| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connector Market Size 2024 |

USD 76,098.78 Million |

| Connector Market, CAGR |

5.85% |

| Connector Market Size 2032 |

USD 1,23,914.28 Million |

Market Overview

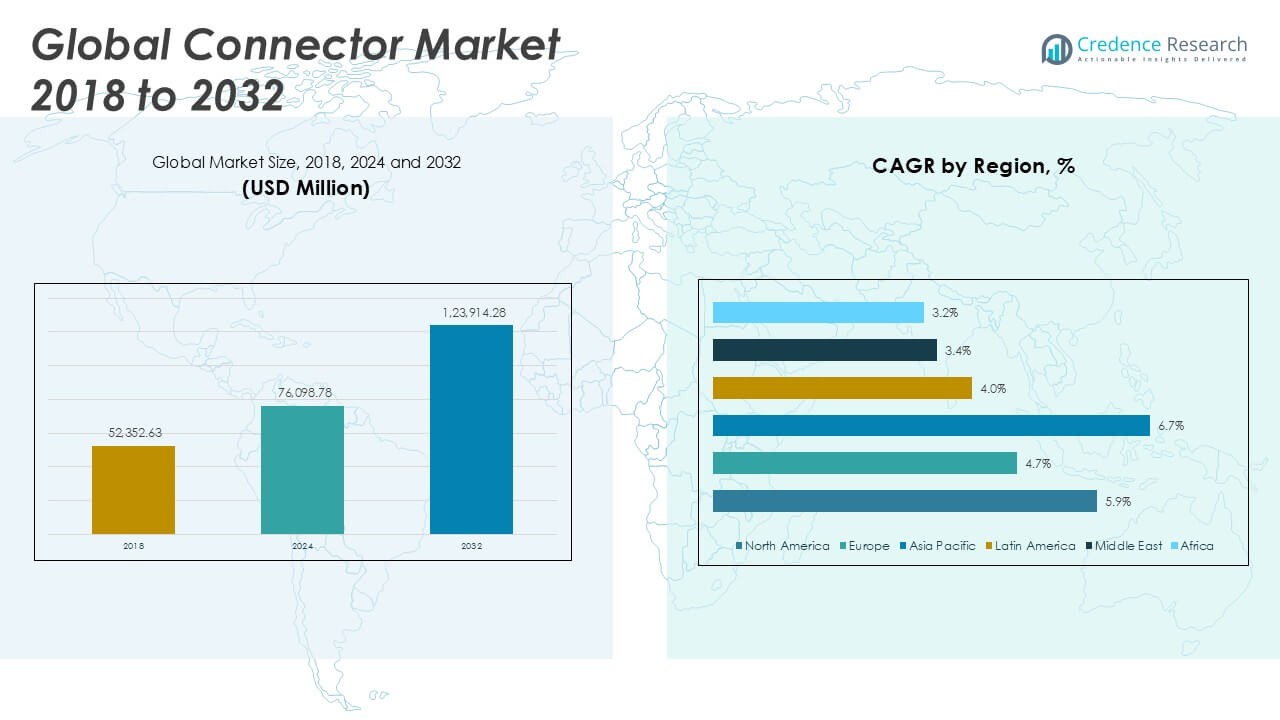

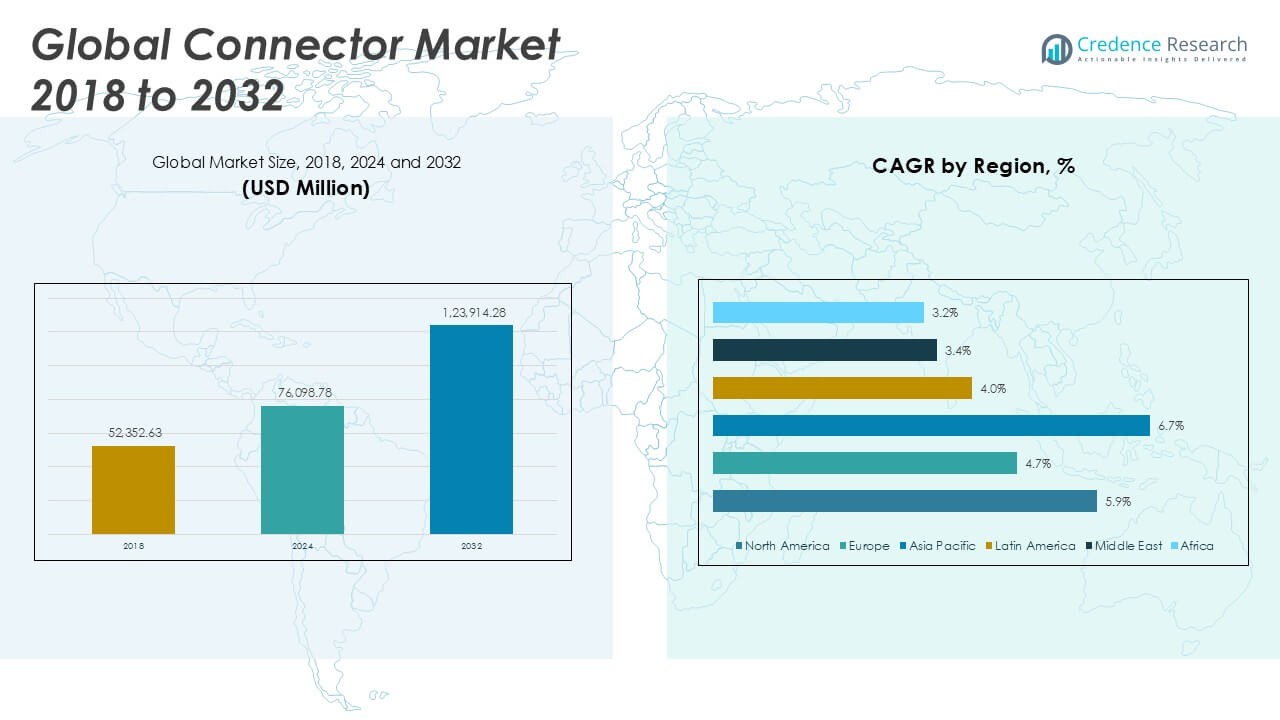

The Connector Market size was valued at USD 52,352.63 million in 2018, grew to USD 76,098.78 million in 2024, and is anticipated to reach USD 1,23,914.28 million by 2032, at a CAGR of 5.85% during the forecast period.

The Connector Market is experiencing steady growth driven by rising demand for high-speed data transmission in consumer electronics, telecommunications, and automotive applications. The increasing adoption of advanced technologies such as 5G, IoT, and electric vehicles is creating significant opportunities for innovative connector solutions with enhanced performance and miniaturization. Additionally, the proliferation of data centers and cloud computing infrastructures continues to fuel the need for robust and high-density connectors. In the automotive sector, the shift toward autonomous and electric vehicles has led to greater integration of electronic components, further boosting connector usage. On the trend front, manufacturers are focusing on producing environmentally sustainable and recyclable connectors, while also investing in smart connectors that enable real-time diagnostics and monitoring. The growing emphasis on compact, lightweight, and high-reliability connectors across sectors reinforces their critical role in evolving electronic architectures.

Geographically, the Connector Market shows strong performance across North America, Europe, and Asia Pacific, with Asia Pacific leading due to its robust electronics manufacturing base and expanding automotive and telecom sectors. North America remains a key region driven by demand in data centers, defense, and electric vehicles, while Europe emphasizes industrial automation and renewable energy applications. Latin America and the Middle East are witnessing gradual growth supported by infrastructure modernization and rising consumer electronics penetration. Africa remains an emerging market with potential in telecom and energy sectors. Key players shaping the competitive landscape include Amphenol Corporation, known for its extensive product range and global reach; TE Connectivity, offering advanced connectivity and sensor solutions; and Molex, which specializes in high-performance connectors for automotive, industrial, and medical applications. Aptiv also plays a significant role, particularly in the development of next-generation automotive connectivity solutions. These companies invest in R&D and strategic partnerships to sustain growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Connector Market was valued at USD 76,098.78 million in 2024 and is projected to reach USD 1,23,914.28 million by 2032, growing at a CAGR of 5.85% during the forecast period.

