Market Overview

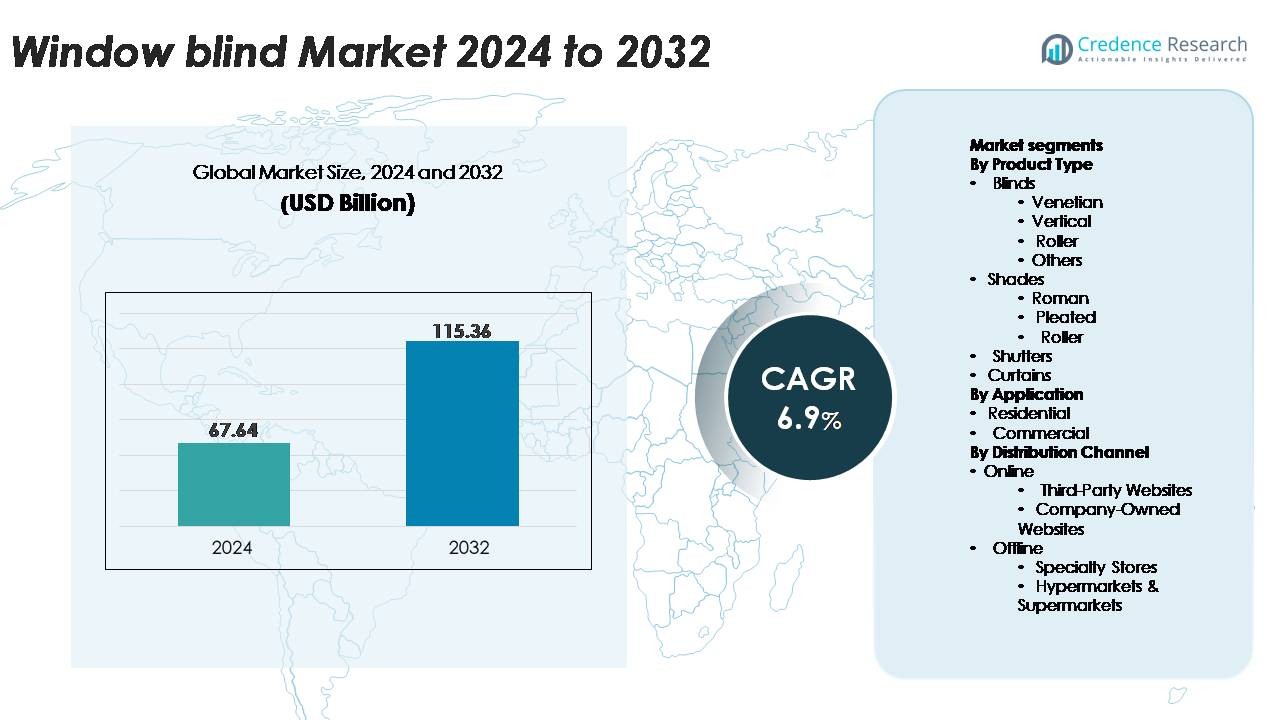

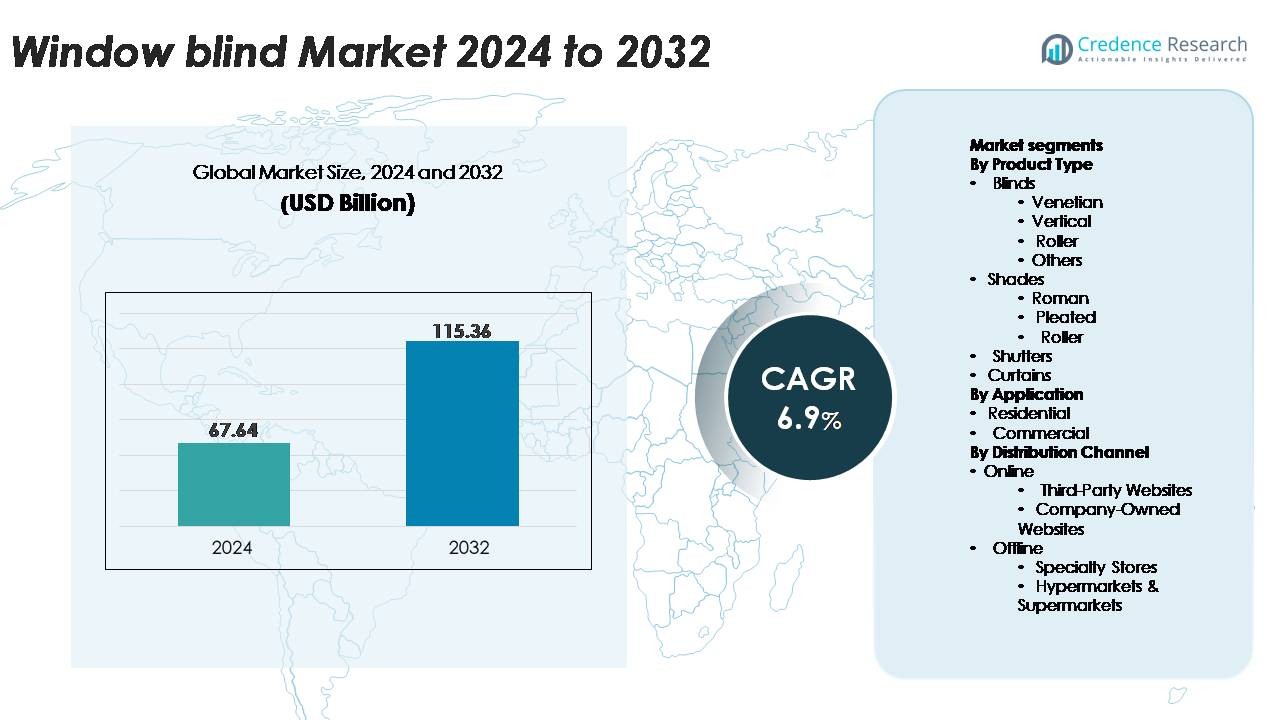

The global window blinds market was valued at USD 67.64 billion in 2024 and is projected to reach USD 115.36 billion by 2032, expanding at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Window Blinds Market Size 2024 |

USD 67.64 Billion |

| Window Blinds Market, CAGR |

6.9% |

| Window Blinds Market Size 2032 |

USD 115.36 Billion |

The window blinds market is shaped by a competitive mix of global and regional manufacturers, with leading players such as Hunter Douglas, Springs Window Fashions, Budget Blinds, Hillarys, Aspect Blinds, Ching Feng Home Fashions, Advanced Window Blinds, Stevens (Scotland) Ltd, Liyang Xinyuan Curtain, and All Blinds Co., Ltd driving innovation and product differentiation. These companies compete through extensive product portfolios, customization capabilities, and growing adoption of motorized and smart home integrated solutions. Asia Pacific stands as the leading regional market with 34% share, supported by rapid urbanization and strong construction activity, followed by North America at 32%, where premium blinds and automated shading systems see high demand across residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global window blinds market reached USD 67.64 billion in 2024 and is projected to hit USD 115.36 billion by 2032, expanding at a CAGR of 6.9%, supported by rising demand across residential and commercial spaces.

- Strong market drivers include increasing home renovation activities, adoption of energy efficient shading systems, and growing consumer preference for modern designs such as Venetian and roller blinds, which together account for the largest product type share.

- Key trends include rapid growth in smart and motorized blinds, rising use of sustainable materials, and expanding online customization tools that strengthen brand engagement and purchasing convenience.

- Competitive intensity remains high as global players such as Hunter Douglas and Springs Window Fashions innovate in automation and premium materials, while low cost imports challenge pricing structures and margin stability.

- Regionally, Asia Pacific leads with 34%, followed by North America at 32% and Europe at 28%, driven by strong construction pipelines and rising adoption of modern window treatment solutions across all channels.

Market Segmentation Analysis:

By Product Type

Blinds dominate the global market, holding the largest share due to their broad adaptability across modern interiors and their availability in multiple configurations such as Venetian, vertical, and roller formats. Venetian blinds remain the most preferred sub segment, driven by their precise light control capability, easy adjustability, and suitability for both residential and commercial settings. Roller blinds continue gaining traction because of their minimalist design and motorization compatibility, while Roman and pleated shades attract demand among premium consumers seeking aesthetic appeal. Shutters and curtains contribute steadily, supported by rising adoption of energy efficient and noise reducing window treatments.

