Market Overview:

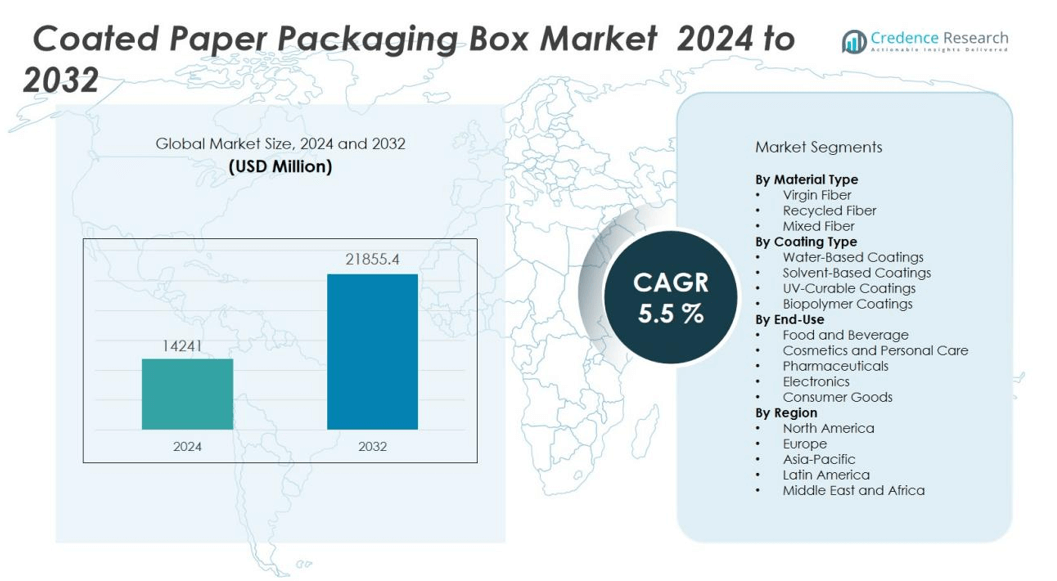

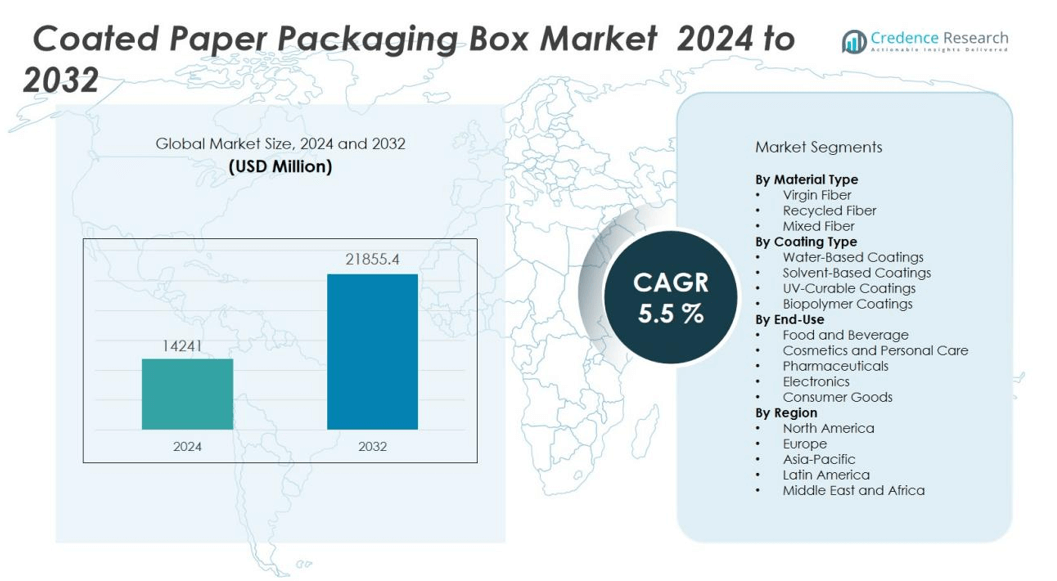

The Coated paper packaging box market size was valued at USD 14241 million in 2024 and is anticipated to reach USD 21855.4 million by 2032, at a CAGR of 5.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coated Paper Packaging Box Market Size 2024 |

