Market Overview

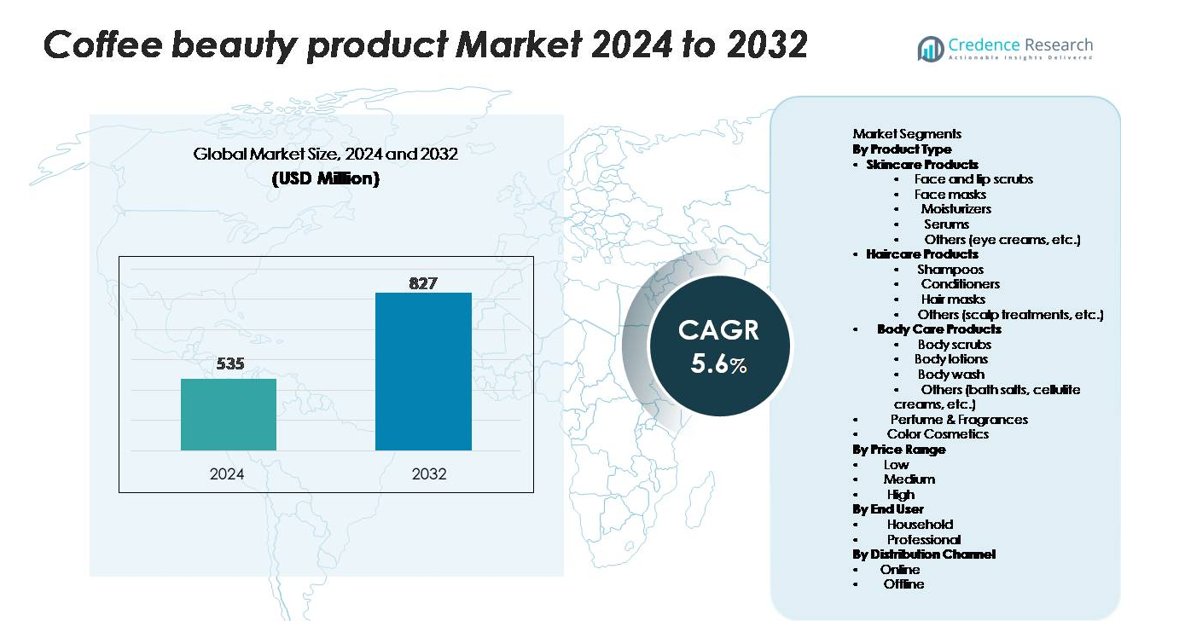

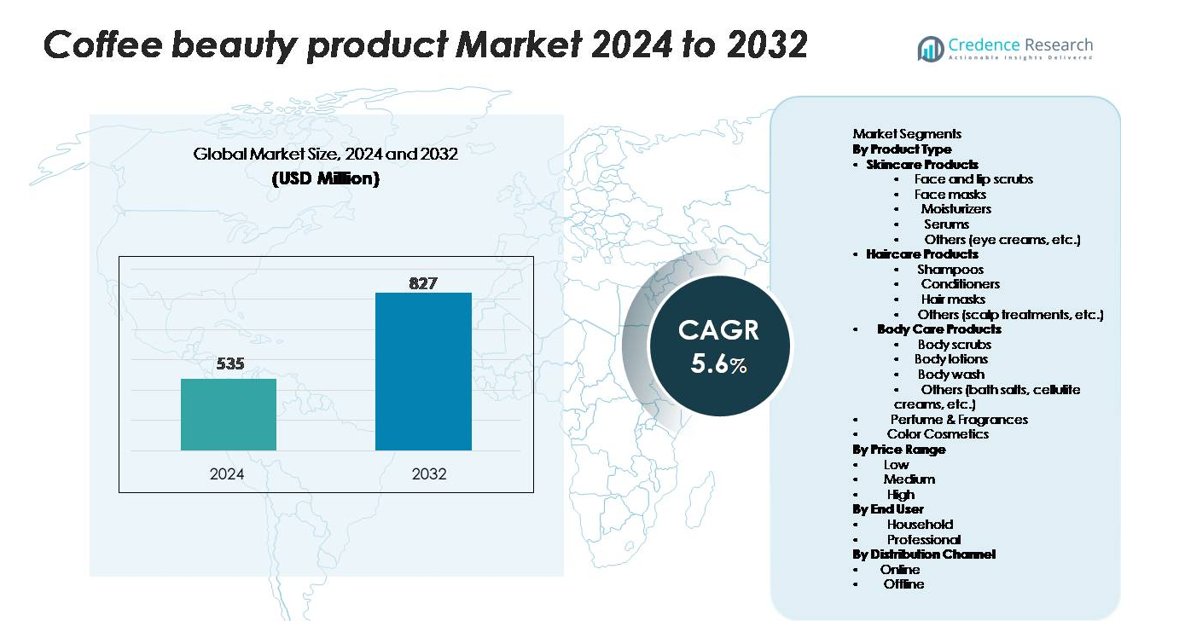

Coffee Beauty Products market size was valued at USD 535.00 million in 2024 and is anticipated to reach USD 827.00 million by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Beauty Products Market Size 2024 |

USD 535.00 million |

| Coffee Beauty Products Market, CAGR |

5.6% |

| Coffee Beauty Products Market Size 2032 |

USD 827.00 million |

Major players shaping the Coffee Beauty Products market include natural skincare brands, premium personal care companies, and emerging organic formulators offering caffeine-enriched scrubs, masks, haircare, and body treatments. Companies strengthen competitiveness through clean-label claims, cruelty-free testing, and dermatologist-approved formulations that appeal to health-focused consumers. Frequent digital campaigns, influencer collaborations, and trial-size kits help brands expand online reach and drive repeat purchases. Asia-Pacific leads the market with 36% share, supported by strong spending on personal care, large youth populations, and fast-growing e-commerce platforms that promote natural skincare. North America and Europe follow with high demand for premium, vegan, and ethically sourced ingredients.

Market Insights

- The Coffee Beauty Products market was valued at USD 535.00 million in 2024 and is projected to reach USD 827.00 million by 2032, growing at a CAGR of 5.6%.

- Rising demand for natural, clean-label skincare drives sales of coffee scrubs, moisturizers, and masks, with skincare products holding the largest segment share at 47%.

- Brands focus on premium formulations, organic sourcing, and influencer-led marketing to capture young consumers through online platforms and trial-size kits.

