Market Overview

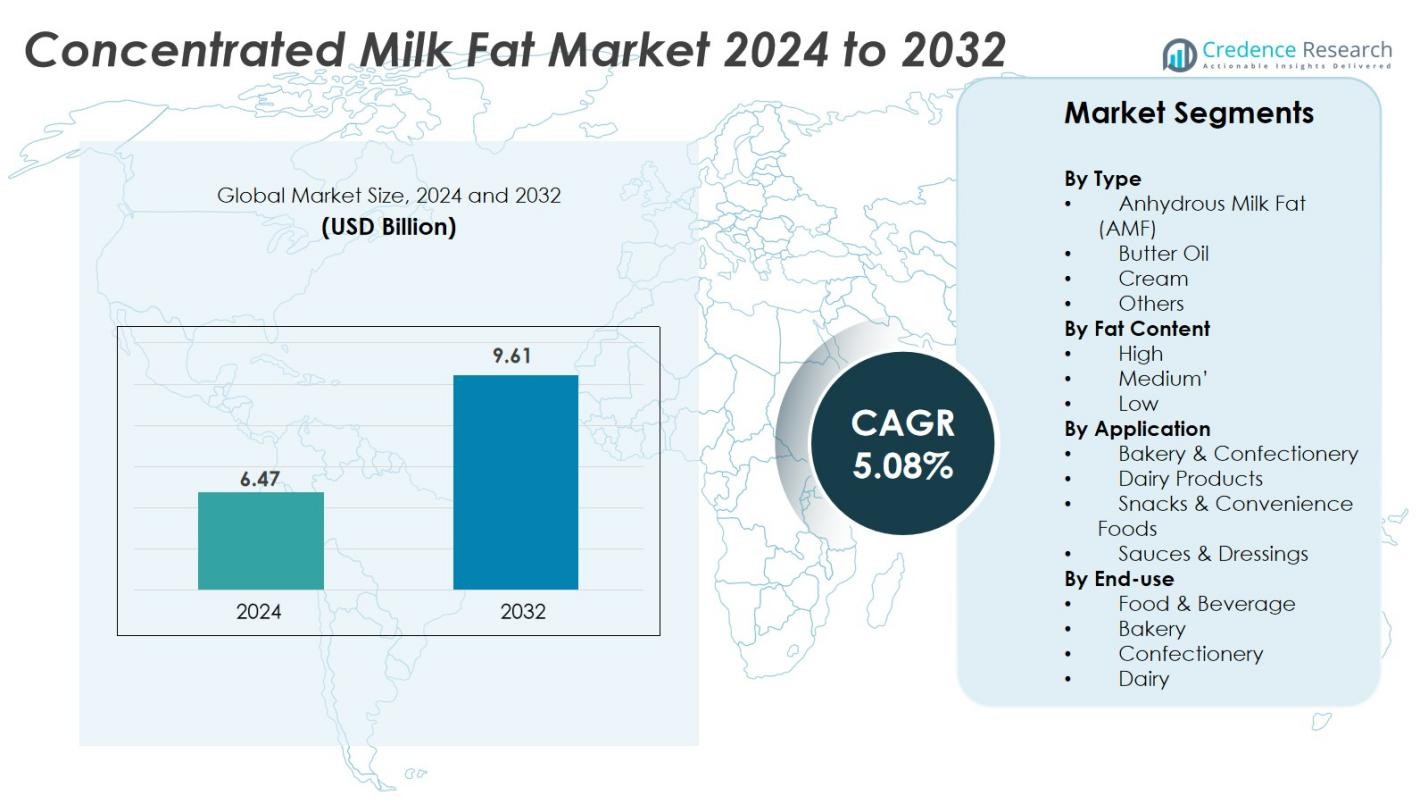

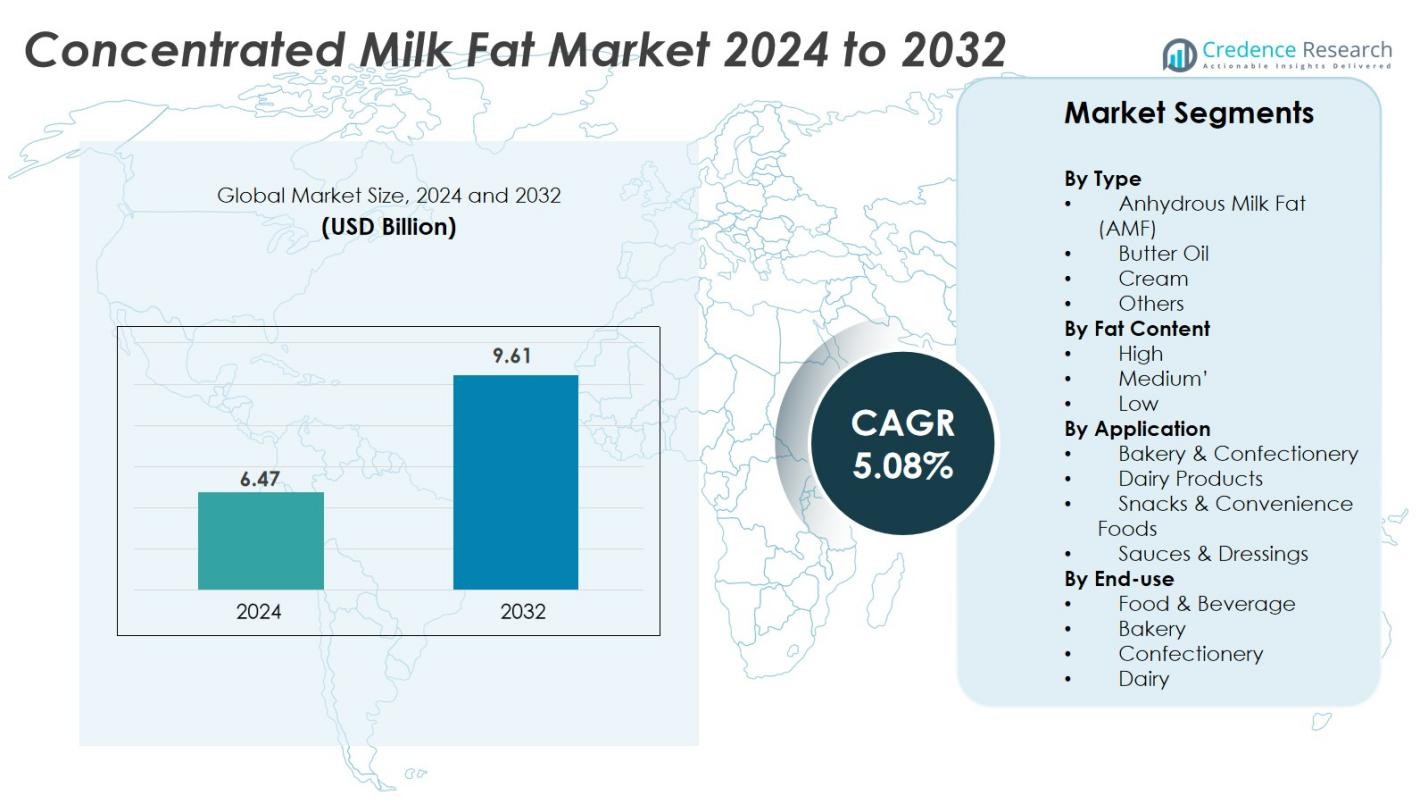

Concentrated Milk Fat market size was valued USD 6.47 Billion in 2024 and is anticipated to reach USD 9.61 Billion by 2032, at a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concentrated Milk Fat Market Size 2024 |

USD 6.47 Billion |

| Concentrated Milk Fat Market, CAGR |

5.08% |

| Concentrated Milk Fat Market Size 2032 |

USD 9.61 Billion |

The Concentrated Milk Fat Market is led by key players such as Fonterra Co-operative Group, Lactalis Ingredients, Darigold, Grassland Dairy Products, California Dairies, Hoogwegt, Pine River Dairy, G&R Food, and JLS Foods International. These companies offer anhydrous milk fat, butter oil, and customized high-fat formulations for bakery, confectionery, ice cream, and ready-to-eat foods. They focus on long-shelf-life products, clean-label profiles, and export-grade quality to supply global food manufacturers. Europe remains the leading region with 32% market share in 2024, supported by strong dairy production, advanced processing facilities, and well-established trade networks that supply high-fat ingredients to Asia, the Middle East, and Latin America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Concentrated Milk Fat market size reached USD 6.47 Billion in 2024 and will grow at a CAGR of 5.08%.

- Rising use of anhydrous milk fat in bakery and confectionery boosts demand due to better texture, flavor release, and shelf stability.

- Clean-label trends push manufacturers toward natural dairy fats over hydrogenated oils, creating opportunities for premium and organic variants.

