Market Overview:

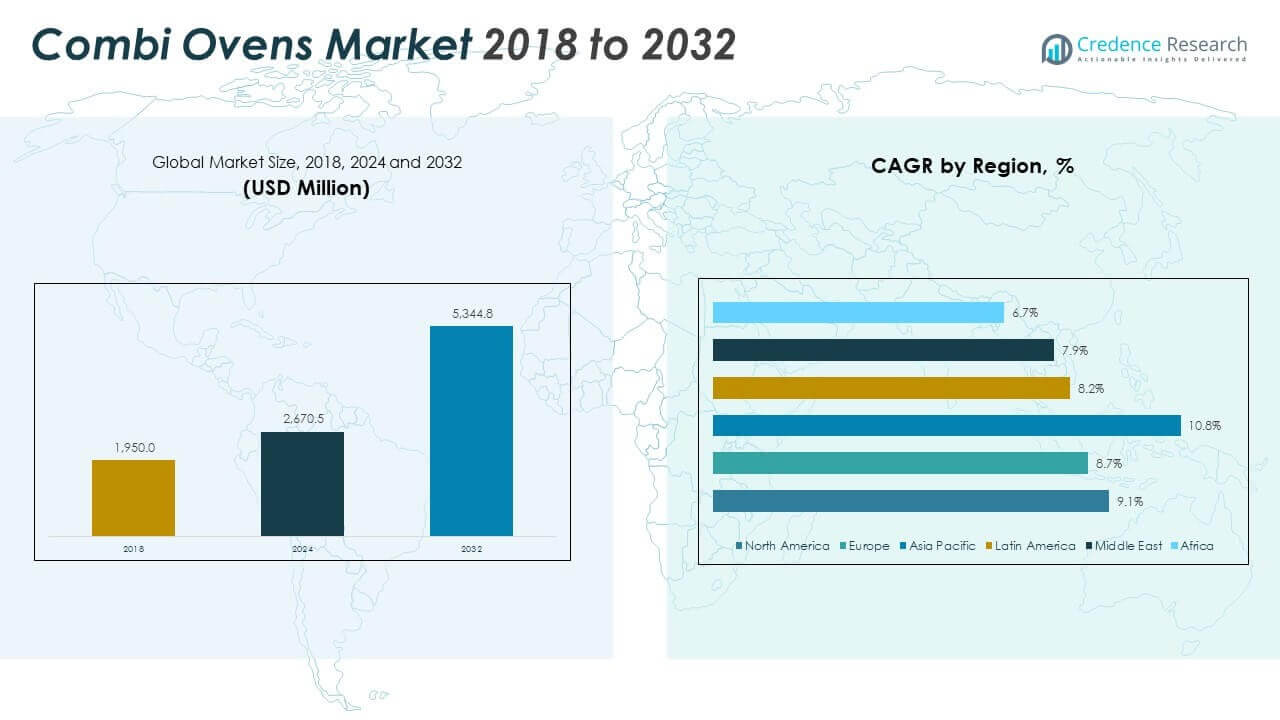

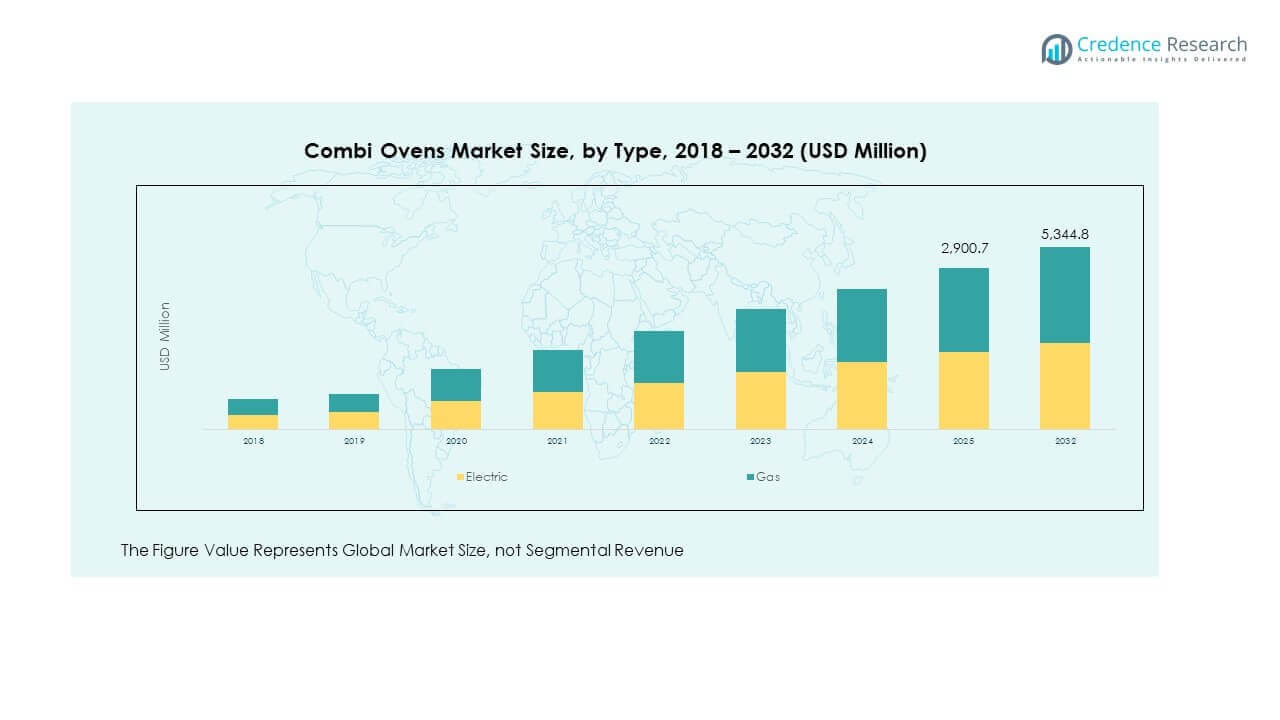

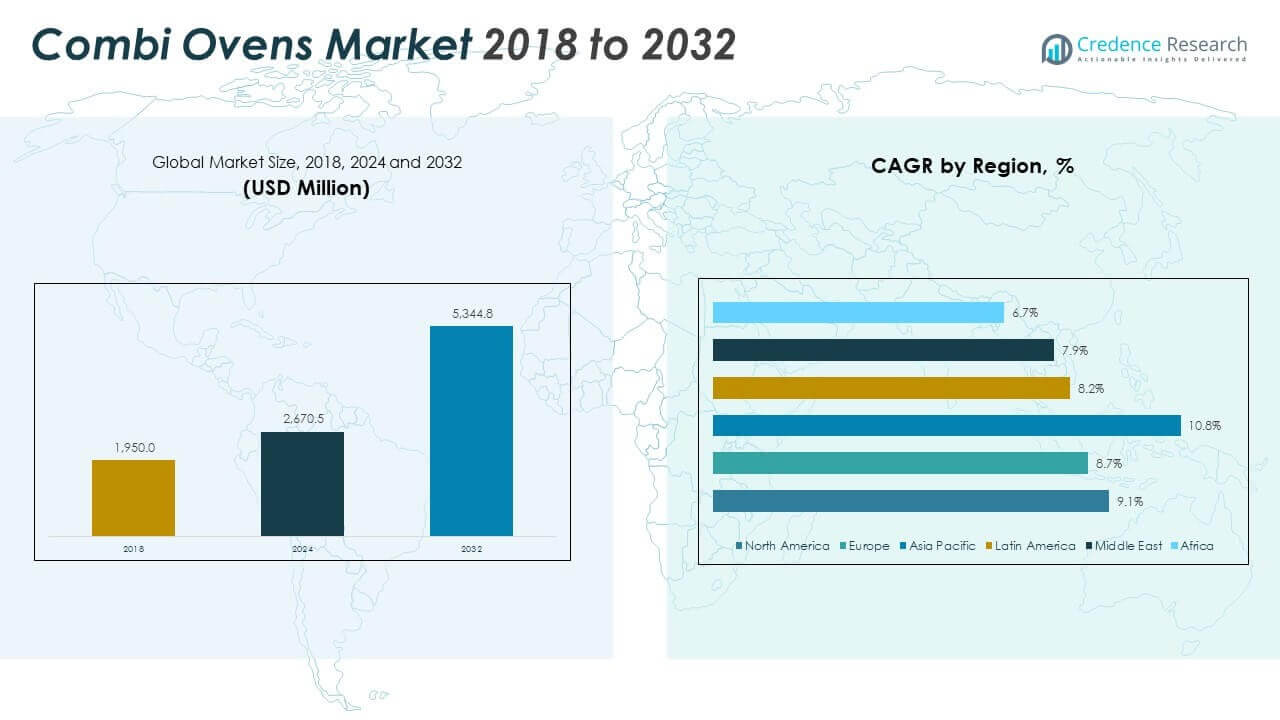

