Market Overview

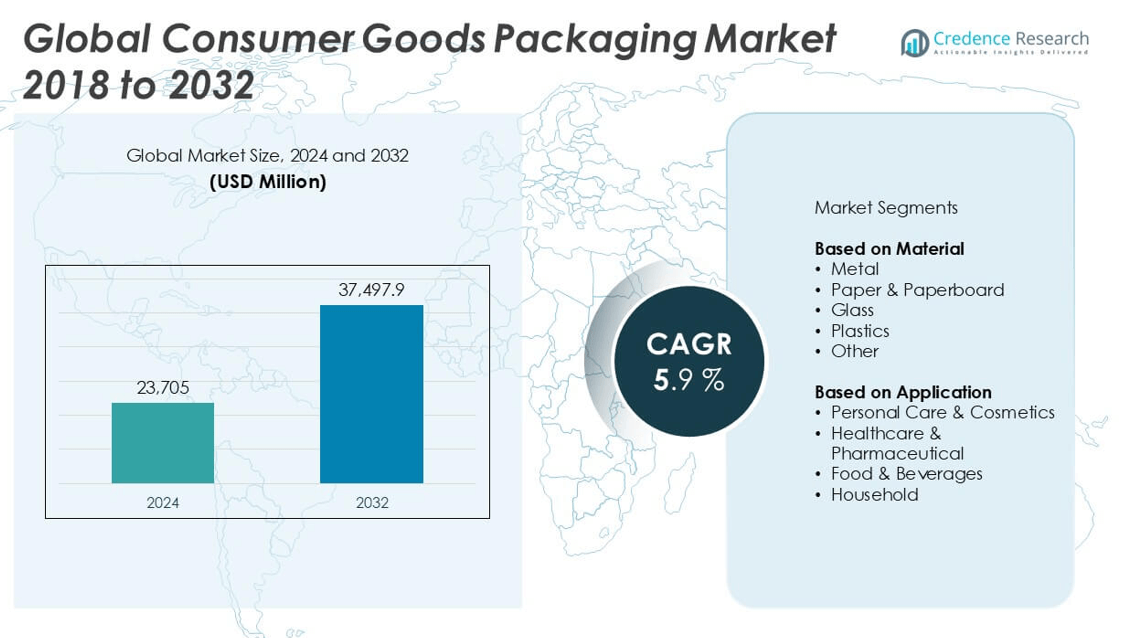

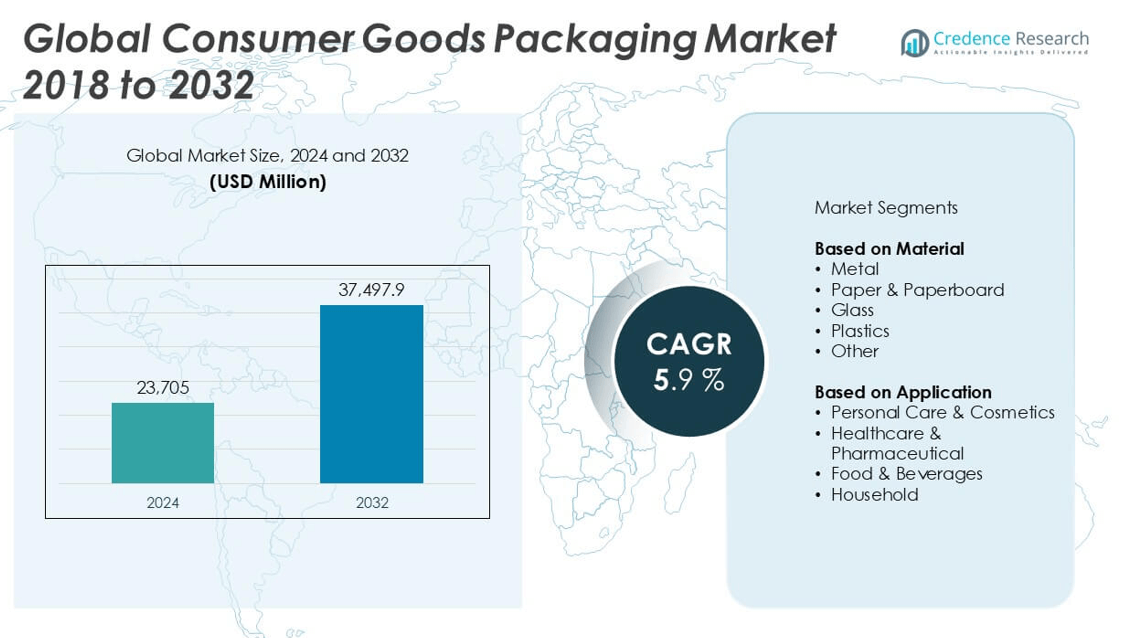

Consumer Goods Packaging market size was valued at USD 23,705 million in 2024 and is anticipated to reach USD 37,497.9 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer Goods Packaging Market Size 2024 |

USD 23,705 million |

| Consumer Goods Packaging Market, CAGR |

5.9% |

| Consumer Goods Packaging Market Size 2032 |

USD 37,497.9 million |

The consumer goods packaging market is led by prominent players such as Amcor plc, Sealed Air, Mondi Group, Berry Global, and International Paper Co, known for their global presence and innovation in sustainable and functional packaging solutions. Other key contributors include Uflex Limited, Graphic Packaging International, Ball Corporation, Crown Cork & Seal Co, Huhtamaki India, and Autofits Packaging Private Limited, which enhance market competitiveness through regional expertise and cost-effective production. In 2024, Asia Pacific emerged as the leading region, accounting for over 35% of the global market share, driven by rapid urbanization, rising consumption of packaged products, and expanding e-commerce.\

Market Insights

- The consumer goos packaging market was valued at USD 23,705 million in 2024 and is expected to reach USD 37,497.9 million by 2032, growing at a CAGR of 5.9% during the forecast period.

- The market is primarily driven by rising demand for sustainable packaging materials, growing e-commerce activity, and increased consumption of packaged food, personal care, and pharmaceutical products.

- Key trends include the adoption of recyclable and biodegradable materials, along with the integration of smart packaging technologies such as QR codes and sensors for traceability and consumer engagement.

- Major players include Amcor plc, Sealed Air, Mondi Group, Berry Global, and International Paper Co, with companies focusing on innovation, acquisitions, and sustainable solutions to stay competitive.

