Market Overview

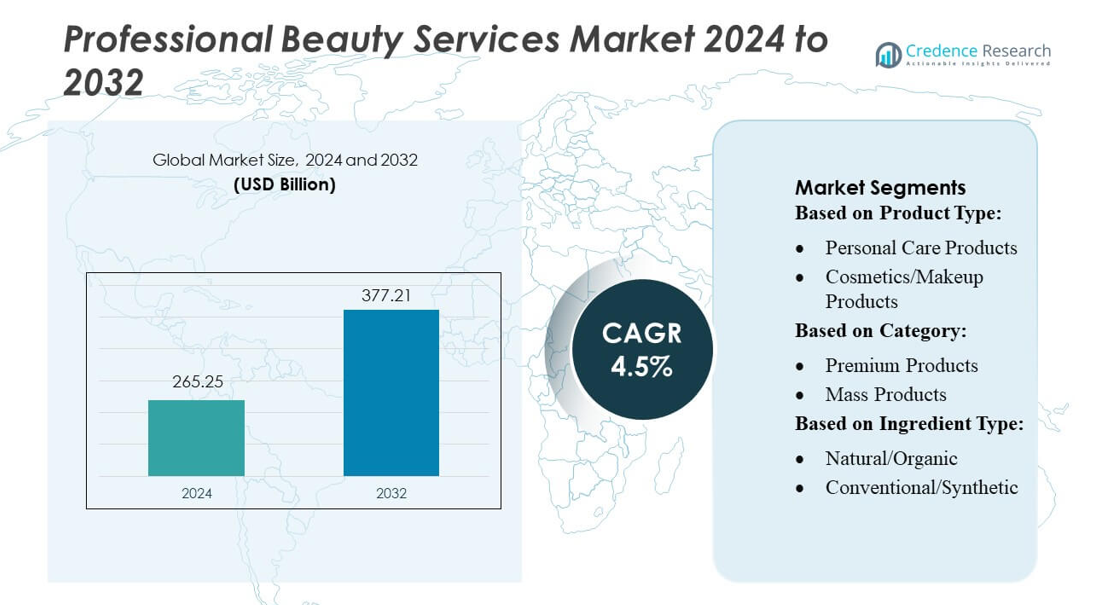

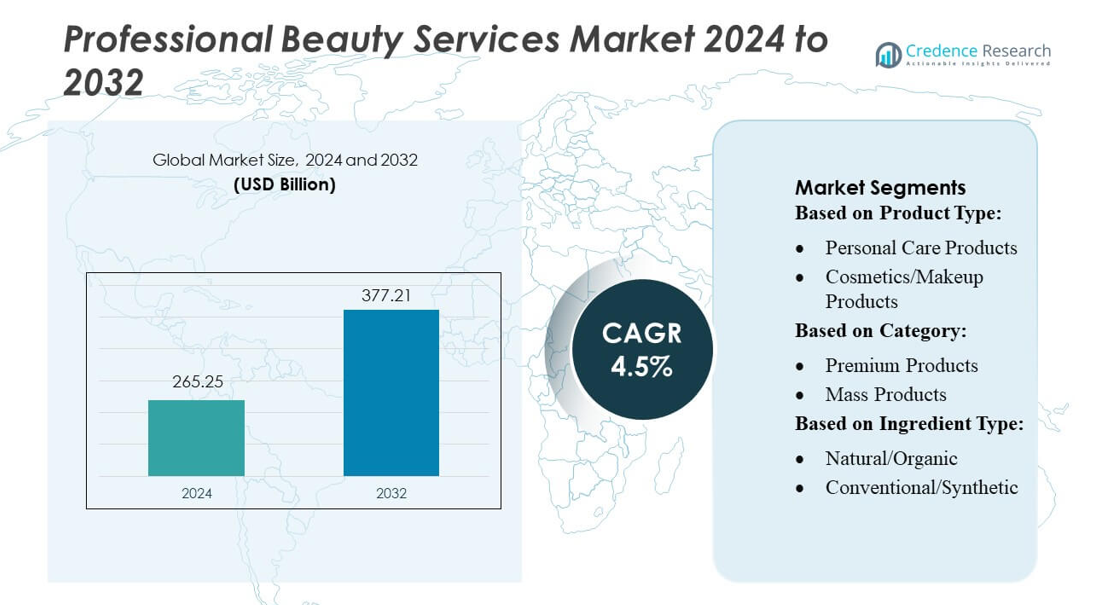

Professional Beauty Services Market size was valued USD 265.25 billion in 2024 and is anticipated to reach USD 377.21 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Professional Beauty Services Market Size 2024 |

USD 265.25 billion |

| Professional Beauty Services Market, CAGR |

4.5% |

| Professional Beauty Services Market Size 2032 |

USD 377.21 billion |

The professional beauty services market is dominated by established global players such as L’Oréal S.A., Coty Inc., Wella, Estée Lauder, Procter & Gamble, Shiseido, Henkel, Kao, Revlon, and Toni & Guy, which together drive innovation in hair, skin, and spa services. These companies are expanding through premium salons, franchise networks, and advanced service offerings. Regionally, North America leads the global professional beauty services market, commanding approximately 38.2 % of the total market, fueled by high disposable incomes, sophisticated salon infrastructure, and robust consumer demand.

Market Insights

- The Professional Beauty Services Market reached USD 265.25 billion in 2024 and is projected to hit USD 377.21 billion by 2032 at a 5% CAGR, supported by rising consumer spending on premium beauty treatments.

- Growing demand for personalized hair, skin, and spa solutions drives market expansion, with consumers increasingly opting for specialized services and technologically enhanced treatments.

- Key trends include rapid adoption of digital booking systems, rising male grooming participation, and strong growth in franchised salon networks across urban centers.

- Competition intensifies as leading players such as L’Oréal, Coty, Wella, Estée Lauder, P&G, Shiseido, Henkel, Kao, Revlon, and Toni & Guy expand service portfolios, while high service costs and skilled labor shortages restrain overall market scalability.

