Market Overview

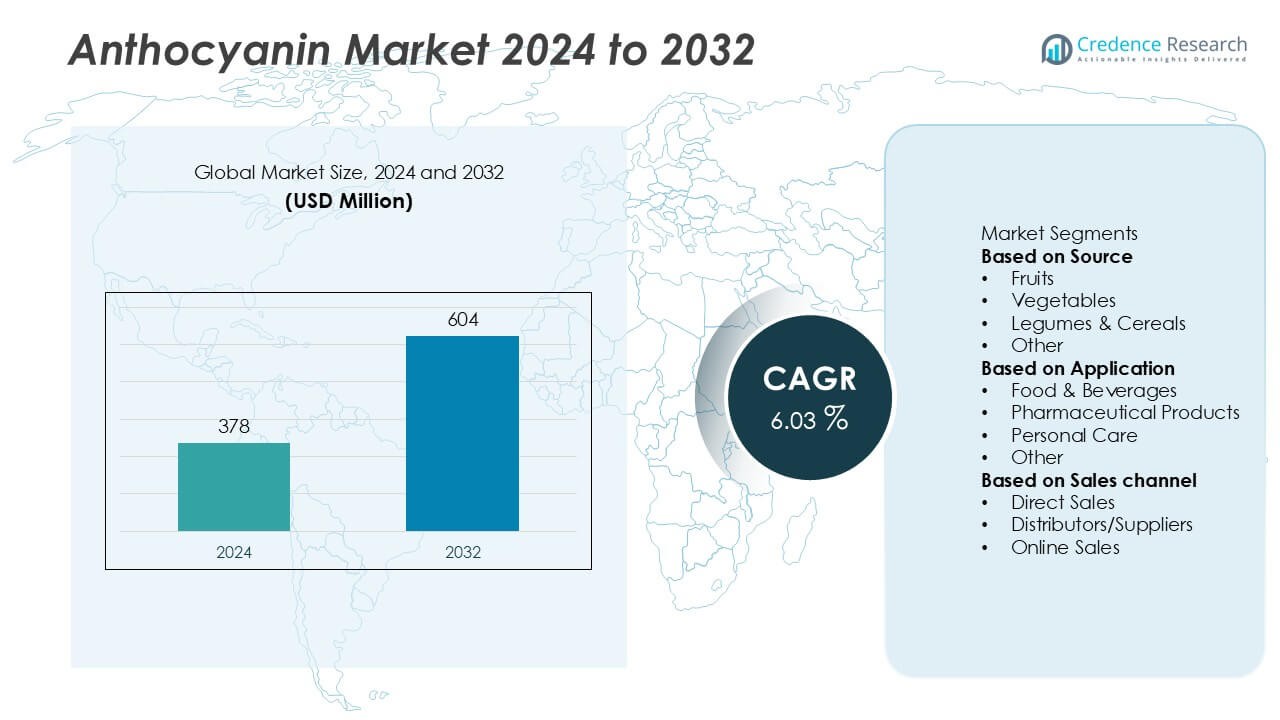

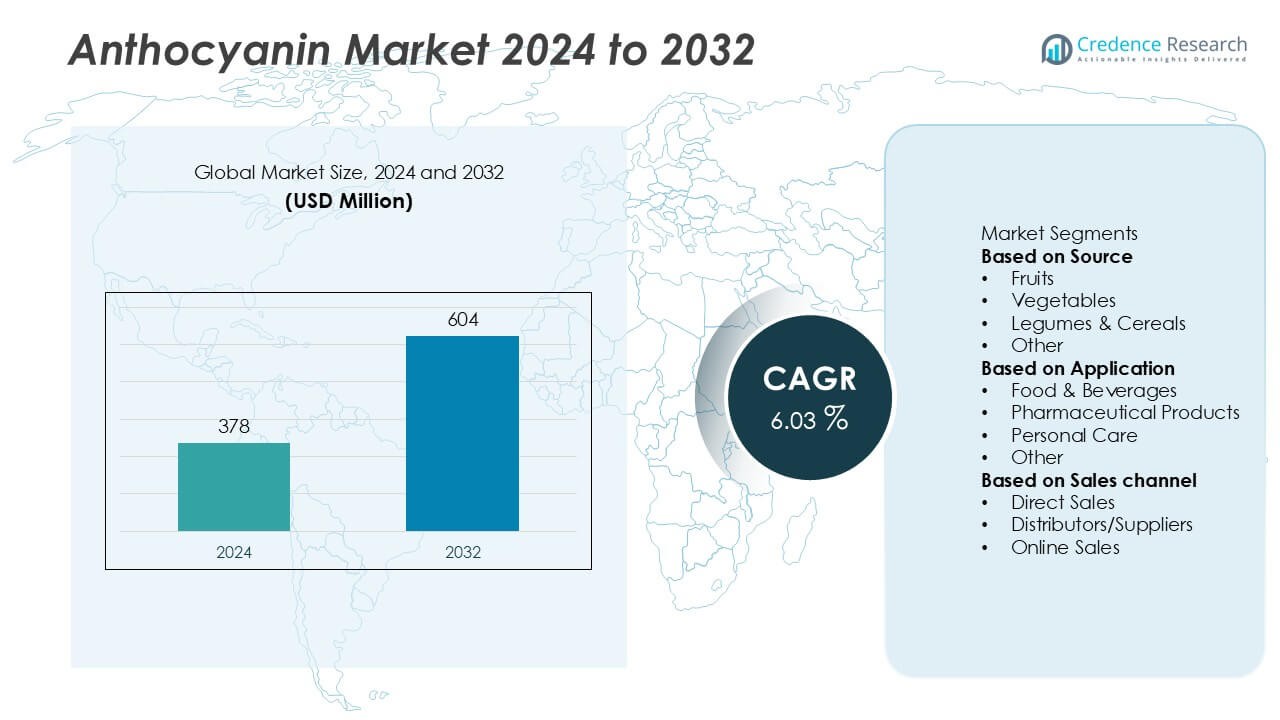

The global Anthocyanin Market was valued at USD 378 million in 2024 and is projected to reach USD 604 million by 2032, growing at a CAGR of 6.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anthocyanin Market Size 2024 |

USD 378 Million |

| Anthocyanin Market, CAGR |

6.03% |

| Anthocyanin Market Size 2032 |

USD 604 Million |

The global anthocyanin market is led by key players such as Chr. Hansen, Givaudan, DDW Color, Cayman Chemical Company, California Natural Colors Inc., Kanegrade Ltd, Biogold Industries LLP, EBC Ingredients, Extrasynthese, and Beton Nutrition Co Ltd. These companies dominate through advanced extraction technologies, sustainable sourcing practices, and strong partnerships with food, beverage, and nutraceutical manufacturers. North America remains the leading region, accounting for 32% of the global market share in 2024, driven by high demand for natural colorants and functional ingredients. Europe follows closely with 29%, supported by stringent regulatory standards promoting the adoption of plant-based and clean-label color solutions.

Market Insights

- The global anthocyanin market was valued at USD 378 million in 2024 and is projected to reach USD 604 million by 2032, registering a CAGR of 6.03% during the forecast period.

- Rising consumer preference for natural and clean-label colorants is driving demand, with the fruits segment holding over 45% of the market share due to its rich anthocyanin content and wide use in food and beverages.

- Key trends include the expansion of functional foods, nutraceuticals, and personal care applications, supported by innovations in extraction and stabilization technologies that improve pigment quality and shelf life.

- The market is moderately competitive, with major players such as Chr. Hansen, Givaudan, DDW Color, and Cayman Chemical Company focusing on sustainability, R&D, and strategic partnerships to strengthen their global presence.

