Market Overview:

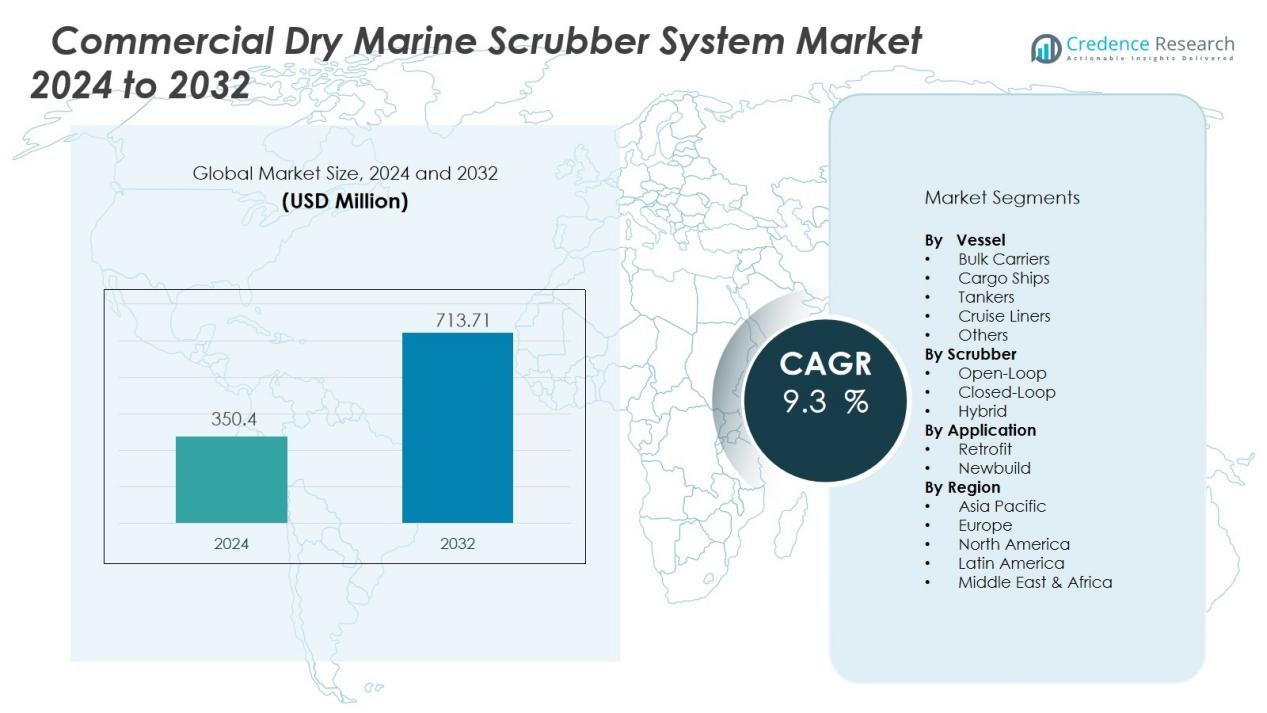

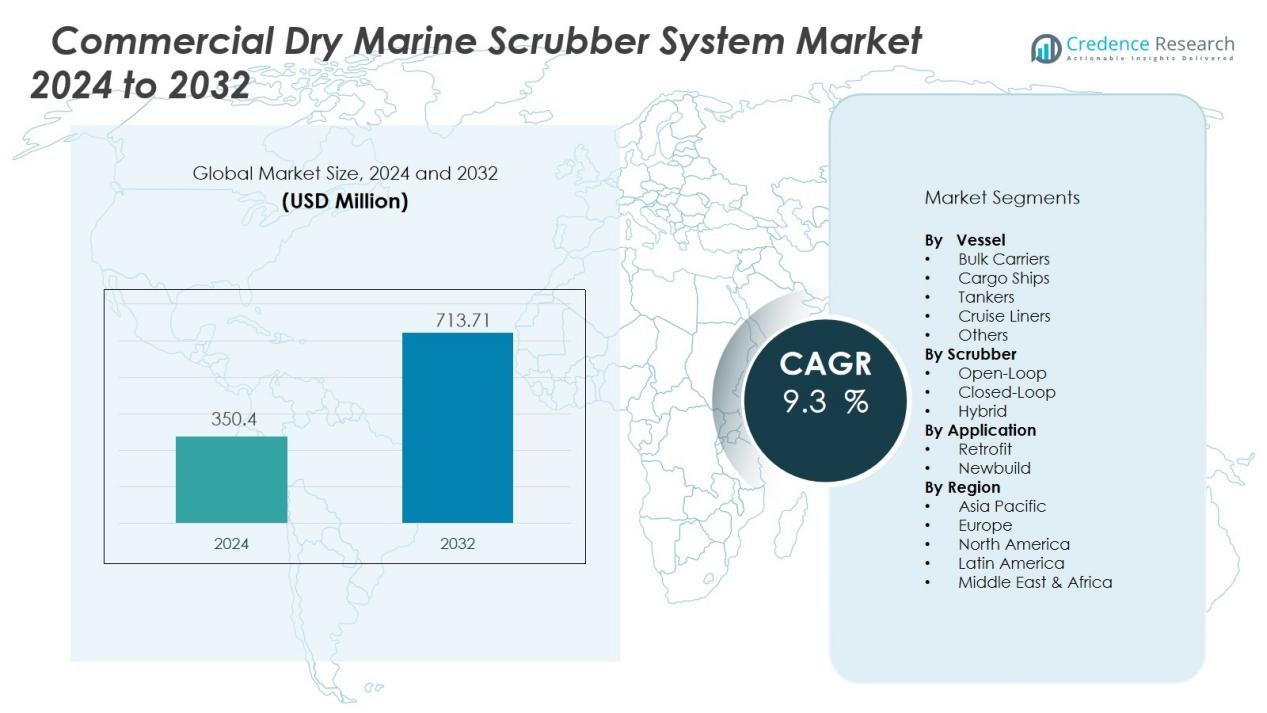

The Commercial dry marine scrubber system market size was valued at USD 350.4 million in 2024 and is anticipated to reach USD 713.71 million by 2032, at a CAGR of 9.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Dry Marine Scrubber System Market Size 2024 |

USD 350.4 Million |

| Commercial Dry Marine Scrubber System Market, CAGR |

9.3 % |

| Commercial Dry Marine Scrubber System Market Size 2032 |

USD 713.71 Million |

Market growth is fueled by tightening global emission control regulations, rising environmental awareness in the maritime sector, and growing preference for systems with low operational complexity. Dry scrubbers offer advantages such as reduced corrosion risk, simplified maintenance, and suitability for a wide range of vessel types, from cargo ships and bulk carriers to cruise liners. The increasing cost of low-sulfur fuels further strengthens the business case for installing these systems, particularly in long-haul commercial shipping.

Regionally, Europe dominates the commercial dry marine scrubber system market due to early regulatory adoption and significant retrofit demand across its extensive shipping fleet. Asia-Pacific is expected to record the fastest growth, supported by expanding shipbuilding activities in China, South Korea, and Japan. North America maintains steady demand, driven by the enforcement of Emission Control Areas (ECAs) and modernization of existing fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The commercial dry marine scrubber system market was valued at USD 350.4 million in 2024 and is projected to reach USD 713.71 million by 2032, growing at a CAGR of 9.3% from 2024 to 2032.

