Market Overview

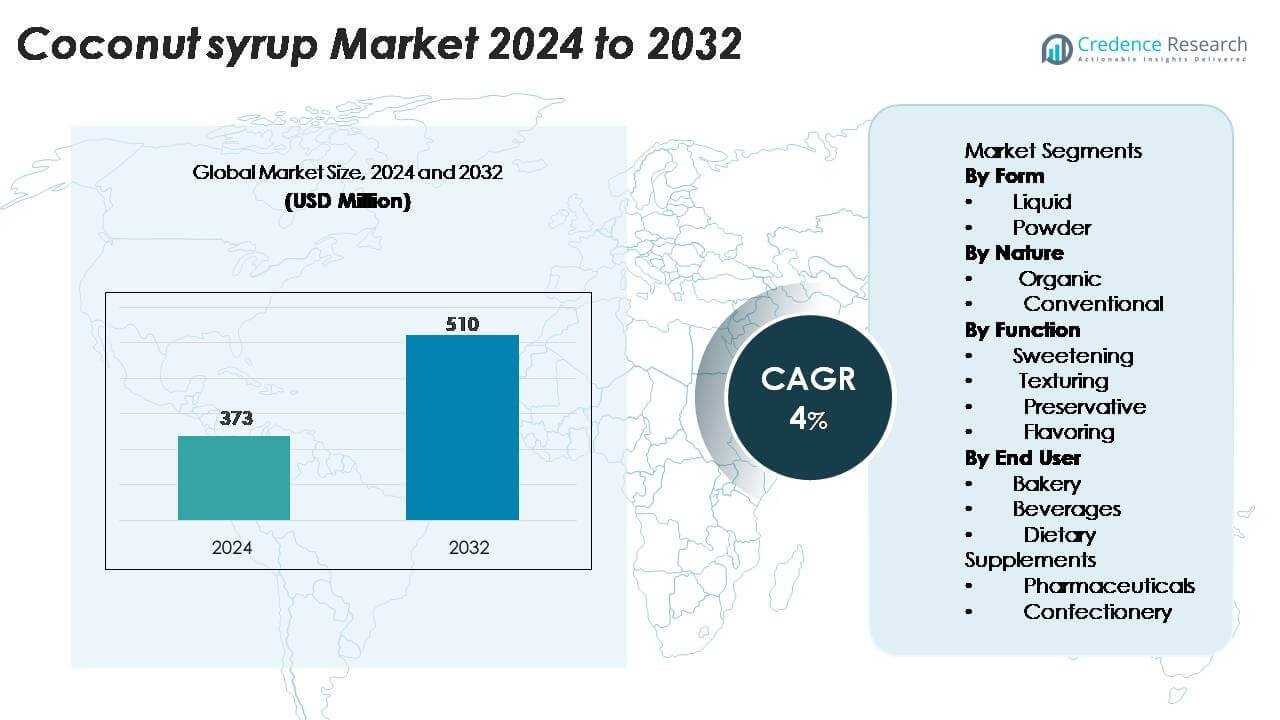

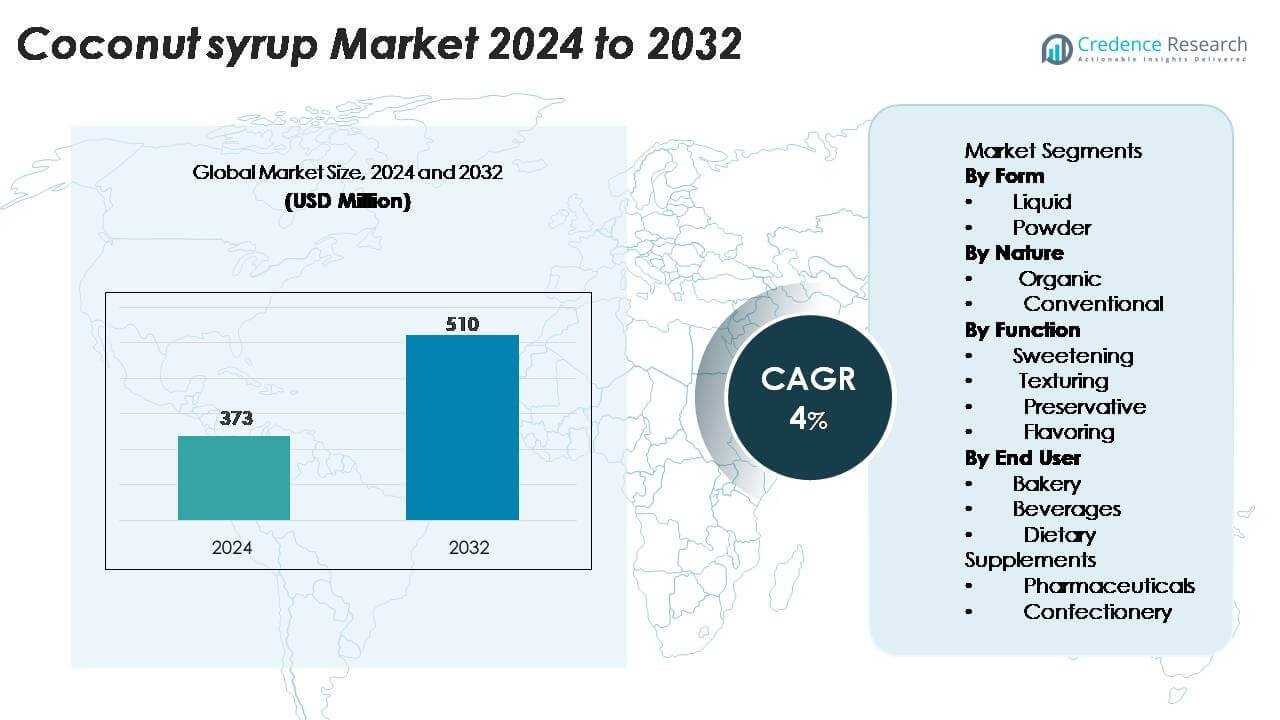

The coconut syrup market size was valued at USD 373 million in 2024 and is anticipated to reach USD 510 million by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coconut Syrup Market Size 2024 |

USD 373 million |

| Coconut Syrup Market, CAGR |

4% |

| Coconut Syrup Market Size 2032 |

USD 510 million |

The coconut syrup market is influenced by key players such as Cocomi Bio Organic, Renuka Foods, The Coconut Company, Fiesta Ingredients Australia Pty Ltd, and Thai Coconut Public Company Limited. These companies focus on organic sourcing, clean-label formulations, and flavored variants to meet rising demand from bakery, beverage, and confectionery manufacturers. North America leads the market with a 32% share due to strong adoption of natural sweeteners across retail and foodservice channels, followed by Europe with 28%, supported by strict clean-label preferences and fair-trade sourcing. Asia-Pacific accounts for 26%, driven by raw material availability and export-focused processing, while Latin America and the Middle East & Africa together contribute the remaining share through growing specialty food consumption.

Market Insights

- The coconut syrup market was valued at USD 373 million in 2024 and is projected to reach USD 510 million by 2032, growing at a CAGR of 4% during the forecast period.

