| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Computer Aided Design (CAD) and PLM Software Market Size 2024 |

USD 16,673.82 million |

| Computer Aided Design (CAD) and PLM Software Market, CAGR |

8.32% |

| Computer Aided Design (CAD) and PLM Software Market Size 2032 |

USD 33,052.05 million |

Market Overview

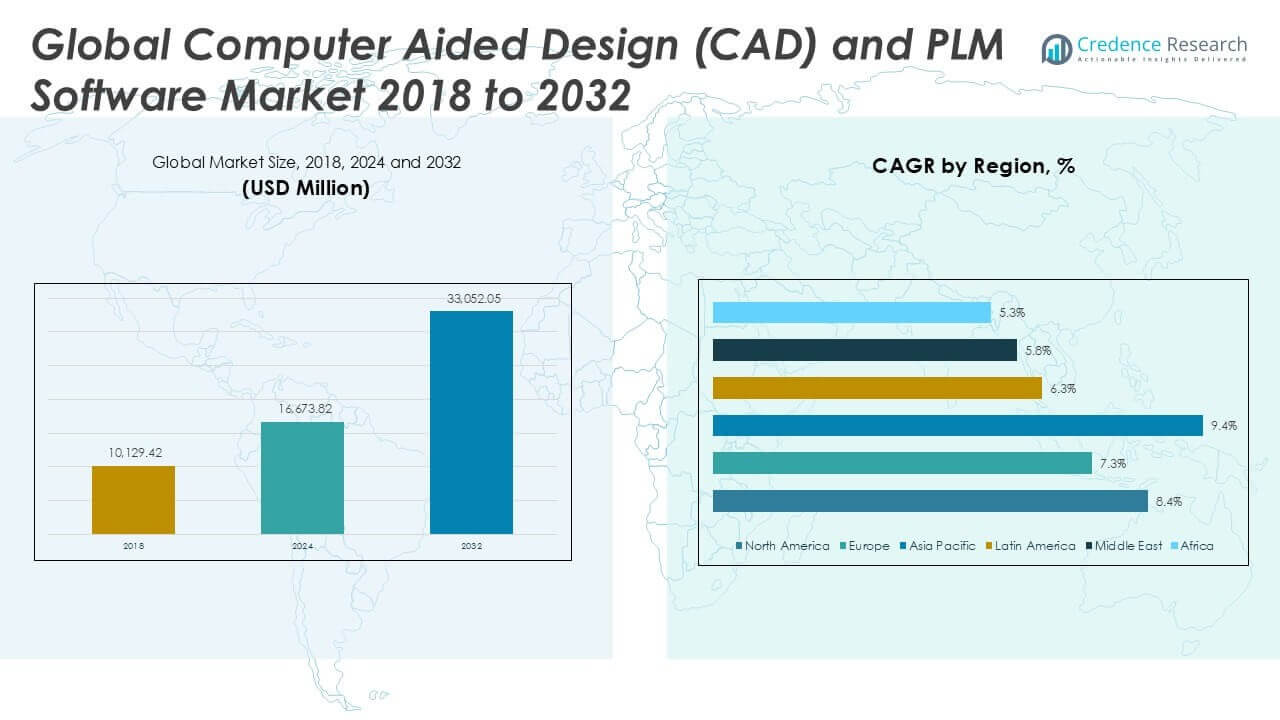

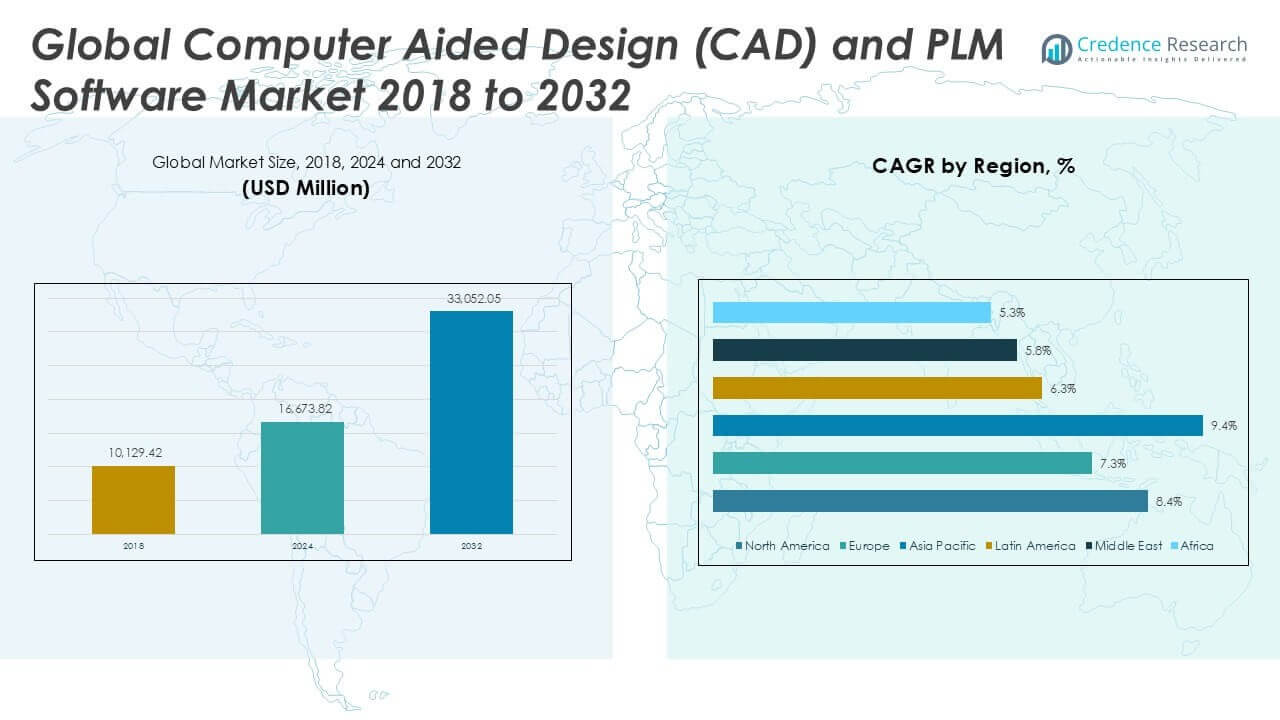

Computer Aided Design (CAD) and PLM Software Market size was valued at USD 10,129.42 million in 2018 to USD 16,673.82 million in 2024 and is anticipated to reach USD 33,052.05 million by 2032, at a CAGR of 8.32% during the forecast period.

The Computer Aided Design (CAD) and PLM Software Market is driven by the growing need for enhanced product innovation, operational efficiency, and streamlined collaboration in design and manufacturing sectors. Increasing adoption of digital transformation strategies across automotive, aerospace, and industrial segments fuels demand for integrated CAD and PLM platforms that offer advanced 3D modeling, real-time data management, and seamless workflow automation. Organizations are investing in cloud-based and AI-powered solutions to accelerate product development cycles and reduce costs, while regulatory requirements for product quality and traceability further encourage market adoption. Key trends include the rise of digital twins, IoT integration, and remote collaboration tools, which are transforming traditional design processes and supporting agile project management. The market continues to benefit from expanding applications in emerging industries, ongoing R&D investments, and the pursuit of sustainable, cost-effective solutions for complex product lifecycle management needs.

The geographical analysis of the Computer Aided Design (CAD) and PLM Software Market highlights robust adoption across North America, Europe, and Asia Pacific, driven by the presence of advanced manufacturing, automotive, and electronics industries. North America leads the market with a strong focus on digital transformation and innovation, while Europe’s established automotive and aerospace sectors drive continuous demand for advanced software solutions. Asia Pacific demonstrates rapid growth, supported by industrialization and expanding infrastructure projects in countries such as China, Japan, and India. Key players shaping the competitive landscape include Autodesk Inc., renowned for its comprehensive CAD solutions, Dassault Systemes, a leader in 3D design and PLM platforms, and Siemens AG, which offers a broad portfolio of digital engineering and lifecycle management tools. PTC Inc. also plays a significant role, leveraging IoT and AR integration to advance digital product development and collaboration across global industries.

