Market Overview

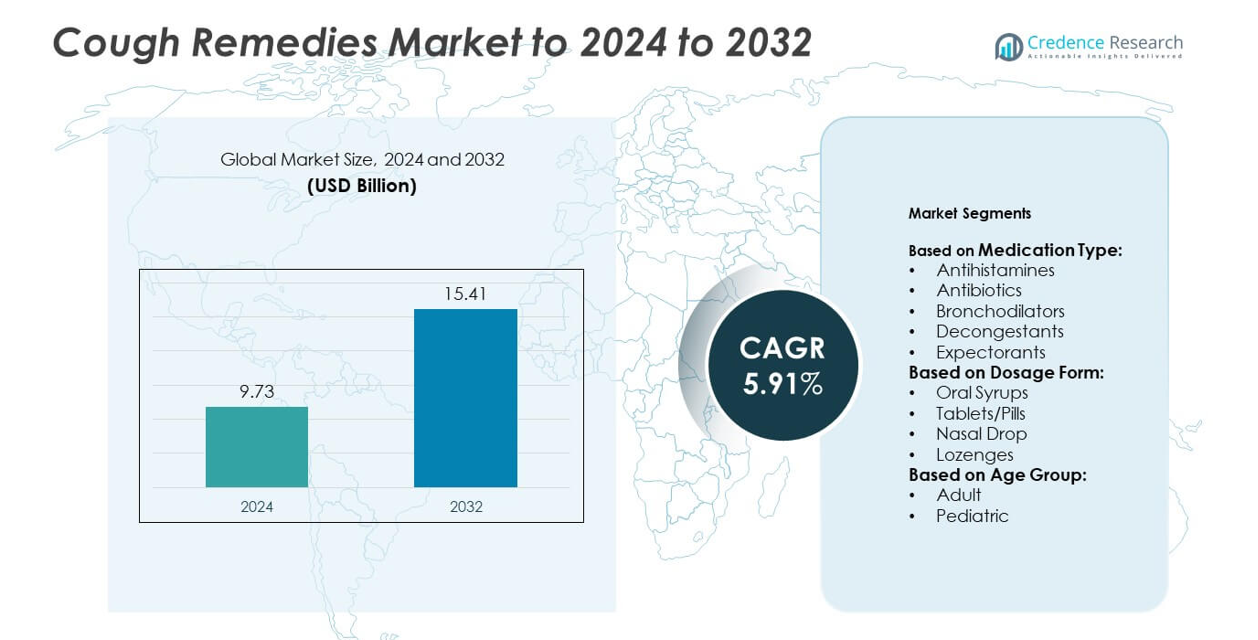

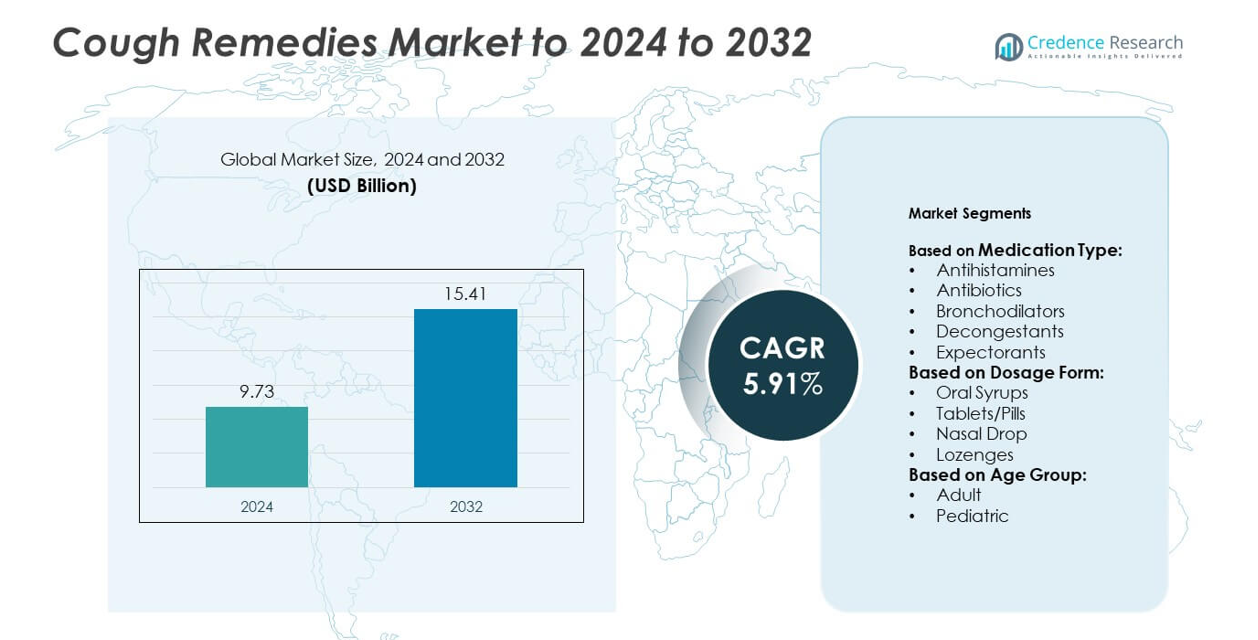

Cough Remedies Market size was valued at USD 9.73 Billion in 2024 and is anticipated to reach USD 15.41 Billion by 2032, at a CAGR of 5.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cough Remedies Market Size 2024 |

USD 9.73 Billion |

| Cough Remedies Market, CAGR |

5.91% |

| Cough Remedies Market Size 2032 |

USD 15.41 Billion |

The cough remedies market is dominated by major pharmaceutical and consumer health companies, including GSK plc, Pfizer Inc., Reckitt Benckiser Group plc, Novartis AG, Johnson & Johnson, Sun Pharmaceutical Industries Ltd, Procter & Gamble, Bayer AG, AstraZeneca plc, and Prestige Consumer Healthcare. These players maintain strong portfolios of OTC and prescription cough treatments, focusing on product innovation, natural formulations, and digital retail expansion. North America led the global market in 2024, holding a 34% share, driven by high healthcare spending, advanced retail infrastructure, and strong consumer preference for OTC medications. Europe followed with 28%, supported by robust regulatory standards and growing adoption of herbal-based remedies.

Market Insights

- The cough remedies market was valued at USD 9.73 billion in 2024 and is projected to reach USD 15.41 billion by 2032, growing at a CAGR of 5.91%.

- Rising cases of respiratory infections, seasonal allergies, and pollution exposure are key factors driving market expansion worldwide.

- Growing consumer shift toward herbal, non-drowsy, and sugar-free formulations defines emerging market trends, supported by e-pharmacy growth.

- The market is moderately competitive, with major companies focusing on combination therapies, brand extensions, and strong OTC distribution networks.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 26%, while oral syrups remained the dominant segment with 41% of total demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Medication Type

Antihistamines led the cough remedies market in 2024, capturing about 29% of the total share. Their dominance is driven by their ability to relieve coughs caused by allergies and upper respiratory infections. These drugs reduce histamine response, easing nasal congestion and throat irritation. Major players are developing combination products pairing antihistamines with decongestants to enhance symptom relief. The widespread use of OTC antihistamine-based cough syrups and tablets in North America and Europe supports steady growth, fueled by increasing seasonal allergies and self-medication practices among adults.

