Market Overview

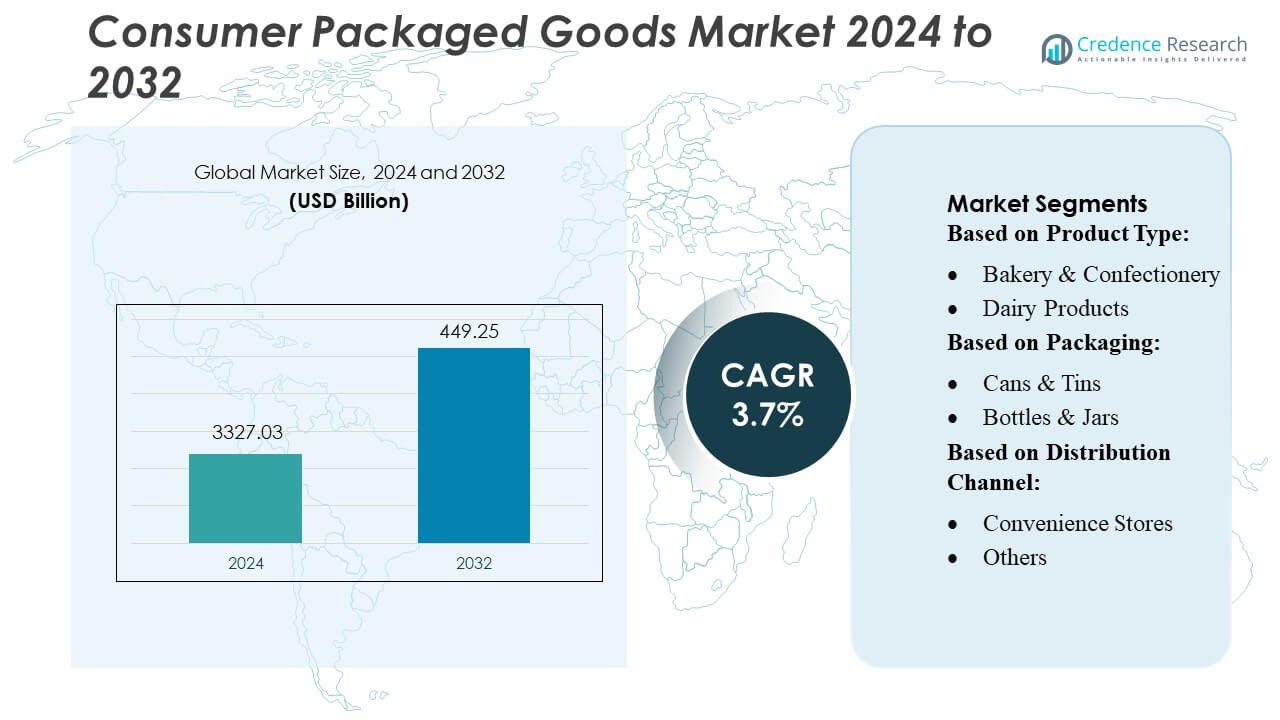

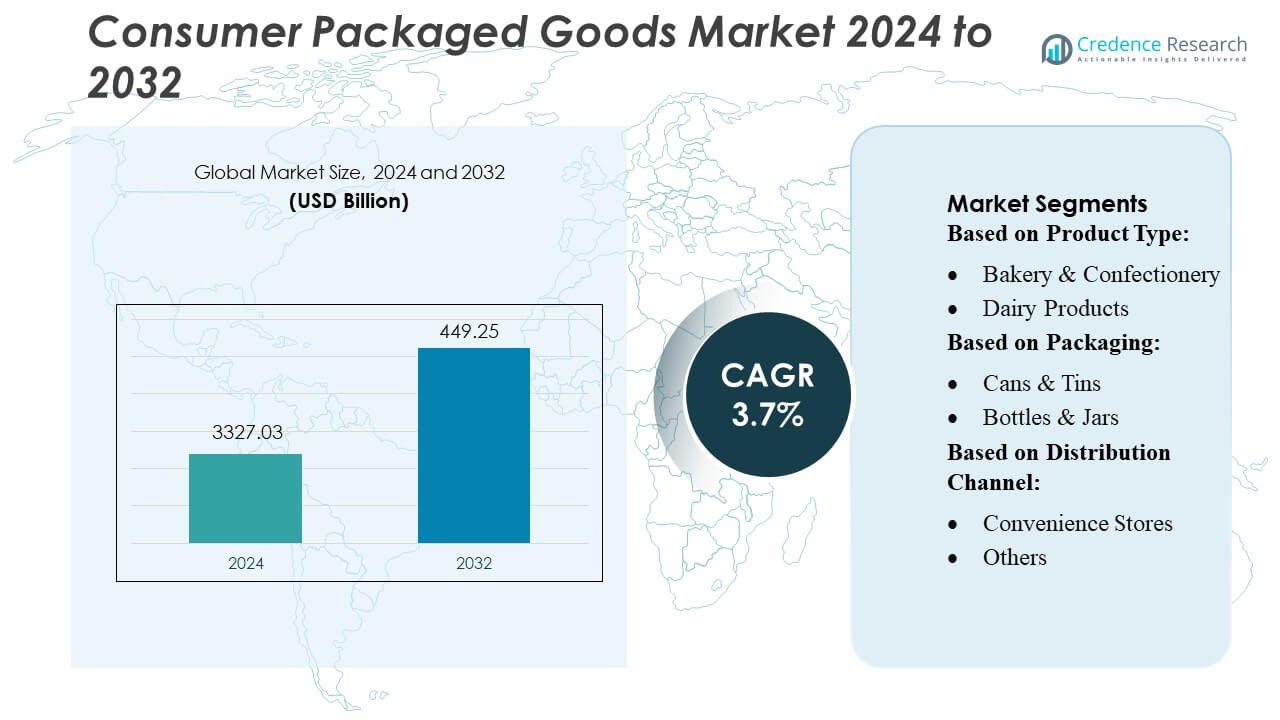

Consumer Packaged Goods Market size was valued USD 3327.03 billion in 2024 and is anticipated to reach USD 449.25 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer Packaged Goods Market Size 2024 |

USD 3327.03 Billion |

| Consumer Packaged Goods Market, CAGR |

3.7% |

| Consumer Packaged Goods Market Size 2032 |

USD 449.25 Billion |

The global Consumer Packaged Goods (CPG) market is dominated by leading companies such as Procter & Gamble, Nestlé, Unilever, The Coca-Cola Company, and L’Oréal, each leveraging extensive brand portfolios across food and beverages, personal care, beauty, and household products. These firms compete fiercely through innovation, strong distribution networks, and investments in sustainability. Regionally, North America stands out as the most significant market, accounting for 34.68 % of global CPG revenue, owing to its high consumer purchasing power, mature retail infrastructure, and widespread brand penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Consumer Packaged Goods Market was valued at USD 3327.03 billion in 2024 and is projected to reach USD 449.25 billion by 2032, registering a CAGR of 3.7% during the forecast period.

- Strong market drivers include rising demand for convenient packaged products, rapid urbanization, and continuous product innovation across food, beverages, personal care, and home-care categories.

- Key trends reflect growing investments in sustainable packaging, increasing adoption of digital retail channels, and premiumization strategies implemented by major brands to enhance consumer loyalty.

- Competitive dynamics remain intense, with leading players such as Procter & Gamble, Nestlé, Unilever, The Coca-Cola Company, and L’Oréal expanding portfolios and strengthening supply chains, while market restraints include fluctuating raw material costs and regulatory pressures.

- Regionally, North America holds a 34.68% share, followed by strong growth in Asia-Pacific, while the food & beverage segment continues to lead overall CPG category share worldwide.

Market Segmentation Analysis:

By Product Type

Bakery & Confectionery leads the Consumer Packaged Goods market, accounting for the largest share—estimated at over 22%—driven by robust demand for convenient indulgence foods, premium artisanal variants, and clean-label formulations. Strong innovation in low-sugar, gluten-free, and fortified bakery items accelerates adoption across urban consumers. Dairy Products and Snacks follow closely, supported by rising consumption of protein-rich beverages, flavored yogurts, and nutrition-focused snack bars. Frozen & Ready-to-Eat Meals continue gaining traction due to rapid urbanization and dual-income households, while Beverages benefit from functional drink launches with added vitamins, probiotics, and natural ingredients.