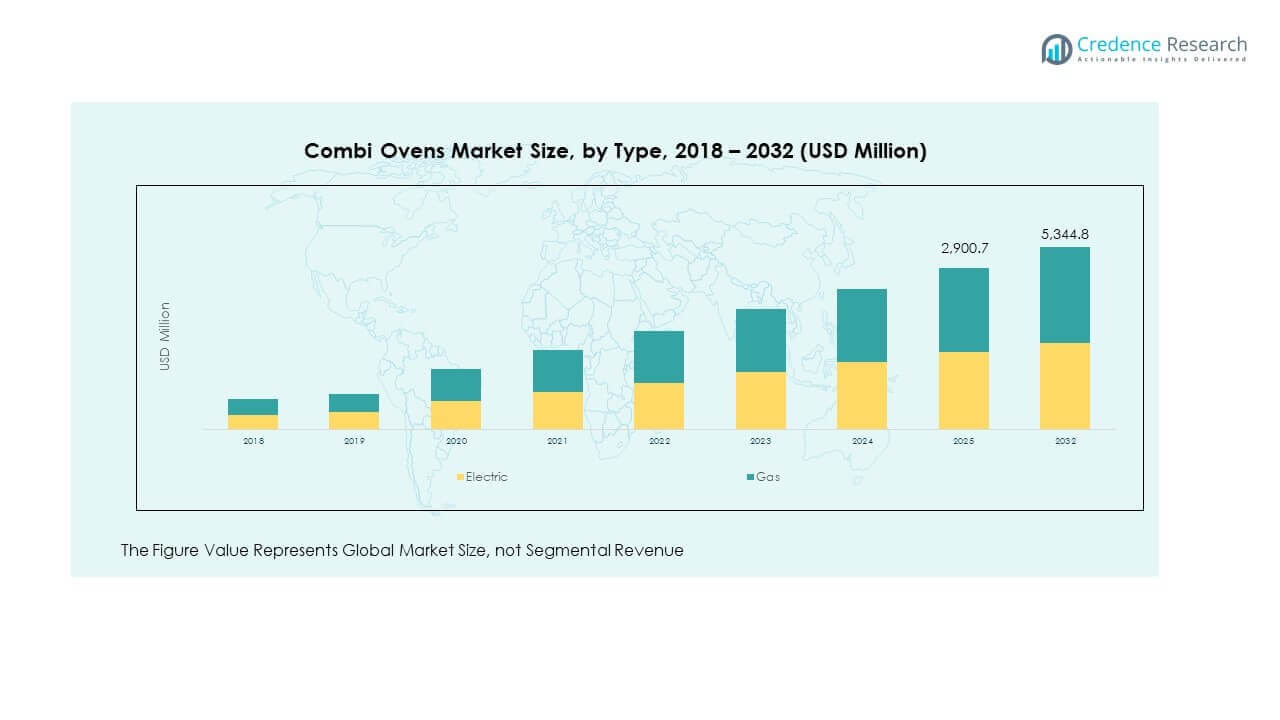

The Combi Ovens Market size was valued at USD 1,950.0 million in 2018 to USD 2,670.5 million in 2024 and is anticipated to reach USD 5,344.8 million by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Combi Ovens Market Size 2024 |