- Adoption rises as food and beverage brands replace refined sugar with natural, plant-based sweeteners. Health-focused consumers drive demand in bakery, confectionery, beverages, and vegan product lines, with liquid form holding the largest share due to easy blending in commercial recipes.

- Market trends show strong movement toward organic sourcing, flavored variants, and clean-label packaged foods. Online retail channels expand visibility for premium and artisanal coconut sweeteners.

- Major players such as Cocomi Bio Organic, Renuka Foods, and Thai Coconut Public Company Limited compete on sustainability, organic certifications, product innovation, and low-cost export supply from Asia-Pacific.

- North America leads with 32% share, followed by Europe at 28% and Asia-Pacific at 26%. Sweetening applications dominate usage, supported by rapid growth in premium bakery and specialty beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form:

Liquid coconut syrup holds the dominant share because bakeries, cafes, and beverage brands prefer ready-to-use sweeteners for easy blending. Liquid formats dissolve faster in smoothies, coffee products, flavored teas, and dessert toppings, helping food processors maintain consistent texture and taste. Manufacturers also offer flavored variants such as vanilla, caramel, and chocolate to attract premium product lines. Powder coconut syrup grows at a steady pace as dry blends gain traction in instant drink mixes, bakery premixes, and packaged foods where shelf stability and low transport cost are essential.