- Asia Pacific held the largest regional share at over 35%, followed by North America (27%) and Europe (25%). By material, plastic dominated the segment due to its versatility, while food & beverages led by application category.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Plastics emerged as the dominant material segment in the Consumer Goods Packaging market in 2024, accounting for the highest market share due to its lightweight properties, cost efficiency, and versatility across diverse product categories. The widespread adoption of PET and HDPE plastics in food, beverage, and personal care packaging has significantly contributed to segment growth. Moreover, technological advancements in biodegradable and recyclable plastic materials have further driven demand amid rising sustainability concerns. Although paper & paperboard are gaining traction due to eco-friendly trends, plastics continue to lead due to durability and mass production capabilities.

- For instance, Berry Global Group produced over 3.5 billion plastic packaging units using post-consumer recycled (PCR) content in 2023, demonstrating its scalable commitment to circular plastic solutions.

By Application

The Food & Beverages segment held the largest share in the application category, driven by the continuous growth in packaged and ready-to-eat food consumption. The demand for extended shelf-life packaging, particularly in dairy, snacks, and beverages, has bolstered the adoption of advanced barrier materials and vacuum-sealed formats. Additionally, the rise of e-commerce and modern retail formats has increased the demand for visually appealing and durable packaging. Personal care & cosmetics and healthcare & pharmaceutical segments are also growing steadily, but food & beverages remain the key driver of overall packaging market expansion.

- For instance, Amcor’s AmPrima™ PE Plus packaging—launched for snack and dairy products—has been validated for recyclability by Cyclos-HTP and is currently used across more than 2,000 SKU units in global food retail chains.

