Market Overview

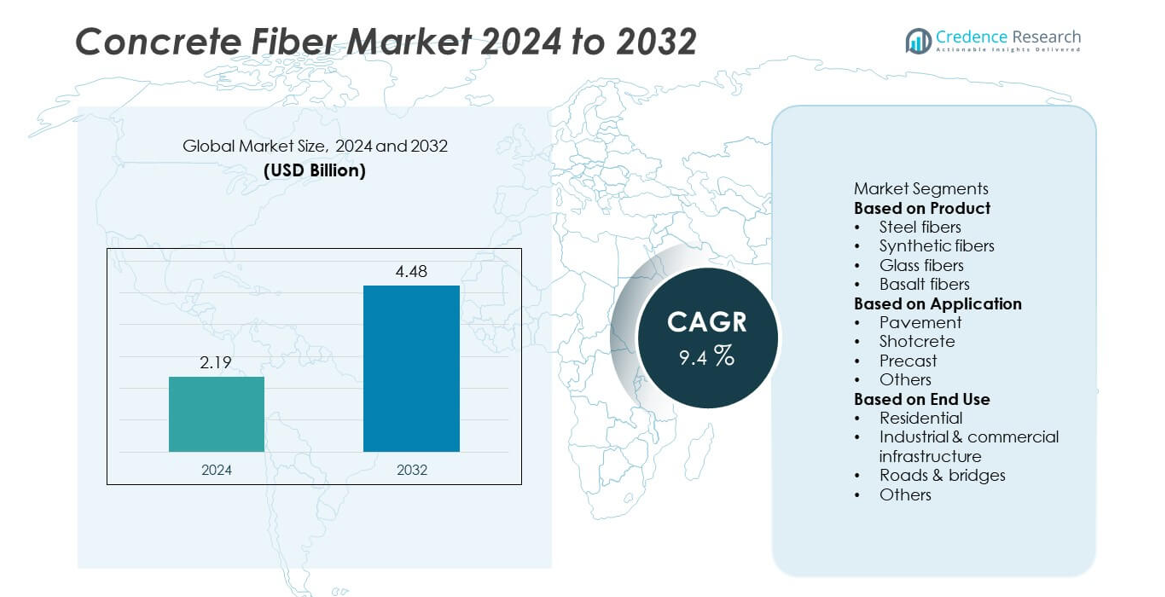

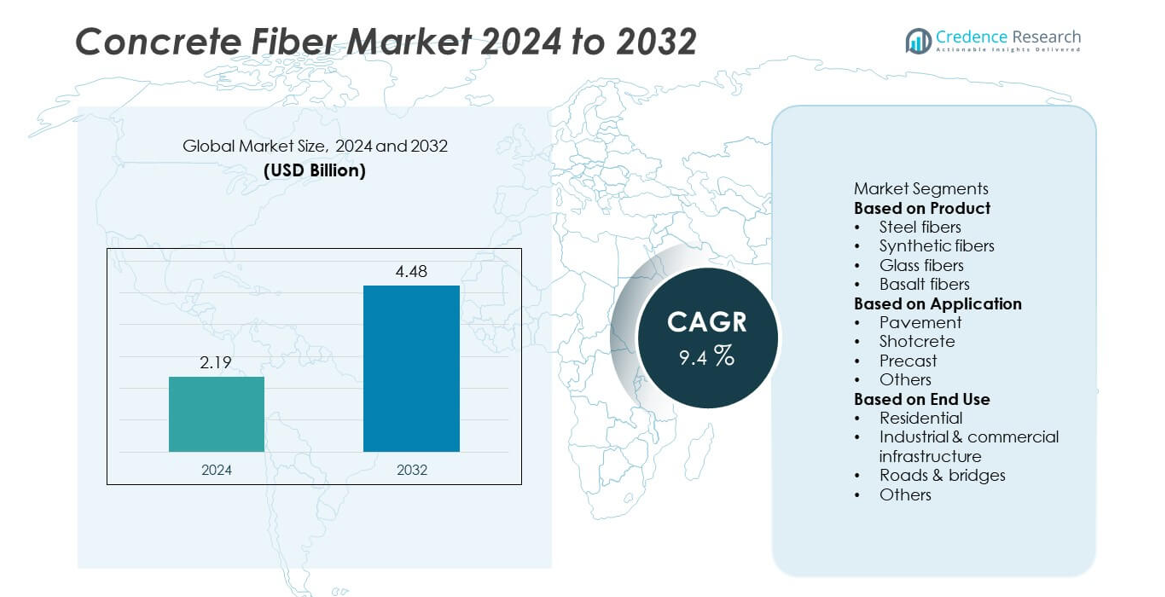

The global concrete fiber market was valued at USD 2.19 billion in 2024 and is projected to reach USD 4.48 billion by 2032, growing at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Fiber Market Size 2024 |