- Competition increases as large FMCG companies and small organic brands offer similar exfoliating and brightening products, creating pricing pressure across low and medium ranges.

- Asia-Pacific leads the market with 36% share, followed by North America at 32% and Europe at 29%, supported by strong beauty retail networks and fast adoption of natural personal care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Skincare products dominate the Coffee Beauty Products market with nearly 47% share, driven by strong demand for natural exfoliation and antioxidant-rich formulations. Coffee-based face scrubs and masks lead this category as they help reduce dead skin cells, improve texture, and support anti-aging claims. Moisturizers and serums also gain traction due to caffeine’s firming properties and ability to reduce puffiness and redness. Haircare products follow as brands introduce coffee shampoos, conditioners, and scalp treatments that target dandruff control and hair strengthening. Body care products, perfumes, and color cosmetics represent smaller shares but grow due to premium positioning and clean-label claims.

- For instance, Frank Body Pty Ltd confirmed in 2017 that it had sold over 2.2 million units of its various coffee body scrubs globally, demonstrating strong consumer acceptance of coffee-based

By Price Range

The medium price range holds the largest share at around 53%, as consumers seek balance between quality and affordability. Brands in this segment offer dermatologically tested and ethically sourced products without premium pricing. Low-price products attract mass-market buyers through retail and online channels, but limited ingredient transparency restricts faster growth. High-priced products show steady expansion led by premium coffee blends, organic certifications, and luxury packaging. Growing awareness of clean beauty and sustainable sourcing boosts premium adoption among wellness-driven consumers.

