Market Overview

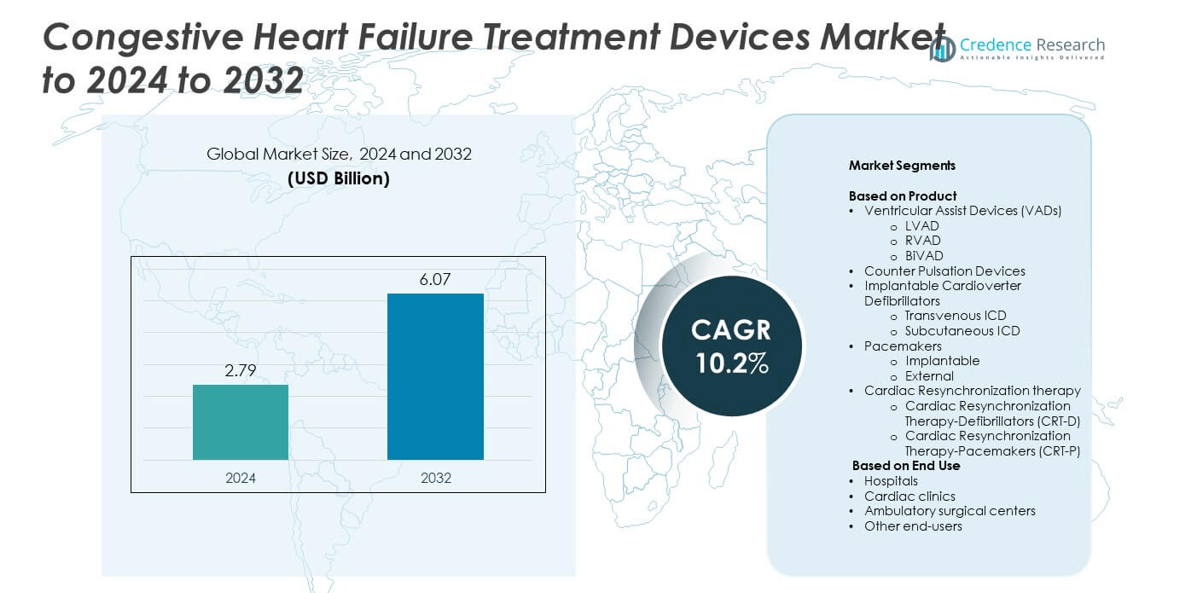

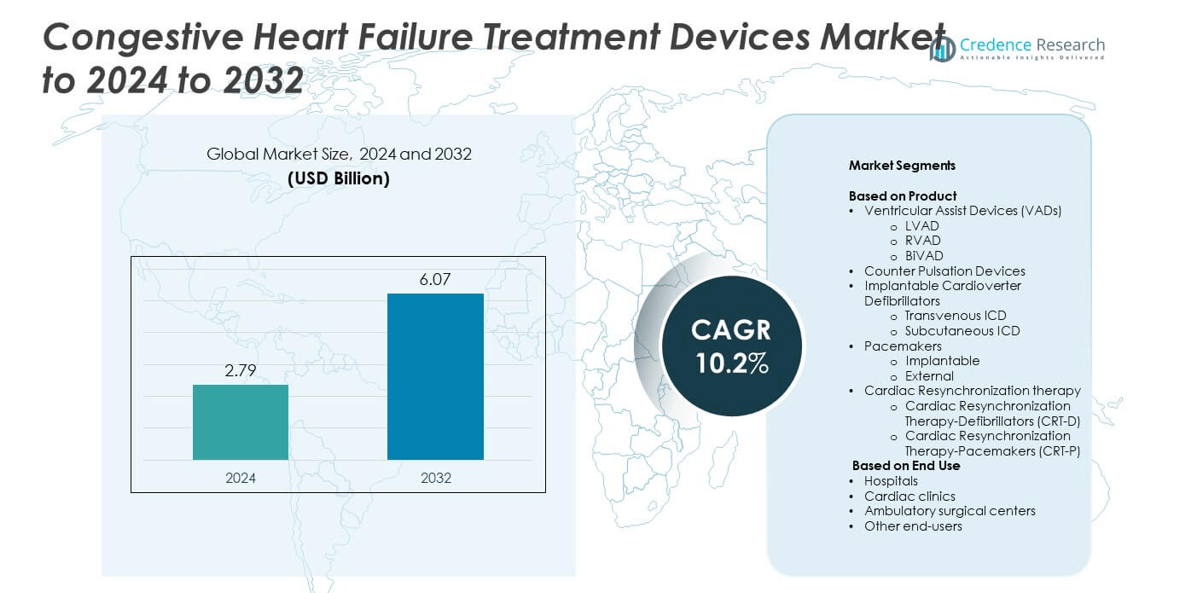

Congestive Heart Failure Treatment Devices Market size was valued at USD 2.79 Billion in 2024 and is anticipated to reach USD 6.07 Billion by 2032, at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Congestive Heart Failure Treatment Devices Market Size 2024 |

