Market Overview

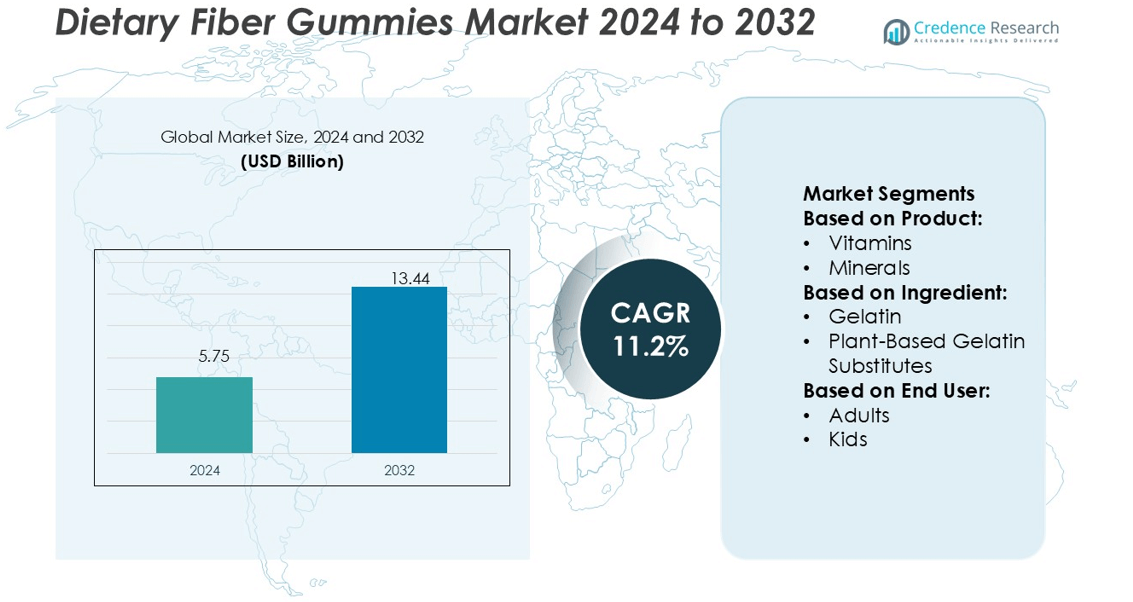

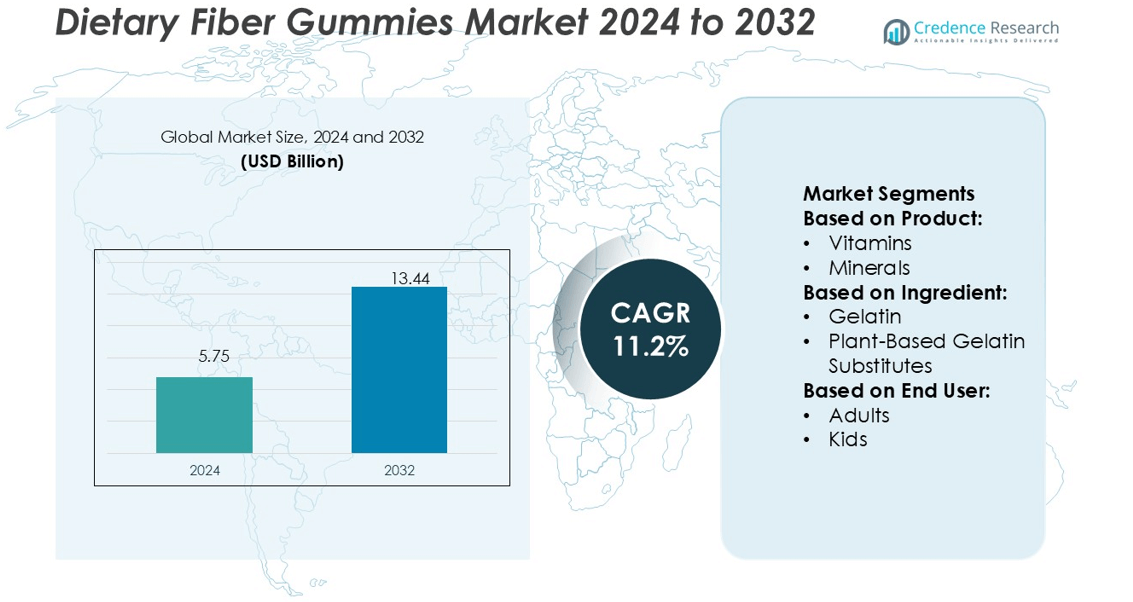

Dietary Fiber Gummies Market size was valued USD 5.75 billion in 2024 and is anticipated to reach USD 13.44 billion by 2032, at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dietary Fiber Gummies Market Size 2024 |

