Market Overview

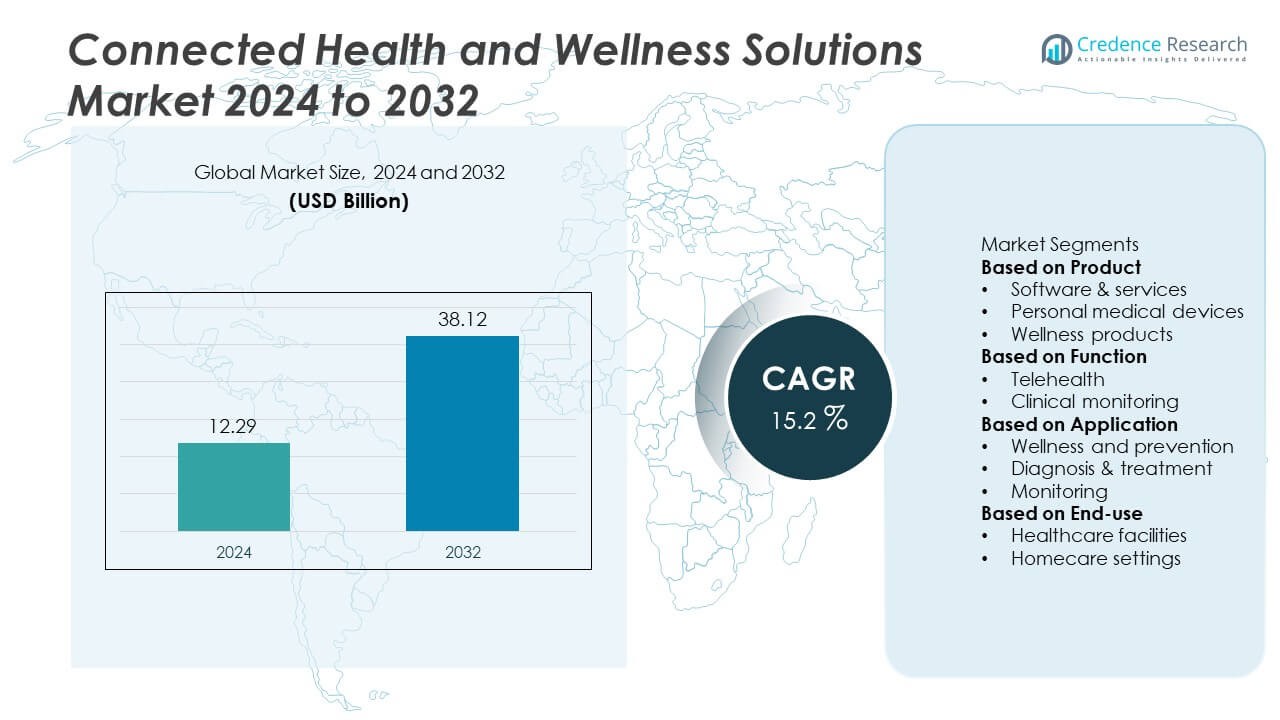

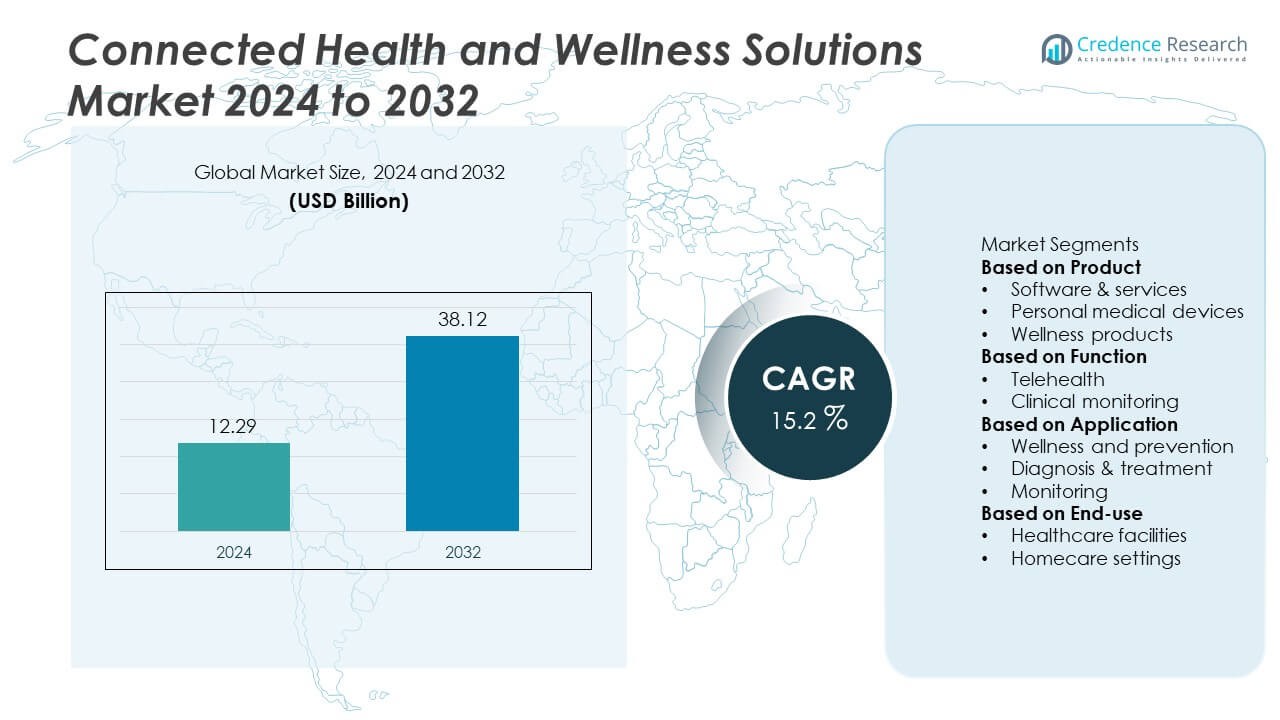

The Connected Health and Wellness Solutions Market was valued at USD 12.29 billion in 2024 and is projected to reach USD 38.12 billion by 2032, registering a CAGR of 15.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Health and Wellness Solutions Market Size 2024 |

USD 12.29 Billion |

| Connected Health and Wellness Solutions Market, CAGR |

15.2% |

| Connected Health and Wellness Solutions Market Size 2032 |

USD 38.12 Billion |

The Connected Health and Wellness Solutions Market is led by major players including Garmin Ltd., GE Healthcare, AliveCor, Inc., Doctor on Demand, Abbott, Fitbit, DexCom, Inc., Babylon Healthcare Services Ltd, Dragerwerk AG & Co. KGaA, and Apple. These companies dominate through strong product portfolios in digital health monitoring, wearable devices, and telehealth services. North America led the market in 2024 with a 37% share, driven by advanced healthcare infrastructure and high adoption of remote monitoring technologies. Asia-Pacific followed with a 30% share, supported by growing telemedicine adoption and digital health investments. Europe held 28%, fueled by eHealth initiatives and increasing use of connected wellness platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Connected Health and Wellness Solutions Market was valued at USD 12.29 billion in 2024 and is projected to reach USD 38.12 billion by 2032, growing at a CAGR of 15.2%.

- Growing demand for remote healthcare, chronic disease management, and personalized wellness solutions is driving strong adoption of connected devices and telehealth platforms.

- Market trends highlight the rise of AI-powered diagnostics, wearable integration, and cloud-based monitoring systems that enhance preventive care and real-time health tracking.

- Key players such as Apple, Abbott, GE Healthcare, and Fitbit are investing in digital ecosystems, interoperability, and user-centric design to gain competitive advantage.

- North America led with a 37% market share in 2024, followed by Asia-Pacific at 30% and Europe at 28%; by product type, the software and services segment dominated with 45% share, supported by the growing use of digital health platforms for monitoring and data analytics.

