Market Overview

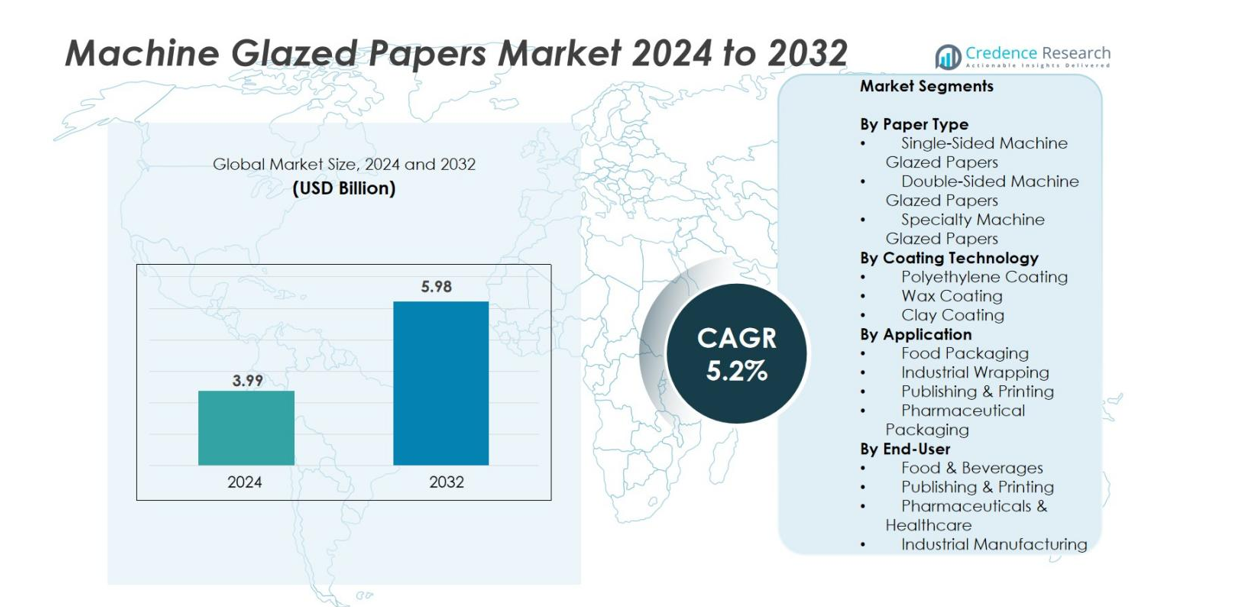

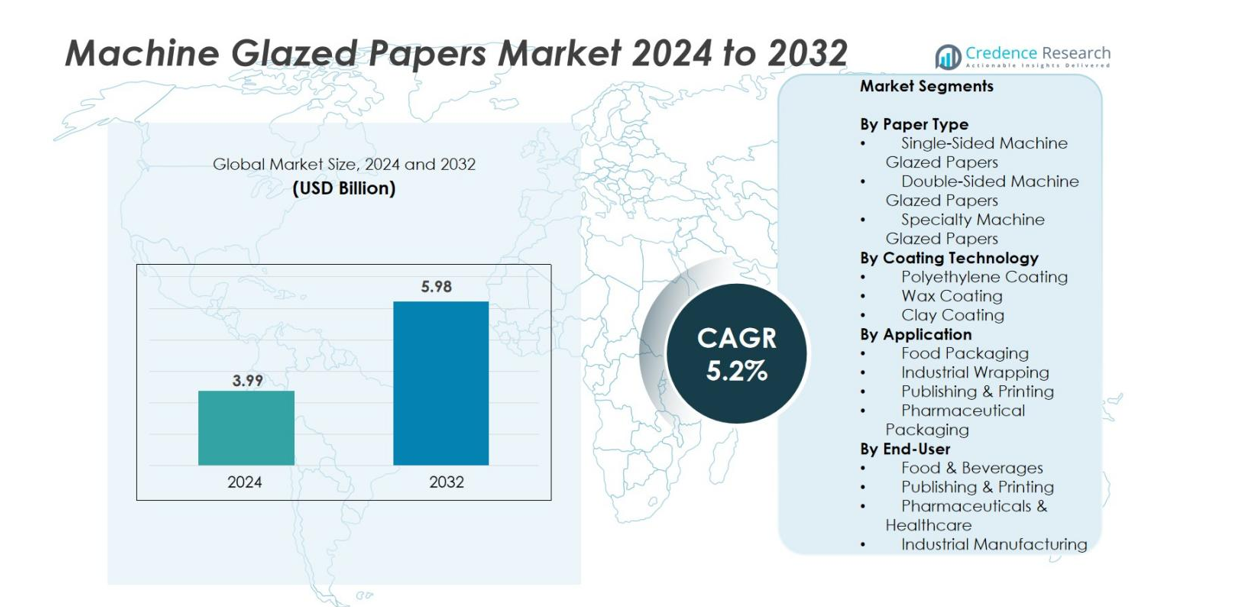

Machine Glazed Papers market size was valued USD 3.99 billion in 2024 and is anticipated to reach USD 5.98 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Machine Glazed Papers Market Size 2024 |

USD 3.99 billion |

| Machine Glazed Papers Market, CAGR |

5.2% |

| Machine Glazed Papers Market Size 2032 |

USD 5.98 billion |

The market is led by key players such as Mondi Group, International Paper Company, Stora Enso, UPM-Kymmene Corporation, Sappi Limited, Nippon Paper Industries, Smurfit Kappa Group, WestRock Company, Verso Corporation, and Ahlstrom-Munksjö. These companies focus on recyclable MG grades, specialty coatings, and branded foodservice packaging to strengthen market presence across food, industrial, and pharmaceutical applications. Asia Pacific remains the leading region with 42% market share, supported by strong demand for food packaging, expanding retail networks, and cost-efficient production systems. Europe follows with 27% share driven by sustainability regulations and rapid adoption of bio-coated MG papers, while North America maintains steady penetration in bakery and takeaway packaging formats.

Market Insights

- The Machine Glazed Papers market was valued at USD 3.99 billion in 2024 and is expected to reach USD 5.98 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

- Strong demand from foodservice, bakery, and takeaway packaging drives steady consumption, as MG papers offer hygiene, grease resistance, and branding capability for direct food contact applications.

- Sustainability trends support rapid adoption of recyclable and bio-coated MG papers, while premium printed wraps and bags gain traction across retail, cafés, and fast-food chains.

- The market is competitive with leading players such as Mondi Group, International Paper, Stora Enso, WestRock, UPM-Kymmene, and Sappi focusing on coated grades, lightweight products, and production capacity expansion.