- Leading players like Fonterra, Lactalis Ingredients, and Darigold compete through export capacity, quality certification, and customized fat blends, while small dairies serve price-sensitive markets.

- Europe held the largest share at 32%, while bakery and confectionery remained the top application with 38% market share, supported by growing demand in North America and Asia-Pacific.

Market Segmentation Analysis

By Type

Anhydrous Milk Fat (AMF) dominated the market with 41% share in 2024. AMF offers longer shelf life, easy transport, and stable performance in high-temperature food processing. Large bakery and confectionery brands use AMF to enhance mouthfeel, aeration, and flavor release in chocolates, cookies, pastries, and premium spreads. Butter oil ranked second due to rising use in frozen desserts and traditional sweets, while cream and other forms saw niche demand in ready-to-eat foods. Growth across all types is driven by rising processed food consumption, global exports, and demand for stable dairy-based fat ingredients.

- For instance, Anhydrous Milk Fat (AMF) is recognized in the food industry for its ability to enhance flavor stability and texture in chocolates and laminated pastries used by industrial bakery brands.

By Fat Content

High-fat concentrated milk products held the largest share at 52% in 2024. This segment benefits from strong usage in bakery fillings, ice creams, spreads, and premium chocolate coatings where rich texture and strong flavor release are essential. Medium-fat products are expanding in snacks and ready meals, offering balanced taste with controlled calories. Low-fat variants grow slowly due to limited application in indulgent foods. Demand for high-fat content is supported by rising preference for premium dairy-based formulations and improving cold-chain networks in major food manufacturing hubs.

- For instance, California Dairy Research Foundation reported in 2023 the use of Milk Protein Concentrates as natural emulsifiers in clean-label ice cream formulations, improving texture and storage stability.

By Application

Bakery and confectionery led the market with 38% share in 2024. Concentrated milk fat improves moisture retention, texture, and shelf stability in cakes, cookies, biscuits, and caramel fillings. Dairy products, including cheese, ice creams, and yogurt blends, form the second-largest segment. Snacks and convenience foods are growing due to ready-to-eat meal expansion and higher consumption of flavored chips and baked snacks. Sauces and dressings adopt concentrated milk fat for emulsification and creamy taste. Growth across applications is driven by processed food exports, innovation in frozen desserts, and premium bakery demand worldwide.

Key Growth Drivers

Rising Demand for Premium Bakery, Confectionery, and Dairy Products

Demand for high-quality bakery and confectionery items continues to increase across developed and emerging markets. Concentrated milk fat enhances texture, aeration, flavor release, and shelf stability, making it a preferred ingredient in chocolates, cookies, pastries, caramel fillings, ice creams, and cheese blends. Growth in premium and artisanal bakery brands also supports higher consumption of AMF and butter oil due to clean-label positioning and rich sensory attributes. Rapid foodservice expansion, frozen dessert innovation, and wider cold-chain availability drive consistent use among manufacturers. In Asia-Pacific and the Middle East, increasing retail presence of packaged sweets and Western-style baked goods fuels adoption.

- For instance, Amul in India has expanded its range of ice creams and cheese blends using concentrated milk fat (milk solids) to standardize product composition, which supports longer shelf life and efficient transport for retail and foodservice channels.

Growth of Processed and Packaged Food Manufacturing Worldwide

Processed foods continue to gain market share due to rising urban population, busy lifestyles, and preference for ready-to-eat snacks. Concentrated milk fat provides heat stability, controlled crystallization, and creamy taste required in snack coatings, instant mixes, sauces, and dressings. Manufacturers prefer AMF due to easy transport, longer shelf life, and minimal moisture, reducing microbial risks. Developing countries invest in new food processing plants, boosting ingredient imports and local blending units. Global brands expand flavored chips, frozen meals, and baked snacks with dairy-based flavor enhancers, increasing demand. Government support for value-added dairy exports in key countries strengthens production capacity and encourages private brands to use concentrated milk fat in innovative packaged products.

- For instance, DairiConcepts’ Ascentra, a dairy-based flavor enhancer made via whole milk fermentation, which reduces sodium content in snack coatings by 25% to 50%, meeting consumer demand for healthier yet flavorful snacks.