Market Segmentation Analysis:

By Product

The software and services segment dominated the Connected Health and Wellness Solutions Market in 2024, accounting for a 47% market share. Its leadership is driven by the growing adoption of telemedicine platforms, electronic health records (EHR), and cloud-based analytics systems that enable remote patient management. Healthcare providers are increasingly integrating AI-driven applications and mobile health platforms to enhance patient engagement and data accuracy. Rising demand for digital consultation and personalized wellness applications is further accelerating growth, supported by healthcare digitization initiatives across developed and emerging economies.

- For instance, GE HealthCare launched its Edison Digital Health Platform, which uses artificial intelligence and analytics to integrate and process data from disparate sources, including hospital EHR systems. The platform, and applications built with it, are designed to enhance clinical, financial, and operational decision-making for clinicians.

By Function

The telehealth segment held the largest share of 52% in the Connected Health and Wellness Solutions Market in 2024. This dominance is attributed to the rising demand for remote consultation, virtual care, and digital communication tools that bridge the gap between patients and healthcare professionals. Advancements in video conferencing, remote diagnostics, and IoT-based medical devices have made telehealth a mainstream healthcare service. Government support for telemedicine reimbursement and growing acceptance of virtual healthcare models continue to strengthen this segment’s global market presence.

- For instance, Included Health (formerly Doctor On Demand) offers integrated virtual care and navigation, providing 24/7 access for primary, behavioral, and urgent health concerns. The platform uses advanced technology, including AI, to enhance efficiency and care coordination for millions of members, covering both virtual and in-person needs

By Application

The monitoring segment led the Connected Health and Wellness Solutions Market in 2024, capturing a 43% share. The segment’s strength lies in increasing use of wearable devices, smart sensors, and mobile applications for continuous health tracking. Patients with chronic conditions such as diabetes, cardiovascular diseases, and hypertension are adopting connected monitoring systems for real-time data collection and analysis. Integration with cloud platforms and healthcare databases allows physicians to make timely interventions. The trend toward personalized health management and preventive care continues to drive the demand for connected monitoring solutions.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of chronic conditions such as diabetes, hypertension, and cardiovascular disorders is driving the Connected Health and Wellness Solutions Market. Patients require continuous monitoring and real-time management, which connected devices and digital platforms efficiently provide. Healthcare systems are integrating smart diagnostics, wearable sensors, and telehealth applications to enhance patient outcomes. The need for early detection, remote supervision, and preventive health management continues to accelerate adoption across hospitals, clinics, and home healthcare environments.

- For instance, Abbott’s FreeStyle Libre 3 continuous glucose monitoring system features a sensor that is worn on the back of the upper arm for up to 14 days and automatically sends real-time glucose readings every 60 seconds to a compatible smartphone via Bluetooth connectivity.

Increasing Adoption of Telehealth and Remote Monitoring

The rapid expansion of telehealth and remote monitoring services is a key market growth driver. Virtual consultations, mobile health apps, and connected medical devices are improving patient accessibility and healthcare efficiency. Rising internet penetration and smartphone usage support seamless connectivity between patients and physicians. Governments and insurers are promoting telemedicine reimbursement, making digital healthcare more accessible. This shift toward remote, technology-enabled care delivery is reshaping global healthcare systems and boosting the adoption of connected health solutions.

- For instance, Dexcom Inc. developed the Dexcom G7 continuous glucose monitor, which automatically sends real-time glucose readings every five minutes to a compatible smart device or receiver.

Technological Advancements in IoT and AI Integration

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) is revolutionizing connected health systems. IoT-enabled wearables and AI-driven analytics platforms collect, process, and interpret real-time health data with high precision. These technologies support predictive diagnostics, early disease detection, and personalized treatment planning. Healthcare providers use AI algorithms for clinical decision support, while patients benefit from smart alerts and digital engagement tools. The convergence of advanced technologies is enhancing care quality and driving the market’s technological evolution.

