brand value. Government support, stricter labelling rules, and premium product launches fuel organic adoption. The shift toward chemical-free foods across baby food, beverages, and dairy products further strengthens this category’s dominance.

- For instance, dsm‑firmenich offers a certified‑organic portfolio of over 400 oils, flavors and extracts (400+) certified by Ecocert, USDA Organic and EU regulation 2018/848.

By End User

Beverages represent the dominant end-user segment. Natural colors, sweeteners, acids, and botanical extracts are widely used in juices, functional drinks, carbonated beverages, and flavored waters. Beverage manufacturers prefer natural additives to replace synthetic stabilizers and improve product positioning. Growing demand for low-sugar, plant-based, and antioxidant-rich drinks drives steady consumption of clean label ingredients. Expansion in ready-to-drink formats and health-focused beverages supports continued market leadership in this segment.

Key Growth Drivers

Rising Health Consciousness

Growing consumer awareness about health and nutrition drives demand for natural food additives. Consumers increasingly prefer products free from synthetic preservatives, artificial colors, and flavors. This trend pushes manufacturers to adopt natural ingredients, enhancing product appeal. For instance, natural antioxidants and plant-based extracts are gaining traction in beverages, bakery, and processed foods. Regulatory encouragement and labeling standards promoting clean-label products further support adoption. Companies investing in R&D for innovative natural formulations benefit from expanded market reach and higher consumer trust, fostering sustained growth across segments.

- For instance, BASF has certified certain vitamin A and vitamin E products with Product Carbon Footprints at least 20 % better than the global market average for comparable products.

Expansion of Clean-Label and Organic Products

The surge in clean-label and organic food offerings fuels the natural food additives market. Products certified as organic, non-GMO, or clean-label attract health-conscious and environmentally aware consumers. Retailers and foodservice providers increasingly stock items with natural additives to meet rising demand. For example, natural colorants and flavor extracts are widely incorporated in bakery, dairy, and beverages. Strategic partnerships between additive manufacturers and food brands accelerate market penetration. This trend aligns with regulatory support for organic standards and labeling, encouraging continuous product innovation and adoption in developed and emerging markets.

- For instance, “Palate Perfect FL‑TM” fermented tomato‑flavour ingredient works at usage rates as low as 0.02 % weight/weight in sauces, dressings and juices, enabling clean‑label claims while replacing conventional tomato solids.

Growth in Processed and Convenience Foods

The proliferation of processed and convenience foods contributes significantly to natural food additive demand. Manufacturers integrate natural preservatives, flavors, and colors to maintain product quality and extend shelf life. Rising urbanization, dual-income households, and fast-paced lifestyles boost ready-to-eat and packaged food consumption. For instance, natural antioxidants are increasingly used in snack foods and frozen meals to enhance stability. Market players focus on innovative additive solutions catering to sensory appeal and health benefits. This integration supports revenue growth by combining convenience with consumer demand for healthier, clean-label alternatives.

Key Trends & Opportunities

Technological Advancements in Extraction Methods

Innovations in extraction and formulation technologies enhance the efficiency and quality of natural additives. Advanced techniques such as supercritical CO₂ extraction and enzyme-assisted processes improve yield, purity, and stability. This enables the development of novel colorants, flavors, and functional ingredients with consistent performance. Companies adopting these technologies can offer high-quality products tailored to bakery, beverage, and dairy applications. The trend opens opportunities for premium product positioning and differentiation, supporting partnerships with large food manufacturers and private-label brands seeking natural and clean-label alternatives.

- For instance, ADM’s “Colors From Nature™” micronized color powders achieved a particle size distribution in which the median diameter (D 50) fell below 10 µm, resulting in opacity improvements enabling color strength gains of up to 30% versus standard natural color powders.