- For instance, Hunter Douglas’ Modern Precious Metals® Venetian blinds use aluminum slats with a spring tempered alloy that enhances durability and ensures stable tilt performance, available in various slat sizes including ½”, 1″, and 2″.

By Application

The residential sector represents the dominant application segment, accounting for the largest market share as homeowners increasingly invest in home décor upgrades, privacy control, and energy efficient window coverings. Demand is further propelled by the widespread adoption of automated blinds and smart home integrated shading solutions. Commercial applications spanning offices, hospitality, retail, and institutional buildings show steady growth as property developers prioritize thermal management, natural light optimization, and professional aesthetics. Commercial users are also adopting durable, fire retardant, and motorized systems to enhance operational efficiency and comply with building standards.

- For instance, Springs Window Fashions equips its Bali® motorized roller shades with the Somfy Sonesse 30 RTS motor, which delivers 2 Nm torque at 28 rpm, enabling smooth operation of commercial grade blinds up to 3.1 m in width while maintaining a low noise level below 44 dB.

By Distribution Channel

Offline channels lead the market, with specialty stores capturing the largest share because they offer extensive product customization, professional installation services, and in store material demonstrations. Hypermarkets and supermarkets support volume sales by offering cost effective, ready to install blinds. Online distribution is expanding rapidly as consumers increasingly rely on third party platforms for variety and competitive pricing, while company owned websites benefit from direct to consumer customization tools and virtual visualization features. The shift toward e commerce is reinforced by convenient delivery, broad product availability, and growing consumer comfort with digital purchasing of home improvement products.

Key Growth Drivers:

Rising Home Renovation and Interior Modernization Activities

Growing investments in home renovation, interior redesign, and aesthetic enhancement strongly accelerate demand for window blinds globally. Consumers increasingly seek functional yet stylish window treatments that enhance privacy, optimize natural light, and complement modern décor themes. The shift toward modular and minimalist interiors encourages adoption of roller blinds, Venetian blinds, and Roman shades due to their clean lines and versatile fabric choices. Additionally, rising residential construction in urban areas, expanding middle class purchasing power, and the trend toward personalized home décor amplify product demand. Homeowners also prioritize energy efficiency by selecting blinds that reduce heat gain and improve indoor climate control. The availability of a wide price spectrum from mass market ready made blinds to premium custom solutions further broadens accessibility, supporting continuous market expansion. Retailers and manufacturers capitalize on this trend by offering diverse materials, colors, and motorization options aligned with evolving consumer expectations.

- For instance, Hunter Douglas’ Sonnette® Cellular Roller Shades feature a unique 2″ (50.8 mm) cellular structure that traps air, creating an insulating air pocket and improving window thermal performance to help reduce heat loss and gain.

Growing Adoption of Smart and Motorized Window Coverings

The increasing integration of smart home technologies is a major growth catalyst for the window blinds market. Motorized blinds, remote controlled shading systems, and app connected roller blinds are becoming mainstream as consumers seek convenience, automated privacy, and enhanced energy efficiency. These systems enable scheduled opening and closing based on daylight levels, temperature, or user preference, improving indoor comfort and reducing HVAC loads. Compatibility with smart home ecosystems such as voice controlled assistants expands adoption among tech savvy homeowners and commercial facility managers. Hospitals, hotels, and office buildings increasingly deploy automated blinds to streamline operations, ensure uniform lighting conditions, and reduce manual intervention in large window installations. Moreover, improvements in battery technology, low voltage motors, and wireless connectivity have made automation more affordable and easier to retrofit, lowering entry barriers for consumers. As sustainability considerations intensify, automated blinds serve as effective daylight management tools, reinforcing their long term market potential.

- For instance, Lutron’s Serena® smart shades use a whisper quiet drive rated at less than 44 dBA and an onboard battery pack capable of delivering up to 36 months of operation per charge depending on usage frequency, while Somfy’s Sonesse® 30 RTS tubular motor delivers 2 Nm torque at 28 rpm, enabling smooth lifting of shades up to 3.1 m in width.