USD 2.79 Billion |

| Congestive Heart Failure Treatment Devices Market, CAGR |

10.2% |

| Congestive Heart Failure Treatment Devices Market Size 2032 |

USD 6.07 Billion |

The congestive heart failure treatment devices market is dominated by major players such as Medtronic, Abbott, Boston Scientific Corp., Johnson & Johnson MedTech, Berlin Heart GmbH, Jarvik Heart Inc., ReliantHeart, Inc., and Biotronik SE & Co. KG. These companies maintain strong market positions through continuous innovation in implantable and assistive cardiac technologies, focusing on device miniaturization, wireless monitoring, and improved patient outcomes. Strategic collaborations with hospitals and research centers enhance their clinical reach and technological edge. Regionally, North America led the market in 2024 with a 39% share, supported by advanced healthcare infrastructure and high adoption of ventricular assist and resynchronization devices across major cardiac care facilities.

Market Insights

- The congestive heart failure treatment devices market was valued at USD 2.79 billion in 2024 and is projected to reach USD 6.07 billion by 2032, growing at a CAGR of 10.2%.

- Rising cases of heart failure, aging populations, and increasing adoption of implantable cardiac devices are driving market growth.

- The market is witnessing trends toward miniaturized, wireless, and AI-integrated devices that enhance monitoring and long-term performance.

- Leading players are investing in product innovation, clinical trials, and strategic collaborations, with Ventricular Assist Devices (VADs) accounting for over 34% share in 2024.

- North America led the market with a 39% share, followed by Europe at 28% and Asia Pacific at 22%, driven by advanced cardiac care infrastructure and strong adoption of next-generation treatment technologies across major hospitals and cardiac centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Ventricular Assist Devices (VADs) held the dominant position in the congestive heart failure treatment devices market, accounting for over 34% share in 2024. The segment’s growth is driven by the rising prevalence of end-stage heart failure and technological advances in long-term implantable support systems. Left Ventricular Assist Devices (LVADs) led within the category, supported by improved biocompatibility, compact design, and reduced thrombosis risks. Companies are investing in next-generation, fully implantable VADs with wireless power transfer, enhancing patient mobility and long-term outcomes, which further strengthens their clinical adoption across leading cardiac centers.

- For instance, Abbott’s HeartMate 3 Left Ventricular Assist Device (LVAD) is capable of achieving flows up to 10 L/min.

By End Use

Hospitals emerged as the leading end-use segment, capturing more than 46% of the market share in 2024. The dominance is attributed to high patient inflow, availability of advanced cardiac care infrastructure, and growing adoption of implantable devices for chronic heart failure management. Multidisciplinary cardiac units in tertiary hospitals increasingly perform complex procedures involving VADs, ICDs, and CRT devices. Favorable reimbursement policies and the integration of remote monitoring technologies in hospital networks further enhance treatment accessibility and patient survival rates, supporting steady market growth within this segment.

- For instance, Medtronic’s CareLink remotely monitors over 2 million patients with CIEDs.

Key Growth Drivers

Rising Prevalence of Heart Failure and Aging Population

The growing global incidence of heart failure cases, driven by an aging population and lifestyle-related diseases, is fueling demand for advanced treatment devices. Increasing hospital admissions for cardiac complications are boosting the adoption of implantable defibrillators, pacemakers, and assist devices. Countries such as the U.S., Japan, and Germany are witnessing higher device utilization rates due to established healthcare systems and early diagnosis. This demographic shift remains the primary driver for sustained market expansion in the coming years.

- For instance, the BIOTRONIK IN-TIME study showed a relative risk reduction of over 60% in all-cause mortality for heart failure patients using Home Monitoring compared to those receiving standard care. The study found that all-cause mortality after one year was 3.4% in the Home Monitoring group compared to 8.7% in the control group.

