Market Overview

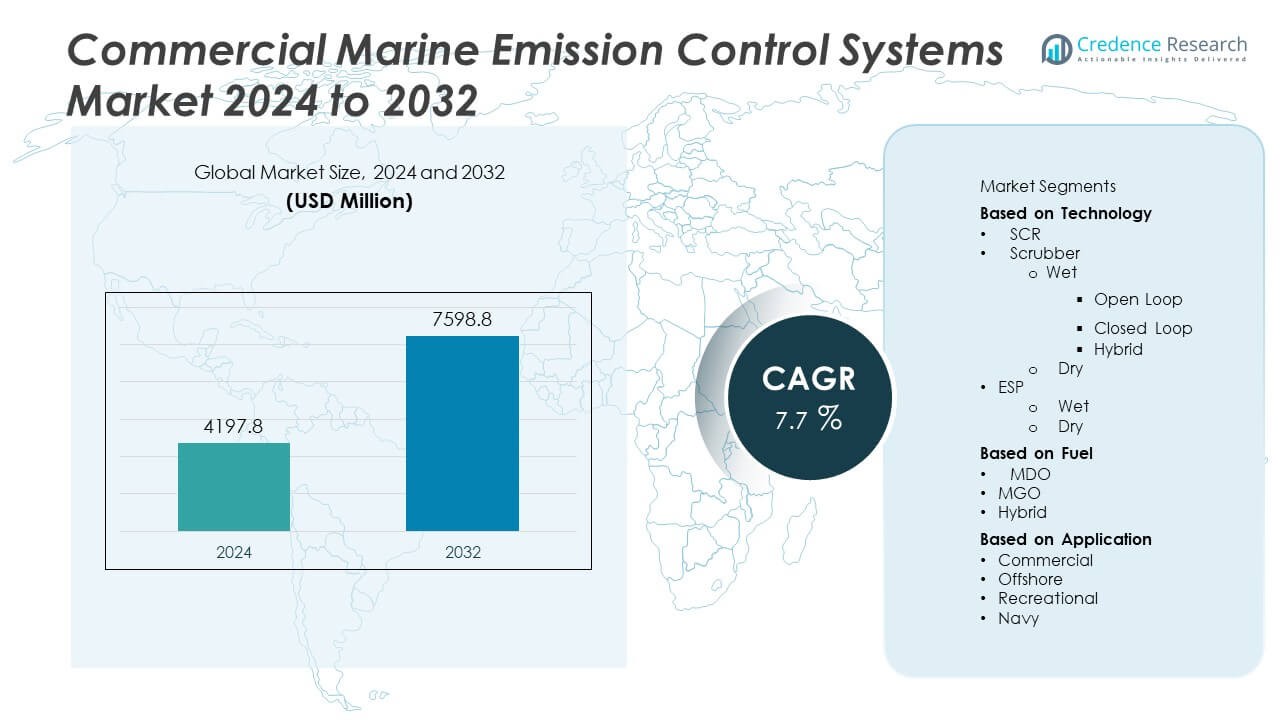

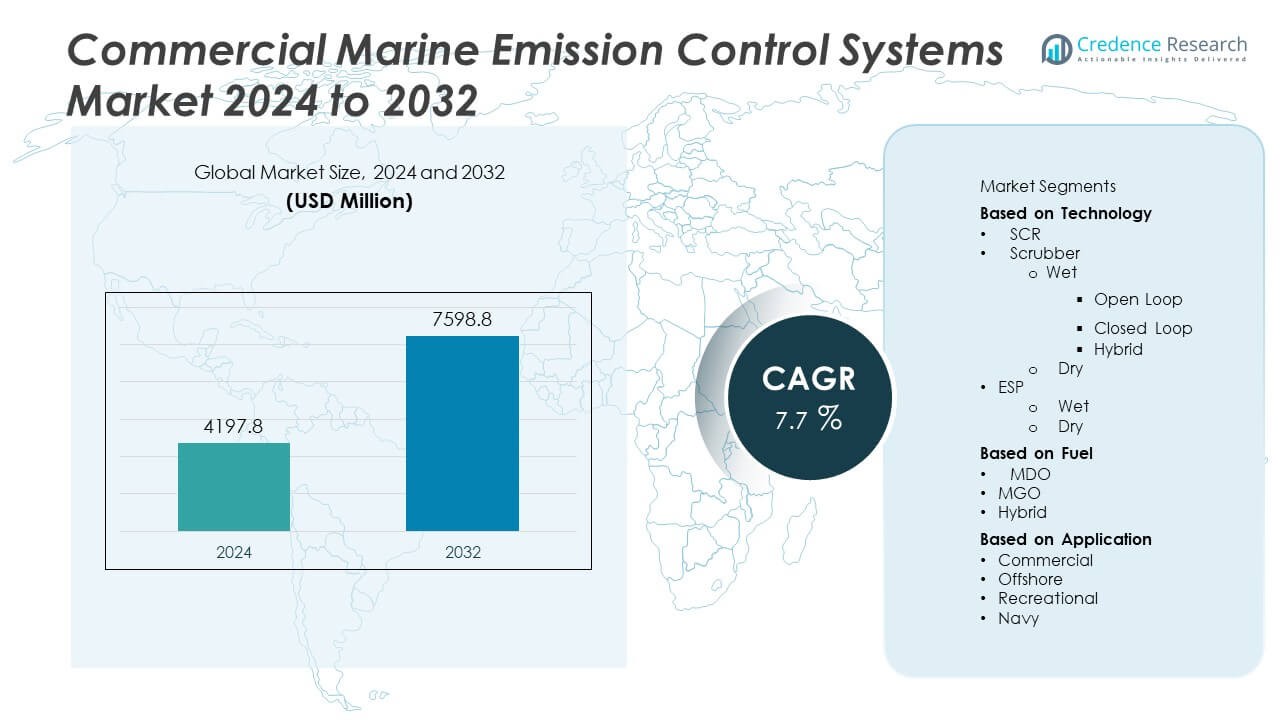

The Commercial Marine Emission Control Systems Market size was valued at USD 4197.8 million in 2024 and is anticipated to reach USD 7598.8 million by 2032, growing at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Marine Emission Control Systems Market Size 2024 |

USD 4197.8 Million |

| Commercial Marine Emission Control Systems Market, CAGR |

7.7% |

| Commercial Marine Emission Control Systems Market Size 2032 |

USD 7598.8 Million |

The Commercial Marine Emission Control Systems Market is driven by stringent international maritime regulations, rising global shipping volumes, and growing adoption of green shipping practices. Operators invest in advanced scrubbers, selective catalytic reduction systems, and hybrid solutions to meet sulfur oxide and nitrogen oxide emission limits. It benefits from technological advancements such as fuel-flexible designs, corrosion-resistant materials, and IoT-enabled monitoring for real-time compliance tracking.

The Commercial Marine Emission Control Systems Market demonstrates strong adoption across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, driven by regulatory enforcement, port infrastructure upgrades, and the shift toward sustainable maritime operations. North America and Europe lead in technology integration, supported by advanced shipyard capabilities and strict compliance frameworks. Asia Pacific shows rapid expansion due to its shipbuilding dominance and increasing regional emission control measures, while Latin America and the Middle East & Africa are steadily