E-Commerce and Digital Distribution Channels

Online platforms expand access to natural food additives globally. E-commerce enables faster delivery, bulk ordering, and subscription-based supply for both B2B and B2C markets. Food manufacturers and small-scale producers increasingly rely on digital channels for procurement of certified organic and clean-label ingredients. Enhanced transparency via online product descriptions, certifications, and reviews drives consumer confidence. This trend also allows emerging brands to penetrate new regional markets efficiently. As a result, companies leveraging e-commerce gain wider distribution, stronger brand visibility, and higher sales potential, creating a strategic growth opportunity.

- For instance, Cargill’s proprietary natural‑antioxidant blend under “Cargill Natural Flavors” extended the shelf life of ground beef by up to 5 days and preserved approximately 1.5 million lbs (680 000 kg) of product per year for major retailers.

Rising Functional and Plant-Based Food Demand

Growing interest in functional foods, dietary supplements, and plant-based diets fuels natural additive adoption. Ingredients like natural antioxidants, prebiotics, and botanical extracts improve nutritional profiles and cater to wellness trends. Consumers demand products enhancing immunity, digestion, and overall health. Food manufacturers incorporate natural additives into beverages, snacks, and dairy alternatives to meet these preferences. This creates opportunities for innovation in product formulations, such as plant-based protein drinks and fortified bakery items. Companies offering diverse, functional natural additives capitalize on evolving dietary patterns, driving growth and market expansion.

Key Challenges

Supply Chain and Raw Material Variability

Natural food additives face challenges from fluctuating raw material availability and quality. Seasonal variations, climate change, and agricultural constraints affect the supply of plant-based ingredients. Inconsistent quality can impact color, flavor, and preservative performance, posing formulation difficulties. Manufacturers must implement robust sourcing strategies, including supplier audits and alternative sourcing. This adds operational costs and complexity, particularly for global production. Ensuring consistent supply while maintaining clean-label or organic certifications remains a significant challenge, potentially limiting scalability and impacting the cost structure of natural food additive products.

Higher Production Costs and Price Sensitivity

Producing natural food additives often involves complex extraction processes, stringent quality standards, and certification requirements, leading to higher costs. These costs are sometimes transferred to end consumers, affecting demand in price-sensitive markets. Small and medium food manufacturers may struggle to adopt premium natural ingredients due to budget constraints. Price competition with synthetic alternatives remains strong, requiring manufacturers to balance cost, quality, and consumer appeal. Additionally, regulatory compliance and testing for natural claims further increase expenses, posing a challenge to widespread adoption despite rising health-conscious consumer trends.

Regional Analysis

North America

The North America region commands roughly 30 % of the global natural food additives market revenue. Regulatory frameworks and growing consumer demand for clean‑label and natural ingredients drive this strength. A robust processed‑food manufacturing sector in the United States and Canada accelerates adoption of natural additives. Key factors include rising health awareness and stringent food‑safety standards that push manufacturers to replace synthetic additives with natural alternatives.

Asia Pacific

Asia Pacific currently holds about 35 % of the global natural food additives market. Rapid urbanisation, increasing disposable incomes, and growing demand for convenience and processed foods underpin the region’s growth. Additionally, emerging markets like China and India show significant uptake of natural‑ingredient solutions amid rising health consciousness. This dynamic is augmented by regional regulatory moves favouring natural additives and food‑safety enhancements.

Europe

Europe accounts for an estimated 25 % of the global natural food additives market. The region benefits from a strong consumer preference for organic, clean‑label and “free‑from” products, supported by strict food‑additive regulation and enforcement. Western European markets, especially Germany, the UK and France, lead in natural‑additive usage across bakery, dairy, and beverages. Manufacturers respond with innovation and formulation shifts aligned to European safety and transparency demands.

Latin America

Latin America holds approximately 5 % of the global natural food additives market. In this region, growth is driven by increasing processed‑food penetration and a rising middle class, though regulatory frameworks and supply‑chain maturity lag those in developed regions. Opportunities exist for local natural‑additive suppliers to expand as clean‑label trends gain traction. Market players must address infrastructure and cost‑efficiency challenges to scale uptake.

