Market Overview

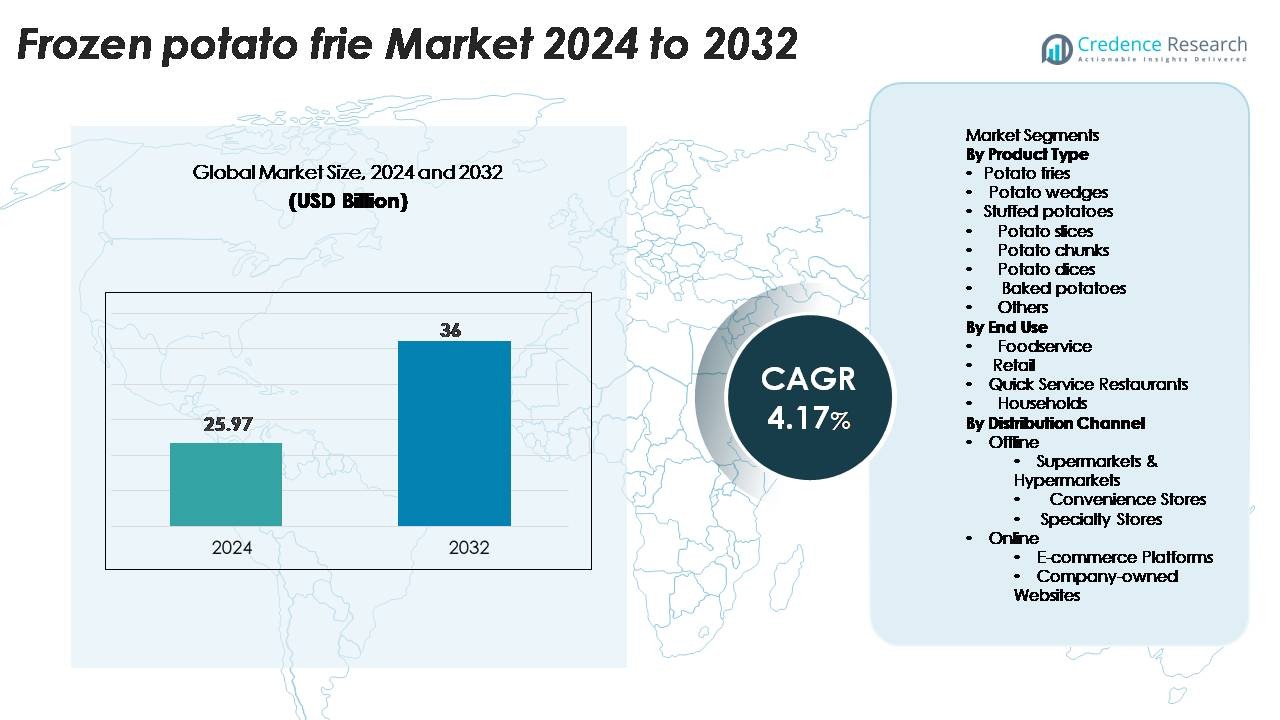

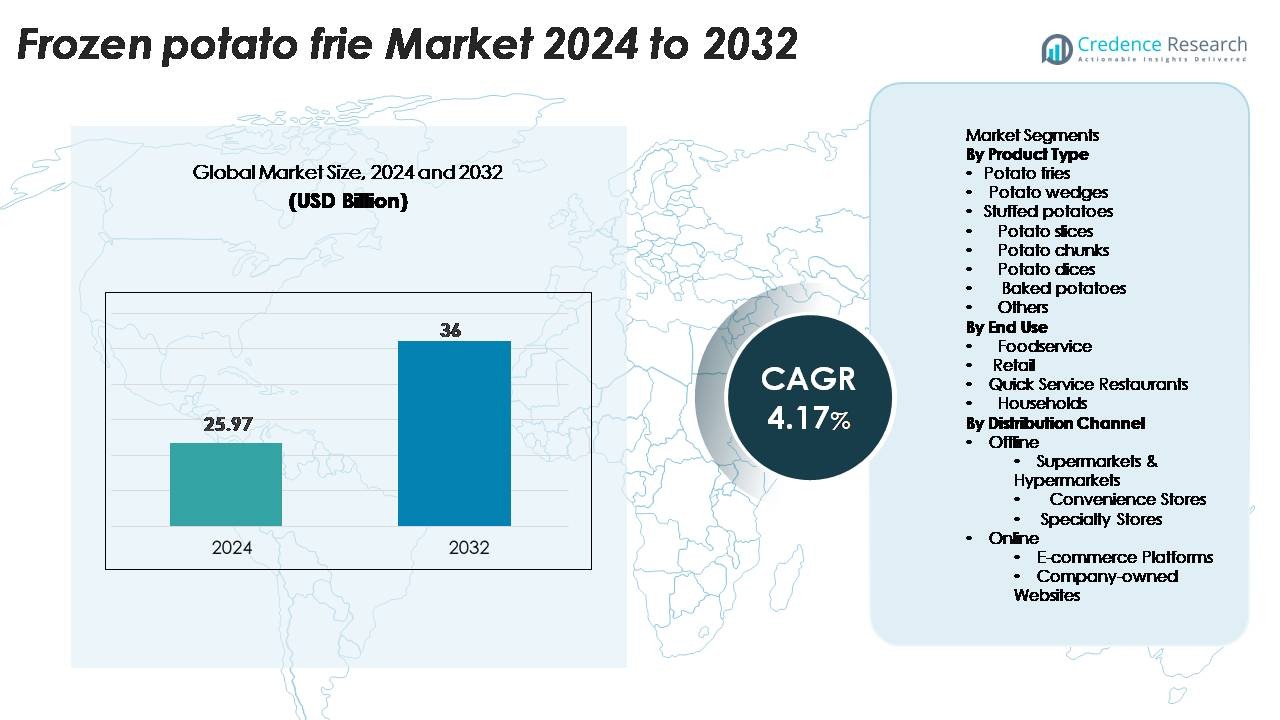

The frozen potato fries market was valued at USD 25.97 billion in 2024. It is expected to reach USD 36.00 billion by 2032, registering a CAGR of 4.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Potato Fries Market Size 2024 |

USD 25.97 Billion |

| Frozen Potato Fries Market, CAGR |

4.17% |

| Frozen Potato Fries Market Size 2032 |

USD 36.00 Billion |

Key producers in the frozen potato fries market include McCain Foods, Lamb Weston Holdings Inc., J.R. Simplot Company, The Kraft Heinz Company, and General Mills Inc. These companies operate large processing units, invest in cold-chain logistics, and supply to major retail and foodservice networks. North America remains the leading region with 34% market share due to strong fast-food penetration and high per-capita consumption. Europe holds 29% share, supported by quick-service restaurants and private-label brands. Asia-Pacific grows steadily with urbanization and rising Western-style diets. Global players expand partnerships and distribution to strengthen presence in emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The frozen potato fries market reached USD 21.89 million in 2024 and will grow at a 5.06% CAGR until 2032, supported by steady demand from foodservice and retail.

- Strong drivers include rising quick-service restaurant chains, growth in online food delivery, and wider adoption of ready-to-cook snacks in homes. Frozen products offer longer shelf life and faster preparation, making them attractive for busy households and commercial kitchens.

- Key trends include cleaner ingredient labels, new seasoning varieties, and crinkle, shoestring, and waffle-cut product formats gaining higher traction. The retail segment holds the largest share due to large supermarket penetration and private-label lines.

- Competition is intense as global players expand capacity, invest in cold-chain logistics, and form supply partnerships with fast-food chains. Pricing pressure and storage cost remain major restraints for smaller vendors.

- North America leads with 34% share, Europe follows with 29%, and Asia-Pacific grows fastest. Fries coated for crisp texture hold a higher segment share in global sales.

