Market Overview:

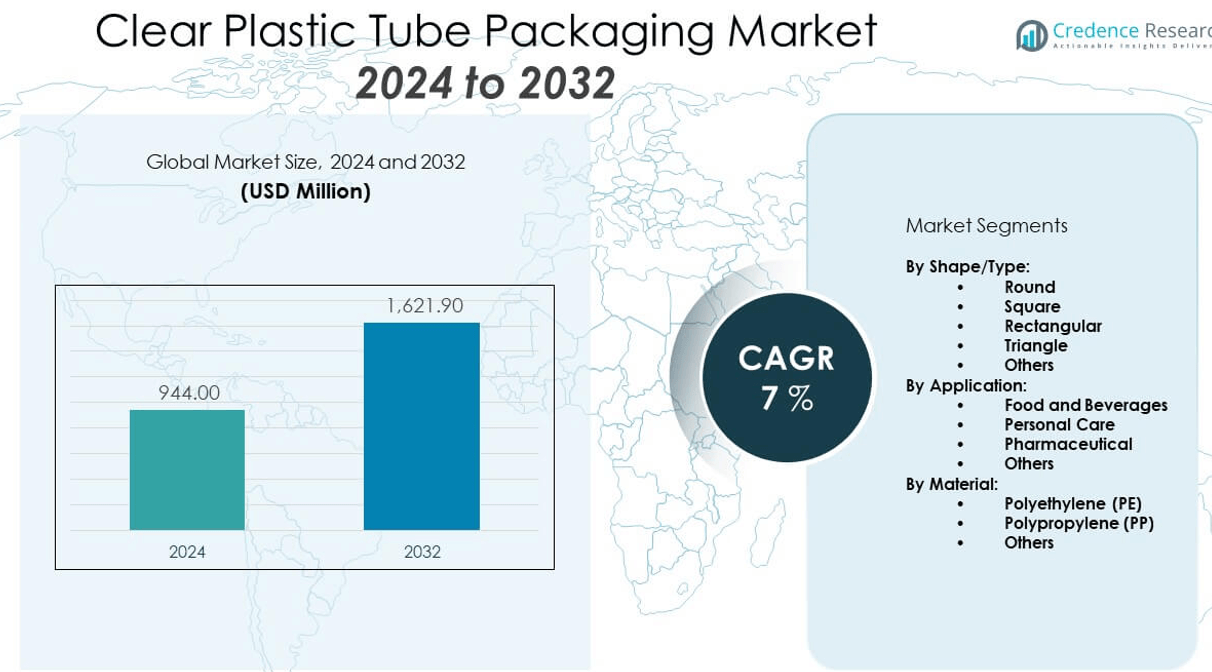

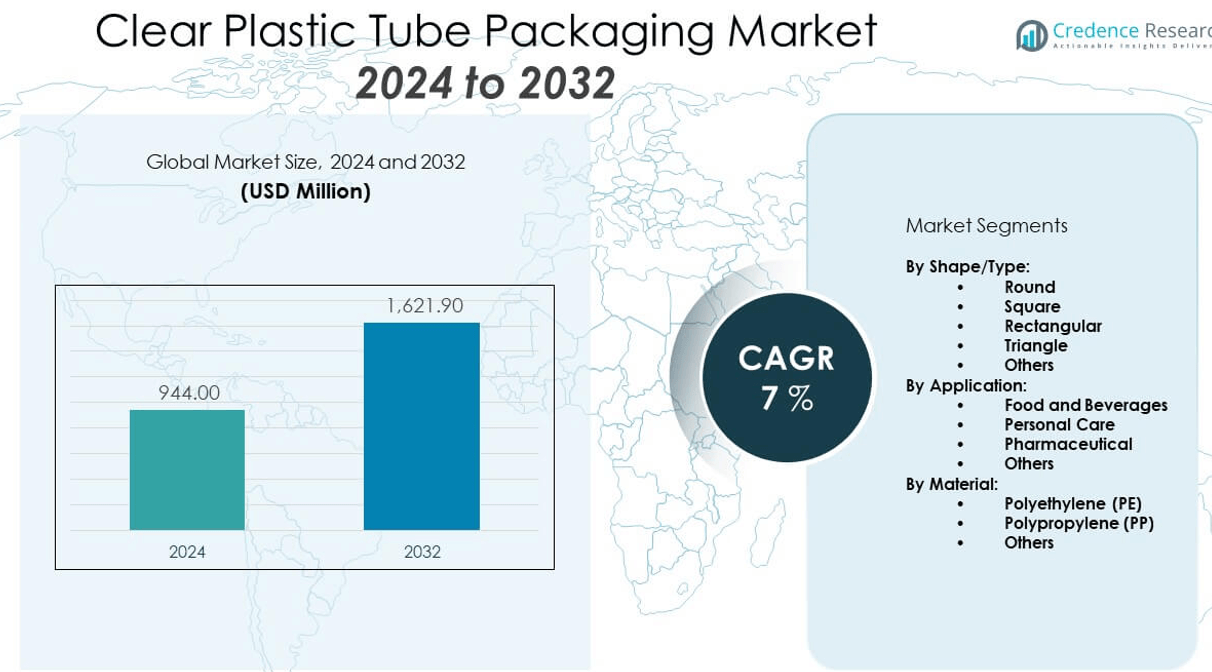

The Compostable Flexible Packaging Market is projected to grow from USD 1,367 million in 2024 to an estimated USD 2,245.4 million by 2032, with a compound annual growth rate (CAGR) of 6.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Flexible Packaging Market Size 2024 |

USD 1,367 million |

| Compostable Flexible Packaging Market, CAGR |

6.4% |

| Compostable Flexible Packaging Market Size 2032 |

USD 2,245.4 million |

Market growth is fueled by increasing regulatory pressure to curb plastic waste and heightened consumer awareness about sustainability. Brands are adopting compostable materials to meet eco-labeling standards and corporate ESG goals. Technological advancements in biopolymers such as PLA and PHA enable the development of durable, shelf-stable compostable films for food, personal care, and household goods. Retailers and manufacturers also support this shift through investments in certified industrial and home compostable formats, ensuring performance without compromising environmental goals.

Europe leads the compostable flexible packaging market due to strict EU legislation on single-use plastics and strong circular economy policies. Countries like Germany, France, and the Netherlands have established composting infrastructure, enabling market penetration. North America follows, supported by eco-conscious consumers and increasing bans on plastic bags and packaging. Asia Pacific is emerging, particularly in countries like India and Australia, where policy reforms and green investment initiatives are promoting sustainable packaging alternatives. Growth in these regions reflects rising demand for biodegradable solutions across food, retail, and e-commerce sectors.