USD 5.75 billion |

| Dietary Fiber Gummies Market, CAGR |

11.2% |

| Dietary Fiber Gummies Market Size 2032 |

USD 13.44 billion |

The dietary fiber gummies market is dominated by top players such as Nordic Naturals, Nutranext (part of Clorox), SmartyPants Vitamins, MegaFood (a division of FoodState), Herbaland Naturals Inc, Vitafusion (Church & Dwight Co., Inc.), Olly Nutrition (Unilever), Now Foods, Nature’s Way (a subsidiary of Schwabe North America), and The Honest Company. These companies focus on product innovation, expanding flavor options, and introducing clean-label ingredients to attract health-conscious consumers. Asia Pacific leads the market with a 34% share, supported by rapid urbanization, rising disposable incomes, and growing awareness of digestive health. Strong retail and e-commerce networks further strengthen the region’s position. Established brands and new entrants continue to invest in advanced formulations, sustainable packaging, and strategic partnerships to enhance their market presence and capture growing consumer demand worldwide.

Market Insights

- The dietary fiber gummies market was valued at USD 5.75 billion in 2024 and is expected to reach USD 13.44 billion by 2032, growing at a CAGR of 11.2%.

- Rising demand for digestive health supplements and clean-label products is driving strong market growth.

- Top companies are focusing on product innovation, flavor expansion, and plant-based formulations to strengthen their competitive edge.

- Limited consumer awareness in some regions and high production costs may restrain faster adoption.

- Asia Pacific leads the market with a 34% share, followed by North America at 32%, supported by strong retail and e-commerce growth, with the vitamins product segment holding the largest share within the category.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The vitamins segment dominates the dietary fiber gummies market with the highest share. Consumers prefer vitamin-rich gummies for immune support, energy, and overall wellness. Vitamin gummies are easy to consume and offer multiple nutrients in one serving. Demand is growing due to preventive health trends and functional food popularity. Brands are introducing multivitamin-fiber blends targeting daily nutrition needs. For instance, Nature Made offers fiber gummies with 3 g of fiber and key vitamins per serving, supporting digestion and immunity. This segment benefits from strong retail availability and active marketing strategies.

- For instance, Fiber Garden gummies, which typically delivered 4 grams of prebiotic fiber per single-serve packet. These supplements, like others in this segment, benefit from strong retail availability and marketing strategies.

By Ingredient

Gelatin remains the dominant ingredient segment in the market. Gelatin provides better texture, chewiness, and shelf stability, making it ideal for mass production. It supports a clean and consistent gummy structure, which attracts both manufacturers and consumers. However, plant-based substitutes are gaining momentum due to rising vegan and clean-label preferences. For example, SmartyPants uses pectin-based gelatin alternatives to appeal to health-conscious buyers. Gelatin’s broad acceptance in conventional supplement formulations maintains its market lead, supported by cost efficiency and ease of processing.

- For instance, SmartyPants’ Kids Fiber & Veggies gummies are vegetarian and use pectin instead of gelatin. Each two-gummy serving delivers 3 g of inulin fiber derived from chicory root to support digestive health.

By End-user

Adults represent the largest end-user segment in the dietary fiber gummies market. Adults seek convenient solutions for digestive health, weight control, and immunity support. Fiber gummies offer an easier alternative to capsules and powders. Brands are launching specialized formulations targeting metabolic health and gut balance. For instance, Olly provides adult fiber gummies with prebiotic blends designed for daily use. Rising awareness of gut health and preventive nutrition drives this segment. Broad product variety and availability in retail and online channels reinforce its market leadership.

Key Growth Drivers

Rising Demand for Functional Confectionery

Consumers are increasingly choosing functional confectionery for convenience and health. Dietary fiber gummies provide an easy way to support digestive wellness without pills or powders. Their chewable format and sweet flavors make them attractive to adults and kids. Food manufacturers are launching gummies with prebiotics and natural ingredients to meet clean-label preferences. For instance, OLIPOP and SmartyPants Vitamins expanded their functional gummy lines in 2024. This growing appeal across age groups drives steady demand in the dietary fiber gummies market.

- For instance, MegaFood’s Women’s Multi Gummies feature a formulation that delivers 19 essential nutrients per two-gummy serving. The formula includes 25 mcg of vitamin D3 sourced from cholecalciferol, 400 mcg of folate (as folic acid, DFE), and methylated B12 for better absorption.

