Market Overview

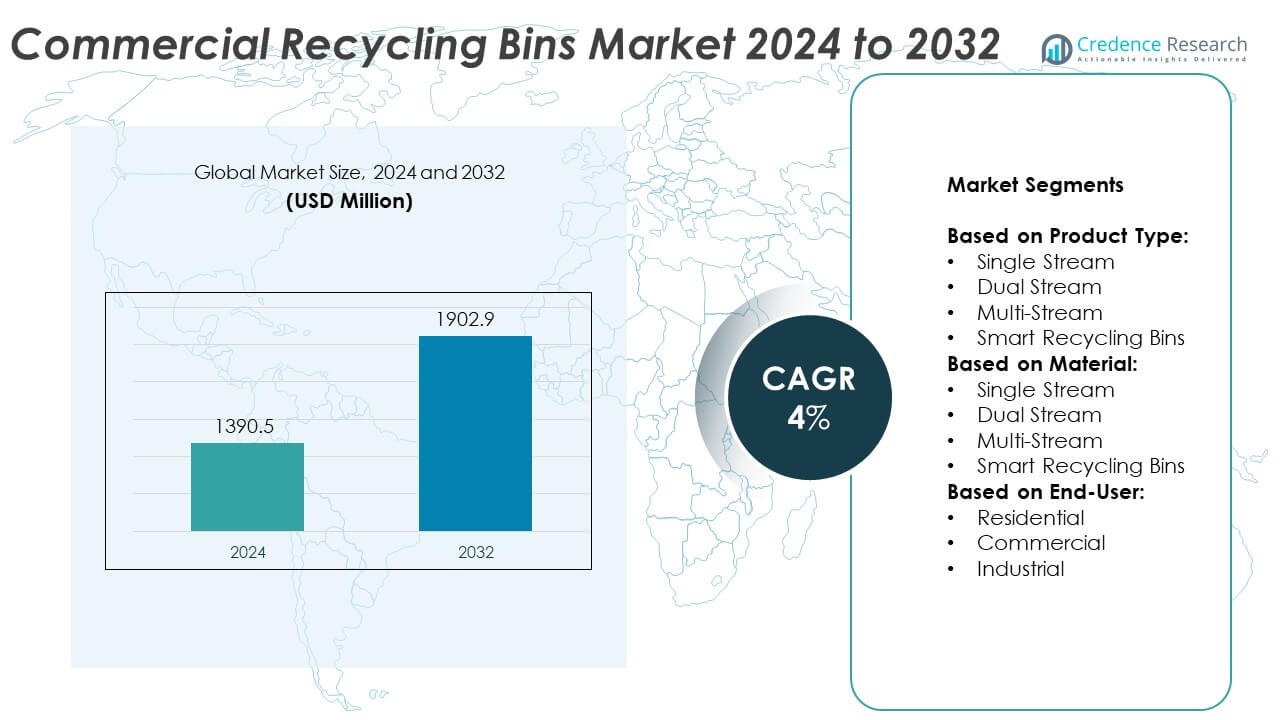

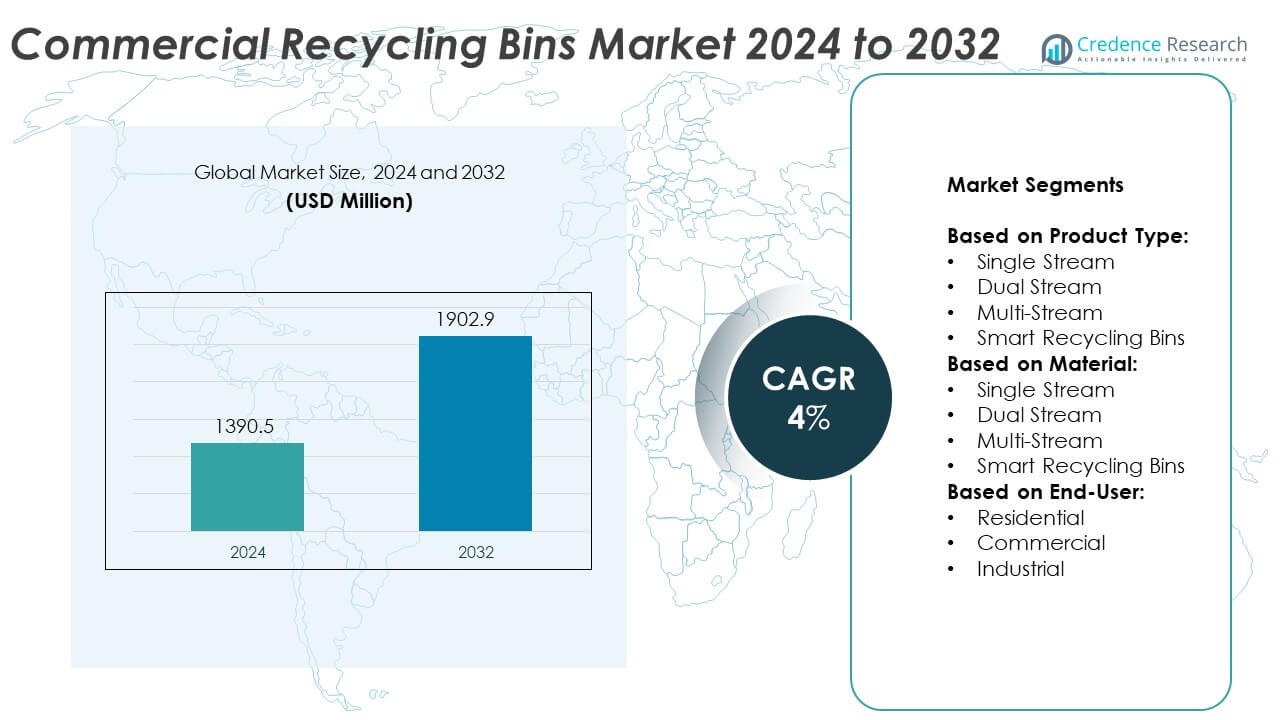

The Commercial Recycling Bins Market size was valued at USD 1390.5 million in 2024 and is anticipated to reach USD 1902.9 million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Recycling Bins Market Size 2024 |

USD 1390.5 Million |

| Commercial Recycling Bins Market, CAGR |

4% |

| Commercial Recycling Bins Market Size 2032 |

USD 1902.9 Million |

The Commercial Recycling Bins market grows due to rising demand for safe, efficient, and automated waste management solutions in commercial, industrial, and public facilities. Increasing enforcement of workplace safety regulations drives the adoption of reliable power isolation systems in recycling equipment. It benefits from the integration of IoT-enabled and smart monitoring features, enabling real-time performance tracking and predictive maintenance. Trends emphasize compact, modular designs.

The Commercial Recycling Bins market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with growth driven by urban infrastructure expansion, smart waste management initiatives, and stricter safety regulations. North America and Europe lead in adoption due to advanced technology integration and established waste management frameworks, while Asia Pacific shows rapid growth supported by smart city projects. Key players include Rubbermaid, Continental Commercial Products, and Toter, known for durable, innovative designs. Other notable participants such as Suncast and Safco Products focus on expanding product lines to meet diverse commercial and industrial requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Recycling market was valued at USD 1390.5 million in 2024 and is projected to reach USD 1902.9 million by 2032, growing at a CAGR of 4% during the forecast period.

- Growing emphasis on workplace safety and regulatory compliance drives demand for reliable disconnect switches in recycling bins, supporting safe power isolation and reducing operational risks.

- Rising adoption of IoT-enabled and smart monitoring technologies enhances operational efficiency, enabling predictive maintenance, real-time tracking, and integration with automated waste management systems.

- The market is competitive, with players such as Rubbermaid, Continental Commercial Products, Toter, and Suncast focusing on innovation, product durability, and customization to meet diverse sector needs.

- High initial investment in advanced disconnect switches and integration challenges with existing systems restrain adoption in cost-sensitive markets, limiting penetration among small and medium enterprises.

- Regional growth patterns show North America and Europe leading adoption due to advanced infrastructure and strong regulatory frameworks, while Asia Pacific experiences rapid expansion from urbanization and smart city projects.

- Increasing infrastructure development, green building certifications, and corporate sustainability programs create significant opportunities for manufacturers to offer energy-efficient, space-optimized, and industry-specific disconnect switch solutions for recycling bins.