- Asia Pacific holds 42% share as the dominant region, followed by Europe at 27% and North America at 18%; within segmentation, single-sided MG papers dominate with 52% share driven by widespread packaging use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Paper Type

Single-sided machine glazed papers hold the dominant share of 52% due to high demand in flexible packaging, grocery bags, and food service applications. The smooth glossy surface on one side offers strong printability, while the opposite side provides better bonding and sealing strength. Double-sided grades serve specialty packaging but remain limited to premium applications. Specialty MG papers grow steadily in hygiene products, confectionery wraps, and release liners. Rising preference for lightweight, recyclable, and biodegradable packaging products in retail and e-commerce continues to strengthen demand for single-sided MG papers across major markets.

- For instance, PaperWise offers a Natural Machine Glazed paper variant that is lightweight, recyclable, and widely used for bakery bags, confectionery wraps, and block-bottom bags for luxury chocolates, leveraging its smooth, printable side for premium appearance and matte side for sealing strength.

By Coating Technology

Polyethylene-coated machine glazed papers lead the segment with a 45% share. They offer superior moisture resistance, grease barrier properties, and heat-sealing capability, making them preferred for bakery wraps, dairy packaging, and ready-to-eat food applications. Wax-coated papers cater to confectionery and produce packaging but show slower growth due to sustainability concerns. Clay coating enhances print quality for premium labels and branding. Food safety regulations, demand for leak-proof wraps, and the expansion of quick-service restaurants drive the need for polyethylene-coated MG papers.