- Market expansion is driven by stricter global emission regulations, rising environmental compliance needs, and demand for systems with low operational complexity.

- Dry scrubbers offer reduced corrosion risk, simplified maintenance, and compatibility with diverse vessel types, enhancing their adoption in cargo ships, bulk carriers, and cruise liners.

- Fluctuating low-sulfur fuel prices make high-sulfur fuel oil with scrubbers a cost-effective compliance solution, strengthening long-term investment appeal.

- High upfront costs and installation complexities remain key barriers, particularly for smaller fleet operators with limited capital resources.

- Europe leads with 41.2% market share due to early IMO 2020 adoption and strong retrofit demand, followed by Asia-Pacific at 33.6% driven by large shipbuilding hubs.

- North America holds 18.7% market share, supported by ECA enforcement, fleet modernization, and ongoing investments in green shipping initiatives.

Market Drivers:

Stringent International Maritime Emission Regulations Driving Adoption:

The enforcement of the International Maritime Organization’s (IMO) 2020 sulfur cap has been a primary catalyst for the commercial dry marine scrubber system market. The regulation limits sulfur content in marine fuels to 0.5%, compelling shipowners to either switch to costly low-sulfur fuels or adopt scrubber systems. Dry scrubbers offer a long-term compliance solution without dependence on fuel price fluctuations. Their ability to reduce sulfur oxide (SOx) emissions while maintaining operational efficiency makes them a preferred choice for vessel operators seeking cost control and environmental compliance.