Technological Advancements in Implantable Devices

Continuous innovation in device miniaturization, biocompatibility, and battery life is transforming the treatment landscape. Next-generation devices now feature remote monitoring, wireless charging, and improved lead durability, enhancing patient comfort and long-term reliability. Integration of AI-enabled diagnostics and telehealth platforms allows clinicians to track cardiac performance in real time, reducing emergency readmissions. These advancements are accelerating the shift toward minimally invasive and personalized heart failure therapies.

- For instance, an analysis of Boston Scientific’s LATITUDE Remote Patient Management system, presented in the PREDICt-RM study at Heart Rhythm 2014, showed a 33% relative risk reduction in mortality and a 19% relative risk reduction in all-cause hospitalizations for remotely monitored patients compared to those not monitored via the system.

Increasing Investments and Government Support

Growing public and private investments in cardiac care infrastructure and clinical trials are strengthening market growth. Governments are funding research for next-generation cardiac assist devices and expanding reimbursement programs to improve access. Partnerships between hospitals and medical device companies are promoting innovation and expanding availability across emerging economies. The combination of financial incentives and supportive regulations is fostering rapid technology adoption in cardiac care.

Key Trends & Opportunities

Shift Toward Remote and Home-Based Cardiac Monitoring

The integration of remote patient monitoring systems with implantable devices is becoming a vital trend. Advanced telemetry and mobile applications enable continuous tracking of cardiac rhythms, improving clinical decision-making and reducing hospital visits. Companies are introducing devices compatible with cloud-based monitoring platforms to expand chronic care management. This shift supports patient-centric treatment models and enhances long-term outcomes, presenting major growth potential in developed markets.

- For instance, Abbott’s Confirm Rx study enrolled 5,666 patients; 97% registered and 92% sent data.

Emergence of Next-Generation Ventricular Assist Devices

Compact, fully implantable VADs with wireless energy transfer and extended durability are redefining treatment standards. Manufacturers are focusing on reducing mechanical wear, infection risks, and device noise to improve patient comfort. These innovations are broadening the scope of mechanical circulatory support beyond end-stage heart failure cases, enabling earlier intervention and improving survival rates. The trend is expected to reshape the competitive landscape in advanced cardiac care.

- For instance, CorWave reported a 6-month in-vivo run and nine 60-day ovine implants without device failure.

Key Challenges

High Device Costs and Limited Accessibility

The high upfront cost of implantable cardiac devices and related surgical procedures remains a key restraint. In developing regions, limited reimbursement coverage and inadequate healthcare infrastructure restrict patient access. Small hospitals face difficulties in maintaining trained personnel and post-surgical monitoring systems. These barriers slow adoption rates despite the clinical benefits offered by advanced heart failure treatment devices.

Regulatory Hurdles and Safety Concerns

Strict approval processes and long regulatory timelines for implantable devices often delay commercialization. Safety issues related to device malfunction, infection risks, and long-term biocompatibility require continuous testing and design refinement. Recalls and product failures can significantly affect manufacturer credibility and patient confidence. These challenges underscore the need for robust quality control and post-market surveillance to ensure reliable device performance.

Regional Analysis

North America

North America held the largest share of 39% in the congestive heart failure treatment devices market in 2024. The region’s dominance is supported by a well-established healthcare infrastructure, high awareness levels, and the strong presence of major medical device manufacturers. The U.S. leads adoption rates due to early regulatory approvals and widespread reimbursement coverage for implantable devices. Advanced research in ventricular assist systems and cardiac resynchronization therapies further boosts regional demand. Increasing prevalence of cardiovascular disorders and high healthcare spending continue to drive sustained growth in the North American market.

Europe

Europe accounted for around 28% of the global market share in 2024, driven by advanced healthcare systems and growing elderly populations. Countries such as Germany, the UK, and France are leading adopters of ventricular assist devices and implantable defibrillators. The European market benefits from strong governmental support for cardiac disease management programs and favorable reimbursement frameworks. Rising emphasis on early diagnosis and the availability of specialized cardiac centers contribute to continued market expansion. The region also witnesses growing collaboration between hospitals and medical device companies to enhance long-term patient outcomes.

