Market Overview

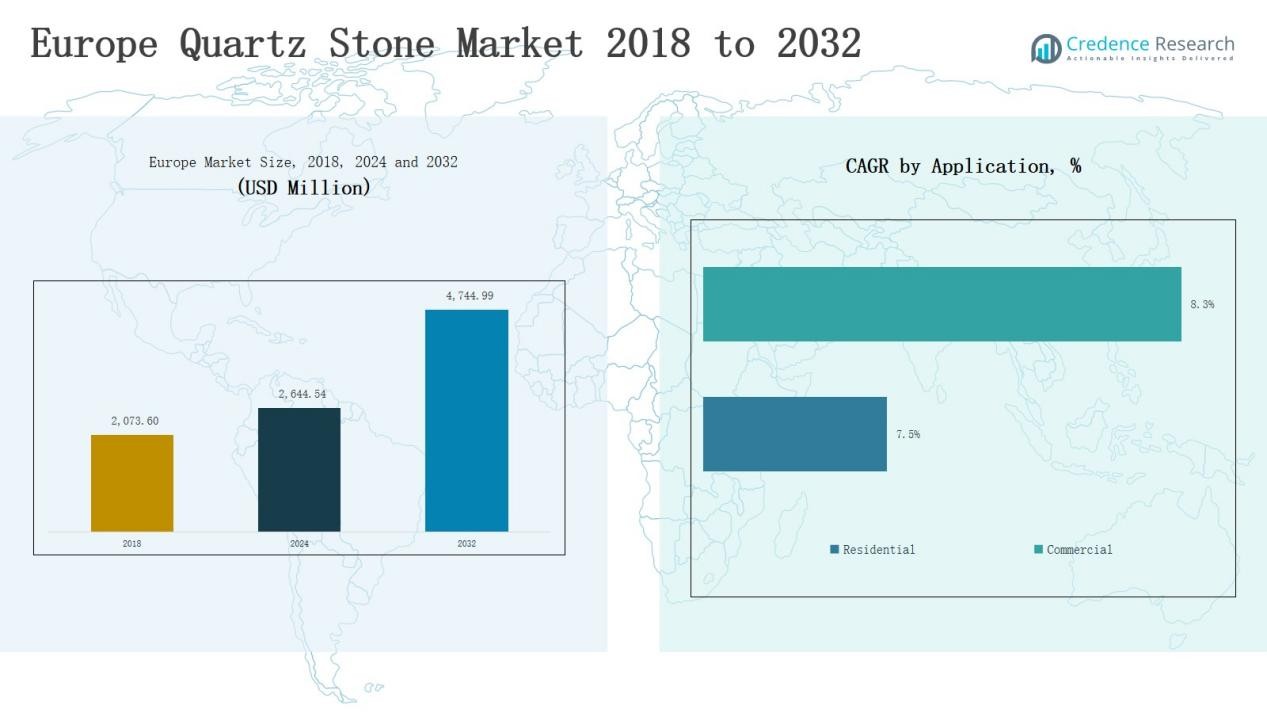

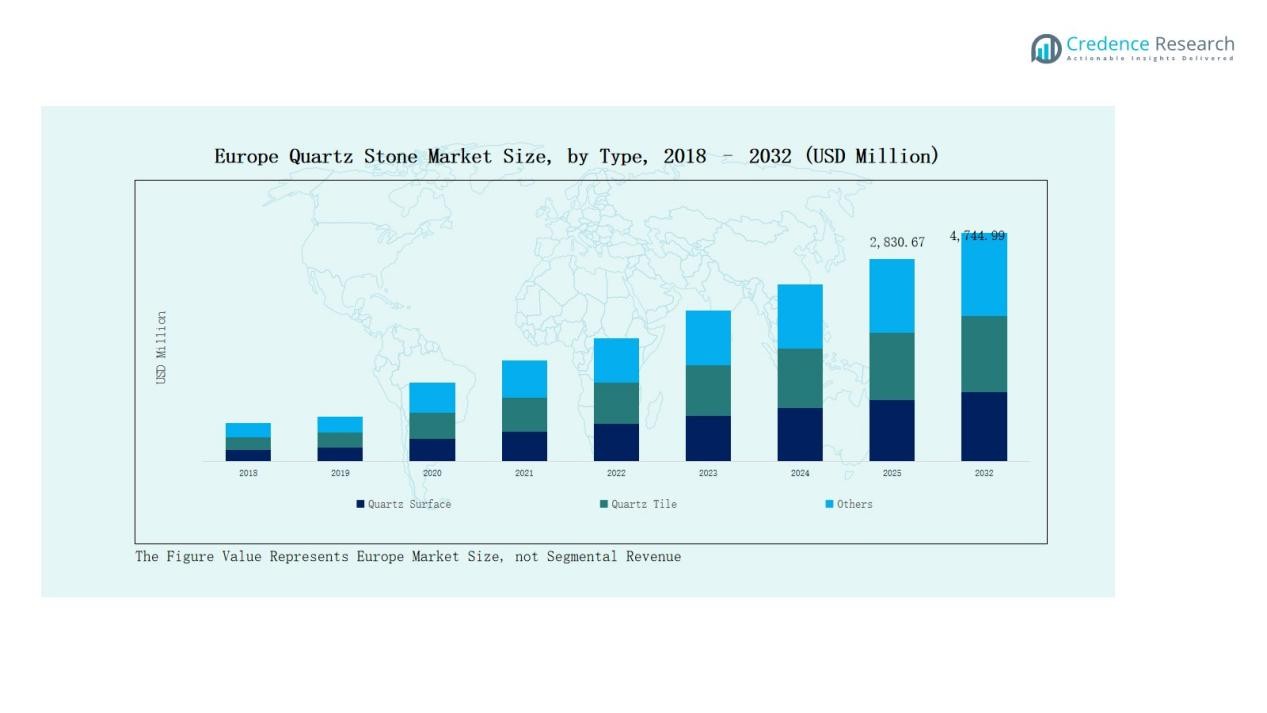

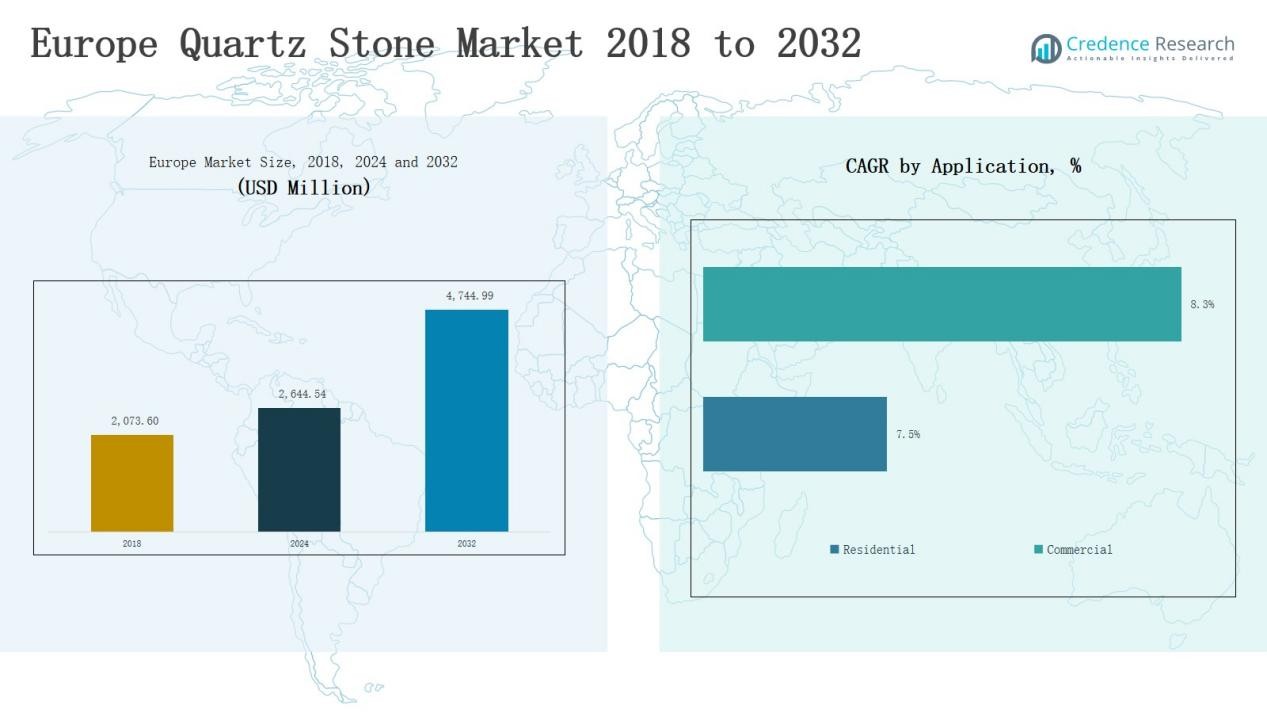