- For instance, Coconut Merchant supplies a 250-millilitre liquid syrup made from coconut sap concentrate, which allows baristas to blend it directly into cold beverages without crystallisation.

By Nature:

Conventional coconut syrup leads the market with the highest share due to wide availability, lower production cost, and established supply chains in major coconut-producing countries. Conventional variants are preferred by large-scale bakeries and beverage manufacturers that require bulk purchasing and consistent flavor profiles. Organic coconut syrup grows faster as clean-label, vegan, and chemical-free ingredients gain stronger consumer preference. Health-conscious buyers choose organic products for reduced additives and natural processing, leading retailers to expand organic product ranges across supermarkets and online platforms.

- For instance, Big Tree Farms supplies conventional coconut syrup in 20-kilogram food-service packs with a measured 72 °Brix soluble-solid concentration, allowing bakery processors to maintain uniform sweetness in batch production.

By Function:

Sweetening is the dominant function, capturing the largest market share as coconut syrup replaces refined sugar and artificial sweeteners in bakery items, beverages, and artisanal food products. Its low glycemic profile and natural caramel flavor make it attractive to premium and health-positioned brands. Texturing applications rise in confectionery and dessert coatings because coconut syrup adds viscosity and shine to sauces and toppings. Preservative and flavoring uses increase as manufacturers develop clean-label formulas, where natural syrup offers both shelf-life support and flavor enhancement in snacks, plant-based foods, and gourmet sauces.

Key Growth Drivers

Rising Demand for Natural and Plant-Based Sweeteners

Growing consumer interest in clean-label and plant-based ingredients drives strong adoption of coconut syrup across food and beverage categories. Many buyers view coconut syrup as a natural substitute for refined sugar, corn syrup, and artificial sweeteners. The syrup contains minerals and has a lower glycemic index than table sugar, which helps attract diabetic and fitness-focused consumers. Manufacturers of bakery products, snacks, health beverages, and ready meals add coconut syrup to position their items as healthier choices. Vegan brands also use it to replace honey in plant-based products. Retail chains highlight coconut sweeteners in “free-from” and natural food sections, which increases visibility among health-conscious shoppers. Growing awareness through online blogs, nutrition channels, and social media campaigns further boosts demand.

- For instance, Bali Nutra reports that its organic coconut syrup has a laboratory-tested glycemic index of 35 and is bottled in 300-millilitre units processed below 60 °C to preserve natural amino acids and micronutrients.

Expansion of Premium and Artisanal Food Products

Premium bakery, gourmet desserts, organic snacks, and specialty beverages use coconut syrup to create rich flavor and clean ingredient labels. Cafes and craft beverage brands prefer coconut syrup because the caramel-like taste enhances coffee, tea, and smoothie blends without chemical sweeteners. Artisanal chocolate makers use the syrup in fillings, coatings, and toppings to offer dairy-free and vegan options. Restaurants and foodservice outlets offer coconut-sweetened sauces, marinades, and condiments, which increases demand from commercial kitchens. Product launches in flavored coconut syrups, such as vanilla and cinnamon, help manufacturers target premium buyers. The strong push toward healthier indulgence supports long-term growth of the premium food industry and keeps coconut syrup demand rising.

- For instance, Cocofina produces a 350-millilitre bottle of organic coconut nectar, which is a stable, pourable syrup designed to resist crystallisation at ambient temperature.

Growing Use in Packaged Foods and Convenience Products

The convenience food industry expands globally due to busy lifestyles and changing eating habits, which benefit coconut syrup manufacturers. Processed cereal bars, instant beverage mixes, flavored yogurts, and ready-to-eat meals use coconut syrup as a natural sweetening and texturing agent. Dry blends and powdered formats offer longer shelf life and easier transport for food processors. Brands add coconut syrup to achieve better color, improved taste, and a natural label claim without artificial additives. E-commerce platforms push coconut-based sweeteners through targeted ads, subscription packs, and combo deals. As companies introduce clean-label packaged foods, demand for coconut syrup continues to rise across both retail and foodservice channels.

