Market Overview

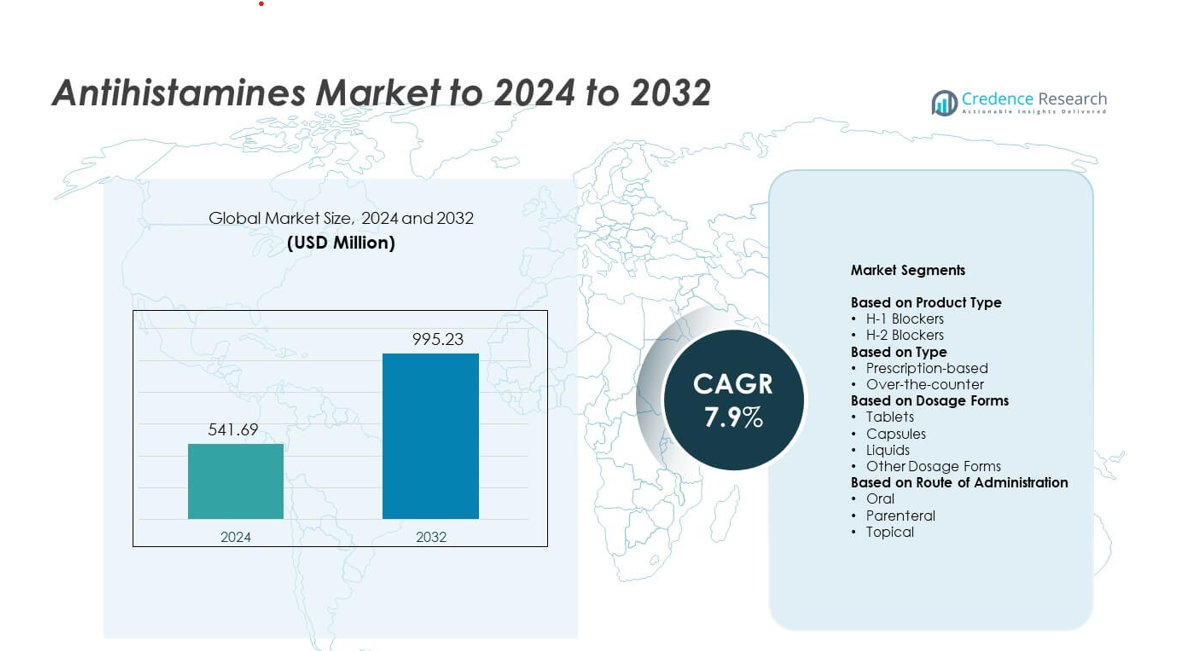

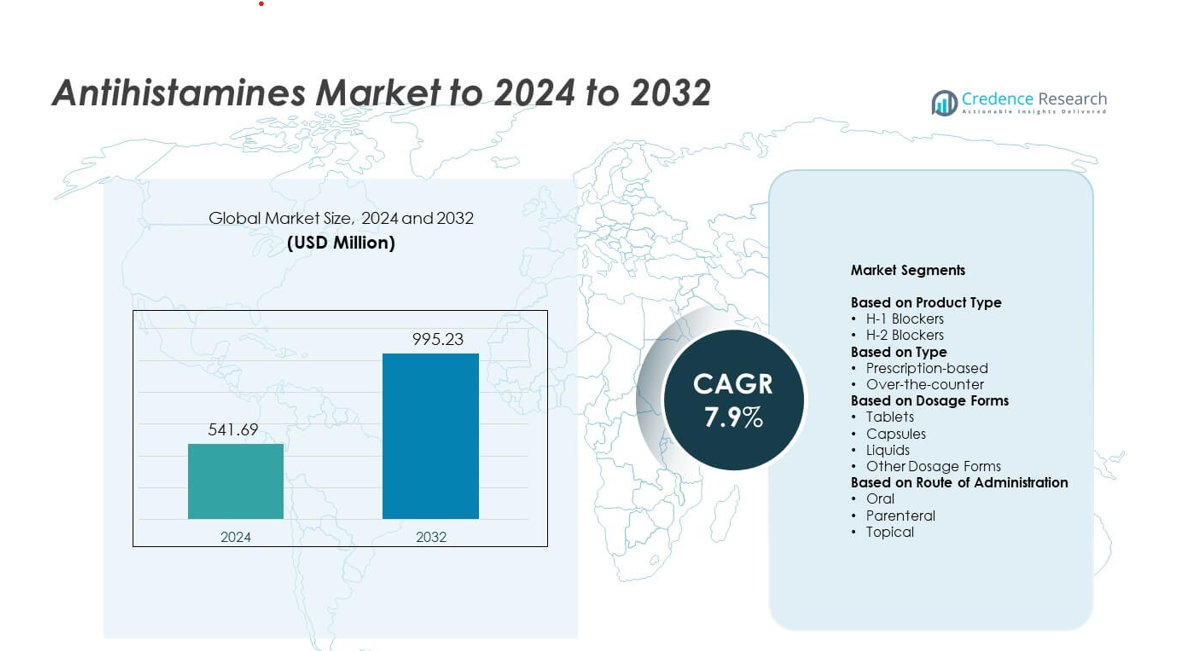

Antihistamines Market size was valued USD 541.69 million in 2024 and is anticipated to reach USD 995.23 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antihistamines Market Size 2024 |

USD 541.69 million |

| Antihistamines Market, CAGR |

7.9% |

| Antihistamines Market Size 2032 |

USD 995.23 million |

The Antihistamines Market is shaped by major global pharmaceutical and consumer health companies that offer wide OTC ranges, prescription options, and advanced non-sedating formulations. These players strengthen their positions through strong pharmacy networks, digital retail expansion, and consistent product innovation aimed at improving safety and daily usability. North America led the market in 2024 with a 38% share, supported by high allergy prevalence and strong access to OTC drugs. Europe followed with about 30% share due to established healthcare systems and rising seasonal allergy cases, while Asia Pacific held nearly 22% share and remained the fastest-growing region.

Market Insights

- The Antihistamines Market reached USD 541.69 million in 2024 and is projected to reach USD 995.23 million by 2032, growing at a CAGR of 7.9%.

- Growing allergy prevalence and strong demand for non-sedating antihistamines drive steady expansion across OTC and prescription channels.

- Extended-release formulations and rising adoption of pediatric-friendly liquids shape key market trends, supported by wider e-commerce accessibility.

- Competition intensifies as major firms expand OTC portfolios, strengthen distribution, and focus on safer second-generation drugs, while generics gain traction in cost-sensitive regions.

