Market Overview

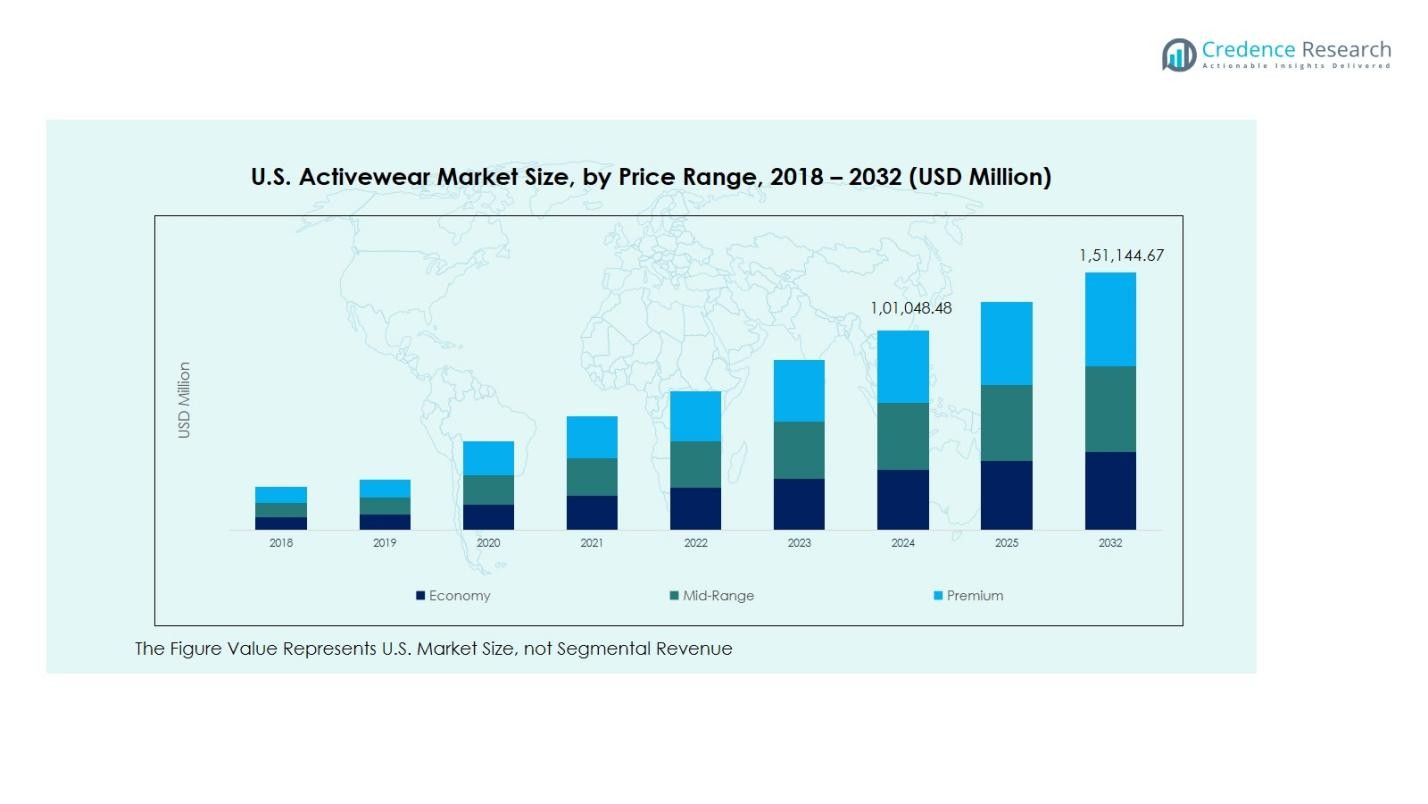

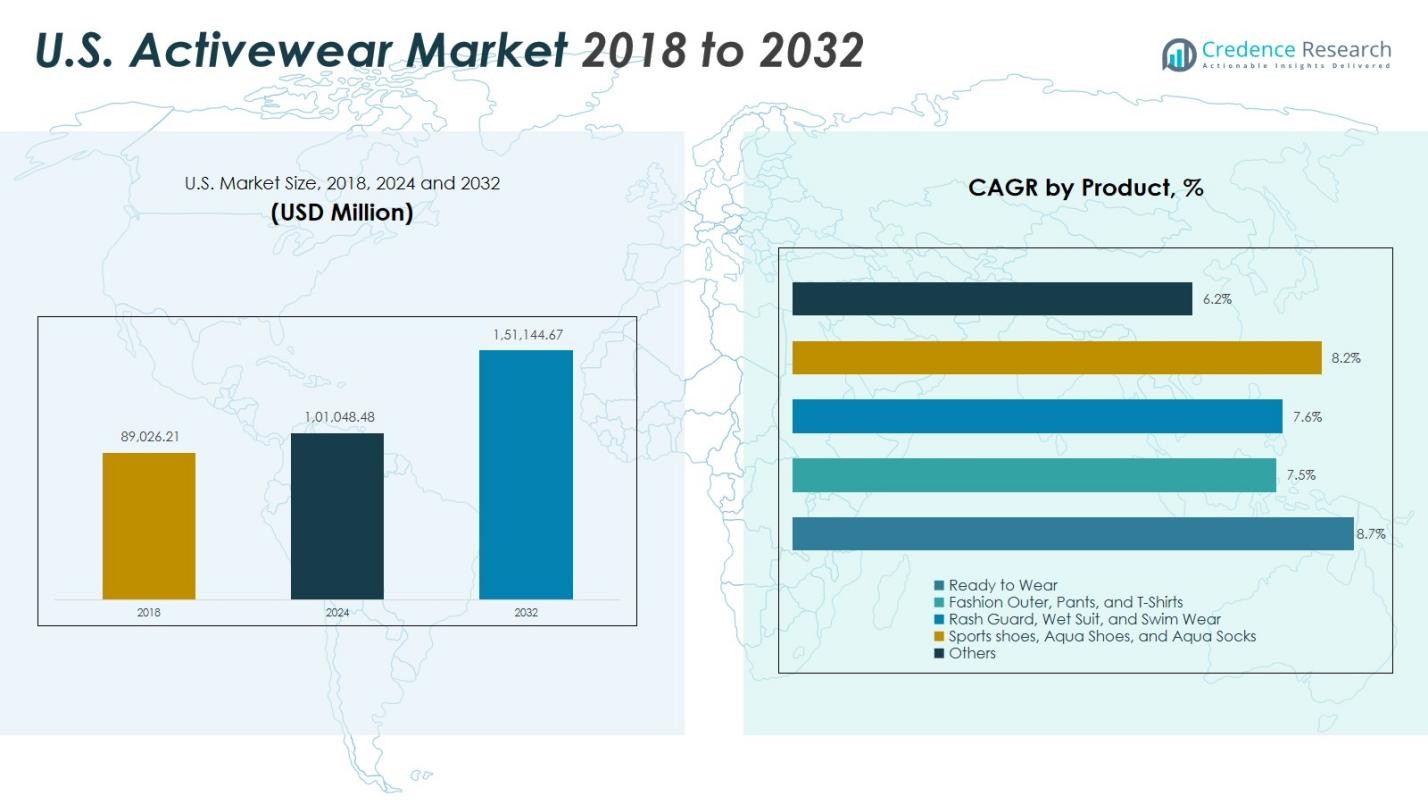

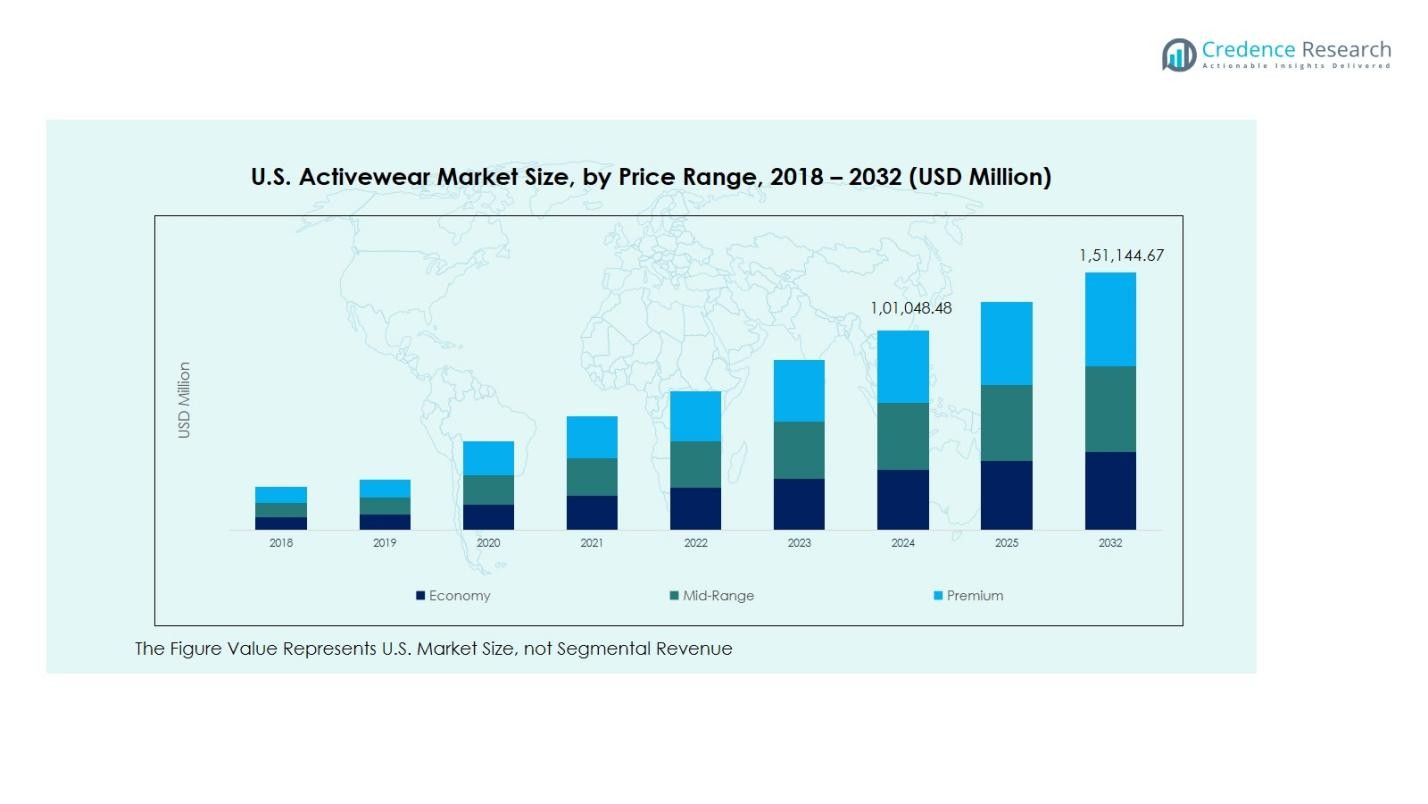

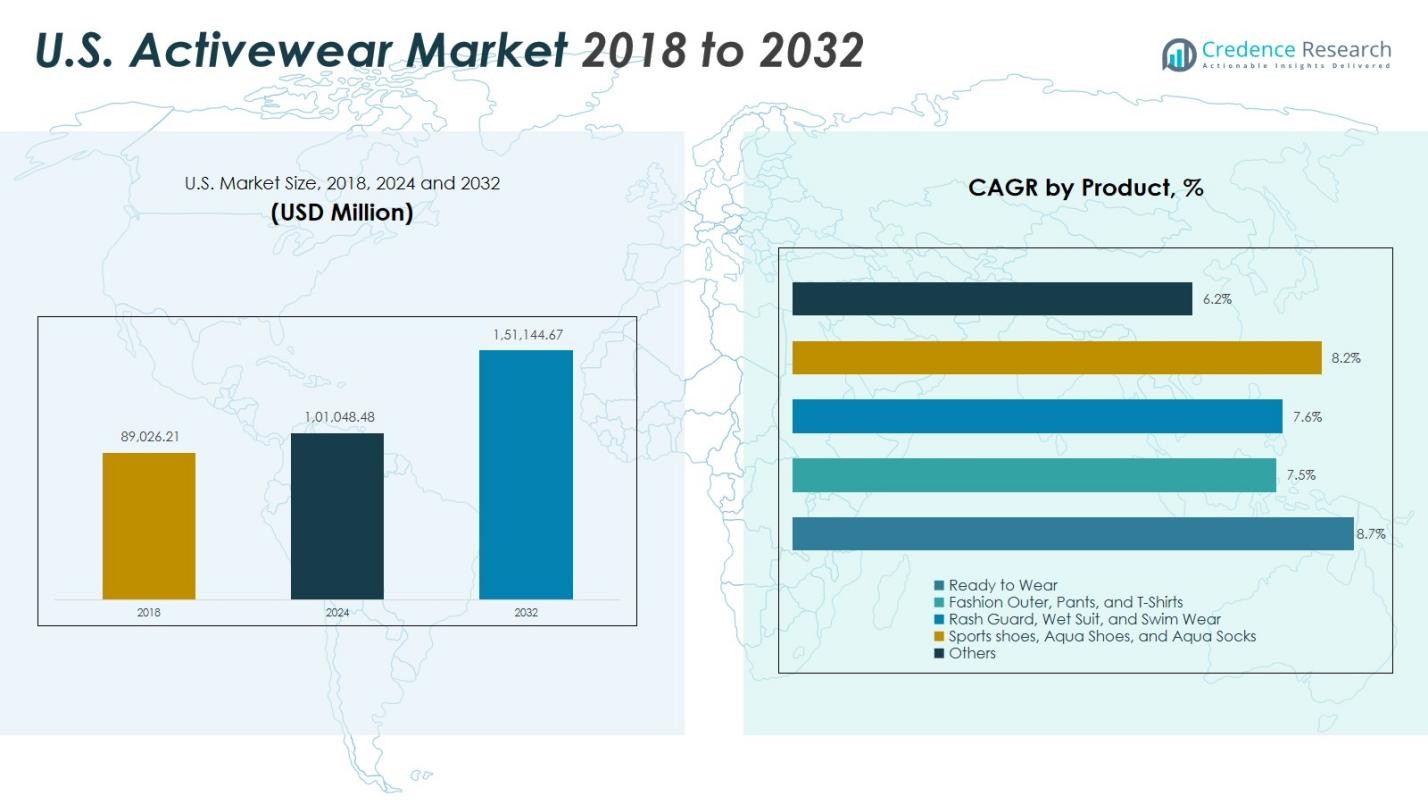

U.S Activewear Market size was valued at USD 89,026.21 Million in 2018, increasing to USD 1,01,048.48 Million in 2024, and is anticipated to reach USD 1,51,144.67 Million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S Activewear Market Size 2024 |

USD 1,01,048.48 Million |

| U.S Activewear Market, CAGR |

5.16% |

| U.S Activewear Market Size 2032 |

USD 1,51,144.67 Million |

U.S. Activewear Market is driven by leading players such as Nike, Adidas, Puma, Under Armour, Lululemon, Columbia Sportswear, VF Corporation, Skechers, Hanesbrands, and New Balance, all of which continue to strengthen their presence through advanced performance fabrics, sustainable materials, and expanding athleisure lines. These companies actively enhance consumer engagement through digital retail, influencer collaborations, and category-specific innovations across running, training, yoga, and outdoor wear. Regionally, the South leads the market with a 31.8% share, supported by its warm climate and strong sports participation. The Northeast and Midwest also contribute significantly due to rising urban fitness culture, growing wellness adoption, and increasing demand for versatile apparel suited for hybrid lifestyles and year-round usage.

Market Insights

Market Insights

- The U.S. Activewear Market recorded strong growth in 2024 with rising revenue of USD 1,01,048.48 Million and continues to advance at a steady CAGR of 5.16% through 2032, supported by expanding athleisure adoption and performance-driven purchasing behavior.

- Market growth is driven by increasing fitness participation, rising demand for versatile apparel, and innovation in technical fabrics such as moisture-wicking, stretch-enhanced, and recycled materials that enhance comfort and durability.

