Market Overview

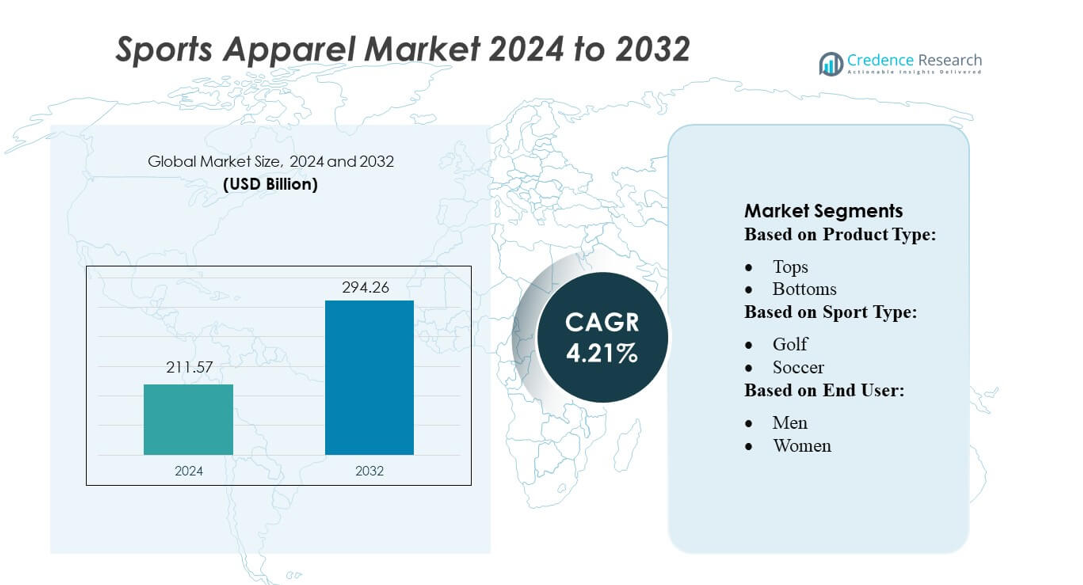

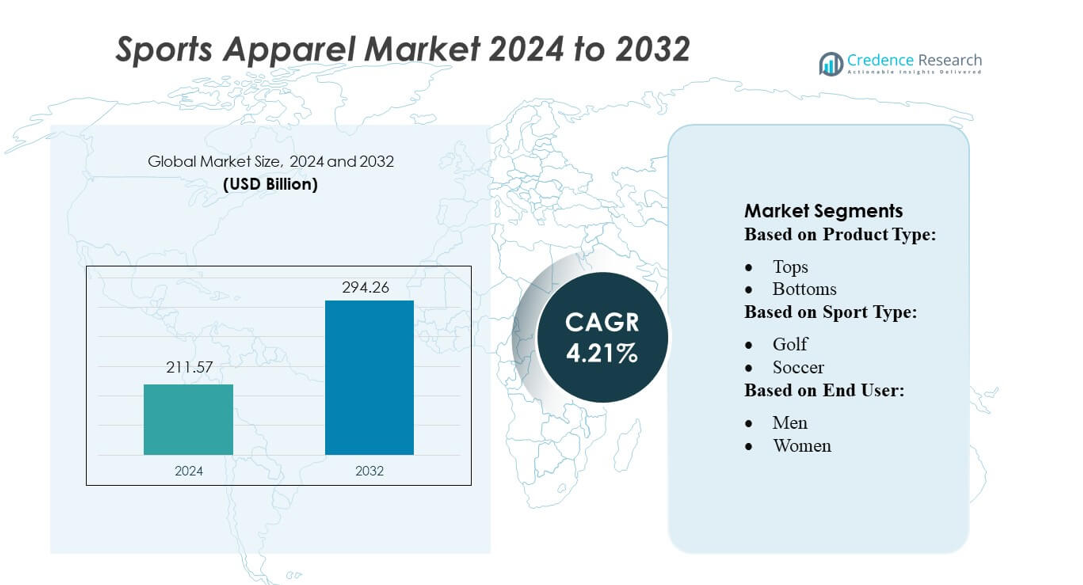

Sports Apparel Market size was valued USD 211.57 billion in 2024 and is anticipated to reach USD 294.26 billion by 2032, at a CAGR of 4.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sports Apparel Market Size 2024 |

USD 211.57 billion |

| Sports Apparel Market, CAGR |

4.21% |

| Sports Apparel Market Size 2032 |

USD 294.26 billion |

The sports apparel market include Nike, Adidas, Lululemon, Under Armour, Puma, Anta, Columbia Sportswear, Fila, Umbro, and LI-Ning, each competing intensely through innovation, branding, and global reach. These companies focus on performance fabrics, sustainable production, and omnichannel distribution to maintain market leadership and expand consumer appeal. North America remains the dominant region in this market, commanding approximately 40 percent of global sales, thanks to its mature fitness culture, high disposable incomes, and well-developed retail and e-commerce infrastructures.