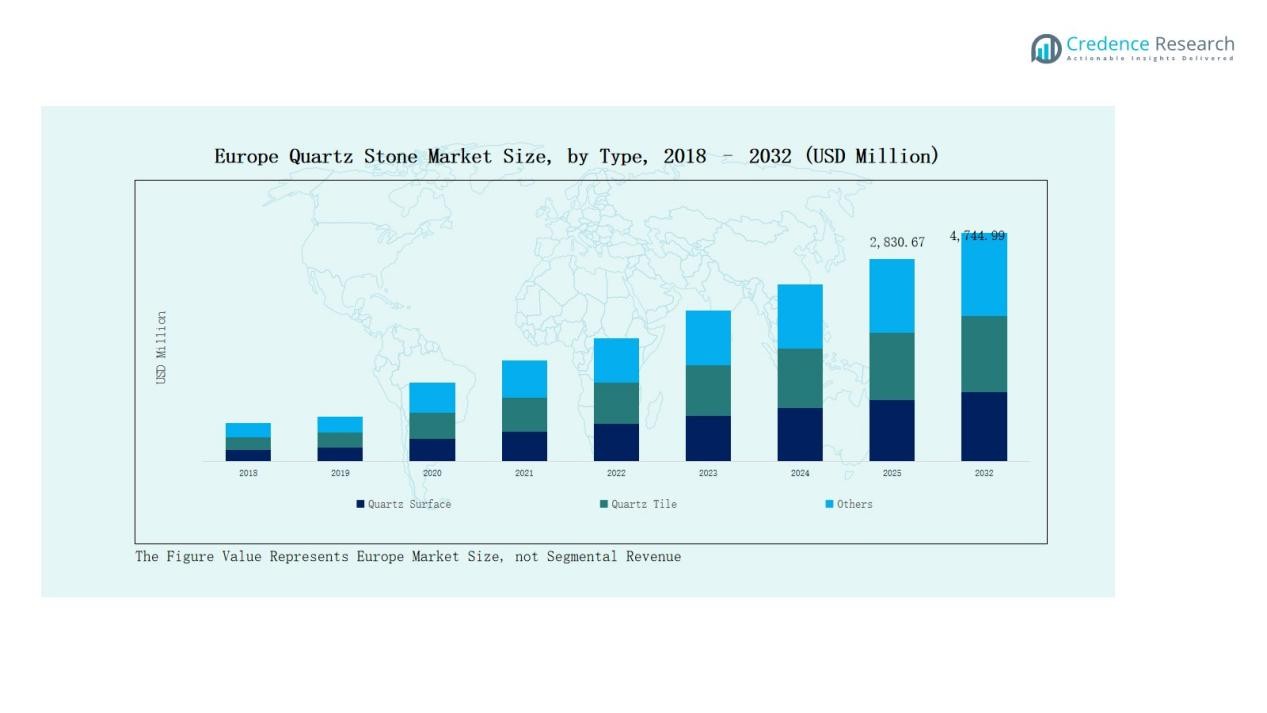

The Europe Quartz Stone Market size was valued at USD 2,073.60 million in 2018, increased to USD 2,644.54 million in 2024, and is anticipated to reach USD 4,744.99 million by 2032, growing at a CAGR of 7.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Stone Market Size 2024 |