USD 2,670.5 Million |

| Combi Ovens Market, CAGR |

9.1% |

| Combi Ovens Market Size 2032 |

USD 5,344.8 Million |

The market growth is driven by rising demand for versatile cooking appliances that deliver efficiency, precision, and energy savings. Foodservice operators across restaurants, hotels, and institutional kitchens increasingly adopt combi ovens for their ability to combine steam, convection, and hybrid cooking modes. Growing emphasis on reducing operational costs, improving food quality, and meeting sustainability targets further fuels adoption. Rapid technological innovations, such as touchscreen controls, automated cleaning systems, and IoT integration, enhance usability, making these ovens indispensable in modern kitchens.

Geographically, Europe holds a leading position due to a strong hospitality sector and a well-established network of quick-service restaurants. North America shows steady growth supported by high adoption among institutional kitchens and healthcare facilities. Asia-Pacific emerges as the fastest-growing region, driven by urbanization, rising disposable incomes, and expansion of the commercial foodservice sector. Meanwhile, Latin America and the Middle East are gradually adopting these solutions, supported by growing tourism and investments in the hospitality industry.

Market Insights:

- The Combi Ovens Market was valued at USD 1,950.0 million in 2018, reached USD 2,670.5 million in 2024, and is projected to hit USD 5,344.8 million by 2032, growing at a CAGR of 9.1%.

- Europe holds the largest share at 40.6%, driven by strong hospitality, bakery, and catering industries. North America follows with 26.9% due to a mature foodservice sector, while Asia Pacific accounts for 19.4%, supported by urban dining expansion.

- Asia Pacific is the fastest-growing region with 19.4% share in 2024, fueled by rising disposable incomes, expanding QSR networks, and increasing urbanization.

- By type, electric combi ovens represent 46% of the market in 2024, reflecting demand for precision, energy management, and ease of installation.

- Gas combi ovens hold 54% in 2024, maintaining dominance in high-volume kitchens and regions with cost-effective gas availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Need for Energy-Efficient Cooking Systems Across Commercial Kitchens

The Combi Ovens Market is experiencing strong growth as commercial kitchens prioritize energy-efficient systems. Restaurants, hotels, and catering services adopt these ovens to reduce utility costs. It allows operators to cook multiple dishes simultaneously without compromising quality. Energy-efficient cooking supports sustainability goals and appeals to businesses facing stricter regulations. Operators value reduced energy bills and improved kitchen workflows. The ability to replace multiple appliances makes combi ovens more attractive. Compact models enhance adoption in small urban kitchens with space constraints. Growing focus on operational efficiency strengthens demand across the foodservice sector.

- For instance, Rational AG’s iCombi Pro oven, introduced in 2020, is engineered to deliver higher energy efficiency than earlier models, equipped with a triple-glass door that improves insulation, and designed with intelligent cooking management that enables preparation of multiple food types at the same time without flavor transfer in commercial kitchens.

Demand for Versatile Appliances Supporting Menu Diversity and Food Quality

Rising consumer expectations for diverse menus drive demand for combi ovens. The Combi Ovens Market benefits as operators need appliances that deliver flexibility in cooking styles. It combines steam, convection, and mixed modes to prepare varied cuisines. Chefs rely on consistent results across meats, baked goods, and vegetables. Foodservice businesses use this versatility to meet shifting customer preferences quickly. Uniform quality boosts customer satisfaction and strengthens brand reputation. Improved cooking precision reduces waste and enhances profitability. The ability to experiment with recipes supports product innovation in kitchens.

Integration of Smart Controls and IoT for Improved Operational Performance

Smart features fuel adoption of combi ovens across global markets. The Combi Ovens Market expands as IoT-enabled models provide real-time monitoring and remote control. It enhances kitchen management with predictive maintenance alerts and automated settings. Operators reduce downtime by receiving early fault detection. Data-driven usage analysis helps businesses optimize menus and kitchen schedules. Touchscreen interfaces and programmable recipes simplify training for staff. Improved consistency ensures food quality across multiple locations. Cloud connectivity enables chain restaurants to standardize cooking processes worldwide.

