Market Overview:

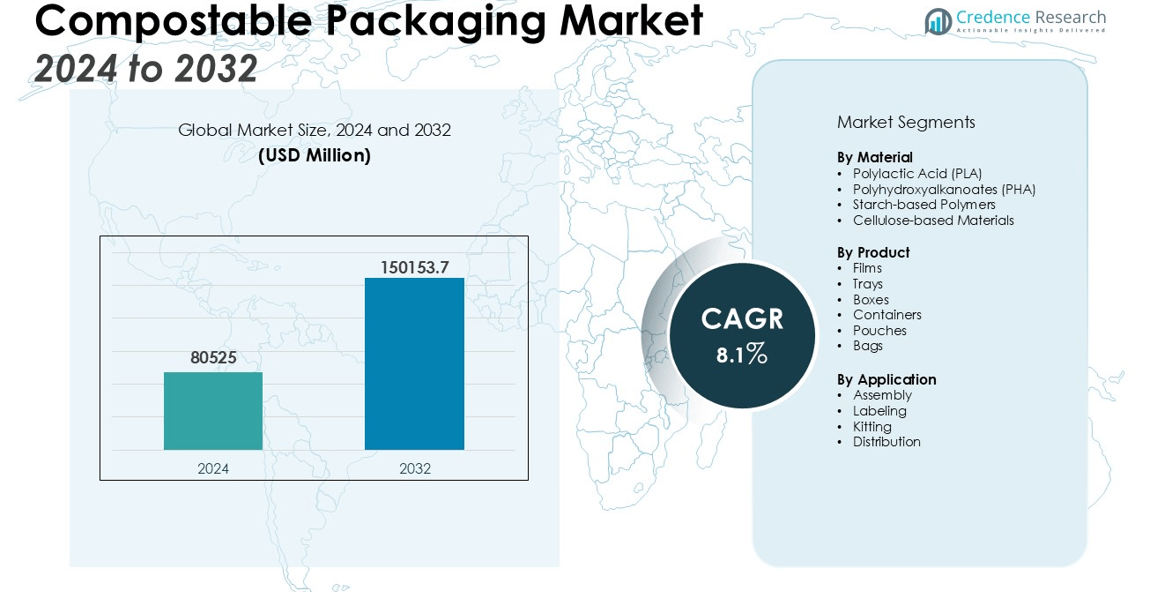

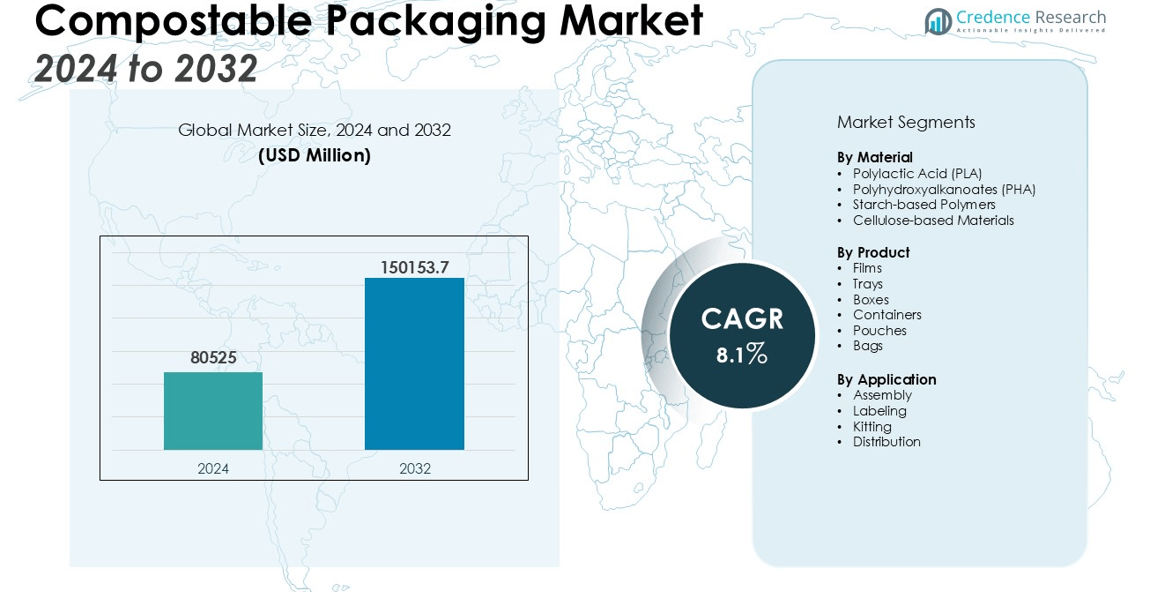

The Compostable Packaging Market size was valued at USD 80525 million in 2024 and is anticipated to reach USD 150153.7 million by 2032, at a CAGR of 8.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Packaging Market Size 2024 |

USD 80525 million |

| Compostable Packaging Market, CAGR |

8.1% |

| Compostable Packaging Market Size 2032 |

USD 150153.7 million |

Several key drivers are propelling the growth of the compostable packaging market. The increasing awareness of the environmental impact caused by plastic packaging has significantly boosted the demand for sustainable alternatives. In addition, global regulatory pressures to reduce plastic usage, combined with the growing consumer preference for environmentally friendly products, are contributing to wider market adoption. Additionally, the shift towards compostable packaging by foodservice companies and retailers aiming to align with sustainability initiatives is playing a crucial role in market expansion.

Regionally, North America commands the largest share of the compostable packaging market, driven by stringent government regulations and strong consumer demand for sustainable packaging solutions. Europe follows closely, supported by its proactive approach to sustainability and policies aimed at reducing plastic waste. The Asia Pacific region is anticipated to experience the highest growth, driven by the increasing adoption of compostable packaging in emerging markets, along with a growing shift toward sustainable practices in the packaging industry. Increased governmental support and rising awareness in key countries such as China and India are expected to significantly accelerate market development in this region.

Market Insights:

- The compostable packaging market was valued at USD 80525 million in 2024 and is expected to reach USD 7 million by 2032, with a CAGR of 8.1%.

- Increasing awareness of the environmental impact of plastic packaging is driving the demand for sustainable alternatives, especially in industries like foodservice and retail.

- Strict government regulations aimed at reducing plastic waste are accelerating the adoption of compostable packaging solutions across various sectors.

- Rising consumer demand for eco-friendly products is pushing businesses to incorporate compostable packaging into their strategies to meet sustainability expectations.