USD 14241 million |

| Coated Paper Packaging Box Market, CAGR |

5.5% |

| Coated Paper Packaging Box Market Size 2032 |

USD 21855.4 million |

The key drivers for the coated paper packaging box market include increased demand for premium packaging solutions and heightened emphasis on sustainability. Consumers and brand owners alike seek packaging that not only protects contents but also communicates value through superior aesthetics and tactile finishes. Growth in e-commerce amplifies requirements for sturdy, lightweight packaging that can withstand transit and maintain shelf presence. Additionally, regulatory initiatives focused on recyclability and material reduction prompt manufacturers to develop coated paper boxes using water-based coatings, recyclable laminates, and biodegradable components, balancing performance with environmental responsibility. Brand differentiation, coupled with consumer awareness of eco-friendly packaging, continues to propel innovation and adoption of advanced coating techniques.

Regionally, the coated paper packaging box market is led by Asia Pacific, which accounts for the largest share due to high manufacturing activity, expanding retail infrastructure, and a rapidly growing middle class. China and India emerge as primary contributors, supported by increasing consumption of packaged goods and investments in packaging innovation. North America follows, driven by established retail chains, strong demand for sustainable packaging, and the presence of leading multinational brands. Europe maintains a significant market position, bolstered by strict environmental regulations, consumer focus on recyclable solutions, and advancements in coating materials and printing technologies. These regional dynamics collectively support sustained growth and diversification within the global coated paper packaging box market.

Market Insights:

- The coated paper packaging box market will reach USD 21,855.4 million by 2032, driven by rising demand for premium and sustainable packaging.

- Brands focus on visual appeal and tactile finishes, investing in advanced coatings for luxury, cosmetics, and electronics sectors.

- E-commerce growth boosts demand for sturdy, lightweight, and attractive boxes that enhance both protection and unboxing experience.

- Manufacturers develop recyclable, water-based, and biodegradable coatings to meet regulatory and consumer expectations for eco-friendly packaging.

- Margin pressure persists due to volatility in raw material prices and global supply chain disruptions, requiring strategic procurement and risk management.

- Asia Pacific leads with 41% market share, supported by strong manufacturing capacity and rapid consumption growth in China and India.

- Europe and North America maintain significant positions, emphasizing regulatory compliance, sustainable materials, and technological innovation in packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Premium Product Presentation and Shelf Appeal Drive Packaging Upgrades:

Brands prioritize packaging that enhances visual appeal and tactile experience to attract consumers in crowded retail environments. The coated paper packaging box market benefits from this demand, with companies investing in advanced coatings that deliver vibrant graphics and smooth finishes. It enables premium positioning, supports luxury branding, and improves customer perception at the point of sale. High-quality printing capabilities on coated surfaces help brands differentiate products and foster loyalty. Sectors such as cosmetics, electronics, and confectionery actively seek superior packaging that communicates value and quality. Retailers prefer coated paper boxes for their ability to maintain structural integrity and aesthetics during handling and display. These factors create a sustained preference for coated paper over uncoated alternatives.

- For instance, Sappi’s latest innovation added a 91g/m² high-barrier functional paper to its range, delivering optimal protection against oxygen, steam, grease, and oil for major food manufacturers.

Rising Consumer Demand for Sustainable and Recyclable Solutions:

Environmental awareness and strict regulatory policies accelerate adoption of recyclable, biodegradable, and water-based coated packaging. The coated paper packaging box market responds by integrating eco-friendly coatings and sustainable fibers. It appeals to environmentally conscious consumers and supports companies in achieving green certifications. Packaging innovations focus on reducing plastic laminates and replacing them with compostable or recyclable coatings. Multinational brands set ambitious sustainability targets, driving the adoption of coated paper boxes that meet both performance and environmental standards. This shift aligns with growing consumer expectations and enhances brand reputation. Manufacturers continuously develop solutions that balance protection, print quality, and sustainability.

- For instance, Huhtamaki’s ICON ice cream packaging is made with 95% renewable biobased materials, and for every 1 million ICON containers recycled, 21 tons of paperboard are removed from landfills—while over 90% of paper fiber is recovered through recycling.