Rising Institutional and Healthcare Sector Adoption of Modern Cooking Equipment

Institutions and healthcare facilities increasingly prefer combi ovens for their operational benefits. The Combi Ovens Market grows as these facilities seek reliable, hygienic, and efficient solutions. It provides healthier meal preparation through steam cooking while reducing oil usage. Hospitals value precise temperature control to meet dietary requirements. Schools adopt ovens to deliver nutritious meals at scale. Long product lifecycles and reduced maintenance needs add value to institutional buyers. Central kitchens benefit from high-capacity models that serve large populations daily. Rising healthcare investments continue to expand market penetration in this sector.

- For instance, Henny Penny’s FlexFusion combi ovens are designed to support institutional kitchens with precise steam cooking that enables healthier meal preparation and significantly reduces oil usage, making them well-suited for hospitals and large-scale foodservice operations.

Market Trends:

Adoption of Automated Cleaning Systems to Enhance Kitchen Hygiene Standards

The Combi Ovens Market is witnessing strong adoption of automated cleaning features. It improves hygiene standards in commercial kitchens where compliance is critical. Self-cleaning programs reduce manual labor and minimize chemical exposure for staff. Operators achieve consistent cleanliness levels with less downtime between cooking cycles. This trend aligns with food safety regulations across major regions. Automatic descaling protects equipment lifespan while lowering maintenance costs. Businesses prefer ovens that meet hygiene demands without extra staffing efforts. Adoption of these systems reinforces combi ovens as premium kitchen assets.

Compact and Countertop Models Gaining Popularity in Urban Foodservice Spaces

Urbanization drives demand for smaller combi oven models tailored to compact kitchens. The Combi Ovens Market benefits from product launches that meet space-saving requirements. It enables restaurants and cafés in dense cities to operate efficiently. Countertop units allow operators to maximize available kitchen space. Businesses appreciate portable designs that maintain cooking versatility. These models support quick-service restaurants with limited back-of-house areas. Operators select smaller ovens for reduced costs while preserving performance. Compact designs expand adoption among independent restaurants and start-up food businesses.

- For instance, UNOX offers its CHEFTOP MIND.Maps™ ONE COUNTERTOP combi oven, available in a 5-tray GN 1/1 configuration, measuring 750 x 783 x 675 mm, equipped with steam and convection functions to support versatile cooking in compact kitchen environments.

Growing Preference for Sustainable Materials and Environment-Friendly Designs

Sustainability influences product innovation in the Combi Ovens Market. It drives manufacturers to design ovens with recyclable materials and energy-efficient components. Operators focus on reducing carbon emissions through equipment choices. Eco-friendly ovens enhance brand image and align with consumer values. This trend accelerates as governments strengthen environmental compliance standards. Appliance producers invest in research to extend lifecycle performance. Sustainable models gain traction with operators targeting green certifications. Demand for energy-conscious designs reshapes product portfolios in competitive markets.

- For instance, Electrolux Professional’s SkyLine combi ovens are designed with up to 95% recyclable materials and deliver up to 20% lower energy consumption compared to earlier models, with sustainability performance validated under the ISO 14001 environmental management certification.

Increasing Customization Options to Support Brand-Specific Kitchen Requirements

Customization is shaping procurement decisions in the Combi Ovens Market. It allows businesses to integrate ovens with brand-specific workflows. Operators request tailored capacity, controls, and software integration. Food chains prefer ovens that match menu requirements at scale. This flexibility supports efficient service across multiple outlets. Integration with POS and inventory systems improves operational visibility. Manufacturers expand offerings to include customizable user interfaces and accessories. Businesses adopt these options to strengthen efficiency and service delivery.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs Limiting Widespread Adoption

The Combi Ovens Market faces challenges due to high upfront purchase costs. It creates barriers for small restaurants and emerging operators with limited budgets. Many businesses hesitate to invest in advanced models despite operational benefits. Ongoing expenses for maintenance and spare parts increase ownership costs. Unplanned downtime due to technical faults disrupts kitchen operations. Some operators delay adoption until financing options become more accessible. Competitive pressure from alternative appliances further complicates purchasing decisions. Cost constraints remain a critical barrier to widespread adoption.