Market Segmentation Analysis:

By Product Type

Potato fries lead this segment with the highest market share due to strong demand in fast food chains, cafes, and home consumption. Ready-to-cook fries offer longer shelf life, uniform size, and consistent taste, which drive repeat purchases. Wedges, dices, chunks, and baked potatoes serve niche applications in snacks and gourmet dishes, while stuffed variants appeal to premium buyers. The rising preference for convenient frozen snacks supports higher adoption of potato fries compared to other formats.

- For instance, McCain Foods operates industrial cutting and par-frying lines that process 25,000 kilograms of potatoes per hour, delivering uniform strip dimensions for large QSR chains.

By End Use

Foodservice remains the dominant end-use segment due to bulk demand from restaurants, cafeterias, catering companies, and hotels. Quick service restaurants strengthen consumption through combo meals and large serving volumes. Retail adoption increases as households stock frozen potato products for easy home cooking. Rising urbanization and changing food habits drive consumption across households and retail stores, yet foodservice continues to hold the largest share due to steady high-volume orders.

- For instance, Lamb Weston supplies major QSR chains through contracts, and a specific joint-venture plant in Russia (with Belaya Dacha) was built with the capacity to process 200,000 tonnes of raw potatoes annually to support local demand for customers like McDonald’s.

By Distribution Channel

Offline channels such as supermarkets and hypermarkets command the largest share because they offer multiple frozen brands, promotional pricing, and reliable cold-chain infrastructure. Convenience stores and specialty outlets expand product reach in urban and semi-urban areas. Online distribution grows rapidly through e-commerce platforms and company-owned websites, driven by home delivery and subscription-based orders. Despite fast online growth, offline retail remains the leading segment due to wider accessibility and strong freezer storage facilities.

Key Growth Drivers

Rising Demand from Fast Food Chains and QSRs

Fast food chains and quick service restaurants drive high consumption of frozen potato fries. These outlets prefer frozen fries because they offer uniform size, faster frying time, and consistent taste. Global chains expand in urban and semi-urban areas, which increases bulk purchasing. Combo meals and snack menus use fries as a standard side item. Many chains focus on faster service speed, and frozen fries reduce preparation effort. Cold storage networks also improve product handling. As more chains enter new regions, demand grows. This strong commercial requirement keeps frozen fries at the center of most quick meal menus.

- For instance, “Large-scale potato processing plants, such as those operated by companies like Lamb Weston, utilize high-capacity systems where production lines can process significant volumes of potatoes, with some equipment in the industry designed to handle up to 30,000 kg per hour.”

Growing Home Consumption Due to Convenience

Households buy frozen potato fries because they provide easy cooking and longer shelf life. Busy lifestyles push consumers toward ready-to-cook snacks. Children and young adults prefer fries as a quick meal. Small pack sizes support frequent home stocking. Air fryers and microwaves make cooking faster and healthier, which attracts more buyers. Modern retail stores display many frozen snack brands, and promotional deals improve sales. Families also prefer frozen fries for parties and gatherings. Rising freezer ownership in households adds to storage convenience.

- For instance, Lamb Weston distributes products, often in resealable packaging, that are designed to maintain quality for an extended period under frozen storage. The typical frozen shelf life for most Lamb Weston frozen potato products is around 540 to 720 days (18 to 24 months) when stored properly at 0°F (-18°C) or below.

Increasing Adoption of Cold Chain and Frozen Food Retail

Improved cold chain logistics support wider distribution of frozen potato products. Modern cold warehouses, temperature-controlled trucks, and freezer-equipped stores reduce product loss. Many retailers expand dedicated frozen sections in supermarkets and hypermarkets. Global and regional brands place more products in these stores. Freezer technology develops in small stores as well. Better storage solves older issues such as thawing and taste change. As frozen food retail expands, brands reach small towns and new markets. This network growth increases overall sales volume.