Key Trends & Opportunities

Shift Toward Organic and Sustainable Sourcing

A clear trend toward organic and chemical-free foods creates strong opportunities in organic coconut syrup. Consumers value sustainable farming, traceable sourcing, and eco-friendly processing. Many brands highlight certifications for fair trade and organic farming to attract environmentally aware buyers. Coconut-producing countries launch farmer-support programs to improve yields and processing quality. Exporters promote organic sweeteners in premium markets such as North America, Europe, and Japan. Online sales platforms help small producers reach international buyers without heavy distribution costs. As sustainability becomes a strong purchase factor, demand for ethically sourced coconut syrup is expected to rise steadily.

- For instance, Lionheart Farms states that its organic coconut-sap production follows a zero-burn cultivation system, an ISO-certified processing line capable of handling sap from 14,000 coconuts per shift, producing syrup with a measured 60 °Brix minimum without synthetic preservatives. These claims align with the company’s publicly stated commitment to sustainable, modern, and high-volume

Rising Adoption in Functional and Nutritional Products

Food and beverage companies develop products that support wellness, weight control, and clean nutrition. Coconut syrup is used in protein bars, plant-based yogurts, probiotic drinks, and fortified snacks because it blends well with natural ingredients. The syrup contains minerals and amino acids, helping brands promote better nutritional value. Clean-label sports drinks and electrolyte beverages also use coconut-based sweeteners. Marketing campaigns focus on reduced use of refined sugar, which strengthens coconut syrup’s appeal. The trend toward healthy indulgence, where consumers want taste along with nutrition, opens new product launch opportunities across snacks, smoothies, and specialty beverages.

- For instance, Big Tree Farms confirms that its coconut nectar retains all 17 naturally occurring amino acids found in fresh sap and is processed at temperatures kept below 60 °C, allowing functional-food brands to maintain nutrient stability when formulating protein bars and sports beverages.

Key Challenges

High Production Cost and Limited Raw Material Supply

Coconut syrup production depends on sap collection and controlled heating, which requires skilled labor and consistent supply of coconut trees. Seasonal changes, low yield, and weather-related disruptions affect production volume, leading to price fluctuations. Small producers face high processing costs and limited access to advanced equipment. When global sugar or corn syrup prices drop, food processors shift to lower-cost sweeteners. Exporters must also handle storage, shipping, and certification expenses, which increase the final selling price. These factors make coconut syrup more expensive than common sweeteners, limiting adoption in cost-sensitive markets.

Competition from Other Natural and Low-Calorie Sweeteners

Coconut syrup competes with honey, maple syrup, agave syrup, stevia, monk fruit, and date syrup. Many of these alternatives offer strong brand recognition and established distribution networks. Stevia and monk fruit attract buyers looking for zero-calorie or low-calorie sweeteners. Maple and agave syrups dominate premium bakery and gourmet products in several developed markets. Coconut syrup producers must educate consumers, expand product availability, and maintain competitive pricing to grow. Limited awareness in some regions slows retail demand, especially where coconut-based products are not part of everyday cuisine.

Regional Analysis

North America

North America holds the largest market share (32%) due to high consumption of natural sweeteners and strong demand from bakery, confectionery, and beverage manufacturers. Consumers prefer plant-based and clean-label ingredients, which supports the use of coconut syrup in organic snacks, gluten-free bakery items, and premium beverages. Retail chains and e-commerce platforms offer wide product visibility, helping brands expand fast. The United States accounts for the dominant share within the region because of large health-focused consumer groups and rising interest in vegan alternatives to honey and refined sugar. Foodservice outlets also use coconut syrup in specialty coffees and desserts.

Europe

Europe captures a significant share (28%) of the coconut syrup market, driven by strong regulations supporting clean-label and chemical-free ingredients. Germany, France, and the United Kingdom are key markets due to high adoption of organic bakery products, artisanal chocolates, and specialty drinks. European consumers prefer natural sweeteners over artificial additives, boosting demand across retail shelves and café chains. Importers expand partnerships with coconut-producing countries to ensure steady supply and certified quality. Sustainability, fair-trade sourcing, and transparent labeling further improve acceptance in premium product segments. Growing vegan and gluten-free food categories contribute to continued market expansion in the region.