- North America holds 38.2% of the global market, while premium salon services lead the segment share globally, driven by well-developed infrastructure and strong brand penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The professional beauty services market remains dominated by personal care products, which account for an estimated 58–62% market share, driven by consistent demand for skincare, haircare, and hygiene-focused formulations used across salons and clinics. Their dominance stems from high-frequency consumption, recurring service-based application, and rapid innovation in targeted solutions such as barrier-repair skincare, salon-grade hair treatments, and anti-pollution formats. Cosmetics and makeup products show steady growth but remain secondary due to lower usage frequency and rising consumer prioritization of skin health over heavy cosmetic application in professional settings.

- For instance, Unilever has integrated AI-driven manufacturing into its personal care factories — at its Hefei, China plant, AI has delivered an 8% increase in overall equipment effectiveness and a 20% reduction in waste.

By Category

Premium products lead the market with an estimated 55–60% share, supported by strong consumer willingness to invest in high-performance, salon-grade formulations that deliver visible results. Growth in dermatological services, ingredient-focused beauty, and luxury salon chains further accelerates preference for premium lines. These products leverage advanced actives, high efficacy claims, and personalized service integration, enabling professionals to charge higher service premiums. Mass products continue to serve price-sensitive segments but face competitive pressure as consumers increasingly associate premium formulations with safety, effectiveness, and long-term skin or hair improvement.

- For instance, Avon launched its Beyond Glow collection with 15+ SKUs featuring glow-boosting actives like snail mucin, niacinamide, vitamin C, ceramides, and peptides, bringing lab-grade Korean skin science to its direct sales network.

