Market Overview

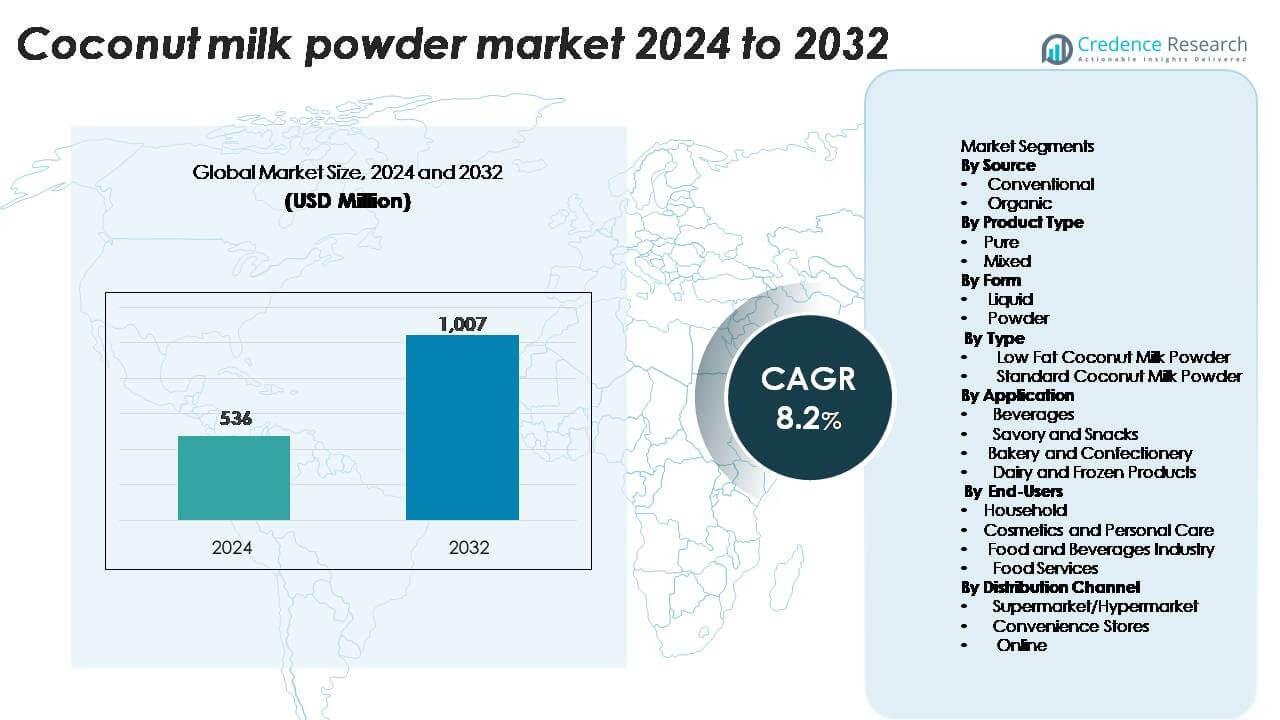

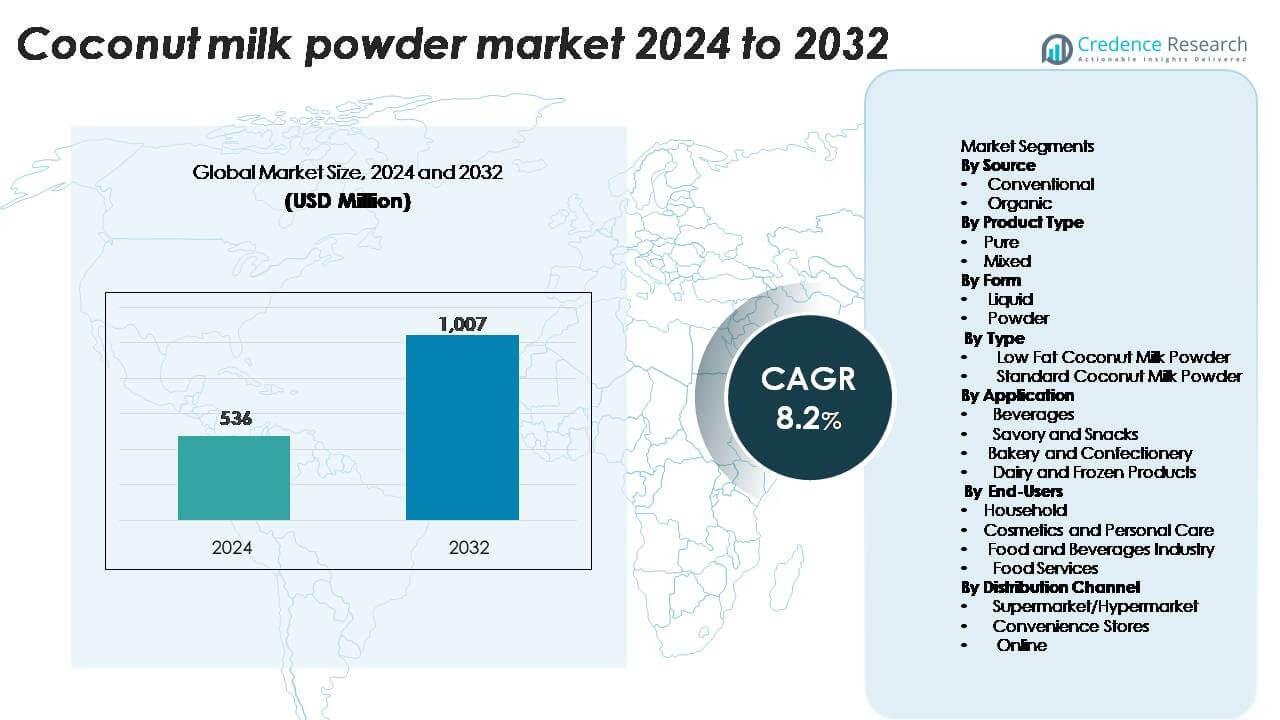

The coconut milk powder market size was valued at USD 536 million in 2024 and is anticipated to reach USD 1,007 million by 2032, growing at a CAGR of 8.2% during the forecast period.”

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coconut Milk Powder Market Size 2024 |

USD 536 million |

| Coconut Milk Powder Market, CAGR |

8.2% |

| Coconut Milk Powder Market Size 2032 |

USD 1,007 million |

The coconut milk powder market includes strong participation from producers such as Nestlé S.A., Danone S.A., Campbell Soup Company, Goya Foods, SunOpta Inc., Cocomi Bio Organic, Thai Coconut Public Company Limited, Axelum Resources Corp., and Sambu Group. These companies focus on clean-label ingredients, organic sourcing, and product innovations for beverages, bakery applications, and ready-to-cook foods. Asia-Pacific remains the leading region with a 34% market share, supported by large-scale coconut cultivation and export capacity across the Philippines, Indonesia, India, and Sri Lanka. North America holds 28%, driven by high vegan and lactose-intolerant consumer segments, while Europe captures 25% due to strong bakery and confectionery demand. Strategic partnerships with food processors and retail expansion strengthen competitive positioning.

Market Insights

- The coconut milk powder market was valued at USD 536 million in 2024 and is projected to reach USD 1,007 million by 2032, expanding at a CAGR of 8.2% during the forecast period.

- Rising demand for plant-based, lactose-free, and vegan food products fuels market growth, with strong adoption in beverages, bakery mixes, confectionery, and ready-to-cook meals.

- Powder form holds the leading segment share because it offers longer shelf life, easy storage, cost-efficient transport, and faster solubility, making it the preferred choice for food manufacturers and households.

- Asia-Pacific leads the market with 34% share, followed by North America with 28% and Europe with 25%, supported by strong retail networks, foodservice expansion, and premium organic product launches.

- Competition intensifies as brands focus on organic sourcing, clean labels, and flavored formulations, while price fluctuations in coconut supply and competition from other plant-based milk alternatives remain key restrain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Conventional coconut milk powder holds the largest share due to wide availability and low production cost. Food brands favor conventional variants for bulk manufacturing in snacks, beverages, and bakery mixes because supply chains remain stable across major producing countries. Organic coconut milk powder grows at a faster pace as health-focused consumers shift toward clean labels and chemical-free ingredients. Rising vegan diets, lactose intolerance, and natural sweetener demand also support organic adoption. Retailers expand shelf space for organic products, but conventional remains dominant because price-sensitive buyers continue to drive high-volume sales through online and supermarket channels.