USD 2,644.54 Million |

| Europe Quartz Stone Market, CAGR |

7.39% |

| Europe Quartz Stone Market Size 2032 |

USD 4,744.99 Million |

The Europe Quartz Stone Market is led by major players such as Caesarstone Ltd., Compac, Technistone a.s., Santa Margherita S.p.A., Quarella S.p.A., DuPont de Nemours, Inc., LG Hausys Ltd., Cambria Company LLC, Cosentino S.A. (Silestone), Vicostone JSC, Hanwha L&C (HanStone Quartz), and Stone Italiana S.p.A. These companies focus on advanced engineering, sustainable production, and design innovation to strengthen their presence across residential and commercial sectors. The United Kingdom emerged as the leading region, commanding 22% of the total market share in 2024, driven by rising renovation projects, luxury housing developments, and growing preference for eco-friendly quartz surfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Quartz Stone Market was valued at USD 2,073.60 million in 2018 and reached USD 2,644.54 million in 2024, projected to hit USD 4,744.99 million by 2032, growing at a CAGR of 7.39%.

- Leading companies include Caesarstone, Compac, Technistone, Santa Margherita, Quarella, DuPont, LG Hausys, Cambria, Cosentino, Vicostone, and Hanwha L&C, focusing on advanced engineering and sustainable production.

- The Quartz Surface segment dominated with 59% share in 2024, driven by strong demand for durable, non-porous, and customizable interior materials.

- The Residential segment led with a 63% revenue share, supported by home renovation projects, rising disposable incomes, and growing demand for premium interior finishes.

- The United Kingdom emerged as the top regional market with a 22% share, followed by Germany at 20% and France at 16%, driven by strong construction and sustainable design adoption.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the Europe Quartz Stone Market in 2024, accounting for 59% of the total share. Its leadership stems from rising demand for durable, non-porous, and aesthetic surfaces across kitchens, bathrooms, and commercial interiors. The material’s stain and scratch resistance, along with easy maintenance, enhance its suitability for high-traffic spaces. Growing architectural preference for seamless, customizable slabs further supports the expansion of quartz surfaces across residential and commercial construction projects in Europe.

- For instance, Cosentino S.A. reported increased demand for its Silestone quartz slabs, highlighting their stain and scratch resistance suitable for kitchens and bathrooms.

By Application:

The Residential segment led the Europe Quartz Stone Market in 2024 with a 63% revenue share. Growth is driven by rising home renovation trends, modern kitchen installations, and the shift toward premium interior materials. Consumers prefer quartz for its long-lasting finish, design versatility, and hygienic properties. Increasing disposable income and urban housing developments across Western Europe further accelerate the adoption of quartz countertops, flooring, and wall cladding in new and refurbished residential projects.

- For instance, Caesarstone introduced new surfaces under its Pebbles Collection in Germany, targeting homeowners seeking natural-inspired finishes for high-traffic areas.

By Material Composition:

The Engineered Quartz segment held the largest share of 71% in the Europe Quartz Stone Market in 2024. Its dominance is supported by consistent quality, strength, and a wide range of design options compared to natural stone. Manufacturers favor engineered quartz for its uniform texture, color variety, and resistance to chemicals. Growing emphasis on sustainable, low-maintenance materials and the integration of recycled quartz aggregates drive further growth across interior design and architectural applications in Europe.

Key Growth Drivers

Rising Demand for Premium Interior Materials

The Europe Quartz Stone Market grows due to the strong demand for premium and durable surface materials in modern construction. Consumers prefer quartz over natural stone for its strength, non-porous structure, and design flexibility. Increasing kitchen and bathroom remodeling projects, combined with the growing preference for high-end interior finishes, support market expansion. Residential builders and designers also emphasize quartz for its consistent quality and low maintenance, driving widespread adoption across both new and renovation projects.

- For instance, Calacatta Quartz, inspired by luxury marble, is widely used in upscale kitchens and bathrooms across Europe for countertops and backsplashes, offering both durability and elegant aesthetics.

Expansion of Residential and Commercial Construction

Rapid urbanization and rising construction investments across Europe strengthen the demand for quartz stone. Residential housing developments, hotels, offices, and retail projects increasingly integrate quartz for countertops, flooring, and wall applications. Government incentives promoting sustainable infrastructure also encourage the use of engineered quartz materials. The trend toward contemporary architectural designs emphasizing luxury and functionality supports continuous growth, especially in countries such as Germany, the UK, France, and Italy, where construction spending remains robust.