Key Trends & Opportunities

Rising Demand for Healthier and Value-Added Variants

Consumers now explore low-oil, baked, and air fryer-friesndly frozen potato fries. Brands launch gluten-free, organic, or seasoned variants to attract health-focused buyers. Premium restaurants also use seasoned wedges and skin-on fries to improve taste. Packaging innovations allow less oil absorption. Brands offer spicy, herb-based, and flavored coatings. This variety helps companies target both premium and budget shoppers. Growing interest in clean-label snacks supports this shift. Healthier variants create strong value opportunities for new product launches.

- For instance, J.R. Simplot’s skin-on oven-baked fries are made from whole-cut potatoes and are processed using high-capacity industrial slicers.

Growth of Online Grocery and Doorstep Freezer Delivery

Online grocery platforms list frozen fries with wide brand choices and doorstep delivery. E-commerce improves access for buyers who do not visit large stores. Digital promotions, coupons, and product bundles improve sales. Some brands offer same-day delivery in key cities. Company-owned websites provide direct ordering and subscription packs. Cold-chain delivery vehicles protect quality during transport. This online push creates faster market penetration. Young buyers rely on mobile apps for grocery needs, supporting strong future demand.

- For instance, “Lamb Weston utilizes a global distribution network and collaborates with various third-party logistics (3PL) providers and distributors, who use refrigerated transport (maintaining a temperature of -18°C or colder) to ensure its frozen potato products reach restaurants and retailers without temperature fluctuation and maintain quality and food safety standards.”

Expansion into Emerging and Developing Markets

Frozen potato fries see rising consumption in emerging regions due to urbanization. More families shift from fresh cooking to fast snacks. Tourism growth increases foodservice outlets, hotels, and cafes. International fast food brands open new stores each year. Small restaurant chains also add fries to menus. Local processors set up plants to reduce import dependence. These markets offer long-term growth opportunities for global and regional producers.

Key Challenges

High Storage and Distribution Costs

Frozen products require reliable cold chain infrastructure. Storage, transport, and handling demand temperature control. Many regions lack strong cold storage facilities. This raises costs for manufacturers and distributors. Small retailers avoid frozen sections due to electricity bills and freezer costs. Poor transport conditions can affect texture and flavor. Brands must invest in cold warehouses and insulated vehicles. These expenses reduce profit margins and limit small-scale expansion.

Health Concerns and Preference for Fresh Snack Alternatives

Some consumers avoid friesd snacks due to high calorie and oil content. Health-focused buyers switch to fresh salads, baked snacks, or vegetable chips. Media reports on obesity and cholesterol increase awareness. Parents reduce friesd food intake at home. This creates a demand shift toward healthier options. Brands must innovate better processing and low-oil recipes. Without upgrades, frozen fries may lose share to healthier snack substitutes in future.

Regional Analysis

North America

North America holds the largest market share due to strong consumption in fast food chains, quick service restaurants, and large retail networks. The United States accounts for a major portion of regional sales because frozen fries are a regular part of meals in diners, cafés, and takeaway outlets. Wide penetration of brands, advanced cold storage infrastructure, and high household freezer ownership support steady demand. Canada also contributes through rising home cooking and retail promotions. Strong presence of global foodservice brands further increases volume. As a result, North America continues to dominate the market with the highest regional share.

Europe

Europe maintains the second-largest market share due to widespread consumption of potato-based snacks and a well-established frozen food culture. Countries such as the United Kingdom, Germany, France, and the Netherlands drive strong demand from supermarkets, restaurants, and canteens. The region benefits from strong agricultural output and established processing facilities. Private-label brands also offer low-cost frozen fries, improving affordability for households. Quick cooking formats such as oven-ready and air-fryer variants are popular among young consumers. Europe continues to show high per-capita consumption, supporting a strong regional market share.