Expanding Commercial Infrastructure and Workplace Modernization

Rapid development of commercial infrastructure including corporate offices, co working spaces, hospitality venues, retail outlets, and educational institutions continues to boost demand for advanced window coverings. Modern workplaces increasingly emphasize energy efficient lighting, glare reduction, and employee comfort, prompting the adoption of vertical blinds, motorized roller systems, and high durability shades. Facility managers prefer materials with fire resistant, antimicrobial, and UV blocking properties to meet building codes and occupational safety requirements. Hotels and retail chains seek premium aesthetic finishes and standardized shading solutions to ensure consistent brand experiences. Large commercial windows and glass façades in contemporary architecture further enhance the role of blinds in heat management and natural light control. Additionally, sustainability certifications including LEED and WELL Building standards encourage the use of blinds that improve thermal performance and reduce energy consumption. This commercial demand creates long term recurring opportunities for manufacturers, installers, and maintenance service providers.

Key Trends & Opportunities:

Increased Demand for Eco Friendly and Sustainable Materials

Sustainability has become a defining trend in the window blinds industry, with rising consumer preference for products manufactured from recycled, organic, or responsibly sourced materials. Blinds made from natural fibers such as bamboo, jute, or cotton and shades using low VOC, recyclable fabrics are gaining traction in both residential and commercial markets. Manufacturers are responding by investing in environmentally responsible production processes and adopting certifications that validate ecological performance. Government policies promoting energy efficient building materials also support the transition toward sustainable blinds that reduce heat gain, improve insulation, and minimize environmental impact. Growing awareness of indoor air quality further strengthens demand for hypoallergenic and chemical free materials. As green construction expands globally, opportunities emerge for brands offering eco conscious designs, modular components, and long lasting products tailored to environmentally aware consumers.

- For instance, Phifer’s SheerWeave® Infinity2 line is produced using 100% REPREVE® recycled polyester each yard incorporating approximately 10 post consumer PET bottles while Mermet’s GreenScreen® Sea Tex™ fabrics contain yarns made from marine plastic waste collected through the SEAQUAL Initiative, with each kilogram of yarn reusing roughly 1 kg of reclaimed ocean debris.

Expansion of Customization, Personalization, and Made to Measure Solutions

Consumers increasingly favor personalized window treatments that align with décor preferences, room dimensions, and functional requirements, driving significant growth in customized window blinds. Technological advancements including digital fabric visualization, online configuration tools, and augmented reality room previews enable buyers to create tailored designs with precise measurements, fabric types, color palettes, and operational mechanisms. This trend benefits specialty retailers and manufacturers offering made to measure roller blinds, Roman shades, and vertical systems. Customization also thrives in the commercial sector, where businesses require uniform shading solutions, branded aesthetics, and performance driven materials for large projects. As consumer expectations shift toward premium, differentiated experiences, companies offering tailored installation, design consultation, and after sales service gain competitive advantage. The rising preference for curated interiors and unique design elements ensures long term opportunity in the customized blinds segment.

- For instance, Hunter Douglas’ Design Studio™ Roman Shades program currently offers over 250 exclusive fabric swatches in sophisticated blends of cottons, linens, silks, and synthetics.

Strengthening E Commerce Penetration and Direct to Consumer Business Models

The rapid growth of e commerce has transformed the window blinds purchasing landscape by offering consumers a wider product selection, transparent pricing, and convenient delivery. Third party platforms and direct to consumer (D2C) brands empower buyers with comparative tools, virtual design assistants, and customer reviews that simplify decision making. Company owned websites benefit from showcasing deep customization features, fabric samples, and measurement guides that replicate the in store experience. The expansion of online retail has also encouraged standardized packaging, easy install blind kits, and improved logistics operations to accommodate large format products. Rising digital literacy, increased trust in online shopping, and advancements in last mile delivery systems create strong opportunity for manufacturers to scale through online exclusive models. As e commerce accelerates, brands leveraging digital marketing, omnichannel fulfillment, and subscription based maintenance services will solidify their market presence.

Key Challenges:

Intense Price Competition and Presence of Low Cost Imports

The global window blinds market faces strong pricing pressure due to the widespread availability of low cost imported products that challenge premium and mid range brands. Manufacturers in regions with lower production costs supply competitively priced blinds that appeal to budget conscious consumers but often lack advanced materials, durability, or automation features. This influx compresses margins for established companies, forcing them to optimize supply chains and innovate while maintaining affordability. Retailers also struggle to differentiate offerings in a crowded market where price becomes the primary decision factor. Additionally, fluctuating raw material costs especially for metals, plastics, and specialty fabrics further heighten production challenges. This competitive environment compels brands to balance cost efficiency with product quality, technological upgrades, and customer service to sustain market credibility.