Market Insights:

- The Compostable Flexible Packaging Market is projected to grow from USD 1,367 million in 2024 to USD 2,245.4 million by 2032, at a CAGR of 6.4% from 2024 to 2032.

- Regulatory bans on single-use plastics and growing ESG commitments are accelerating the shift toward certified compostable packaging solutions.

- Rising demand for compostable food wrappers, pouches, and mailers across retail and foodservice drives strong application growth.

- High production costs and limited performance in moisture- and oxygen-sensitive applications hinder broader industry adoption.

- Inadequate composting infrastructure and lack of consumer disposal awareness restrain the market’s sustainable impact.

- Europe leads due to stringent environmental regulations and a well-developed industrial composting network.

- Asia Pacific is emerging rapidly as local governments and startups promote bio-based packaging innovation and green investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Consumer Preference for Sustainable and Plastic-Free Alternatives:

The Compostable Flexible Packaging Market benefits from a widespread consumer shift toward eco-friendly and plastic-free packaging. Shoppers now demand transparency in sourcing, production, and disposal practices. This push for sustainable packaging is especially strong in food and personal care sectors. Consumers associate compostable packaging with health, safety, and environmental responsibility. Brands that align with these values build loyalty and gain a competitive edge. Retailers are also stocking more compostable options to meet this demand. Product differentiation based on environmental attributes influences buying decisions. This consumer-driven pressure creates continuous momentum in the Compostable Flexible Packaging Market.