By Ingredient Type

Natural and organic ingredient-based products hold the dominant position with an estimated 52–55% share, driven by expanding demand for clean beauty, chemical-free treatments, and eco-conscious salon offerings. Professional consumers increasingly prefer botanical extracts, plant-based actives, and allergen-free formulations to minimize irritation and align with sustainability expectations. Their adoption is further boosted by regulatory tightening on synthetic ingredients and rising awareness of ingredient transparency. Conventional and synthetic formulations remain relevant due to affordability and performance stability but are gradually losing share as salons rebrand around wellness-aligned natural solutions.

Key Growth Drivers

Rising Consumer Demand for Personalized and Premium Treatments

Growing consumer preference for tailored beauty experiences significantly accelerates market expansion. Clients increasingly seek advanced skin, hair, and wellness treatments designed around their lifestyle, skin type, and aesthetic goals. Premium offerings—such as dermal therapies, laser treatments, and customized hair services—strengthen service differentiation and boost repeat business. This demand is especially strong among urban, high-income consumers who value quality, safety, and expertise. As personalization becomes a core decision factor, service providers invest in skilled professionals and advanced tools to enhance outcomes and customer retention.

- For instance, Shiseido’s VOYAGER digital platform uses AI trained on over 500,000 data points — combining raw-material chemistry, ingredient interactions, and cutaneous science — to rapidly generate new personalized formulations.

Proliferation of Technology-Enabled Service Models

Digital integration is reshaping how beauty services are delivered and experienced. Online appointment systems, virtual consultations, AI-driven skin analysis tools, and CRM-based loyalty programs streamline operations and improve service accuracy. Technology also enables better capacity management, faster onboarding of clients, and stronger data-driven decision-making. Salons and clinics adopting automation, digital payment systems, and app-based engagement platforms achieve higher customer satisfaction and operational efficiency. Additionally, social media marketing and influencer partnerships magnify brand visibility, supporting faster expansion for both organized chains and independent professionals.

- For instance, Beauty Genius virtual beauty assistant uses generative AI and has been trained on more than 750 L’Oréal Paris products, combining data from over 16,000 skin images and 150,000 dermatologist-annotated images to provide personalized routines.

Growing Popularity of Wellness and Holistic Beauty Solutions

Consumers increasingly blend beauty with wellness, fueling demand for integrative services such as therapeutic massages, organic skincare treatments, aromatherapy, and non-invasive rejuvenation procedures. This shift aligns with a broader lifestyle trend toward preventive care, stress reduction, and long-term skin health. Service providers offering holistic packages gain a competitive edge by addressing both physical appearance and emotional well-being. The surge in clean-beauty awareness further encourages salons and clinics to use natural ingredients and eco-friendly products, helping strengthen brand trust and attract sustainability-conscious clients.

Key Trends & Opportunities

Expansion of Male Grooming and Unisex Service Segments

The male grooming segment has evolved rapidly from basic haircuts to advanced skincare, beard styling, and wellness services. Growing awareness of personal appearance and professional presentation among men presents new revenue opportunities for salons and grooming studios. Unisex service formats allow operators to diversify their client base and optimize capacity. Many brands are launching male-specific product lines and premium grooming lounges, indicating substantial opportunity for operators who tailor their offerings to this expanding demographic with specialized expertise and curated service experiences.

- For instance, RNA-monitoring technology that extracts sebum on a single oil-blotting film and reads RNA information for over 10,000 genes, enabling non-invasive insights into skin and scalp health.

Rapid Growth of Organized Salon Chains and Franchise Models

The market is witnessing strong consolidation as organized chains expand through franchising to meet rising demand for standardized, hygienic, and professionally managed beauty services. Consumers increasingly prefer brands that offer consistent service quality, certified technicians, transparent pricing, and high safety protocols. Franchise models help leading players tap into Tier II and Tier III cities with minimal capital investment, enabling faster geographical penetration. This trend creates opportunities for investors and entrepreneurs seeking predictable returns, streamlined training systems, and brand-led operational support.

- For instance, Oriflame has introduced a digital AI Skin Advisor, developed in partnership with Revieve, which analyzes over 120 skin metrics via selfie and questionnaire inputs and has logged more than 100,000 completed consultations with an 80% completion rate.