- For instance, Kenvue sells Benadryl tablets with 25 mg diphenhydramine per tablet.

By Dosage Form

Oral syrups dominated the cough remedies market in 2024, holding roughly 41% of the overall share. Their quick onset of action, ease of consumption, and suitability for both adults and children drive their widespread use. Manufacturers are introducing sugar-free, alcohol-free, and herbal-based variants to meet rising health-conscious demand. The availability of pleasant-flavored and soothing syrups further enhances consumer preference. The segment benefits from broad accessibility across pharmacies and online channels, particularly in Asia-Pacific, where increasing pediatric consumption boosts market penetration.

- For instance, Pfizer’s current Corex DX syrup contains 10 mg of Dextromethorphan Hydrobromide and 4 mg of Chlorpheniramine Maleate per 5 mL, which is used to relieve dry cough and allergy-related symptoms. The original Corex cough syrup, which contained the addictive opioid codeine, was banned in India in 2016. Following the ban, Pfizer relaunched the brand with new, non-codeine formulations, such as Corex DX, to continue serving the respiratory market.

By Age Group

Adults accounted for the largest market share of approximately 64% in 2024, supported by high incidences of cough caused by pollution, smoking, and lifestyle factors. The adult population often relies on OTC products for immediate relief, increasing demand for fast-acting tablets and syrups. Manufacturers are expanding product portfolios with multi-symptom formulations addressing dry, wet, and chronic coughs. Growing awareness of respiratory health and rising air quality concerns in urban centers continue to drive product adoption. The segment remains dominant across developed regions, supported by broad product availability and self-care trends.

Key Growth Drivers

Rising Prevalence of Respiratory Infections

The increasing incidence of respiratory tract infections, such as influenza, bronchitis, and seasonal allergies, is a major growth driver for the cough remedies market. Frequent weather changes, pollution exposure, and post-COVID respiratory complications continue to elevate cough occurrences. According to WHO, respiratory infections remain among the top causes of outpatient visits globally. This rising disease burden has boosted demand for both prescription and OTC cough treatments, encouraging manufacturers to develop faster-acting, combination-based, and symptom-specific medications for broader patient coverage.