Market Insights

- The Computer Aided Design (CAD) and PLM Software Market was valued at USD 10,129.42 million in 2018, reached USD 16,673.82 million in 2024, and is projected to achieve USD 33,052.05 million by 2032, with a CAGR of 8.32%.

- Rising demand for digital transformation and product innovation in manufacturing, automotive, and electronics industries continues to drive the adoption of advanced CAD and PLM solutions.

- Market trends highlight rapid migration to cloud-based platforms, growing use of artificial intelligence and automation, and expanding applications of digital twin technology for improved product lifecycle management.

- Key industry players include Autodesk Inc., Dassault Systemes, Siemens AG, and PTC Inc., each offering comprehensive portfolios that address diverse industry needs and advance digital engineering capabilities.

- High implementation costs, integration complexity, and concerns around data security act as major restraints, especially for small and mid-sized enterprises with limited IT resources.

- North America, Europe, and Asia Pacific represent the strongest regions for market growth, with North America and Asia Pacific leading adoption due to technology infrastructure and expanding industrial activity, while Europe maintains steady demand in automotive and aerospace.

- Competitive dynamics are shaped by ongoing investments in R&D, strategic partnerships, and the integration of emerging technologies, as vendors strive to offer scalable, user-friendly, and secure CAD and PLM platforms to meet evolving industry requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Digital Transformation and Product Innovation Accelerates Market Growth

The Computer Aided Design (CAD) and PLM Software Market experiences robust growth due to the widespread adoption of digital transformation initiatives across manufacturing, automotive, and aerospace industries. Companies increasingly pursue advanced digital tools to streamline workflows, shorten product development cycles, and support complex design requirements. Integration of CAD and PLM platforms enhances collaboration among multidisciplinary teams, allowing seamless sharing of design data and real-time updates. Digital twins, 3D modeling, and simulation features are becoming standard, enabling precise prototyping and testing before physical production. Organizations recognize the value of these solutions in fostering continuous innovation and reducing time-to-market for new products. Market leaders continue to invest in R&D to deliver platforms that support agile product development and address evolving customer needs.

- For instance, the adoption of digital twin technology in manufacturing has increased by 40%, enabling precise prototyping and real-time monitoring of product development.

Cloud-Based Platforms and AI Integration Support Scalable and Agile Operations

Cloud technology adoption stands out as a critical driver in the Computer Aided Design (CAD) and PLM Software Market, offering scalable solutions and lowering infrastructure costs for businesses of all sizes. Cloud-based CAD and PLM platforms enable remote collaboration, secure data storage, and efficient workflow management, which supports hybrid and distributed work environments. The integration of artificial intelligence automates repetitive design tasks, detects errors, and optimizes processes, which helps organizations improve accuracy and productivity. AI-powered analytics provide actionable insights for decision-making, resource allocation, and lifecycle management. Companies benefit from enhanced operational flexibility and can respond swiftly to market changes or shifting project requirements. The market’s cloud and AI capabilities create new opportunities for both established enterprises and emerging startups.

- For instance, AI-powered analytics in PLM software are helping companies optimize resource allocation and lifecycle management.

Stringent Regulatory Requirements and Quality Standards Promote Software Adoption

Compliance with industry-specific regulations and global quality standards plays a pivotal role in driving demand for CAD and PLM software. The market addresses the need for documentation, traceability, and product validation required by government and industry bodies. Integrated platforms streamline compliance processes by automating audit trails, change management, and version control, which minimizes risk and ensures adherence to regulations. Companies in highly regulated sectors such as medical devices, aerospace, and automotive depend on these solutions to maintain quality and safety benchmarks. The push for greater transparency and accountability in product development compels organizations to invest in robust software tools. This regulatory landscape positions CAD and PLM solutions as essential for sustainable business growth and global competitiveness.

