Market Overview

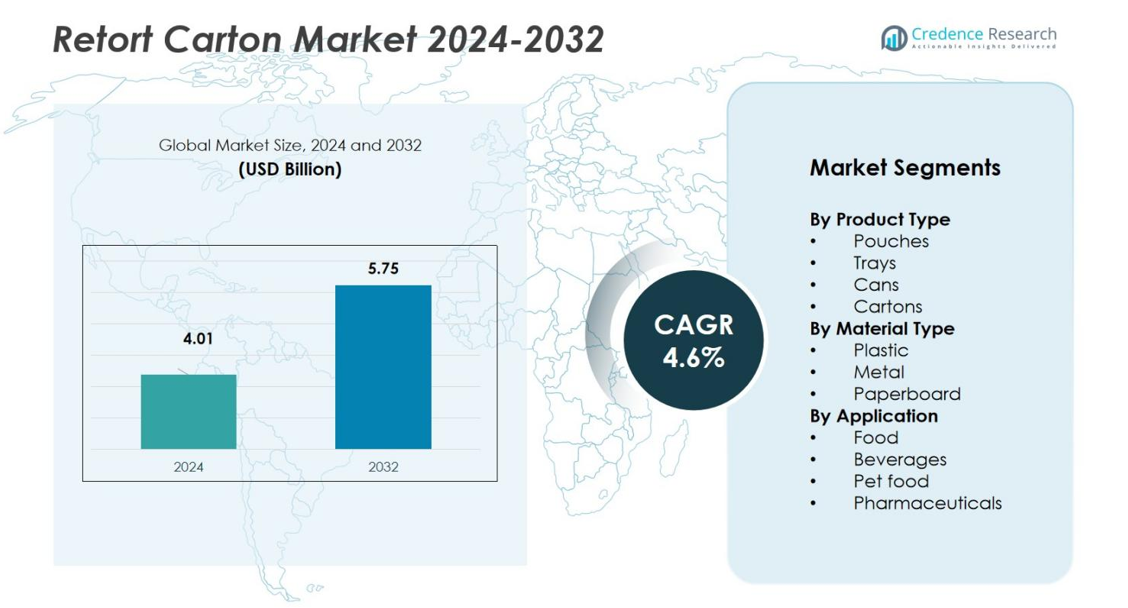

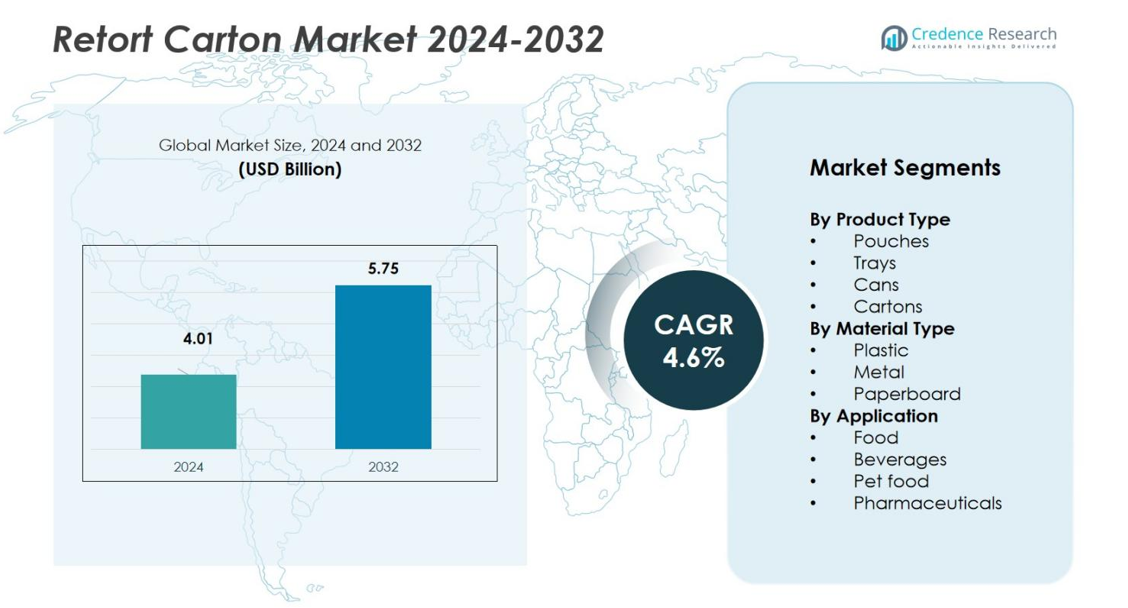

Retort Carton market size was valued USD 4.01 Billion in 2024 and is anticipated to reach USD 5.75 Billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retort Carton Market Size 2024 |