aligning with global standards through port modernization and LNG-fueled fleet investments. Key players such as ALFA LAVAL, Fuji Electric, Clean Marine, and CR Ocean Engineering focus on delivering efficient, corrosion-resistant, and fuel-flexible solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Marine Emission Control Systems Market was valued at USD 4197.8 million in 2024 and is projected to reach USD 7598.8 million by 2032, growing at a CAGR of 7.7% during the forecast period.

- Stringent international maritime regulations, including IMO 2020 and MARPOL Annex VI, drive adoption of advanced emission control technologies across global fleets.

- The market trends toward hybrid systems, fuel-flexible designs, IoT-enabled monitoring, and predictive maintenance to enhance compliance and operational efficiency.

- Competition is shaped by leading players such as ALFA LAVAL, Fuji Electric, Clean Marine, and CR Ocean Engineering, which focus on innovation, corrosion-resistant materials, and strategic shipyard partnerships.

- High installation and operational costs, combined with complex regulatory requirements and space constraints on older vessels, act as restraints to rapid adoption.

- North America and Europe lead in technology deployment due to strict compliance standards and advanced shipyard capabilities, while Asia Pacific grows rapidly through shipbuilding dominance and emerging emission control zones.

- Latin America and the Middle East & Africa are expanding adoption through port modernization, LNG bunkering projects, and alignment with global emission standards, creating new opportunities for equipment suppliers.