- For instance, Mondi plc produces specialty extrusion-coated MG papers that enable high-speed bakery wrap production with consistent grease and moisture barriers.

By Application

Food packaging dominates the application segment with 48% market share, supported by high usage in bakery bags, sandwich wraps, confectionery pouches, and fast-food packaging. Machine glazed papers provide clean appearance, hygiene compliance, and resistance to oil and moisture, making them ideal for direct food contact. Industrial wrapping sees strong adoption in metal parts, glassware, and consumer goods due to high tensile strength. Publishing and pharmaceutical packaging grow steadily with improved printability and barrier treatments. Rising consumption of packaged and takeaway food continues to fuel demand within the food segment.

Key Growth Drivers

Rising Demand in Foodservice and Takeaway Packaging

Foodservice chains, bakeries, and quick-service restaurants increasingly rely on machine glazed papers for wrapping, bags, and pouches. The hygienic surface, grease resistance, printability, and smooth finish make them suitable for direct food contact. As urbanization increases consumer spending on ready-to-eat and takeaway food, consumption of MG packaging continues to rise. Small and medium food vendors also shift from plastic to paper-based packaging due to compliance pressure and brand differentiation. Growing use in bakery wraps, sandwich papers, cones, and confectionery packaging drives steady volume growth.

- For instance, PaperWise’s Natural Machine Glazed Super Calendered Paper is widely used for bakery packaging such as bread bags, rolls, and filled pastry wraps, combining excellent printability with low moisture resistance.

Shift Toward Sustainable and Recyclable Packaging

Global sustainability policies and bans on single-use plastics strongly support the transition to fiber-based packaging products. Machine glazed papers are recyclable, compostable, and biodegradable, making them a viable replacement for films and coated plastics in bags, food wraps, and e-commerce packaging. Brand owners and retailers adopt paper-based formats to meet sustainability certifications and reduce plastic footprints. Food brands favor MG papers due to lower environmental impact and easier recovery in existing waste systems. Innovation in bio-coatings and water-based treatments further increases interest in barrier-enhanced grades without compromising recyclability.

- For instance, Billerud (formerly BillerudKorsnäs) offers eco-friendly machine glazed paper solutions and actively develops bio-based coatings that improve barrier properties while ensuring compostability and recyclability.

Expansion in Industrial and Pharmaceutical Wrapping

Industries rely on machine glazed papers for strength, tear resistance, and dimensional stability. Manufacturers of metal parts, glassware, and consumer goods use MG papers for wrapping and interleaving to prevent abrasion and contamination. In pharmaceuticals, coated MG papers provide hygiene, print clarity, and sealing performance for pouches and blister overwraps. As supply chains expand, demand grows from contract packers and logistics companies that require lightweight and cost-efficient packaging. Advances in coatings also allow MG paper to replace plastic wraps in moisture-sensitive applications. With steady growth in industrial production and healthcare packaging, MG papers continue to gain relevance across non-food sectors.

Key Trends & Opportunities

Adoption of Bio-Coated and Water-Based Barrier Papers

A major trend involves replacing polyethylene and wax coatings with bio-based and water-based barriers that improve recyclability. Paper mills develop formulations offering grease, moisture, and oxygen resistance without adding plastic layers. This transition helps brands comply with sustainability targets and packaging waste regulations. Bio-coated MG papers attract foodservice players seeking eco-friendly alternatives for bakery items, pastries, and confectionery wraps. The trend also opens export opportunities as international markets implement strict plastic restrictions. Suppliers that commercialize recyclable barrier MG grades gain a competitive edge, especially in Europe and North America.

- For instance, Mondi Group has introduced customized barrier MG papers designed for recycling with a high paper-to-plastic ratio of up to 95/5, balancing grease, moisture, and oxygen resistance while enabling compliance with industry recyclability standards.