Key Trends & Opportunities

Growing Popularity of Wearable and Mobile Health Devices

Wearable technology, such as fitness trackers, smartwatches, and biosensors, is becoming a core element of connected wellness ecosystems. These devices provide continuous health insights, empowering users to monitor physical activity, heart rate, and sleep patterns. Integration with mobile apps enhances user engagement and data sharing with healthcare professionals. The rising preference for proactive health management and personalized wellness programs creates significant opportunities for manufacturers and service providers in the connected health landscape.

- For instance, Apple Inc. introduced the Apple Watch Series 11 with the S10 chip, which features a 64-bit dual-core processor and a 4-core Neural Engine. The watch can track health data, including ECG and oxygen saturation, provide notifications for high or low heart rate, and offer insights through the Vitals app.

Integration of Cloud-Based and Interoperable Healthcare Platforms

Cloud computing and interoperable systems are reshaping healthcare connectivity. Cloud-based platforms enable secure storage, analysis, and exchange of health data across hospitals, insurers, and patients. This integration improves care coordination and data accessibility. The increasing use of interoperability standards such as HL7 and FHIR is strengthening cross-platform communication. Healthcare organizations are adopting cloud infrastructure to scale operations, reduce IT costs, and enhance remote collaboration, presenting major growth opportunities in digital healthcare networks.

- For instance, eMed Healthcare UK now operates the former U.K. digital health platform, acquired after Babylon Health’s bankruptcy in 2023. This acquisition includes the former “GP at Hand” service, now rebranded as eMed GP at Hand. The company’s U.S. business was liquidated after filing for Chapter 7 bankruptcy in August 2023, following mounting financial difficulties.

Key Challenges

Data Security and Privacy Concerns

The widespread use of connected devices increases the risk of cyberattacks and data breaches in healthcare networks. Sensitive patient information must be securely stored and transmitted across digital platforms. Compliance with data protection regulations such as HIPAA and GDPR adds operational complexity. Healthcare providers and technology companies must invest heavily in encryption, authentication, and cybersecurity measures to safeguard patient trust and maintain regulatory compliance in the digital ecosystem.

High Implementation Costs and Infrastructure Limitations

Implementing connected health systems involves significant investment in hardware, software, and network infrastructure. Many small and medium healthcare providers struggle with the high costs of integration and maintenance. In developing regions, inadequate internet connectivity and limited digital literacy further hinder adoption. These financial and logistical barriers slow market expansion, particularly in rural and resource-constrained settings, where connected healthcare solutions could offer the greatest benefits.

Regional Analysis

North America

North America held a 37% market share in the Connected Health and Wellness Solutions Market in 2024. The region’s leadership stems from advanced healthcare infrastructure, high adoption of digital health technologies, and strong regulatory support for telemedicine. The United States dominates due to widespread use of wearable health devices, AI-driven diagnostics, and cloud-based monitoring systems. Favorable reimbursement policies and increasing focus on chronic disease management drive demand for connected health solutions. Strategic partnerships between healthcare providers and technology companies continue to enhance integration and accessibility of remote healthcare services across the region.

Europe

Europe accounted for a 28% share of the Connected Health and Wellness Solutions Market in 2024. Market growth is driven by government-backed digital health initiatives, rising elderly populations, and strong adoption of electronic health records. Countries such as Germany, the United Kingdom, and France are leading users of telehealth and connected care platforms. The European Union’s emphasis on data interoperability and healthcare digitization under its eHealth strategy further supports expansion. Increasing investment in preventive healthcare and wellness technologies continues to strengthen Europe’s position as a key market for connected health innovation.

Asia-Pacific

Asia-Pacific dominated the Connected Health and Wellness Solutions Market in 2024 with a 30% market share. Rapid digitalization, growing healthcare expenditure, and expanding telemedicine networks are fueling demand across China, India, and Japan. The region’s large population base and high smartphone penetration are accelerating adoption of mobile health apps and wearable devices. Government initiatives promoting remote patient monitoring and digital health access are further boosting growth. Local startups and multinational companies are collaborating to expand cloud-based healthcare platforms, establishing Asia-Pacific as the fastest-growing region for connected health technologies.