- For instance, Frank Body Pty Ltd stated that its coffee-based scrubs were shipped to over 32 countries and achieved over 3.2 million units in cumulative sales for its core range. By August 2021, the company had expanded its sales to customers in 149 countries.

By End User

Households account for over 78% of market share, supported by strong e-commerce demand and daily skincare routines. Coffee scrubs and masks are widely purchased for at-home exfoliation and brightening, especially among young consumers seeking natural ingredients. Professional use grows in spas, salons, and dermatology clinics using coffee-based body polishes, hair treatments, and cellulite reduction therapies. This segment expands due to rising wellness tourism and premium spa services. However, household usage remains dominant because of wider accessibility, product variety, and frequent replenishment cycles through online and offline beauty retail.

Key Growth Drivers

Rising Preference for Natural and Clean-Label Personal Care

Consumers shift from chemical-based cosmetics to natural ingredients, which boosts demand for coffee beauty products. Coffee scrubs, creams, and masks appeal to buyers who prefer plant-based formulas. Brands highlight caffeine’s antioxidant and anti-inflammatory properties to support anti-aging, skin brightening, and acne-control claims. Clean-label positioning, cruelty-free testing, and organic sourcing add trust. This driver remains strong in skincare and body care, where exfoliation and gentle skin renewal are major needs. Many brands also remove parabens and sulfates to support sensitive skin users. Eco-friendly packaging and ethical farming add extra value. Rising social media content and influencer-led promotions help spread awareness, especially among young buyers across online channels.

- For instance, the Body Shop did offer a Nicaraguan Coffee Intense Awakening Mask in a 75ml size, enriched with coffee bean particles from Nicaragua and community fair-trade sesame oil, designed to reduce signs of fatigue and clear impurities.

High Social Media Influence and Beauty Personalization

Social media platforms shape buyer choices in the beauty space. Influencers promote coffee scrubs, hair masks, and serums through short videos and before-and-after results. Personalized beauty routines gain attention, and coffee fits well into multi-step skincare. Consumers search for fast skin glow and tan removal, which helps coffee-based products gain daily use. User-generated reviews build trust and push repeat buying. Brands launch trial packs, travel kits, and sampler sets to meet demand for experimentation. Custom blends for oily, dry, or sensitive skin strengthen market reach. Viral trends on Instagram and TikTok encourage new launches, bundling, and seasonal campaigns.

- For instance, Kiehl’s personalization program recorded millions of digital skin assessments through its online Instant Skin Reader tool, which uses AI to analyze moisture levels and sensitivity data captured through a questionnaire and a photo scan, and recommends a personalized skincare routine with specific Kiehl’s product formulations (e.g., those with Squalane or Vitamin C).

Expansion of Online Retail and Global Beauty Brands

E-commerce fuels steady growth because small and new brands find direct access to buyers. Online stores list coffee scrubs, masks, and shampoos at competitive prices with detailed ingredient information. Subscription services support repeat orders for daily grooming and weekly exfoliation. International brands enter new markets through online platforms, offering certified organic coffee blends and premium haircare. Cross-border shipping and digital marketing make coffee beauty a global category. Reviews, ratings, and influencer videos help buyers compare performance and safety. Specialist grooming brands also enter men’s skincare using coffee-infused face wash and beard care.

Key Trends & Opportunities

Growth of Premium and Dermatologist-Tested Coffee Formulations

Premium brands introduce dermatologically tested products with gentle, non-irritating formulas. Coffee blends with hyaluronic acid, vitamin C, glycolic acid, or niacinamide improve anti-aging and skin-firming effects. Haircare brands create scalp-focused shampoos that claim less hair fall and stronger roots. Luxury bath salts and cellulite creams gain demand in spas and wellness centers. Organic certification and ethical sourcing allow premium pricing and stronger brand loyalty. This trend supports opportunities in clean beauty, vegan formulas, and sulfate-free haircare.

