Market Overview

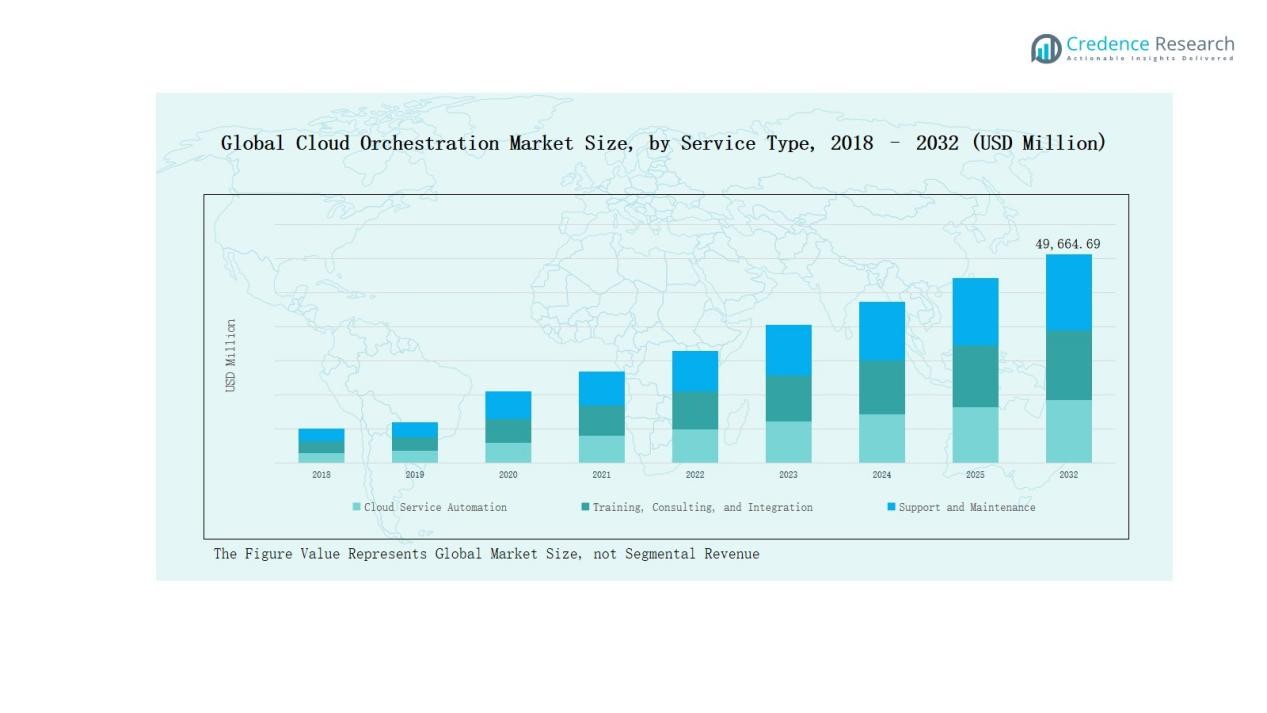

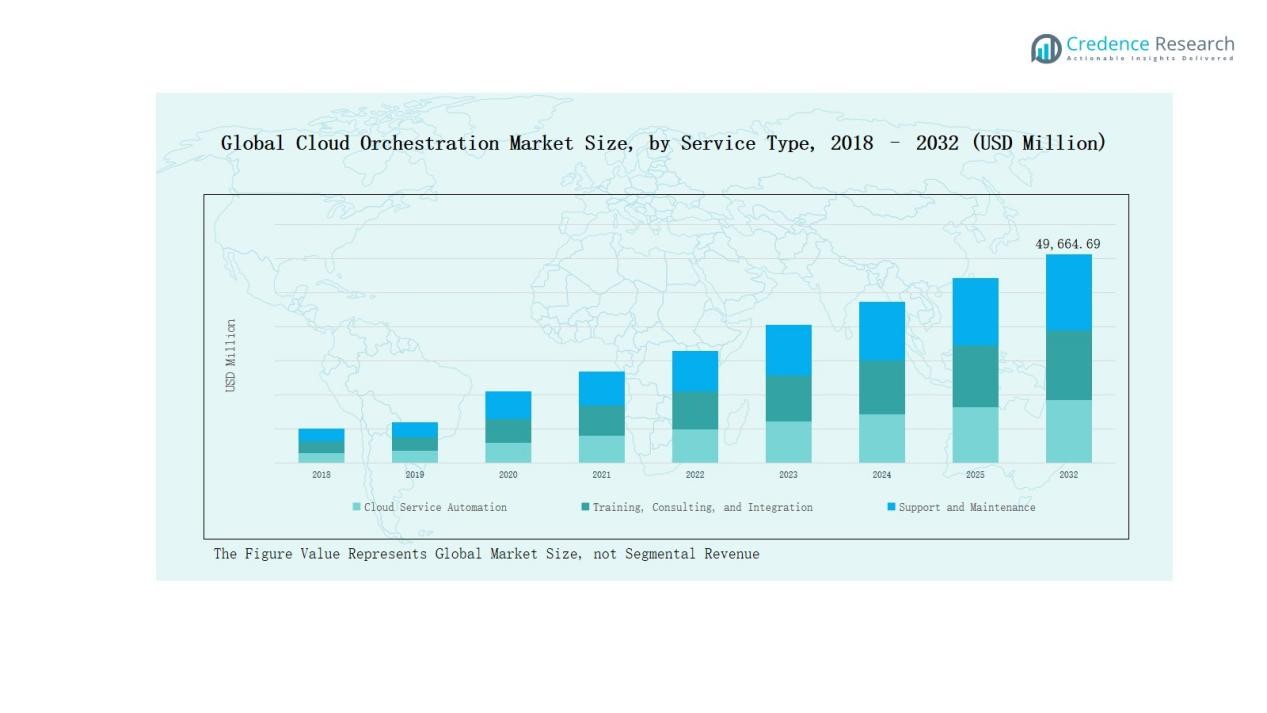

Cloud Orchestration Market size was valued at USD 5,429.62 million in 2018 to USD 11,764.67 million in 2024 and is anticipated to reach USD 49,664.69 million by 2032, at a CAGR of 18.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Orchestration Market Size 2024 |

USD 11,764.67 Million |

| Cloud Orchestration Market, CAGR |

18.39% |

| Cloud Orchestration Market Size 2032 |

USD 49,664.69 Million |

In the Cloud Orchestration Market, the foremost players include Amazon Web Services (AWS), BMC Software, Cisco Systems, DXC Technology, HP Inc., IBM Corporation, VMware, Rackspace, Oracle, and Flexiscale Technologies. These vendors lead the industry by offering comprehensive orchestration solutions that span configuration, automation, and hybrid-cloud management. They invest heavily in innovation, strategic partnerships, and advanced service offerings to meet the rising demand for scalable and secure cloud environments across industries. Regionally, North America dominates, securing approximately 41.3% of the global cloud orchestration market in 2025, driven by strong adoption of cloud technologies, mature IT infrastructure, and high enterprise demand for multi-cloud strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insight

- The Cloud Orchestration Market grew from USD 5,429.62 million in 2018 to USD 11,764.67 million in 2024 and is expected to reach USD 49,664.69 million by 2032.

- Key players such as AWS, IBM, Microsoft, Google, VMware, Cisco, and Oracle lead through automation, hybrid-cloud management, innovation, and strategic partnerships.

- Multi-cloud adoption, demand for operational efficiency, and heightened security requirements are major drivers accelerating market growth across multiple industries.

- North America holds the largest share, driven by mature IT infrastructure, strong enterprise adoption, and high investments in hybrid and multi-cloud strategies.

- High implementation costs, multi-cloud management complexity, and security compliance risks remain challenges despite strong growth opportunities in emerging markets.