Latin America

Latin America captured a 3% market share in the Connected Health and Wellness Solutions Market in 2024. The region’s growth is supported by increasing investments in healthcare modernization and digital transformation. Countries such as Brazil, Mexico, and Chile are expanding telemedicine services and adopting connected monitoring platforms to improve patient care accessibility. Rising health awareness and smartphone usage are driving adoption of fitness trackers and mobile wellness apps. Partnerships between governments, insurers, and technology providers are helping to enhance healthcare delivery efficiency and bridge gaps in medical service availability.

Middle East & Africa

The Middle East & Africa region held a 2% share of the Connected Health and Wellness Solutions Market in 2024. Market expansion is driven by growing demand for remote healthcare solutions and digital wellness platforms. The Gulf Cooperation Council (GCC) countries, led by Saudi Arabia and the United Arab Emirates, are investing in national eHealth strategies and telemedicine infrastructure. In Africa, increasing internet penetration and donor-supported healthcare programs are improving access to digital diagnostics. Rising focus on preventive care and the development of smart healthcare cities are further driving market adoption across the region.

Market Segmentations:

By Product

- Software & services

- Personal medical devices

- Wellness products

By Function

- Telehealth

- Clinical monitoring

By Application

- Wellness and prevention

- Diagnosis & treatment

- Monitoring

By End-use

- Healthcare facilities

- Homecare settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Connected Health and Wellness Solutions Market includes key players such as Garmin Ltd., GE Healthcare, AliveCor, Inc., Doctor on Demand, Abbott, Fitbit, DexCom, Inc., Babylon Healthcare Services Ltd, Dragerwerk AG & Co. KGaA, and Apple. These companies dominate through continuous innovation in wearable technology, telehealth platforms, and remote monitoring systems. Market leaders are investing in AI-driven health analytics, cloud integration, and personalized wellness solutions to enhance patient engagement and outcomes. Strategic partnerships between healthcare providers, insurers, and technology firms are expanding digital care accessibility. Companies are also focusing on interoperability, cybersecurity, and data-driven diagnostics to strengthen reliability and compliance with healthcare standards. The rising demand for connected devices and remote care ecosystems continues to intensify competition, prompting major players to develop scalable, secure, and user-friendly health platforms that align with preventive and personalized healthcare models globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Garmin Ltd.

- GE Healthcare

- AliveCor, Inc.

- Doctor on Demand

- Abbott

- Fitbit

- DexCom, Inc.

- Babylon Healthcare Services Ltd

- Dragerwerk AG & Co. KGaA

- Apple

Recent Developments

- In October 2025, Garmin Ltd. launched its Health Status feature on Garmin Connect, combining five key overnight metrics-heart rate, HRV, respiration rate, SpO₂, and skin temperature-to deliver advanced wellness insights. Garmin also integrated its devices with Google’s Health Connect, improving interoperability and real-time health data sharing across platforms.

- In March 2025, GE HealthCare partnered with NVIDIA to co-develop autonomous imaging systems using Physical AI for real-time clinical diagnostics across X-ray and ultrasound modalities.

- In 2025, Apple Inc. launched the Apple Watch Series 11 equipped with hypertension monitoring and a new sleep quality scoring feature. The company also enhanced Apple Intelligence at WWDC 2025, enabling privacy-focused AI-powered health insights across Apple devices.

Report Coverage

The research report offers an in-depth analysis based on Product, Function, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising demand for remote healthcare and telemedicine.

- Integration of AI and IoT will enhance personalized patient monitoring and predictive health management.

- Wearable devices will become more advanced with continuous tracking and real-time analytics.

- Cloud-based healthcare data systems will support seamless connectivity across digital platforms.

- Preventive care and wellness programs will drive higher adoption of connected health solutions.

- Partnerships between tech firms and healthcare providers will strengthen digital care ecosystems.

- Asia-Pacific will emerge as a key growth region due to rising digital healthcare investments.

- Data privacy and cybersecurity advancements will play a major role in platform reliability.

- Regulatory frameworks will evolve to support telehealth reimbursement and interoperability.

- The convergence of fitness, diagnostics, and digital therapeutics will redefine global healthcare delivery.