Market Overview

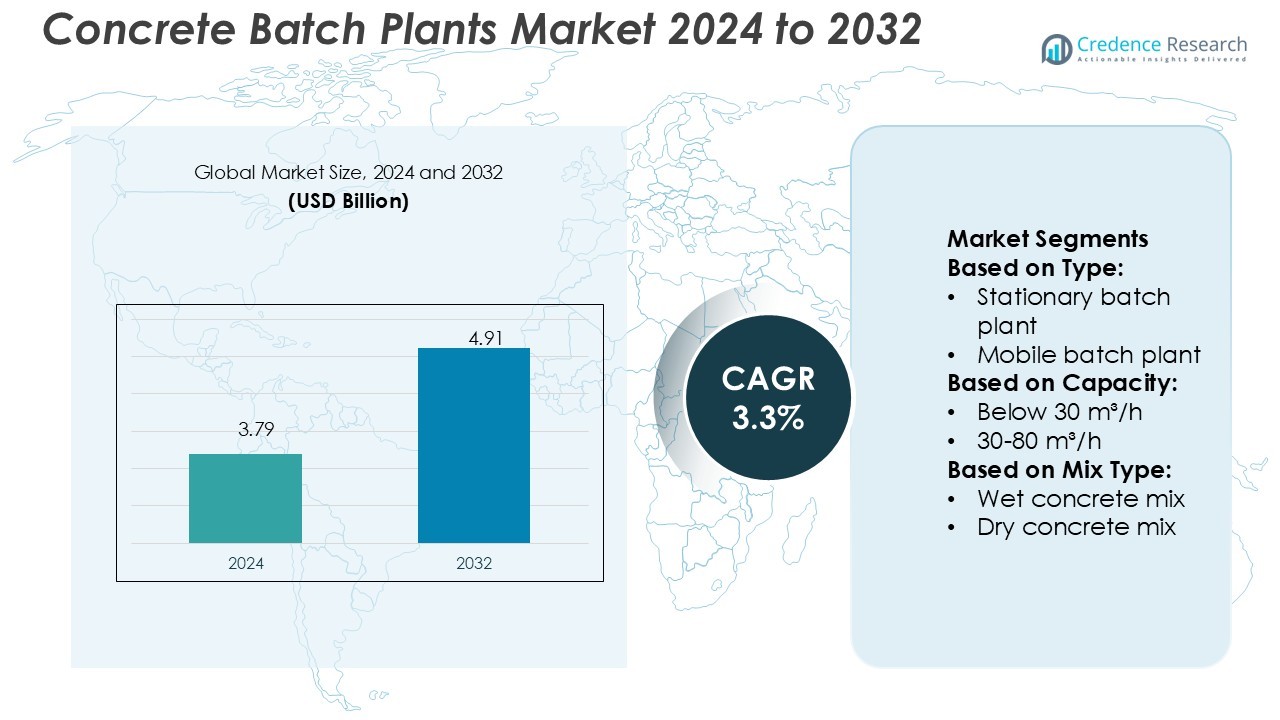

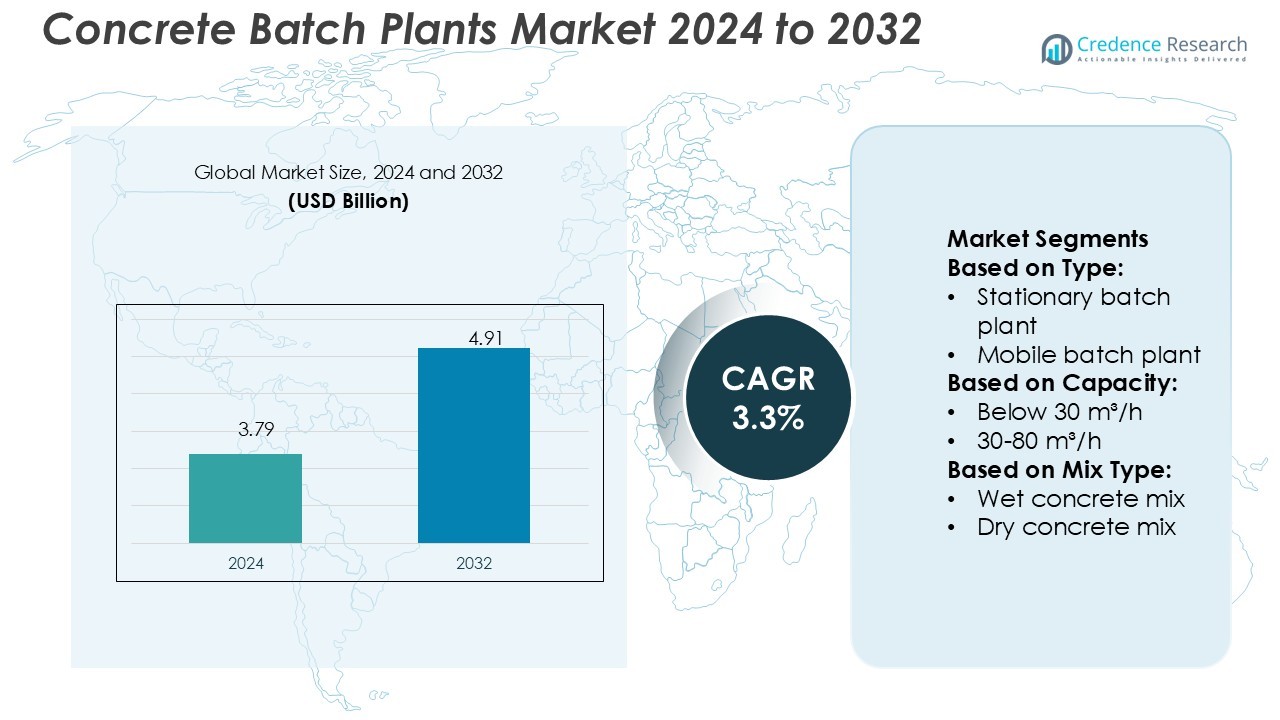

Concrete Batch Plants Market size was valued USD 3.79 billion in 2024 and is anticipated to reach USD 4.91 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Batch Plants Market Size 2024 |

USD 3.79 Billion |

| Concrete Batch Plants Market, CAGR |

3.3% |

| Concrete Batch Plants Market Size 2032 |

USD 4.91 Billion |

The concrete batch plants market is shaped by leading players such as Elkon, Sany, Putzmeister, AIMIX Group, JEL Concrete Plants, Liebherr, Ammann, Astec, Meka, and Cemco. These companies focus on product innovation, advanced automation, and modular plant designs to strengthen their market position. Many emphasize sustainable and energy-efficient solutions to align with global construction standards. Strategic expansions, partnerships, and smart batching technologies help them meet diverse project demands across regions. Asia Pacific leads the global market with a 38% share, driven by rapid urbanization, infrastructure investments, and rising adoption of high-capacity batching systems for large-scale construction projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The concrete batch plants market size was valued at USD 3.79 billion in 2024 and is projected to reach USD 4.91 billion by 2032, registering a CAGR of 3.3%.

- Strong infrastructure development, rapid urbanization, and rising adoption of ready-mix concrete drive steady market expansion across residential, commercial, and industrial projects.

- Modular and mobile batching plants, energy-efficient systems, and digital control technologies are key trends transforming the industry landscape.

- The market is competitive with major players focusing on automation, smart monitoring, and sustainable designs to strengthen their global presence.

- Asia Pacific leads with a 38% regional share, supported by large-scale infrastructure investments, while the 30–80 m³/h capacity segment dominates due to its versatility and cost efficiency.

Market Segmentation Analysis:

By Type

Stationary batch plants dominate the market with a major share. These plants are widely adopted for large infrastructure and commercial projects that demand high output and consistent quality. They support automated control systems, which enhance operational efficiency and reduce material wastage. Stationary plants also enable precise mixing, ensuring uniform concrete composition. This capability makes them a preferred choice for urban development and large-scale construction. Their robust design and long-term cost benefits drive adoption in industrial and infrastructure projects, maintaining their lead over mobile batch plants.