- Increasing demand for high-speed data transmission in consumer electronics, automotive systems, and 5G infrastructure is driving market growth across key application areas.

- High-speed, miniaturized, and high-density connector designs are trending across industries, fueled by rising adoption of IoT, smart manufacturing, and compact devices.

- Leading players such as Amphenol Corporation, TE Connectivity, Molex, and Aptiv maintain competitive advantage through extensive product portfolios, global presence, and continuous R&D investments.

- Supply chain disruptions, fluctuating raw material costs, and design complexities for high-frequency applications pose challenges to consistent market expansion.

- Asia Pacific dominates the global landscape with strong demand from China, Japan, and South Korea, followed by North America and Europe with active investments in automotive and telecom sectors.

- Emerging markets in Latin America, the Middle East, and Africa are gaining traction due to growing infrastructure development and consumer electronics penetration, creating new long-term opportunities.

Market Drivers

Proliferation of Advanced Electronic Devices and Consumer Demand for Connectivity

The Connector Market benefits significantly from the rising use of electronic devices across consumer, industrial, and commercial sectors. Smartphones, tablets, wearables, and smart home systems all require compact and high-performance connectors to ensure fast and reliable data transfer. The miniaturization trend in consumer electronics has created demand for connectors that offer high signal integrity in smaller footprints. Manufacturers are developing micro and nano connectors to meet these evolving device requirements. High-speed connectivity standards such as USB Type-C and Thunderbolt drive the replacement cycle for existing systems. The Connector Market continues to expand in line with rising consumer expectations for seamless connectivity.

- For instance, Hirose Electric developed its BM29 series of board-to-board connectors with a 0.35 mm pitch and 0.6 mm stacking height, supporting up to 5 Gbps differential transmission for ultra-thin mobile devices.

Expansion of 5G Networks and Internet of Things (IoT) Infrastructure

The deployment of 5G infrastructure and the growth of IoT ecosystems are key drivers in the Connector Market. These technologies require high-density, low-latency connectors to support real-time communication and increased bandwidth. IoT devices across smart cities, industrial automation, and healthcare demand durable and efficient connectors for power and data. It supports a massive volume of machine-to-machine connections that rely on robust signal transmission. Telecom operators and network equipment manufacturers prioritize advanced connectors for base stations, antennas, and edge computing devices. The Connector Market gains momentum from ongoing investments in digital infrastructure.

- For instance, TE Connectivity’s ERFV coax connectors are rated up to 6 GHz and achieve shielding effectiveness greater than 90 dB, enabling interference-free 5G signal performance in base station applications.

Rising Electric Vehicle (EV) Adoption and Automotive Electronics Integration

The automotive industry’s transition toward electric mobility and digital driving systems fuels connector demand. Electric vehicles require multiple connectors for battery management, power distribution, infotainment, and safety systems. It drives innovation in high-voltage, heat-resistant, and lightweight connectors. Automotive OEMs emphasize the integration of sensors, ADAS, and communication modules, creating new requirements for reliable and secure connectivity. The Connector Market sees strong growth potential in hybrid and fully electric vehicle platforms. Enhanced in-vehicle networking further strengthens market dynamics.

Growth in Data Centers and Cloud Computing Infrastructure Development

Global expansion of data centers and cloud infrastructure boosts demand for high-performance interconnect solutions. These facilities require dense, energy-efficient, and thermally stable connectors to manage data transmission and power delivery. The shift toward AI workloads and edge computing intensifies these requirements. It accelerates adoption of fiber optic and high-speed copper connectors. Enterprises invest in advanced connector systems to improve uptime, reduce latency, and support scalable networks. The Connector Market plays a crucial role in supporting the backbone of digital transformation.

Market Trends

Miniaturization and High-Density Connector Development Across Applications

The trend toward compact electronic devices has pushed connector manufacturers to innovate smaller, high-density designs without compromising performance. Consumer electronics, medical devices, and industrial automation tools all demand space-efficient components. It drives the development of micro and nano connectors with higher pin counts and enhanced data transfer rates. Manufacturers invest in precision engineering and material science to meet these requirements. The Connector Market reflects this trend through a steady increase in compact, multi-functional product offerings. Miniaturization supports product differentiation in tightly packed electronic assemblies.