Technical Complexity and Training Requirements Restricting Efficient Utilization

The complexity of advanced models creates operational challenges. The Combi Ovens Market requires staff to undergo training to use features effectively. It slows adoption in businesses with high employee turnover. Untrained staff risk inconsistent food quality and equipment misuse. Technical reliance on software updates and IoT systems creates dependencies. Some regions face limited access to skilled technicians for maintenance. Complexity can discourage smaller operators from investing in advanced ovens. Training limitations reduce the full potential of technology integration in kitchens.

Market Opportunities:

Expansion in Quick-Service and Cloud Kitchen Sectors Across Emerging Regions

The Combi Ovens Market offers strong opportunities in fast-growing quick-service and cloud kitchens. It supports operators aiming for rapid service, consistent quality, and reduced cooking times. Cloud kitchens value compact models that enhance throughput in delivery-focused operations. Growing consumer reliance on food delivery platforms boosts adoption rates. Fast-food chains prefer ovens that integrate digital cooking controls. These segments highlight significant growth potential in emerging markets. Expanding urban populations increase the need for efficient, scalable kitchen solutions. Manufacturers targeting these operators strengthen long-term growth prospects.

Rising Focus on Technological Innovation and Smart Connectivity Features

Technological innovation creates new growth avenues in the Combi Ovens Market. It includes smart connectivity, predictive maintenance, and advanced automation features. Operators gain improved efficiency through real-time monitoring and remote management. Integration with kitchen networks supports data-driven operations. AI-based cooking programs help reduce human error and training needs. Manufacturers offering advanced digital solutions attract large-scale buyers. Smart ovens strengthen appeal among multi-outlet restaurants seeking uniformity. Continuous product innovation positions manufacturers to capture higher market share.

Market Segmentation Analysis:

The Combi Ovens Market is segmented

By type into electric and gas models. Electric ovens are gaining wider preference due to ease of installation, precision in temperature control, and better energy management. Gas ovens continue to hold relevance in regions where gas availability is abundant and cost-effective. It is evident that electric ovens are increasingly favored in urban and developed markets, while gas models maintain strong use in traditional and high-volume commercial kitchens.

- For instance, Rational’s iCombi Pro electric combi ovens feature intelligent sensors that continuously monitor cooking conditions to maintain precise temperature control and optimize energy use through adaptive heating management. Blodgett’s gas combi ovens are engineered for high-volume cooking in commissary and institutional kitchens, offering powerful performance supported by reliable gas supply for consistent throughput.

By power rating, the market is divided into low, medium, and high categories. Low power ovens serve smaller operations such as cafés and compact bakeries, where space and energy savings are critical. Medium power units are widely used in restaurants and institutional setups, offering a balance between performance and efficiency. High power ovens dominate large-scale kitchens, hotels, and catering services, meeting demands for higher throughput and rapid cooking.

- For instance, UNOX’s CHEFTOP MIND.Maps™ ONE countertop electric combi ovens are available in 5-tray GN 1/1 configurations with compact dimensions around 750 mm in width, making them suitable for small bakeries and limited kitchen spaces. Medium-capacity models such as Vulcan’s Chef’sCombi line include 10-tray configurations designed for restaurant operations, combining steam and convection modes to deliver consistent performance in mid-sized kitchens.

By application, the Combi Ovens Market is segmented into restaurants and quick-service restaurants (QSR’s), hotels and hospitality, bakeries, and institutional kitchens. Restaurants and QSR’s represent the largest share due to the need for speed, consistency, and versatility. Hotels and hospitality sectors value these ovens for their ability to support diverse menus and bulk cooking. Bakeries adopt them to achieve consistent baking results and enhance productivity. Institutional kitchens in schools, hospitals, and corporate facilities also use them to ensure quality meals at scale. This broad application base continues to drive expansion across global foodservice industries.