Market Drivers

Rising Focus on Workplace Safety and Compliance

The Commercial Recycling Bins market benefits from increasing emphasis on workplace safety and adherence to regulatory standards. Industries and commercial facilities require reliable disconnect switches to ensure safe handling and maintenance of recycling equipment. Compliance with occupational safety guidelines drives the adoption of advanced safety mechanisms integrated into these switches. It supports operational safety by enabling quick and secure power isolation during maintenance or emergencies. Growing enforcement of safety protocols in public and private sector facilities strengthens the demand for such solutions. Manufacturers invest in developing products that meet or exceed safety certifications to maintain market competitiveness.

- For instance, Square D NEMA 1 safety switches offer current rating ranging from 10,000 to 20,000, enabling quick isolation of high-horsepower circuits.

Expansion of Sustainable Waste Management Practices

Sustainability goals encourage businesses to improve waste management systems, directly boosting the need for dependable in recycling bin operations. The Commercial Recycling Bins Disconnect Switch market sees growth from the rising integration of electrical and automated features in commercial recycling equipment. Disconnect switches facilitate smooth and safe equipment operation, enhancing efficiency and reducing downtime. It addresses the growing adoption of electric compaction systems in recycling bins, which require precise power control. Corporate sustainability commitments further drive the demand for reliable safety solutions. Government-led environmental programs also accelerate adoption across multiple sectors.

- For instance, Rubbermaid Sustain mixed recycling container includes modular customization and weighs approximately 14 kg, simplifying handling and maintenance in busy environments.

Technological Advancements in Recycling Equipment

Advances in recycling equipment design require matching innovations in electrical safety components. The Commercial Recycling Bins market benefits from the integration of smart monitoring features and compact switch designs. It enables better space utilization while maintaining operational reliability. Demand grows for switches with enhanced load-handling capacity to support high-performance recycling systems. Increased automation in recycling processes boosts the need for responsive and durable disconnect switches. Continuous research in materials and switch design ensures improved longevity and performance under heavy usage conditions.

Growing Commercial Infrastructure Development

The expansion of commercial buildings, industrial facilities, and public infrastructure creates more opportunities for the Commercial Recycling Bins market. Modern facilities incorporate advanced waste segregation and recycling systems, increasing demand for integrated disconnect switches. It supports scalable waste management solutions in large complexes such as malls, airports, and corporate campuses. Growing investments in green building projects also drive adoption of compliant and energy-efficient electrical components. The market benefits from urbanization trends and the retrofitting of older facilities with modern recycling systems. Global infrastructure growth continues to create long-term opportunities for manufacturers and suppliers.

Market Trends

Integration of Smart and IoT-Enabled Switches

The Commercial Recycling Bins market is witnessing a growing trend toward smart and IoT-enabled solutions. These switches allow remote monitoring and control, enabling facility managers to track equipment status in real time. It improves operational safety by providing instant alerts during faults or overloads. The trend supports predictive maintenance, reducing downtime and extending equipment life. IoT integration also aligns with sustainability goals by optimizing energy use in recycling operations. Manufacturers are investing in developing connected solutions to cater to technologically advanced facilities.

- For instance, Rubbermaid Commercial Products’ Sustain station supports capacities of 15 gal and 23 gallon (roughly 57 and 87 liters), offering scalable solutions for different venue sizes.

Shift Toward Compact and Modular Designs

Market demand is moving toward compact and modular disconnect switch designs for recycling equipment. The Commercial Recycling Bins market benefits from space-efficient solutions that fit seamlessly into automated systems. It helps maximize usable space within equipment housings while maintaining high safety standards. Modular designs enable quick replacement and customization based on operational needs. This trend aligns with the broader movement toward streamlined equipment layouts in commercial facilities. Lightweight yet durable materials are increasingly used to enhance portability and ease of installation.

- For instance, Eaton’s enclosed rotary switch models offer ampere ratings from 400 A within compact units capable of fitting into housings under 10 inches in depth.