- For instance,TIPA, an Israel-based pioneer in compostable packaging, has supplied fully compostable films used by Dutch supermarket chain Ekoplaza across over 80 store locations, resulting in the elimination of more than 50 metric tons of conventional plastic annually from their produce section.

Strict Regulatory Pressure Encouraging Biodegradable Packaging Adoption:

Regulatory authorities across Europe, North America, and Asia enforce bans or penalties on non-degradable plastics. These policies compel businesses to invest in certified compostable alternatives. Governments incentivize compostable packaging development through grants and sustainability mandates. This external regulatory framework has reshaped supply chains and procurement standards. It reinforces the transition from traditional plastic films to biopolymer-based flexible formats. The Compostable Flexible Packaging Market expands under this policy push, fostering innovation in materials and end-of-life solutions. Enforcement of Extended Producer Responsibility (EPR) schemes also drives change. Regulatory compliance becomes a growth catalyst and competitive requirement.

- For instance,BioBag’s compostable bags and wraps, certified to the EN 13432 standard in the EU, comply with municipal mandates in more than 150 Italian municipalities that require only compostable packaging for household organic waste collection.

Accelerating Innovation in Biopolymer Materials and Film Technologies:

Technology is playing a central role in enhancing the performance of compostable packaging. New formulations using PLA, PBS, PHA, and starch blends improve strength, heat resistance, and shelf life. Manufacturers develop multilayer and coated compostable films to meet industry-specific standards. Innovation supports applications in chilled, frozen, and liquid packaging. These advancements address durability concerns and widen usage across sectors. Packaging converters scale up R&D to match regulatory certifications. The Compostable Flexible Packaging Market integrates functional additives and bio-based inks. It evolves quickly with material science breakthroughs. Technology ensures compostability does not compromise packaging integrity.

Corporate Sustainability Commitments and Circular Economy Targets:

Global brands pledge carbon neutrality and zero-waste targets, directly influencing packaging choices. These sustainability roadmaps prioritize renewable and compostable materials. Companies invest in lifecycle assessments and traceability tools to validate claims. Circular economy strategies encourage closed-loop systems with compostable inputs. The Compostable Flexible Packaging Market gains traction as firms realign procurement with ESG metrics. Procurement teams integrate compostable options into sourcing portfolios. Sustainability ratings and public reporting further fuel adoption. Businesses seek long-term value through ethical sourcing and reduced landfill waste. Corporate alignment with green goals boosts consistent market penetration.

Market Trends:

Expansion of Home Compostable and Backyard-Compatible Packaging Formats:

Companies develop packaging formats that meet home composting standards instead of only industrial composting requirements. Certification bodies validate products for home compost systems, increasing accessibility for end users. Brands promote home compostable logos on packaging to improve consumer trust. Urban households without industrial facilities benefit from these solutions. The Compostable Flexible Packaging Market evolves to serve both decentralized and centralized waste systems. Consumers prefer packaging they can manage without third-party services. This trend supports adoption in regions with limited composting infrastructure. It influences product labelling and retail marketing strategies.

- For instance,Notpla, a London-based packaging innovator, achieved “Home Compostable” certification from TÜV Austria for its seaweed-based flexible films, which fully disintegrate in home compost conditions within 4–6 weeks, as verified in third-party lab testing in 2022.

Integration of Smart Labelling and QR Codes for Composting Guidance:

Manufacturers are incorporating digital tools into compostable packaging to enhance usability. QR codes offer disposal instructions, composting locations, and compliance information. These features simplify consumer participation in composting programs. The Compostable Flexible Packaging Market adopts traceability features to strengthen transparency. Interactive packaging supports educational campaigns and builds awareness. Smart labels also provide expiry data, ingredient origins, and sustainability metrics. This added functionality turns packaging into a consumer engagement platform. Brands use data-driven feedback from scanned codes to refine strategies. Digital tools bridge gaps in composting literacy and infrastructure.