Segmentation:

By Type

By Power Rating

By Application

- Restaurants / QSR’s

- Hotels & Hospitality

- Bakery

- Institutional Kitchen

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Combi Ovens Market size was valued at USD 532.7 million in 2018 to USD 717.8 million in 2024 and is anticipated to reach USD 1,433.6 million by 2032, at a CAGR of 9.1% during the forecast period. North America holds 26.9% of the global market share in 2024. The region benefits from a mature foodservice industry with strong penetration of quick-service restaurants and institutional kitchens. The Combi Ovens Market here is driven by increasing adoption of energy-efficient models across large-scale kitchens. It is also influenced by high investments in healthcare and education facilities that demand efficient cooking solutions. Operators prefer advanced ovens with IoT integration to streamline kitchen operations. Strong presence of established food chains ensures consistent demand for high-capacity ovens. Hotels and hospitality sectors continue to invest in modern kitchen technologies to improve productivity. Rising demand for premium dining experiences further sustains growth.

Europe

The Europe Combi Ovens Market size was valued at USD 811.2 million in 2018 to USD 1,083.6 million in 2024 and is anticipated to reach USD 2,093.9 million by 2032, at a CAGR of 8.7% during the forecast period. Europe accounts for 40.6% of the global market share in 2024. Strong regulatory emphasis on energy efficiency and food safety shapes adoption across the region. The Combi Ovens Market benefits from well-established hospitality, catering, and bakery industries. It is supported by advanced kitchen infrastructure across restaurants and hotels. Large institutional kitchens, including hospitals and schools, increasingly rely on combi ovens for consistency and scalability. Demand for compact and electric models is rising in urban markets. Local manufacturers strengthen competitive intensity with innovations in automation and sustainability. Growing focus on reducing carbon footprints ensures continued adoption across industries.

Asia Pacific

The Asia Pacific Combi Ovens Market size was valued at USD 357.2 million in 2018 to USD 518.2 million in 2024 and is anticipated to reach USD 1,173.9 million by 2032, at a CAGR of 10.8% during the forecast period. Asia Pacific represents 19.4% of the global market share in 2024. Strong economic growth, urbanization, and rising disposable incomes drive adoption. The Combi Ovens Market in this region is expanding with rapid growth in foodservice chains and bakeries. It is particularly strong in China, Japan, and India where urban dining trends are accelerating. Hotels and hospitality investments in Southeast Asia and Australia further support expansion. Restaurants and quick-service outlets adopt compact models for efficiency and consistency. Rising middle-class populations fuel demand for diverse menu offerings. Manufacturers focus on introducing cost-effective products to penetrate emerging economies. The regional market continues to outpace others in growth rate.

Latin America

The Latin America Combi Ovens Market size was valued at USD 138.5 million in 2018 to USD 188.0 million in 2024 and is anticipated to reach USD 352.1 million by 2032, at a CAGR of 8.2% during the forecast period. Latin America contributes 7.0% of the global market share in 2024. Growth is supported by rising investments in hospitality and tourism-driven foodservice sectors. The Combi Ovens Market in this region is expanding across Brazil, Argentina, and emerging economies. It is influenced by increasing adoption in hotels, cafés, and bakeries seeking efficiency and product consistency. Urbanization and the expansion of international restaurant chains fuel new demand. Operators prefer medium-capacity ovens that balance cost and productivity. Regional economic shifts impact purchasing decisions, yet adoption continues in premium segments. Improved supply chains and partnerships with global manufacturers support accessibility. Growing tourism activities reinforce opportunities in key countries.

