Market overview

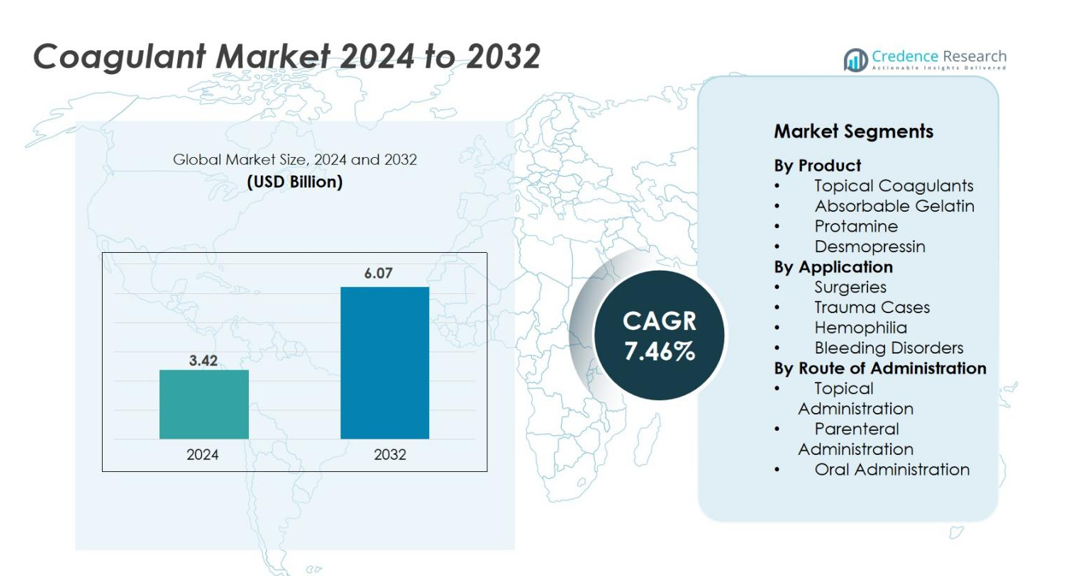

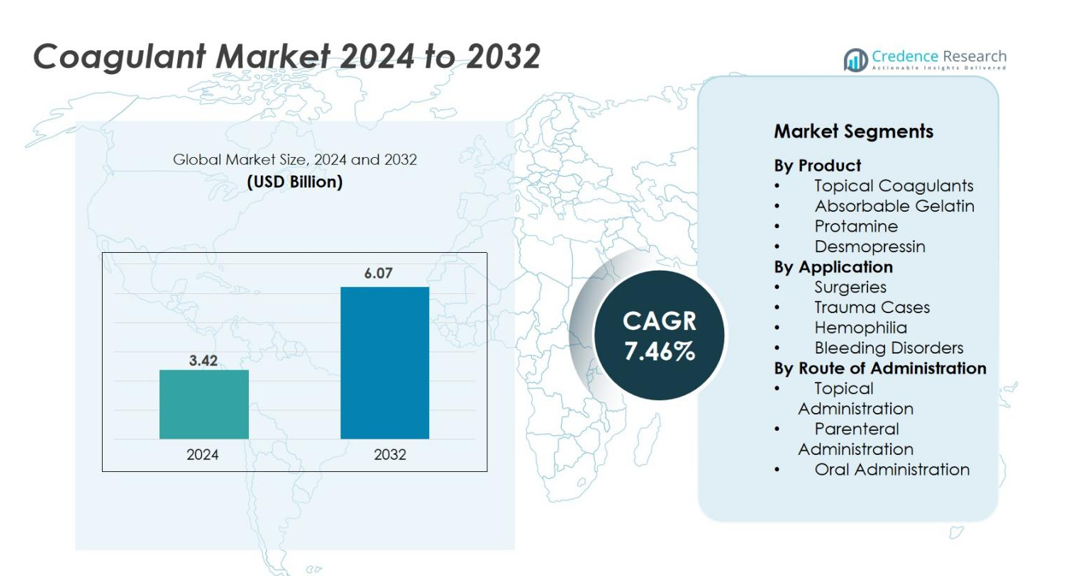

The coagulant market size was valued at USD 3.42 billion in 2024 and is anticipated to reach USD 6.07 billion by 2032, at a CAGR of 7.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coagulant Market Size 2024 |

USD 3.42 billion |

| Coagulant Market, CAGR |

7.46% |

| Coagulant Market Size 2032 |

USD 6.07 billion |

The Coagulant market is anchored by leading players such as Johnson & Johnson, Baxter International Inc., Pfizer Inc., Bristol‑Myers Squibb Company, Sanofi S.A., Bayer AG, Novo Nordisk A/S, CSL Behring, Octapharma AG and Grifols S.A., all of whom invest heavily in innovation, global distribution and therapeutic applications. Regionally, North America leads with approximately 40.39% market share, driven by advanced infrastructure and high healthcare spending. Europe and Asia‑Pacific follow, with the latter emerging as a fast‑growing market owing to expanding healthcare access and rising surgical volumes. These conditions create a competitive yet opportunity‑rich landscape for these incumbents.