Growing Focus on Gut Health Awareness

Awareness of gut health benefits is driving demand for fiber-enriched products. Consumers are learning more about how fiber supports digestion, immunity, and weight control. This shift is pushing brands to add inulin, chicory root fiber, and resistant starch to gummies. For example, Garden of Life and Goli Nutrition reported strong sales growth from their fiber gummy lines in 2024. Marketing campaigns focusing on digestive wellness and product transparency further strengthen consumer trust and boost adoption.

- For instance, Herbaland also bolstered manufacturing scale: currently it operates seven production lines across four facilities, producing about 70 million bottles annually. Herbaland achieved B-Corp certification.

Expanding Retail and Online Distribution

Wider availability through retail and e-commerce is fueling market expansion. Leading supplement brands are collaborating with supermarkets, pharmacies, and online platforms to increase product visibility. The growing role of D2C channels also allows brands to build loyal customer bases. For example, HUM Nutrition increased online gummy sales through personalized subscription models in 2024. Easy access, promotional offers, and flexible delivery options are making dietary fiber gummies more accessible to a global consumer base.

Key Trends & Opportunities

Innovation in Clean Label and Plant-Based Formulations

Consumers are demanding products with natural sweeteners, organic fibers, and gelatin alternatives. Brands are replacing animal-based gelatin with pectin or other plant-based ingredients to appeal to vegans and vegetarians. For example, MaryRuth Organics launched a new line of vegan fiber gummies in 2024. This clean-label trend creates opportunities for brands to expand into emerging health-conscious markets. Transparent labeling and allergen-free claims further enhance trust and adoption.

- For instance, Vitafusion Calcium Gummies, contains 500 mg of calcium and 1,000 IU of vitamin D per two gummies, while being free of artificial sweeteners, gluten, dairy, and synthetic dyes.

Personalized Nutrition and Functional Blends

Personalization is becoming a key growth trend in the gummy supplement segment. Brands are combining dietary fiber with other functional ingredients like vitamins, probiotics, and adaptogens. For example, Goli Nutrition launched fiber gummies with vitamin D for immunity support. Subscription models and data-driven personalization allow companies to target specific health needs. This trend creates strong potential for product diversification and premium pricing.

- For instance, Olly Fiber Gummy Rings supply 5 g of fructo-oligosaccharides (FOS) per 2 gummies to support digestive regularity. Olly states these rings are formulated with no synthetic flavors, no artificial colors, and 100% PCR PET bottles as packaging, reflecting clean label commitments.

Strategic Collaborations and Product Expansion

Partnerships between food tech startups, ingredient suppliers, and supplement brands are rising. These collaborations accelerate R&D and enhance flavor, stability, and nutrient delivery. For example, DSM-Firmenich partnered with gummy brands in 2024 to integrate advanced prebiotic fiber blends. Expanding product lines with unique flavors and multi-functional benefits creates strong opportunities to capture new consumer segments.

Key Challenges

Regulatory and Labeling Compliance

Compliance with supplement regulations is a major challenge for manufacturers. Different countries have strict rules on health claims, ingredient usage, and labeling. Inconsistent regulations across regions can delay product launches and increase operational costs. Companies must invest in legal and regulatory expertise to avoid penalties. This complex environment can slow down innovation and expansion, especially for smaller brands.

High Ingredient and Production Costs

Functional gummies require high-quality fibers, stabilizers, and flavoring agents. These ingredients are often more expensive than standard confectionery materials. Maintaining taste, texture, and nutrient stability adds further cost pressure. Smaller manufacturers may struggle to achieve economies of scale, limiting their competitiveness. Rising raw material and logistics costs further tighten profit margins, especially in price-sensitive markets.

Regional Analysis

North America

North America holds a 32% market share in the dietary fiber gummies market. Rising consumer focus on digestive health and preventive nutrition drives strong product demand. Functional gummies enriched with fiber are gaining popularity among health-conscious millennials and Gen Z. Leading brands offer sugar-free and prebiotic fiber gummies, boosting retail and e-commerce sales. The U.S. dominates the regional market due to high supplement usage and product innovation. Expansion in clean-label and plant-based formulations is further supporting growth, with Canada showing increasing adoption in urban centers.