- For instance, Amphenol ICC introduced its Micro Board-to-Board 0.4 mm pitch connector, delivering 30 positions and supporting 10 Gbps data rates in a 1.5 mm stacking height.

Growing Demand for High-Speed and High-Frequency Signal Transmission

The growing need for faster data processing and lower latency across multiple sectors fuels interest in high-speed and high-frequency connectors. Sectors like data centers, telecom, and automotive rely on connectors capable of supporting protocols such as USB 4.0, HDMI 2.1, and PCIe 5.0. It enables reliable communication between devices with minimal signal loss. Signal integrity, electromagnetic interference resistance, and thermal performance become critical design factors. The Connector Market responds with advanced shielding techniques and low-loss dielectric materials. High-speed connectors are becoming standard across performance-critical applications.

- For instance, Molex’s Mirror Mezz connector supports PCIe Gen 5 data rates at 32 GT/s with a mated height of 7.7 mm, designed for use in AI-enabled servers and next-gen data infrastructure.

Shift Toward Modular and Customizable Connector Solutions

There is a rising trend toward modular and application-specific connector designs tailored to industry needs. Manufacturers aim to reduce assembly time, enhance flexibility, and simplify maintenance through plug-and-play configurations. It helps OEMs adapt connector systems to diverse operating environments, from aerospace to medical imaging. Customizable solutions address both functional and regulatory requirements in specialized sectors. The Connector Market embraces this trend by offering configurable layouts and hybrid connector types. Versatility and scalability define the next generation of connector solutions.

Emphasis on Sustainable Materials and Eco-Friendly Manufacturing

Sustainability trends are shaping connector design and production methods across industries. Companies now incorporate recyclable materials and adopt low-impact manufacturing techniques. It aligns with broader environmental goals set by global regulations and end-users. Green connectors with halogen-free insulations and lead-free finishes are gaining traction. The Connector Market is gradually integrating sustainability into its value proposition. This shift strengthens brand reputation and meets compliance in regulated markets.

Market Challenges Analysis

Complexity in Designing for High-Speed and High-Density Applications

The shift toward faster and more compact devices presents significant design challenges for connector manufacturers. High-speed and high-density connectors must maintain signal integrity while fitting into limited board space. It requires advanced materials, precise tolerances, and extensive testing, increasing production costs and lead times. Engineers must also manage electromagnetic interference, thermal dissipation, and mechanical durability within tighter constraints. The Connector Market faces pressure to deliver reliable performance while minimizing size and weight. Meeting these demands often leads to higher development cycles and limited standardization across applications.

Supply Chain Disruptions and Fluctuating Raw Material Prices

Global supply chain instability and fluctuating prices of key raw materials create cost and delivery challenges. Copper, plastic resins, and specialty alloys used in connector manufacturing often face pricing volatility and procurement delays. It affects production planning, inventory management, and overall profitability for manufacturers. Dependence on specific suppliers or regions increases vulnerability during geopolitical tensions or logistical breakdowns. The Connector Market must adapt by diversifying sourcing strategies and investing in resilient supply networks. Navigating these uncertainties while maintaining competitive pricing remains a critical concern.

Market Opportunities

Rising Demand for Connectors in Electric Vehicles and Charging Infrastructure

The global push toward electrification in transportation opens significant growth avenues for connector manufacturers. Electric vehicles require specialized connectors for battery systems, power electronics, and advanced driver assistance systems. It drives innovation in high-voltage, heat-resistant, and ruggedized connector solutions. The expansion of EV charging networks, including fast and ultra-fast chargers, further supports connector demand. The Connector Market can capitalize on government incentives and infrastructure investments to strengthen its role in the EV ecosystem. Tailored solutions for vehicle-to-grid communication and modular charging designs offer long-term growth potential.