- For instance, L’Oréal has commercialized its Revitalift range with a 1.5% pure hyaluronic acid concentration, and several SKUs in this line contain caffeine as a supporting ingredient to reduce puffiness during clinical testing.

Product Diversification Beyond Skincare

Brands expand into perfumes, lip balms, foundations, and hair styling with coffee extracts. Coffee-based fragrances attract niche buyers who like earthy and warm scents. Men’s grooming grows through coffee shaving creams, face washes, and de-tan scrubs. Retailers bundle coffee scrub with moisturizers to increase cart value. Brands also launch seasonal flavors like mocha or vanilla coffee to appeal to younger buyers. Functional claims such as anti-cellulite, skin polishing, and brightening create strong positioning for body care and spa services.

Key Challenges

High Competition and Ingredient Substitution

The market shows strong competition with sugar scrubs, charcoal scrubs, clay masks, and green tea products. These alternatives offer similar exfoliation and detox benefits at similar or lower prices. Large FMCG brands have stronger shelf space and higher marketing budgets, which reduces visibility for small brands. Many coffee products are easy to imitate, so differentiation remains difficult without unique formulas or clinical claims. Price pressure increases in low-cost online channels. As a result, brands focus on innovation, gentle formulas, and sustainable sourcing to stay competitive.

Limited Clinical Validation and Short Shelf Life

Many coffee-based products rely on claims of exfoliation and brightening, but few offer clinical trials. Buyers with sensitive skin prefer dermatologist-tested brands. Coffee scrubs can feel harsh for daily use, so repeat demand may reduce. Natural blends with fewer preservatives face shorter shelf life, especially in humid climates. Brands invest in stabilizers, airtight packaging, and moisture-resistant containers to solve this issue. Clear ingredient labels, lab testing, and safety certifications help build trust and support long-term growth.

Regional Analysis

North America

North America holds 32% of the Coffee Beauty Products market, supported by high spending on natural cosmetics and clean-label skincare. Consumers prefer coffee scrubs, face masks, and moisturizers for exfoliation and anti-aging results. Strong retail presence across specialty beauty stores and online platforms improves product visibility. Premium brands use organic ingredients, recyclable packaging, and dermatologist-tested claims to attract health-conscious buyers. The U.S. drives most sales through frequent product launches, influencer promotions, and large spa chains using coffee-based body treatments. Canada shows rising demand through wellness retailers and subscription boxes offering natural grooming essentials.

Europe

Europe accounts for 29% of global share, driven by strong demand for vegan, cruelty-free, and eco-certified cosmetic products. Consumers show high interest in organic sourcing and gentle exfoliation formulas suitable for sensitive skin. Germany, France, and the United Kingdom lead purchases of coffee scrubs, serums, and body polishes. Beauty brands focus on clinical testing, ingredient transparency, and sustainable packaging to meet regulatory standards. Spas and wellness centers in Italy and Spain promote coffee wraps and cellulite treatments, boosting body care sales. Growing awareness of ethical sourcing and fair-trade ingredients further strengthens adoption among premium buyers.

Asia-Pacific

Asia-Pacific leads the market with 36% share supported by booming personal care spending, large young populations, and strong online beauty retail. India, South Korea, Japan, and Indonesia are major growth hubs. Coffee scrubs, de-tan masks, and hair treatments gain demand due to pollution-related skin concerns and rising interest in natural remedies. K-beauty brands incorporate coffee extracts into brightening serums and pore-care products. E-commerce platforms offer affordable travel packs and combo kits, increasing household usage. Influencer content and home-spa trends drive recurring purchases. Premium brands expand through malls and specialty cosmetic stores across major cities.

Latin America

Latin America holds 8% share fueled by growing popularity of natural skincare and strong coffee culture. Brazil and Colombia lead production and consumption due to abundant raw material availability and widespread local sourcing. Consumers prefer body scrubs, cellulite creams, and haircare products promoted through pharmacies and supermarkets. New artisan and organic cosmetic brands use roasted coffee extracts and cold-pressed oils for premium body polishes. Beauty salons adopt coffee-based hair masks and scalp treatments. However, price sensitivity affects premium imported brands, pushing demand for value-focused domestic manufacturers.