Market Segment Insights

By Service Type

In the Cloud Orchestration Market, Cloud Service Automation emerges as the dominant sub-segment, driven by the rising demand to streamline multi-cloud operations and reduce manual workloads. Businesses are increasingly adopting automation to improve resource utilization, accelerate deployment timelines, and maintain consistent policy enforcement across diverse cloud environments. This approach enhances operational efficiency and supports faster innovation cycles, making it the preferred choice for organizations seeking agility and scalability.

- For instance, AWS Fargate enables container orchestration by automatically provisioning infrastructure based on workload demands, accelerating deployment and scaling without manual intervention.

By Enterprise Size

Within enterprise size categories, Large Enterprises lead the market due to their extensive IT infrastructures, complex operational requirements, and broader adoption of hybrid and multi-cloud strategies. These organizations prioritize advanced orchestration solutions to enhance interoperability, ensure compliance, and optimize cloud resource allocation across global operations. Their ability to invest in sophisticated platforms and integrate orchestration into enterprise-wide digital transformation initiatives further reinforces their market leadership.

For instance, Tata Consultancy Services (TCS) has integrated multi-cloud orchestration into its digital transformation projects, such as enhancing Celcom Axiata Berhad’s business support systems and enabling European retailer Kingfisher to streamline omnichannel checkout processes.

By Deployment Mode

The Hybrid Cloud segment holds the leading position in deployment mode, supported by the growing need to balance workload distribution between public and private environments. Enterprises favor hybrid models for their flexibility, enabling secure and compliant data management while optimizing costs and performance. This approach also facilitates seamless integration of legacy systems with modern cloud platforms, driving widespread adoption across industries seeking both innovation and operational stability.

Key Growth Drivers

Rising Adoption of Multi-Cloud Strategies

The increasing preference for multi-cloud environments is a major growth driver for the Cloud Orchestration Market. Organizations are leveraging multiple cloud service providers to avoid vendor lock-in, improve redundancy, and optimize performance. This complexity creates a pressing need for orchestration platforms that can unify management, automate workflows, and ensure seamless interoperability across diverse cloud ecosystems. The shift toward multi-cloud adoption is particularly strong in industries handling sensitive data, as it allows them to strategically allocate workloads based on security, compliance, and cost considerations.

- For instance, Netflix uses AWS for content delivery and Google Cloud Platform (GCP) for analytics to ensure high-quality streaming and data insights.

Growing Demand for Operational Efficiency and Automation

Enterprises are prioritizing automation to enhance operational efficiency, reduce manual intervention, and accelerate application deployment. Cloud orchestration tools enable centralized control, automated resource allocation, and consistent policy enforcement across cloud infrastructures. This efficiency translates into reduced operational costs, improved uptime, and faster response to market demands. With digital transformation accelerating, businesses view orchestration as a key enabler for scaling operations, streamlining processes, and ensuring that cloud resources are utilized optimally without compromising governance or security requirements.

- For instance, Microtica automates cloud infrastructure management using Infrastructure as Code, enabling consistent and secure deployments while providing developer self-service and real-time monitoring, which accelerates delivery and reduces errors.

Increased Focus on Compliance and Security

Rising cybersecurity threats and stringent regulatory requirements are compelling organizations to adopt advanced orchestration solutions that incorporate robust security and compliance features. Cloud orchestration platforms help ensure consistent implementation of security policies, access controls, and compliance frameworks across diverse environments. By automating security configurations and enabling real-time monitoring, these solutions reduce vulnerabilities and facilitate audit readiness. This focus is particularly critical in regulated industries such as finance, healthcare, and government, where data protection and compliance with evolving standards are top priorities.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

AI and ML are increasingly integrated into cloud orchestration platforms, enabling predictive analytics, intelligent workload placement, and automated anomaly detection. These capabilities enhance decision-making, optimize resource utilization, and improve system resilience. The use of AI-driven orchestration also supports proactive incident management, reducing downtime and operational disruptions. As organizations seek smarter, self-optimizing cloud ecosystems, AI-enabled orchestration presents a significant opportunity for vendors to differentiate their offerings and deliver higher value to customers through innovation-driven automation.