Increasing Adoption of Eco-Friendly and Sustainable Practices

Sustainability is becoming a defining trend as clients prioritize environmentally responsible beauty choices. Salons integrating biodegradable products, water-efficient equipment, vegan formulations, and reduced-waste protocols attract eco-conscious consumers and strengthen brand reputation. Additionally, green certifications and sustainable product partnerships enable service providers to differentiate themselves in a competitive landscape. This shift opens opportunities to introduce organic treatment lines, refillable product stations, and energy-efficient technologies, creating value while meeting regulatory expectations and environmental standards.

Key Challenges

Shortage of Skilled Professionals and High Training Costs

The market faces persistent talent gaps due to the limited availability of certified beauty therapists, stylists, and dermatology-trained technicians. Continuous upskilling is essential to keep pace with evolving trends, advanced equipment, and safety requirements, but training costs remain high for both individuals and service providers. This challenge affects service consistency, brand standardization, and expansion plans—especially for smaller operators. As customer expectations rise for premium experiences and specialized procedures, the industry must invest heavily in structured training and professional development frameworks.

High Competition and Price Sensitivity in Local Markets

Despite growing demand, the market remains highly fragmented with intense competition from independent salons, home-service professionals, and emerging online platforms. Many consumers remain price-sensitive, especially in developing regions, limiting operators’ ability to increase service rates or introduce premium packages. Discount-driven marketing and low switching costs further pressure margins. Organized players struggle to balance competitive pricing with rising overheads for skilled labor, rent, and technology adoption. This dynamic makes it essential for service providers to differentiate through quality, hygiene, and customer engagement strategies.

Regional Analysis

North America

North America holds approximately 32% of the Professional Beauty Services Market, driven by strong consumer spending on premium skincare, aesthetic treatments, and advanced salon services. High adoption of technology-enabled platforms and demand for medical-grade beauty solutions reinforce market growth. The region benefits from well-established salon chains, dermatology clinics, and wellness centers offering specialized treatments. Urban centers such as New York, Los Angeles, and Toronto contribute significantly due to high service penetration and disposable incomes. Strict hygiene standards, skilled professionals, and rising interest in holistic wellness further support sustained market expansion.

Europe

Europe accounts for nearly 27% of the global market, supported by a mature beauty ecosystem, strong regulatory standards, and high consumer awareness of professional skincare and haircare services. Demand remains strong for anti-aging treatments, organic beauty solutions, and wellness-integrated service packages. Countries such as Germany, France, Italy, and the UK lead market adoption with established salon chains and dermatology-driven beauty clinics. The region’s preference for sustainability, clean beauty practices, and premium formulations encourages providers to innovate. Growth is further driven by rising tourism-based beauty services and expanding male grooming trends.

Asia-Pacific

Asia-Pacific dominates the market with approximately 34% share, fueled by rapid urbanization, rising disposable income, and strong cultural affinity for beauty and grooming. The region experiences robust growth in professional skincare, haircare, and technologically advanced aesthetic services, particularly in China, India, South Korea, and Japan. Expanding middle-class populations and increasing adoption of global beauty standards accelerate demand. Organized salon chains and franchise models are scaling rapidly across tiered cities. Additionally, the influence of K-beauty, social media-driven trends, and younger demographic participation significantly strengthens long-term market potential.

Latin America

Latin America represents around 4% of the market, with growth centered on Brazil, Mexico, and Argentina. Rising interest in hair treatments, skincare services, and wellness-focused beauty offerings supports gradual expansion. Urban consumers increasingly prioritize professional grooming, while local beauty cultures drive demand for specialized haircare and body treatments. Economic fluctuations and price sensitivity limit market acceleration, yet increasing adoption of franchise salon models and digital booking platforms enhances accessibility. Growing tourism and demand for premium services in major cities further contribute to steady development in the region’s professional beauty services landscape.