Strong Export Trade and Global Dairy Ingredient Supply Chain

Major exporters such as New Zealand, the U.S., and Europe continue to supply AMF and butter oil to Asia, Latin America, and Africa. Flexible trade agreements and tariff reductions help manufacturers scale distribution. Concentrated milk fat is preferred for international shipments because of low moisture, reduced storage space, and long stability at ambient temperature. Global confectionery, ice cream, and fast-food brands source standardized dairy fat grades for consistent taste across markets. Rising demand from bakery hubs in Southeast Asia and the Middle East supports higher import volumes.

Key Trends & Opportunities

Increasing Shift Toward Clean-Label and Natural Fat Ingredients

Food brands promote natural dairy fats as healthier alternatives to synthetic additives and hydrogenated oils. Concentrated milk fat provides a short ingredient list, clean taste profile, and regulatory acceptance in most regions. Clean-label positioning supports penetration into infant nutrition, flavored yogurts, artisan chocolates, and private-label bakery goods. Small confectionery and bakery manufacturers adopt concentrated milk fat to match premium texture without artificial flavor enhancers. The trend creates opportunities for organic, grass-fed, and hormone-free variants targeting high-income consumers in Europe and North America.

- For instance, Valio’s lactose-free concentrated milk fat is now used in artisan chocolates and flavored yogurts, providing a regulatory-compliant, clean taste profile favored by specialty food manufacturers in North America.

Product Innovation in Flavored, Blended, and Functional Dairy Fat Systems

Companies introduce customized milk fat blends for whipping creams, aerated desserts, coating fats, and non-dairy applications. Innovation in enzymatic modification and fractionation creates fats with specific melting points and flavor release profiles. These developments help manufacturers enhance mouthfeel in chocolates, improve spreadability in bakery fillings, and stabilize emulsions in sauces. Growth of lactose-free dairy and keto-focused foods also drives demand for specialty milk fats. New product lines with longer stability for tropical climates create opportunities in Asia-Pacific, Africa, and South America, where refrigeration is limited.

- For instance, Fonterra, in collaboration with Nourish Ingredients, has advanced specialty dairy fats with their Creamilux™ line, providing enzymatically crafted milk fat solutions that enhance creamy taste and texture in premium dairy products, tailored for applications such as whipping creams and aerated desserts.

Key Challenges

Price Volatility and Supply Chain Uncertainty

Global milk fat prices fluctuate due to seasonal milk production, weather conditions, animal feed cost, and exchange rate movements. Sharp price swings affect long-term planning for food manufacturers that depend on stable ingredient costs. Importing countries face higher logistics expenses, cold storage fees, and tariff barriers, increasing total procurement cost. Competition from cheaper vegetable fat substitutes, including palm and coconut oil, challenges adoption in price-sensitive markets. Small manufacturers struggle to maintain product consistency when prices fluctuate, forcing them to switch formulations or reduce dairy content, which can impact taste and texture.

Rising Regulatory Pressure and Quality Compliance

Dairy ingredients must comply with strict regulations related to safety, purity, fat percentage, and origin traceability. Countries enforce labeling rules, antibiotic residue checks, and contamination standards, increasing compliance costs for exporters. Delays in certification or rejection of shipments can disrupt production schedules for food processors. Premium claims such as organic or grass-fed require certification audits, adding financial burden for smaller dairies. Growing consumer scrutiny on additives, allergens, and ethical sourcing adds complexity to product development. Manufacturers must invest in testing technology, clean processing facilities, and transparent supply chains to maintain market access and trust.

Regional Analysis

North America

North America held 28% market share in 2024, supported by strong demand for premium bakery, confectionery, cheese, and frozen desserts. Large food manufacturers and quick-service restaurant chains use concentrated milk fat for flavor enhancement, aeration, and texture improvement. The U.S. leads production due to advanced dairy processing plants and stable milk supply, while Canada grows through clean-label and organic fat ingredients. Export activity to Mexico and the Caribbean also contributes to revenue. Rising consumption of packaged snacks and frozen bakery products continues to support market expansion, along with product innovation in flavored and specialty dairy fats.

Europe

Europe commanded the largest share with 32% in 2024, backed by well-established dairy farming, strict quality regulations, and strong exports. Germany, France, and the Netherlands supply high-fat dairy ingredients for chocolates, cheese blends, butter cookies, and ice creams. Premium confectionery brands create steady demand for anhydrous milk fat and butter oil. The region benefits from robust trade networks with the Middle East and Asia. Growth in artisanal bakery goods, flavored spreads, and clean-label dairy launches further boosts adoption. Sustainability programs and traceability certification also help European suppliers secure long-term contracts with multinational food manufacturers.