Growth of E-Commerce and Direct-to-Consumer Distribution Channels:

The expansion of online retail channels increases the need for sturdy, lightweight, and attractive packaging that survives transit and enhances unboxing experiences. The coated paper packaging box market supports these requirements by offering options with high tear resistance, moisture barriers, and customizable finishes. It enables brands to deliver safe, visually appealing packages directly to consumers. The market adapts to smaller batch sizes, seasonal promotions, and personalized packaging trends, which are prevalent in e-commerce operations. Enhanced protection and printability foster repeat purchases and positive online reviews. This trend reinforces the role of coated paper boxes in modern logistics and digital retail.

Advancements in Coating Technologies and Functional Performance:

Ongoing research into coating formulations results in paper boxes with improved barrier properties against moisture, grease, and oxygen. The coated paper packaging box market leverages these advancements to serve sensitive applications, such as food, pharmaceuticals, and electronics. It enables longer shelf life and protects product integrity without compromising recyclability. New coatings support digital printing and customization, allowing flexible response to market trends and consumer preferences. Manufacturers deploy water-based and UV-curable coatings that reduce environmental impact while enhancing durability and appearance. The ability to combine functional and aesthetic benefits positions coated paper packaging as a preferred choice across diverse end-use industries.

Market Trends:

Emphasis on Sustainable Coatings and Circular Packaging Initiatives:

Sustainability remains a central trend shaping the coated paper packaging box market. Manufacturers shift toward water-based, biodegradable, and compostable coatings that enable easier recycling and reduce environmental impact. It supports a circular economy by minimizing plastic content and promoting the use of renewable, responsibly sourced paper fibers. Major brands demand packaging that aligns with ambitious sustainability commitments, prompting innovation in barrier technologies that eliminate the need for non-recyclable laminates. The industry prioritizes certifications such as FSC and PEFC to assure consumers of responsible sourcing practices. Companies launch closed-loop recycling programs, driving greater adoption of recyclable coated boxes. This trend responds to both regulatory mandates and evolving consumer preferences.

- For instance, Smurfit WestRock manages approximately 20,000 tons of Atlanta’s recycling monthly, including about 6,000 tons solely from single-stream materials at just one plant; this recovered fiber is directly reprocessed into new packaging products, showcasing their commitment to large-scale, circular solutions.

Expansion of Personalization, Digital Printing, and Smart Packaging Features:

The rise of digital printing allows brands to implement personalized graphics, limited editions, and region-specific campaigns on coated paper boxes. The coated paper packaging box market leverages advanced printing technologies to deliver high-definition imagery and tactile finishes that engage consumers at multiple touchpoints. It facilitates fast turnaround, flexible batch sizes, and reduced inventory, supporting e-commerce and direct-to-consumer strategies. Smart packaging features—such as QR codes and NFC tags—gain popularity, enabling product authentication, interactive experiences, and enhanced supply chain visibility. Brands use coated surfaces to improve print quality for marketing messages and trackable content. The integration of these technologies helps manufacturers meet rising expectations for both aesthetics and functionality in packaging.

- For instance, OTACA Tequila digitized 5,000 bottles with NFC during its pilot launch and expanded by another 50,000 bottles in the following quarter, becoming a pioneer in smart NFC-enabled spirits packaging.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Volatility Pressure Margins:

Volatility in the prices of paper pulp, specialty coatings, and chemicals creates ongoing challenges for manufacturers. The coated paper packaging box market faces margin pressure due to fluctuating input costs and unpredictable supply chain disruptions. It must navigate logistical bottlenecks and higher transportation expenses, particularly during periods of global uncertainty. Raw material shortages may delay production and impact delivery timelines for large-scale clients. Manufacturers find it necessary to optimize procurement strategies and diversify suppliers to reduce risk. These cost fluctuations can affect profitability and complicate long-term planning for market participants.

Balancing Performance, Recyclability, and Regulatory Compliance:

Increasing regulatory scrutiny and evolving standards challenge the industry to balance performance with sustainability goals. The coated paper packaging box market must address the technical difficulty of creating coatings that offer robust barrier protection while remaining recyclable or compostable. It requires significant investment in research and development to meet both environmental regulations and end-user expectations. Regulatory differences across regions complicate product design and certification, raising compliance costs for global brands. Companies must frequently update formulations and production processes to align with new guidelines. The need for continuous innovation increases complexity and operational demands within the market.