- For instance, Evoware’s packaging is entirely biodegradable and meets relevant compostability standards, offering practical disposal instructions and supporting environmental outreach initiatives.

Adoption of Transparent and Barrier-Enhanced Biopolymer Films:

Traditional compostable films often lack barrier performance needed for perishables and liquids. To solve this, manufacturers now develop clear, moisture-resistant biopolymer films with enhanced barrier properties. These materials enable broader application across dairy, snacks, and beverages. The Compostable Flexible Packaging Market introduces solutions combining visibility and shelf stability. Brands demand clarity for visual appeal, especially in premium segments. Technology enables printing and sealing without degrading compostability. This shift increases compatibility with automated filling and sealing lines. Transparent biofilms support branding, product safety, and visual merchandising.

Use of Localized Sourcing and Decentralized Manufacturing Models:

Supply chain disruptions and emission goals push companies to localize raw material sourcing. Producers set up decentralized plants to reduce transport emissions and promote traceability. The Compostable Flexible Packaging Market benefits from this regional production strategy. Local feedstocks like corn starch, cassava, or sugarcane reduce dependence on global imports. Decentralized models also support job creation and regional economic development. Sourcing locally improves carbon footprints and boosts sustainability reporting. It ensures responsiveness to local policy shifts and customer expectations. Brands showcase local impact as a differentiator in packaging communication.

Market Challenges Analysis:

Limited Composting Infrastructure and End-of-Life Management Gaps:

Infrastructure for composting remains insufficient in many regions, particularly in emerging economies and suburban areas. Even in urban settings, industrial composting facilities may lack the capacity to handle large volumes of compostable packaging. This misalignment between packaging innovation and waste disposal capabilities creates functional bottlenecks. Consumers may discard compostable packaging in regular bins, reducing its environmental value. The Compostable Flexible Packaging Market faces skepticism from buyers unsure of proper disposal outcomes. Without investment in parallel waste processing systems, market adoption slows. Education and infrastructure development must move in sync to bridge this gap.

Cost Competitiveness and Material Performance Limitations Compared to Conventional Films:

Compostable packaging materials are still priced higher than petroleum-based plastic films. Biopolymers require specialized processing and certifications, increasing manufacturing costs. Many buyers in cost-sensitive sectors remain hesitant to switch, despite regulatory pressure. In some cases, compostable films underperform in high-barrier, high-speed applications. Packaging converters must often redesign machinery to handle alternative materials, further raising investment needs. The Compostable Flexible Packaging Market encounters resistance from large-scale processors balancing performance and economics. Without price parity and machinery compatibility, adoption remains limited in competitive segments. Scaling production and reducing raw material costs will be essential to overcome this challenge.

Market Opportunities:

Growing Demand Across Foodservice, E-Commerce, and Agricultural Packaging Segments:

Demand for compostable formats rises in foodservice, where single-use bans drive adoption of sustainable wrappers, sachets, and liners. E-commerce platforms adopt compostable mailers and pouches to replace traditional plastics. Agricultural producers seek biodegradable mulch films and crop covers. The Compostable Flexible Packaging Market finds new opportunities across short-cycle, disposable applications. These segments align well with compostable materials’ end-of-life potential. Partnerships with delivery platforms and retail chains create rapid market entry channels. Growth in these end-use industries supports volume scalability and public visibility for compostable innovations.

Strategic Collaborations and Certification Expansion Strengthen Market Confidence:

Collaborations between packaging firms, composting companies, and standard bodies strengthen ecosystem integration. Global certifications such as OK Compost, BPI, and TUV improve buyer confidence. The Compostable Flexible Packaging Market gains trust through third-party validation. Brands highlight certification logos on packaging to support marketing claims. These partnerships also streamline testing, labelling, and product launch cycles. Standardized criteria and global benchmarks reduce market fragmentation. With stronger validation and shared platforms, market participants reduce barriers to entry and accelerate consumer acceptance.