- For instance, Elkon’s stationary concrete batching plant ELKOMIX-200 features a 200 m³/h capacity and an automated twin-shaft mixer system, enabling precise and continuous production for high-volume projects.

By Capacity

The 30–80 m³/h capacity segment holds the dominant share in the market. This segment is popular because it offers a balance between operational flexibility and high production output. It caters to mid-sized construction projects, such as residential complexes, commercial buildings, and road construction. Many contractors prefer this capacity range as it provides efficient batching without requiring large-scale investment. Its adaptability to both stationary and mobile setups further strengthens its market position. High demand in emerging economies with active construction activities drives this segment’s growth.

- For instance, Sany offers a range of batching plants, including models with a rated output of 60 m³/h, such as the HZS60F, HZS60G, or HZS60X8. These models are typically equipped with a twin-shaft mixer with a 1000 L capacity and are suitable for medium-scale projects, while the HZS60V8 model has a rated output of 50 m³/h and a 1000 L mixer.

By Mix Type

Wet concrete mix plants lead the market with a significant share. These plants ensure high-quality and uniform concrete by combining all materials with water before discharge. Wet mix plants deliver better strength and durability, making them suitable for critical construction applications such as bridges, tunnels, and highways. Their faster batching and consistent performance support large-scale, time-sensitive projects. The increasing emphasis on quality standards in construction further boosts the adoption of wet mix plants over dry mix alternatives, reinforcing their dominant position in the market.

Key Growth Drivers

Rapid Urbanization and Infrastructure Development

Rising urbanization and growing infrastructure projects drive the demand for concrete batch plants. Governments and private developers are investing in road networks, bridges, housing, and commercial spaces. High-capacity stationary plants are preferred for large projects due to their reliability and efficiency. For instance, large-scale metro and expressway projects require continuous concrete production to meet strict timelines. This infrastructure boom, especially in emerging economies, strengthens market growth and encourages investment in advanced batching technology to meet rising concrete production requirements.

- For instance, Putzmeister’s MT 3.0 batching plant is designed for continuous high-output operations, offering a 120 m³/h production capacity with an advanced 3000 L twin-shaft mixer and an automated moisture control system for precise concrete quality during large infrastructure builds.

Advancements in Automation and Digitalization

Automation and digital control systems are transforming the concrete batching process. Modern batch plants integrate sensors, SCADA systems, and IoT-based monitoring to improve accuracy and reduce manual errors. Automated systems enable consistent concrete quality, efficient material use, and lower operational costs. Companies are also adopting predictive maintenance to minimize downtime. These advancements increase productivity and improve plant performance. As construction projects demand tighter quality control and faster output, the integration of smart technologies becomes a strong driver for market expansion.

- For instance, The AIMIX AJ-60 stationary concrete batching plant features a PLC and touchscreen system with one-click start and dual-mode control.

Rising Demand for Ready-Mix Concrete

The growing preference for ready-mix concrete boosts the adoption of concrete batch plants. Contractors prefer ready-mix due to its uniform quality, faster application, and reduced labor requirements. Urban construction and infrastructure projects require quick delivery of large concrete volumes, which batch plants can provide efficiently. The trend is strong in commercial and residential projects where on-site mixing is less feasible. Increased investment in ready-mix facilities worldwide supports market expansion, driving demand for both stationary and mobile batching solutions.

Key Trends & Opportunities

Shift Toward Modular and Mobile Plants

The adoption of mobile and modular batching plants is rising due to their flexibility and cost efficiency. These plants are ideal for remote locations and temporary project sites. Mobile units allow rapid setup and relocation, reducing installation costs and delays. Contractors use modular systems to scale production capacity based on project needs. This flexibility attracts infrastructure developers looking to optimize operational efficiency. The shift creates opportunities for manufacturers to develop compact, transportable, and energy-efficient models tailored to evolving construction requirements.