Europe

Europe accounts for a 27% market share, supported by growing awareness of gut health and clean eating habits. Demand for functional food supplements is rising across Germany, the UK, and France. Regulatory support for dietary supplements strengthens consumer trust and market penetration. European consumers prefer natural ingredients and plant-based fibers, pushing companies to innovate in formulation and flavors. The presence of established nutraceutical brands enhances competitive strength. Rising adoption among elderly populations and urban professionals is expected to maintain steady regional growth.

Asia Pacific

Asia Pacific leads with a 34% market share, driven by rapid urbanization and rising disposable income. Strong demand from China, India, and Japan fuels regional growth. Growing health awareness and preference for convenient nutrition support fiber gummies adoption. Local brands are expanding distribution through supermarkets and e-commerce channels. Government programs promoting healthy lifestyles also contribute to rising consumption. Increasing product launches and regional manufacturing capacity strengthen Asia Pacific’s leadership in the global market.

Latin America

Latin America holds a 4% market share in the dietary fiber gummies market. Brazil and Mexico drive most of the regional demand due to urban population growth and changing dietary habits. Consumers are adopting functional gummies as a convenient daily supplement. Limited product availability and higher costs pose challenges, but expanding retail and online channels are improving access. International brands are entering the market through strategic partnerships, boosting awareness and product reach across urban areas.

Middle East & Africa

The Middle East & Africa region represents a 3% market share, with gradual growth supported by rising health awareness. Urban centers in the UAE, Saudi Arabia, and South Africa show increasing demand for dietary supplements. Consumers are shifting toward preventive healthcare, creating opportunities for dietary fiber gummies. High import dependency and price sensitivity restrict faster expansion. However, growing health campaigns and the entry of global brands are improving regional product penetration, particularly through pharmacy and online retail channels.

Market Segmentations:

By Product:

By Ingredient:

- Gelatin

- Plant-Based Gelatin Substitutes

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dietary fiber gummies market is highly competitive, with key players including Nordic Naturals, Nutranext (part of Clorox), SmartyPants Vitamins, MegaFood (a division of FoodState), Herbaland Naturals Inc, Vitafusion (Church & Dwight Co., Inc.), Olly Nutrition (Unilever), Now Foods, Nature’s Way (a subsidiary of Schwabe North America), and The Honest Company. The dietary fiber gummies market is characterized by intense competition and rapid product innovation. Companies focus on developing advanced formulations with natural, plant-based ingredients and enhanced fiber content to meet rising health-conscious consumer demand. Product differentiation is driven by clean-label claims, sugar-free options, and added functional benefits such as prebiotic support. Strong distribution networks, including retail partnerships and e-commerce channels, play a key role in market expansion. Sustainability initiatives, such as eco-friendly packaging and transparent sourcing, further strengthen brand positioning. Ongoing investment in R&D supports innovation in taste, texture, and nutritional value, creating strong growth opportunities in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nordic Naturals

- Nutranext (part of Clorox)

- SmartyPants Vitamins

- MegaFood (a division of FoodState)

- Herbaland Naturals Inc

- Vitafusion (Church & Dwight Co., Inc.)

- Olly Nutrition (Unilever)

- Now Foods

- Nature’s Way (a subsidiary of Schwabe North America)

- The Honest Company

Recent Developments

- In April 2025, VIVAZEN introduced a new botanical gummy line, Feel Great. These gummies provide an effective and convenient solution to support energy, improve focus, encourage relaxation, and enhance mood.

- In April 2024, Nestlé Health Science announced initiatives to bring its products to more consumers and patients in India, aiming to expand its footprint in the region. Nestlé India and Dr. Reddy’s to form joint venture to take health science nutraceutical portfolio to consumers across India and other agreed territories.

- In October 2023, Clasado Biosciences, a U.K. based biotechnology research company and Stratum Nutrition, an ingredient distributor in Tunisia, partnered to introduce its latest prebiotic-postbiotic gummy supplements.

- In June 2023, P&G, an American multinational company, expanded their product offerings of gummies via its brand VOOST. These gummies offer the most essential benefits in a convenient form which fulfills the unique needs of millennials and the on-the-go lifestyle population

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers prioritize digestive health and wellness.

- Product innovation will focus on clean-label and plant-based formulations.

- Demand for sugar-free and low-calorie gummies will rise steadily.

- E-commerce will drive faster product reach and global accessibility.

- Personalized nutrition will shape new product development strategies.

- Sustainable packaging will become a key brand differentiation factor.

- Prebiotic and probiotic blends will gain strong consumer interest.

- Functional gummies targeting multiple health benefits will increase.

- Partnerships with retail and pharmacy chains will strengthen distribution.

- Technological advancements will improve taste, texture, and nutrient delivery.