Expanding Applications Across Emerging Sectors and Continuous Innovation Stimulate Adoption

Diverse applications across new and emerging sectors contribute to the expansion of the Computer Aided Design (CAD) and PLM Software Market. Industries such as renewable energy, electronics, and smart infrastructure are embracing these platforms to meet their specialized design and lifecycle management needs. Ongoing advancements in user interface design, mobile compatibility, and interoperability with other enterprise systems increase adoption among a wider range of end-users. Vendors focus on delivering customizable solutions that cater to industry-specific requirements, fostering a flexible approach to implementation. Continuous innovation in product features, integration with IoT, and support for advanced manufacturing technologies like additive manufacturing further propel market penetration. The industry’s ability to address both traditional and emerging challenges solidifies its long-term growth trajectory.

Market Trends

Increasing Adoption of Cloud-Based Solutions Reshapes Software Deployment Models

The Computer Aided Design (CAD) and PLM Software Market witnesses a significant shift toward cloud-based solutions, redefining how organizations deploy and manage design platforms. Businesses leverage the cloud for greater flexibility, real-time collaboration, and simplified software maintenance. It enables remote teams to access project files and design tools from any location, which accelerates workflow efficiency and decision-making. Subscription-based licensing models are replacing traditional perpetual licenses, allowing firms to scale usage according to project demands and budget constraints. The transition to cloud-based platforms also enhances cybersecurity and ensures compliance with evolving data privacy regulations. This trend positions the market to support hybrid and distributed workforces across multiple industries.

- For instance, subscription-based CAD software models have gained popularity, allowing businesses to scale usage based on project demands.

Integration of Artificial Intelligence and Automation Drives Intelligent Design Processes

Artificial intelligence integration continues to shape the Computer Aided Design (CAD) and PLM Software Market, with automation streamlining design processes and enhancing accuracy. AI algorithms identify errors, optimize product structures, and recommend design improvements, supporting faster project completion. Automated features such as generative design and simulation help engineers explore multiple design alternatives and select optimal solutions. AI-powered analytics deliver real-time insights, informing better resource allocation and lifecycle management decisions. Organizations recognize the value of these innovations in reducing manual intervention and fostering creativity. The market’s ongoing emphasis on AI adoption is redefining competitive benchmarks for design productivity.

- For instance, AI-driven generative design tools are enabling engineers to explore multiple design alternatives and optimize product structures.

Expansion of Digital Twin Technology Enhances Product Lifecycle Visibility

Digital twin technology is gaining momentum in the Computer Aided Design (CAD) and PLM Software Market, offering a comprehensive view of product performance across the entire lifecycle. Organizations create digital replicas of physical assets to monitor real-world conditions, predict maintenance needs, and optimize product designs. It enables cross-functional teams to collaborate on design updates and validate changes before implementation. The use of digital twins also supports predictive maintenance strategies, which reduce downtime and extend asset life. Sectors such as manufacturing, automotive, and aerospace are at the forefront of this trend, driving broader adoption and innovation. The focus on lifecycle intelligence strengthens the role of CAD and PLM platforms in strategic planning.

Growing Focus on Interoperability and Integration with Enterprise Systems

Demand for seamless interoperability and integration with broader enterprise software ecosystems influences the evolution of the Computer Aided Design (CAD) and PLM Software Market. Companies seek solutions that connect with ERP, MES, and supply chain management tools to unify data and streamline operations. It drives development of open APIs, standard data formats, and modular architectures that support flexible deployment. The ability to exchange information across platforms eliminates data silos and accelerates product development cycles. End-users benefit from unified dashboards and automated data flows, which improve decision quality and operational transparency. This trend supports the market’s progression toward comprehensive, end-to-end digital transformation.

Market Challenges Analysis

High Implementation Costs and Complexity Limit Adoption Among Small and Mid-Sized Enterprises

The Computer Aided Design (CAD) and PLM Software Market faces significant challenges due to the high costs and complexity of implementation, particularly for small and mid-sized enterprises. Many organizations encounter difficulties with the upfront investment required for software licenses, integration, and employee training. Legacy system compatibility issues and the need for specialized IT infrastructure further raise barriers for widespread adoption. It can be difficult for smaller firms to justify the return on investment when operating with limited budgets and technical resources. Long deployment cycles and concerns over potential business disruption deter some companies from fully embracing advanced CAD and PLM platforms. The need for ongoing technical support and regular system upgrades adds to the total cost of ownership.