- Advancements in compostable materials and packaging technologies are improving product performance, making eco-friendly options more affordable and scalable.

- High production costs and limited availability of raw materials remain challenges to the widespread adoption of compostable packaging solutions.

- North America leads the market with a 40% share, followed by Europe at 35%, while the Asia Pacific region is poised for significant growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Environmental Awareness Driving Demand for Sustainable Alternatives

The growing recognition of the environmental damage caused by plastic packaging is a key driver of the compostable packaging market. As concerns over plastic waste and its detrimental effects on ecosystems intensify, consumers are increasingly seeking alternatives that align with their sustainability values. In response to this shift, businesses are prioritizing eco-friendly packaging solutions. The demand for compostable materials has expanded across industries, particularly in foodservice and retail, where companies are under pressure to meet environmental expectations. This heightened awareness is prompting both consumers and manufacturers to make sustainable choices, further accelerating the adoption of compostable packaging.

Stringent Regulations and Policies Promoting Sustainable Packaging Solutions

Government regulations aimed at reducing plastic waste play a crucial role in driving the growth of the compostable packaging market. Many regions, particularly in Europe and North America, are introducing stricter policies that limit the use of single-use plastics. As a result, industries are turning to compostable packaging as a viable alternative. Regulatory frameworks that promote recycling, waste reduction, and sustainable manufacturing have further heightened the demand for compostable materials. The market is responding to these regulations by enhancing production capacity, improving product quality, and fostering innovation to meet the growing need for sustainable packaging solutions.

- For instance, AMS Compostable, a U.S.-based manufacturer, has achieved a monthly production capacity of over 1,000,000 cubic feet of compostable foodservice packaging, meeting the increasing demand for plastic alternatives in the hospitality and foodservice sectors.