USD 2.19 billion |

| Concrete Fiber Market, CAGR |

9.4% |

| Concrete Fiber Market Size 2032 |

SD 4.48 billion |

The concrete fiber market is led by major players such as Owens Corning, Fibercon International, BASF SE, The Euclid Chemical Company, Bekaert SA, Nycon Corporation, Sika AG, GCP Applied Technologies, CEMEX S.A.B. de C.V., and ABC Polymer Industries. These companies dominate through advanced product innovation, global distribution strength, and strategic partnerships with construction and infrastructure firms. Asia-Pacific emerged as the leading regional market with a 34% share in 2024, driven by rapid urbanization and large-scale infrastructure projects. North America followed with a 31% share, supported by ongoing modernization of transportation and industrial facilities.

Market Insights

- The concrete fiber market was valued at USD 2.19 billion in 2024 and is projected to reach USD 4.48 billion by 2032, growing at a CAGR of 9.4% during the forecast period.

- Growing infrastructure investments, urban expansion, and demand for durable construction materials are major drivers supporting the adoption of fiber-reinforced concrete across roads, bridges, and industrial facilities.

- Market trends show rising use of synthetic and basalt fibers, along with hybrid fiber systems designed to enhance tensile strength, crack control, and sustainability performance in modern construction projects.

- The market is moderately consolidated, with key players such as Owens Corning, BASF SE, Sika AG, Bekaert SA, and CEMEX S.A.B. de C.V. focusing on product innovation, partnerships, and expansion in emerging economies.

- Asia-Pacific led the market with 34% share in 2024, followed by North America at 31%, while steel fibers dominated the product segment with 41% share, driven by their superior strength and durability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Steel fibers dominated the concrete fiber market in 2024, accounting for nearly 41% of the total share. Their high tensile strength, durability, and crack resistance make them preferred in structural concrete reinforcement for industrial flooring and heavy-duty pavements. The growing use of hooked and crimped steel fibers in tunnel linings and shotcrete applications strengthens their adoption. Synthetic fibers, including polypropylene and nylon, are gaining traction due to superior corrosion resistance and cost efficiency. Rising infrastructure renovation projects continue to drive demand for both metallic and polymer-based fiber materials.

- For instance, the Hong Kong–Zhuhai–Macao Bridge utilized various concrete and steel components to meet rigorous durability standards for its 120-year design life.

By Application

The pavement segment led the market with approximately 38% share in 2024, driven by the growing need for durable and low-maintenance road surfaces. Concrete fibers enhance load-bearing capacity and minimize shrinkage cracking in highways, airports, and industrial yards. Rising infrastructure spending across Asia-Pacific and North America supports large-scale pavement projects using fiber-reinforced concrete. The shotcrete segment follows, supported by increased tunneling and mining activities. Fiber use in shotcrete improves cohesion and reduces rebound losses, ensuring superior structural integrity in underground construction.

- For instance, The Euclid Chemical Company’s TUF-STRAND SF fibers are used to reinforce concrete in various applications, improving flexural toughness as shown in standard ASTM C1609 testing.

By End Use

The roads and bridges segment accounted for around 36% of the market share in 2024, driven by the need for improved tensile performance and reduced maintenance in high-traffic infrastructure. Fiber-reinforced concrete provides enhanced fatigue resistance and durability under cyclic loads, supporting long-term structural performance. Expanding highway modernization programs in China, India, and the U.S. further boost adoption. The industrial and commercial infrastructure segment also shows steady growth as developers integrate fiber-reinforced concrete in flooring, foundations, and precast panels to meet safety and performance standards.

Key Growth Driver

Rising Infrastructure Development and Urbanization

Rapid urban growth and infrastructure expansion are fueling demand for fiber-reinforced concrete. Governments across major economies are investing in roads, bridges, tunnels, and industrial zones to improve connectivity and resilience. Concrete fibers enhance structural strength, reduce cracking, and extend service life, making them ideal for modern infrastructure. Urbanization and public infrastructure projects continue to support widespread fiber integration in large-scale construction and redevelopment works, particularly across transport and industrial sectors seeking long-lasting performance.

- For instance, the Mexico City–Toluca railway viaduct, also known as El Insurgente, is a major railway project that has involved various contractors and suppliers. The project includes numerous civil structures, such as bridges and tunnels, and has required specialized materials to meet specific engineering and seismic standards.

