Market Overview

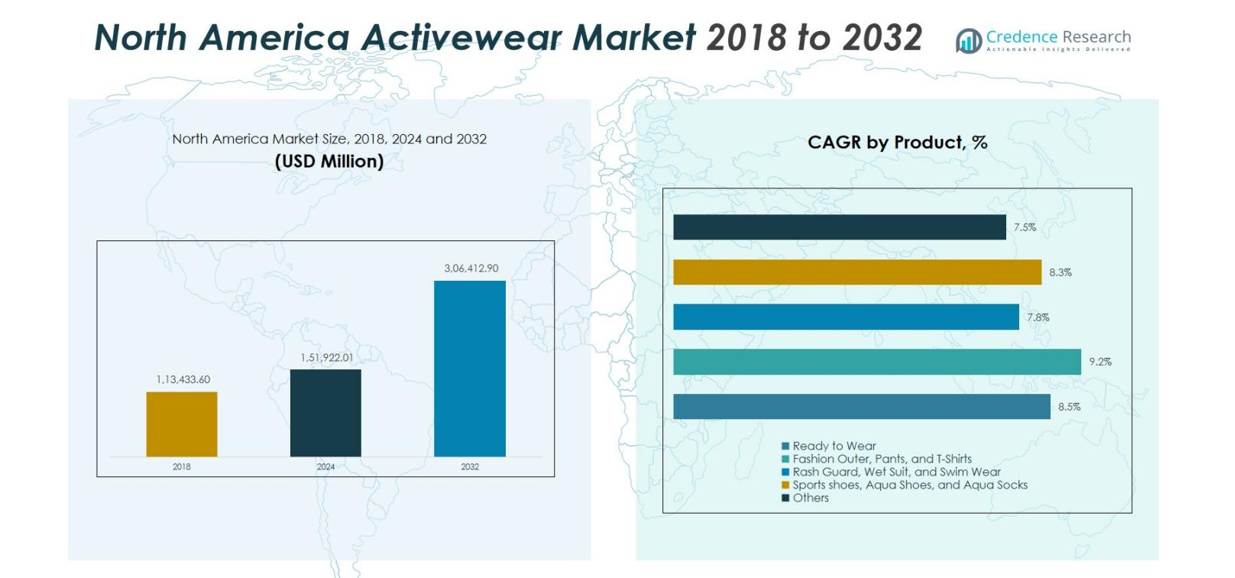

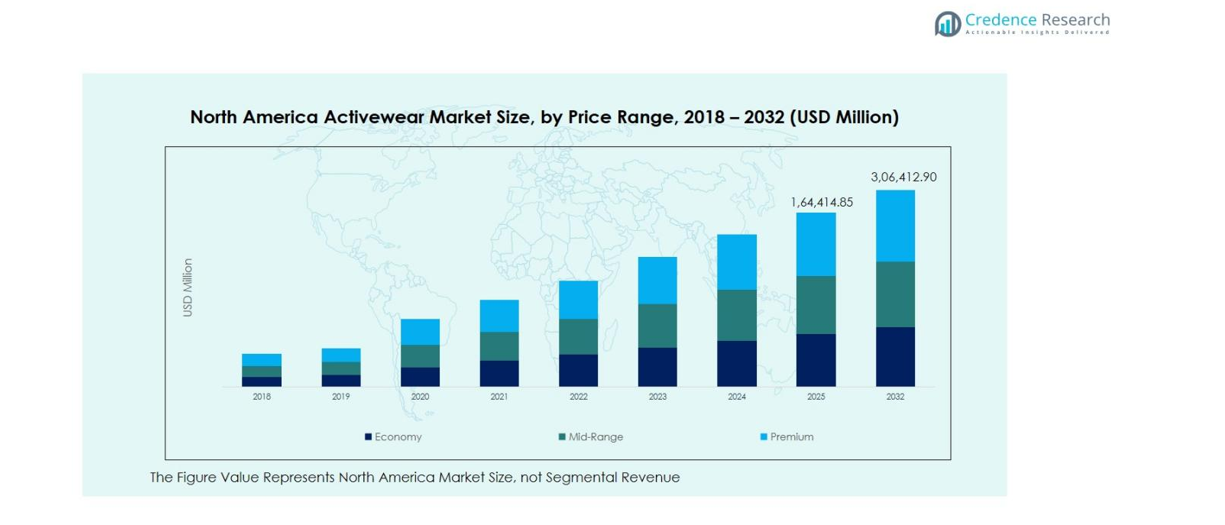

The North America Activewear Market size was valued at USD 113,433.60 Million in 2018, increased to USD 151,922.01 Million in 2024, and is anticipated to reach USD 306,412.90 Million by 2032, at a CAGR of 9.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Activewear Market Size 2024 |