- North America leads with 32% of the market share, followed by Europe at 29% and Asia-Pacific at 25%, driven by growing health awareness and demand for natural ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The fruits segment dominated the anthocyanin market in 2024, accounting for over 45% of the total market share. Fruits such as berries, grapes, and cherries are the primary natural sources of anthocyanins due to their high pigment concentration and consumer preference for plant-based colorants. The demand for fruit-derived anthocyanins is driven by the growing shift toward clean-label and natural ingredients in food and beverages. Additionally, advancements in extraction technologies have enhanced yield and stability, further supporting the dominance of fruit-based anthocyanins over vegetables, legumes, cereals, and other sources.

- For instance, Chr. Hansen developed a stabilized black carrot extract delivering an anthocyanin concentration exceeding 1,200 mg per 100 g of pigment, ensuring longer shelf stability for beverage formulations. The company uses precision-controlled pH and microencapsulation to maintain color intensity across storage cycles.

By Application

The food and beverages segment held the largest share of around 55% of the anthocyanin market in 2024, driven by increasing utilization in natural food coloring, confectionery, and functional beverages. Rising consumer awareness regarding the health benefits of anthocyanins, including their antioxidant and anti-inflammatory properties, has fueled their inclusion in a wide range of food products. Manufacturers are replacing synthetic dyes with natural alternatives, aligning with clean-label trends. Pharmaceutical and personal care applications are growing steadily as anthocyanins gain recognition for their role in promoting cardiovascular health and skin protection.

- For instance, Givaudan’s Active Beauty division formulated an anthocyanin-enriched extract from black rice containing 350 mg of cyanidin-3-glucoside per 100 g, used in skin-care emulsions with proven antioxidant activity. Clinical testing showed a 22% reduction in oxidative markers after 14 days of use.

By Sales Channel

The distributors and suppliers segment led the anthocyanin market in 2024, capturing approximately 48% of total sales. This dominance is attributed to the established supply chain networks and partnerships between producers and large-scale food and pharmaceutical companies. Distributors facilitate bulk supply, ensuring consistent quality and availability across global markets. However, online sales channels are expanding rapidly, supported by e-commerce growth and increasing demand from small-scale manufacturers and research institutions seeking direct product access. The combination of digitalization and convenience continues to strengthen online anthocyanin sales in emerging markets.

Key Growth Drivers

Rising Demand for Natural Food Colorants

The growing consumer preference for clean-label and plant-based ingredients is a primary driver of the anthocyanin market. Manufacturers are increasingly replacing synthetic dyes with natural pigments derived from fruits and vegetables to meet regulatory standards and consumer expectations. Anthocyanins offer vibrant coloration along with health benefits, enhancing their appeal in food and beverage formulations. This shift toward natural alternatives, coupled with stricter restrictions on artificial additives, continues to strengthen demand across global markets.

- For instance, DDW The Color House (now Givaudan Sense Colour) utilizes the naturally high concentration of stable, acylated anthocyanins found in purple carrots to create natural colorants for food and beverages.

Expanding Applications in Pharmaceuticals and Nutraceuticals

Anthocyanins are gaining traction in pharmaceutical and nutraceutical formulations due to their potent antioxidant, anti-inflammatory, and cardiovascular health benefits. Growing awareness of their role in preventing chronic diseases and promoting overall well-being has driven their inclusion in supplements, functional foods, and therapeutic products. Increasing research and clinical validation of anthocyanin efficacy have encouraged investment in product development, supporting market expansion. The rising aging population and growing interest in preventive healthcare further boost demand for anthocyanin-based formulations.

- For instance, cyanidin-3-O-glucoside is a natural anthocyanin with documented antioxidant activity, which has been the subject of research for its potential anti-inflammatory and cardiovascular benefits.

Technological Advancements in Extraction and Stabilization

Innovations in extraction techniques-such as supercritical fluid extraction and membrane filtration-have improved the efficiency and purity of anthocyanin production. These advancements have enhanced color stability, shelf life, and cost-effectiveness, enabling broader applications in food, cosmetics, and pharmaceuticals. Additionally, research into encapsulation technologies has addressed degradation issues caused by pH and temperature variations. As a result, improved production processes have increased commercial viability, allowing manufacturers to meet the growing global demand for high-quality natural pigments.

