Market Overview

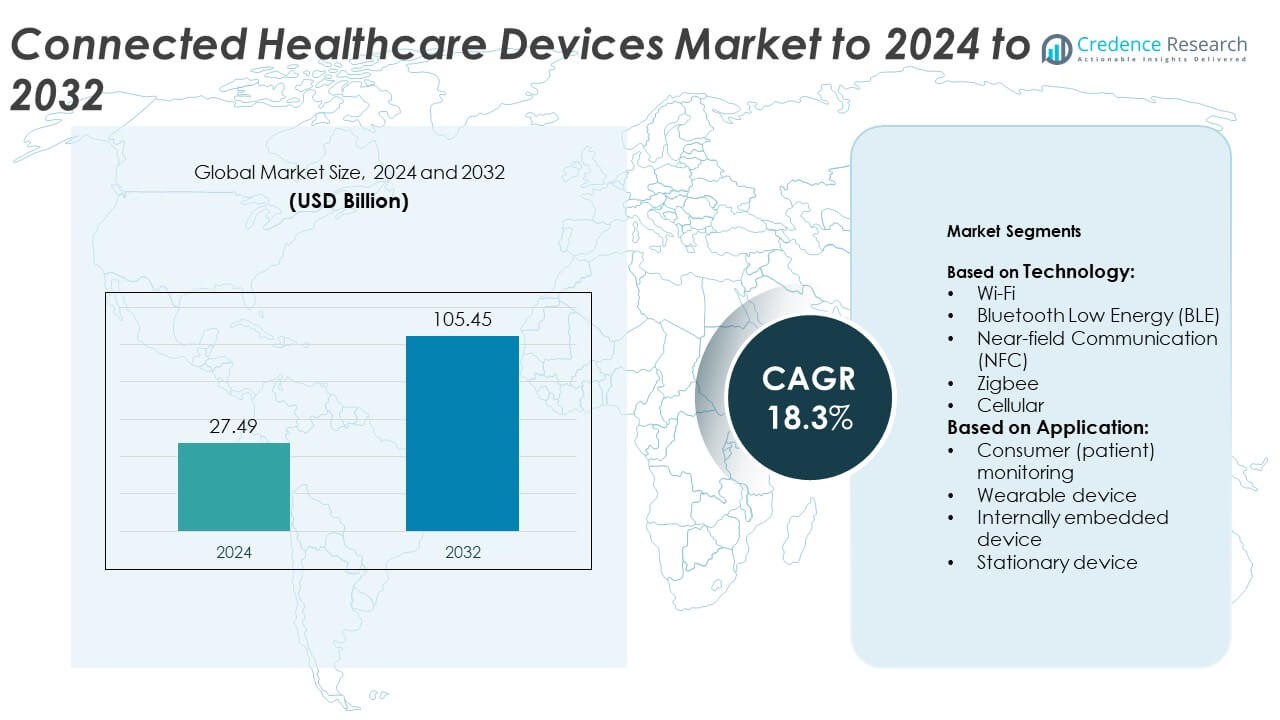

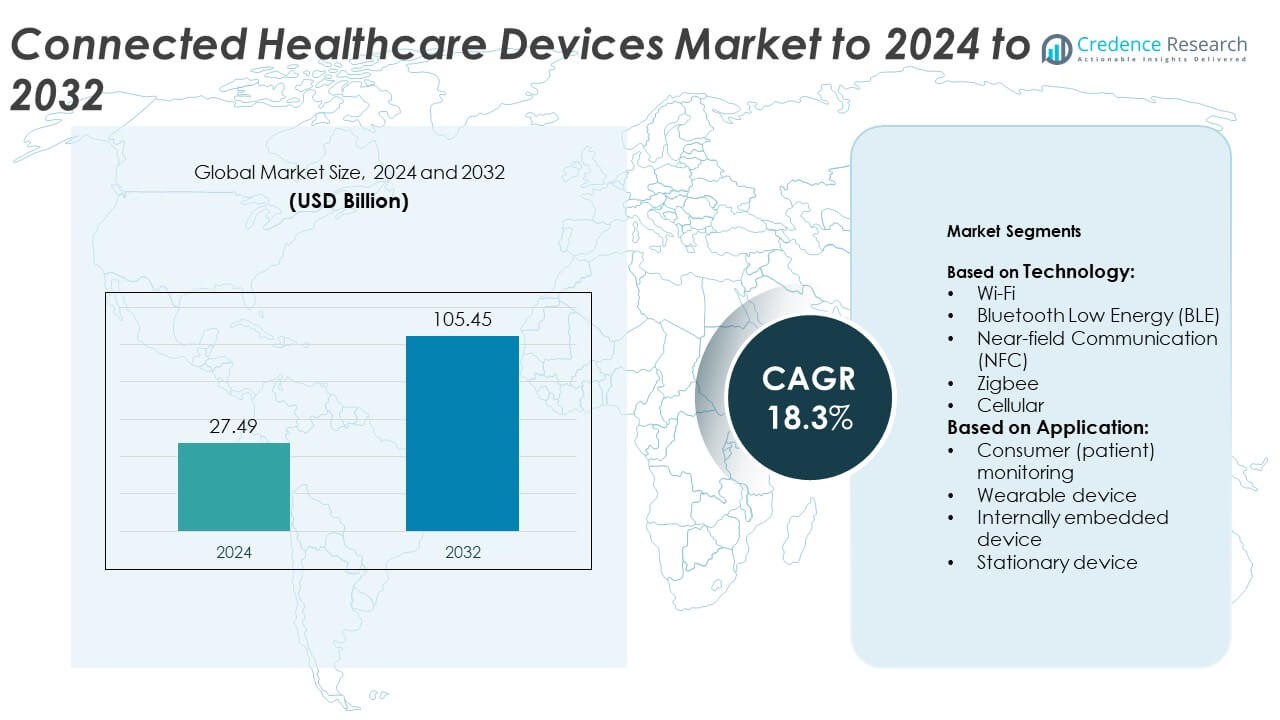

Connected Healthcare Devices Market size was valued at USD 27.49 Billion in 2024 and is anticipated to reach USD 105.45 Billion by 2032, at a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Healthcare Devices Market Size 2024 |

USD 27.49 Billion |

| Connected Healthcare Devices Market, CAGR |

18.3% |

| Connected Healthcare Devices Market Size 2032 |

USD 105.45 Billion |

The connected healthcare devices market is highly competitive, with major players such as Siemens Healthineers, GE Healthcare, Fitbit, Omron Corporation, Medtronic Inc., Abbott Laboratories, Honeywell International Inc., Dexcom Inc., Boston Scientific Corporation, and Koninklijke Philips NV driving technological innovation. These companies are focusing on IoT-enabled monitoring systems, AI-driven diagnostics, and wearable health devices that enhance real-time patient management. Strategic partnerships and product advancements are strengthening their global presence. North America emerged as the leading region, accounting for 41% of the market share in 2024, supported by advanced healthcare infrastructure, strong telehealth adoption, and growing investment in digital health technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The connected healthcare devices market was valued at USD 27.49 Billion in 2024 and is projected to reach USD 105.45 Billion by 2032, growing at a CAGR of 18.3%.

- Increasing demand for remote patient monitoring and AI-integrated healthcare systems is driving strong market expansion.

- Key trends include the adoption of wearable health technologies, 5G-enabled medical connectivity, and cloud-based patient data management platforms.

- The market is competitive, with leading companies focusing on IoT-enabled monitoring devices and digital health collaborations to enhance interoperability and user engagement.