- Trends such as sustainable activewear, circular textile models, and digital retail expansion are reshaping consumer expectations, while the Ready to Wear segment leads with 2% share due to its multifunctional appeal.

- Key players including Nike, Adidas, Puma, Under Armour, Lululemon, and VF Corporation focus on design upgrades, influencer-led engagement, and omnichannel strategies, although pricing pressure and raw material volatility remain restraints.

- Regionally, the South holds the largest share at 8%, followed by the Northeast at 27.4%, Midwest at 21.6%, and West at 19.2%, reflecting diverse climate-driven and lifestyle-based activewear preferences across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Ready to Wear category dominates the U.S. Activewear Market, capturing 41.2% market share in 2024 due to rising adoption of athleisure for daily use and multifunctional performance apparel. Consumers increasingly prefer comfortable, stretchable, and breathable garments suitable for both casual and fitness activities, driving stronger demand for leggings, joggers, and performance tops. Fashion Outer, Pants, and T-Shirts gain traction with evolving design trends, while Sports Shoes and Aqua Shoes expand through growing demand for specialized footwear. Rash Guard and Swim Wear benefit from rising participation in water sports, collectively enriching category diversity.

- For instance, in swimwear, Speedo’s rash guard collection has gained traction, reflecting heightened awareness of UV protection and comfort during water activities, particularly among paddle sports participants.

By Fabric

Polyester emerges as the leading fabric in the U.S. Activewear Market with a 46.7% market share, supported by its durability, moisture-wicking abilities, and cost-efficient production. The segment benefits from growing use of recycled polyester, aligning with sustainability-led preferences. Spandex remains a high-growth sub-segment due to its superior elasticity, while Nylon appeals to premium performance wear for its abrasion resistance. Cotton-based activewear gains demand among consumers preferring natural fibers with comfort advantages. Neoprene and Polypropylene serve niche performance applications, strengthening fabric versatility across sports, outdoor, and training apparel.

- For instance, Adidas launched the “Primeblue” activewear line made using recycled ocean plastics, showcasing its commitment to sustainability while leveraging polyester’s properties.

By Material

The Synthetic material segment leads the U.S. Activewear Market with a 72.5% market share, driven by the superior performance benefits of polyester, nylon, and spandex blends. These materials offer moisture management, durability, shape retention, and enhanced elasticity, making them preferred for high-intensity and athleisure applications. Natural materials, including cotton and organic fibers, hold steady demand due to rising consumer interest in breathable and skin-friendly textiles. However, synthetics continue to dominate as brands innovate with recycled fibers, antimicrobial coatings, and heat-regulating technologies to deliver advanced functional apparel.

Key Growth Drivers

Rising Adoption of Athleisure Lifestyle

The increasing integration of comfort-driven apparel into daily wear continues to fuel demand across the U.S. Activewear Market. Consumers gravitate toward versatile outfits that combine performance attributes with stylish designs, supporting strong uptake of leggings, joggers, and multipurpose tops. The shift toward hybrid lifestyles, where work, fitness, and social activities blend, accelerates this trend, prompting brands to expand collections that balance functionality and aesthetics. This growing athleisure culture significantly strengthens market momentum and broadens the consumer base across age groups.

- For instance, Nike’s recent launch of the NikeSKIMS activewear line features about 40 versatile styles crafted for both gym and casual wear, blending advanced performance technology with fashion-forward design.

Expanding Fitness Participation and Wellness Awareness

Fitness participation is rising rapidly across the U.S. as consumers prioritize health, weight management, and active routines. Increasing membership in gyms, boutique studios, and outdoor sports activities boosts demand for performance apparel that enhances mobility, breathability, and comfort. Wearables and fitness apps further reinforce exercise habits, leading to continuous replacement of activewear. The growth of running, yoga, and strength training also stimulates demand for category-specific gear, positioning performance-oriented activewear as a key enabler of the evolving wellness ecosystem.

- For instance, Nike introduced Aero-FIT, its elite performance apparel featuring cooling technology that doubles airflow compared to previous materials, designed to help athletes stay dry and comfortable during intense exercise, while being made from 100% recycled textile waste showcasing innovation in sustainability and performance.