Asia-Pacific

Asia-Pacific holds the fastest-growing share (26%) as countries such as the Philippines, Indonesia, India, and Sri Lanka lead coconut production and processing. The region benefits from strong export channels, large raw material availability, and low-cost manufacturing. Rising urbanization and expansion of modern retail boost consumer interest in natural and organic sweeteners. Local food producers use coconut syrup in bakery items, snacks, beverages, and traditional desserts. Increasing global demand supports investments in advanced processing, packaging, and value-added flavored variants. Strong participation of small and medium producers keeps competition high, while export-oriented companies cater to Europe, North America, and Japan.

Latin America

Latin America maintains a moderate share (17%), supported by growing health awareness and expansion of organic food retail chains. Brazil, Mexico, and Chile show increasing adoption of plant-based diets and natural sweeteners. Foodservice outlets and artisanal bakeries use coconut syrup in desserts, confectionery, and premium beverages. Import dependence remains high, as coconut production is limited compared to Asia-Pacific. However, e-commerce channels improve access to international brands, helping manufacturers expand into urban consumer groups. Rising demand for clean-label packaged foods and vegan products is expected to support steady growth across the region during the forecast period.

Middle East & Africa

The Middle East & Africa region holds a small (7%) but growing share due to rising interest in natural sweetening solutions for bakery, confectionery, and beverage applications. The UAE and Saudi Arabia show strong consumption in premium retail formats, driven by expatriate populations and expanding specialty food stores. Coconut syrup imports from Asia-Pacific supply most commercial demand. Growth accelerates as café chains and foodservice outlets introduce healthier menus with natural sweeteners. Limited local production and higher prices restrict faster penetration, but increasing awareness and expansion of vegan and organic product ranges support positive long-term potential.

Market Segmentations:

By Form

By Nature

By Function

- Sweetening

- Texturing

- Preservative

- Flavoring

By End User

- Bakery

- Beverages

- Dietary Supplements

- Pharmaceuticals

- Confectionery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coconut syrup market features a mix of global food manufacturers, specialty ingredient suppliers, and private-label brands competing through product quality, organic sourcing, and flavor innovation. Leading companies focus on clean-label, vegan, and non-GMO formulations to cater to health-conscious consumers in bakery, confectionery, and beverage segments. Many brands introduce flavored variants such as vanilla, caramel, and cinnamon to target premium cafés and artisanal food producers. Suppliers strengthen distribution through e-commerce platforms, retail partnerships, and direct-to-consumer channels. Companies also invest in sustainable sourcing, fair-trade certifications, and improved processing techniques to meet rising demand in North America and Europe. Private-label brands from supermarkets challenge established manufacturers by offering lower-priced alternatives, while export-focused producers from Asia-Pacific maintain cost advantages through abundant raw material availability. Growing competition encourages continuous product development, packaging upgrades, and expansion into new markets.Top of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coconut Merchant

- Nutiva

- Coco Natura

- Bali Nutra

- Natures Way

- Tropical Traditions

- Cocofina

- Lucia Coconut Company

- Big Tree Farms

- Kauai Organic Farms

Recent Developments

- In March 2023, the government of St. Lucia ran training programmes for coconut farmers covering pre-/post-harvest handling, hand-pollination, pruning and storage to strengthen the coconut value chain.

- In 2023, Vita Coco spiked with Captain Morgan’ to offer adult consumers convenient options to enjoy delectable tropical cocktails

Report Coverage

The research report offers an in-depth analysis based on Form, Nature, Function, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue to rise as brands shift to natural sweeteners in bakery, beverages, and confectionery.

- Organic and clean-label coconut syrup will gain stronger presence in premium retail shelves.

- More cafés and foodservice chains will add coconut-sweetened drinks and desserts to attract health-focused customers.

- Flavored coconut syrup variants will expand, supporting premium and artisanal product lines.

- Powder forms will grow faster in dry mixes, instant beverages, and packaged foods due to longer shelf life.

- E-commerce sales will increase as small producers and private labels reach global buyers online.

- Asia-Pacific exporters will strengthen their role through cost-efficient production and improved processing technology.

- Manufacturers will invest in fair-trade certifications and sustainable sourcing to meet ethical purchasing trends.

- Product innovation will rise in vegan, dairy-free, and gluten-free product categories.

- Growing awareness of reduced-sugar diets will help coconut syrup replace refined sugar across multiple applications.