Market Drivers

Stringent International Maritime Emission Regulations

The Commercial Marine Emission Control Systems Market is driven by increasingly strict global maritime emission standards, such as IMO 2020 and MARPOL Annex VI, which limit sulfur oxide and nitrogen oxide emissions. Compliance requires advanced systems capable of meeting low-emission thresholds in international waters and emission control areas. It pushes shipowners to adopt scrubbers, selective catalytic reduction systems, and hybrid solutions to avoid penalties. Enforcement by port authorities accelerates retrofitting across existing fleets. Regulatory pressure is particularly strong in regions with dense maritime traffic, prompting rapid adoption of certified technologies. Manufacturers invest in R&D to deliver systems that meet or exceed evolving compliance requirements.

- For instance, CR Ocean Engineering’s scrubber systems achieve sulfur removal at levels down to 0.1 percent, outperforming the mandated 0.5 percent threshold and demonstrating high compliance capability.

Rising Global Maritime Trade Volumes

The expansion of global shipping activities directly supports the demand for emission control systems. The Commercial Marine Emission Control Systems Market benefits from the steady increase in cargo transportation, which raises fuel consumption and emission levels. It compels shipping operators to install reliable control technologies to maintain operational licenses and safeguard environmental performance. Growth in containerized trade, bulk shipping, and passenger cruises sustains equipment demand across vessel classes. Emerging economies with expanding port infrastructure further contribute to new installations. Fleet modernization projects incorporate emission control as a standard requirement for long-term competitiveness.

- For instance, Alfa Laval’s PureSOx scrubber systems, used on numerous ships, enable compliance with environmental regulations by effectively reducing sulfur oxide emissions and supporting fuel efficiency. These systems are designed to remove over 98% of sulfur oxides and up to 80% of particulate matter from exhaust gases, exceeding IMO standards according to Alfa Laval.

Growing Focus on Green Shipping and Sustainability Goals

The marine sector’s commitment to sustainability drives investment in advanced emission control solutions. The Commercial Marine Emission Control Systems Market responds to shipping companies adopting environmental, social, and governance (ESG) frameworks. It creates opportunities for technologies that minimize fuel-related emissions while improving efficiency. Adoption of hybrid scrubbers and systems compatible with alternative fuels aligns with decarbonization strategies. Port authorities and logistics partners increasingly prioritize eco-certified vessels for preferential berthing and operational incentives. This shift enhances the commercial appeal of high-performance emission control systems.

Technological Advancements in Emission Reduction Solutions

Continuous innovation in system design and materials enhances the performance and cost-effectiveness of marine emission control technologies. The Commercial Marine Emission Control Systems Market benefits from advances in catalyst formulations, corrosion-resistant alloys, and automated monitoring systems. It allows operators to reduce maintenance intervals while ensuring consistent emission compliance. Integration with digital platforms enables real-time performance tracking and predictive maintenance. Advanced designs reduce energy consumption, lowering the overall environmental footprint of the systems themselves. Collaborative R&D between marine equipment suppliers and shipbuilders accelerates the deployment of next-generation solutions across global fleets.

Market Trends

Adoption of Hybrid and Fuel-Flexible Systems

The Commercial Marine Emission Control Systems Market is witnessing a growing shift toward hybrid systems capable of operating across multiple fuel types. Ship operators seek solutions that combine scrubbers with selective catalytic reduction to meet varied regional and voyage-specific regulations. It enables vessels to adapt to different emission control area requirements without extensive retrofits. Hybrid designs also provide operational flexibility as the industry moves toward low-sulfur fuels and alternative energy sources. Manufacturers are expanding portfolios to include systems compatible with LNG, methanol, and biofuels. This approach supports long-term compliance and protects investments against regulatory changes.

- For instance, CROE’s hybrid scrubber system reduces SO₂ emissions to below levels found in 0.1% sulphur fuel even when using high-sulphur fuel oil.

Integration of Digital Monitoring and Predictive Maintenance

Advances in digital technology are transforming emission control system management. The Commercial Marine Emission Control Systems Market benefits from the integration of IoT-enabled sensors and cloud-based analytics for real-time emissions tracking. It allows operators to detect deviations instantly and schedule maintenance proactively. Digital dashboards provide compliance documentation for port inspections, reducing administrative burdens. Predictive maintenance capabilities extend component lifespans and improve operational efficiency. The trend aligns with the broader adoption of smart shipping solutions across global fleets.

- For instance, PiServe’s IoT-powered fleet monitoring platform enables SMEC Marine to track key vessel operational metrics in real time—reporting parameters like engine status, emissions, and fuel usage through cloud dashboards with updates every minute.