Rising Preference for Energy-Efficient Components

Energy efficiency is becoming a major trend influencing design in recycling applications. The Commercial Recycling Bins Disconnect Switch market sees higher demand for switches that minimize power loss and support sustainable operations. It aligns with global energy conservation regulations and corporate environmental policies. Manufacturers focus on incorporating low-resistance contacts and advanced insulation to improve performance. This trend supports cost savings for operators while reducing carbon footprint. Adoption of such energy-conscious components is expected to grow steadily across industrial and commercial sectors.

Customization for Industry-Specific Applications

A trend toward industry-specific customization is shaping product development strategies. The Commercial Recycling Bins market responds to varying requirements from sectors such as retail, manufacturing, and public services. It involves designing switches with specific load capacities, enclosure ratings, and control features to meet distinct operational needs. This customization ensures compatibility with different recycling bin configurations and automation levels. The trend enhances user satisfaction and operational efficiency across diverse environments. Manufacturers are leveraging customer feedback to create targeted product lines that address unique market demands.

Market Challenges Analysis

High Initial Costs and Budget Constraints

The Commercial Recycling Bins market faces challenges from the relatively high initial cost of advanced safety switches. Many small and medium-sized enterprises delay adoption due to budget limitations, opting for lower-cost alternatives that may lack advanced features. It affects market penetration, particularly in cost-sensitive regions. High-quality disconnect switches with smart monitoring or energy-efficient designs require significant investment in manufacturing and materials. Limited funding for infrastructure upgrades in certain public and private sectors further restricts large-scale deployment. This cost barrier slows the replacement cycle of outdated equipment, impacting revenue growth for manufacturers.

Technical Integration and Maintenance Complexities

Complex integration with modern automated recycling systems presents another challenge for the Commercial Recycling Bins market. Compatibility issues between existing equipment and newer switch technologies can delay installation or require costly retrofitting. It increases downtime and impacts operational efficiency in high-volume facilities. Maintenance of advanced switches, especially IoT-enabled models, demands skilled technicians and ongoing technical support. A shortage of trained professionals in certain regions limits smooth adoption. Manufacturers must address these integration and servicing hurdles to ensure consistent performance and customer satisfaction.

Market Opportunities

Rising Demand from Smart Waste Management Initiatives

The Commercial Recycling Bins market holds significant opportunities from the expansion of smart waste management systems in commercial and public facilities. Integration of automation and IoT in recycling bins increases the need for reliable and responsive disconnect switches. It supports safe operation, quick power isolation, and enhanced monitoring capabilities in advanced waste-handling equipment. Governments and municipalities are investing in smart city projects, creating strong demand for such solutions. Corporate sustainability programs also encourage upgrades to high-performance recycling systems with advanced safety features. This shift opens new avenues for manufacturers to offer technologically advanced and eco-friendly products.

Growth Potential in Emerging Markets and Infrastructure Projects

Rapid urbanization and infrastructure development in emerging economies create expanding opportunities for the Commercial Recycling Bins market. Modern commercial complexes, airports, shopping centers, and industrial parks require efficient recycling systems with robust electrical safety mechanisms. It enables suppliers to target large-scale projects where integrated recycling equipment is part of the facility design. International green building certifications further drive the adoption of high-quality disconnect switches to meet safety and environmental standards. Market players can strengthen their position by offering region-specific designs that meet local regulations and operational conditions. Strategic partnerships with recycling equipment manufacturers in these markets can accelerate adoption.

Market Segmentation Analysis:

By Product Type:

The Commercial Recycling Bins market is segmented into single stream, dual stream, multi-stream, and smart recycling bins. Single stream bins dominate in environments where convenience and speed of disposal are priorities, supported by disconnect switches that ensure safe operation during maintenance. Dual stream bins gain adoption in facilities aiming for higher material recovery rates by separating recyclables at the source, requiring reliable power isolation systems. Multi-stream bins cater to large-scale operations and public spaces with diverse waste categories, benefiting from robust and durable disconnect switches. Smart recycling bins, equipped with sensors and automated compaction, demand advanced switch systems that enable efficient monitoring and fault protection. It supports integration with IoT-based waste management platforms, expanding their role in smart infrastructure projects.

- For instance, Siemens’ 3LD2 rotary switches cover ratings from 16 A to 250 A and meet IP65 protection, reducing energy leakage through high-quality insulation and robust handles.