Evolving Consumer Preferences for Eco-friendly Products

A significant factor in the compostable packaging market’s growth is the shifting consumer preference towards environmentally responsible products. As sustainability becomes a core value for many consumers, packaging choices have become a key factor in purchasing decisions. Consumers are increasingly inclined to choose products that are packaged with compostable or biodegradable materials, as they recognize the positive environmental impact. This evolving consumer behavior is pushing brands across various sectors to align their packaging strategies with eco-conscious ideals. Companies that incorporate compostable packaging not only meet the demands of today’s environmentally aware consumers but also build brand loyalty and attract new, sustainability-focused customers.

- For instance, in 2022, Dell Technologies shipped over 565,000 computer units in molded pulp packaging—which is compostable and fiber-based—replacing traditional plastic foam within that portion of their product portfolio.

Innovation in Compostable Materials and Packaging Technologies

Ongoing innovation in compostable materials and packaging technologies is propelling the growth of the compostable packaging market. Advances in bioplastics and biodegradable materials, such as polylactic acid (PLA), are making compostable packaging more accessible and effective for a wide range of applications. These innovations have significantly improved the strength, durability, and cost-effectiveness of compostable materials, expanding their use beyond niche markets into mass-market packaging solutions. With the continued development of new technologies, compostable packaging is becoming more versatile, sustainable, and affordable. These advancements are driving increased adoption across industries and enabling the market to scale in response to rising demand.

Market Trends:

Growing Adoption of Compostable Packaging in the Food and Beverage Sector

The food and beverage sector is increasingly embracing compostable packaging, reflecting a key trend in the compostable packaging market. This shift is largely driven by rising consumer demand for sustainable packaging options, as more individuals seek environmentally responsible products. In response, foodservice companies and packaged food producers are adopting compostable materials to meet consumer expectations and regulatory requirements. Governments worldwide are introducing stricter regulations on single-use plastics, further pushing the industry toward eco-friendly alternatives. Innovations in compostable materials, including plant-based plastics and biodegradable films, have made these solutions more viable for large-scale production. As consumer awareness of environmental issues grows, brands in the food and beverage sector are leveraging compostable packaging as part of their sustainability initiatives, improving both their environmental impact and brand perception.

- For example, the Government of Canada implemented the Single-use Plastics Prohibition Regulations in June 2022, banning six categories of single-use plastic items nationwide, thereby influencing food businesses to adopt compostable packaging for millions of meals served annually.

Advancements in Compostable Material Innovation and Technology

The compostable packaging market is experiencing significant advancements in material innovation and packaging technologies. Research into biodegradable plastics, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), has expanded the range of compostable options available, making them suitable for diverse applications across various industries. These innovations are not only enhancing the performance and functionality of compostable packaging but also making it more cost-effective. Improvements in manufacturing processes are increasing efficiency and scalability, enabling companies to produce compostable packaging at a larger scale. As the development of new materials continues, compostable packaging solutions are expected to become more versatile and accessible, leading to further market growth and wider adoption beyond food and beverage sectors.

- For instance, NatureWorks is advancing PLA technology with its Blair, Nebraska facility, which currently has a production capacity of 150,000 metric tons of Ingeo PLA biopolymer annually, making it one of the largest PLA manufacturing plants globally.

Market Challenges Analysis:

High Cost and Limited Availability of Compostable Materials

A significant challenge facing the compostable packaging market is the high cost associated with compostable materials. The production of biodegradable plastics and other sustainable packaging materials tends to be more expensive than traditional plastic options. This price premium is due to factors such as the sourcing of raw materials and the complexities involved in manufacturing processes. As a result, businesses, particularly those in cost-sensitive sectors, may hesitate to adopt compostable packaging solutions. Furthermore, the limited availability of raw materials such as plant-based inputs can restrict production capacity, making it challenging for suppliers to meet growing demand. This combination of high costs and supply chain limitations presents a barrier to the broader adoption of compostable packaging solutions across various industries.

Consumer and Industrial Misunderstanding of Compostable Packaging

A key challenge for the compostable packaging market is the lack of understanding among consumers and businesses regarding proper disposal methods. Many consumers are unaware that compostable packaging requires specific conditions, such as industrial composting facilities, to break down effectively. Without proper disposal infrastructure, compostable materials may end up in landfills, where they do not decompose as intended. Similarly, companies may face difficulties integrating compostable materials into their existing packaging systems due to logistical challenges and insufficient infrastructure for composting. These misunderstandings regarding the environmental benefits of compostable packaging could slow its widespread adoption.