- For instance, CloudBolt’s Augmented FinOps solution leverages AI-driven automation to coordinate complex workflows across multi-cloud environments, ensuring cost-effective and performance-optimized cloud resource management.

Expansion of Edge Computing Integration

The rapid growth of edge computing presents a new opportunity for the Cloud Orchestration Market, as businesses seek solutions capable of managing distributed workloads across cloud and edge environments. Orchestration platforms are evolving to support seamless integration, enabling low-latency processing and real-time data handling at the network edge. This capability is crucial for applications in IoT, autonomous vehicles, and remote operations. Vendors that can deliver robust orchestration for both centralized and edge infrastructures are well-positioned to capture emerging market demand.

- For instance, Red Hat’s OpenShift Kubernetes platform enables containerized applications to run across cloud and edge infrastructure, supporting real-time IoT and autonomous vehicle workloads.

Key Challenges

Complexity of Multi-Cloud Management

While multi-cloud adoption offers flexibility and resilience, it also introduces significant management complexity. Integrating and orchestrating services from multiple providers requires advanced capabilities to maintain interoperability, security, and performance. Many organizations struggle with visibility, policy consistency, and operational control across diverse cloud infrastructures. Addressing these challenges demands sophisticated orchestration solutions, yet the implementation process can be resource-intensive, deterring smaller enterprises from adopting comprehensive platforms.

High Implementation and Maintenance Costs

Deploying advanced cloud orchestration solutions often requires substantial investment in infrastructure, skilled personnel, and integration services. For many organizations, particularly SMEs, these high initial and ongoing costs present a significant barrier to adoption. Additionally, frequent updates, customization requirements, and the need for continuous monitoring add to the total cost of ownership. Vendors must address cost concerns through scalable pricing models, managed services, and simplified deployment options to expand market penetration.

Security and Compliance Risks in Complex Environments

As organizations manage increasingly complex cloud ecosystems, ensuring consistent security and compliance across all environments becomes challenging. Misconfigurations, inconsistent policy enforcement, and limited visibility into distributed resources can expose businesses to vulnerabilities and regulatory non-compliance. These risks are heightened in hybrid and multi-cloud deployments, where data flows between multiple platforms. Without robust orchestration strategies that prioritize security and compliance automation, enterprises face potential financial penalties, reputational damage, and operational disruptions.

Regional Analysis

North America

North America remains the powerhouse of the Cloud Orchestration Market, holding 33.9% share in 2024, up from USD 2,401.77 million in 2018 to USD 5,150.69 million in 2024, and forecast to hit USD 21,803.29 million by 2032. The region’s dominance is underpinned by a mature IT ecosystem, aggressive cloud adoption, and heavy investment from tech leaders. The U.S. spearheads advancements in hybrid and multi-cloud orchestration, while Canada and Mexico follow with strong adoption in finance, healthcare, and public services. AI-driven automation and edge-cloud integration are emerging as decisive growth accelerators here, supported by a CAGR of 18.4%.

Europe

Europe’s share stands at 21.2% in 2024, representing a rise from USD 1,539.06 million in 2018 to USD 3,214.45 million, with projections pointing toward USD 12,775.18 million by 2032. Strong digital transformation policies, strict data protection under GDPR, and high standards for compliance shape the market environment. The UK, Germany, and France remain the epicenters of activity, with industries like telecom, manufacturing, and finance leading orchestration adoption. Sustainability in data centers and IoT-driven automation are becoming important decision factors, supporting the region’s healthy 17.5% CAGR over the forecast period.

Asia Pacific

Asia Pacific is the fastest-growing regional market, climbing from USD 1,044.36 million in 2018 to USD 2,452.70 million in 2024, and expected to surge to USD 11,726.83 million by 2032. Its 16.2% market share in 2024 is driven by rapid digitization in China, India, Japan, and South Korea. Governments are actively promoting smart city development, while e-commerce giants and telecom providers are fueling demand for scalable cloud orchestration. With a projected CAGR of 20.2%, the region benefits from competitive service pricing, a vast talent pool, and accelerated AI adoption, positioning it as the market’s most dynamic growth hub.