Expansion of Industrial Automation and Smart Manufacturing Systems

The rise of Industry 4.0 and smart factories creates new opportunities for advanced connector technologies. Industrial environments demand connectors that offer high reliability under exposure to dust, moisture, vibration, and extreme temperatures. It encourages the development of rugged, sealed, and quick-disconnect connector systems for machinery, robotics, and control systems. The Connector Market benefits from automation trends in logistics, packaging, and production lines. Integration of sensors, actuators, and real-time monitoring devices expands the need for secure, data-capable interconnects. Growth in industrial digitalization supports long-term adoption of robust and intelligent connector platforms.

Market Segmentation Analysis:

By Product Type:

PCB connectors hold the dominant share due to their widespread use in circuit board assemblies across consumer electronics, industrial automation, and medical equipment. I/O connectors follow closely, supporting peripheral connections in computing, networking, and data transfer systems. Circular connectors gain traction in harsh environments where durability and mechanical stability are critical, such as military, aerospace, and industrial sectors. Fiber optic connectors experience rising demand with the expansion of high-speed internet infrastructure and data centers. RF coaxial connectors cater to telecommunications and broadcasting applications that require minimal signal loss. The others segment includes hybrid and custom connectors tailored for niche applications.

- For instance, Rosenberger’s SMP coaxial connectors are designed for 40 GHz performance in rugged conditions and feature a mating durability of over 100 cycles.

By Material:

Copper remains the most widely used due to its excellent electrical conductivity and flexibility in design. It supports the majority of power and signal transmission across applications. Aluminum, while lighter, is used in applications prioritizing weight reduction and corrosion resistance. Stainless steel appears in environments requiring high mechanical strength and resistance to extreme temperatures or chemicals. Plastic materials play a critical role in insulation, housing, and non-conductive applications, especially in consumer electronics and medical devices. The others category includes advanced composites and specialty alloys used in high-performance or regulated applications.

- For instance, Yazaki developed a copper alloy terminal with tin plating that successfully passed 1,000 thermal cycles at 125°C without degradation in electrical resistance, tailored for automotive engine bay conditions.

By End-User:

Consumer electronics dominates the Connector Market due to high-volume production and frequent product upgrades. It drives demand for compact, multifunctional connectors used in smartphones, tablets, and wearables. Telecommunications and networking represent a major segment driven by 5G infrastructure, cloud computing, and expanding broadband networks. The automotive segment grows steadily, supported by rising EV production and advanced in-vehicle electronics. Energy and utilities require connectors for power grids, smart meters, and renewable energy systems. Government and defense demand rugged, secure connectors suited for mission-critical operations. Healthcare continues to expand its usage with connectors integrated into diagnostic equipment, imaging systems, and patient monitoring devices. Others include sectors like aerospace, marine, and industrial automation with highly specialized connector needs.

Segments:

Based on Product Type:

- PCB Connectors

- I/O Connectors

- Circular Connectors

- Fiber Optic Connectors

- RF Coaxial Connectors

- Others

Based on Material:

- Copper

- Aluminum

- Stainless Steel

- Plastic

- Others

Based on End-User:

- Consumer Electronics

- Telecommunications and Networking

- Automotive

- Energy and Utilities

- Government and Defense

- Healthcare

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Connector Market

North America Connector Market grew from USD 17,195.54 million in 2018 to USD 24,649.99 million in 2024 and is projected to reach USD 40,287.13 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.9%. North America is holding a 20% market share. The region benefits from advanced manufacturing ecosystems in the U.S. and Canada, strong demand in automotive electronics, and expansion in cloud infrastructure. The U.S. leads the regional market with investments in aerospace, defense, and electric vehicle technologies. High-speed data communication and automation drive continuous upgrades in connector designs. It sees strong supplier activity and early adoption of fiber optic and high-density connectors. Integration of 5G and smart technologies strengthens regional growth.

Europe Connector Market

Europe Connector Market grew from USD 10,337.34 million in 2018 to USD 14,247.87 million in 2024 and is projected to reach USD 21,217.68 million by 2032, reflecting a CAGR of 4.7%. Europe holds a 15% market share. Key markets such as Germany, France, and the UK support demand through robust automotive, industrial automation, and renewable energy sectors. It emphasizes sustainable manufacturing and compliance with strict safety standards. European manufacturers focus on advanced materials and miniaturized connectors for space-constrained applications. Strong defense and aerospace industries contribute to specialized connector requirements. The region’s strategic position and export strength help drive stable market expansion.