Asia-Pacific

Asia-Pacific shows the fastest growth and holds a rising market share due to expanding fast food chains, café culture, and higher urban household adoption. India, China, Japan, and South Korea lead demand through QSR chains, supermarkets, and home delivery platforms. Young consumers prefer fries as a quick snack, and e-commerce improves product availability in major cities. Growing cold chain infrastructure supports distribution to new markets. Domestic manufacturers also expand processing capacity to reduce imports. The region’s improving retail penetration and changing food habits continue to increase its share each year.

Latin America

Latin America holds a moderate market share supported by steady consumption in restaurants, cinemas, and snack outlets. Brazil, Mexico, and Argentina lead demand due to rising preference for Western-style fast food and increasing middle-class spending. Retail sales grow as supermarkets add larger frozen food sections. Local production also supports price stability. However, cold chain limitations in rural areas restrict wider penetration. Despite these challenges, expanding QSR franchises and home delivery services help increase the region’s overall share.

Middle East & Africa

The Middle East & Africa region holds a smaller but growing market share due to expanding tourism, hotels, and international restaurant chains. Countries such as the UAE, Saudi Arabia, and South Africa show strong adoption of frozen food products. Rising expatriate population and changing food habits support consumption of fries in cafés and fast-food outlets. Retail chains develop larger freezer sections in urban supermarkets. Limited cold storage infrastructure in several African markets restricts deeper penetration, but improving logistics and rising urbanization continue to increase the region’s overall market share.

Market Segmentations:

By Product Type

- Potato fries

- Potato wedges

- Stuffed potatoes

- Potato slices

- Potato chunks

- Potato dices

- Baked potatoes

- Others

By End Use

- Foodservice

- Retail

- Quick Service Restaurants

- Households

By Distribution Channel

- Offline

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- E-commerce Platforms

- Company-owned Websites

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The market remains highly competitive with the presence of global brands, regional processors, and private-label manufacturers. Leading companies focus on large-scale production, advanced freezing technology, and strong distribution partnerships with QSR chains and retail outlets. Many brands offer multiple product formats such as straight-cut fries, crinkle-cut, wedges, and specialty seasoned varieties to capture diverse consumer preferences. Innovation centers work on improving texture, reducing oil absorption, and enhancing taste consistency. Retail penetration increases as companies expand freezer space in supermarkets and convenience stores. Private-label brands compete through lower pricing and bulk packs targeted at budget shoppers. Global players invest in new processing plants, cold chain expansion, and automated packaging lines to maintain efficiency. Marketing strategies include discount offers, combo packs, and co-branding with restaurant chains. As competition rises, companies differentiate through product quality, seasoning innovation, health-focused variants, and stronger digital presence across online grocery platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Greenyard Group

- McCain Foods Limited

- Lamb Weston Holdings Inc.

- Coöperatie Koninklijke Cosun U.A.

- The Hain Celestial Group, Inc.

- Mondelez International Inc.

- J.R. Simplot Company

- General Mills Inc.

- Koninklijke Cosun U.A.

- The Kraft Heinz Company

Recent Developments

- In June 2025 its subsidiary Aviko expanded its potato-flake capacity in China by 70 % per year to meet rising demand.

- In April 2025, Mondelez International, Inc. published its “Snacking Made Right” report detailing progress on sustainability and innovation in its snack portfolio.

- In November 2024, the company opened a new production facility in Kruiningen, Netherlands, adding 195 million kg annual capacity.

Report Coverage

The research report offers an in-depth analysis based on Product type, End use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as quick-service restaurants expand in small and mid-sized cities.

- Online grocery platforms will boost home consumption of frozen fries.

- Coated and seasoned fries will gain higher preference for crisp texture after frying or baking.

- Automated processing lines will improve product consistency and reduce waste in factories.

- Cold-chain investments will enhance distribution in emerging markets.

- Private-label brands will widen product ranges in supermarkets and hypermarkets.

- Health-focused variants with reduced oil absorption will attract urban consumers.

- Fast-casual and cloud kitchen chains will increase bulk procurement.

- Sustainable packaging and cleaner ingredient labels will become standard.

- Regional players will collaborate with global brands for technology and supply expansion.