- For instance, Renuka Foods PLC’s organic coconut milk powder uses matured coconuts from its own certified plantations, is spray dried, packaged with minimal human interaction, and claims the reconstituted milk closely matches freshly‑squeezed coconut in aroma and texture.

By Product Type

Pure coconut milk powder dominates this segment because brands prefer single-ingredient compositions that offer better flavor and aroma. Pure variants are used across beverages, sauces, desserts, and ready-to-cook mixes, helping manufacturers replace dairy cream in vegan recipes. Mixed coconut milk powder develops demand in flavored drinks, confectionery fillings, and fortified food blends. However, pure products maintain higher usage in household and foodservice channels as they deliver more consistent fat content and richer taste. The clean-label trend encourages brands to highlight pure formulations, strengthening leadership in retail and food processing applications.

- For instance, The Coconut Company’s vegan coconut milk powder contains 65 % coconut oil content and is produced from approximately 96 % freshly‑squeezed coconut milk and 4 % maltodextrin.

By form and Type

Powder form accounts for the majority share as it provides longer shelf life, easy storage, lower transportation cost, and quick solubility in beverages and culinary applications. Liquid formats are used in cafés and professional kitchens but represent a smaller portion due to higher packaging and logistics expense. Within powder types, standard coconut milk powder leads because it matches the fat level needed for curries, bakery recipes, and packaged foods. Low-fat coconut milk powder gains traction in weight-management beverages and health foods, yet standard variants remain dominant due to stronger demand from mainstream food processors and household buyers.

Key Growth Drivers

Growing Demand for Plant-Based and Lactose-Free Products

The rising shift toward plant-based diets acts as a major growth engine for coconut milk powder. Consumers with lactose intolerance, dairy allergies, or vegan preferences are replacing traditional milk with plant-based alternatives in beverages, cooking, and confectionery. Food manufacturers use coconut milk powder to create dairy-free chocolates, creamers, ice creams, sauces, and ready-to-drink beverages because the powder format improves shelf stability, reduces wastage, and blends smoothly with dry mixes. Household adoption also increases due to its long shelf life and easy storage compared to liquid coconut milk. Health-conscious buyers view coconut derivatives as natural sources of healthy fats, clean labels, and minimally processed ingredients. In international cuisines, coconut remains a core component in curries, soups, and bakery fillings, supporting strong usage in restaurants and foodservice chains. As plant-based diets continue expanding across North America, Europe, and Asia-Pacific, coconut milk powder gains deeper penetration across retail shelves and packaged food categories.

- For instance, MAGGI Coconut Milk Powder is produced using hand‑picked Sri Lankan coconuts and employs a spray‑drying process.

Expansion of Packaged and Convenience Food Consumption

Growth in ready-to-eat meals, instant beverages, and bakery snacks drives large-scale use of coconut milk powder in food manufacturing. Brands prefer the powdered format because it reduces refrigeration needs, extends product shelf life, lowers transportation weight, and offers controlled fat concentration for standardized recipes. Instant soups, dehydrated meal kits, coffee mixes, and frozen desserts rely on coconut milk powder to enhance texture and flavor without separation issues common in liquid milk. Online and supermarket chains continue launching flavored powders, travel-friendly sachets, and resealable pouches for household cooking. The foodservice sector also adopts powdered coconut milk to streamline kitchen operations in cafés, hotels, and bakery outlets. Demand strengthens further as multinational food brands introduce dairy-free desserts and global cuisines using coconut bases. This rising dependence on convenience and processed food formats boosts bulk requirement from food industries and supports long-term market expansion.

- For instance, MAGGI Coconut Milk Powder is manufactured using a hygienic spray drying technique, and a 1 kg pack yields 5 L of thin coconut milk or 2 L of thick coconut cream, depending on the water ratio used.

Rising Popularity of Organic and Clean-Label Ingredients

Clean-label consumer behavior plays an important role in shaping product development in coconut milk powder. Shoppers now examine ingredient lists for chemical-free formulas, non-GMO claims, and natural processing methods. This trend directly benefits coconut milk powder, especially organic variants that avoid synthetic fertilizers or pesticides during cultivation. Food brands market coconut-based beverages and bakery mixes as healthier alternatives to dairy creams and artificial additives. Organic coconut milk powder also appeals to premium nutritional brands launching plant-based protein shakes, smoothie powders, and infant food blends. Retailers expand their organic, gluten-free, and vegan product sections, increasing visibility in hypermarkets and online channels. Clean-label certification, ethical sourcing, and eco-friendly packaging further strengthen brand positioning. As consumers become more aware of natural ingredients in everyday cooking and packaged foods, demand for organic coconut milk powder increases across developed and emerging markets.