Market Overview

Rising Demand for Sustainable and Eco-Friendly Packaging

The increasing consumer and regulatory focus on environmental sustainability has become a major driver for the consumer goods packaging market. Brands are investing in biodegradable, recyclable, and compostable materials to reduce plastic waste and meet evolving compliance standards. This shift is further accelerated by global bans on single-use plastics and the adoption of Extended Producer Responsibility (EPR) regulations. Manufacturers are integrating recycled content and minimalistic designs, driving innovation across materials like paperboard, bio-plastics, and plant-based polymers, thus reshaping the market landscape with green packaging alternatives.

- For instance, Mondi converted over 81% of its consumer flexible packaging solutions to paper-based or recyclable materials by the end of 2022 as part of its MAP2030 sustainability initiative.

Growth in E-commerce and Direct-to-Consumer Channels

The rapid expansion of e-commerce and direct-to-consumer models has significantly boosted the demand for innovative, protective, and visually engaging packaging solutions. Online retailing, especially in personal care, household goods, and food delivery services, requires packaging that ensures product integrity during transit while providing a positive unboxing experience. This has led to a surge in demand for tamper-proof, lightweight, and branded packaging formats. The need for compact, sustainable shipping options and return-friendly designs has made e-commerce packaging a key growth engine in the consumer goods sector.

- For instance, Sealed Air shipped over 6.4 billion mailer units globally through its e-commerce solutions in 2023, supporting direct-to-consumer delivery for major platforms like Amazon and Shopify.

Increasing Urbanization and Changing Lifestyles

Rapid urbanization and changing consumer lifestyles have increased the demand for convenience-driven packaging solutions such as resealable, single-serve, and on-the-go formats. As dual-income households rise and time constraints grow, consumers are seeking quick-access, easy-to-use packaging across food, beverages, and personal care products. This behavioral shift encourages manufacturers to innovate functional and ergonomic packaging. Furthermore, premium and aesthetically appealing packaging designs are gaining popularity in urban markets, especially among younger demographics, boosting volume sales and strengthening brand differentiation.

Key Trends & Opportunities

Technological Advancements in Smart Packaging

The integration of technologies such as QR codes, NFC tags, and sensors into packaging is reshaping consumer engagement and supply chain transparency. Smart packaging enables real-time tracking, anti-counterfeit verification, and interactive brand experiences. In the healthcare and food sectors, smart labels help monitor product freshness and dosage tracking. As IoT adoption increases and costs of implementation decrease, smart packaging presents a lucrative opportunity for brands seeking to enhance safety, personalization, and traceability in consumer goods packaging.

- For instance, Tetra Pak deployed over 1.2 billion smart packaging units with QR codes and serialized tracking in 2023 across its beverage packaging lines in Asia and Europe.

Growing Emphasis on Circular Economy Practices

There is a notable trend toward closed-loop packaging systems, driven by circular economy principles. Companies are investing in reusable and refillable packaging models, particularly in cosmetics and home care segments. Loop-based initiatives and deposit return schemes (DRS) are being piloted and scaled globally, offering opportunities for brands to reduce environmental impact and enhance brand loyalty. Collaboration across supply chains to enable effective recycling infrastructure and material recovery is unlocking new value streams in sustainable packaging.

- For instance, Unilever’s partnership with Loop has enabled over 2.1 million refill transactions across its home care and personal care products, reducing single-use packaging waste across multiple global markets.

Key Challenges

Fluctuating Raw Material Costs

Volatile prices of key packaging materials such as plastic resins, paperboard, and aluminum pose a significant challenge for manufacturers. Global supply chain disruptions, inflationary pressures, and geopolitical tensions often result in unpredictable cost structures. These fluctuations impact profit margins, especially for small and medium enterprises, and compel manufacturers to continuously adjust procurement strategies and pricing models. Managing long-term supply agreements and material substitutions becomes critical in maintaining competitiveness.