Market Opportunities:

Expansion of Eco-Friendly Packaging Solutions Unlocks Growth Potential:

Rising consumer demand for environmentally responsible packaging opens new avenues for product innovation. The coated paper packaging box market can capitalize by offering recyclable, compostable, and bio-based coatings that address sustainability requirements. It enables manufacturers to differentiate products and appeal to brand owners seeking to enhance their environmental credentials. Opportunities exist to collaborate with retailers and consumer goods companies to design bespoke solutions tailored to specific market segments. Adoption of advanced water-based and solvent-free coating technologies supports regulatory compliance and reduces environmental impact. These innovations position coated paper packaging as a preferred choice across food, cosmetics, and electronics sectors.

Integration of Smart and Digital Packaging Technologies Supports Value Creation:

Adoption of smart packaging and digital printing technologies presents significant value-creation opportunities. The coated paper packaging box market stands to benefit by incorporating interactive features such as QR codes, near-field communication tags, and anti-counterfeiting elements. It enhances product traceability, supports direct consumer engagement, and improves supply chain transparency. Brands can leverage variable data printing for personalized marketing and limited-edition campaigns. Investments in digital production capabilities enable rapid customization and short-run flexibility. These technological advancements help manufacturers serve evolving client needs and capture growth in premium and specialty packaging segments.

Market Segmentation Analysis:

By Material Type;

The coated paper packaging box market features segments such as virgin fiber, recycled fiber, and mixed fiber. Virgin fiber dominates demand for premium and food-grade packaging due to its strength and purity. Recycled fiber appeals to brands prioritizing sustainability and cost efficiency, especially in retail and e-commerce sectors. Mixed fiber solutions combine durability with improved environmental credentials, meeting both performance and regulatory needs. Material choice directly impacts box strength, visual quality, and recyclability.

- For instance, Smurfit Westrock blends recycled and virgin fibers to recycle paper fibers up to 7 times—nearly double the global average of 2.4 times—boosting both strength and recyclability in their packaging products.

By Coating Type:

Segments include water-based, solvent-based, UV-curable, and biopolymer coatings. Water-based coatings lead adoption for their low environmental impact and compliance with food safety standards. Solvent-based coatings offer high resistance for specialized applications but face stricter regulation due to VOC emissions. UV-curable coatings deliver rapid curing, vibrant finishes, and chemical resistance, serving luxury and electronics packaging. Biopolymer coatings gain traction for biodegradable and compostable packaging solutions.

- For instance, Electrolube’s new UV cure conformal coatings guarantee a full chemical cure within just 6 hours, compared to the typical 8–14 days for conventional systems, enabling immediate board handling and reducing production time by over 90% in electronics manufacturing.

By End-Use:

Key end-use segments cover food and beverage, cosmetics and personal care, pharmaceuticals, electronics, and consumer goods. The coated paper packaging box market serves food and beverage brands seeking packaging with moisture barriers and premium aesthetics. Cosmetics and personal care companies select coated boxes for branding and shelf impact. Pharmaceutical and electronics firms demand high-performance, tamper-evident, and protective packaging. Consumer goods benefit from versatile, customizable solutions that balance cost, branding, and sustainability requirements.

Segmentations:

By Material Type:

- Virgin Fiber

- Recycled Fiber

- Mixed Fiber

By Coating Type:

- Water-Based Coatings

- Solvent-Based Coatings

- UV-Curable Coatings

- Biopolymer Coatings

By End-Use:

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Electronics

- Consumer Goods

By Printing Technology:

- Offset Printing

- Digital Printing

- Flexographic Printing

- Gravure Printing

- Screen Printing

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific :

Asia Pacific holds 41% share of the coated paper packaging box market, driven by robust manufacturing capabilities and rising packaged goods consumption. China and India anchor regional demand with their expanding retail sectors and investments in automated packaging lines. The market benefits from a growing middle class, increasing urbanization, and evolving consumer preferences that emphasize product presentation and quality. Regional suppliers invest in sustainable coating technologies and efficient logistics networks to serve diverse industry needs. Rapid growth in food, cosmetics, and electronics sectors fuels demand for innovative and high-performance coated packaging. Governments promote eco-friendly packaging practices, encouraging manufacturers to adopt recyclable and biodegradable materials. These factors secure Asia Pacific’s position as the leading hub for coated paper packaging solutions.