- For instance, Yara Marine Technologies completed the retrofit of 30 in-line dry scrubber systems on Berge Bulk carriers in 2021, enhancing their compliance across key trade routes.

Operational Advantages and Reduced Maintenance Requirements:

The operational simplicity of dry marine scrubbers significantly contributes to their growing acceptance. Unlike wet scrubbers, they do not require seawater for scrubbing, eliminating issues related to water treatment and discharge compliance. It offers reduced corrosion risk, lower maintenance frequency, and longer component lifespans, which directly translate to lower total cost of ownership. These benefits position dry scrubbers as a cost-efficient and reliable technology for both retrofit and newbuild projects.

- For instance: Hamworthy-Krystallon installed a dry scrubber on P&O Ferries’ Pride of Kent, which operated continuously for 30,000 hours before requiring overhaul while maintaining 98% SOx reduction throughout its service life.

Rising Fuel Cost Pressures Encouraging Alternative Compliance Solutions:

Fluctuations and persistent increases in low-sulfur fuel prices have prompted ship operators to seek more stable long-term cost strategies. The commercial dry marine scrubber system market benefits from its ability to enable the continued use of high-sulfur fuel oil (HSFO), which is often more affordable. By ensuring compliance while reducing reliance on expensive fuel types, dry scrubbers provide a strong return on investment, especially for vessels with high annual fuel consumption.

Growing Demand in Retrofitting and Newbuild Ship Segments:

The demand for dry marine scrubbers spans both retrofitting of existing vessels and integration into new ship designs. Retrofitting enables older ships to meet emission standards without operational downtime beyond scheduled maintenance periods. In the newbuild segment, shipyards are increasingly incorporating dry scrubbers into designs for bulk carriers, tankers, and cruise ships to meet future-proof compliance requirements. This dual market penetration strengthens the technology’s long-term growth outlook.

Market Trends:

Integration of Hybrid and Modular Scrubber Designs to Enhance Flexibility:

A key trend shaping the commercial dry marine scrubber system market is the shift toward hybrid and modular designs that allow greater operational flexibility. Ship operators increasingly prefer systems that can be adapted to varying fuel types and emission requirements, enabling compliance across multiple regulatory zones. Hybrid configurations, which combine dry and wet scrubbing capabilities, are gaining traction for vessels operating globally with diverse environmental regulations. Modular designs simplify installation and maintenance, reducing downtime and retrofit complexity. It also allows shipowners to scale or upgrade systems as regulations evolve, ensuring long-term operational compliance. This adaptability is becoming a critical factor in investment decisions for both retrofit and newbuild projects.

- For instance, ANDRITZ AG installed the largest multi-inlet hybrid scrubber at Chengxi shipyard on the reefer container ship Dole Maya, featuring a scrubber tower with an outer diameter of 4.1 meters treating exhaust from one main engine and four auxiliary engines, verified by DNV GL certification after sea trials.

Growing Focus on Energy Efficiency and Digital Performance Monitoring;

Energy efficiency improvements are emerging as a significant trend in the adoption of dry marine scrubbers, with manufacturers introducing designs that minimize power consumption and operational costs. The integration of advanced digital monitoring tools enables real-time tracking of emissions performance, system health, and compliance reporting. Ship operators are leveraging data analytics to optimize maintenance schedules, extend equipment life, and ensure regulatory adherence without unnecessary fuel penalties. It enhances operational transparency and supports automated compliance documentation, reducing administrative burdens. The emphasis on combining emissions reduction with operational efficiency is reinforcing the market’s growth potential, particularly among large fleet operators focused on sustainability and cost optimization.

- For instance, Alfa Laval PureSOx Connect’s ALREM system collects over 500 data points every 30 seconds and has supported more than 1.5 million hours of compliant operation, enabling data-driven benchmarking and predictive maintenance across hundreds of vessels.

Market Challenges Analysis:

High Capital Investment and Installation Complexity Limiting Adoption:

The commercial dry marine scrubber system market faces challenges due to the high upfront costs associated with procurement and installation. Many shipowners, particularly operators of smaller fleets, hesitate to invest because of the significant capital expenditure and potential disruption to operations during retrofitting. It also requires specialized engineering and shipyard capabilities, which can extend project timelines. Variations in vessel design further complicate integration, leading to customization expenses. These financial and technical barriers can delay adoption despite the long-term operational savings.