USD 151,922.01 Million |

| North America Activewear Market, CAGR |

9.14% |

| North America Activewear Market Size 2032 |

USD 306,412.90 million |

The North America Activewear Market is driven by strong participation from leading players such as Nike Inc., Adidas AG, Under Armour Inc., Lululemon Athletica Inc., Puma SE, Columbia Sportswear Company, VF Corporation, Skechers USA Inc., Hanesbrands Inc., and New Balance Athletics Inc. These companies strengthen market growth through continuous innovation, advanced performance fabrics, sustainability initiatives, and direct-to-consumer expansion. Within the regional landscape, the United States leads with a 68.4% market share, supported by high consumer spending, strong brand presence, and a mature fitness culture. Canada and Mexico follow, contributing to the region’s growing demand for versatile, performance-oriented activewear.

Market Insights

- The North America Activewear Market is valued at USD 151,922.01 Million in 2024 and is projected to reach USD 306,412.90 Million by 2032, advancing at a CAGR of 9.14%.

- The market is driven by rising athleisure adoption, growth in fitness participation, and increased demand for performance fabrics that offer moisture control, durability, and stretch.

- Key trends include the expansion of sustainable activewear, digital retail acceleration, and growing preference for premium, multifunctional apparel across demographic groups.

- Leading companies such as Nike, Adidas, Under Armour, Lululemon, Puma, Columbia Sportswear, and VF Corporation strengthen market dynamics through innovation, branding, and direct-to-consumer strategies, while price-sensitive consumers create pressure on mid-range providers.

- Regionally, the United States dominates with a 68.4% share, followed by Canada at 21.7% and Mexico at 9.9%, while segment-wise, Sports Shoes, Aqua Shoes, and Aqua Socks lead with a 38.6% share and Polyester dominates fabrics with a 41.3% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The North America Activewear Market exhibits strong diversification across multiple product categories, with Sports Shoes, Aqua Shoes, and Aqua Socks emerging as the dominant sub-segment, capturing 38.6% of the market share in 2024. This leadership reflects rising participation in fitness activities, expanding athleisure adoption, and continuous innovation in performance footwear. Brands are integrating responsive cushioning, lightweight materials, and biomechanically optimized designs to enhance comfort and injury prevention. Additionally, increased engagement in water sports and aquatic fitness is strengthening demand for specialized aqua footwear, positioning this sub-segment as the most influential contributor to product-level revenue growth.

- For instance, Hoka introduced a variety of road, trail, and hiking shoes like the CLIFTON 9 and ROCKET X2, expanding their reach to diverse outdoor activity enthusiasts.

By Fabric

Fabric selection serves as a key differentiator driving product performance, with Polyester accounting for the dominant 41.3% market share in 2024 within North America’s activewear landscape. Polyester’s leadership is driven by its durability, moisture-wicking efficiency, quick-drying attributes, and cost-effectiveness, making it the preferred choice for high-performance sportswear. Its compatibility with recycled fiber technologies has further supported adoption amid growing sustainability commitments across brands. Enhanced breathability, improved thermal regulation, and better stretch-recovery capabilities offered through polyester-based blends continue to strengthen its appeal across both mass and premium categories, reinforcing its position as the most widely used activewear fabric.

- For instance, Adidas has extensively adopted recycled polyester in their Gym Training clothing line, emphasizing moisture management and sustainability without compromising performance.

By Material

The North America Activewear Market displays a clear preference for engineered performance materials, with the Synthetic segment holding the dominant 67.8% market share in 2024. This segment’s advantage stems from superior flexibility, abrasion resistance, moisture management, and long-term durability qualities essential for high-intensity training, outdoor activities, and competitive sports. Synthetic materials also support advanced textile technologies such as compression engineering, antimicrobial treatments, and temperature-regulating finishes. Their ability to integrate elastomers and polyester-nylon blends further enhances garment functionality, enabling brands to deliver lightweight, stretch-optimized, and performance-oriented products that align with evolving consumer expectations.