Middle East & Africa

The Middle East & Africa region also represents about 5 % of the global natural food additives market. While awareness of natural and clean‑label ingredients is growing, widespread adoption remains constrained by fragmented food supply chains and less mature regulatory environments. Key growth drivers include demand in the Gulf Cooperation Council (GCC) countries and South Africa, where food‑service and packaged food sectors are expanding. Investments in ingredient sourcing and local manufacturing will be critical for future growth.

Market Segmentations:

By Form:

By Certification:

By End User:

- Bakery & confectionery

- Beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The natural food additives market players such as Givaudan, DSM, BASF SE, Ajinomoto Co., Inc., ADM, International Flavors & Fragrances Inc. (IFF), Cargill, Incorporated, Ingredion, Biospringer and Tate & Lyle Plc. The natural food additives market is highly competitive, driven by innovation, regulatory compliance, and growing consumer demand for clean‑label products. Companies focus on developing plant‑based sweeteners, natural emulsifiers, colors, and preservatives to meet diverse industry needs across bakery, beverages, dairy, and processed foods. Strategic investments in research and development, along with partnerships and collaborations, enhance product portfolios and accelerate market penetration. Sustainability and traceability in sourcing have become critical differentiators, influencing purchasing decisions. Rapid adoption of natural alternatives, coupled with increasing health awareness and stringent regulations on synthetic additives, continues to shape the competitive dynamics and drive continuous innovation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Givaudan

- DSM

- BASF SE

- Ajinomoto Co., Inc.

- ADM

- International Flavors & Fragrances Inc. (IFF)

- Cargill, Incorporated

- Ingredion

- Biospringer

- Tate & Lyle Plc

Recent Developments

- In April 2025, Godrej Industries’ chemicals business acquired the food additives business of Savannah Surfactants. The Savannah business will be part of the specialty chemicals sector. The addition of this food additives business will expand our specialty offerings and build a larger specialty business going forward.

- In March 2025, Cargill opened a new corn milling plant in Gwalior, Madhya Pradesh, operated by Indian manufacturer Saatvik Agro Processors, to meet increasing demand from India’s confectionery, infant formula, and dairy industries.

- In July 2024, Tate & Lyle launched Optimizer Stevia 8.10, a new stevia formulation designed to provide manufacturers with a budget-friendly sweetener alternative. Optimizer Stevia 8.10 closely mimics the taste of sugar, even at elevated sugar replacement ratios. This stevia variant is more economical, delivering enhanced value over other premium stevia sweeteners.

- In June 2024, Azelis, a prominent player in the specialty chemicals and food ingredients sector, signed a distribution agreement with BASF for the China market. BASF is known for developing sustainable, high-quality nutritional ingredients.

Report Coverage

The research report offers an in-depth analysis based on Form, Certification, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing consumer demand for clean‑label food products will continue to propel adoption of natural additives.

- Manufacturers will increasingly prioritise plant‑based sources and substitute synthetic ingredients to meet regulatory and consumer pressure.

- Technological advances in extraction and formulation methods will enhance cost‑efficiency and scalability of natural food additive production.

- Emerging regions with expanding processed‑food sectors will generate strong growth opportunities for natural additive suppliers.

- Integration of sustainability and traceability in sourcing will become a key differentiator for ingredient providers.

- The food and beverage industry will increase use of multifunctional natural additives that deliver taste, texture and preservation in one.

- Partnerships, acquisitions and collaboration between ingredient firms and food manufacturers will accelerate innovation and market penetration.

- Reformulation of existing products to feature natural additives will replace legacy synthetic‑based versions across categories.

- Regulatory efforts favouring natural over synthetic additives will reduce barriers and support market expansion.

- Mature markets will shift from volume expansion to value‑driven growth, focusing on premium, health‑oriented additive solutions.