Data Security Concerns and Integration Hurdles Impact Market Expansion

Data security remains a persistent concern for organizations using CAD and PLM software, especially when sensitive intellectual property and proprietary designs are involved. The Computer Aided Design (CAD) and PLM Software Market contends with the risk of cyberattacks and data breaches, prompting companies to prioritize robust cybersecurity protocols. Integration challenges also arise when connecting CAD and PLM systems with other enterprise applications, often requiring custom solutions to ensure seamless data exchange. It can be difficult to achieve interoperability across multiple software platforms, which hampers efficiency and workflow optimization. Organizations must continuously monitor regulatory compliance related to data privacy, which complicates global operations. The combination of these challenges impacts the pace of market growth and the ability of companies to maximize value from their digital investments.

- For instance, cybersecurity threats targeting CAD and PLM platforms have increased, prompting companies to strengthen encryption and access control measures.

Market Opportunities

Expansion into Emerging Industries and Global Markets Fuels New Revenue Streams

The Computer Aided Design (CAD) and PLM Software Market holds substantial opportunities through expansion into emerging sectors such as renewable energy, electric vehicles, and smart infrastructure. Companies in these industries seek advanced design and lifecycle management solutions to address complex product requirements and regulatory demands. The market can leverage increasing investments in infrastructure and digital transformation across developing regions to widen its global footprint. It benefits from supporting innovation in sectors undergoing rapid technological advancement. Partnerships with local technology providers and tailored solutions for unique industry needs can accelerate adoption. By extending reach into underpenetrated markets, vendors position themselves for sustainable growth and diversified revenue streams.

Integration with Advanced Technologies Enhances Value Proposition and Customer Experience

Integration of CAD and PLM software with advanced technologies such as artificial intelligence, IoT, and augmented reality presents new growth avenues for the market. These innovations enable organizations to optimize product development, enhance predictive maintenance, and create immersive design environments. The Computer Aided Design (CAD) and PLM Software Market can capitalize on the shift toward digital twins and smart manufacturing, providing solutions that drive operational efficiency and agility. It empowers customers to manage increasingly complex projects and respond to evolving market demands. Continuous advancements in cloud computing and mobile compatibility further expand deployment options and improve user accessibility. This focus on technological integration supports long-term competitiveness and market differentiation.

Market Segmentation Analysis:

By Deployment:

The Computer Aided Design (CAD) and PLM Software Market is structured by deployment and industry segments, each contributing unique value to the market’s overall growth trajectory. By deployment, the market divides into on-premise and cloud segments. On-premise solutions appeal to organizations with strict data security policies and complex customization requirements, particularly in sectors handling sensitive intellectual property. These systems offer robust control over data and integration with legacy IT infrastructure, making them a preferred choice for large enterprises in highly regulated environments. However, on-premise deployments typically demand significant upfront investment in hardware, software, and ongoing maintenance, which can limit adoption among smaller businesses. Cloud-based deployment is experiencing rapid adoption, driven by the need for scalable, cost-effective, and easily accessible solutions. The market benefits from the flexibility and agility of cloud platforms, enabling real-time collaboration, remote access, and automatic software updates without heavy infrastructure costs. Organizations leverage cloud CAD and PLM systems to support distributed teams, accelerate design cycles, and ensure business continuity.

By Industry:

The Computer Aided Design (CAD) and PLM Software Market serves a diverse set of sectors. Automotive remains a leading segment, utilizing these tools to innovate vehicle designs, manage complex supply chains, and streamline product development processes. The electronics industry leverages CAD and PLM platforms to address fast-paced product lifecycles and the need for precision in component design. Heavy manufacturing adopts these systems to improve operational efficiency, minimize errors, and reduce time-to-market for large-scale industrial products. Oil and gas companies turn to CAD and PLM solutions for asset management, compliance, and engineering design in highly regulated settings. The chemicals sector implements these tools for process optimization and regulatory documentation, while healthcare organizations rely on them to manage medical device development and ensure traceability. The market also extends its reach to other sectors such as construction and consumer goods, underlining the versatility and expanding applicability of CAD and PLM technologies across the modern industrial landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Deployment:

Based on Industry:

- Automotive

- Electronics

- Heavy Manufacturing

- Oil and Gas

- Chemicals

- Healthcare

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Computer Aided Design (CAD) and PLM Software Market

North America Computer Aided Design (CAD) and PLM Software Market grew from USD 3,833.48 million in 2018 to USD 6,234.59 million in 2024 and is projected to reach USD 12,398.32 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.4%. North America is holding a 34% market share. The United States and Canada dominate this region, driven by advanced manufacturing, automotive innovation, and high investments in digital transformation. Leading industries deploy sophisticated CAD and PLM solutions to optimize design, accelerate product launches, and ensure regulatory compliance. Market growth is further supported by strong technology infrastructure and the presence of leading software vendors. Demand for cloud-based and AI-enabled platforms remains high as organizations seek agility and operational efficiency.

Europe Computer Aided Design (CAD) and PLM Software Market

Europe Computer Aided Design (CAD) and PLM Software Market grew from USD 2,314.07 million in 2018 to USD 3,638.61 million in 2024 and is expected to reach USD 6,683.87 million by 2032, posting a CAGR of 7.3%. Europe commands a 20% market share, with key contributors including Germany, France, the United Kingdom, and Italy. The region’s established automotive, aerospace, and heavy manufacturing sectors drive adoption of advanced CAD and PLM tools for precision engineering and quality control. Regulatory requirements and sustainability initiatives stimulate further market expansion. Organizations invest in digital platforms to improve product lifecycle visibility and ensure compliance with EU standards.

Asia Pacific Computer Aided Design (CAD) and PLM Software Market

Asia Pacific Computer Aided Design (CAD) and PLM Software Market grew from USD 3,152.58 million in 2018 to USD 5,458.43 million in 2024 and is projected to reach USD 11,733.64 million by 2032, registering the highest CAGR of 9.4%. Asia Pacific holds a 35% market share, led by China, Japan, India, and South Korea. Rapid industrialization, infrastructure growth, and expanding electronics and automotive sectors fuel demand for CAD and PLM solutions. Companies invest in cloud deployments to support distributed teams and modernize manufacturing processes. Regional governments promote digitalization, making it a dynamic market for software vendors.

Latin America Computer Aided Design (CAD) and PLM Software Market

Latin America Computer Aided Design (CAD) and PLM Software Market grew from USD 400.72 million in 2018 to USD 649.83 million in 2024 and is forecast to reach USD 1,110.97 million by 2032, with a CAGR of 6.3%. Latin America accounts for 3% market share, with Brazil and Mexico emerging as key countries. The market benefits from growing investments in automotive, oil and gas, and construction industries. Organizations are adopting CAD and PLM tools to streamline project management, improve productivity, and align with international standards. Market growth is supported by government incentives for digital adoption.

Middle East Computer Aided Design (CAD) and PLM Software Market

Middle East Computer Aided Design (CAD) and PLM Software Market grew from USD 266.81 million in 2018 to USD 399.06 million in 2024 and is expected to reach USD 658.84 million by 2032, growing at a CAGR of 5.8%. The Middle East contributes 2% market share, with the United Arab Emirates and Saudi Arabia leading regional adoption. Industrial diversification, major infrastructure projects, and digital transformation strategies drive demand for advanced design platforms. Organizations seek integrated solutions for engineering, asset management, and compliance. Cloud deployments are becoming more common as enterprises modernize their operations.

Africa Computer Aided Design (CAD) and PLM Software Market

Africa Computer Aided Design (CAD) and PLM Software Market grew from USD 161.77 million in 2018 to USD 293.31 million in 2024 and is projected to reach USD 466.40 million by 2032, reflecting a CAGR of 5.3%. Africa holds a 1% market share, with South Africa and Nigeria serving as primary markets. The region experiences gradual adoption, led by the construction, oil and gas, and mining industries. Organizations use CAD and PLM tools to enhance project planning, improve asset management, and ensure compliance with evolving industry regulations. Limited IT infrastructure and skills gaps remain challenges, but ongoing investments present opportunities for future market growth.

Key Player Analysis

- SAP SE

- Autodesk Inc.

