Market Overview

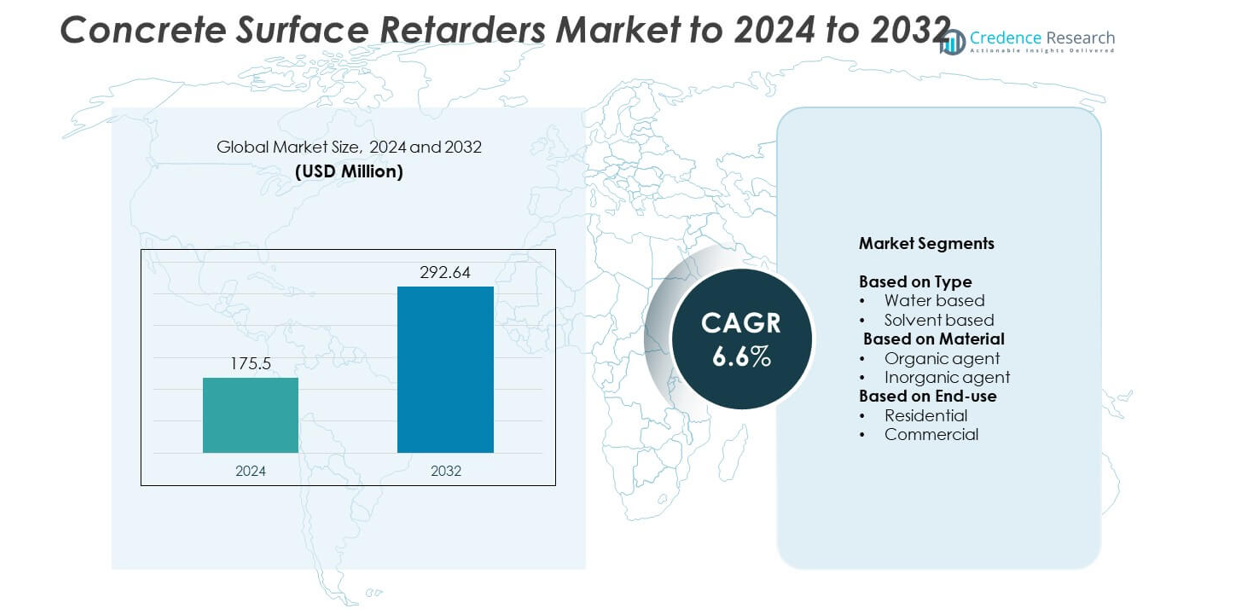

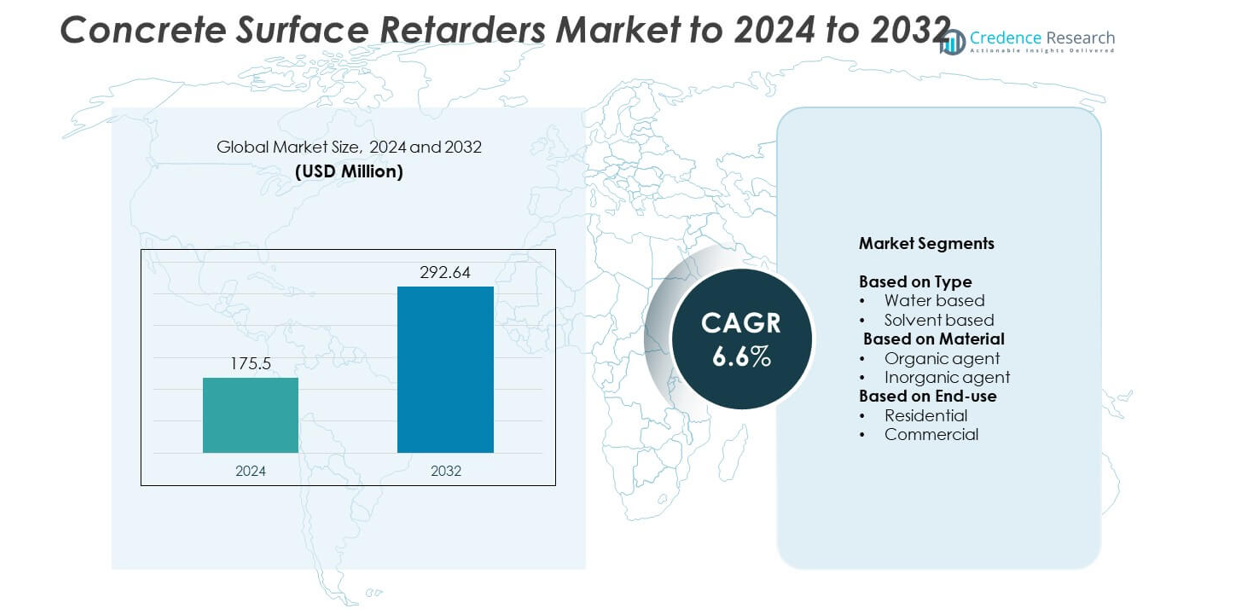

The Concrete Surface Retarders Market size was valued at USD 175.5 million in 2024 and is anticipated to reach USD 292.64 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Surface Retarders Market Size 2024 |

USD 175.5 million i |

| Concrete Surface Retarders Market , CAGR |

6.6% |

| Concrete Surface Retarders Market Size 2032 |

USD 292.64 million |

The Concrete Surface Retarders Market is highly competitive, with key players such as Sika, BASF, Arkema, Mapei, RPM International, Chryso, The Euclid Chemical Company, LATICRETE International, Fosroc International, and MBCC Group leading global operations. These companies emphasize product innovation, eco-friendly formulations, and expansion of distribution networks to meet evolving sustainability and performance standards. Strategic collaborations and acquisitions are strengthening their presence in high-growth markets. North America dominated the global market in 2024 with a 37% share, driven by strong construction activity and growing demand for decorative and sustainable concrete finishes, followed by Europe with 29% and Asia-Pacific with 26%.

Market Insights

- The Concrete Surface Retarders Market was valued at USD 175.5 million in 2024 and is projected to reach USD 292.64 million by 2032, growing at a CAGR of 6.6%.

- Rising demand for decorative and textured concrete in commercial and residential construction is driving market expansion globally.

- Growing preference for water-based and eco-friendly formulations aligns with sustainable building practices and environmental regulations.

- The market is competitive, with companies focusing on product innovation, regional expansion, and advanced application technologies to strengthen their presence.

- North America led with a 37% share in 2024, followed by Europe at 29% and Asia-Pacific at 26%, while the water-based segment dominated with 64% of the overall market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The water-based segment dominated the Concrete Surface Retarders Market in 2024 with a 64% share. These formulations are preferred for their low VOC emissions, ease of cleanup, and environmental compliance. They offer better surface uniformity and are widely adopted in green construction projects. Demand is driven by rising sustainability standards and regulatory pressure to reduce solvent emissions in construction chemicals. Water-based retarders are also gaining traction in large-scale infrastructure projects where eco-friendly solutions and worker safety are prioritized over traditional solvent-based alternatives.