Latin America

Although Latin America holds a modest 3.3% market share in 2024, growth momentum is strong — from USD 230.52 million in 2018 to USD 492.57 million in 2024, with forecasts indicating USD 1,813.20 million by 2032. Brazil and Mexico dominate, propelled by investments in cloud infrastructure, digital banking, and telecom modernization. Hybrid cloud deployment is particularly appealing in the region, balancing cost efficiency with operational flexibility. Despite challenges such as inconsistent regulations and uneven infrastructure, the market is advancing at a CAGR of 16.4%, supported by a growing appetite for automation in retail, healthcare, and manufacturing.

Middle East

In the Middle East, the market is valued at USD 136.99 million in 2018, reaching USD 268.51 million in 2024, and expected to touch USD 934.86 million by 2032. Holding 1.8% of the 2024 market, the region’s growth is propelled by national digital agendas in the UAE, Saudi Arabia, and Israel. Smart city projects, oil and gas sector modernization, and advanced e-government initiatives are creating fertile ground for orchestration adoption. The push for data sovereignty encourages preference for hybrid and private cloud models. With a CAGR of 15.5%, the Middle East is steadily transitioning from emerging potential to sustained adoption.

Africa

Africa’s cloud orchestration market is still developing, representing 1.2% of the 2024 global share. Valuations rise from USD 76.93 million in 2018 to USD 185.75 million in 2024, and are projected to reach USD 611.33 million by 2032. South Africa leads the pack, with Egypt and Nigeria emerging as promising markets. Demand is fueled by improving internet connectivity, mobile-driven business models, and early-stage cloud deployments in education, finance, and telecom. Infrastructure gaps and high adoption costs remain hurdles, but with a 14.7% CAGR, the region’s trajectory suggests steady, long-term opportunity as data center investments continue to expand.