Installation Complexities and Limited Consumer Awareness of Advanced Solutions

Although demand for motorized and high performance blinds is growing, many consumers lack awareness of the functional advantages these solutions offer, including energy savings, automated light management, and enhanced privacy. This knowledge gap slows adoption in both residential and small commercial markets. Installation challenges also pose a barrier, as motorized systems often require technical setup, precise measurements, and occasional integration with smart home networks. Inadequate installer networks, especially in developing regions, further restrict market penetration. High installation costs and fear of compatibility issues deter potential buyers, despite improvements in wireless and battery powered systems. Addressing this challenge requires stronger consumer education, simplified installation kits, professional training programs, and expanded after sales support to increase confidence in advanced window covering technologies.

Regional Analysis:

North America

North America holds a significant share of the global window blinds market, accounting for around 32% due to high adoption of premium home décor products, smart home technologies, and energy efficient shading systems. Strong residential renovation activity in the U.S. and Canada further drives demand for Venetian, roller, and motorized blinds. Commercial real estate modernization, especially in hospitality and office buildings, supports steady growth in advanced shading solutions with fire resistant and automated capabilities. Well established retail networks, strong e commerce penetration, and the presence of leading manufacturers reinforce the region’s continued market dominance.

Europe

Europe represents approximately 28% of the global market, supported by stringent energy efficiency regulations, widespread use of thermal insulating blinds, and a strong preference for minimalist interior designs. Countries such as Germany, the U.K., France, and the Nordics show high demand for automated roller blinds and sustainable materials including bamboo and recycled fabrics. Renovation of historic buildings and rising adoption of smart shading solutions in commercial facilities further contribute to market expansion. Europe’s mature retail infrastructure, coupled with growing e commerce adoption, continues to strengthen product accessibility and regional competitiveness.

Asia Pacific

Asia Pacific leads global growth momentum and captures about 34% of the market, driven by rapid urbanization, expanding middle class income levels, and strong residential and commercial construction across China, India, Japan, and Southeast Asia. Consumers increasingly choose affordable roller blinds, vertical blinds, and modern shades to enhance privacy and optimize natural light in compact living spaces. Commercial demand rises from office towers, hospitality developments, and retail infrastructure emphasizing energy efficient shading. Expanding e commerce platforms and local manufacturing capabilities further support price competitive offerings, positioning Asia Pacific as the fastest growing regional market.

Latin America

Latin America accounts for around 4% of the global market, supported by a gradual rise in residential remodeling and increasing adoption of modern blinds over traditional curtains. Brazil, Mexico, and Chile represent the strongest demand corridors, driven by expanding urban housing and growing preference for cost efficient roller and vertical blinds. Commercial applications grow steadily in hospitality and small office environments seeking durable and easy to maintain shading solutions. However, inconsistent economic cycles and import dependency impact pricing dynamics. Despite these challenges, expanding retail channels and digital marketplaces are enhancing product accessibility across the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 2% of the global market, with demand concentrated in the UAE, Saudi Arabia, South Africa, and Nigeria. The region’s hot climate boosts adoption of thermal insulating blinds and solar control roller systems in both residential and commercial buildings. Rapid urban development, luxury property projects, and growth in hospitality infrastructure further support market expansion. However, limited local manufacturing and reliance on imports affect product affordability. Growing awareness of energy efficiency and the rise of modern retail outlets gradually strengthen the region’s long term market potential.

Market Segmentations:

By Product Type

- Blinds

- Venetian

- Vertical

- Roller

- Others

- Shades

- Shutters

- Curtains

By Application

By Distribution Channel

- Online

- Third Party Websites

- Company Owned Websites

- Offline

- Specialty Stores

- Hypermarkets & Supermarkets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the window blinds market is characterized by a mix of global manufacturers, regional brands, and specialized custom solution providers competing across design, material innovation, and automation capabilities. Leading companies focus on expanding their product portfolios with motorized blinds, smart home compatible shading systems, and sustainable materials to address evolving consumer preferences. Many players invest in digital retail channels, offering customization tools, virtual room visualizers, and direct to consumer models to strengthen market reach. Partnerships with interior designers, construction firms, and commercial developers enhance project based sales, particularly in office, hospitality, and retail spaces. Price competition remains intense, driven by low cost imports and private label offerings, prompting established brands to differentiate through durability, installation services, and value added features. With rising emphasis on energy efficiency, automation, and eco friendly materials, companies increasingly channel R&D investment into advanced fabrics, noise free motors, and improved light control technologies to maintain a competitive edge in both residential and commercial markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hunter Douglas