- For instance, W. R. Meadows TOP-STOP lists coverage of 150–300 ft²/gal (3.68–7.36 m²/L) for water-soluble surface retarders, supporting low-VOC, easy-cleanup use on large pours.

By Material

The organic agent segment led the market with a 58% share in 2024. These agents provide superior control over surface texture and depth, enhancing architectural finish and decorative applications. Organic retarders are favored for their consistent performance and compatibility with various concrete mixes. Their growing use in precast and decorative concrete applications supports segment expansion. Demand is propelled by the rising trend of exposed aggregate surfaces in commercial and residential spaces, where aesthetic quality and precision control over surface exposure are key requirements.

- For instance, CHRYSO EXP-2089 offers 12 etch depths with application rates of 350–500 ft²/gal (8.6–12.3 m²/L) for controlled architectural finishes.

By End-use

The commercial segment accounted for 61% of the market share in 2024, leading the Concrete Surface Retarders Market. Growth is driven by increasing investments in commercial buildings, pavements, and architectural projects that require decorative or textured finishes. High durability and surface quality make retarders vital in creating slip-resistant and visually appealing structures. Urban development projects, including walkways, plazas, and parking areas, further enhance product adoption. The segment benefits from expanding commercial construction in Asia-Pacific and North America, where aesthetic and functional concrete designs are in high demand.

Key Growth Drivers

Rising Demand for Decorative and Architectural Concrete Finishes

Increasing preference for decorative concrete in modern infrastructure is driving market growth. Surface retarders help create exposed aggregate finishes, enhancing both aesthetics and functionality. Demand from commercial spaces, walkways, and public infrastructure is expanding due to urban beautification initiatives. Architects and contractors favor retarders for achieving uniform textures without mechanical treatment. Growing emphasis on sustainable construction and long-term durability further supports adoption, making decorative finishes one of the strongest growth drivers in the concrete surface retarders market.