Key Trends & Opportunities

Innovation in Flavored and Fortified Coconut Milk Powder

Product innovation opens new commercial opportunities in flavored and fortified blends. Manufacturers develop vanilla, chocolate, strawberry, and spice-based powders for smoothies, coffee, desserts, and meal kits. Fortified versions enriched with vitamins, minerals, and plant proteins target nutrition-focused buyers, athletes, and children. Companies explore sugar-free variants for diabetic and keto-friendly diets, expanding use across health-conscious consumer groups. In foodservice and cafés, coconut milk powder enhances dairy-free lattes, bakery toppings, and vegan dessert recipes. Ready-to-mix sachets and single-serve packets attract travel, camping, and office consumption. These innovations increase product variety and help brands differentiate in competitive retail markets.

- For instance, an organic coconut milk powder specification from Kaskade (Sri Lanka origin) shows moisture content < 2.5 g/100 g and total fat 55 g/100 g.

Expansion Across Foodservice, Bakery, and Global Cuisines

Growing exposure to international cuisines boosts demand for coconut-based ingredients in restaurant chains, hotels, and packaged meal brands. Asian, fusion, and tropical recipes use coconut milk powder for curries, sauces, dips, and gravies. The powder format reduces storage issues and eliminates refrigeration, making it suitable for small food stalls, kiosks, and cloud kitchens. Bakery companies use coconut milk powder to improve texture in pastries, cakes, cookies, and gourmet desserts. Frozen dessert makers adopt the powder for creamy dairy-free ice creams and whipped toppings. As global food chains and ready-meal brands expand into new cities and countries, coconut milk powder becomes a versatile ingredient with strong commercial appeal.

- For instance, a specification sheet by Celebration Holdings (Pvt) Ltd for an organic coconut milk powder lists Total Fat as 50.0 g per 100 g, Protein as 6.25 g per 100 g, and Carbohydrate as 40.25 g per 100 g.

Key Challenges

Price Volatility and Raw Material Dependence

Coconut milk powder depends on coconut farming, which faces climate risks such as cyclones, droughts, and seasonal disruptions in producing countries. Variations in coconut yield affect procurement costs for manufacturers, leading to price fluctuations across global markets. Supply chain constraints, labor shortages, and export regulations in producing regions further challenge stable pricing for large food companies. When raw material prices increase, packaged food manufacturers may substitute coconut with cheaper alternatives such as soy or almond bases in formulated foods. These uncertainties limit affordability in price-sensitive markets and create planning difficulties for brands relying on predictable cost structures.

Competition from Other Plant-Based Milk Alternatives

The competitive landscape includes almond, soy, oat, rice, and cashew milk powders, many of which are gaining strong consumer acceptance. Large beverage and bakery brands experiment with multiple plant-based ingredients, reducing dependency on coconut alone. Some consumers prefer low-fat or low-calorie alternatives, and certain diets favor soy or oat formulations for protein or fiber content. Manufacturers of competing dairy-free products invest in marketing, clean labels, and fortified blends, making the category highly competitive. Retail shelf space is shared among several plant-based options, increasing pressure on pricing and brand differentiation. To stay competitive, coconut milk powder suppliers must invest in product innovation, quality improvement, and strong branding strategies.

Regional Analysis

North America

North America holds a significant share of the coconut milk powder market, led by strong adoption of plant-based and dairy-free foods. The region accounts for 28% of total revenue, driven by high lactose intolerance rates and demand from vegan consumers. Food manufacturers use powdered coconut milk in desserts, coffee creamers, and ready-mix beverages because it offers longer shelf life than liquid variants. Restaurants and bakery chains also use it to enhance flavor in global cuisine menus. Well-established retail networks and online platforms support continuous product accessibility, while clean-label and organic products drive premium segment growth.

Europe

Europe captures 25% of the global market, fueled by expanding vegan populations and the clean-label trend. The United Kingdom, Germany, France, and the Netherlands remain leading importers. Bakery brands, chocolate producers, and plant-based beverage manufacturers use coconut milk powder to replace dairy cream in premium recipes. Demand rises in cafés and foodservice chains offering coconut-based lattes and vegan pastries. EU regulations supporting natural ingredients increase the presence of organic powders on shelves. Growing interest in Southeast Asian cuisine further drives consumption, while supermarkets and e-commerce channels strengthen distribution across urban and suburban regions.