Market Insights

- The Sports Apparel Market was valued at USD 211.57 billion in 2024 and is projected to reach USD 294.26 billion by 2032, growing at a CAGR of 4.21% during the forecast period.

- Market growth is driven by rising fitness participation, expanding athleisure adoption, and increasing demand for performance fabrics across both premium and mass-market segments.

- Key trends include the shift toward sustainable materials, rapid e-commerce expansion, and brand focus on digital customization and athlete-inspired product innovation.

- Competitive intensity remains high as leading global brands and regional players invest in technology, branding, and omnichannel distribution while facing restraints such as price sensitivity and supply chain disruptions.

- North America leads with around 40% of the global share, while Asia-Pacific grows fastest; the athleisure segment continues to dominate category demand, accounting for a significant share of overall sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Tops remain the dominant product category in the sports apparel market, accounting for over one-third of global revenue, driven by high replacement frequency and broad usage across performance and athleisure activities. Moisture-wicking fabrics, lightweight knits, and seamless construction technologies strengthen demand in this segment as consumers prioritize comfort and flexibility. Bottoms and outerwear continue to grow steadily, supported by innovations such as temperature-adaptive materials and ergonomic paneling. Rising participation in gym training, running, and team sports keeps tops the preferred entry-level purchase, reinforcing their lead across mature and emerging markets.

- For instance, Under Armour integrates CELLIANT infrared technology—formulated with 13 active minerals—into its recovery tops to enhance energy absorption and conversion, demonstrating how material-science-driven apparel innovations elevate performance functionality.

By Sport Type

Soccer leads the market, capturing around 30% of global sports apparel demand, supported by extensive fan engagement, strong merchandising activity, and broad global participation across age groups. Growth accelerates as clubs and brands expand performance lines featuring breathable mesh zones, laser-cut ventilation, and recycled polyester blends. Basketball and golf also show strong momentum, driven by premium product innovation and expanding youth participation. Seasonal league events, sponsorship programs, and athlete-influenced fashion trends enhance demand for sport-specific apparel, but soccer maintains dominance due to its universal appeal and continuous year-round consumption cycle.

- For instance, Lululemon leverages its Silverescent™ technology—powered by X-STATIC® fibers that contain a bonded layer of 99.9% pure silver—to inhibit odor-causing bacteria in high-sweat training tops.

By End User

The men’s segment holds the largest share, contributing over 45% of total market revenue, fueled by high spending on performance wear, training apparel, and team-sport merchandise. Demand increases with rising fitness participation and the adoption of athleisure in daily routines. The women’s segment shows the fastest growth, supported by inclusive sizing, body-adaptive designs, and expanding interest in wellness activities. Children’s sports apparel continues to benefit from school athletics and grassroots programs, but men remain the dominant end-user group due to broader product availability and consistent purchasing across sports categories.

Key Growth Drivers

Rising Health Consciousness and Fitness Participation

The global rise in health consciousness continues to expand demand for sports apparel as consumers adopt active lifestyles. Increased participation in running, cycling, gym workouts, and organized sports accelerates product purchases across both performance and athleisure categories. Governments and corporate wellness programs also drive sports engagement, supporting steady volume growth. Consumers increasingly seek comfortable, durable, and breathable apparel that enhances performance, which encourages brands to innovate in moisture-wicking fabrics, ergonomic designs, and lightweight materials, strengthening market expansion across regions and demographics.

- For instance, ANTA integrates its Smart Running Shoe system built with a 6-axis motion sensor operating at a 200-hertz sampling rate, enabling precise gait analysis and stride tracking, while its supercritical nitrogen-infused Nitroedge midsole platform delivers measured rebound improvements validated through in-house mechanical testing.

Expansion of Athleisure and Lifestyle Sportswear

Athleisure’s rapid mainstream adoption significantly boosts the sports apparel market as consumers integrate activewear into daily wear. The blurring boundary between fitness clothing and casual fashion drives continuous demand for versatile, stylish, and comfort-driven products. Influencers, social media platforms, and fashion collaborations further amplify product visibility. Urbanization and evolving work cultures reinforce the appeal of multifunctional attire suitable for work, travel, and recreation. This trend stimulates higher consumption frequencies and broadens customer bases beyond athletes, making athleisure a primary long-term growth catalyst.

- For instance, Umbro incorporates a thin synthetic upper—with key models like the original Velocita Pro weighing approximately 165 grams (for a UK size 8)—to deliver enhanced breathability and rapid directional movement in its high-performance football boots.