- For instance, Caesarstone offers durable, low-maintenance quartz surfaces suitable for hotels and other commercial projects, with some of its products containing recycled materials.

Advancements in Manufacturing and Design Technologies

Ongoing technological progress enhances product quality and design diversity in the quartz stone industry. European manufacturers adopt advanced automation, 3D surface printing, and precision polishing to deliver customized patterns and finishes. These innovations improve product uniformity, aesthetic appeal, and sustainability. Increasing use of recycled raw materials and eco-friendly binders also supports green production initiatives. The integration of digital modeling tools in design further enables architects and consumers to choose bespoke quartz surfaces that meet modern lifestyle needs.

Key Trends & Opportunities

Growing Adoption of Sustainable Quartz Solutions

Sustainability is a key market trend, with rising adoption of eco-friendly quartz made from recycled glass, resins, and aggregates. European consumers and builders prioritize low-emission, energy-efficient materials that align with green building certifications. Manufacturers focus on developing products with reduced carbon footprints, recyclable content, and improved lifecycle performance. Government initiatives promoting circular economy principles create further opportunities for producers investing in clean production technologies and sustainable quartz formulations.

- For instance, GEOS manufactures a sustainable surfacing product composed of 55-60% recycled glass combined with a polyester-based resin binder, providing durability and resistance to stains without the need for sealing, setting it apart from traditional quartz and granite surfaces.

Increasing Customization and Aesthetic Innovation

The trend toward personalized interior designs drives demand for customizable quartz stones. Modern consumers seek unique colors, veining patterns, and surface textures that match specific design themes. Advancements in digital printing and resin technology allow for tailored designs replicating marble or granite aesthetics. High-end projects, including luxury homes and boutique hotels, increasingly adopt these customized surfaces. This shift toward aesthetic innovation positions quartz as both a functional and decorative material in Europe’s evolving design landscape.

- For instance, Cosentino introduced its Silestone Urban Crush series with four colors inspired by the textures of the city, based on materials like concrete, limestone, bronze, and ash. The series includes one color, “Cinder Craze,” that features veining, though it was designed for industrial-style interiors, not historic architecture.

Key Challenges

High Production and Installation Costs

The Europe Quartz Stone Market faces cost-related challenges due to expensive raw materials, advanced processing, and high installation charges. Small contractors and consumers often opt for cheaper alternatives such as laminates or ceramics. Energy-intensive manufacturing processes and rising labor costs in Europe add further pressure on profitability. Managing costs while maintaining premium quality remains a significant hurdle for producers, especially amid volatile energy markets and stricter environmental regulations affecting industrial operations.

Supply Chain Disruptions and Raw Material Dependence

Fluctuating supply of quartz minerals and reliance on imports impact market stability. Supply chain disruptions caused by geopolitical tensions or trade restrictions can delay production and raise costs. Limited domestic quartz sources in certain European countries increase dependency on suppliers from Asia and Africa. Companies face challenges in maintaining consistent quality and pricing while navigating logistics and currency fluctuations. Strengthening local sourcing and developing alternative material mixes are key mitigation strategies.

Rising Competition from Substitute Materials

Competition from natural stones, ceramics, and solid-surface composites limits quartz stone adoption in price-sensitive markets. These substitutes offer comparable aesthetics at lower costs, attracting budget-conscious consumers. The growing popularity of sintered surfaces and porcelain slabs further intensifies competition, especially in the commercial sector. To maintain market share, quartz manufacturers must emphasize product differentiation through superior durability, design innovation, and sustainable production, ensuring continued appeal amid evolving consumer preferences and material choices.

Regional Analysis

United Kingdom

The United Kingdom held a 22% share of the Europe Quartz Stone Market in 2024. It benefits from strong residential renovation activity and expanding luxury housing projects. High adoption of engineered quartz in modern kitchens and bathrooms supports steady demand. Increasing focus on sustainable construction practices drives investment in eco-friendly quartz materials. The presence of advanced design firms and strong retail distribution channels further strengthens market growth. Rising consumer preference for premium and low-maintenance interior surfaces enhances its long-term potential.