Market Insights

- The global coagulant market was valued at USD 3.42 billion in 2024 and is forecasted to grow at a CAGR of 7.46%.

- Growth drivers include expanding surgical volumes and increased trauma cases globally, which boost demand for rapid‑acting coagulants in emergency and operating‑room settings.

- Trends and opportunities highlight rising uptake in point‑of‑care hemostatic solutions and expanding penetration into emerging regions such as Asia Pacific where healthcare infrastructure is rapidly improving.

- Competitive analysis shows the market is led by established healthcare companies (e.g., Johnson & Johnson, Baxter International, Pfizer) that leverage large‑scale R&D and global distribution networks to dominate major product and regional segments.

- Market restraints include high costs associated with advanced coagulant therapies and stringent regulatory safety requirements, as well as regional share variances. North America leads with around 40% market share and Asia Pacific captures about 35% of the total.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The coagulant market is segmented by product type, with topical coagulants, absorbable gelatin, protamine, and desmopressin being the key categories. Among these, topical coagulants dominate the market, accounting for a significant share due to their widespread use in emergency settings, surgeries, and trauma care. Topical coagulants, often in the form of powders, gels, or sprays, facilitate rapid hemostasis, driving their demand. The absorbable gelatin segment also holds a notable share, owing to its compatibility with human tissue and use in surgical procedures. Increased preference for minimally invasive surgeries fuels the growth of these products.

- For instance, absorbable gelatin products, favored for their biocompatibility and tissue compatibility, are widely used in surgical procedures, especially as sponges and matrices that promote clot formation.

By Application

The application segment of the coagulant market is categorized into surgeries, trauma cases, hemophilia, and bleeding disorders. The surgeries segment holds the dominant market share, driven by the rising number of surgical procedures globally, particularly in orthopedics, cardiovascular, and general surgery. Coagulants are essential in minimizing blood loss and ensuring patient safety during surgery. Trauma cases also contribute significantly to market demand, as coagulants are critical in emergency care. The hemophilia and bleeding disorder segments are expanding due to advancements in treatments and growing awareness of clotting factor therapies.

- For instance, in orthopedic surgeries like total hip replacements, the use of direct oral anticoagulants like rivaroxaban has significantly reduced venous thromboembolism and improved outcomes post-surgery.

By Route of Administration

The coagulant market is divided by route of administration into topical, parenteral, and oral administration. Topical administration remains the dominant sub-segment, commanding the largest market share due to its effectiveness in providing immediate control over localized bleeding during surgeries and trauma care. Parenteral administration, particularly injectable forms, also holds a significant share, driven by the need for rapid and systemic intervention in severe bleeding cases. Oral coagulants, while growing, still represent a smaller portion of the market, with demand mainly fueled by chronic conditions such as bleeding disorders.

Key Growth Drivers

Rising Surgical Procedures and Trauma Cases

The increasing number of surgical procedures, coupled with a higher incidence of trauma cases globally, is a major driver of growth in the coagulant market. With advancements in healthcare technologies and the rising prevalence of chronic diseases, the demand for surgeries particularly in orthopedics, cardiovascular, and cancer treatment has escalated. As a result, the use of coagulants to manage bleeding during and after surgical interventions has become critical. Additionally, the frequency of traumatic injuries from accidents, natural disasters, and violence has heightened the need for efficient hemostatic products to control bleeding.

- For instance, the hemostatic dressing QuikClot® Combat Gauze (by Z‑Medica/Teleflex) was documented in a case series of 103 uses, of which 69 were by U.S. military personnel in Iraq, showing an overall efficacy rate of 92 % in controlling hemorrhage.

Advancements in Hemophilia and Bleeding Disorder Treatments

The growing global awareness and advances in the treatment of bleeding disorders, especially hemophilia, are significantly driving the coagulant market. Hemophilia, a genetic disorder that impairs the blood’s ability to clot, has seen substantial progress in its management, thanks to innovations in clotting factor therapies and recombinant products. As a result, individuals with bleeding disorders are living longer, contributing to an increased demand for coagulants. The development of targeted therapies and personalized medicine tailored to bleeding disorders has expanded the treatment options available for patients, encouraging better patient outcomes.