Key Growth Drivers

Rising Adoption of Athleisure Across Demographics

The North America Activewear Market benefits significantly from the widespread shift toward athleisure, driven by consumers seeking versatile apparel suitable for both daily wear and fitness activities. Growing remote work adoption has increased the preference for comfortable yet stylish clothing, accelerating athleisure penetration across all age groups. Brands are responding with hybrid apparel lines offering enhanced stretch, breathability, and aesthetic appeal. The blurring boundaries between casual and athletic wear continues to expand the customer base, strengthening demand for multi-functional garments and supporting consistent market expansion.

- For instance, Under Armour, Inc. continues to focus on performance-driven innovation with its UA RUSH fabric technology, which uses mineral-infused fabric to recycle the body’s energy and improve endurance.

Growth in Fitness Participation and Outdoor Activities

Increasing engagement in structured fitness programs, home workouts, and outdoor recreational activities remains a major catalyst for activewear demand in North America. Rising health awareness, gym memberships, and participation in activities such as hiking, running, cycling, and aquatic sports have led consumers to invest in performance-oriented apparel and footwear. Advancements in product technologies ranging from moisture control and thermal regulation to impact cushioning are reinforcing replacement demand among frequent users. As fitness lifestyles become more mainstream, brands benefit from sustained volume growth across both core and specialized product categories.

- For instance, Adidas incorporates moisture-wicking and temperature-regulating technologies such as AEROREADY and Heat.RDY in their apparel, enabling athletes to remain dry and comfortable during intense physical activities.

Innovation in Performance Fabrics and Material Technologies

The market experiences strong momentum from advancements in textile engineering, particularly in moisture-wicking, stretch-enhancement, anti-odor, and thermo-regulating fabric technologies. Brands are integrating lightweight synthetics, recycled polyester, and elastane blends to elevate comfort, durability, and flexibility. The emergence of seamless construction, compression technology, and eco-engineered fabrics also enhances product differentiation. Continuous investment in R&D enables manufacturers to meet evolving consumer expectations for high-performance apparel, helping capture premium demand and strengthening market competitiveness.

Key Trends & Opportunities

Expansion of Sustainable and Eco-Friendly Activewear

Sustainability is emerging as a transformative trend, creating substantial opportunities for companies adopting recycled materials, biodegradable fibers, and low-impact production methods. Consumers increasingly seek environmentally responsible options, encouraging brands to scale the use of recycled polyester, organic cotton, and bio-based synthetics. Circular design initiatives including take-back programs and garment upcycling are gaining momentum. This shift allows both established and emerging players to differentiate themselves while aligning with regulatory pressures and corporate sustainability commitments across the region.

- For instance, HH Chemical launched BIODEX®, the first fully integrated biobased materials brand, which offers bio-based fibers that reduce carbon emissions by up to 73% compared to conventional synthetics.

Digitalization of Retail and Growth of Direct-to-Consumer Channels

The rapid digitalization of retail presents significant opportunities for activewear brands to expand customer engagement through e-commerce, mobile platforms, and direct-to-consumer (D2C) models. Personalization tools, virtual try-ons, and AI-driven product recommendations enhance shopping experiences, boosting online sales conversion. Brands are leveraging data analytics to optimize inventory, pricing, and product development, resulting in more targeted offerings. The rise of digital fitness ecosystems and influencer-led brand collaborations further amplifies online visibility, supporting sustained growth across digital retail channels.

- For instance, Adidas has integrated augmented reality into its iOS app, allowing customers to virtually try on shoes from its Alphaedge 4D running line, improving the online shopping experience and reducing product returns.

Key Challenges

Intense Competitive Pressure and Price Sensitivity

The North America Activewear Market faces stiff competition from global brands, regional labels, and fast-fashion companies offering performance-inspired apparel at competitive prices. This dynamic forces established players to balance innovation with affordability, often compressing margins. Price-sensitive consumers, particularly in mass-market segments, gravitate toward lower-cost alternatives, challenging premium and mid-tier brands. To sustain differentiation, companies must continuously invest in technology, design, and brand positioning, which raises operational complexity in an already crowded marketplace.

Volatility in Raw Material Costs and Supply Chain Disruptions

Fluctuating costs of synthetic fibers, cotton, and advanced performance materials pose a significant challenge for manufacturers. Supply chain disruptions—including delays in fabric sourcing, freight bottlenecks, and dependency on overseas production—intensify cost pressures and impact inventory availability. These issues can lead to extended lead times, reduced production flexibility, and increased operational risk for brands. Navigating these constraints requires companies to diversify suppliers, strengthen regional manufacturing capabilities, and adopt agile procurement strategies to maintain consistent product availability.