Increased Retrofitting of Existing Fleets

Retrofitting older vessels with modern emission control systems is gaining momentum as operators aim to extend asset lifecycles. The Commercial Marine Emission Control Systems Market experiences steady demand for compact, modular designs that fit within space-constrained engine rooms. It offers a cost-effective route to meet current regulations without full vessel replacement. Retrofitting also allows shipowners to access emission-regulated ports and secure charter contracts. Shipyards and service providers are expanding retrofit capabilities to meet rising demand, especially in regions with stringent enforcement.

Focus on Corrosion-Resistant and Low-Maintenance Materials

Material innovations are shaping the next generation of marine emission control systems. The Commercial Marine Emission Control Systems Market is seeing wider use of duplex stainless steels, titanium alloys, and advanced coatings to withstand harsh marine environments. It reduces maintenance intervals and lowers total cost of ownership for operators. Resistance to acidic wash water and high-temperature exhaust gases enhances system reliability. Manufacturers are also optimizing designs for ease of inspection and part replacement. This focus on durability supports consistent performance in high-usage vessels, from cargo carriers to passenger ships.

Market Challenges Analysis

High Installation and Operational Costs

The Commercial Marine Emission Control Systems Market faces challenges from the substantial capital investment required for installation and integration. Advanced scrubbers, selective catalytic reduction units, and hybrid solutions involve high equipment and engineering expenses, which can deter smaller shipping operators. It also demands specialized shipyard facilities and skilled labor, further increasing project costs. Ongoing operational expenses, including reagent supply, maintenance, and periodic inspections, add to the financial burden. Fluctuating fuel prices and uncertain freight rates make it difficult for operators to commit to large-scale retrofits. Shipowners must carefully balance compliance needs with return on investment, slowing adoption in cost-sensitive segments.

Complex Regulatory Landscape and Technological Limitations

Compliance with marine emission standards requires navigating a complex mix of international, regional, and port-specific regulations. The Commercial Marine Emission Control Systems Market is challenged by varying enforcement levels and evolving environmental rules. It forces operators to invest in systems that can adapt to multiple emission thresholds and testing protocols. Technological limitations, such as space constraints on smaller vessels and integration issues with older engines, further complicate deployment. Harsh operating conditions can reduce system efficiency, demanding frequent maintenance or replacements. Manufacturers must address these engineering and regulatory challenges to ensure consistent market growth.

Market Opportunities

Expansion of Green Shipping Initiatives and Alternative Fuel Adoption

The Commercial Marine Emission Control Systems Market is positioned to benefit from the global push toward green shipping practices. Governments, regulatory bodies, and industry alliances are setting ambitious decarbonization targets, creating strong demand for systems that minimize harmful emissions. It opens opportunities for solutions compatible with alternative fuels such as LNG, methanol, ammonia, and biofuels. Hybrid emission control designs that operate across multiple fuel types offer shipowners flexibility while ensuring long-term compliance. Shipping companies aiming for ESG certification are likely to prioritize advanced, eco-efficient technologies. This trend creates a favourable environment for suppliers with proven expertise in fuel-flexible system engineering.

Growth Potential in Retrofit and Emerging Market Segments

Retrofitting existing fleets presents a significant opportunity for market expansion, particularly in regions with tightening environmental regulations. The Commercial Marine Emission Control Systems Market benefits from increasing investment in upgrading older vessels to extend operational life and maintain access to emission-restricted ports. It encourages the development of modular, space-saving designs that can be installed with minimal vessel downtime. Emerging markets in Asia, Latin America, and the Middle East are expanding port infrastructure, driving demand for compliant shipping solutions. Partnerships between global manufacturers and regional shipyards can accelerate adoption by offering localized production and maintenance support. This combination of regulatory pressure and infrastructure growth will continue to fuel demand for advanced emission control systems.

Market Segmentation Analysis:

By Technology

The Commercial Marine Emission Control Systems Market is segmented by technology into scrubbers, selective catalytic reduction (SCR) systems, exhaust gas recirculation (EGR) systems, and hybrid solutions. Scrubbers hold a leading share due to their effectiveness in removing sulfur oxides from exhaust gases and their compatibility with high-sulfur fuels. It enables ship operators to comply with IMO 2020 regulations while maintaining operational flexibility. SCR systems are gaining adoption for their ability to reduce nitrogen oxide emissions by over 90%, meeting stringent Tier III standards in emission control areas. EGR systems appeal to operators seeking integrated engine-based solutions with lower installation complexity. Hybrid configurations, combining multiple technologies, are increasingly favored for vessels operating across varying regulatory zones.

