Market Overviews

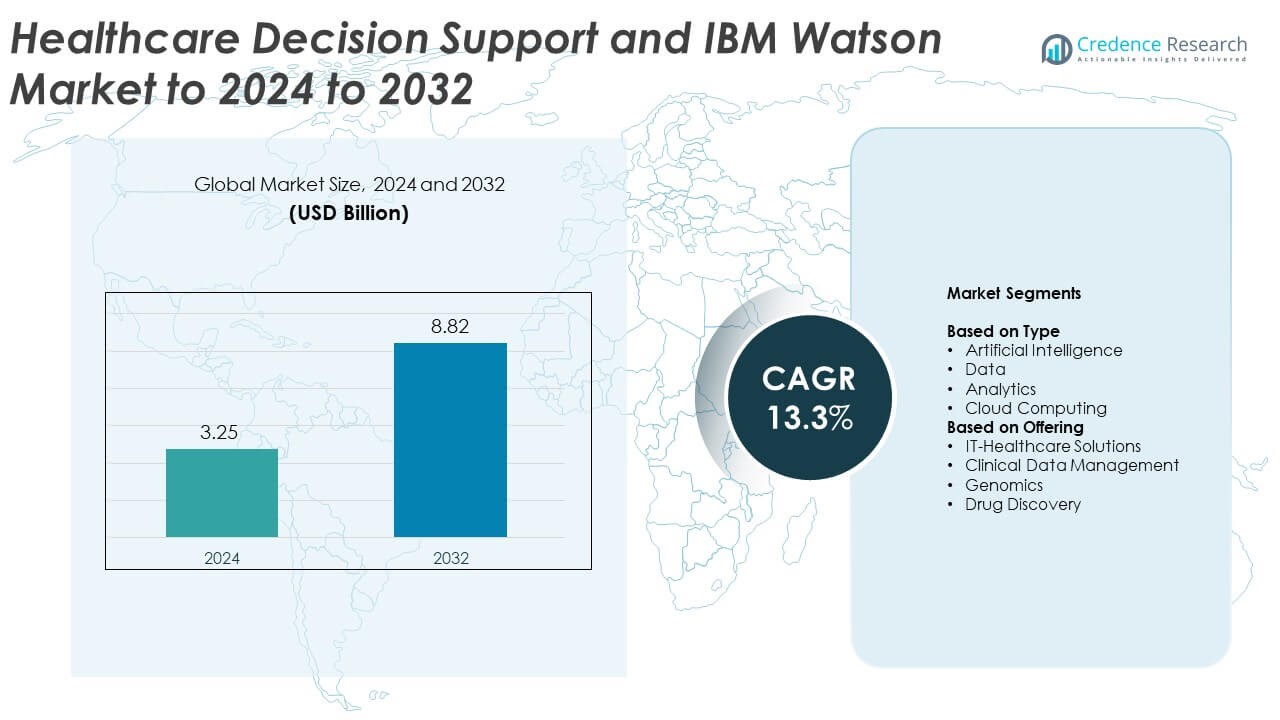

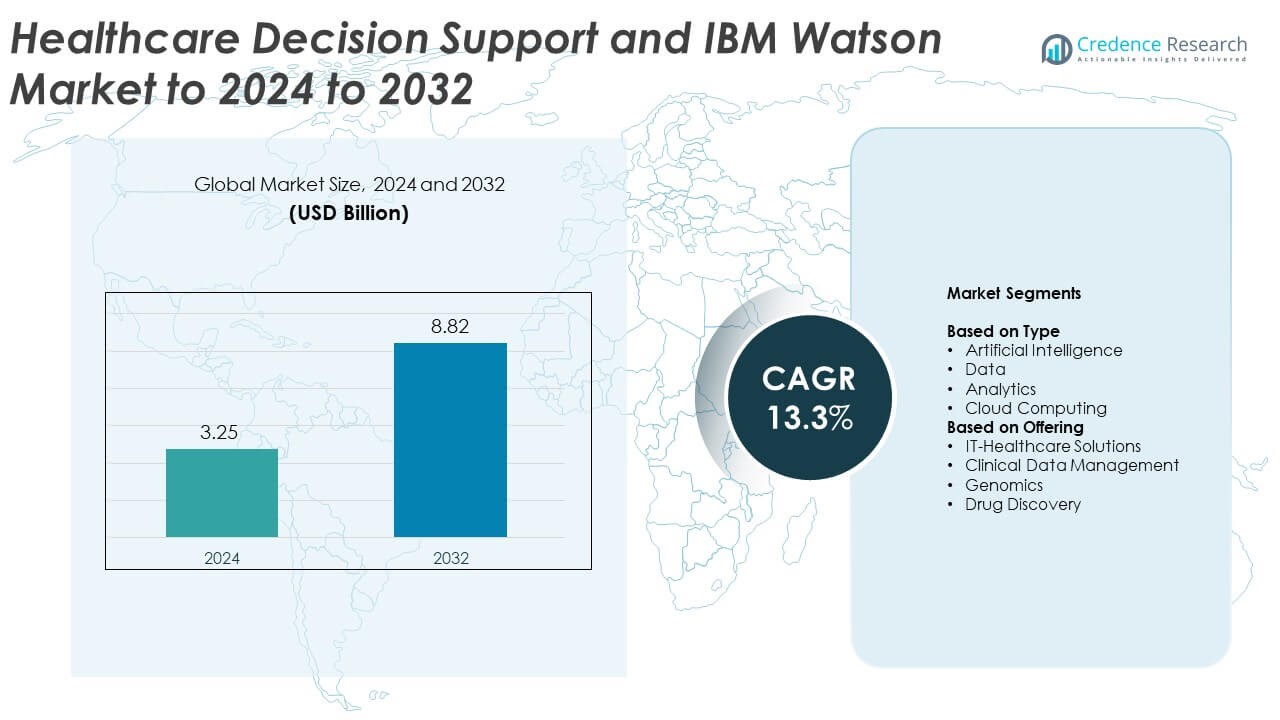

Healthcare Decision Support and IBM Watson market size was valued at USD 3.25 billion in 2024 and is anticipated to reach USD 8.82 billion by 2032, growing at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Decision Support and IBM Watson Market Size 2024 |

USD 3.25 Billion |

| Healthcare Decision Support and IBM Watson Market, CAGR |

13.3% |

| Healthcare Decision Support and IBM Watson Market Size 2032 |

USD 8.82 Billion |

The Healthcare Decision Support and IBM Watson market includes key players such as Wolters Kluwer, IBM, Siemens, Philips Healthcare, Truven Health Analytics, Zynx Health, National Decision Support, Navera, and EVeritas. These companies advanced clinical decision platforms through AI-driven insights, real-time analytics, and strong integration with electronic records. Vendors focused on improving diagnostic accuracy, workflow efficiency, and data interoperability across large healthcare networks. North America remained the leading region in 2024 with about 41% share, supported by heavy investments in digital health, strong regulatory frameworks, and widespread adoption of AI-enabled clinical tools that enhanced care delivery across major health systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 3.25 billion in 2024 and will hit USD 8.82 billion by 2032 with a CAGR of 13.3%.

- Growth rose as hospitals adopted AI tools and cloud platforms to improve diagnosis and strengthen workflow speed.

- Trends showed rising use of precision-care engines and wider integration of multimodal clinical data across major systems.