Market Segmentation Analysis:

By Product Type

The Compostable Flexible Packaging Market includes bags & pouches, films & wraps, and trays & clamshells. Bags & pouches lead the segment due to high demand in food, beverage, and retail packaging. Their ease of use, resealability, and compatibility with automated filling lines support wide adoption. Films & wraps see strong uptake in fresh produce, snacks, and bakery segments where lightweight and shelf-life protection are critical. Trays & clamshells gain popularity in foodservice, driven by the growth of takeout and ready-to-eat meals.

- For instance, Amcor’s AmLite Ultra Recyclable pouch is one of the few flexible packaging solutions certified by cyclos-HTP Institute, an independent laboratory validating recyclability and composability.

By Material

This segment comprises bioplastics—particularly PLA and PHA—and paper & paperboard. Bioplastics hold a dominant position, offering compostability, lightweight design, and sufficient functional properties for many packaging needs. PLA remains cost-effective and process-friendly, while PHA provides better biodegradation and temperature resistance. Paper & paperboard appeal to consumers seeking plastic-free packaging, especially in dry goods and personal care items. It adapts well to flexographic printing and recyclable labelling.

- For instance, Danimer Scientific’s Nodax Polyhydroxyalkanoate (PHA) resin is the first bioplastic to be certified by TÜV Austria (formerly Vinçotte) as biodegradable and compostable in all environments: industrial, home, soil, freshwater, and marine. Its certifications confirm biodegradation in less than a year for most conditions and full food contact safety per FDA approval.

By End-Use/Application

Key end-use segments include food & beverage packaging, retail & consumer goods, and healthcare & pharmaceuticals. Food & beverage packaging leads the market, supported by regulations on single-use plastics and growing preference for sustainable packaging. Retail & consumer goods companies integrate compostable formats to boost sustainability credentials and reduce plastic dependency. Healthcare & pharmaceuticals emerge as a new opportunity, focusing on eco-friendly packaging for OTC products and personal healthcare lines. The Compostable Flexible Packaging Market aligns these applications with environmental goals and evolving consumer expectations.

Segmentation:

By Product Type

- Bags & Pouches

- Films & Wraps

- Trays & Clamshells

By Material

- Bioplastics (notably PLA and PHA)

- Paper & Paperboard

By End-Use/Application

- Food & Beverage Packaging

- Retail & Consumer Goods

- Healthcare & Pharmaceuticals

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Maintains Market Leadership with Robust Infrastructure and Policy Support

Europe holds the largest share in the Compostable Flexible Packaging Market at 38%, driven by strong regulatory mandates, mature waste management systems, and circular economy initiatives. Countries such as Germany, France, and the Netherlands enforce strict packaging waste directives and actively support compostable material certification schemes. Leading packaging manufacturers in the region collaborate with municipal composting facilities to ensure material compatibility and performance. Retailers and food producers align with EU Green Deal goals, accelerating adoption of certified compostable formats. Public awareness campaigns and EPR policies further boost market confidence and scale. Europe continues to be the benchmark for compostable packaging adoption and policy-driven innovation.

North America Expands Through Corporate Sustainability and State-Level Legislation

North America captures 32% share of the Compostable Flexible Packaging Market, driven by growing corporate ESG targets and state-level restrictions on single-use plastics. Brands in the U.S. and Canada increasingly invest in compostable film solutions across foodservice, grocery, and e-commerce channels. Municipal composting remains fragmented, but pilot programs in California, Oregon, and New York support scalable adoption. Strategic partnerships between brands and composting firms aim to address collection and sorting challenges. Consumer education campaigns improve understanding of disposal protocols. It leverages technological innovation and market-driven sustainability to expand compostable formats in high-volume sectors.