- For instance, Sika SikaCem-110 Surface Retarder 15 specifies coverage 175–300 ft²/gal, supporting consistent results across highways and public works.

Expansion of Green Construction Practices

Green building standards and environmental regulations are boosting demand for eco-friendly concrete chemicals. Water-based retarders are increasingly replacing solvent-based alternatives due to their low VOC content and easy cleanup. Governments and private developers are prioritizing sustainable materials in residential and commercial projects. Manufacturers are developing biodegradable formulations to comply with environmental norms. This shift toward sustainable materials not only supports regulatory compliance but also positions eco-friendly retarders as a core driver of long-term market expansion.

- For instance, Fosroc Preco RWB is a water-based retarder with a flexible time factor up to 24 hours, aiding low-VOC compliance on site.

Growing Infrastructure Development Worldwide

Rapid urbanization and rising infrastructure investments in emerging economies are fueling market growth. Construction of highways, airports, bridges, and public facilities demands superior concrete finishing solutions. Concrete surface retarders provide consistent surface texture and improved bonding, essential for high-performance construction. Expanding budgets for civil infrastructure and government-led development programs strengthen product demand across large-scale projects. The infrastructure boom in Asia-Pacific and the Middle East remains a critical driver for the global concrete surface retarders market.

Key Trends and Opportunities

Adoption of Advanced Application Techniques

Technological advancements in spraying and coating systems are improving the efficiency of surface retarder application. Automated and precision-controlled spraying reduces material waste and enhances finish consistency. Contractors are adopting these technologies to increase productivity on large-scale sites. Integration of digital control systems ensures uniform surface exposure and reduced labor dependency. This growing adoption of advanced equipment is creating opportunities for manufacturers to develop user-friendly formulations compatible with automated systems.

- For instance, Euclid Chemical Surface Retarder S shows 100–200 ft²/gal coverage and requires rinsing 12–24 hours after application, aligning with the needs of large area projects.

Rising Popularity of Exposed Aggregate Concrete in Urban Design

The increasing use of exposed aggregate finishes in urban landscaping projects is shaping market trends. These finishes are widely used in pavements, plazas, and building facades for aesthetic enhancement. Designers favor surface retarders to achieve customized textures without mechanical abrasion. Growing investment in smart city projects and public beautification efforts amplifies this demand. As architects continue integrating decorative surfaces into modern infrastructure, the exposed aggregate trend presents significant opportunities for manufacturers and applicators.

- For instance, Dayton Superior TOP-CAST provides 12 graded etch depths in a color-coded system, simplifying controlled textures for plazas and walkways.

Key Challenges

High Sensitivity to Weather Conditions

Concrete surface retarders often show variable performance under extreme weather. Excessive heat or humidity can alter the penetration depth, affecting surface uniformity. This makes consistent application difficult across different climatic zones. Contractors require trained personnel to manage curing conditions effectively. The dependence on controlled temperature and timing increases project complexity and labor costs. Overcoming these environmental limitations remains a significant challenge for ensuring consistent finish quality and product reliability in diverse construction environments.

Limited Awareness in Developing Regions

In several developing markets, awareness about the benefits of surface retarders remains low. Contractors often rely on traditional mechanical methods for surface treatment due to lack of technical knowledge. This limits product penetration, especially in small and mid-scale construction projects. Additionally, limited availability of skilled applicators and modern spraying tools restricts adoption. To address this challenge, manufacturers are focusing on training initiatives and partnerships with local contractors to expand awareness and market reach.

Regional Analysis

North America

North America held the largest share of 37% in the Concrete Surface Retarders Market in 2024. The region’s dominance is driven by strong demand from commercial and residential construction, supported by renovation of public infrastructure and decorative concrete applications. The United States leads due to widespread adoption of sustainable building materials and advanced finishing technologies. Growing investments in urban landscaping and architectural paving projects further stimulate product demand. Additionally, the shift toward water-based formulations aligns with strict environmental regulations, strengthening the region’s leadership in the global market.

Europe

Europe accounted for 29% of the Concrete Surface Retarders Market in 2024. Demand is supported by advanced construction practices and the increasing focus on energy-efficient buildings. Countries such as Germany, France, and the United Kingdom are major contributors due to rising investments in decorative concrete and sustainable materials. The market benefits from stringent EU environmental directives promoting low-VOC chemical use. Growth in architectural concrete applications and infrastructure modernization across Western and Northern Europe further enhances regional adoption. Manufacturers in the region emphasize eco-friendly, performance-oriented formulations to meet sustainability standards.