Evolving Regulatory Framework and Uncertain Return on Investment:

Frequent changes in global and regional maritime emission regulations create uncertainty for ship operators considering scrubber installations. The commercial dry marine scrubber system market must adapt to shifting standards, which may require costly modifications or upgrades in the future. Fluctuating fuel price differentials between high-sulfur and low-sulfur fuels also affect the payback period, making ROI projections less predictable. Operators may defer investment until regulatory clarity improves. This uncertainty impacts market momentum, particularly in regions where enforcement varies in scope and strictness.

Market Opportunities:

Expansion in Emerging Maritime Economies and Shipbuilding Hubs:

The commercial dry marine scrubber system market holds strong growth potential in emerging maritime economies where shipping activity and shipbuilding capacity are expanding. Countries such as China, South Korea, and India are increasing their focus on eco-compliant vessel production, creating opportunities for system manufacturers. It can leverage this demand through partnerships with regional shipyards and integration into newbuild projects. Rising trade volumes and port modernization initiatives in these regions further boost adoption. Localized production and service networks can also reduce costs, making the technology more accessible to regional operators.

Growing Retrofit Demand Driven by Extended Vessel Lifecycles:

An increasing number of vessel operators are opting for retrofitting to comply with stricter emission regulations while extending fleet operational life. The commercial dry marine scrubber system market benefits from this trend as older vessels remain economically viable when upgraded with emission control solutions. It allows shipowners to avoid premature vessel replacement and maintain competitive operating costs. Retrofitting demand is particularly strong in bulk carriers, tankers, and container ships engaged in long-haul routes. Service providers offering turnkey retrofit solutions, including engineering, installation, and after-sales support, are well-positioned to capture this expanding segment.

Market Segmentation Analysis:

By Vessel:

The commercial dry marine scrubber system market serves a wide range of vessel types, with bulk carriers and cargo ships accounting for the largest share due to their extensive long-haul operations and high fuel consumption. Tankers follow closely, driven by the need to comply with emission standards on global trade routes. Cruise liners also represent a significant segment, adopting dry scrubbers to meet strict port regulations while ensuring passenger comfort.

- For instance, Japan’s Koyo Kaiun retrofitted its chemical tanker M/V Valentine with a PureSOx U-type open-loop scrubber in 2019, marking one of the first single-vessel installations demonstrating seamless integration within a two-week yard slot.

By Scrubber:

The market is segmented into open-loop, closed-loop, and hybrid systems, with hybrid configurations gaining traction for their operational flexibility in varying regulatory zones. Dry scrubbers are preferred for their ability to operate without seawater, reducing discharge-related compliance risks. Closed-loop designs are increasingly adopted in areas with strict water discharge restrictions, offering a reliable alternative for global operators.

- For instance, Langh Tech installed a hybrid scrubber on Finnlines’ vessel, which achieved sulfur dioxide (SO₂) emission reduction from 3.5% down to below 0.1% m/m, meeting IMO 2020 and Emission Control Area regulations while allowing seamless operation in different maritime zones.

By Applications:

Applications span both retrofit and newbuild installations, with retrofits currently leading due to the large number of existing vessels adapting to IMO 2020 standards. The newbuild segment is expanding rapidly as shipyards integrate dry scrubbers into vessel designs to ensure long-term compliance. It benefits from growing demand across commercial shipping lines seeking to align with environmental regulations while controlling operational costs.

Segmentations:

By Vessel:

- Bulk Carriers

- Cargo Ships

- Tankers

- Cruise Liners

- Others

By Scrubber:

- Open-Loop

- Closed-Loop

- Hybrid

By Applications:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe :

Europe accounted for 41.2% market share in 2024, supported by early adoption of IMO 2020 compliance measures and strict regional emission control regulations. The commercial dry marine scrubber system market in this region is driven by the high concentration of shipping companies operating in Emission Control Areas (ECAs) such as the Baltic and North Seas. It benefits from the significant demand for retrofitting across cargo vessels, ferries, and cruise liners to meet sulfur emission limits. European shipowners also favor dry scrubbers for their ability to operate in ports with water discharge restrictions. Established manufacturing and engineering expertise within the region further strengthens market penetration.