- For instance, scrubbers can extract 96–100% of SO₂ from exhaust gases, equating emissions to those produced with 0.1% sulfur fuel.

By Fuel

Market segmentation by fuel includes heavy fuel oil (HFO), marine diesel oil (MDO), liquefied natural gas (LNG), and alternative fuels such as methanol and biofuels. The Commercial Marine Emission Control Systems Market continues to see strong demand for systems compatible with HFO, driven by the cost advantage of this fuel when paired with efficient scrubbers. LNG-powered vessels require advanced control systems to manage methane slip while maintaining compliance with carbon reduction goals. It creates growth opportunities for emission control solutions optimized for dual-fuel engines. Methanol, ammonia, and biofuels are gaining interest as shipping companies explore low-carbon propulsion options, prompting development of adaptable emission control designs.

- For instance, Alfa Laval’s PureSOx scrubber operates on HFO with SO2 removal efficiency exceeding 98%, enabling vessels to meet IMO 2020 limits without switching to low-sulfur fuels.

By Application

By application, the market includes commercial cargo vessels, passenger ships, and offshore vessels. Cargo vessels represent the largest segment due to their global operational footprint and high fuel consumption, which makes them a priority for emission control retrofits and new installations. The Commercial Marine Emission Control Systems Market also serves the passenger ship segment, where compliance and environmental stewardship are critical for cruise operators. It drives the adoption of low-noise, compact, and aesthetically integrated systems to meet both operational and passenger experience requirements. Offshore vessels, including supply ships and drilling support units, demand rugged, corrosion-resistant systems capable of performing in harsh environments. Increasing offshore energy projects and deepwater exploration activities are expected to sustain demand in this segment.

Segments:

Based on Technology

- SCR

- Scrubber

- Wet

- Open Loop

- Closed Loop

- Hybrid

- Dry

- ESP

Based on Fuel

Based on Application

- Commercial

- Offshore

- Recreational

- Navy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 33% of the Commercial Marine Emission Control Systems Market, supported by strict enforcement of environmental standards under the U.S. Environmental Protection Agency (EPA) and the North American Emission Control Area (ECA) regulations. The region’s ports, including Los Angeles, Long Beach, and Vancouver, require vessels to comply with stringent sulfur oxide and nitrogen oxide limits. It drives adoption of scrubbers, selective catalytic reduction systems, and hybrid solutions across container ships, bulk carriers, and cruise lines. The U.S. and Canada benefit from strong ship repair and retrofit capabilities, enabling faster integration of advanced emission control technologies. Growth is also driven by increasing investments in LNG-powered vessels, which require specialized systems to control methane slip and ensure compliance.

Europe

Europe accounts for 30% of the global market, driven by strict environmental frameworks such as the European Union’s Sulphur Directive and the Baltic and North Sea ECAs. The region’s dense maritime traffic and high port activity in countries like Germany, the Netherlands, and Norway create strong demand for compliant emission control solutions. It benefits from government-backed green shipping incentives, including grants for retrofitting and transitioning to low-sulfur fuels. European shipyards have advanced expertise in integrating hybrid and fuel-flexible systems. The adoption rate is high among both commercial cargo operators and passenger cruise lines, especially in Scandinavia, where environmental stewardship is a competitive advantage.

Asia Pacific

Asia Pacific holds 24% of the Commercial Marine Emission Control Systems Market, fueled by rapid growth in maritime trade and port infrastructure. China, Japan, and South Korea are key contributors, with their extensive shipbuilding capacity and expanding fleets. It benefits from increasing domestic regulations targeting air pollution in coastal waters and emission control zones in major ports such as Shanghai, Busan, and Yokohama. LNG bunkering facilities are expanding, supporting the adoption of dual-fuel vessels that require advanced emission control solutions. Regional shipowners are also investing in retrofitting older vessels to meet international compliance, creating sustained demand for modular and compact systems.

Latin America

Latin America captures 8% of the global market, led by Brazil, Mexico, and Chile. Growth is supported by modernization of port facilities and gradual alignment with international maritime emission standards. It is driven by the adoption of emission control technologies in vessels servicing offshore oil and gas projects, as well as container and bulk cargo routes. Retrofitting opportunities are expanding as regional shipping companies seek to enter North American and European trade routes with stricter environmental requirements. Partnerships between global equipment suppliers and local shipyards are helping to improve accessibility and reduce installation lead times.