Regulatory Compliance and Packaging Waste Management

Stringent environmental regulations around packaging waste, recyclability, and labeling continue to challenge packaging producers. Compliance with diverse global standards—such as the EU Packaging and Packaging Waste Directive, FDA guidelines, and plastic tax mandates—requires continuous material innovation and process updates. Non-compliance can result in heavy penalties and loss of market access. Moreover, the absence of uniform recycling infrastructure in many regions complicates efforts to meet sustainability goals.

Balancing Innovation with Cost Efficiency

While innovation in packaging design and functionality is essential for brand differentiation, it often comes at a higher cost. Introducing smart features, biodegradable materials, or premium aesthetics requires investment in R&D and advanced manufacturing capabilities. For cost-sensitive segments, especially in emerging markets, this poses a challenge as brands must deliver value without compromising affordability. Achieving the right balance between performance, sustainability, and cost remains a persistent hurdle in competitive markets.

Regional Analysis

North America

North America held a significant share of the consumer goods packaging market in 2024, accounting for approximately 27% of the global market. The region’s dominance is supported by a mature consumer base, high demand for premium and sustainable packaging, and strong retail infrastructure. The U.S. leads with widespread use of recyclable and functional packaging, particularly in food and personal care segments. Technological advancements and regulatory pressures, such as plastic bans and EPR policies, are driving innovation. Additionally, the growth of e-commerce and direct-to-consumer brands is fueling demand for customized and protective packaging formats across North America.

Europe

Europe accounted for nearly 25% of the global consumer goods packaging market in 2024, driven by stringent environmental regulations and a strong push toward circular economy practices. Countries like Germany, France, and the UK are at the forefront of adopting sustainable materials such as recycled paperboard, compostable plastics, and reusable formats. The market benefits from robust infrastructure, advanced packaging technologies, and high consumer awareness regarding eco-friendly solutions. Rising demand for premium and biodegradable packaging in cosmetics, food, and healthcare sectors further boosts regional growth. Government mandates and active industry participation are shaping a highly innovation-focused packaging ecosystem.

Asia Pacific

Asia Pacific dominated the consumer goods packaging market with a commanding share of over 35% in 2024, led by China, India, and Japan. The region’s rapid urbanization, growing middle-class population, and increasing consumption of packaged food and personal care products are major drivers. Flexible and cost-effective plastic packaging remains prevalent, though demand for sustainable alternatives is growing due to environmental concerns. The rise of online retail, especially in India and Southeast Asia, fuels demand for tamper-evident and branded packaging. Investments in manufacturing capabilities and expanding domestic production support strong regional growth across both developed and emerging economies.

Latin America

Latin America contributed around 8% to the global consumer goods packaging market in 2024, with Brazil and Mexico serving as key markets. Economic recovery, expanding retail sectors, and increased consumer preference for packaged goods are fostering growth. Food and beverage packaging dominates due to high consumption of processed and convenience foods. Although plastic remains the dominant material, demand for biodegradable and paper-based packaging is increasing, driven by regulatory developments and consumer awareness. Regional players are also adopting automation and localized packaging designs to enhance efficiency and meet diverse consumer needs across income levels.

Middle East & Africa

The Middle East & Africa (MEA) region held an estimated 5% share of the global consumer goods packaging market in 2024. Rising urbanization, population growth, and an expanding retail landscape are driving demand for packaged consumer products, particularly in food, hygiene, and cosmetics. The UAE and South Africa are leading markets, supported by growing disposable incomes and modern trade penetration. While plastic packaging remains widespread due to cost advantages, regulatory attention on sustainability is gradually influencing material choices. However, infrastructure and recycling limitations continue to pose challenges, constraining the widespread adoption of eco-friendly packaging in the region.