Asia Pacific Connector Market

Asia Pacific Connector Market grew from USD 20,342.14 million in 2018 to USD 30,796.80 million in 2024 and is projected to reach USD 53,572.48 million by 2032, reflecting the highest CAGR of 6.7%. Asia Pacific holds the largest market share at 43%. China, Japan, South Korea, and India lead regional growth through large-scale electronics production, expanding EV manufacturing, and rising internet penetration. It benefits from low-cost manufacturing, skilled labor, and growing local demand. Rapid urbanization and digital transformation initiatives support long-term growth. Government incentives for semiconductor and telecom infrastructure development further strengthen the outlook.

Latin America Connector Market

Latin America Connector Market grew from USD 2,158.71 million in 2018 to USD 3,093.17 million in 2024 and is projected to reach USD 4,372.54 million by 2032, reflecting a CAGR of 4.0%. Latin America accounts for a 4% market share. Brazil and Mexico lead regional demand, supported by automotive assembly operations and growing telecommunications infrastructure. It faces challenges in technology adoption but benefits from rising consumer electronics penetration. Investments in renewable energy and industrial automation are emerging drivers. Connector suppliers are expanding local partnerships to improve distribution and reduce import dependency. The market remains under development with potential for accelerated growth.

Middle East Connector Market

Middle East Connector Market grew from USD 1,384.73 million in 2018 to USD 1,829.68 million in 2024 and is projected to reach USD 2,483.68 million by 2032, reflecting a CAGR of 3.4%. The Middle East holds a 2% market share. The UAE and Saudi Arabia lead investments in smart cities, defense electronics, and telecom networks. It supports demand for rugged and secure connectors across industrial applications. Oil and gas sector automation also drives connector integration. Regional government programs focused on digital infrastructure create moderate growth opportunities. The limited manufacturing base may constrain fast scalability.

Africa Connector Market

Africa Connector Market grew from USD 934.18 million in 2018 to USD 1,481.27 million in 2024 and is projected to reach USD 1,980.78 million by 2032, reflecting a CAGR of 3.2%. Africa holds a 2% market share. South Africa and Nigeria contribute most to regional demand through energy, telecom, and infrastructure projects. It remains a price-sensitive market with limited access to advanced connector technologies. Local industries are adopting basic connectors for automotive and consumer electronics. Infrastructure gaps and supply chain limitations slow overall growth. The market holds untapped potential with long-term development programs in ICT and power sectors.

Key Player Analysis

- Amphenol Corporation

- Aptiv

- HIROSE ELECTRIC CO., LTD.

- Hongteng Precision Technology Co., Ltd.

- IRISO Electronics Co., Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Molex

- Rosenberger

- TE Connectivity

- Yazaki Corporation

Competitive Analysis

The Connector Market features a competitive landscape dominated by key players such as Amphenol Corporation, TE Connectivity, Molex, Aptiv, HIROSE ELECTRIC CO., LTD., Yazaki Corporation, Rosenberger, Japan Aviation Electronics Industry, Ltd., IRISO Electronics Co., Ltd., and Hongteng Precision Technology Co., Ltd. These companies compete based on product innovation, global distribution networks, technological integration, and customized solutions across industries. Companies compete by expanding their product portfolios, improving connector performance, and addressing specific needs across automotive, telecommunications, industrial, and healthcare applications. Innovation in high-speed, miniaturized, and ruggedized connectors plays a key role in maintaining competitive edge, especially in sectors like electric vehicles, 5G infrastructure, and industrial automation. Global manufacturers focus on strategic collaborations and acquisitions to strengthen their technological capabilities and global distribution networks. Regional players emphasize cost-effective solutions tailored to local requirements, creating competition in price-sensitive markets. Research and development remains central to staying ahead, with efforts directed toward sustainable materials, signal integrity, and advanced data transmission capabilities. Market participants continuously invest in enhancing quality, durability, and regulatory compliance to meet the evolving demands of both established and emerging industries.