- Competition increased as vendors expanded analytics depth and improved interoperability while meeting strict data rules.

- North America held 41% share in 2024, followed by Europe at 29% and Asia Pacific at 22%, while AI led type with 46% and IT-healthcare solutions led offerings with 52%.

Market Segmentation Analysis:

By Type

Artificial intelligence held the dominant position in 2024 with about 46% share of the Healthcare Decision Support and IBM Watson market. Hospitals used AI tools to enhance early diagnosis, automate clinical workflows, and improve treatment planning. Growth rose as providers adopted AI-driven decision support to reduce errors and handle rising patient loads. Data, analytics, and cloud computing also expanded as healthcare systems upgraded digital infrastructure and shifted toward integrated platforms that support real-time insights and remote access.

- For instance, IBM Watson Health added 215 million records from Truven in 2016. This brought IBM’s total health dataset to about 300 million patient records.

By Offering

IT-healthcare solutions led this segment in 2024 with nearly 52% share of the Healthcare Decision Support and IBM Watson market. Demand increased as hospitals invested in digital platforms that support electronic records, clinical decision engines, and workflow automation. Growth was driven by rising need for efficient patient management, better care coordination, and advanced decision support capabilities. Clinical data management, genomics, and drug discovery also grew as organizations adopted precision-medicine tools and data-driven research systems to improve outcomes.