USD 4.01 Billion |

| Retort Carton Market, CAGR |

4.6% |

| Retort Carton Market Size 2032 |

USD 5.75 Billion |

Top players in the Retort Carton market include Amcor PLC, Berry Global Inc., Sonoco, Huhtamaki Oyj, Mondi Group, Otsuka Holdings Co. Ltd, Tredegar Corporation, Coveris, Clondalkin, and Sealed Air Corporation. These companies focus on recyclable paperboard structures, heat-resistant laminates, and advanced filling technologies to replace metal cans and multilayer plastic packaging. Strategic partnerships with food and beverage brands strengthen product portfolios across ready meals, sauces, dairy drinks, and baby food. North America leads the market with 34% share, supported by strong retail networks and high consumption of shelf-stable products, while Europe follows with 29% share due to sustainability regulations and rapid adoption of fiber-based packaging.

Market Insights

- The Retort Carton market reached USD 4.01 Billion in 2024 and is projected to hit USD 5.75 Billion by 2032 at a CAGR of 4.6%, supported by rising adoption in ready meals, sauces, and baby food.

- Demand grows due to the shift from metal cans and plastic pouches to recyclable, lightweight paperboard cartons that reduce logistics cost and offer long shelf life without refrigeration.

- Technology advancements in barrier coatings, aseptic filling, and high-temperature sealing support premium and organic food launches, while leading players expand digital printing and sustainable laminates.

- Competition remains intense as paperboard cartons face pressure from retort pouches and metal cans, and manufacturers must meet strict food-contact safety and recycling regulations.

- North America leads with 34% share, followed by Europe at 29%, while Asia-Pacific holds 25%; by product type, pouches command 46% share, and within material type, paperboard leads with 54% due to sustainability mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Product types include pouches, trays, cans, and cartons used for shelf-stable packaging. Pouches hold the dominant position with 46% market share due to flexible structures, low material usage, and reduced shipping costs. Food brands use retort pouches for curries, sauces, soups, and ready meals because they heat quickly and occupy less storage space than cans or trays. Cartons gain traction in premium beverages and meal kits, while trays support microwave-ready convenience food. The growth of pouches is driven by lightweight formats, faster sterilization, and rising demand for portable single-serve packs.

- For instance, Smurfit Kappa offers paper-based microwave trays made from renewable resources that provide heat resistance and insulation for ready-to-heat convenience foods, supporting sustainability by reducing plastic use.

By Material Type

Material types include plastic, metal, and paperboard. Paperboard leads the market with 54% market share because manufacturers shift to recyclable packaging with reduced environmental impact. Food producers choose coated paperboard for aroma and moisture barriers in ambient storage. Metal formats remain relevant for high-acid products, and plastic retains use in high-strength multilayer structures. Paperboard gains faster adoption in soups, baby food, flavored milk, and international cuisines. Sustainability mandates, premium printing, and lower transport weight drive the dominant use of paperboard in large-scale food packaging.

- For instance, Stora Enso’s patented high-barrier coating on paperboard combines multilayer EVOH and polyethylene polymers, providing excellent oxygen, humidity, and aroma protection, widely adopted for delicate foods like chocolate and dairy products.

By Application

Applications include food, beverages, pet food, and pharmaceuticals. The food segment dominates with 62% market share due to widespread demand for ready-to-eat meals, pasta sauces, broths, and infant food. Retort cartons maintain shelf stability without refrigeration, which reduces cold-chain cost and expands reach across retail channels. Beverage producers adopt cartons for dairy alternatives and nutritional drinks, while pet food brands explore recyclable formats. Pharmaceutical usage remains smaller but focuses on sterile liquid filling. Convenience trends, long shelf life, and sustainable packaging laws support the food segment’s leading position.

Key Growth Drivers

Rising Demand for Shelf-Stable and Ready-to-Eat Food

Growing adoption of shelf-stable meals fuels strong demand for retort carton packaging. Urban consumers prefer ready-to-eat curries, soups, pasta sauces, and baby food that require no refrigeration. Retort cartons provide high heat resistance, extended shelf life, and lightweight handling for retailers and consumers. Food brands reduce logistics cost as ambient products eliminate cold-chain transportation. Supermarkets expand private-label offerings using retort cartons for international cuisine and organic meals. Heat-processing seals nutrients and flavor, which supports premium and health-oriented food launches. This shift toward convenience food continues to elevate retort carton volumes across domestic and export markets.

- For instance, Tetra Pak’s Tetra Recart retortable cartons stand out as the only retortable 100ml carton packaging in the market. This specific size, the Tetra Recart 100 Mini, is ideal for baby food that requires sterilization at temperatures above 121°C (the retorting process) while preserving nutrients and flavor. The retort process is the same as that used for traditional metal cans and glass jars, ensuring equivalent shelf life.