Asia-Pacific

Asia-Pacific captured 25% market share in 2024 and remains the fastest-growing region. Bakery and confectionery consumption is rising due to urbanization, western-style snacking, and expansion of café chains. Import-dependent markets such as China, Indonesia, and the Philippines increase purchases of AMF for chocolate coatings, cookies, and frozen desserts. India and Australia support regional supply through growing dairy production. E-commerce distribution broadens access for small bakeries and food processors. New processing facilities and cold-chain investments strengthen storage and distribution capabilities, driving higher adoption of concentrated milk fat in packaged foods and ready-to-eat snacks.

Latin America

Latin America held 8% share in 2024, driven by demand for concentrated milk fat in ice creams, cookies, and confectionery. Brazil and Mexico lead consumption as international bakery chains and dairy brands expand their product lines. Import reliance remains high, supporting trade relationships with the U.S. and Europe. Local processors use AMF for caramel fillings, flavored spreads, and chocolate coatings. Growth remains steady as supermarkets increase premium dessert offerings and cold storage improves in major cities. Rising middle-class spending on packaged sweets and branded bakery products continues to create a sustainable pathway for market expansion.

Middle East & Africa

The Middle East & Africa accounted for 7% market share in 2024. The region depends largely on imports due to limited dairy production, with strong demand from bakery manufacturers, confectionery companies, and hotel-catering chains. Saudi Arabia, UAE, and South Africa lead usage as processed food consumption rises. Western-style sweets and premium ice creams gain popularity, boosting adoption of high-fat dairy ingredients. Investments in food processing parks, frozen storage, and trade partnerships improve access to concentrated milk fat. Growth also benefits from expanding quick-service restaurants and private-label bakery brands across major urban centers.

Market Segmentations

By Type

- Anhydrous Milk Fat (AMF)

- Butter Oil

- Cream

- Others

By Fat Content

By Application

- Bakery & Confectionery

- Dairy Products

- Snacks & Convenience Foods

- Sauces & Dressings

By End-use

- Food & Beverage

- Bakery

- Confectionery

- Dairy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concentrated milk fat (AMF) market features global dairy processors, ingredient suppliers, and exporters serving bakery, confectionery, dairy, and snack manufacturers. Leading companies such as Fonterra, Lactalis Ingredients, and Darigold compete on product purity, fat percentage, shelf life, and technical functionality. These firms maintain strong international presence through large-scale processing plants and advanced fractionation technologies, producing high-fat, heat-stable ingredients for industrial use. Companies like Grassland Dairy Products, California Dairies, Inc., and Pine River Dairy strengthen market positions with value-added variants, clean-label offerings, and sustainable sourcing. Players also expand storage and distribution networks to support fast delivery across export markets. Private-label ingredient suppliers and regional dairies, including G&R Food, JLS Foods International, and Hoogwegt, increase competition by offering cost-effective AMF and butter oil to price-sensitive markets. Strategic partnerships with chocolate, ice cream, and bakery manufacturers help companies secure long-term contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Volac Wilmar Feed Ingredients (a joint venture between Volac and Wilmar International) launched a new product formulation called Mega‑Fat 70.

- In November 2023, a new range of anhydrous milk fat products was launched by Glanbia Ingredients specifically for the bread and confectionery industries (enhancing flavour, texture, shelf life).

- In January 2023, California Dairies,Inc. effectively bought DairyAmerica as a means of unlocking significant synergies and improving its efficiencies in providing high-quality dairy ingredients.

Report Coverage

The research report offers an in-depth analysis based on Type, Fat Content, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for concentrated milk fat will rise as premium bakery and confectionery production expands.

- Clean-label and natural ingredient positioning will boost adoption across dairy and snacks.

- Asia-Pacific will record the fastest growth as western-style food consumption increases.

- Companies will invest in fractionation technology to create customized fat profiles.

- Export activity will strengthen as manufacturers target high-demand markets in the Middle East and Africa.

- Organic and grass-fed concentrated milk fat will gain traction among health-conscious consumers.

- New cold-chain infrastructure will improve distribution for small and mid-sized food processors.

- Flavored and functional fat systems will support product innovation in chocolates and ice creams.

- Competition from low-cost vegetable fats will push suppliers to enhance quality and technical performance.

- Sustainability, traceability, and clean sourcing will become key purchase criteria for global buyers.