- North America held 38% share in 2024, Europe accounted for 30%, and Asia Pacific captured 22%, while H-1 blockers dominated by product type with 72% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

H-1 blockers dominated the Antihistamines Market in 2024 with nearly 72% share. Strong adoption came from their role in treating allergic rhinitis, urticaria, and seasonal allergies. Rising cases of pollen allergies and greater demand for non-sedating second-generation drugs supported wider use. H-2 blockers held a smaller share due to their focused use in gastric acid control rather than broad allergy treatment. Growing awareness of long-term acid-related conditions kept demand steady but lower than H-1 agents.

- For instance, Sanofi’s Allegra (fexofenadine), a second-generation H-1 blocker, is approved for adults and children 12 years and older at a dose of 60 mg twice daily for seasonal allergic rhinitis or 180 mg once daily for chronic idiopathic urticaria.

By Type

Over-the-counter antihistamines led the market in 2024 with about 63% share. Easy access, wide retail availability, and strong demand for self-medication boosted growth. Non-sedating OTC drugs such as cetirizine, loratadine, and fexofenadine gained steady traction. Prescription-based antihistamines held a moderate share, driven by severe allergy cases and chronic urticaria management. Physician-led therapy remained essential for patients requiring higher-strength or combination treatment options.

- For instance, Johnson & Johnson’s OTC brand Zyrtec Allergy recommends one 10 mg cetirizine tablet once daily for adults and children 6 years and over, with a clear limit of not more than one 10 mg tablet in 24 hours.