Key Trends & Opportunities

Growth of Functional and Fortified Foods

The rising popularity of functional and fortified foods presents a significant opportunity for anthocyanin manufacturers. Consumers are increasingly seeking products that offer both taste and health benefits, such as antioxidant-rich beverages, dairy products, and snacks. Anthocyanins’ dual role as a natural colorant and bioactive compound enhances their value in this segment. Food producers are leveraging this multifunctionality to differentiate their offerings and meet the growing demand for healthier, visually appealing products in developed and emerging markets alike.

- For instance, Kanegrade Ltd. is a supplier of food ingredients, including various fruit extracts and natural colors like elderberry concentrate. Commercial elderberry extracts are available with standardized anthocyanin content, such as a 13% anthocyanin standardized extract mentioned in a scientific study.

Increasing Use in Personal Care and Cosmetics

The personal care industry is emerging as a promising application area for anthocyanins, driven by their antioxidant and anti-aging properties. These compounds are being incorporated into skincare, haircare, and cosmetic formulations to protect against oxidative stress and enhance skin vitality. Growing consumer interest in natural and sustainable cosmetic ingredients supports this trend. Cosmetic manufacturers are leveraging anthocyanins’ vibrant pigmentation and protective qualities to formulate clean-label, eco-friendly products that align with evolving beauty standards.

- For instance, Biogold Industries LLP is an ISO-certified company that manufactures and exports a range of agro products, organic fertilizers, animal feed supplements, natural food colors, and dehydrated vegetable powders.

Key Challenges

High Production and Processing Costs

The extraction and purification of anthocyanins from natural sources are cost-intensive processes, often involving advanced technologies and raw material variability. High production costs limit their use in price-sensitive markets and create challenges for small and medium manufacturers. Additionally, fluctuations in the availability of raw materials such as berries and grapes impact supply stability. These cost-related constraints restrict scalability, making synthetic colorants a more affordable option for certain applications despite regulatory and consumer pressures for natural alternatives.

Stability and Shelf-Life Limitations

Anthocyanins are sensitive to environmental factors such as light, temperature, and pH, which can lead to degradation and color fading during storage and processing. This instability limits their application in certain food and beverage categories that require long shelf life or high thermal stability. Manufacturers face challenges in maintaining consistent product quality and appearance over time. Although encapsulation and stabilization technologies offer partial solutions, ensuring long-term pigment stability remains a key technical barrier to wider anthocyanin adoption.

Regional Analysis

North America

North America held a market share of 32% in 2024, driven by the strong demand for natural food colorants and functional ingredients in the food and beverage industry. Consumers’ increasing awareness of clean-label and health-oriented products has accelerated the adoption of anthocyanins in beverages, dairy, and dietary supplements. The U.S. leads the regional market due to the presence of established manufacturers and a well-developed nutraceutical sector. Supportive regulatory frameworks and technological advancements in extraction processes continue to strengthen North America’s position throughout the 2024–2032 forecast period.

Europe

Europe accounted for 29% of the anthocyanin market share in 2024, supported by stringent regulations restricting synthetic additives and the strong preference for natural colorants. Countries such as Germany, France, and the U.K. are leading consumers, driven by growing applications in food, cosmetics, and pharmaceuticals. The region’s mature food processing industry and proactive sustainability initiatives have accelerated the use of plant-based ingredients. Continuous R&D investments and collaborations between research institutions and manufacturers are fostering innovation in extraction and stabilization technologies, reinforcing Europe’s dominance in the anthocyanin market.

Asia-Pacific

Asia-Pacific captured 25% of the global anthocyanin market share in 2024 and is expected to register the fastest growth through 2032. The region’s expansion is fueled by increasing consumer awareness of natural health products and the rising adoption of anthocyanins in functional foods and beverages. China, Japan, and India are major contributors due to their large agricultural bases and expanding food manufacturing sectors. The growing middle-class population, coupled with the rapid growth of e-commerce platforms, supports broader access to anthocyanin-based products, positioning Asia-Pacific as a key growth engine for the market.