Technological Advancements in High-Performance Fabrics

Innovations in sportswear materials—such as compression fabrics, anti-odor coatings, thermoregulation technologies, and recycled polyester—strengthen the competitive landscape and enhance product value. Advanced R&D enables brands to engineer apparel that improves mobility, reduces sweat retention, and adapts to temperature changes. Integration of smart textiles, including sensors that monitor biometrics, is emerging as an additional performance differentiator. These advancements attract both professional and recreational athletes seeking science-backed benefits, while sustainability-focused innovations expand appeal among environmentally conscious consumers, accelerating premium segment growth.

Key Trends & Opportunities

Growth of Sustainable and Eco-Friendly Sportswear

Sustainability remains a core opportunity as consumers increasingly prioritize eco-friendly products. Brands are investing in recycled fibers, biodegradable materials, and closed-loop manufacturing processes to reduce environmental impact. Certifications and transparent sustainability claims support consumer trust and premium pricing. Circular business models such as apparel take-back programs and repair services are gaining momentum. This shift encourages market players to redesign supply chains and develop environmentally responsible product lines, positioning sustainability as both a competitive advantage and a long-term growth opportunity.

- For instance, Adidas reports producing approximately 17 million pairs of shoes made with Parley Ocean Plastic® in a single year, and its Futurecraft Loop initiative uses a 100% reusable TPU composite that can be continuously remade into new footwear, demonstrating measurable progress toward circular product engineering.

Digital Commerce Acceleration and Customization

The rapid expansion of e-commerce creates new opportunities for sportswear brands to reach broader audiences with personalized shopping experiences. AI-driven size recommendations, virtual try-ons, and customizable designs enhance customer engagement and conversion rates. Direct-to-consumer models enable brands to control pricing, product launches, and consumer data, improving profitability. Growing online fitness communities also drive higher engagement with performance wear. As digital touchpoints multiply, companies can scale faster and respond more effectively to evolving consumer preferences.

- For instance, Columbia Sportswear integrates product-level technologies such as Omni-Heat™ Infinity—which uses a pattern of gold metallic dots that deliver up to 40% increased thermal reflectivity compared with earlier Omni-Heat™ systems—into its digitally merchandised outerwear lines, enabling consumers to evaluate quantified performance benefits during online product selection.

Rising Demand for Women’s Sports Apparel

Women’s sportswear is emerging as one of the fastest-growing segments, driven by rising female participation in fitness activities and increasing social focus on women’s health. Brands are expanding inclusive sizing, performance-specific designs, and fashion-forward collections tailored to female athletes. Marketing campaigns that spotlight women’s empowerment further accelerate adoption. The segment’s premiumization trend, supported by improved functionality and style, presents strong revenue potential for brands targeting underserved categories and niche sports.

Key Challenges

Intense Competitive Pressure and Price Sensitivity

The sports apparel market faces significant competitive pressure as global brands, fast-fashion retailers, and emerging direct-to-consumer players intensify price rivalry. High marketing expenses, frequent product launches, and rapid trend cycles increase operating costs. Consumers’ growing price sensitivity, especially in emerging markets, limits premium segment penetration. This competitive environment forces companies to balance innovation with affordability while maintaining brand differentiation. Failure to manage cost structures effectively may reduce margins and hinder scalability in saturated markets.

Supply Chain Complexities and Raw Material Volatility

Sports apparel production depends on complex global supply chains vulnerable to disruptions in logistics, labor availability, and material procurement. Price fluctuations in synthetic fibers, cotton, and specialty fabrics directly impact manufacturing costs. Sustainability requirements also add pressure to source responsibly while maintaining cost efficiency. Delays in shipping and geopolitical uncertainties can strain inventory levels and product timelines. These challenges require brands to invest in supply chain resilience, diversified sourcing, and advanced forecasting tools to ensure consistent market supply.

Regional Analysis

North America

North America holds the largest share of the sports apparel market at around 40%. The region benefits from high fitness participation, strong athletic culture, and the presence of leading brands such as Nike, Under Armour, and Lululemon. Consumers show strong demand for both high-performance wear and athleisure, supporting steady growth. Advanced retail networks and rapid e-commerce adoption further strengthen the market. Innovation in fabric technology and premium product positioning help maintain the region’s dominance across diverse consumer groups.

Europe

Europe accounts for about 25% of the global sports apparel market, driven by widespread interest in recreational sports, outdoor activities, and growing adoption of sustainable clothing. Western Europe remains the largest contributor due to high purchasing power and strong brand awareness. The region also benefits from rising demand for fashionable activewear that blends performance and everyday comfort. Increasing environmental regulations encourage brands to shift toward eco-friendly materials, which further strengthens market growth and supports innovation in design and manufacturing.