North America :

North America accounts for 26% share in the coated paper packaging box market, supported by established retail infrastructure and advanced supply chain management. The United States leads with consumer preferences shifting toward premium, branded packaging and stringent environmental regulations. It benefits from a concentration of multinational brands and a proactive approach to sustainability initiatives, including the adoption of water-based and biopolymer coatings. Manufacturers introduce new functional features and customization capabilities to address the needs of the food, beverage, and electronics sectors. Growth in e-commerce strengthens the demand for durable and visually appealing packaging boxes. The region’s innovation ecosystem supports ongoing research into eco-friendly coatings and advanced printing technologies, ensuring competitive differentiation for local suppliers.

Europe:

Europe holds 21% share of the coated paper packaging box market, propelled by rigorous environmental regulations and consumer focus on recyclable solutions. Germany, France, and the United Kingdom lead with high per capita packaged goods consumption and a preference for sustainable materials. The market responds to evolving regulatory frameworks by investing in new barrier coatings and recyclable paper substrates. It serves luxury, cosmetics, and pharmaceutical sectors with premium boxes that combine protection, aesthetics, and compliance. Collaboration between packaging manufacturers and technology providers accelerates the development of innovative solutions. Stringent waste management policies and active sustainability campaigns further support the adoption of advanced coated paper packaging across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Shenzhen Pack Materials

- Koch Industries

- Mondi Group

- Guangzhou Bonroy Cultural Creativity,

- Shanghai Forest Packing

- Shenzhen Sheng Bo Da Pack Manufacture

- JK Paper

- Shanghai Custom Packaging

- Muge Packaging

- The Siam Cement Public Company

Competitive Analysis:

The coated paper packaging box market features a competitive landscape shaped by both global corporations and regional specialists. Leading companies include Shenzhen Pack Materials, Koch Industries, Mondi Group, Guangzhou Bonroy Cultural Creativity, Shanghai Forest Packing, Shenzhen Sheng Bo Da Pack Manufacture, JK Paper, and Shanghai Custom Packaging. It prioritizes innovation in coating technologies, print quality, and sustainable solutions to maintain market position. Key players invest in automated manufacturing processes and digital printing to enhance customization and efficiency. Strategic collaborations with brand owners and retailers support the development of premium, eco-friendly packaging options. The market rewards firms that deliver high performance, regulatory compliance, and visually distinctive products, ensuring ongoing competition and continuous improvement across the industry.

Recent Developments:

- In May, 2024,JK Paper completed the acquisition of the remaining 15% equity stake in its subsidiaries Horizon Packs Private Ltd (HPPL) and Securipax Packaging Private Ltd (SPPL), making them wholly owned subsidiaries.

- In Sept 2024, JK Paper placed an order with Valmet for a new pulp and evaporator line, with planned startup at the end of 2025, continuing its technology partnership.

Market Concentration & Characteristics:

The coated paper packaging box market displays moderate concentration, with a mix of global conglomerates and regional manufacturers shaping competition. It features strong innovation cycles, driven by demand for premium aesthetics, advanced coatings, and sustainability. Key companies invest in research, automation, and digital printing to deliver high-quality, customizable solutions for diverse end-use sectors. The market rewards flexibility, product differentiation, and adherence to evolving environmental regulations. It responds quickly to changing consumer preferences and retailer requirements, supporting continuous development of recyclable, biodegradable, and functional packaging options. This dynamic environment sustains healthy competition and promotes technological advancement across the industry.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Coating Type, End-Use, Printing Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry participants will accelerate adoption of water-based and compostable coatings to meet evolving sustainability mandates.

- It will support expansion of recyclable and biodegradable product lines aligned with consumer and regulatory expectations.

- Brands pursue variable data printing on coated surfaces to launch personalized campaigns and limited-edition packaging.

- Manufacturers invest in digital production lines that offer short runs, quick turnaround, and packaging customization.

- It will integrate smart packaging features—such as QR codes and NFC tags—for product authentication and interactive consumer engagement.

- Suppliers develop advanced barrier coatings that extend shelf life and preserve quality in sensitive applications like food and pharmaceuticals.

- It will expand e-commerce-focused solutions that provide packaging strength, damage resistance, and premium unboxing experiences.

- Regional manufacturers—especially in emerging markets—will scale up production capacity to meet rising demand for coated paper solutions.

- It will enhance collaboration between packaging providers and consumer goods companies to co-create tailored and brand-centric solutions.

- Innovation efforts will focus on balancing functionality, print quality, and environmental performance to ensure market differentiation.