By Dosage Forms

Tablets dominated the market in 2024 with roughly 58% share. Strong preference came from ease of use, long shelf life, and wide availability across retail and online channels. Tablets offered consistent dosing and supported strong patient adherence. Liquid forms grew in pediatric and geriatric groups due to easier swallowing and flexible dosing. Capsules and other forms maintained niche demand for users seeking alternative delivery formats or rapid-release options.

Key Growth Drivers

Rising Allergy Prevalence

Global allergy cases continue to rise due to pollution, climate shifts, and urban lifestyles. This increase expands demand for fast-acting antihistamines across all age groups. Growing diagnoses of allergic rhinitis and chronic urticaria further strengthen product uptake. Wider access to both OTC and prescription drugs supports steady growth across pharmacies and online platforms.

- For instance, the U.S. FDA reported that more than 60 million packages of oral allergy medicines such as cetirizine products (including Johnson & Johnson’s Zyrtec) and levocetirizine products were sold in 2022, while over 200 global cases of severe itching after stopping these drugs were identified between April 2017 and July 2023, indicating very high real-world use.

Shift Toward Non-Sedating Antihistamines

Second-generation antihistamines gain strong traction due to fewer side effects and better safety. Consumers prefer non-sedating options for daily use, especially during peak allergy seasons. Broader physician endorsement and strong clinical support also drive adoption. Market players expand non-drowsy formulations to meet high demand in retail and e-commerce channels.

- For instance, Opella’s Xyzal Allergy 24HR tablets contain 5 mg levocetirizine, and OTC Drug Facts and professional dosing guides specify one 5 mg tablet once daily in the evening for adults and children 12–64 years, with the option of 2.5 mg once daily for milder symptoms, reflecting once-daily, low-sedation regimens.

Expansion of OTC Availability

OTC antihistamines remain a major growth engine due to easy access and high self-medication rates. Retail chains, supermarkets, and online pharmacies enhance reach for leading brands. Growing consumer awareness encourages early symptom management. This shift reduces dependence on prescriptions and boosts overall market volume.

Key Trends & Opportunities

Growth of Combination and Extended-Release Formulations

Pharmaceutical firms invest in advanced formulations that offer longer relief and multi-symptom control. Extended-release products improve patient convenience and reduce dosing frequency. Combination options addressing nasal congestion and seasonal triggers gain wider interest. These innovations open strong opportunities for differentiation in a competitive market.

- For instance, Bayer’s extended-release Claritin-D / equivalent loratadine–pseudoephedrine tablets contain 5 mg loratadine and 120 mg pseudoephedrine in each 12-hour tablet, with dosing guidance for adults and children 12 years and older of one tablet every 12 hours, and a maximum of two tablets in 24 hours.

Expansion in Pediatric and Geriatric Demand

Rising allergy awareness among caregivers boosts demand for child-friendly liquids and dissolvable formats. Aging populations also require safer antihistamines due to comorbidities and sensitivity to sedation. Companies expand dosing options to meet diverse patient needs. This trend supports higher market penetration across both age-specific segments.

- For instance, Zuventus Healthcare’s Elriz Syrup (levocetirizine) pediatric labeling recommends a total daily dose of 2.5 mg for young children, given as 1.25 mg (2.5 mL) twice daily, directly addressing pediatric dosing needs with an age-tailored liquid format.

Key Challenges

Adverse Effects and Safety Concerns

Some antihistamines pose risks of drowsiness, cognitive impairment, and interactions with existing therapies. Older first-generation drugs face scrutiny due to sedation effects. These concerns push consumers and physicians to seek safer alternatives. Regulatory bodies monitor labeling and restrict certain formulations, limiting wider adoption.

Competition from Alternative Therapies

Allergy immunotherapy, nasal corticosteroids, and biologics present strong alternatives for chronic conditions. These treatments reduce reliance on antihistamines in severe cases. Growing use of long-term desensitization therapies shifts demand patterns. Market players must innovate to stay competitive against advanced and targeted options.