Latin America

Latin America represented 8% of the anthocyanin market share in 2024, with growth driven by abundant natural sources such as berries, grapes, and tropical fruits. Brazil and Chile are emerging as significant producers and exporters of anthocyanin-rich raw materials. Increasing demand for clean-label and plant-based products in food and beverage applications is fostering market expansion. Regional investment in agricultural innovation and extraction technology is improving supply efficiency. Although the market remains in an early growth stage, rising health awareness and export opportunities are expected to accelerate its development by 2032.

Middle East & Africa

The Middle East and Africa held a 6% share of the global anthocyanin market in 2024, supported by growing consumer interest in natural and functional food products. The food and beverage sector is expanding rapidly in Gulf countries, where urbanization and rising disposable incomes are increasing demand for premium, health-focused products. South Africa and the UAE are key markets, with rising awareness of plant-based colorants in both food and personal care applications. Limited local production capacity presents challenges, but increasing imports and investment in natural ingredient industries are expected to support steady market growth.

Market Segmentations:

By Source

- Fruits

- Vegetables

- Legumes & Cereals

- Other

By Application

- Food & Beverages

- Pharmaceutical Products

- Personal Care

- Other

By Sales channel

- Direct Sales

- Distributors/Suppliers

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive analysis of the anthocyanin market highlights the presence of major players including Chr. Hansen, Givaudan, DDW Color, Cayman Chemical Company, California Natural Colors Inc., Kanegrade Ltd, Biogold Industries LLP, EBC Ingredients, Extrasynthese, and Beton Nutrition Co Ltd. These companies focus on innovation, sustainable sourcing, and strategic collaborations to strengthen their market position. Leading firms are investing in advanced extraction and stabilization technologies to improve pigment purity, color consistency, and cost efficiency. The market is moderately consolidated, with global players emphasizing clean-label, plant-based solutions to meet regulatory and consumer demands. Expansion through mergers, acquisitions, and regional partnerships remains a key growth strategy, enabling companies to enhance distribution networks and product portfolios. Continuous research into novel sources and improved bioavailability of anthocyanins is further intensifying competition, positioning innovation and sustainability as central differentiators in the global anthocyanin market from 2024 to 2032.

Key Player Analysis

- EBC Ingredients

- Cayman Chemical Company

- Kanegrade Ltd

- Hansen

- Biogold Industries LLP

- Givaudan

- Beton Nutrition Co. Ltd

- DDW Color

- Extrasynthese

- California Natural Colors Inc.

Recent Developments

- In October 2025, Beton Nutrition Co Ltd promoted its integrated raw-material-to-finished-brand solution at HI Japan 2025, positioning plant-extract ingredients (which include anthocyanin-rich powders) for targeted formulation support.

- In July 2024, Givaudan Sense Colour launched its Amaize® orange-red anthocyanin-based colour, a corn-derived pigment designed to match Red 40 in acidic applications.

- In 2023, DDW The Color House (now integrated into Givaudan as “Givaudan Sense Colour”) publicly highlighted anthocyanins as a natural colour trend in beverages and functional drinks development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Application, Sales channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anthocyanin market will experience steady growth driven by increasing demand for natural and clean-label colorants across industries.

- Technological advancements in extraction and encapsulation will enhance pigment stability and expand application potential.

- The food and beverage sector will continue to dominate due to rising consumer preference for natural ingredients and functional products.

- Growing use of anthocyanins in nutraceuticals and pharmaceuticals will support market expansion in health-focused applications.

- The personal care industry will adopt anthocyanins more widely for antioxidant and anti-aging formulations.

- Emerging economies in Asia-Pacific and Latin America will present strong growth opportunities through rising disposable incomes and awareness.

- Sustainability initiatives and ethical sourcing will remain a key focus among leading manufacturers.

- Strategic partnerships, mergers, and acquisitions will accelerate market consolidation and global reach.

- Online distribution channels will gain traction as digital platforms expand accessibility.

- Continuous innovation and regulatory support for natural additives will shape long-term industry competitiveness.