Sustainability and Shift from Metal and Plastic Packaging

Sustainability commitments encourage a transition from rigid metal cans and multilayer plastic pouches to recyclable retort cartons. Paperboard offers lower carbon footprint, easy disposal, and strong printability for brand differentiation. Governments impose packaging waste regulations that favor biodegradable or recyclable solutions. Brands adopt plant-based coatings and barrier layers to match metal-level protection for soups and baby food. Retailers promote eco-friendly products and educate buyers through labeling programs. This shift drives investments in carton sterilization lines, heat-resistant coatings, and lightweight formats, strengthening retort cartons’ position as a sustainable replacement for legacy packaging.

- For instance, SIG Combibloc developed a heat-resistant retort carton structure with a special polymer allowing sterilization in autoclaves, ensuring high-quality preservation of chunky foods and soups without bisphenol A (BPA).

Expanding Retail Networks and E-Commerce Penetration

Supermarkets, hypermarkets, and online grocery platforms drive higher consumption of retort-packaged food and beverages. Retail chains develop ambient food aisles with global cuisines, dairy alternatives, and meal kits packaged in cartons. E-commerce platforms build cold-chain-free delivery models that reduce shipping complexity, enabling long-distance transportation of shelf-stable products. Subscription-based meal and baby food brands offer regular home deliveries using carton packaging. Improved supply chain visibility, SKU expansion, and strong private-label growth reinforce adoption. These factors collectively push manufacturers to scale retort packaging capacity for mass-market retail and online fulfillment.

Key Trends & Opportunities

Growth of Premium and Organic Food Launches

Premium food products adopt retort cartons for sophisticated branding, enhanced shelf appeal, and safe heat processing. Organic baby food, specialty sauces, and gourmet meal kits favor retort cartons to avoid preservatives. As consumers seek clean-label and nutrient-rich meals, brands experiment with premium coatings and oxygen barriers. This trend creates opportunities for co-packers and private-label producers to supply customizable carton formats with advanced sterilization processes. The rise of allergen-free, vegan, and additive-free food options widens the premium application base, offering new revenue potential for market players.

- For instance, NaturPak Pet, a leading co-manufacturer of premium pet food, produces innovative 3-ounce Tetra Pak Recart retort cartons that combine multi-layer protection with consumer convenience and recyclability, ideal for premium small portions.

Technology Advancement in Coatings and Sealing

Advances in barrier coatings and sealing layers enhance product protection, heat resistance, and aroma retention. Manufacturers replace aluminum layers with plant-based or fiber-coated solutions to improve recyclability. Smart filling lines reduce processing time and energy usage, enabling faster commercialization of new SKUs. Investments in digital printing help brands launch seasonal designs and limited-edition variants at low cost. Technology partnerships among carton makers, food processors, and machinery suppliers create a strong innovation pipeline. These enhancements increase acceptance of retort cartons in beverages and high-acid food categories.

- For instance, SML produces MDO-PE films that replace PET in laminates, creating mono-material films that are easier to recycle while offering excellent barrier properties and integrated sealing layers for efficient production.

Key Challenges

Competition from Metal Cans and Flexible Pouches

Metal cans and retort pouches remain strong alternatives due to established processing lines, wide consumer familiarity, and high barrier performance. Many canned food producers invest in marketing and product innovation to retain their user base. Retort pouches offer low material cost and strong performance in portable, single-serve packs. Switching to carton-based packaging requires filling line upgrades and high initial capital. Smaller brands hesitate to shift due to transition costs and certification requirements. These competitive packaging formats restrict faster penetration of retort cartons in mass-market food categories.

Stringent Safety and Material Compliance Regulations

Retort packaging must comply with strict food-contact safety laws, sterilization standards, migration limits, and recyclability benchmarks. Paperboard must withstand high-temperature processing without affecting flavor, odor, or nutrition. Manufacturers invest heavily in testing, certification, and specialized coating materials. Compliance varies across countries, adding cost for multinational food suppliers. Failure to meet safety standards results in product recalls, brand damage, and regulatory penalties. These barriers slow down adoption for small and mid-sized packaging converters entering the retort carton market.

Regional Analysis

North America

North America holds 34% market share, supported by high consumption of ready-to-eat meals, dairy alternatives, and ambient baby food. Retail chains expand private-label retort packaged soups, broths, and international cuisines, which boosts carton demand. Consumers prefer lightweight, recyclable packaging over metal cans because of convenience and sustainability. Leading food processors invest in aseptic filling and heat-resistant coatings to extend product variety. E-commerce platforms offer wide distribution for shelf-stable products without cold-chain costs. Government emphasis on eco-friendly packaging strengthens adoption of paperboard-based retort cartons across the U.S. and Canada.