Asia Pacific Emerges as a High-Growth Region with Policy Shifts and Local Sourcing

Asia Pacific holds 21% share of the Compostable Flexible Packaging Market and shows strong growth potential due to policy reforms, green investment, and local biopolymer production. Countries like India, China, Japan, and Australia support bans on plastic packaging and promote indigenous alternatives. Local sourcing of compostable feedstocks such as corn starch and cassava reduces dependence on imports and supports regional manufacturing. Packaging startups collaborate with government-led sustainability initiatives to scale compostable solutions in retail and agriculture. Rising urbanization and e-commerce adoption drive demand for low-impact, disposable packaging formats. It expands quickly in response to environmental concerns and increasing industrial capacity.

Rest of the World accounts for the remaining 9% share, including Latin America, the Middle East, and Africa. These regions show slower growth due to limited infrastructure but receive growing attention through international partnerships and NGO-driven sustainability programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Mondi Group

- BASF SE

- Smurfit Kappa

- Stora Enso

- WestRock Company

- DS Smith

- International Paper

- NatureWorks LLC

- TIPA Ltd

Competitive Analysis:

The Compostable Flexible Packaging Market features a moderately consolidated landscape with a mix of global packaging giants and specialized sustainable packaging firms. Key players such as Amcor plc, Mondi Group, BASF SE, and NatureWorks LLC invest heavily in material innovation and certification to maintain competitive advantage. Companies focus on developing high-barrier, printable, and certified compostable films to serve diverse end-use sectors. Strategic collaborations, regional expansions, and vertically integrated operations define competitive positioning. It reflects a strong emphasis on R&D, sustainability compliance, and alignment with circular economy targets. Players differentiate through compostability certifications, feedstock traceability, and scalable supply capabilities.

Recent Developments:

- In June 2025, Stora Enso entered into a strategic partnership with Matrix Pack, aimed at advancing the development and scale-up of formed fiber packaging. Stora Enso acquired a minority stake in Matrix Pack and joined its board, leveraging both firms’ strengths in renewables, global manufacturing, and commercialization. This partnership accelerates the adoption and industrial scaling of compostable, fiber-based packaging as a replacement for plastic-based formats.

- In May 2025, BASF SE entered a strategic partnership with Metpack to introduce home-compostable packaging for the food industry. This collaboration uses Metpack’s paper Ezycompost and BASF’s ‘ecovio 70 PS14H6’ biopolymer to create packaging solutions certified for home composting, allowing for safe disposal and high performance with exposure to liquids, heat, and food applications.

- In April 2025, Mondi Group completed the acquisition of Schumacher Packaging’s Western Europe operations, thereby adding more than 1 billion square meters of packaging capacity and expanding its corrugated portfolio to offer more sustainable and innovative solutions for eCommerce and FMCG sectors. This acquisition allows Mondi to further meet the demand for compostable flexible packaging through enhanced product range, production flexibility, and stronger supply security.

Market Concentration & Characteristics:

The Compostable Flexible Packaging Market exhibits moderate market concentration with a mix of established global players and emerging regional participants. It demonstrates strong innovation intensity and regulatory-driven product development. Companies compete on compostability standards, barrier performance, and alignment with sustainability goals. The market favors certified materials and scalable manufacturing processes. Industry characteristics include short innovation cycles, growing consumer influence, and pressure for transparency across the packaging lifecycle.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material, and End-Use/Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Regulatory bans on single-use plastics will continue to drive material shifts across food and retail packaging.

- Biopolymer innovations will improve strength, barrier performance, and compostability under various conditions.

- Home compostable formats will gain traction in regions lacking industrial composting infrastructure.

- Large brands will scale adoption of compostable packaging to meet ESG and lifecycle impact goals.

- E-commerce packaging will create high-volume opportunities for compostable mailers and wraps.

- Emerging economies will invest in green infrastructure, accelerating market entry for sustainable packaging.

- Consumer awareness and labeling clarity will improve adoption across all age groups and regions.

- Strategic partnerships between material producers and CPG brands will enable rapid product rollouts.

- Investments in certification and traceability systems will enhance trust and market compliance.

- Market competition will intensify, encouraging localized production and innovation in compostable formats.