- For instance, the therapy Hemlibra (emicizumab-kxwh) by Roche and Genentech has been used to treat more than 20,000 individuals worldwide living with haemophilia A, with or without factor VIII inhibitors.

Technological Advancements and Product Innovations

Technological innovations in coagulant formulations and delivery mechanisms are significantly contributing to the market’s growth. New and improved products such as faster-acting topical hemostats, absorbable gels, and advanced injectable agents are transforming the field of hemostasis. For example, the development of bioengineered coagulants with enhanced efficacy and safety profiles is attracting more healthcare professionals. In addition, research into innovative delivery methods, including nanoparticle-based formulations and self-administered products, is gaining traction. These innovations not only enhance the effectiveness of coagulants but also reduce the risk of side effects and improve patient compliance.

Key Trends & Opportunities

Growing Focus on Point-of-Care (POC) Solutions

A major trend in the coagulant market is the growing demand for point-of-care (POC) hemostatic solutions. Healthcare providers are increasingly turning to POC products that can be administered outside of hospital settings, such as in ambulances, emergency rooms, or even at home. These solutions are particularly valuable for trauma care, where quick response times are crucial to prevent blood loss. Advances in portable devices and self-administered coagulants are enhancing the convenience and accessibility of these treatments. For instance, compact, easy-to-use topical coagulants are gaining popularity in pre-hospital care, enabling first responders to control bleeding before patients reach medical facilities.

- For instance, QuikClot® Combat Gauze, developed by Z-Medica, is used by first responders in the field to control bleeding before patients arrive at the hospital.

Expanding Market in Emerging Economies

The coagulant market is witnessing significant growth opportunities in emerging economies, where healthcare infrastructure is rapidly improving. Countries in Asia-Pacific, Latin America, and Africa are investing heavily in their healthcare systems, leading to an increase in the availability of advanced medical treatments. This includes better access to hemostatic agents, which are crucial in managing surgeries, trauma, and bleeding disorders. The rise in healthcare awareness, coupled with the growing prevalence of conditions like hemophilia and chronic diseases, is expected to drive the demand for coagulants in these regions.

- For instance, in Asia Pacific, countries like Japan have approved advanced recombinant factor VIII products such as ALTUVIIIO to better manage hemophilia A, significantly reducing bleeding episodes.

Key Challenges

High Cost of Advanced Coagulant Therapies

One of the significant challenges facing the coagulant market is the high cost of advanced coagulant therapies, especially for patients with bleeding disorders like hemophilia. The cost of recombinant clotting factors, as well as newer biologic therapies, can be prohibitively expensive, limiting access for patients, particularly in developing countries. Despite technological advancements, many patients remain unable to afford these treatments due to their high price tags. Additionally, the high cost of research and development for new coagulant products further adds to the expense, which is eventually passed on to consumers and healthcare systems.

Regulatory and Safety Concerns

The coagulant market faces significant challenges related to regulatory approval and safety concerns, especially with newer and more complex products. Each coagulant formulation must undergo rigorous clinical trials and regulatory scrutiny before reaching the market, which can delay the availability of new products and increase the cost of bringing them to market. Additionally, there is an inherent risk of side effects and complications, such as thromboembolic events or allergic reactions, especially with injectable coagulants. These concerns often lead to stringent regulatory requirements, which can slow down product development. Manufacturers must navigate these regulatory hurdles while ensuring their products meet the highest safety standards, making it a challenge to bring innovative products to market in a timely manner.

Regional Analysis

North America

The North America region holds the largest share of the global coagulant market, at 40 % as of 2023. This dominance is supported by advanced healthcare infrastructure, high incidence of bleeding disorders, and extensive use of coagulation therapies in surgeries and trauma care. Strong R&D activity and favourable reimbursement policies further drive growth. The region’s well‑established hospital networks, skilled professionals, and rapid adoption of novel coagulant products sustain steady demand. Regulatory clarity and high patient awareness also contribute to the strong regional position.

Europe

In Europe, the coagulant market accounts for 20% of global revenues. The region benefits from strong regulatory frameworks, high per‑capita healthcare spending, and increasing incidence of hemophilia and other clotting disorders. There is a trend toward advanced therapies and an ageing population that raises demand for effective hemostatic management. National health systems in Western Europe prioritise surgical safety and minimise blood loss, which supports coagulant uptake. While growth is moderate compared to emerging regions, Europe remains a stable and mature market with solid share.