Market Opportunities:

Growing Demand for Sustainable Packaging Across Multiple Industries

The rising consumer preference for environmentally responsible products is creating significant opportunities for the compostable packaging market. Industries such as food and beverage, consumer goods, and cosmetics are increasingly adopting sustainable packaging solutions to meet demand. As environmental regulations around plastic packaging become more stringent, businesses are seeking alternatives that align with sustainability goals while maintaining product integrity. Compostable packaging offers a practical solution, enabling companies to reduce their carbon footprint and enhance brand reputation. With more industries shifting towards eco-friendly practices, the compostable packaging market is well-positioned to benefit from this growing trend, providing substantial opportunities for expansion.

Advancements in Compostable Material Development and Waste Management Infrastructure

Technological advancements in compostable material development, combined with improvements in waste management infrastructure, present key opportunities for the compostable packaging market. Innovations in bioplastics and biodegradable materials are making compostable packaging more affordable and scalable for widespread use. Additionally, the expansion of composting facilities and more efficient waste management systems create the necessary infrastructure to support increased adoption of compostable packaging. These advancements not only reduce the environmental impact of packaging but also improve its accessibility to businesses across various sectors. As consumers become more conscious of sustainability, businesses will increasingly turn to compostable packaging, driving further growth in the market.

Market Segmentation Analysis:

By Material

The compostable packaging market is primarily driven by materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based polymers. PLA leads the market due to its widespread use in food packaging applications, offering a biodegradable alternative to conventional plastics. These materials align with sustainability goals, as they decompose efficiently under industrial composting conditions, making them ideal for reducing environmental impact.

- For instance, NatureWorks’ Ingeo™ 2003D grade PLA achieves a melt flow index of 6 grams/10 minutes at 210°C, demonstrating suitability for extrusion-based packaging applications.

By Product

In terms of product types, the market includes films, trays, boxes, and containers. Films are widely used for food packaging due to their flexibility, lightweight nature, and ability to protect products. Trays and containers are becoming increasingly popular in the foodservice sector, particularly for takeout and delivery services. These products are designed to offer sustainability without compromising functionality, catering to the growing demand for eco-friendly packaging solutions.

- For instance, ProAmpac unveiled the ProActive Recyclable Fresh Tray FT-1000, a foam polypropylene tray comprised of 90% air, delivering robust impact resistance and achieving approval for curbside recycling in the U.S. market.

By Application

The compostable packaging market is heavily influenced by demand from the food and beverage sector, which accounts for the largest share. Consumers’ growing preference for environmentally responsible packaging in foodservice, retail, and takeaway applications is driving this demand. Other key applications include personal care and consumer goods, where companies are adopting compostable packaging to meet both consumer expectations and regulatory requirements. As sustainability trends evolve, industries across the board are incorporating compostable materials into their packaging strategies.

Segmentations:

By Material

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-based Polymers

- Cellulose-based Materials

By Product

- Films

- Trays

- Boxes

- Containers

- Pouches

- Bags

By Application

- Food and Beverage

- Personal Care and Cosmetics

- Consumer Goods

- Healthcare

- Electronics

- Homecare

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Strong Regulatory Support and High Consumer Demand

North America commands a 40% share in the compostable packaging market, driven by stringent government regulations and strong consumer demand for sustainable packaging solutions. The United States and Canada have introduced policies to reduce plastic waste and encourage the use of eco-friendly alternatives, significantly impacting industries such as foodservice, retail, and cosmetics. As consumers become more environmentally conscious, businesses are increasingly adopting compostable packaging to meet sustainability goals. This growing preference for green alternatives, combined with robust regulatory frameworks, positions North America as a leader in the compostable packaging market. The region’s regulatory support and consumer-driven demand are expected to continue driving the market forward.

Europe: Leading with Sustainability-Focused Policies

Europe holds a 35% share in the compostable packaging market, largely due to its emphasis on sustainability and comprehensive regulatory policies. The European Union has implemented strict regulations to curb plastic waste, promoting the widespread adoption of compostable materials. Countries such as Germany, France, and the UK have strengthened national policies to foster the use of biodegradable packaging and reduce environmental impact. Consumer demand for eco-friendly products is high, further supporting the transition to compostable packaging. Europe’s forward-thinking policies and sustainability initiatives continue to make it a dominant region in the global compostable packaging market, driving both innovation and adoption.