By Material:

Segmentation by material includes metal, plastic, composite, and others. Metal bins are preferred for high-durability applications in industrial and public environments, where must withstand frequent use and exposure to harsh conditions. Plastic bins offer lightweight handling and corrosion resistance, making them suitable for indoor commercial use with compact and efficient switch designs. Composite materials combine strength and lightweight properties, creating opportunities for integrating advanced electrical components without compromising structure. Others include customized or hybrid materials tailored for specific operational needs, where the disconnect switch design adapts to unique bin configurations. It supports performance consistency across varied environments and usage patterns.

- For instance, Ultra‑Poly, a prominent company in recycled resin solutions, produces more than 320 million pounds of recycled plastic annually. This highlights the scale of their operations and the growing importance of recycled plastics in the market.

By End-User:

The end-user segment covers residential, commercial, and industrial applications. Residential adoption is rising in multi-unit housing complexes, where compact recycling bins with built-in safety switches enhance user convenience and safety. The commercial segment, including offices, malls, airports, and educational institutions, remains a key growth driver, supported by the need for high-capacity bins with advanced disconnect features. Industrial facilities demand heavy-duty bins with switches capable of managing higher electrical loads and frequent operational cycles. It addresses the stringent safety requirements and continuous operational demands of manufacturing and logistics environments. This segmentation reflects the diverse application scope, with each end-user category presenting distinct design and performance needs for disconnect switches.

Segments:

Based on Product Type:

- Single Stream

- Dual Stream

- Multi-Stream

- Smart Recycling Bins

Based on Material:

- Single Stream

- Dual Stream

- Multi-Stream

- Smart Recycling Bins

Based on End-User:

- Residential

- Commercial

- Industrial

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 35% of the Commercial Recycling Bins market, driven by strong adoption of advanced waste management technologies in the United States and Canada. Stringent safety regulations and environmental policies promote the integration of reliable disconnect switches in both public and private recycling systems. It benefits from widespread deployment of smart recycling bins in urban areas, supported by municipal and corporate sustainability programs. The presence of leading manufacturers and suppliers in the region ensures consistent innovation and product availability. High awareness of occupational safety standards encourages investment in safety-certified electrical components. Growth is further supported by large-scale infrastructure projects and retrofitting initiatives in commercial complexes, airports, and industrial facilities.

Europe

Europe accounts for 28% of the Commercial Recycling Bins market, with demand fueled by the region’s strict environmental regulations and circular economy targets. Countries such as Germany, the UK, France, and the Netherlands are at the forefront of adopting automated and smart waste management systems. It benefits from the region’s emphasis on sustainable design and integration of energy-efficient electrical components. High recycling rates in the European Union create a favorable environment for advanced safety technologies in recycling bins. Manufacturers focus on developing switches that comply with European safety and energy standards, supporting both residential and commercial applications. Investments in smart city initiatives further strengthen the market’s position across the region.

Asia Pacific

Asia Pacific holds 22% of the Commercial Recycling Bins market, supported by rapid urbanization and expanding commercial infrastructure in countries like China, Japan, India, and Australia. It benefits from increasing investment in waste management modernization and adoption of IoT-enabled recycling systems. Governments across the region implement stricter waste disposal regulations, driving demand for reliable and durable disconnect switches. The rise of smart city projects, particularly in China and Southeast Asia, accelerates integration of advanced safety technologies. Local manufacturing capabilities help reduce costs, improving accessibility for small and medium-sized facilities. Commercial and industrial adoption continues to grow alongside infrastructure expansion.

Latin Americ

Latin America represents 9% of the Commercial Recycling Bins market, with growth led by Brazil, Mexico, and Chile. It is driven by the gradual modernization of waste management systems and increased focus on workplace safety in commercial environments. Adoption of recycling bins with integrated disconnect switches remains higher in large metropolitan areas where waste volume is significant. Government initiatives to improve urban waste collection efficiency are creating new opportunities for advanced safety component suppliers. Challenges such as budget constraints and uneven infrastructure development limit wider adoption but present scope for gradual market penetration.