Asia-Pacific

Asia-Pacific represents roughly 22% of the global market and stands as the fastest-growing region. Rising health awareness, expanding middle-class populations, and rapid urbanization contribute to increasing demand for sports apparel. China, India, and Southeast Asian countries drive consumption of both affordable athleisure and premium performance wear. E-commerce growth significantly boosts accessibility, encouraging international brands to expand manufacturing and retail operations. Local brands are also gaining popularity, adding competitive diversity and supporting continued market expansion.

Latin America

Latin America holds around 8% of the sports apparel market. Growth is supported by expanding fitness culture, increasing interest in outdoor sports, and stronger retail presence in key markets such as Brazil, Mexico, and Argentina. Consumers are increasingly adopting athleisure for daily wear, while international brands continue to strengthen distribution networks. Economic fluctuations and price sensitivity remain challenges, but rising digital commerce and youth-focused sports initiatives are creating steady opportunities for long-term market development.

Middle East & Africa

The Middle East & Africa region accounts for about 5% of the global market. Growth is driven by rising youth populations, increasing sports participation, and government investments in fitness and sports infrastructure. Gulf countries show strong demand for premium and luxury sportswear, while African markets are gradually expanding through urban retail development and growing interest in active lifestyles. E-commerce adoption is accelerating, creating new channels for both global and local brands. Despite higher price sensitivity in some markets, long-term potential remains strong.

Market Segmentations:

By Product Type:

By Sport Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sports apparel market features a highly competitive landscape led by major global brands such as Under Armour, Fila, Inc., Lululemon Athletica Incorporation, Anta Sports Products Limited, Inc., Umbro Ltd., Adidas AG, Columbia Sportswear Company, Puma SE, Inc., Nike, Inc., and LI-NING Company Limited. The sports apparel market remains intensely competitive, defined by rapid innovation cycles, diversified product strategies, and strong brand-driven differentiation. Companies continuously invest in advanced materials, performance-enhancing technologies, and sustainable manufacturing to appeal to both athletes and lifestyle consumers. The growing influence of athleisure has broadened competition, drawing in fashion brands and digitally native entrants that challenge traditional sportswear leaders. Price competitiveness is increasing as consumers balance premium expectations with affordability, especially in emerging markets. E-commerce expansion has further intensified rivalry, enabling brands to scale direct-to-consumer channels and leverage data-driven personalization. Marketing strategies built on athlete partnerships, social media influence, and localized product development play critical roles in capturing market share. As sustainability gains prominence, firms integrate recycled textiles, circular design, and transparent supply chain practices to strengthen brand trust and meet global regulatory expectations. Overall, competitive pressure continues to rise as innovation, speed-to-market, and consumer engagement define long-term leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Under Armour

- Fila, Inc.

- Lululemon Athletica Incorporation

- Anta Sports Products Limited, Inc.

- Umbro Ltd.

- Adidas AG

- Columbia Sportswear Company

- Puma SE, Inc.

- Nike, Inc.

- LI-NING Company Limited

Recent Developments

- In April 2025, Warner Bros. Discovery (WBD) Sports Europe, in collaboration with Amazon Web Services (AWS), launched the Cycling Central Intelligence (CCI) platform at the WHOOP UCI Mountain Bike World Series season opener in Araxá, Brazil. CCI utilizes generative AI technologies like Amazon Bedrock and Anthropic’s Claude 3.5 to provide real-time data on riders, venues, and race histories, enhancing live sports coverage.

- In January 2025, HockeyStack raised in a Series A funding round led by Bessemer Venture Partners, with participation from Y Combinator, Uncorrelated Ventures, and Qnbeyond Ventures.

- In June 2024, Reebok introduced its first ever pickleball shoe, the Nano Court. Designed for sports such as pickleball, padel, and tennis, the shoe prioritizes grip, stability, and durability. It features Flexweave Pro uppers, incorporating Reebok’s most resilient Flexweave knit yet, with zoned stability yarns for targeted support.

- In February 2024, Puma and Bundesliga club RB Leipzig announced a long-term partnership to supply equipment for all men’s, women’s, and youth teams, starting with the 2024/25 season. This deal also includes kit supply, merchandising, and digital activations, replacing RB Leipzig’s previous supplier, Nike.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Sport Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger demand for athleisure as consumers continue blending comfortwear with everyday fashion.

- Brands will increase investments in sustainable materials and circular production models.

- Digital channels will expand further, with e-commerce becoming the dominant sales platform.

- Customization and personalized apparel designs will gain more traction among younger consumers.

- High-performance and smart textiles will play a larger role in product differentiation.

- Women’s sportswear will grow faster as fitness participation among women continues to rise.

- Localized product development will increase to meet regional performance and style preferences.

- Supply chain resilience will become a strategic priority for global sportswear companies.

- Collaborations between sportswear brands, celebrities, and designers will enhance consumer engagement.

- Emerging markets will drive future volume growth through rising fitness awareness and urbanization.