Innovation in Technical Fabrics and Sustainable Materials

Advancements in moisture-wicking, thermal-regulating, and stretch-enhancing fabrics serve as a major catalyst for market expansion. Brands increasingly invest in recycled polyester, bio-based fibers, and antimicrobial technologies to improve durability while meeting sustainability expectations. These innovations elevate product appeal for performance-driven consumers seeking high-quality, long-lasting apparel. Enhanced manufacturing techniques, such as seamless construction and advanced knitting, further optimize comfort and fit, strengthening technological differentiation and supporting premiumization within the U.S. Activewear Market.

Key Trends & Opportunities

Growth of Sustainable and Circular Activewear

Sustainability has emerged as a defining trend, creating substantial opportunities for brands adopting eco-friendly production. Consumers increasingly prefer garments made from recycled plastics, organic cotton, and low-impact dyes, prompting companies to redesign supply chains and reduce carbon footprints. Circular business models, including recycling programs and resale platforms, gain traction as environmental awareness intensifies. Brands that integrate transparency, traceability, and green certifications position themselves favorably among conscious consumers, enabling competitive differentiation and long-term brand loyalty.

- For instance, Levi’s has pledged to use 100% renewable electricity across all company-operated facilities by 2025, reduce freshwater usage by 50% in water-stressed areas compared to 2018 levels, and supports sustainable farming through sourcing organic cotton directly from farmers.

Acceleration of Digital Commerce and Omni-Channel Retailing

Online and omni-channel ecosystems continue to reshape purchasing behavior by providing convenience, broader assortments, and personalized shopping experiences. E-commerce platforms expand access to performance and lifestyle activewear, while virtual try-ons, size recommendation tools, and AI-driven product suggestions enhance decision-making. Retailers increasingly integrate seamless fulfillment options, including curbside pickup and same-day delivery, to improve accessibility. These digital advancements open growth avenues for emerging brands and enable established players to strengthen customer engagement and market reach.

- For instance, Lululemon offers a Buy Online, Pick Up in Store (BOPIS) option at select stores, which often allows shoppers to pick up their orders within two hours of placing them, enhancing accessibility in local areas.

Key Challenges

Intense Market Saturation and Pricing Pressure

The U.S. Activewear Market faces rising competition as established global brands, niche labels, and fast-fashion companies simultaneously target the same consumer segments. This saturation intensifies pricing pressure and reduces differentiation, compelling brands to continually innovate to retain market share. Promotional discounts and frequent product drops create margin challenges, particularly for mid-sized manufacturers. As consumer expectations grow, companies must balance affordability with performance innovation, making strategic positioning increasingly essential for sustainable growth.

Supply Chain Disruptions and Cost Volatility

Volatility in raw material prices, logistics delays, and labor shortages pose persistent challenges for activewear manufacturers. Fluctuations in costs for polyester, spandex, and cotton directly affect production budgets, while global supply chain congestion impacts inventory planning and lead times. Brands must manage these disruptions while maintaining product availability and competitive pricing. Increasing reliance on overseas manufacturing intensifies vulnerability, pushing companies to diversify suppliers, enhance forecasting capabilities, and explore nearshoring strategies to stabilize operations.

Regional Analysis

Northeast

The Northeast holds a 27.4% market share in the U.S. Activewear Market, supported by strong participation in fitness clubs, outdoor running communities, and recreational sports. Urban centers such as New York, Boston, and Philadelphia drive premium activewear demand due to higher disposable incomes and fashion-forward consumer behavior. The region benefits from high adoption of athleisure for work, travel, and social activities, influencing stronger sales of performance apparel and footwear. Seasonal variations, including cold winters, further boost demand for thermal activewear, layered outfits, and durable outdoor gear suited for diverse climate conditions.

Midwest

The Midwest accounts for a 21.6% market share, driven by increasing engagement in outdoor activities, school sports, and community fitness programs. Consumers prioritize value-oriented activewear with durability, comfort, and weather adaptability, supporting demand for versatile jackets, joggers, and performance basics. Retail chains play a strong role in distribution, complemented by growing online purchases across suburban markets. The region’s moderate climate variation encourages demand for year-round apparel suitable for workouts and casual wear. Rising health awareness and expanding participation in home-based fitness routines further contribute to stable category growth.