Recent Developments

- In July 2024, the Indian Government had reported that 5 percent of the Universal Service Obligation Fund (USOF) was earmarked for telecoms Research and Development in the fiscal year 2023 – 24. USOF has since been transformed into Digital Bharat Nidhi and was done along with a major spending outlay figure surpassing USD 9.5 billion. The allocation of money has a purpose of providing necessary finance towards the monetization of the R&D work from the telecom industry in order to promote modern practices.

- In May 2024, the semiconductor industry is anticipated to receive a significant boost with investments projected to exceed USD 47 billion after the government of China established its third planned state-backed investment fund. This would in turn grow the market by enhancing adoption of product in consumer electronics & telecommunication industry.

- In October 2023, Amphenol will showcase its latest innovation in the field of connectors for electric vehicles at the Avnet Green Days: e-Mobility 2023 event in Hanoi and Ho Chi Minh, Vietnam, from October 24th to October 27th. The showcased products are DuraEV, MicroSpace High Voltage Crimp-to-Wire Connector, MicroSpaceXS 1.27mm Waterproof Crimp-to-Wire/Wire-to-Wire Connector, MicroSpace Crimp-To-Wire Connector, WireLock, USB, Ve-NET, NETBridge+, and HSBridge+.

- In August 2023, Molex, a leading global connectivity and electronics solutions provider, has captured a prestigious IoT Product Award at the recent OFweek 2023 (8th) IoT / AI Conference recently hosted in Shenzhen, China. Molex received the award for Mezz Pro and Mirror Mezz Enhanced high-speed connectors.

- In July 2023, ABB announced the launch of the world’s first full range of hinged high voltage connector backshells to heavy-duty electric vehicles (EV). Harnessflex EVO connector interfaces increase cable-to-connector stability in high voltage applications.

- In June 2023, FIT Hon Teng, a subsidiary of HonHai, received the “Red Dot Design Award”, known as the “Oscar of the Design Industry.” FIT focused on the hottest topic of AI and showcased its excellent design capabilities with its innovative 800G high-speed connector under the theme “FITCONN,” winning the Design Concept Award. This innovative solution not only adheres to the specifications and design rules of existing data centers but also greatly improves data transmission efficiency.

- In March 2023, Hirose Electric announced the launch of the IT14 Series, a hermaphroditic board-to-board connector that supports up to 112Gbps PAM4 transmission speed. IT14 is the licensed second source for “Mirror Mezz”, which was developed by connector manufacturer Molex in 2018 for applications such as servers, data communications, and telecommunications equipment.

Market Concentration & Characteristics

The Connector Market exhibits a moderately concentrated structure with a mix of established multinational corporations and regional manufacturers competing across global and local segments. It is characterized by high barriers to entry due to technological complexity, strict quality standards, and the need for advanced manufacturing capabilities. Leading players maintain strong customer relationships and extensive product portfolios, allowing them to serve diverse industries such as automotive, telecommunications, consumer electronics, and industrial automation. The market favors companies that can deliver high-reliability connectors with miniaturization, high-speed performance, and environmental resistance. It shows a strong emphasis on customization and application-specific solutions, particularly in emerging technologies like electric vehicles and 5G networks. Pricing pressure remains moderate due to demand for specialized features and consistent product quality. Innovation cycles are short, requiring continuous investment in R&D to sustain competitive advantage. The Connector Market maintains stability through long-term contracts and global supply chains, supported by the critical role connectors play in modern electronic infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The connector market will continue to grow due to increasing demand for advanced electronics in automotive and industrial sectors.

- Rising adoption of electric vehicles is expected to drive the need for high-performance connectors.

- Expanding 5G infrastructure will create new opportunities for RF and fiber optic connectors.

- Growth in consumer electronics will fuel the demand for compact and high-speed connectors.

- Industrial automation and robotics will further accelerate the deployment of durable and reliable connectors.

- The medical devices sector will increasingly adopt miniaturized connectors for compact equipment designs.

- Rising investments in data centers and cloud computing will enhance the need for high-speed and efficient data connectors.

- Technological advancements will lead to the development of smart connectors with enhanced safety and functionality.

- Stringent environmental regulations will encourage manufacturers to focus on eco-friendly connector solutions.

- The Asia-Pacific region will remain a dominant market due to large-scale manufacturing and growing electronic device consumption.