- North America held the largest share at 41% in 2024, followed by Europe at 28% and Asia Pacific at 20%, while the Wi-Fi technology segment dominated with 39% share due to its strong adoption across healthcare facilities.

Market Segmentation Analysis:

By Technology

Wi-Fi technology dominated the connected healthcare devices market in 2024, accounting for nearly 39% of the total share. Its dominance stems from the widespread integration of wireless connectivity in hospitals, clinics, and home healthcare systems. Wi-Fi enables seamless data transmission between medical devices, cloud platforms, and electronic health records for real-time patient monitoring. The increasing adoption of telehealth and cloud-based diagnostic platforms is fueling this segment. Companies like GE Healthcare and Philips have deployed Wi-Fi-enabled monitoring systems across healthcare facilities to enhance operational efficiency and patient outcomes.

- For instance, Cisco equipped EPIC Management with 120 Meraki APs across 20 sites, enabling hospital-wide device connectivity.

By Application

Consumer (patient) monitoring held the largest market share in 2024, capturing about 41% of the connected healthcare devices market. The segment’s growth is driven by rising demand for remote health tracking, chronic disease management, and personalized care solutions. Devices such as wearable sensors, smart patches, and glucose monitors enable continuous data exchange with healthcare providers. Increasing awareness of preventive care and the expansion of home-based monitoring programs are supporting adoption. Major players such as Medtronic and Abbott have launched connected glucose and cardiac monitoring devices that enable 24/7 patient data collection and remote analytics.

- For instance, Dexcom closed 2024 with over 2.8 million global CGM users.