- For instance, JEL’s Decumulator mobile precast plant supports a 20-ton daily capacity, with optional expansion to 40 tons, and uses individual aggregate scales for pre-blending before mixer feed.

Sustainable Construction and Green Technologies

Sustainability is becoming a major focus in the construction industry. Manufacturers are introducing batching plants with reduced energy use, low emissions, and recycling capabilities. Integration of water recycling systems and eco-friendly admixtures supports green building practices. Regulations promoting low-carbon construction create opportunities for companies offering sustainable plant designs. Growing interest in LEED-certified projects and net-zero goals further drives this trend. As environmental standards tighten globally, sustainable concrete batching solutions gain a competitive advantage in the market.

- For instance, Liebherr’s new generation of Betomix and Mobilmix plants use frequency converters to smooth power peaks and optimize mixing, reducing energy consumption by up to 30%. With an advanced dosing accuracy of ±0.35% for cement, the plants can save up to 8 kg of cement per cubic meter of concrete in a typical mix.

Integration of Advanced Control and Monitoring Systems

The increasing use of cloud-based monitoring and AI-driven control systems enhances operational visibility. Smart batching plants track material flow, mixing accuracy, and plant performance in real time. These systems help contractors maintain quality standards and reduce wastage. Digital dashboards allow remote monitoring and quick decision-making, improving overall productivity. Companies are investing in advanced controls to differentiate their offerings and meet modern construction demands. This technological shift presents strong opportunities for innovation and market growth.

Key Challenges

High Initial Investment and Maintenance Costs

The cost of setting up concrete batch plants is a major barrier for small and medium contractors. Stationary plants, in particular, require significant capital for installation, power infrastructure, and automated controls. Maintenance costs further add to operational expenses, impacting profitability for low-volume projects. This financial burden limits adoption in smaller construction firms and rural projects. Manufacturers need to address this challenge by offering modular financing, leasing options, or low-cost plant models to encourage wider market penetration.

Stringent Environmental Regulations

Tighter environmental norms for dust control, emissions, and water usage pose operational challenges. Concrete batching involves dust generation and high water consumption, which must comply with local environmental standards. Meeting these regulations often requires installing advanced dust collectors, recycling systems, and emission control units, increasing costs. Non-compliance can lead to penalties or shutdowns. Adapting to these regulations without reducing productivity remains a key challenge for plant operators and manufacturers, especially in regions with strict sustainability policies.

Regional Analysis

North America

North America holds a 28% share of the concrete batch plants market, driven by strong infrastructure investments and advanced construction technologies. The U.S. leads the region with large-scale projects in transportation, commercial real estate, and residential development. Government initiatives, such as highway expansions and bridge rehabilitation programs, support steady demand for stationary and mobile batching solutions. The region also emphasizes sustainability, encouraging the use of energy-efficient and low-emission plants. Technological adoption, including automated control systems and smart monitoring, enhances plant productivity and quality control, further strengthening North America’s position as a key contributor to global market growth.

Europe

Europe accounts for a 22% market share, supported by strict construction quality standards and environmental regulations. Countries like Germany, France, and the U.K. lead infrastructure modernization, renewable energy projects, and urban housing developments. The region prioritizes low-emission and energy-efficient concrete batch plants to align with its carbon reduction targets. Advanced batching technologies and automation drive adoption in both public and private sector projects. Additionally, the circular economy trend encourages the integration of water recycling systems in batching facilities. These factors position Europe as a technologically mature and environmentally focused market with stable long-term growth prospects.

Asia Pacific

Asia Pacific dominates the market with a 38% share, driven by rapid urbanization, industrialization, and large infrastructure investments. China, India, and Southeast Asian countries are leading contributors, supported by government-led transportation and housing projects. The demand for high-capacity stationary and mobile batching plants is growing due to mega infrastructure programs such as metro rail networks, highways, and smart cities. Rising adoption of ready-mix concrete and automation enhances efficiency across construction sites. Manufacturers are expanding production facilities to meet increasing regional demand, making Asia Pacific the fastest-growing and most dynamic region in the global concrete batch plants market.