Middle East

The Middle East Combi Ovens Market size was valued at USD 80.0 million in 2018 to USD 103.1 million in 2024 and is anticipated to reach USD 187.6 million by 2032, at a CAGR of 7.9% during the forecast period. The region represents 3.9% of the global market share in 2024. Expanding tourism, hospitality, and luxury dining sectors fuel demand. The Combi Ovens Market benefits from strong investments in hotels, resorts, and institutional kitchens. It is supported by growth in GCC countries where foodservice standards are rising. Compact and premium ovens gain popularity in urban centers such as Dubai and Riyadh. Healthcare facilities also adopt these ovens for reliable and hygienic food preparation. Manufacturers establish partnerships to strengthen regional distribution networks. Growing demand for Western cuisines in metropolitan markets accelerates adoption. Institutional and corporate dining further supports steady expansion.

Africa

The Africa Combi Ovens Market size was valued at USD 30.4 million in 2018 to USD 59.8 million in 2024 and is anticipated to reach USD 103.7 million by 2032, at a CAGR of 6.7% during the forecast period. Africa holds 2.2% of the global market share in 2024. Rising urbanization and development of foodservice industries support market growth. The Combi Ovens Market in Africa is driven by growing adoption in South Africa and Egypt. It is gradually expanding in hotels, restaurants, and institutional kitchens across emerging cities. Limited access to high-end models and cost constraints slow adoption in smaller economies. Demand is stronger in premium hospitality and international restaurant chains. Local distributors and partnerships improve equipment availability in key markets. Rising tourism and hospitality projects across North and Southern Africa create new opportunities. The market is developing steadily but at a slower pace compared to other regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Rational AG

- Electrolux Professional

- Convotherm

- Unox

- Alto-Shaam, Inc.

- The Middleby Corporation

- Vulcan Equipment

- Lincat Catering Equipment

- Henny Penny Corporation

- Retigo Ltd.

- Falcon Foodservice Equipment

- Turbofan

- Carbolite Gero

- Merrychef

Competitive Analysis:

The Combi Ovens Market is characterized by strong competition among global and regional manufacturers. Leading players include Rational AG, Electrolux Professional, Convotherm, Unox, Alto-Shaam, The Middleby Corporation, and Henny Penny. It is shaped by continuous innovation, with companies introducing energy-efficient models, IoT-enabled controls, and automated cleaning features. Rational AG and Electrolux maintain dominance through broad product portfolios and global reach. Unox and Convotherm strengthen their presence with versatile mid-range models favored by restaurants and bakeries. The Middleby Corporation leverages acquisitions to expand its market footprint. Smaller manufacturers compete by offering cost-effective solutions tailored to regional needs. Strategic partnerships, regional expansions, and product diversification remain critical approaches for sustaining competitive advantage. The market continues to evolve with growing emphasis on sustainability, digitalization, and user-friendly designs, positioning innovation as the key factor driving leadership among top brands.

Recent Developments:

- In March 2025, Panasonic unveiled the HomeCHEF Connect 4-in-1 Multi-Oven, a significant product launch featuring AI-driven cooking logic and remote recipe uploads, tailored to the needs of both residential and commercial kitchens.

- In March 2025, Chef Robotics secured USD 43.1 million in Series A financing to accelerate the scaling of AI kitchen robots, which work alongside combi-oven workflows. This partnership highlights the synergy between robotics and combi ovens to enhance automation, reduce labor costs, and drive consistency in commercial kitchens.

Report Coverage:

The research report offers an in-depth analysis based on Type, Power Rating and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Combi Ovens Market will witness strong adoption driven by the need for energy-efficient kitchen solutions.

- Smart connectivity and IoT integration will shape product development and kitchen management efficiency.

- Compact and countertop models will see rising demand in urban areas with limited kitchen space.

- Growth in quick-service restaurants and cloud kitchens will fuel higher sales across emerging economies.

- The bakery sector will expand its use of combi ovens to ensure consistency and productivity.

- Sustainability and eco-friendly designs will remain a priority for manufacturers and operators.

- Institutional kitchens in healthcare and education will increasingly invest in advanced cooking systems.

- Global competition will intensify with strategic partnerships and product innovations dominating market strategies.

- Asia Pacific will lead in growth rate, supported by rising disposable incomes and urban dining expansion.

- Automation and customization options will become standard features, enhancing user experience and operational outcomes.