Europe

Europe accounts for 29% market share, driven by strict recycling regulations and a well-developed convenience food industry. Sustainable fiber-based cartons replace aluminum and plastic-heavy formats in baby food, sauces, dairy drinks, and premium soups. Large supermarket chains promote organic and allergen-free meals in shelf-stable form, which supports retort carton growth. Manufacturers upgrade sterilization lines to meet EU safety standards and flavor protection requirements. Germany, the U.K., France, and Nordic countries lead consumption due to strong adoption of plant-based coatings, recyclable barriers, and ambient meal kits with premium branding.

Asia-Pacific

Asia-Pacific commands 25% market share, supported by large populations, rising disposable income, and rapid urbanization. Consumers adopt ready meals, curry sauces, and flavored dairy drinks packaged in heat-processed cartons. Japan and South Korea lead in high-grade sterilization technology, while India and Southeast Asia expand usage through affordable ambient foods. Domestic brands invest in lightweight cartons to reduce logistics cost and extend shelf life in regions with limited cold-chain access. E-commerce growth, export-led food production, and sustainability initiatives drive stronger demand for paperboard retort packaging across emerging economies.

Latin America

Latin America holds 7% market share, with growth led by Brazil, Mexico, Argentina, and Chile. Packaged meals, sauces, and baby foods gain visibility in modern retail and discount stores. Food producers shift from metal cans to retort cartons to reduce shipping weight in long-distance distribution. Government support for recycling, coupled with consumer preference for portable formats, drives adoption. Regional manufacturers invest in aseptic carton filling lines to expand product range for dairy and nutritional drinks. Growing reliance on ambient packaging improves product access in remote and rural markets.

Middle East & Africa

The Middle East & Africa represent 5% market share, supported by rising imports of shelf-stable international food and dairy drinks. Supermarkets and hypermarkets expand ambient food aisles to cater to expatriate and millennial shoppers. Limited cold-chain infrastructure makes retort cartons attractive for long-distance transport and high-temperature climates. Regional food processors adopt paperboard-based solutions for sauces and broths, while global brands distribute ready meals in lightweight cartons. Investments in sustainable packaging and expanding organized retail networks are expected to boost growth across GCC nations and South Africa.

Market Segmentations

By Product Type

- Pouches

- Trays

- Cans

- Cartons

By Material Type

By Application

- Food

- Beverages

- Pet food

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Retort Carton market includes multinational packaging manufacturers and specialized food packaging converters offering high-barrier, heat-resistant, and recyclable carton structures. Key players such as Amcor PLC, Berry Global Inc., Sonoco, Huhtamaki Oyj, Mondi Group, Otsuka Holdings Co. Ltd, Tredegar Corporation, Coveris, Clondalkin, and Sealed Air Corporation focus on improving barrier coatings, fiber-based laminates, and advanced sterilization compatibility to replace traditional metal and plastic formats. Companies invest in aseptic filling lines, digital printing assets, and lightweight paperboard innovations to serve ready meals, dairy drinks, sauces, and baby food brands. Sustainability remains the major competitive factor, pushing manufacturers to use renewable raw materials and mono-material solutions that support recycling. Strategic partnerships with food producers, retail chains, and meal kit providers help expand product portfolios and regional reach. Leading players acquire regional converters and strengthen research capabilities to enhance performance, aroma protection, and high-temperature stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Amcor PLC launched an industry-first 2 oz retort bottle designed for nutritional shots and low-acid, shelf-stable drinks. This bottle was developed in partnership with Insymmetry LLC using Amcor’s StormPanel™ technology.

- In May 2024, Tetra Pak, in collaboration with the University of Georgia, launched North America’s first trial facility for Tetra Recart® cartons. This facility allows food producers to test the shelf stability and formulations of products using this retort carton format.

- In June 2023, SIG Group announced that Italian food producer La Doria SpA invested in SIG’s “Safe 12 Food Retort” filling line. This investment enables them to pack food in SIG’s SafeBloc carton packs (200–500 ml) instead of using cans or glass containers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will expand paperboard-based retort solutions to replace metal cans and multilayer plastics.

- Digital printing and smart packaging will support seasonal designs and private-label growth.

- Aseptic filling lines will scale to meet demand for dairy drinks, sauces, and infant food.

- Sustainability regulations will drive investment in recyclable and mono-material coatings.

- Ready-to-eat meals and international cuisine launches will increase adoption in retail chains.

- E-commerce grocery delivery will boost shelf-stable product distribution without cold-chain costs.

- Premium and organic food brands will use retort cartons for clean-label and preservative-free offerings.

- Emerging markets in Asia and Latin America will adopt lightweight cartons to cut transport cost.

- Partnerships between food processors and packaging converters will accelerate product innovation.

- Development of heat-resistant fiber barriers will reduce dependence on aluminum layers.