Middle East & Africa

The Middle East & Africa account for 6% of the Commercial Recycling Bins market, influenced by infrastructure growth and increasing environmental awareness. It benefits from large-scale commercial and public projects in Gulf countries, where integrated waste management systems are part of urban planning. In Africa, adoption remains concentrated in developed urban centers with established recycling programs. Growing demand for high-durability components that can operate in extreme environmental conditions supports market opportunities. Investments in green building projects and hospitality infrastructure further drive adoption in premium commercial facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Burgess Enterprises

- Continental Commercial Products

- Safco Products

- Eagle Manufacturing

- Avery Products Corporation

- Suncast

- Commercial Zone

- Victory Innovations

- Wooden Duck

- Industrial

- BPI

- InterMetro Industries

- Rubbermaid

- Toter

Competitive Analysis

The Commercial Recycling Bins market features leading players such as Rubbermaid, Continental Commercial Products, Toter, Suncast, and Safco Products, each contributing to innovation, product diversity, and market reach. These companies focus on developing high-quality disconnect switch-integrated recycling solutions that meet evolving safety and efficiency standards. They leverage advanced materials, smart monitoring capabilities, and modular designs to enhance performance in commercial, industrial, and public environments. Strong distribution networks and strategic partnerships with waste management system providers strengthen their market presence. Product differentiation through durability, customization, and compliance with regulatory requirements remains a core strategy. Continuous investment in R&D supports the integration of IoT features and energy-efficient components, appealing to customers pursuing sustainability goals. Competitive positioning is reinforced through targeted marketing, expansion into emerging markets, and adaptation of products to meet region-specific operational conditions. The market’s competitive landscape is defined by the ability to balance cost efficiency with technological advancement, ensuring reliable operation across diverse applications. Growing demand for smart waste management systems and infrastructure modernization initiatives provides these companies with opportunities to capture new customer segments while retaining their established base through consistent quality and innovation.

Recent Developments

- In 2024, Wingecarribee Shire Council is expanding waste services, including a review of the Community Waste Disposal Assistance scheme and improvements to existing waste services.

- In October 2023, commercial zone products unveiled the earthcraft series, a waste management solution tailored for retail businesses, schools, community centers, stadiums, and various other facilities. the earthcraft series boasts customization options and is constructed from uv-resistant recycled plastic, ensuring durability against the elements for both indoor and outdoor use.

- In January 2023, dtg recycle announced its acquisition of united recycling. based in Snohomish, Washington, united recycling specializes in metal recycling, commercial and demolition recycling, and organics services. operating from two material recovery facilities and a container fleet, united recycling serves king and Snohomish counties.

Market Concentration & Characteristics

The Commercial Recycling Bins market shows a moderate to high level of concentration, with a few established players holding significant influence through strong brand presence, extensive distribution channels, and diversified product portfolios. It is characterized by consistent innovation in design, integration of smart monitoring technologies, and adherence to strict safety and environmental standards. The market caters to a broad range of applications, from residential complexes to large-scale industrial and commercial facilities, requiring varying load capacities and customization. Product durability, ease of integration, and compliance with regional regulations are key competitive factors. It reflects a growing emphasis on sustainability, with manufacturers introducing energy-efficient and space-optimized solutions to align with global waste management goals. The competitive environment encourages strategic collaborations, product upgrades, and expansion into emerging markets to capture untapped demand. While barriers to entry exist due to technical expertise requirements and regulatory certifications, niche players can gain traction by targeting specific application segments with tailored solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increasing adoption of IoT-enabled disconnect switches for real-time monitoring and predictive maintenance.

- Demand will rise from smart city projects and modern urban waste management initiatives.

- Manufacturers will focus on compact, modular designs to optimize space in recycling equipment.

- Energy-efficient components will gain priority to meet global sustainability and regulatory targets.

- Integration with automated recycling systems will become a standard requirement across sectors.

- Customization for industry-specific applications will drive product differentiation and competitive advantage.

- Emerging markets will offer strong growth opportunities through infrastructure development and urbanization.

- Strategic partnerships between equipment manufacturers and component suppliers will strengthen market presence.

- Compliance with evolving safety and environmental regulations will remain a core focus for innovation.

- Replacement of outdated systems with advanced, durable, and smart-enabled switches will accelerate market expansion.