Middle East & Africa

The Middle East & Africa region holds 5% of the Commercial Marine Emission Control Systems Market, with adoption concentrated in the Gulf Cooperation Council (GCC) states and South Africa. Strategic ports such as Dubai, Abu Dhabi, and Durban are enforcing tighter emission controls to comply with international standards. It is supported by investments in LNG-fueled fleet expansion, particularly for tanker and offshore supply vessels. Harsh operational conditions in the region create demand for corrosion-resistant materials and robust system designs. Although market penetration is currently lower compared to other regions, upcoming regulatory shifts and growing maritime trade are expected to boost adoption rates in the near future.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CR Ocean Engineering

- Fuji Electric

- ALFA LAVAL

- ME Production

- Ecospray Technologies

- Langh Tech

- Clean Marine

- Babcock and Wilcox Enterprises

- Ecospec

- Tenneco

Competitive Analysis

ALFA LAVAL, Fuji Electric, Clean Marine, CR Ocean Engineering, Ecospray Technologies, and Tenneco are among the leading players in the Commercial Marine Emission Control Systems Market. These companies leverage advanced engineering capabilities to deliver high-performance scrubbers, selective catalytic reduction systems, and hybrid solutions that comply with global maritime emission regulations. They prioritize durability through the use of corrosion-resistant materials such as duplex stainless steel and titanium alloys, ensuring reliable operation in harsh marine environments. Product portfolios are increasingly focused on fuel-flexible systems compatible with LNG, methanol, ammonia, and biofuels to address evolving decarbonization strategies. Strategic collaborations with shipbuilders and retrofit service providers enable faster installation and integration across vessel classes. Leading players invest heavily in IoT-enabled monitoring solutions that offer real-time emission tracking, predictive maintenance, and compliance documentation to streamline port inspections. By combining technological innovation, regulatory expertise, and global service networks, these companies maintain strong market positions and meet the operational demands of both new-build and retrofit projects.

Recent Developments

- In July 2025, the company announced integration of Oberlin Filter’s automatic, low‑maintenance washwater filtration system with its scrubber units, enhancing closed-loop and hybrid exhaust gas cleaning performance.

- In June 2025, Alfa Laval secured an order to deliver the world’s first marine boiler system designed as an Ammonia Release Mitigation System (ARMS) for safe incineration of ammonia wastes aboard four dual‑fuel vessels, slated for delivery in 2027–2028.

- In June 2025, Ecospray, a company specializing in maritime carbon capture solutions, continued to develop its amine-based carbon capture technology, building upon the successful pilot trials conducted in 2023, actively advancing its offering towards commercialization within the shipping industry.

Market Concentration & Characteristics

The Commercial Marine Emission Control Systems Market is moderately concentrated, with a mix of established global manufacturers and specialized marine technology providers competing for market share. It is defined by high entry barriers driven by strict international maritime regulations, complex engineering requirements, and the need for certified compliance with IMO and regional emission standards. Leading players maintain an advantage through advanced R&D capabilities, fuel-flexible system designs, and proven track records in retrofitting and new-build installations. The market demands solutions that combine durability, corrosion resistance, and operational efficiency, supporting continuous vessel performance in harsh marine environments. Growing demand for hybrid systems, IoT-enabled monitoring, and compatibility with alternative fuels shapes product development priorities. Regional dynamics influence adoption patterns, with advanced economies favoring high-technology integration and emerging markets focusing on cost-effective, regulation-compliant solutions. Strong after-sales service networks, strategic shipyard partnerships, and the ability to deliver turnkey installations are key competitive factors sustaining market leadership.

Report Coverage

The research report offers an in-depth analysis based on Technology, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stricter global maritime emission regulations.

- Adoption of hybrid and fuel-flexible systems will increase across vessel types.

- IoT-enabled monitoring and predictive maintenance will become standard features.

- Demand for corrosion-resistant and low-maintenance materials will rise.

- Retrofitting of older vessels will create significant growth opportunities.

- Alternative fuels such as LNG, methanol, and ammonia will drive system innovation.

- Partnerships between equipment manufacturers and shipyards will strengthen installation capabilities.

- Digital compliance reporting will gain importance for port inspections.

- Emerging markets will accelerate adoption through port modernization projects.

- Technological integration will improve efficiency and reduce operational costs.