Regional Analysis

United States

The United States dominates the North America Activewear Market with a 68.4% share in 2024, driven by high consumer spending on fitness apparel, strong presence of global brands, and widespread participation in sports and recreational activities. The market benefits from rapid adoption of athleisure, rising gym memberships, and increasing emphasis on wellness lifestyles. Innovation in performance fabrics and expansion of direct-to-consumer channels continue to strengthen demand. Premium segments show strong traction due to higher brand loyalty and preference for technologically advanced products, positioning the U.S. as the leading contributor to regional revenue growth.

Canada

Canada accounts for 21.7% of the North America Activewear Market in 2024, supported by a rising focus on outdoor sports, winter-specific performancewear, and growing health-conscious consumer behavior. Demand is reinforced by expanding participation in activities such as running, hiking, athletics, and winter sports, which drive interest in durable and thermal-regulating apparel. Sustainable and eco-friendly activewear is gaining substantial traction due to strong environmental preferences among Canadian consumers. The presence of premium brands and increased online retail penetration further support market expansion, enabling Canada to maintain a steady growth trajectory within the regional landscape.

Mexico

Mexico holds 9.9% of the North America Activewear Market in 2024, with growth fueled by rising urbanization, increasing fitness awareness, and expanding access to organized retail channels. Younger consumers are driving demand for fashionable yet affordable activewear, particularly within mid-range and value categories. Local and international brands are strengthening their presence through targeted pricing strategies and digital retail initiatives. Improvements in sports infrastructure and rising interest in running, soccer, and gym training continue to stimulate product consumption. Despite a smaller base, Mexico presents strong long-term potential as fitness participation and disposable income continue to rise.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America Activewear Market is shaped by the strong presence of leading brands such as Nike Inc., Adidas AG, Under Armour Inc., Lululemon Athletica Inc., Puma SE, Columbia Sportswear Company, VF Corporation, Skechers USA Inc., Hanesbrands Inc., and New Balance Athletics Inc. These companies compete through continuous innovation, premium product positioning, and expanding direct-to-consumer strategies. The market reflects high brand loyalty, with established players investing heavily in fabric technology, sustainable materials, and digital retail integration to enhance differentiation. Mergers, partnerships, and athlete endorsements further strengthen competitive advantages, while mid-sized and emerging brands compete on affordability and fashion-oriented designs. As demand for versatile and performance-driven apparel grows, competition intensifies across both mass and premium segments, encouraging brands to prioritize product innovation, responsive supply chains, and targeted marketing to maintain regional leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Columbia Sportswear Company

- VF Corporation (The North Face, Vans)

- Skechers USA, Inc.

- Hanesbrands Inc.

- Lululemon Athletica Inc.

- New Balance Athletics, Inc.

Recent Developments

- In June 2025, S&S Activewear signed an exclusive partnership with HanesBrands Inc. to become the sole distributor of the Hanes brand in the North American printwear channel.

- In August 2025, Gildan Activewear Inc. named S&S Activewear as the exclusive wholesale distributor for its American Apparel brand in the U.S. imprintables market.

- In June 2025, Authentic Brands Group announced a new distribution deal for its Reebok brand across North America and Europe.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Fabric, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained demand as athleisure continues to blur the lines between sportswear and everyday fashion.

- Brands will increasingly adopt recycled fibers and eco-friendly materials to meet rising sustainability expectations.

- Direct-to-consumer channels will expand further as companies strengthen digital platforms and personalized shopping experiences.

- The adoption of smart textiles and wearable-integrated apparel will accelerate across performance-focused categories.

- Growth in fitness participation and outdoor recreation will continue to drive replacement purchases and product diversification.

- Premium activewear will gain stronger traction as consumers prioritize comfort, design, and advanced functionality.

- Supply chain localization and nearshoring will rise as brands aim to reduce lead times and improve responsiveness.

- Collaborations with influencers, athletes, and lifestyle creators will play a larger role in brand visibility and consumer engagement.

- Innovations in moisture management, compression technology, and thermal regulation will shape future product development.

- Retailers will increasingly leverage data analytics to optimize inventory, pricing, and product customization strategies.