- For instance, Epic Systems reports that electronic records for more than 300 million patients are held in its EHR platforms worldwide.

Key Growth Drivers

Rising adoption of AI-enabled clinical decision systems

Hospitals increased investment in AI-enabled tools that support diagnosis, treatment selection, and workflow automation. Healthcare leaders used these systems to reduce clinical errors and handle rising patient volumes across busy departments. AI platforms helped teams interpret complex data and deliver faster insights during critical care. Adoption grew as providers sought stronger decision accuracy, improved productivity, and better patient outcomes across digital care models.

- For instance, Nuance healthcare solutions capture and communicate over 300 million patient stories each year for more than 500,000 clinicians in 10,000 organizations.

Shift toward data-driven and evidence-based care

Healthcare organizations expanded digital ecosystems to support evidence-based care and real-time analytics. Decision platforms helped teams analyze patient records, imaging data, and lab reports to create more accurate clinical pathways. This shift reduced variation in treatment patterns and strengthened care quality across large networks. Demand grew as providers worked to align their practices with regulatory guidelines and outcome-driven care initiatives.

- For instance, Flatiron Health’s oncology network includes over 5 million de-identified patient records and more than 1.5 billion data points used for real-world evidence research.

Growing demand for integrated cloud healthcare platforms

Cloud-based systems offered scalable access to clinical data, predictive models, and AI engines. Providers adopted these platforms to manage multi-site operations and support remote clinical decision making. Cloud tools reduced IT overhead and enabled faster updates across decision support modules. Growth accelerated as hospitals modernized digital infrastructure to improve data security, interoperability, and deployment speed.

Key Trends & Opportunities

Rapid expansion of precision-medicine solutions

Healthcare teams relied on advanced analytics and genomics-driven insights to tailor treatment strategies for complex conditions. Decision platforms integrated genomic profiles with clinical data, enabling more accurate predictions and personalized therapies. Growth continued as oncology centers and research hospitals invested in precision-care engines supported by AI and cloud systems.

- For instance, Tempus has assembled over 350 petabytes of connected clinical and molecular data, linked to more than 40 million de-identified research records and over 4 million genomic profiles/sequenced samples.

Increasing integration of multimodal clinical data

Providers began using unified decision systems that combine imaging, pathology, wearable data, and electronic records. This convergence improved diagnostic speed and reduced fragmentation across departments. Adoption expanded as hospitals explored new opportunities to strengthen predictive care, early detection, and real-time risk assessment.

- For instance, Paige’s Virchow (first generation) model was trained on datasets that included about 1.5 million pathology slides from Memorial Sloan Kettering Cancer Center (MSKCC).

Expanding role of automation in clinical workflows

Healthcare systems used automated triage, alerts, and documentation tools to reduce staff workload. Decision engines improved clinical efficiency and enabled teams to prioritize high-risk cases faster. Opportunities grew as organizations aimed to improve throughput and reduce burnout through smart automation.

Key Challenges

Data privacy concerns and strict regulatory compliance

Healthcare teams faced rising pressure to manage patient data securely while meeting demanding regulations. Decision support platforms needed strong encryption, access controls, and audit frameworks, which increased development complexity. Providers hesitated to adopt new solutions when privacy standards were uncertain or integration risks were high.

High implementation costs and skill-gap issues

Hospitals struggled with the heavy investment required for AI systems, cloud upgrades, and analytics integration. Many facilities lacked trained staff capable of managing complex decision support engines. Adoption slowed when teams needed extensive training, technical resources, or system customization to achieve full operational value.

Regional Analysis

North America

North America held the leading position in the Healthcare Decision Support and IBM Watson market in 2024 with about 41% share. Growth came from strong adoption of AI-enabled clinical systems across large hospital networks and advanced research centers. Healthcare providers invested in cloud platforms, predictive analytics, and integrated decision engines to enhance diagnostic accuracy and improve operational workflows. Supportive regulations and high spending on digital health further strengthened regional leadership. Partnerships between technology firms and healthcare organizations also expanded, helping the region maintain its dominant share during the forecast period.