- For instance, CDC reports ~120 million U.S. ambulatory visits yearly are for acute respiratory infections.

Growing Adoption of Over-the-Counter Medications

Expanding consumer preference for OTC drugs to manage mild cough and cold symptoms drives market growth. Easy accessibility, affordability, and quick symptom relief contribute to higher adoption rates. Pharmacies and e-commerce platforms now offer a wide range of products, including natural and non-drowsy options. Regulatory bodies in regions like North America and Europe are also simplifying OTC drug approvals. This accessibility trend benefits pharmaceutical firms investing in consumer-centric marketing and expanding retail presence, further strengthening the cough remedies market’s overall revenue base.

- For instance, IQVIA found Germany’s online pharmacy share reached 20% of the market by 2022.

Increased Focus on Herbal and Natural Formulations

Rising health awareness and skepticism toward synthetic chemicals are accelerating the shift to herbal and natural cough remedies. Products featuring honey, menthol, ginger, and eucalyptus oils are gaining preference due to minimal side effects and enhanced safety. Manufacturers like Himalaya and Zandu are introducing clinically tested herbal formulations targeting both dry and productive coughs. The trend aligns with growing consumer demand for clean-label, sustainable healthcare solutions. Expanding product portfolios in herbal segments and supportive government regulations for traditional medicine further drive this growth.

Key Trends and Opportunities

Digitalization of Retail and E-Pharmacy Growth

The rise of digital healthcare platforms and e-pharmacies is reshaping the cough remedies distribution landscape. Consumers increasingly prefer online purchasing for convenience and access to a wider product range. Major pharmacy chains are collaborating with online platforms to enhance delivery speed and customer engagement. The availability of subscription-based refill services for chronic cough patients presents new revenue opportunities. This growing digitalization also enables manufacturers to gather consumer insights, optimize pricing strategies, and introduce targeted marketing campaigns for online shoppers.

- For instance, DocMorris served over 9 million active customers in 2023 and has parcel capacity of >27 million per year.

Product Innovation through Combination and Extended-Release Formulations

Pharmaceutical companies are focusing on developing combination therapies and extended-release products to improve treatment efficiency. New formulations combining antihistamines, decongestants, and expectorants in a single dose offer comprehensive relief. Extended-release syrups and tablets ensure prolonged action, reducing dosing frequency and improving compliance. For instance, companies are investing in microencapsulation and controlled-release technologies to achieve sustained drug delivery. These innovations not only enhance therapeutic outcomes but also allow differentiation in a highly competitive OTC market segment.

- For instance, Reckitt (Mucinex DM) provides 600 mg guaifenesin + 30 mg dextromethorphan per extended-release tablet; Mucinex D provides 600 mg guaifenesin + 60 mg pseudoephedrine.

Key Challenges

Stringent Regulatory Compliance and Approval Processes

Strict regulations governing drug formulations and labeling continue to challenge market growth. Authorities such as the FDA and EMA require extensive clinical data and safety validation for new cough medications, leading to long approval timelines. Frequent updates in dosage and ingredient guidelines increase compliance costs for manufacturers. The growing scrutiny over codeine-based formulations also limits product availability. Smaller firms face difficulty meeting these regulatory demands, which restricts innovation and delays product launches, particularly in the OTC and herbal remedy segments.

Rising Competition and Price Pressure in OTC Segment

Intense competition among local and global pharmaceutical companies exerts significant price pressure on OTC cough remedies. The market is flooded with generic and private-label products, forcing established players to reduce margins to retain market share. Retail price wars, especially across online channels, further compress profitability. Additionally, consumers often switch brands based on minor price differences or promotions. This environment makes it challenging for manufacturers to sustain premium pricing, pushing them to focus on volume-based sales and frequent product differentiation strategies.

Regional Analysis

North America

North America held the largest share of 34% in the cough remedies market in 2024. The region’s dominance is driven by high healthcare spending, strong OTC product availability, and increasing cases of respiratory infections during seasonal flu outbreaks. Widespread adoption of combination therapies and natural formulations supports consistent market demand. Major pharmaceutical companies like Johnson & Johnson and Pfizer continue to invest in innovative formulations and digital marketing channels. The U.S. remains the primary revenue contributor, supported by consumer awareness and a well-established retail pharmacy infrastructure across urban and suburban areas.