Germany

Germany accounted for 20% of the regional share in 2024, driven by high industrial precision standards and expanding commercial infrastructure. It has a well-established base of quartz processing and surface manufacturing companies. Growth is supported by a surge in residential construction and demand for durable materials in public projects. German consumers prefer quartz for its design flexibility and resistance to wear. Strict environmental regulations encourage manufacturers to adopt sustainable production technologies. Continuous innovation in surface finishing and customization sustains steady market expansion.

France

France represented 16% of the total share in 2024. It shows strong demand from interior designers and residential developers focusing on premium aesthetics. The rising adoption of engineered quartz in high-end apartments and hospitality spaces drives market revenue. French manufacturers focus on advanced polishing techniques and eco-certified products to meet environmental goals. The renovation of heritage and modern properties further contributes to consistent demand. Expanding retail networks and growing interest in sustainable décor materials strengthen the country’s position.

Italy

Italy captured a 15% share of the Europe Quartz Stone Market in 2024. The nation’s architectural heritage and craftsmanship culture promote demand for aesthetic and durable materials. Italian producers specialize in luxury quartz products that blend design precision and technical strength. Rising export volumes to other European markets boost local production. Increasing usage of quartz in luxury commercial interiors and residential remodeling enhances its adoption. It remains a key design and innovation hub within the regional surface material industry.

Spain

Spain held a 12% market share in 2024, supported by strong domestic manufacturing capabilities and global export presence. Its growing real estate and tourism infrastructure drive consumption of quartz in hotels, resorts, and residential spaces. Spanish producers focus on sustainable, design-driven surfaces to match European standards. Government-backed construction initiatives and modern housing development further support demand. The country’s advanced distribution networks and design versatility help maintain competitiveness across regional and international markets.

Rest of Europe

The Rest of Europe accounted for 15% of the total share in 2024. Countries such as Poland, the Netherlands, and the Nordic nations show rising adoption of engineered quartz for housing and office applications. Growing construction activity and increasing awareness of sustainable interiors support steady growth. Import dependence remains high, but improved logistics and trade agreements enhance supply access. It continues to attract investment from major quartz manufacturers expanding production and distribution capacities across Central and Eastern Europe.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

- In July 2025, Caesarstone introduced ICON™, a silica-free surface made with about 80% recycled materials, enhancing its sustainable product line in Europe.

- In May 2025, RAK Ceramics commissioned a next-generation slab production plant equipped with Continua+ PCR 2180 technology to boost its manufacturing capacity.

- In July 2025, Vicostone unveiled ten new quartz surface colors aimed at strengthening its presence in the European solid-color market.

- In April 2025, RAK Ceramics inaugurated a Design Hub in Milan to provide creative support for architects, designers, and clients across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone Ltd.

- Compac

- Technistone a.s.

- Santa Margherita S.p.A.

- Quarella S.p.A.

- DuPont de Nemours, Inc.

- LG Hausys Ltd.

- Cambria Company LLC

- Cosentino S.A. (Silestone)

- Pokarna Limited (Quantra Quartz)

- Vicostone JSC

- Stone Italiana S.p.A.

- Hanwha L&C (HanStone Quartz)

- Alicante Surfaces

- Lapitec S.p.A.

Recent Developments

- In September 2025, MSI launched seven new Q Quartz colors designed for the European market to expand its premium surface offerings.

- In September 2024, Cosentino introduced the “Le Chic Bohème by SilestoneXM” collection, featuring four low-silica colors aimed at sustainable design in Europe.

- In 2025, Caesarstone Ltd. unveiled its Lioli Porcelain brand and collection with 6 mm slabs for multiple architectural and design applications across Europe.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz will continue to rise due to durability and design flexibility.

- Residential renovation and remodeling projects will drive steady consumption across major European cities.

- Eco-friendly quartz production will gain traction through use of recycled materials and low-emission processes.

- Advancements in digital printing and surface finishing will expand customization opportunities.

- Partnerships between designers and manufacturers will enhance product innovation and market reach.

- Growth in luxury real estate and hospitality sectors will boost demand for premium quartz surfaces.

- Retail expansion and online platforms will strengthen product accessibility and customer engagement.

- Strict environmental regulations will encourage adoption of sustainable production technologies.

- Emerging markets in Central and Eastern Europe will experience higher adoption of quartz materials.

- Investments in automation and precision manufacturing will improve efficiency and product quality across the region.