Asia Pacific: Accelerating Adoption in Emerging Economies

Asia Pacific represents 20% of the compostable packaging market, with significant growth expected in the coming years. Emerging economies, particularly China and India, are increasingly adopting sustainable packaging solutions due to growing environmental awareness and government initiatives. Rapid urbanization and rising disposable incomes are contributing to a shift in consumer preferences toward more eco-conscious products. The region’s improving waste management infrastructure and expanding consumer education on sustainability further drive demand for compostable packaging. As industries, particularly in the food and beverage sector, begin to embrace eco-friendly alternatives, Asia Pacific is poised for substantial market growth in the compostable packaging sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- TIPA Ltd

- Rocktenn

- Ultra-Green Sustainable Packaging

- Özsoy Plastik

- International Paper Company

- Mondi

- SmartSolve Industries

- Tetra Pak International SA

- Amcor plc

- DS Smith

- Klabin SA

- WestRock Company

Competitive Analysis:

The compostable packaging market is becoming increasingly competitive, with major players such as Tetra Pak, Mondi Group, and Smurfit Kappa driving innovation and market growth. These companies are focused on developing advanced compostable materials like PLA and PHA to offer sustainable packaging solutions that meet the rising demand for eco-friendly alternatives. Smaller companies are also entering the market, specializing in specific niches, contributing to the diversity of available compostable packaging products. Established players are investing in research and development to improve product quality, reduce costs, and scale up production capacity. The competitive landscape is shaped by a strong emphasis on sustainability, with companies aligning their strategies with regulatory requirements and consumer expectations for greener packaging options. Strategic partnerships and expansions in production capabilities are common tactics used to strengthen market positions, ensuring continued growth and innovation in the compostable packaging space.

Recent Developments:

- In September 2023, WestRock and Smurfit Kappa publicly announced their merger to form Smurfit WestRock, creating one of the largest global paper and packaging companies.

- In April 2024,International Paper and DS Smith officially agreed to the terms of an all-share merger, ending previous acquisition discussions DS Smith held with Mondi.

- In February 2025, Amcor Rigid Packaging partnered with Avantium to advance plant-based packaging using Avantium’s Releaf® polymer (PEF), with Amcor securing a multi-year capacity reservation for this new sustainable material.

Market Concentration & Characteristics:

The compostable packaging market exhibits a moderate to high level of concentration, with several key players dominating the industry. Major companies, such as Tetra Pak, Mondi Group, and Smurfit Kappa, control a significant portion of the market share, driving innovation and setting industry standards. However, the market also features a growing number of smaller, specialized players catering to niche applications. This mix of large corporations and emerging businesses fosters a competitive environment, pushing for continuous advancements in materials and production processes. The market is characterized by a strong focus on sustainability, with companies increasingly adopting eco-friendly materials like PLA and PHA to meet consumer demand. The ongoing development of scalable compostable packaging solutions and partnerships between industry leaders further contributes to the dynamic and evolving landscape of the compostable packaging market.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for sustainable products is significantly driving the adoption of compostable packaging across industries.

- Governments are implementing stricter regulations globally to reduce plastic waste, promoting the use of compostable packaging.

- Ongoing research and development efforts are leading to innovations in compostable materials, improving their performance and cost-effectiveness.

- The Asia Pacific region is seeing rapid growth in compostable packaging adoption due to urbanization and growing environmental awareness.

- Compostable packaging is integral to circular economy models, focusing on sustainability and waste reduction.

- Companies are increasingly incorporating compostable packaging into their sustainability strategies to meet both consumer expectations and regulatory requirements.

- Efforts to educate consumers on proper disposal methods are essential for maximizing the environmental benefits of compostable packaging.

- Advancements in supply chain logistics are improving the efficiency and scalability of compostable packaging production and distribution.

- Increased investment in composting facilities and waste management infrastructure is supporting the growth of the compostable packaging market.

- Strategic collaborations between manufacturers, governments, and environmental organizations are fostering the development and adoption of compostable packaging solutions.