Growth of Premium Printed Packaging for Branding

Retailers, cafés, bakeries, and food chains treat packaging as a branding tool. Machine glazed papers offer a glossy surface on one side that supports high-quality printing, attractive graphics, and customized branding. Improvements in clay-coated MG papers enhance color reproduction and surface smoothness, enabling premium bags and wraps for specialty food products. E-commerce and luxury gifting segments also adopt MG papers for labels, liners, and protective wraps. The combination of print performance and sustainability creates long-term opportunities for suppliers offering premium finished products to brand-conscious customers.

- For instance, Charta Global in the US produces food-grade machine glazed Kraft paper certified by the FDA, used for sandwich wrappers and biscuit bags, ensuring both print quality and food safety.

Key Challenges

Price Sensitivity and Cost Fluctuations in Raw Materials

The market faces cost challenges due to fluctuations in pulp, chemicals, and energy expenses. Paper mills operate under tight margins, and price-sensitive end-users often shift to cheaper kraft or poly-laminated alternatives when input costs rise sharply. Volatile raw material pricing also affects small converters and local producers with limited procurement power. Maintaining stable supply and profit margins requires efficiency upgrades, recycling integration, and long-term sourcing contracts. Without cost control, pricing pressure may limit the adoption of premium MG grades in emerging markets.

Competition from Plastic and Flexible Packaging Alternatives

Although sustainability pushes demand toward fiber-based packaging, plastic films remain cheaper, stronger, and widely available for many applications. Barrier plastics provide superior moisture and oxygen protection, making them competitive in frozen food and pharma packaging. Some industries and SMEs still prefer plastic due to convenience and durability. To compete, MG paper suppliers must improve barrier performance, sealing quality, and moisture resistance. If innovation gaps persist, plastic-based formats may continue holding share in high-performance segments, slowing MG paper penetration.

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of 42% driven by high consumption of food packaging, industrial wrapping, and retail paper bags. China, India, Indonesia, and Vietnam expand MG paper use due to growing bakery chains, modern retail formats, and flexible packaging manufacturing. Local producers invest in capacity expansions and recyclable coated grades to serve foodservice and e-commerce sectors. Rising demand for plastic-free packaging and rising urban food consumption further strengthen regional leadership. Strong pulp availability and cost-effective production also support Asia Pacific’s dominant position in global trade.

Europe

Europe accounts for 27% of the market, supported by mature packaging infrastructure, strict sustainability regulations, and rapid adoption of recyclable substitutes for single-use plastics. MG papers gain demand in bakery wraps, premium branding, labeling, and pharmaceutical packaging. Germany, Italy, France, and the U.K. lead production, supported by advanced mills and specialty coating technology. Retailers and food chains favor paper-based formats to meet circular economy targets. Growth in water-based and bio-coated machine glazed papers positions Europe as a hub for innovation and export of sustainable packaging grades.

North America

North America represents 18% of global share with strong usage in bakery bags, food takeaway, industrial packaging, and logistics protective wrapping. The U.S. and Canada experience rising demand from quick-service restaurants, cafes, and e-commerce sellers using branded paper bags and wraps. Investments in clay-coated and polyethylene-coated MG grades expand use in premium food brands and pharmaceutical applications. Sustainability regulations at state and federal levels gradually phase out plastic-based packaging, boosting adoption of recyclable alternatives. Market growth remains steady as converters upgrade equipment for barrier-coated and high-strength MG formats.

Latin America

Latin America holds 8% market share, led by Brazil, Mexico, Argentina, and Chile. The region shows increasing preference for MG papers in bakery goods, fruit packaging, and consumer product wrapping. Growing retail chains and food exports support steady demand. Domestic producers expand lightweight grades to reduce logistics cost and serve small food vendors. Adoption of polyethylene-coated MG papers rises in dairy and confectionery packaging. However, market growth faces competition from low-cost plastic films. Rising environmental awareness and regulatory actions against single-use plastics support long-term opportunities.