Asia Pacific

Asia Pacific is poised for rapid growth and already accounts for 30% of the global coagulant market share. This region is driven by large‑scale industrialisation, rising healthcare expenditures, growing surgical volumes, and expanding access to diagnostics and treatment for bleeding disorders. Demand in major countries such as China, India and Japan is surging due to increasing infrastructure investment, rising trauma incidence, and rising awareness. The region offers significant opportunity for new entrants and product expansion given its high unmet need and expanding healthcare coverage.

Latin America

Latin America currently represents 10 % of the coagulant market. Growth is propelled by improving healthcare infrastructure, rising elective surgeries, and growing prevalence of trauma and bleeding disorders. However, adoption is constrained by reimbursement challenges, economic variability and uneven access across countries. With increasing public and private healthcare spending, manufacturers have opportunities to introduce lower‑cost formulations and expand distribution networks in this region.

Middle East & Africa

The Middle East & Africa region contributes 7 % of the global coagulant market share. It is characterised by slower uptake due to limited healthcare resources, lower diagnosis rates of clotting disorders and logistical challenges. Nevertheless, the region is increasingly investing in healthcare infrastructure, trauma care services and emergency medicine, which presents growth potential. Partnerships with global players and targeted product offerings for emerging markets can help capitalise on rising demand in this region.

Market Segmentations

By Product

- Topical Coagulants

- Absorbable Gelatin

- Protamine

- Desmopressin

By Application

- Surgeries

- Trauma Cases

- Hemophilia

- Bleeding Disorders

By Route of Administration

- Topical Administration

- Parenteral Administration

- Oral Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the competitive landscape of the global coagulant market, several major players dominate and continuously shape industry dynamics. Companies such as Johnson & Johnson, Baxter International Inc., Pfizer Inc., Bristol‑Myers Squibb Company, Sanofi S.A., Bayer AG, Novo Nordisk A/S, CSL Behring, Octapharma AG, and Grifols S.A. hold substantial market share and have considerable influence over product innovation, pricing, and global expansion. These companies invest heavily in R&D to bring advanced hemostatic products to the market and often engage in strategic partnerships, mergers, or geographic expansion to strengthen their footprint. For example, they are leveraging their manufacturing and distribution networks to support emerging markets and increasing surgical/trauma care demands. Despite the presence of these large incumbents, the competitive rivalry remains intense due to rising numbers of mid‑tier players launching niche or regional coagulant solutions tailored to specific applications. The result is an environment where innovation, regulatory compliance, and global reach become key differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer Inc.

- Johnson & Johnson

- Grifols S.A.

- CSL Behring

- Octapharma AG

- Bristol-Myers Squibb Company

- Sanofi S.A.

- Baxter International Inc.

- Novo Nordisk A/S

- Bayer AG

Recent Developments

- In November 2023, Ethicon, a Johnson & Johnson MedTech company, received approval for ETHIZIA, a first-of-its-kind hemostatic sealing patch that effectively controls bleeding in hard-to-manage areas.

- In December 2022, Pfizer Inc. reported positive Phase 3 results from the BENEGENE-2 study evaluating fidanacogene elaparvovec as a gene therapy for adult males with moderate to severe hemophilia B.

- In May 2022, Takeda introduced Adynovate in India, expanding hemophilia A treatment options with its extended half-life recombinant Factor VIII therapy developed using controlled PEGylation technology.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The coagulant market is projected to expand steadily as increasing surgical procedures and trauma cases raise demand for effective hemostatic agents.

- Growing penetration into emerging markets will drive regional growth, with Asia‑Pacific and Latin America becoming important contributors in the near term.

- Technological innovations and novel delivery mechanisms will enhance product efficacy and safety, encouraging wider adoption across clinical settings.

- Rising regulatory focus on environmental and safety standards in water and wastewater treatment will boost demand for coagulant chemicals in industrial applications.

- Expansion of outpatient and home‑care treatment models will open new avenues for coagulants designed for ease of use and quick deployment.

- Increasing investments in healthcare infrastructure in developing nations will facilitate broader access and faster uptake of coagulant therapies.

- Partnerships and M&A activity among leading firms will intensify, enabling broader distribution and enhanced product portfolios.

- Demand for sustainable, eco‑friendly coagulant solutions will rise, pushing manufacturers toward greener chemistries and operational methods.

- The high cost of advanced therapies will continue to pose a barrier, but affordable formulations and generics will gradually erode this restraint.

- The market will experience competitive pressure from alternative technologies and treatment methods, prompting continuous innovation and cost optimisations.