South

The South leads the market with a 31.8% market share, benefiting from warm weather, strong sports culture, and higher participation in outdoor activities such as running, hiking, and team sports. States including Texas, Florida, and Georgia drive robust consumption of lightweight, breathable, and moisture-wicking apparel. The region’s expanding population and growing interest in wellness lifestyles fuel accelerated adoption of athleisure and performance wear. Retail and online channels both show strong momentum, while demand for swimwear, yoga apparel, and training outfits reflects the region’s climate-driven preferences.

West

The West captures a 19.2% market share, supported by an active lifestyle culture and strong alignment with sustainability trends. States such as California and Colorado lead demand for eco-conscious fabrics, outdoor performance gear, and athleisure suited for both fitness and casual wear. The region benefits from high participation in hiking, cycling, yoga, and boutique fitness, fueling growth in category-specific apparel. Tech-savvy consumers also drive strong e-commerce penetration, supporting direct-to-consumer brands. The West’s climate, combined with a strong health-centric demographic, reinforces steady demand across premium and mid-range activewear segments.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- North East

- Mid west

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Activewear Market is shaped by leading players such as Nike, Adidas, Puma, Under Armour, Lululemon, Columbia Sportswear, VF Corporation, Skechers, Hanesbrands, and New Balance, each leveraging strong brand equity and advanced product portfolios. These companies compete through continuous innovation, launching performance-enhancing fabrics, sustainable material lines, and versatile athleisure collections tailored to shifting consumer lifestyles. Premium brands emphasize high-end technical apparel, while value-driven players focus on affordability and mass-market reach. Digital retail expansion, influencer partnerships, and data-driven product personalization further intensify competition, enabling brands to enhance consumer engagement. Investments in omnichannel capabilities, supply chain optimization, and strategic collaborations strengthen market presence, while sustainability commitments become increasingly essential for differentiation. As consumer expectations for comfort, durability, and style continue to rise, leading players pursue aggressive innovation pipelines and market diversification strategies to maintain dominance and capture emerging growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Columbia Sportswear Company

- VF Corporation (The North Face, Vans)

- Skechers USA, Inc.

- Hanesbrands Inc.

- Lululemon Athletica Inc.

- New Balance Athletics, Inc.

Recent Developments

- In February 2025, Target Corporation announced a strategic partnership with Champion to launch a new collection of more than 500 activewear and sporting goods items for adults and kids, available in Target stores and online starting in August.

- In February 2025, Nike announced a collaboration with SKIMS (founded by Kim Kardashian) to launch a new women’s activewear brand called Nike SKIMS, comprising training apparel, footwear and accessories.

- In July 2025, Beyond Yoga partnered with Issa Rae as the face of its new “Seek Beyond” campaign and Outdoor product line to reinforce its positioning in the active‑/athleisure market.

- In August 2025, Gildan Activewear announced the planned acquisition of Hanesbrands Inc. for USD 2.2 billion an expansion move in the broader active/apparel space in the U.S. market.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Fabric, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Activewear Market will continue to expand as athleisure becomes a mainstream wardrobe essential across age groups.

- Brands will prioritize sustainable materials and circular production models to meet rising environmental expectations.

- Growth in digital retail will intensify, with AI-driven personalization shaping consumer purchasing behavior.

- Performance-enhancing fabrics and advanced textile technologies will drive innovation pipelines across categories.

- Demand for versatile apparel suitable for hybrid work, travel, and fitness routines will strengthen market penetration.

- Premium activewear will gain traction as consumers invest in high-quality, long-lasting performance gear.

- Partnerships with influencers, athletes, and fitness platforms will remain critical for brand visibility and engagement.

- Outdoor and sports-specific apparel will witness increased adoption as recreational activities rise nationwide.

- Supply chain modernization and nearshoring strategies will gain importance to reduce delays and cost volatility.

- Brands will expand inclusive sizing, adaptive apparel, and gender-neutral collections to reach wider consumer segments.

Market Insights

Market Insights