Key Growth Drivers

Rising Demand for Remote Patient Monitoring

The growing prevalence of chronic diseases and the need for continuous patient data are fueling demand for connected healthcare devices. Remote patient monitoring solutions enable real-time tracking of vital signs, reducing hospital readmissions and improving care delivery. Healthcare systems are integrating wearable sensors and IoT-enabled devices to monitor conditions such as diabetes and cardiovascular disorders. The expansion of telehealth infrastructure further accelerates the use of connected devices for remote consultation and early diagnosis.

- For instance, ResMed reports having over 30 million cloud-connectable devices on the market and over 23 billion nights of clinical respiratory data on its platforms

Integration of IoT and AI in Healthcare Systems

The integration of Internet of Things (IoT) and artificial intelligence (AI) technologies is a key driver of market growth. AI-powered analytics enhance diagnostic accuracy and predict potential health risks by interpreting large datasets collected from connected devices. IoT-enabled medical equipment allows seamless connectivity and interoperability between patients and healthcare professionals. Major companies are embedding AI algorithms into monitoring platforms to enable personalized treatment and automated alerts, improving clinical efficiency and decision-making.

- For instance, Oracle Health runs a shared EHR domain across 4 NHS Trusts, with peaks of 7,600 concurrent staff users.

Government Support and Digital Health Initiatives

Supportive government policies and funding for digital healthcare transformation are promoting connected device adoption. National health systems are deploying digital tools to expand access to quality care, particularly in remote regions. Programs encouraging telemedicine adoption and electronic health record integration are enhancing interoperability and data accessibility, government-backed initiatives in the U.S., Europe, and Asia are expanding broadband access and promoting connected medical infrastructure, thereby strengthening healthcare connectivity and efficiency.

Key Trends & Opportunities

Growing Adoption of Wearable Health Technologies

The increasing use of wearable devices for fitness tracking, vital monitoring, and chronic disease management presents a major opportunity. Smartwatches, biosensors, and health patches are being integrated with cloud-based analytics for continuous health insights. Consumer preference for preventive healthcare and personalized diagnostics is fueling this trend. Companies such as Apple and Fitbit are advancing wearable ecosystems that sync with telehealth platforms, providing a connected health experience across multiple user environments.

- For instance, Apple has cumulatively shipped an estimated 281.2 million Apple Watches from 2015 to the end of 2024, driving connected health features at scale.

Expansion of 5G Connectivity in Healthcare Networks

The rollout of 5G networks is enhancing the performance and reliability of connected healthcare systems. High-speed, low-latency data transfer supports real-time communication between patients and healthcare providers. This advancement enables remote surgeries, continuous monitoring, and rapid transmission of diagnostic data. 5G connectivity also supports the scalability of IoT medical devices in large hospital systems, driving new use cases for tele-ICU monitoring and emergency response applications.

- For instance, Verizon deployed a private 5G mmWave network at Cleveland Clinic’s Mentor Hospital, the provider’s first full 5G hospital installation, launched in July 2023

Key Challenges

Data Privacy and Security Concerns

Rising connectivity in healthcare increases the risk of cyber threats and data breaches. Sensitive medical information transmitted between devices and cloud systems remains vulnerable without strong encryption and security frameworks. Compliance with data protection laws such as HIPAA and GDPR is becoming more complex as cross-border data sharing expands. Healthcare providers are investing in cybersecurity infrastructure and blockchain-based systems to safeguard patient data and maintain regulatory compliance.

High Implementation Costs and Interoperability Issues

The deployment of connected healthcare devices requires substantial investment in digital infrastructure and system integration. Smaller hospitals and clinics face financial challenges in adopting advanced monitoring technologies. Interoperability issues between different device platforms and legacy systems also limit scalability. Standardization of data protocols and open API development are essential to ensure smooth data exchange and system compatibility across diverse healthcare networks.

Regional Analysis

North America

North America held the largest share of 41% in the connected healthcare devices market in 2024. The region’s growth is driven by advanced healthcare infrastructure, widespread telehealth adoption, and high consumer awareness of wearable medical technologies. The United States leads with strong integration of IoT-based medical devices and government support for digital health transformation. Major companies such as Medtronic, Abbott, and GE Healthcare are expanding AI-powered monitoring systems and connected diagnostic platforms. Increasing investments in home healthcare solutions and chronic disease management are further boosting market penetration across hospitals and homecare settings.

Europe

Europe accounted for 28% of the global connected healthcare devices market in 2024. The region benefits from well-established healthcare systems, high digital literacy, and supportive regulatory initiatives for e-health adoption. Countries such as Germany, the United Kingdom, and France are leading in wearable device integration and telemedicine deployment. The European Commission’s focus on cross-border healthcare data sharing and interoperability is improving connected healthcare frameworks. Collaborations between healthcare providers and technology firms are accelerating innovation in remote diagnostics and patient engagement, supporting the region’s transition toward preventive and personalized healthcare solutions.