Market Segmentations:

By Material

- Metal

- Paper & Paperboard

- Glass

- Plastics

- Other

By Application

- Personal Care & Cosmetics

- Healthcare & Pharmaceutical

- Food & Beverages

- Household

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the consumer goods packaging market is characterized by the presence of both global leaders and regional players striving for market share through innovation, sustainability, and strategic partnerships. Companies such as Amcor plc, Sealed Air, Mondi Group, and Berry Global lead the market with their extensive product portfolios, advanced manufacturing capabilities, and strong global distribution networks. These players continuously invest in research and development to introduce eco-friendly and functional packaging solutions tailored to evolving consumer preferences. Meanwhile, firms like Uflex Limited, Huhtamaki India, and Autofits Packaging Private Limited strengthen their positions in emerging markets through localized production and cost-efficient operations. Strategic mergers, acquisitions, and collaborations are common as companies aim to expand their geographic footprint and technological expertise. With increasing regulatory pressure and consumer demand for sustainable packaging, competition has intensified, pushing companies to innovate in areas such as biodegradable materials, smart packaging, and circular economy practices to maintain their market relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Uflex Limited

- Graphic Packaging International

- Sealed Air

- Berry Global

- Amcor plc

- Huhtamaki India

- Crown Cork & Seal Co

- International Paper Co

- Mondi Group

- Autofits Packaging Private Limited

- Ball Corporation

Recent Developments

- In April 2025, FMCG brands adopt a new packaging strategy for q-commerce and kirana stores.

- In June 2024, Saica and Mondelez collaborated to launch a new paper-based product targeted to multipack products for the confectionery, biscuits and chocolate markets.

- In June 2024, General Manager at Saica Flex, Miguel Angel Dora, expressed, “We believe that packaging sustainability is a very serious challenge that required our full commitment and far-reaching collaborations with companies equally committed, like Mondelez.”

- In May 2025, the company launched Always Pocket Flexfoam, a compact, tiny pouch with a resealable wrapper ideal for on-the-go use. It offers full-sized Flexfoam pad protection in a discreet, portable pack.

- In March 2025, Unilever launched a premium range of multi-purpose soaps and body washes that combine skincare benefits with germ protection. The packaging is designed for convenient shower use, featuring modern, attractive bottles that appeal to younger, skin-savvy consumers.

- In February 2025, Colgate-Palmolive’s Hill’s Pet Nutrition division acquired Prime100, an Australian fresh pet food brand, to enter the fresh pet food category and strengthen its presence in Australia. Transaction expected to close Q2 2025, financed by debt and cash, pending regulatory approval.

Market Concentration & Characteristics

The Consumer Goods Packaging Market demonstrates moderate to high market concentration, with a mix of global giants and regional players shaping its competitive dynamics. Leading companies such as Amcor plc, Sealed Air, Mondi Group, and Berry Global hold significant shares due to their broad product portfolios, global distribution networks, and continuous innovation. It features a strong focus on sustainability, material efficiency, and product differentiation, particularly in segments such as food and beverages and personal care. The market benefits from long-term supply agreements and technological advancements in barrier protection, lightweight materials, and smart packaging. Regional players like Uflex Limited and Huhtamaki India contribute through cost-effective manufacturing and localized solutions. Entry barriers remain moderate due to capital-intensive production setups, strict regulatory requirements, and the need for supply chain efficiency. It is also shaped by evolving consumer preferences, sustainability regulations, and rapid growth in e-commerce, which drive the demand for protective, visually appealing, and functionally advanced packaging solutions.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising demand for packaged food, beverages, and personal care products.

- Eco-friendly packaging solutions will gain strong momentum as sustainability becomes a top priority for consumers and regulators.

- Flexible packaging formats will see increased adoption due to their cost-efficiency, lightweight nature, and convenience.

- E-commerce growth will drive demand for tamper-evident, durable, and visually appealing packaging.

- Smart packaging technologies such as NFC tags and QR codes will become more common to enhance traceability and user interaction.

- Companies will increase investment in biodegradable and recyclable materials to meet environmental compliance.

- Digital printing and customization will expand to support personalized consumer experiences and branding.

- Asia Pacific will remain the leading region due to growing consumption and production capacity.

- Technological advancements will improve packaging functionality, shelf-life, and waste reduction.

- Strategic partnerships, mergers, and acquisitions will rise as companies seek to strengthen market position and global reach.