Europe

Europe accounted for a 28% market share in 2024, supported by high consumer preference for OTC cough treatments and robust pharmaceutical manufacturing capacity. Rising prevalence of chronic respiratory conditions, such as asthma and bronchitis, contributes to sustained product demand. The market also benefits from strong regulatory focus on safety and formulation transparency. Increasing adoption of herbal and homeopathic cough remedies in countries like Germany and France further strengthens growth. Additionally, government initiatives promoting reduced antibiotic misuse encourage the use of non-prescription alternatives, boosting sales across both offline and e-commerce distribution channels.

Asia-Pacific

Asia-Pacific captured around 26% of the global market share in 2024, driven by growing urbanization, rising pollution levels, and increasing respiratory illness rates. Expanding healthcare infrastructure and improving accessibility to OTC medications across India, China, and Japan continue to support strong market growth. The region is witnessing a notable shift toward herbal and traditional cough formulations due to cultural acceptance and affordability. Local manufacturers are investing in regional brand expansions, while multinational players are strengthening distribution networks. Increasing digital penetration and growing middle-class income levels further enhance product consumption across emerging economies.

Latin America

Latin America held a 7% share in the cough remedies market in 2024, supported by rising incidences of respiratory infections and increasing OTC drug usage. Countries like Brazil and Mexico lead the market due to growing awareness of self-medication and expanding retail pharmacy presence. Affordable pricing and easy access to OTC syrups and tablets drive sales across urban populations. However, limited healthcare infrastructure in rural areas continues to challenge market penetration. Increasing marketing campaigns promoting herbal-based products and expansion of online pharmacy services are creating new growth opportunities in this region.

Middle East & Africa

The Middle East and Africa region accounted for a 5% share of the global cough remedies market in 2024. The market is primarily driven by increasing respiratory diseases linked to dust exposure, smoking, and urban pollution. Growth is further supported by improving access to OTC medicines and expanding healthcare distribution networks. The United Arab Emirates and South Africa are the leading contributors, with rising consumer inclination toward quick-relief and natural formulations. Government health awareness programs and the growing presence of multinational pharmaceutical companies are also enhancing product availability across the region.

Market Segmentations:

By Medication Type:

- Antihistamines

- Antibiotics

- Bronchodilators

- Decongestants

- Expectorants

By Dosage Form:

- Oral Syrups

- Tablets/Pills

- Nasal Drop

- Lozenges

By Age Group:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cough remedies market is highly competitive, with major players such as GSK plc, Pfizer Inc., Reckitt Benckiser Group plc, Novartis AG, Johnson & Johnson, Sun Pharmaceutical Industries Ltd, Procter & Gamble, Bayer AG, AstraZeneca plc, and Prestige Consumer Healthcare leading the landscape. Competition is driven by continuous product innovation, wide OTC availability, and strong brand presence across global markets. Companies are emphasizing formulation improvements, including sugar-free, alcohol-free, and herbal-based products to align with growing health-conscious trends. Strategic mergers, partnerships, and marketing collaborations enhance market penetration and retail visibility. Many firms are expanding digital outreach through e-pharmacy channels and online campaigns to strengthen consumer engagement. The growing focus on combination therapies and extended-release products also differentiates offerings in a crowded market. Regional manufacturing expansion and regulatory compliance remain key strategies to maintain pricing efficiency and ensure product availability across both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GSK plc

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Novartis AG

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd

- Procter & Gamble

- Bayer AG

- AstraZeneca plc

- Prestige Consumer Healthcare

Recent Developments

- In 2024, Reckitt (brands include Mucinex and Robitussin) introduced new Children’s Mighty Chews. This innovation offered the first over-the-counter (OTC) medicated children’s soft chewable tablet for cough relief.

- In 2023, GSK plc announced its acquisition of the Canadian biotech company Bellus Health Inc.

- In 2023, Novartis officially completed the spin-off of its generics and biosimilars division, Sandoz, into an independent company.

Report Coverage

The research report offers an in-depth analysis based on Medication Type, Dosage Form, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cough remedies market will continue to grow due to rising respiratory infections worldwide.

- Demand for OTC and self-medication products will expand across developing and developed regions.

- Herbal and natural formulations will gain higher consumer preference for safety and mild effectiveness.

- Pharmaceutical companies will invest more in combination and extended-release formulations.

- Online pharmacy platforms will strengthen global distribution and product accessibility.

- Increasing pollution and lifestyle-related respiratory issues will boost consistent product demand.

- Pediatric formulations will grow as parents prefer non-drowsy and sugar-free medicines for children.

- Regulatory approval processes will become faster for clinically tested herbal cough remedies.

- Technological advances in drug delivery will enhance the effectiveness of long-acting formulations.

- Strategic mergers and partnerships will help companies expand regional footprints and product portfolios.