Middle East & Africa

The Middle East & Africa region holds approximately 3% share, driven by rising demand for luxury beauty services, aesthetic treatments, and high-end salon experiences across the UAE, Saudi Arabia, and South Africa. Growth is supported by expanding expat populations, strong retail beauty culture, and increasing acceptance of non-invasive cosmetic procedures. Premium malls and beauty hubs fuel service adoption. However, market fragmentation and limited availability of advanced training restrict wider penetration. Despite these challenges, increasing wellness tourism, salon franchising, and investment in modern beauty clinics position the region for progressive long-term growth.

Market Segmentations:

By Product Type:

- Personal Care Products

- Cosmetics/Makeup Products

By Category:

- Premium Products

- Mass Products

By Ingredient Type:

- Natural/Organic

- Conventional/Synthetic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Professional Beauty Services Market players such as Coty Inc., Unilever, AVON PRODUCTS, INC, Shiseido, L’Oréal S.A., Kao Corporation, Estée Lauder, ORIFLAME COSMETICS S.A., Revlon, and Procter & Gamble. The Professional Beauty Services Market features a dynamic and highly fragmented competitive environment with strong participation from global brands, regional chains, and independent service providers. Competition intensifies as companies prioritize service innovation, premium treatment development, and digital integration to enhance the customer experience. Advanced skincare technologies, personalized treatment programs, and wellness-oriented offerings help businesses differentiate in a crowded market. Many providers invest in technician training, hygiene standards, and loyalty programs to strengthen client retention. Franchise models continue to expand, enabling faster penetration into emerging cities while maintaining standardized service quality. Additionally, digital booking platforms, social media marketing, and influencer collaborations reshape competitive strategies by increasing brand visibility and client engagement. Sustainability practices, such as eco-friendly products and energy-efficient equipment, further influence competitive positioning as consumers increasingly seek ethical and safe beauty solutions. Overall, the market remains competitive, with innovation, experience quality, and brand trust defining long-term success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coty Inc.

- Unilever

- AVON PRODUCTS, INC

- Shiseido

- L’Oréal S.A.

- Kao Corporation

- Estée Lauder

- ORIFLAME COSMETICS S.A.

- Revlon

- Procter & Gamble

Recent Developments

- In January 2025, Albéa Matamoros and Drunk Elephant formed a partnership to introduce three sustainable skincare products in the United States market: D-Bronzi, O-Bloos, and B-Goldi.

- In January 2025, L’Oréal partnered with IBM to develop sustainable cosmetic formulations using generative artificial intelligence (AI). The company utilized IBM’s GenAI technology to analyze cosmetic formulation data, enabling the incorporation of sustainable raw materials while reducing energy consumption and material waste.

- In April 2024, Italian salon chain Luca Piattelli is now in India with its first flagship store at South Delhi’s Safdarjung Enclave. Located in the Sardarjung neighborhood of New Delhi, the salon provides an extensive range of services for both men and women.

- In June 2023, Estee Lauder launched the Responsible Store Design Program, which will augment the environmental targets and engage with consumers in retail sustainability. It was created in collaboration with a sustainability consulting firm that specializes in green building design and is subject to third-party review to ensure credibility & precision

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Ingredient Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as consumers increasingly prioritize personalized, premium, and wellness-oriented beauty services.

- Digital platforms and AI-based skin and hair diagnostics will play a larger role in service delivery and client engagement.

- Demand for non-invasive aesthetic treatments will rise as clients seek effective solutions with minimal downtime.

- Organized salon chains and franchise models will gain stronger market share through standardized quality and scalable operations.

- Sustainability and clean-beauty practices will become essential differentiators for service providers.

- Male grooming services will grow steadily as awareness and willingness to invest in appearance increase.

- Hybrid beauty models combining in-salon experiences with at-home service extensions will gain popularity.

- Training and certification programs for beauty professionals will expand to meet rising expectations for expertise and safety.

- Technology-enabled appointment systems, loyalty platforms, and CRM tools will strengthen customer retention.

- Market competition will intensify as regional players introduce niche, affordable, and culturally tailored service offerings.