Latin America

Latin America holds an 8% market share, driven by rising investments in infrastructure modernization and urban development. Countries like Brazil and Mexico are witnessing growing demand for efficient batching solutions for residential and commercial construction. Mobile and modular plants are gaining traction due to their flexibility and lower setup costs. Public-private partnerships in road and transport infrastructure further fuel the market. However, slower economic growth and regulatory gaps limit large-scale technology adoption. Despite these challenges, increasing construction activity and foreign investments present steady opportunities for batching plant manufacturers in the region.

Middle East & Africa

The Middle East & Africa region captures a 4% market share, supported by growing construction and infrastructure development, particularly in GCC countries. Mega projects such as smart cities, highways, and commercial complexes drive the demand for advanced batching solutions. UAE and Saudi Arabia lead regional growth with investments in sustainable and high-capacity stationary plants. African countries are increasingly adopting mobile plants for cost-effective construction in remote areas. While infrastructure financing remains a challenge in parts of Africa, ongoing government initiatives and foreign investments are expected to strengthen the region’s contribution to the global concrete batch plants market.

Market Segmentations:

By Type:

- Stationary batch plant

- Mobile batch plant

By Capacity:

By Mix Type:

- Wet concrete mix

- Dry concrete mix

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The concrete batch plants market is highly competitive, with major players including Elkon, Sany, Putzmeister, AIMIX Group, JEL Concrete Plants, Liebherr, Ammann, Astec, Meka, and Cemco. The concrete batch plants market is characterized by strong competition, continuous innovation, and a growing focus on sustainability. Manufacturers are prioritizing advanced automation, digital monitoring, and energy-efficient designs to enhance plant performance. Many companies are introducing modular and mobile systems to meet the needs of infrastructure projects in both urban and remote areas. Technological integration, including smart control systems and real-time production monitoring, improves quality control and operational flexibility. The market also sees rising investment in eco-friendly solutions to comply with stricter environmental regulations. Expansion strategies, product differentiation, and after-sales service offerings further intensify the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Ammann India offers Super-Tech asphalt batch mix plants, a 10 meter Ammann ABG track pavers, concrete batching plants, CE Stage V Compactors. Ammann has ventured into concreting solutions with its trailer-mounted stationary pumps, concrete batch mix plants that feature ELBA technology working on Ammann’s software.

- In December 2024, Normet introduced a new series of construction equipment in India, such as low-cost concrete spraying machines and hydraulic breakers for better efficiency. The new arrivals at Bauma CONEXPO India 2024 are for tunneling and underground applications to meet increasing infrastructure needs in India through better and economical technologies.

- In October 2024, SBM Mineral Processing presented the new SBM Euromix 1600 Nova mobile concrete mixing plant. It is a replacement for the previous entry-level model in the Euromix range, with up to 80 m³/h of hardened concrete production capacity. The concepts important cornerstones are a high degree of operator comfort and safety paired with high efficiency in year-round operation.

- In July 2024, AJAX Engineering introduced Concrete GPT, an India construction sector AI-powered platform. Powered by GPT-4, it offers technical data, maintenance alerts, and regulation news in various languages. With chatbot, voice, and WhatsApp support, it enhances project efficiency and skill enhancement, which facilitates better operation of concrete equipment and new age technologies in the industry.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Mix Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for mobile and modular batching plants will increase to support flexible construction needs.

- Automation and digital control technologies will become standard features across new plant installations.

- Sustainable and energy-efficient designs will gain stronger adoption due to stricter environmental regulations.

- Smart monitoring and IoT integration will enhance operational efficiency and reduce downtime.

- Urbanization and infrastructure development will drive strong market expansion in emerging economies.

- Ready-mix concrete production will continue to be a key growth area for plant installations.

- Manufacturers will focus on compact designs to reduce setup time and improve mobility.

- Strategic collaborations and partnerships will help companies expand their regional footprint.

- Advanced recycling systems will support eco-friendly construction practices and resource optimization.

- Continuous R&D investment will lead to improved productivity and higher precision in batching processes.