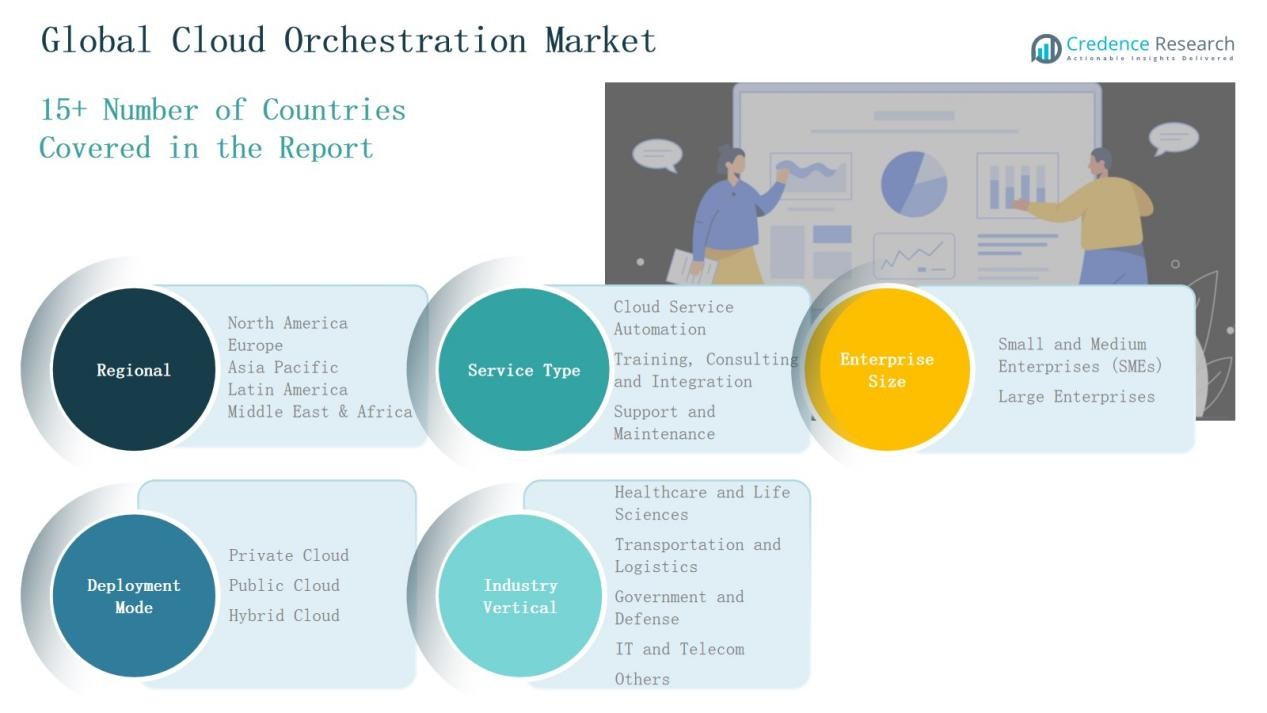

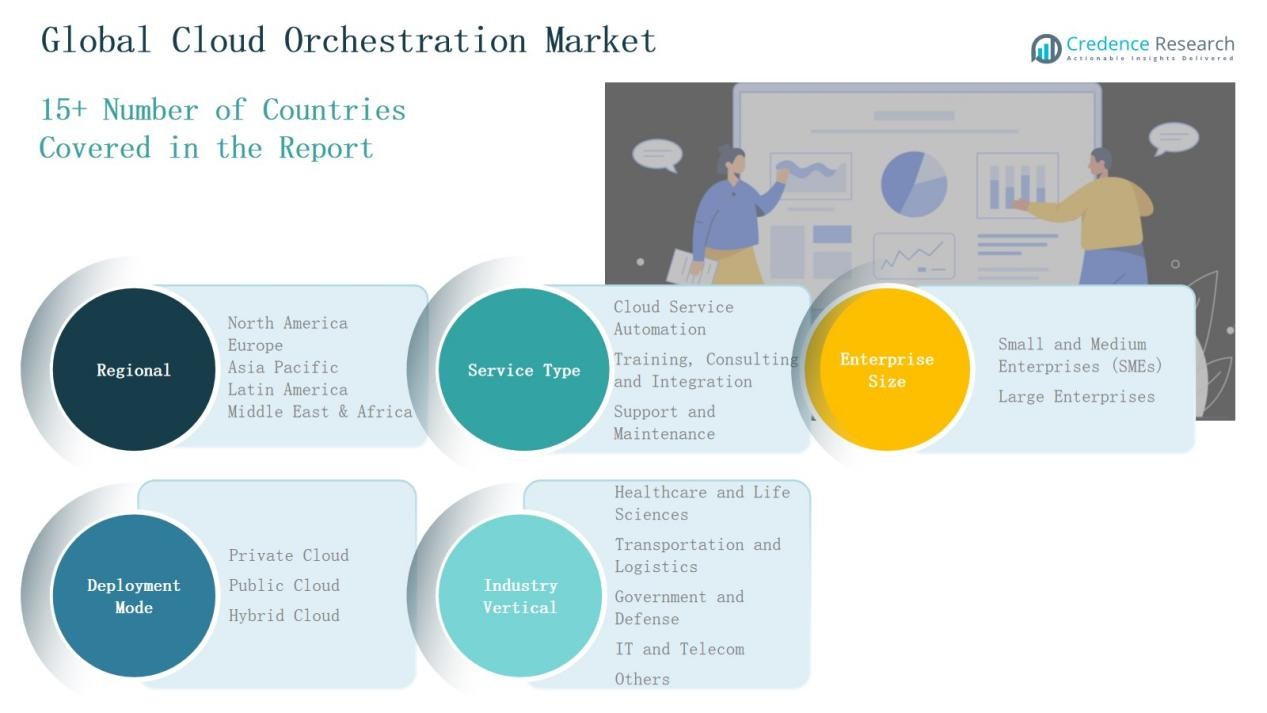

Market Segmentations:

By Service Type

- Cloud Service Automation

- Training, Consulting, and Integration

- Support and Maintenance

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Mode

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Industry Vertical

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Defense

- IT and Telecom

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Cloud Orchestration Market is characterized by the presence of global technology leaders and specialized solution providers competing through innovation, scalability, and service differentiation. Key players such as IBM Corporation, Hewlett Packard Enterprise, Microsoft Corporation, Amazon Web Services, Google LLC, VMware, Cisco Systems, Red Hat, BMC Software, ServiceNow, Oracle Corporation, and Cloudify focus on expanding their orchestration capabilities to address the growing complexity of hybrid and multi-cloud environments. Strategies include integrating AI and machine learning for predictive analytics, enhancing security and compliance features, and offering industry-specific solutions. Partnerships, acquisitions, and cloud ecosystem integrations are central to strengthening market positioning. Vendors also emphasize flexible pricing models and managed services to attract both large enterprises and SMEs. With rising competition, the market is witnessing accelerated product innovation cycles, regional expansions, and increased investment in automation capabilities, positioning leading players to capture emerging opportunities in edge, AI-driven, and hybrid cloud orchestration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC

- VMware, Inc.

- Cisco Systems, Inc.

- Red Hat, Inc.

- BMC Software, Inc.

- ServiceNow, Inc.

- Oracle Corporation

- Cloudify

Recent Developments

- In August 2025, Bharti Airtel introduced its new cloud platform, Xtelify, featuring AI-powered tools in partnership with Singtel, Globe Telecom, and Airtel Africa to deliver scalable infrastructure and enhanced data management services.

- In February 2025, IBM finalized the acquisition of HashiCorp for USD 6.4 billion, enhancing its hybrid cloud platform with advanced infrastructure orchestration and automation capabilities.

- In February 2024, Dell Technologies introduced its Telco Cloud Automation Suite, aimed at streamlining the management of multi-vendor network cloud infrastructures.

- In April 2025, CloudBolt acquired StormForge, a Kubernetes cost-optimization platform, strengthening its hybrid cloud orchestration and management offerings.

Market Concentration & Characteristics

The Cloud Orchestration Market demonstrates a moderately high level of concentration, with a few dominant players holding significant market shares alongside a growing number of emerging vendors. It is shaped by rapid technological advancements, rising multi-cloud adoption, and increasing demand for automation in complex IT environments. The market is driven by innovation in AI integration, security enhancements, and hybrid cloud capabilities, which serve as key differentiators among competitors. Leading providers maintain strong global footprints, extensive partner networks, and diversified service portfolios, enabling them to cater to both large enterprises and SMEs. It remains highly competitive, with companies investing in R&D, strategic alliances, and vertical-specific solutions to expand their presence. Regional demand patterns vary, influenced by regulatory requirements, digital transformation initiatives, and cloud infrastructure maturity. The industry is expected to sustain robust growth, supported by evolving enterprise needs for scalability, efficiency, and cost optimization in orchestrating diverse cloud environments.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Enterprise Size, Deployment Mode, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hybrid and multi-cloud orchestration solutions will continue to expand across industries.

- Integration of AI and machine learning will enhance automation, predictive analytics, and decision-making.

- Security-focused orchestration platforms will gain prominence to address compliance and data protection needs.

- Edge computing adoption will drive demand for orchestration capable of managing distributed workloads.

- Industry-specific orchestration solutions will emerge to cater to unique operational requirements.

- Partnerships between cloud providers and technology firms will accelerate feature development and service reach.

- Simplified orchestration tools will target SMEs seeking cost-effective cloud management.

- Vendor competition will intensify, leading to shorter product innovation cycles.

- Open-source orchestration frameworks will see increased adoption for flexibility and customization.

- Global expansion of cloud infrastructure will create new opportunities in emerging markets.