Middle East & Africa

The Middle East & Africa region accounts for 5% share, with rising demand for exfoliating scrubs, body polishes, and tanning removal creams. The United Arab Emirates and Saudi Arabia drive most purchases due to strong retail expansion and premium beauty salons. Coffee beauty products gain traction in spa resorts and wellness tourism areas. African markets like South Africa and Kenya show gradual growth through online channels and specialty organic brands. Hot climates increase usage of body scrubs and moisturizers, but high pricing of imported products limits mass-market adoption. Local sourcing opportunities support long-term expansion.

Market Segmentations:

By Product Type

- Skincare Products

- Face and lip scrubs

- Face masks

- Moisturizers

- Serums

- Others (eye creams, etc.)

- Haircare Products

- Shampoos

- Conditioners

- Hair masks

- Others (scalp treatments, etc.)

- Body Care Products

- Body scrubs

- Body lotions

- Body wash

- Others (bath salts, cellulite creams, etc.)

- Perfume & Fragrances

- Color Cosmetics

By Price Range

By End User

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Coffee Beauty Products market features a mix of international cosmetic brands, organic beauty start-ups, and private-label manufacturers. Leading players focus on natural formulations, caffeine-infused skincare, and dermatologist-tested products to strengthen brand trust. Many brands highlight sustainable sourcing, cruelty-free testing, and recyclable packaging to match clean-beauty preferences. Product expansion into body scrubs, masks, shampoos, and serums increases store visibility across online and offline retail. Social media plays a major role, with influencers and beauty creators driving viral trends and review-based purchasing. Companies launch limited-edition fragrances, combo kits, and seasonal collections to attract repeat buyers. Small brands compete through affordable pricing, subscription delivery, and direct-to-consumer sales, while premium players target salons and spas with professional-grade body treatments and cellulite care. Continuous innovation in gentle exfoliation, sensitive skin formulas, and organic coffee extracts remains key to maintaining market differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coty Inc.

- LVMH Moët Hennessy Louis Vuitton SE

- Frank Body Pty Ltd

- Johnson & Johnson

- Kiehl’s LLC

- Beiersdorf AG

- Avon Products, Inc.

- L’Oréal S.A.

- Colgate-Palmolive Company

- Innisfree Corporation

Recent Developments

- In September 2025, Natura announced a binding agreement to sell its Avon International business in Europe, Africa, and Asia. This sale is part of Natura’s strategy to simplify its operations and fully focus on growth in Latin America.

- In April 2025, Coty launched the next phase of its “All-in to Win” transformation program targeting fixed-cost savings and productivity enhancements across its operations.

- In June 2024, The Estée Lauder Companies Inc. completed acquisition of a Canada-based, multi-brand company; DECIEM Beauty Group Inc. The Estée Lauder Companies Inc. started investing in DECIEM in 2017, increased its stake in 2021 and in 2024 exercised its choice to acquire the remaining stake

Report Coverage

The research report offers an in-depth analysis based on Product type, Price range, End-User, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label skincare will continue rising across global beauty markets.

- Brands will expand coffee-based moisturizers, serums, and hair treatments with dermatologist-tested claims.

- Premium products will grow as consumers look for organic sourcing and sustainable packaging.

- Online retail and influencer-driven marketing will remain major sales channels for new launches.

- Men’s grooming will adopt coffee-based face washes, scrubs, and beard care for daily grooming.

- Spas and salons will use professional-grade coffee scrubs and body polishing treatments.

- Product innovations will blend coffee with vitamins, AHAs, and plant oils for better skin results.

- Travel-size kits and gift packs will support frequent buying and brand sampling.

- Demand will rise in Asia-Pacific as young consumers spend more on skincare routines.

- Competition will increase, encouraging companies to focus on ingredient transparency and clinical testing.