Asia Pacific

Asia Pacific captured approximately 22% of the global market share in 2024, with significant growth potential driven by rapid healthcare modernization and increasing cardiovascular disease incidence. China, Japan, and India are major contributors, supported by expanding hospital infrastructure and improving access to cardiac care. Growing awareness of advanced heart failure therapies and rising healthcare spending among middle-class populations are accelerating device adoption. Local manufacturing initiatives and government investments in healthcare technology are further reducing costs and enhancing device availability across emerging Asian economies, positioning the region for the fastest growth through 2032.

Latin America

Latin America represented about 7% of the market share in 2024, supported by rising healthcare investments and increasing demand for cardiac implants. Brazil and Mexico dominate the regional market due to expanding hospital networks and improved diagnostic capabilities. Growth is further encouraged by government efforts to strengthen public healthcare and by partnerships with international device manufacturers. Although limited reimbursement policies and cost constraints remain challenges, ongoing public awareness campaigns and gradual adoption of remote monitoring solutions are enhancing treatment accessibility and patient outcomes across Latin America.

Middle East & Africa

The Middle East & Africa held a market share of nearly 4% in 2024, with growth mainly concentrated in Gulf Cooperation Council countries and South Africa. Increasing investment in healthcare infrastructure and the introduction of advanced cardiac treatment facilities are boosting regional adoption. Governments are prioritizing cardiovascular health initiatives to address rising chronic disease rates. However, limited device availability and affordability challenges persist in several low-income nations. Expanding collaborations between regional hospitals and global medical technology firms are gradually improving access to life-saving congestive heart failure treatment devices.

Market Segmentations:

By Product

- Ventricular Assist Devices (VADs)

- Counter Pulsation Devices

- Implantable Cardioverter Defibrillators

- Transvenous ICD

- Subcutaneous ICD

- Pacemakers

- Cardiac Resynchronization therapy

- Cardiac Resynchronization Therapy-Defibrillators (CRT-D)

- Cardiac Resynchronization Therapy-Pacemakers (CRT-P)

By End Use

- Hospitals

- Cardiac clinics

- Ambulatory surgical centers

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The congestive heart failure treatment devices market is led by major players such as Medtronic, Abbott, Boston Scientific Corp., Johnson & Johnson MedTech, Berlin Heart GmbH, Jarvik Heart Inc., ReliantHeart, Inc., and Biotronik SE & Co. KG. These companies compete through technological innovation, product diversification, and strategic collaborations with healthcare institutions. The market is characterized by a strong focus on developing miniaturized, energy-efficient, and wireless implantable devices that improve patient outcomes and reduce complications. Continuous investments in R&D, clinical trials, and AI-enabled monitoring technologies are enhancing device reliability and long-term performance. Manufacturers are also expanding into emerging markets through localized production and partnerships to meet growing global demand. Strategic mergers, acquisitions, and regulatory approvals play a vital role in strengthening their market position. The competitive environment emphasizes innovation, cost-effectiveness, and post-implantation support services to ensure superior treatment outcomes and sustained market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic

- Abbott

- Boston Scientific Corp.

- Johnson & Johnson MedTech

- Berlin Heart GmbH

- Jarvik Heart Inc.

- ReliantHeart, Inc.

- Biotronik SE & Co. KG

Recent Developments

- In 2024, Johnson & Johnson acquired V-Wave Ltd., adding a minimally invasive device device for treating heart failure with reduced ejection fraction (HFrEF) by reducing left atrial pressure.

- In 2024, Boston Scientific announced the FDA approval of an expanded indication for its INGEVITY+ pacing leads. This allowed for conduction system pacing of the left bundle branch area, potentially improving ventricular synchrony and reducing the long-term risk of heart failure associated with traditional right ventricular pacing.

- In 2023, Abbott received U.S. FDA approval for its AVEIR Dual Chamber (DR) leadless pacemaker system.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion driven by rising global heart failure cases.

- Advancements in miniaturized and wireless implantable devices will enhance patient comfort.

- Remote monitoring technologies will become standard in post-implantation care and diagnostics.

- Hospitals will continue to dominate usage, supported by integrated cardiac care programs.

- Emerging economies will see higher adoption due to improved healthcare infrastructure.

- Research in bioengineered and fully implantable assist systems will gain strong momentum.

- AI and predictive analytics will improve early detection and personalized device programming.

- Regulatory frameworks will evolve to support faster approval of innovative cardiac devices.

- Strategic partnerships between device makers and hospitals will strengthen market penetration.

- Growing awareness and favorable reimbursement policies will enhance patient access globally.