Middle East & Africa

Middle East & Africa command 5% share with rising consumption in foodservice, bakery, and confectionery sectors. GCC countries invest in premium printed MG papers for branded fast-food packaging and retail bags. South Africa and Kenya see increasing use in industrial wrapping, FMCG products, and agricultural packaging. Imports dominate supply due to limited regional manufacturing, but local converters expand capacity for coated and specialty grades. Growth remains moderate due to lower price sensitivity and competition from plastics, yet sustainability campaigns and urban retail expansion continue to strengthen market prospects.

Market Segmentations

By Paper Type

- Single-Sided Machine Glazed Papers

- Double-Sided Machine Glazed Papers

- Specialty Machine Glazed Papers

By Coating Technology

- Polyethylene Coating

- Wax Coating

- Clay Coating

By Application

- Food Packaging

- Industrial Wrapping

- Publishing & Printing

- Pharmaceutical Packaging

By End-User

- Food & Beverages

- Publishing & Printing

- Pharmaceuticals & Healthcare

- Industrial Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Machine Glazed Papers market features a mix of global pulp and paper manufacturers, regional converters, and specialty coating companies. Leading players include Mondi Group, International Paper Company, WestRock, Stora Enso, Sappi, Nippon Paper Industries, UPM-Kymmene, Smurfit Kappa Group, Verso Corporation, and Ahlstrom-Munksjö. These companies invest in high-speed MG paper machines, recyclable barrier coatings, and lightweight grades to meet rising demand from foodservice, pharmaceuticals, and industrial packaging. Product portfolios focus on single-sided and polyethylene-coated MG papers with strong printability and moisture resistance. Market players also expand through partnerships with converters and food brands to supply customized bakery bags, wraps, and branded packaging. Sustainability-focused innovation remains a key competitive factor, with European and North American suppliers advancing bio-based and water-based coating solutions. Competition intensifies as mills in Asia and Latin America increase production capacity and offer cost-competitive grades to global buyers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mondi Group

- WestRock Company

- Sappi Limited

- Verso Corporation

- Smurfit Kappa Group

- International Paper Company

- Ahlstrom-Munksjö

- Stora Enso

- Nippon Paper Industries

- UPM-Kymmene Corporation

Recent Developments

- In June 2025, Mondi Group launched the re/cycle PaperPlus Bag Advanced, a sustainable paper bag with a high‑barrier film for moisture‑sensitive products, significantly reducing plastic use.

- In May 2025, Lecta introduced a new series of kraft and uncoated papers, both brown and white, for bags and flexible packaging, focusing on improved printability and sustainability.

- In August 2025, Mondi Group announced the ramp‑up of FunctionalBarrier Paper Ultimate, a high‑performance, sustainable paper‑based barrier solution designed for recyclability and low OTR/WVTR to support circular economy goals.

- In April 2022, Ahlstrom‑Munksjö Oyj launched an expanded range of sustainable release papers, including machine‑glazed (MG) and machine‑finished (MF) bases, designed for silicone‑coating and other industrial applications.

Report Coverage

The research report offers an in-depth analysis based on Paper Type, Coating Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable foodservice packaging will continue to boost machine glazed paper consumption.

- Bio-coated and water-based barrier grades will replace polyethylene and wax coatings.

- Premium printed MG papers will gain adoption in branded bakery, café, and takeaway packaging.

- Industrial wrapping will expand as supply chains grow across automotive, electronics, and consumer goods.

- Pharmaceutical and healthcare packaging will adopt MG papers for hygiene and print clarity.

- Lightweight grades will grow as manufacturers reduce logistics and material costs.

- Digital printing compatibility will support customized short-run packaging for e-commerce and retail.

- Capacity expansions in Asia will increase cost-competitive supply for global buyers.

- Sustainability regulations will push retailers away from single-use plastics toward paper-based formats.

- Innovation in moisture and grease resistance will help MG papers compete with flexible plastics in more applications.