Asia Pacific

Asia Pacific captured 20% of the connected healthcare devices market share in 2024, driven by expanding healthcare digitization and growing smartphone penetration. Rapid urbanization and rising chronic disease prevalence in China, Japan, and India are fueling device adoption. Governments are investing in telehealth networks and digital monitoring infrastructure to improve access in rural areas. Local manufacturers are introducing affordable connected solutions to meet increasing demand for remote patient care. The growing presence of technology firms, along with favorable government programs promoting smart healthcare ecosystems, continues to enhance regional market growth.

Latin America

Latin America represented 7% of the global connected healthcare devices market in 2024. The region’s progress is supported by the expansion of mobile health applications and wearable monitoring solutions. Brazil and Mexico are key markets due to increasing healthcare digitalization and teleconsultation adoption. Public-private partnerships are enhancing healthcare access and improving remote patient management in underserved areas. Despite challenges such as infrastructure gaps and regulatory complexity, the growing focus on preventive healthcare and digital inclusion initiatives is creating strong opportunities for connected healthcare solutions across the region.

Middle East & Africa

The Middle East & Africa accounted for 4% of the connected healthcare devices market share in 2024. The region is witnessing growing investment in telehealth platforms and digital health infrastructure, particularly in the Gulf Cooperation Council countries. Increasing healthcare expenditure and government-led smart hospital projects are driving adoption. Countries such as the UAE and Saudi Arabia are integrating connected monitoring systems to enhance patient care efficiency. However, limited broadband access and high equipment costs remain barriers. Ongoing collaborations with global technology providers are expected to expand connected healthcare adoption in the coming years.

Market Segmentations:

By Technology:

- Wi-Fi

- Bluetooth Low Energy (BLE)

- Near-field Communication (NFC)

- Zigbee

- Cellular

By Application:

- Consumer (patient) monitoring

- Wearable device

- Internally embedded device

- Stationary device

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the connected healthcare devices market is characterized by the presence of major players such as Siemens Healthineers, Fitbit, Omron Corporation, GE Healthcare, AliveCor, Stanley Healthcare, Medtronic Inc., Honeywell International Inc., Dexcom, Inc., Abbott Laboratories, NXP Semiconductors NV, Boston Scientific Corporation, Garmin Ltd, Koninklijke Philips NV, and Biotronik SE & Co. KG. These companies focus on developing advanced IoT-enabled medical devices that enable real-time monitoring, data integration, and remote patient management. The market is witnessing strong innovation in wearable technologies, biosensors, and cloud-connected monitoring systems. Strategic collaborations between technology providers and healthcare institutions are driving interoperability and improving care outcomes. Continuous investments in AI-powered diagnostics, wireless connectivity, and miniaturized sensors are shaping product differentiation. Additionally, firms are expanding digital health platforms to support telemedicine, predictive analytics, and chronic disease management solutions, strengthening their position in the evolving global healthcare technology ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Healthineers

- Fitbit

- Omron Corporation

- GE Healthcare

- AliveCor

- Stanley Healthcare

- Medtronic Inc.

- Honeywell International Inc.

- Dexcom, Inc.

- Abbott Laboratories

- NXP Semiconductors NV

- Boston Scientific Corporation

- Garmin Ltd

- Koninklijke Philips NV

- Biotronik SE & Co. KG

Recent Developments

- In 2025, AliveCor Launched the Kardia 12L, an AI-powered handheld 12-lead electrocardiogram (ECG) system, in India. The device is designed for use by healthcare professionals for rapid cardiac diagnostics.

- In 2024, Abbott secured FDA clearance for its FreeStyle Libre 2 and 3 sensors to be used during X-ray, CT, and MRI procedures, which streamlines a key clinical workflow.

- In 2023, Biotronik SE & Co. KG Celebrated its 60th year with innovations in implantable devices and digital healthcare technologies. Launched the Amvia pacemaker family and laid the groundwork for the Prospera™ spinal cord stimulation system.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as digital health ecosystems become more integrated.

- Increasing use of AI and predictive analytics will enhance remote diagnostics accuracy.

- Wearable technology will continue to dominate personal health monitoring applications.

- 5G connectivity will improve data transfer speed and enable real-time medical communication.

- Cloud-based healthcare platforms will gain adoption for secure patient data management.

- Home healthcare demand will grow as patients prefer continuous remote monitoring.

- Regulatory frameworks will strengthen data protection and interoperability standards globally.

- Emerging markets will witness accelerated adoption due to improving telehealth infrastructure.

- Device miniaturization and sensor innovation will support seamless patient engagement.

- Collaborations between healthcare providers and tech firms will shape next-generation digital care models.