Regional Analysis

North America

North America held the largest share of the antihistamines market in 2024 with nearly 38%. Strong allergy prevalence, widespread OTC adoption, and a mature retail pharmacy network supported high demand. Seasonal pollen surges and rising chronic allergy cases further expanded product use. The region also benefits from strong awareness campaigns and rapid access to newer non-sedating formulations. Broad insurance coverage for prescription products and strong e-commerce growth strengthened the overall market position.

Europe

Europe accounted for about 30% share of the antihistamines market in 2024. High rates of allergic rhinitis, strict clinical standards, and increased preference for second-generation antihistamines drove wider adoption. The region’s strong healthcare infrastructure enabled consistent diagnosis and treatment. Growth in self-care and pharmacy-led guidance further boosted OTC sales. Expanding demand across Germany, the U.K., France, and Italy supported stable market expansion during the period.

Asia Pacific

Asia Pacific held roughly 22% share in 2024 and remained the fastest-growing region. Rising pollution levels, expanding urban populations, and increasing allergy awareness contributed to higher antihistamine use. Affordable OTC access and a growing middle-income group supported strong product uptake. Countries such as China, India, and Japan saw notable demand for both tablet and liquid formats. Rapid e-commerce penetration further strengthened sales across this region.

Latin America

Latin America captured nearly 6% share of the market in 2024. Increasing diagnoses of seasonal allergies and expanding access to OTC medicines supported gradual growth. Urbanization and rising exposure to environmental triggers created stronger demand for daily-use antihistamines. Brazil and Mexico led market expansion due to broader retail pharmacy networks. Economic constraints limited premium product adoption but sustained demand for affordable generic formulations.

Middle East and Africa

The Middle East and Africa accounted for about 4% share in 2024. Growth came from improving healthcare access, rising awareness of allergy conditions, and expanding pharmacy chains. Warmer climates and dust exposure contributed to higher cases of allergic rhinitis. Countries such as Saudi Arabia, the UAE, and South Africa showed steady uptake of OTC antihistamines. Limited specialist access in some areas slowed prescription demand but drove wider reliance on retail channels.

Market Segmentations:

By Product Type

- H-1 Blockers

- H-2 Blockers

By Type

- Prescription-based

- Over-the-counter

By Dosage Forms

- Tablets

- Capsules

- Liquids

- Other Dosage Forms

By Route of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Antihistamines Market features major companies such as Sun Pharmaceutical Industries Inc., Novartis AG, Himalaya Wellness Company, GlaxoSmithKline PLC, Bayer AG, and Sanofi Consumer Healthcare. These players compete through strong retail presence, expanded OTC portfolios, and steady development of safer second-generation formulations. Manufacturers focus on wider availability across pharmacies and e-commerce channels to reach broader consumer groups. Product innovation centers on non-sedating options, extended-release formats, and pediatric-friendly solutions to strengthen brand preference. Companies also invest in awareness programs that support early allergy management and boost repeat purchases. Rising demand for daily-use products encourages firms to enhance supply chains and improve global distribution efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, GlaxoSmithKline PLC launched an upgraded Claritin-equivalent antihistamine in Asia-Pacific markets.

- In 2025, Sanofi Consumer Healthcare India Limited launched Allegra-D in India.

- In 2025, Novartis received FDA approval for Rhapsido (remibrutinib), the first oral targeted BTKi for chronic spontaneous urticaria (CSU) in patients symptomatic on H1 antihistamines

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Dosage Forms, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-sedating antihistamines will grow as consumers seek safer daily use options.

- OTC sales will rise due to strong self-medication habits and wider digital pharmacy access.

- Extended-release and multi-symptom formulations will gain traction for longer relief.

- Allergy cases will increase with pollution and climate shifts, driving steady market expansion.

- Pediatric-friendly liquids and dissolvable formats will see higher adoption across key markets.

- Digital allergy management tools will support better treatment adherence and product selection.

- Biologics and immunotherapy will pressure antihistamines but expand combination treatment opportunities.

- Generic antihistamines will strengthen share in cost-sensitive regions.

- E-commerce platforms will boost product visibility and accelerate repeat purchases.

- Manufacturers will increase investment in safer, targeted, and faster-acting formulations.