Increasing Adoption in Precast and Industrial Applications

Precast concrete producers are increasingly integrating fibers to improve durability, efficiency, and surface finish. Fiber reinforcement eliminates the need for traditional steel mesh, lowering labor time and production costs. Industrial flooring applications benefit from superior abrasion resistance and reduced cracking under heavy mechanical loads. As factories, warehouses, and logistics facilities expand globally, the preference for fiber-reinforced precast elements continues to strengthen, ensuring improved reliability and longer service life for industrial infrastructure.

- For instance, a different supplier, BarChip, provided fiber-reinforced concrete flooring for Amazon’s Nova Santa Rita fulfillment center in Brazil, an area of 41,180 square meters. Instead of being tested for compressive strength, the BarChip fiber-reinforced concrete was designed to be a high-performance, jointless floor.

Growing Shift Toward Sustainable and Low-Maintenance Materials

The market is benefiting from the rising demand for eco-friendly and durable construction materials. Fiber-reinforced concrete contributes to sustainability by reducing cement consumption, minimizing maintenance, and extending service life. Synthetic and basalt fibers offer corrosion resistance and lightweight performance, supporting energy-efficient construction. Environmental regulations and green building certifications are further encouraging the shift toward low-maintenance materials that align with long-term sustainability goals in modern construction.

Key Trend and Opportunity

Advancements in Synthetic and Basalt Fiber Technology

Continuous improvements in fiber technology are expanding the performance capabilities of concrete reinforcement. Synthetic fibers now provide enhanced durability, chemical stability, and flexibility across varied construction environments. Basalt fibers are gaining traction as a sustainable and cost-effective alternative due to their natural origin and superior strength-to-weight ratio. Manufacturers are developing hybrid fiber systems that combine multiple materials to achieve balanced mechanical performance, creating opportunities in infrastructure and high-performance concrete applications.

- For instance, Nycon Corporation is a manufacturer of synthetic fibers and admixtures for concrete, and studies have shown that high-performance fiber-reinforced concrete (HPFRC) containing steel or basalt fibers can be utilized in bridge decks to enhance durability and structural integrity under freeze-thaw cycling conditions.

Expansion in Smart Infrastructure and Repair Projects

The growing focus on smart infrastructure and renovation projects is opening new growth avenues. Fiber-reinforced concrete is increasingly used in rehabilitation works for roads, bridges, and tunnels to improve durability and reduce maintenance costs. The technology’s ability to prevent cracking and resist fatigue enhances long-term reliability in aging structures. Governments and private developers are prioritizing fiber use in infrastructure upgrades and digitalized construction projects to achieve higher sustainability and resilience standards.

- For instance, Sika AG implements its SikaFiber Force synthetic macro-fibers in shotcrete applications for tunnels and other structures to increase ductility and enhance performance. In large-scale projects like Switzerland’s Gotthard Base Tunnel, Sika provides extensive concrete solutions and waterproofing systems.

Key Challenge

High Initial Costs and Material Compatibility Issues

The relatively high initial cost of fiber materials and complex mixing processes can limit adoption among small contractors. Different fiber types may not blend uniformly with certain concrete mixtures, leading to uneven performance or clumping. These challenges affect mechanical strength and project cost-efficiency. Continuous innovation in fiber production, improved dispersion technologies, and standard mixing guidelines are essential to address these limitations and promote wider commercial acceptance.

Lack of Standardization and Skilled Workforce

The absence of uniform standards for fiber selection, dosage, and testing often creates uncertainty in construction projects. Regional variations in regulations and limited knowledge among engineers and contractors slow adoption rates. Inadequate training and inconsistent installation practices can reduce the performance benefits of fiber-reinforced concrete. Establishing clear technical guidelines, certification systems, and professional training programs is crucial to ensure consistent quality and expand industry adoption globally.

Regional Analysis

North America

North America held a market share of 31% in 2024, driven by strong infrastructure renewal and industrial construction activity. The United States leads due to heavy investment in road rehabilitation, bridge reconstruction, and commercial building upgrades. Fiber-reinforced concrete is increasingly used for its durability and crack resistance in highways, airport pavements, and industrial flooring. Government initiatives promoting sustainable materials and extended lifespan construction practices are further boosting demand. Canada follows with growing adoption in cold-weather applications where fibers enhance freeze-thaw durability and long-term structural performance in residential and municipal projects.