- Advanced Window Blinds

- Ching Feng Home Fashions

- Aspect Blinds

- Hillarys

- Springs Window Fashions

- Stevens (Scotland) Ltd

- Budget Blin

- Liyang Xinyuan Curtain

- All Blinds Co., Ltd

Recent Developments:

In December 2024, Springs Window Fashions completed a significant capital infusion and refinancing of a portion of its outstanding debt under the ownership of Clearlake Capital Group. The transaction provided substantially increased liquidity and included a new first-out term loan facility, a revolving credit facility, a new second-out term loan to refinance the outstanding term loan, and new second lien notes to exchange for a portion of its outstanding senior notes. Springs extended the maturity of its ABL facility, moving the nearest debt maturity dates from 2026 to 2028, providing greater financial flexibility. This capital infusion was designed to support Springs’ long-term growth objectives and its value creation plan under Clearlake’s ownership. The company also reported a 5% increase in its workforce in 2024, signaling expansion in operational capacity to serve home-center chains and commercial contractors. Additionally, Springs Window Fashions had previously acquired B&C International, a leading European window treatment manufacturer, in January 2021, establishing a major manufacturing presence in Europe with brands such as Bece and Decosol.

- In August 2024, Ching Feng Home Fashions announced an equity buyback program for 2 million shares (representing 1.12% of its issued share capital) at a price range of TWD 15 to TWD 31 per share, with the program expiring in October 2025. The buyback was initiated to transfer shares to employees. More significantly, Ching Feng Home Fashions is pursuing an aggressive “SSS Innovation Strategy” focused on Safety, Sustainability, and Smart functionality. The company launched smart control blinds and remote control blinds in the second half of 2024, with plans to increase the smart proportion of products to over 5% by 2025. Additionally, Ching Feng is expanding its sustainability initiatives, with eco-friendly products representing 42.5% of production in the first half of 2024, targeting growth to over 45% by 2025. The company is also enhancing its omni-channel business model and expanding into e-commerce and professional markets while customizing cordless and smart window covering products for North American and Asian markets through its facilities in Taiwan and the USA.

- In May 2024, Hunter Douglas acquired Azenco Outdoor, a luxury outdoor living brand specializing in innovative bioclimatic pergolas, cabanas, carports, and swimming pool covers. The acquisition, which closed around May 19, 2024, was designed to expand Hunter Douglas’s outdoor shading portfolio across North America and Europe. Derek Forbes, president of Hunter Douglas Outdoor, stated that the company’s goal was to expand Azenco’s reach and make their products available nationwide. This strategic move diversified Hunter Douglas’s product offerings beyond interior window coverings into premium exterior solutions. Additionally, in February 2022, 3G Capital completed the acquisition of a 75% stake in Hunter Douglas for an enterprise value of approximately $7.1 billion (€6.3 billion), with the founding Sonnenberg family retaining a 25% interest, signaling significant capital investment and support for the company’s global expansion. Hunter Douglas remains widely considered the world market leader in window coverings, with a significant market share in the global sector.

Report Coverage:

The research report offers an in depth analysis based on Product type, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will increasingly shift toward smart and motorized blinds as automation becomes a standard feature in modern households and commercial buildings.

- Adoption of energy efficient shading solutions will accelerate as consumers prioritize thermal control and reduced HVAC loads.

- Sustainable materials such as bamboo, recycled fabrics, and low VOC textiles will gain stronger preference among environmentally conscious buyers.

- Customization and made to measure offerings will expand, supported by digital visualization tools and online configuration platforms.

- Commercial infrastructure growth will drive demand for durable, fire resistant, and large format blinds.

- Integration of blinds with smart home ecosystems and voice assistants will become more widespread.

- E commerce channels will capture a larger share as buyers increasingly rely on online product selection and doorstep installation services.

- Manufacturers will invest more in silent motor technology and long lasting components to improve user comfort.

- Partnerships with architects, interior designers, and construction firms will strengthen project based sales.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will experience faster adoption due to rising urbanization and expanding housing developments.