Asia-Pacific

Asia-Pacific captured a 26% share of the Concrete Surface Retarders Market in 2024, driven by rapid urbanization and industrial expansion. China, India, and Japan lead regional growth, supported by infrastructure development and rising commercial construction. Increasing adoption of decorative and textured concrete surfaces in urban projects boosts product demand. The market benefits from growing investments in smart city initiatives and large-scale public works. Local manufacturers are expanding product portfolios with cost-effective and eco-friendly solutions. Economic growth and strong construction activity continue to position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America accounted for 5% of the Concrete Surface Retarders Market in 2024. Brazil and Mexico are the leading markets, driven by infrastructure renewal and increasing urban development. The region’s construction sector is gradually adopting advanced finishing techniques for pavements and commercial buildings. Rising preference for exposed aggregate surfaces in residential landscaping also supports growth. However, limited awareness of product benefits and high import dependence slightly restrict adoption. Government-backed housing and infrastructure projects are expected to create future opportunities for market expansion across the region.

Middle East & Africa

The Middle East & Africa held a 3% share of the Concrete Surface Retarders Market in 2024. Growth is led by increasing investments in infrastructure, tourism, and commercial projects across the Gulf Cooperation Council countries. High demand for decorative concrete in urban developments such as Dubai and Riyadh strengthens product use. Ongoing megaprojects, including airport expansions and mixed-use complexes, drive adoption of high-quality surface finishes. In Africa, infrastructure modernization and public construction initiatives support gradual market growth. However, dependence on imported materials continues to challenge local market penetration.

Market Segmentations:

By Type

- Water based

- Solvent based

By Material

- Organic agent

- Inorganic agent

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Concrete Surface Retarders Market features strong competition among leading players such as Sika, BASF, Arkema, Mapei, RPM International, Chryso, The Euclid Chemical Company, LATICRETE International, Fosroc International, W. R. Grace, MBCC Group, Koster Bauchemie, GCP Applied Technologies, Cemex, W. R. Meadows, and Schlumberger. The market is characterized by continuous innovation in eco-friendly and high-performance formulations designed to enhance surface quality and reduce VOC emissions. Companies focus on expanding product portfolios to meet evolving sustainability and construction standards across diverse applications. Strategic mergers, acquisitions, and collaborations are helping players strengthen their distribution networks and regional presence. Rising demand for decorative and architectural concrete solutions has encouraged investment in research and advanced coating technologies. Manufacturers are also emphasizing digital integration in formulation processes to improve efficiency and consistency. Intense competition and increasing environmental regulations are driving continuous product differentiation and sustainable innovation in the global market.

Key Player Analysis

- Sika

- BASF

- Arkema

- Mapei

- RPM International

- Chryso

- The Euclid Chemical Company

- LATICRETE International

- Fosroc International

- R. Grace

- MBCC Group

- Koster Bauchemie

- GCP Applied Technologies

- Cemex

- R. Meadows

- Schlumberger

Recent Developments

- In 2025, The Euclid Chemical Company Euclid Chemical confirmed participation at World of Concrete 2025. Booth S10615 hosted demonstrations.

- In 2024, W. R. Meadows Launched a new environmentally friendly concrete surface retarder, addressing the market trend toward sustainable and low-VOC (volatile organic compound) products.

- In 2024, CHRYSO (part of Saint-Gobain) Launched EnviroMix®, its first global range of admixtures designed for sustainable, low-carbon concrete.

- In 2023, Sika released the water-based concrete surface retarder, SikaCem®-110 Surface Retarder 03, to meet the growing demand for efficient and environmentally friendly materials for high-quality exposed aggregate finishes.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing use of decorative and exposed aggregate concrete will drive future demand.

- Water-based and low-VOC formulations will gain wider adoption due to sustainability trends.

- Rising infrastructure investments in emerging economies will create strong market opportunities.

- Manufacturers will focus on developing fast-acting and weather-resistant surface retarders.

- Integration of automated spraying systems will improve application efficiency on large projects.

- Expanding use of decorative concrete in urban landscaping will support long-term growth.

- Increased government spending on public infrastructure will boost commercial segment demand.

- Collaboration between manufacturers and contractors will enhance product training and awareness.

- Technological innovations in eco-friendly chemicals will strengthen regulatory compliance.

- Asia-Pacific is expected to remain the fastest-growing region, supported by rapid urbanization.