Asia-Pacific :

Asia-Pacific held 33.6% market share in 2024, driven by large-scale shipbuilding hubs in China, South Korea, and Japan. The commercial dry marine scrubber system market in this region is supported by the integration of emission control systems into newbuild vessels. It benefits from the rising export of eco-compliant ships to international markets with strict environmental regulations. Regional governments are investing in maritime infrastructure and promoting cleaner shipping technologies, creating a favorable environment for adoption. Local suppliers and competitive pricing also accelerate uptake across both domestic and international fleets.

North America :

North America captured 18.7% market share in 2024, with demand primarily concentrated in vessels operating within the U.S. and Canadian ECAs. The commercial dry marine scrubber system market in this region benefits from strict enforcement of sulfur emission limits along coastal routes. It is further supported by fleet modernization initiatives among shipping companies serving transatlantic and Pacific trade routes. The presence of specialized marine engineering firms and technology providers enhances installation and maintenance capabilities. Continuous investment in green shipping initiatives ensures steady adoption across commercial fleets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ALFA LAVAL

- KWANG SUNG

- ANDRITZ

- Fuji Electric Co., Ltd.

- CR Ocean Engineering

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Wärtsilä

- Yara (Okapi Energy Group)

- Drizgas Tech

- Pacific Green (Pacific Green Group of companies)

- Valmet

Competitive Analysis:

The commercial dry marine scrubber system market is moderately consolidated, with competition driven by technological expertise, regulatory compliance, and global service capabilities. Key players such as ALFA LAVAL, KWANG SUNG, ANDRITZ, Fuji Electric Co., Ltd., CR Ocean Engineering, MITSUBISHI HEAVY INDUSTRIES, LTD., and Wärtsilä maintain strong market positions through advanced engineering solutions and proven operational performance. It is characterized by a focus on system efficiency, reduced maintenance needs, and compatibility with a wide range of vessel types. Leading companies actively invest in R&D to develop hybrid and modular scrubber designs that address varying operational and regulatory demands. Strategic collaborations with shipyards and fleet operators help secure long-term contracts, particularly for retrofit projects. Global distribution networks and dedicated after-sales service teams further enhance competitiveness, enabling rapid installation, compliance support, and lifecycle management for diverse maritime customers.

Recent Developments:

- In September 2024, Alfa Laval launched three new heat exchangers for propane, CO₂, and ammonia applications at Chillventa 2024, expanding their sustainable and efficient HVAC product line.

- In February 2025, ANDRITZ signed a cooperation agreement with Duesenfeld, a German firm, to jointly develop lithium-ion battery recycling solutions and advance sustainable recycling technology.

- In June 2025, ANDRITZ announced the acquisition of Diamond Power International, LLC, enhancing its portfolio in the power boiler and pulp & paper industry sectors.

Market Concentration & Characteristics:

The commercial dry marine scrubber system market exhibits a moderately consolidated structure, with a limited number of global and regional players holding significant competitive influence. It is characterized by high entry barriers due to substantial capital requirements, advanced engineering expertise, and strict regulatory compliance needs. Leading manufacturers compete on technology efficiency, durability, and lifecycle cost advantages, while also focusing on customization for diverse vessel types. The market sees strong participation from established maritime equipment suppliers with integrated service capabilities, including design, installation, and maintenance. Strategic alliances with shipyards and fleet operators are common to secure long-term contracts. Continuous innovation in hybrid and modular systems further defines the competitive landscape, supporting differentiation in a regulation-driven market.

Report Coverage:

The research report offers an in-depth analysis based on Vessel, Scrubber, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand will increase as global maritime regulations on sulfur emissions tighten further, prompting wider adoption across vessel categories.

- Retrofitting activity will remain strong, driven by operators extending the service life of existing fleets while ensuring compliance.

- Hybrid and modular scrubber designs will gain market traction, offering operational flexibility and easier integration for both newbuilds and retrofits.

- Digital monitoring and automation features will become standard, enabling real-time emissions tracking and compliance reporting.

- Shipowners will prioritize systems with lower operational costs and minimal maintenance requirements to improve return on investment.

- Expansion in shipbuilding hubs across Asia-Pacific will create opportunities for integrated scrubber installations in new vessels.

- Fuel price volatility will continue to make high-sulfur fuel oil paired with scrubbers a cost-effective operating strategy.

- Partnerships between scrubber manufacturers and shipyards will strengthen, ensuring faster delivery timelines and better installation efficiency.

- Regional adoption will grow in emerging economies as port authorities implement stricter environmental controls.

- Continuous innovation in energy-efficient designs will align with the shipping industry’s broader decarbonization strategies, supporting long-term market growth.