Europe

Europe accounted for 27% of the global market share in 2024, supported by stringent environmental standards and the rising focus on sustainable building materials. Countries such as Germany, the United Kingdom, and France are leading adopters of fiber-reinforced concrete in roads, tunnels, and prefabricated construction elements. The region’s emphasis on low-carbon materials aligns with the use of basalt and synthetic fibers for improved durability and reduced maintenance. Infrastructure renovation and transport modernization projects under the European Green Deal continue to stimulate market growth, with increasing adoption in both civil and industrial construction applications.

Asia-Pacific

Asia-Pacific dominated the concrete fiber market with a 34% share in 2024, fueled by large-scale urbanization, industrialization, and infrastructure expansion. China, India, and Japan are key contributors, investing heavily in smart city projects, high-speed rail networks, and highway systems. Fiber-reinforced concrete is widely used in bridges, tunnels, and commercial structures to improve load-bearing capacity and crack control. The growing construction sector, coupled with government-led sustainability programs, is driving demand for advanced fiber technologies. Rising domestic manufacturing capabilities and the availability of low-cost raw materials further enhance the region’s competitive advantage.

Latin America

Latin America captured a 5% share of the global concrete fiber market in 2024, driven by ongoing urban infrastructure and road development projects. Brazil and Mexico are the leading contributors, with rising investments in housing, highways, and industrial facilities. Fiber-reinforced concrete is gaining popularity for its durability and reduced maintenance needs in regions with varying climatic conditions. The growing preference for cost-effective, sustainable materials is supporting market expansion. Efforts to modernize public infrastructure and improve construction standards are expected to strengthen regional adoption over the forecast period.

Middle East and Africa

The Middle East and Africa region held a 3% share of the market in 2024, supported by rising infrastructure and commercial development across the Gulf states and sub-Saharan Africa. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing in large-scale projects, including transport networks, airports, and industrial facilities. Fiber-reinforced concrete is increasingly used to enhance durability in high-temperature and corrosive environments. Expanding urbanization, coupled with the construction of megaprojects like smart cities and industrial zones, is driving steady demand for advanced fiber materials across the region.

Market Segmentations:

By Product

- Steel fibers

- Synthetic fibers

- Glass fibers

- Basalt fibers

By Application

- Pavement

- Shotcrete

- Precast

- Others

By End Use

- Residential

- Industrial & commercial infrastructure

- Roads & bridges

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete fiber market includes key players such as Owens Corning, Fibercon International, BASF SE, The Euclid Chemical Company, Bekaert SA, Nycon Corporation, Sika AG, GCP Applied Technologies, CEMEX S.A.B. de C.V., and ABC Polymer Industries. These companies focus on expanding product portfolios, improving fiber performance, and strengthening global distribution networks. Strategic initiatives such as mergers, product launches, and capacity expansions are driving competition. Manufacturers are emphasizing advanced fiber materials, including synthetic and basalt variants, to meet the growing demand for sustainable and durable concrete reinforcement. Partnerships with construction firms and infrastructure developers are increasing to enhance application reach and performance reliability. Continuous R&D investments in lightweight, corrosion-resistant, and high-strength fibers are shaping technological advancements. Global players are also targeting emerging markets in Asia-Pacific and Latin America, where infrastructure development and urbanization continue to accelerate adoption.

Key Player Analysis

- Owens Corning

- Fibercon International

- BASF SE

- The Euclid Chemical Company

- Bekaert SA

- Nycon Corporation

- Sika AG

- GCP Applied Technologies

- CEMEX S.A.B. de C.V.

- ABC Polymer Industries

Recent Developments

- In February 2025, Owens Corning confirmed it would sell its glass reinforcements business (which includes glass fiber products) to Praana Group.

- In October 2024, Bekaert SA received the Pioneer Award alongside Société du Grand Paris and Eiffage for the use of its Dramix® steel fibers in Grand Paris Express tunnels, recognizing excellence in tunnel durability and performance.

- In March 2024, Sika Group introduced a new eco-friendly concrete fiber product line built from recycled materials.

- In January 2023, ABC Polymer Industries rebranded its FiberForce division to FullForce, aligning with its strategic expansion into high-performance macro and micro fiber systems for industrial and precast concrete

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to rising infrastructure modernization worldwide.

- Increasing use of fiber-reinforced concrete in smart city projects will boost demand.

- Synthetic and basalt fibers will gain wider acceptance for sustainable construction.

- Advancements in hybrid fiber technology will enhance concrete performance and lifespan.

- Government initiatives promoting eco-friendly materials will support long-term market expansion.

- Precast and industrial applications will continue to dominate new construction segments.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization and industrialization.

- North America will expand through renovation projects and durable pavement solutions.

- Continuous R&D investment will lead to cost-effective and high-strength fiber innovations.

- Collaboration between material producers and construction companies will shape future market competitiveness.