Europe

Europe accounted for nearly 29% share of the Healthcare Decision Support and IBM Watson market in 2024, driven by strong demand for evidence-based care tools and digital health standards across member states. Hospitals expanded use of clinical analytics, early-warning systems, and AI-based triage tools to improve patient safety and reduce treatment delays. National healthcare programs supported modernization efforts, while vendors introduced interoperable platforms for multi-country deployment. The region’s focus on quality improvement and patient outcome optimization helped sustain steady adoption across both public and private healthcare settings.

Asia Pacific

Asia Pacific captured around 22% share of the Healthcare Decision Support and IBM Watson market in 2024, supported by rapid digital transformation in China, Japan, India, and South Korea. Hospitals upgraded data systems and adopted AI-driven diagnostic tools to address rising patient volumes and growing chronic disease cases. Governments promoted digital health initiatives and expanded funding for smart hospitals. Local and global vendors introduced scalable cloud tools tailored to regional needs, improving accessibility for mid-sized facilities. Rising investments in precision medicine and analytics-driven care strengthened the region’s growth outlook.

Latin America

Latin America held close to 5% share of the Healthcare Decision Support and IBM Watson market in 2024. Adoption grew gradually as major countries invested in digital health infrastructure, clinical data platforms, and decision support tools. Healthcare providers used analytics-based systems to improve care delivery and manage resource constraints. Regional growth faced challenges from budget limitations, yet demand increased in private hospitals and specialized centers. Expansion of cloud solutions and government-backed digital health programs supported broader system upgrades across emerging economies.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share of the Healthcare Decision Support and IBM Watson market in 2024. Growth was led by advanced healthcare projects in the Gulf region, where hospitals adopted AI-supported diagnostic engines and digital decision systems. Investments in smart hospital initiatives improved the region’s digital readiness. Several African nations adopted basic analytics tools to enhance clinical processes, though adoption remained slower due to funding constraints. Expansion of cloud-based healthcare platforms improved accessibility and supported gradual integration across leading facilities.

Market Segmentations:

By Type

- Artificial Intelligence

- Data

- Analytics

- Cloud Computing

By Offering

- IT-Healthcare Solutions

- Clinical Data Management

- Genomics

- Drug Discovery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Healthcare Decision Support and IBM Watson market features key players such as Wolters Kluwer, IBM, Siemens, Philips Healthcare, Truven Health Analytics, Zynx Health, National Decision Support, Navera, and EVeritas. Vendors focused on developing advanced clinical engines that support accurate diagnosis, treatment selection, and workflow optimization across complex care settings. Many companies expanded cloud-based platforms to enhance data access and system scalability for large hospital networks. Developers prioritized strong interoperability to support seamless integration with electronic records and imaging systems. AI-driven insights, real-time alerts, and predictive analytics remained central to product upgrades that strengthened clinical accuracy and decision reliability. Firms also invested in enhanced data security frameworks to meet regulatory compliance and protect sensitive patient information. Partnerships with hospitals, research institutions, and technology providers helped accelerate innovation and broaden deployment across global healthcare systems. As demand for precision care and evidence-based workflows increased, market competition intensified, encouraging rapid advancement across decision support technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Wolters Kluwer continues enhancing its clinical decision support systems by integrating extensive evidence-based content and analytics tools to help clinicians standardize care and reduce variability in treatment.

- In 2024, Zynx Health partnered with Innovaccer to integrate evidence-based clinical decision support content into a comprehensive care management system.

- In 2024, IBM Japan and FBRI launched an AI-embedded clinical development platform using generative AI for streamlined clinical trials.

Report Coverage

The research report offers an in-depth analysis based on Type, Offering and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI-driven clinical decision tools across hospitals.

- Cloud-based platforms will support faster deployment and easier access to advanced analytics.

- Precision-medicine engines will grow as genomic and clinical data integration increases.

- Clinical workflow automation will expand to reduce staff workload and improve efficiency.

- Predictive analytics will guide early risk detection and improve treatment planning.

- Interoperability improvements will allow smoother data exchange across healthcare systems.

- Real-time decision support will strengthen emergency and critical-care operations.

- Investment from private hospitals will rise as digital transformation accelerates.

- Vendors will focus on secure, scalable platforms to meet strict regulatory needs.

- Adoption in emerging regions will grow as cloud and AI systems become more accessible.