- Dassault Systemes

- PTC Inc.

- Oracle Corporation

- Siemens AG

- Infor Inc.

- Aras Corporation

- Propel Software Solutions Inc.

- DuroLabs

Competitive Analysis

The competitive landscape of the Computer Aided Design (CAD) and PLM Software Market is defined by the presence of several global leaders, including Autodesk Inc., Dassault Systemes, Siemens AG, PTC Inc., SAP SE, Oracle Corporation, Infor Inc., Aras Corporation, Propel Software Solutions Inc., and DuroLabs. These companies command significant market influence by offering a broad range of solutions that cater to diverse industries such as automotive, aerospace, manufacturing, electronics, and healthcare. Market leaders invest heavily in research and development to deliver innovative features like AI-driven automation, cloud-based deployment, and digital twin integration, ensuring their platforms remain at the forefront of technology trends. Strategic collaborations, acquisitions, and expansion into emerging markets further reinforce their market positions. Each player focuses on developing user-friendly interfaces, strong data security protocols, and seamless integration capabilities to address the evolving needs of modern enterprises. Competition remains intense, with vendors differentiating their portfolios through continuous product upgrades, industry-specific solutions, and enhanced customer support. This dynamic environment drives technological advancement and compels all market participants to maintain agility in adapting to changing client demands and regulatory requirements.

Recent Developments

- In February 2024, Cadence launched the Millennium Enterprise Multiphysics Platform, designed for creating digital twins, enhancing simulation capabilities for complex systems.

- In July 2024, PTC forecasted higher-than-expected fourth-quarter revenue and profit, attributing growth to increased demand for its industrial software solutions.

- In September 2022, PTC launched a new product coined ‘Onshape-Arena Connection’, which connects Arena Solutions Product Lifecycle Management (PLM) and Onshape Product Development. This accelerates data sharing, which aids organizations to improve product development processes and maintain partnerships with supply chain partners.

- In September 2022, Aras Corporation partnered with AVEVA, which is a provider and developer of digital software, offering digital transformation and sustainability. The partnership resulted in the development and licensing of Asset Lifecycle Management, by integrating Aras Innovator Platform.

- In August 2022, Autodesk launched Fusion 360 Manage with Upchain, which is an integration of acquired PLM software with the CAD solution. This enables organizations to purchase all-in-one products at a single price.

Market Concentration & Characteristics

The Computer Aided Design (CAD) and PLM Software Market exhibits a moderate to high level of market concentration, with a few leading multinational corporations such as Autodesk Inc., Dassault Systemes, Siemens AG, and PTC Inc. capturing a substantial portion of the market share. It is characterized by a strong focus on innovation, high barriers to entry, and the need for continuous technological advancement to remain competitive. Major players leverage their global presence, robust product portfolios, and significant R&D investments to set industry benchmarks and influence market direction. The market demonstrates a growing preference for cloud-based, AI-enabled, and interoperable solutions that facilitate real-time collaboration and data management across the product lifecycle. Customers seek platforms that ensure scalability, strong data security, and integration with other enterprise systems. The ability to deliver industry-specific solutions and superior customer support remains a critical differentiator for success in this evolving market landscape.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Industry duct offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see accelerated adoption of cloud-based CAD and PLM platforms across industries.

- Artificial intelligence and machine learning features will become standard for automating design and lifecycle management processes.

- Digital twin technology will gain prominence, enabling organizations to optimize products and operations in real time.

- Integration with IoT devices will expand, improving predictive maintenance and asset management capabilities.

- Demand for cybersecurity and data privacy features will rise as more organizations shift to digital and remote environments.

- Industry-specific customization and modular software offerings will attract a broader range of users, including small and mid-sized enterprises.

- Advanced simulation and generative design tools will drive faster innovation cycles and reduce time-to-market for new products.

- Partnerships and collaborations between software providers and manufacturing companies will support the development of next-generation solutions.

- The market will experience increased penetration in emerging regions, supported by infrastructure investments and government digitalization initiatives.

- Continuous focus on user-friendly interfaces and seamless integration with enterprise systems will remain crucial for competitive differentiation.