Asia-Pacific

Asia-Pacific dominates the market with the 34% share due to large-scale coconut cultivation and processing. India, Indonesia, the Philippines, Sri Lanka, and Thailand act as major production and export hubs. Food companies in the region use coconut milk powder in traditional dishes, powdered beverages, bakery goods, and packaged meals. Domestic consumption grows as households prefer long-lasting and easy-to-store alternatives to liquid coconut milk. International brands source raw materials from APAC due to strong supply availability and cost advantages. Expansion of food exports, rising packaged food adoption, and increased organic farming support sustained market leadership.

Latin America

Latin America represents 7% of global demand, supported by growing interest in functional foods and dairy alternatives. Brazil, Mexico, and Chile show rising consumption as bakeries, confectionery producers, and beverage brands adopt coconut milk powder in flavored drinks and dessert mixes. Importers expand product portfolios through specialty retail, vegan stores, and online sales. Although share remains smaller than developed markets, growth accelerates as consumers seek plant-based and allergen-free choices. Tourism-driven foodservice chains also introduce coconut-based dishes and beverages. Strengthening distribution networks and rising health awareness create steady future prospects in the region.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 6% of global sales, with demand growing across premium foodservice outlets and international restaurant chains. The UAE, Saudi Arabia, and South Africa lead adoption as retailers promote imported coconut-based beverages, bakery mixes, and culinary ingredients. Powdered formats perform better due to hot climate storage conditions and limited refrigeration in small shops and catering units. Vegan diets and specialty cafés increase consumption of coconut-based desserts and lattes. Although market penetration is still developing, rising urbanization and expanding modern retail formats continue to attract new consumer groups.

Market Segmentations:

By Source

By Product Type

By Form

By Type

- Low Fat Coconut Milk Powder

- Standard Coconut Milk Powder

By Application

- Beverages

- Savory and Snacks

- Bakery and Confectionery

- Dairy and Frozen Products

By End-Users

- Household

- Cosmetics and Personal Care

- Food and Beverages Industry

- Food Services

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coconut milk powder market features strong competition among global and regional manufacturers focused on product purity, clean-label formulations, and expanding foodservice partnerships. Companies invest in advanced drying technologies to enhance solubility, aroma retention, and fat stability for use in beverages, bakery mixes, and frozen desserts. Leading brands introduce organic, low-fat, and flavored variants to capture health-conscious and vegan consumers. Packaging innovation also supports market expansion, with resealable pouches, sachets, and bulk industrial packs gaining traction across retail and commercial channels. Strategic mergers and supply agreements with food processors help manufacturers secure long-term demand. Many companies strengthen sourcing networks across Southeast Asia to ensure consistent coconut supply. E-commerce platforms widen geographic reach, while private label products intensify price competition in supermarkets. Overall, continuous product development, quality certification, and strong distribution remain key strategies for maintaining a competitive edge in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Thai Food Products International: The Thai ingredient developer partnered with online B2B platform “Food Farm Hub” to distribute high-quality powdered beverages, food additives, and ingredients globally. The portfolio includes coconut cream milk powder and freeze-dried durian powder.

- In November 2022, Sternchemie, a German-based supplier of ingredients, introduced SternCream, a coconut-milk-based powder for use in vegan ice cream, pralines, and other applications. This ingredient can be easily purchased across the German market.

Report Coverage

The research report offers an in-depth analysis based on Source, Product type, Form, Type, Application, End- users, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more consumers adopt vegan and lactose-free diets.

- Food manufacturers will use coconut milk powder in bakery, beverages, and meal kits.

- Organic and clean-label products will gain stronger traction in retail shelves.

- Powder formats will replace liquid coconut milk in cafés and foodservice due to easier storage.

- Flavored and fortified coconut milk powders will create new premium product lines.

- E-commerce expansion will increase product reach across urban and rural areas.

- Tourism and global cuisine growth will boost usage in restaurants and packaged foods.

- Companies will invest in advanced drying technologies for better solubility and taste.

- Partnerships between processors and food brands will secure long-term supply.

- Competition from almond, soy, oat, and rice powders will push brands toward innovation and price efficiency.