- For instance, Gotham Greens’ technological strength under pins this trend: its Chicago rooftop greenhouse, spanning 75,000 sq ft, uses proprietary systems to yield the equivalent of more than 50 acres of conventional production, thanks to up to 30× crop-per-acre efficiency.

By Packaging

Flexible Packaging remains the dominant sub-segment, capturing more than 35% of the packaging share, driven by lightweight materials, lower production costs, and strong compatibility with snacks, frozen meals, and condiments. Its barrier properties and customizability support extended shelf life and branding flexibility. Bottles & Jars retain steady demand in beverages, sauces, and dairy categories, while Cans & Tins remain preferred for long-shelf-life products such as canned seafood and soups. Boxes & Cartons grow due to sustainability regulations encouraging recyclable formats, whereas Trays & Containers expand in ready-to-eat and fresh meal kits.

- For instance, Mann also innovated its packaging: a redesign of its Culinary Cuts line transitioned from clamshells to bags, reducing packaging material by 38% in large trays and 43% in small trays, thus cutting about 1.4 million pounds of plastic waste annually.

By Distribution Channel

Offline channels dominate, with Supermarkets/Hypermarkets holding the highest share—above 45%—supported by extensive product availability, competitive pricing, and strong in-store promotions that influence consumer purchasing behavior. Specialty Stores retain relevance for premium, organic, and category-focused products. Convenience Stores show steady growth due to impulse purchases and proximity shopping. Online channels accelerate rapidly, with E-commerce Platforms emerging as the fastest-growing sub-segment, driven by doorstep delivery, subscription models, and AI-driven personalization. Brand Websites gain traction as companies push direct-to-consumer strategies to improve margins and customer engagement.

Key Growth Drivers

- Rapid Digital Commerce Expansion

Digital commerce continues to accelerate Consumer Packaged Goods (CPG) growth as brands leverage omnichannel distribution, data-driven pricing, and real-time inventory visibility. Companies increasingly deploy AI-led demand forecasting and automated fulfillment systems to reduce stockouts and improve delivery accuracy across online marketplaces. Subscription-based replenishment models also boost recurring sales for personal care, hygiene, and household products. The integration of quick-commerce networks further strengthens last-mile efficiency, enabling CPG firms to capture impulse and convenience-driven purchases while expanding access to previously underserved micro-markets.

- For instance, Dole Food company also deployed two 2.8 MW wind turbines at its Soledad, California vegetable facility, cutting CO₂ emissions by 14,921 tons per year, and installed a solar system rated at 120 kWp at its site in Belfast, Ireland.

- Premiumization and Health-Conscious Consumption

Growing consumer preference for healthy, clean-label, and sustainably sourced products drives premiumization across food, beverages, beauty, and homecare categories. Brands invest in product reformulation, incorporating functional ingredients, low-sugar alternatives, and plant-based proteins to address rising wellness expectations. Packaging innovations that highlight ingredient transparency and environmental credentials enhance shelf differentiation. As consumers demonstrate a willingness to pay higher prices for quality and safety assurances, CPG companies strengthen their margins while expanding premium product lines tailored to specific lifestyle, dietary, and environmental priorities.

- For instance, Fresh Express implemented its Master Pack Vision System in all five regional plants, which reads a 2D code on condiment packs to verify allergen content (e.g., peanuts, milk, soy) and halts production if the code does not match expected data.

- Supply-Chain Modernization and Automation

CPG companies adopt advanced supply-chain technologies such as IoT sensors, automated warehousing, and blockchain-based traceability to improve reliability and operational efficiency. Predictive analytics optimize raw-material procurement and production planning, reducing waste and enhancing cost control. Manufacturers increase resilience by diversifying sourcing, nearshoring production, and deploying real-time logistics monitoring. These modernization efforts help companies respond faster to demand fluctuations, maintain consistent product availability, and meet stringent retailer service-level requirements, ultimately supporting scalable growth across global and regional markets.

Key Trends & Opportunities

- Sustainability-Driven Product and Packaging Innovation

Sustainability remains a core innovation theme as CPG players shift toward recyclable, biodegradable, and lightweight packaging materials. Brands increasingly adopt circular-economy models, integrating refillable packaging, return-and-reuse programs, and reduced plastic content. Clean manufacturing processes and carbon-neutral product lines present new differentiation opportunities. As regulatory pressure intensifies across key markets, companies that proactively invest in low-impact packaging and transparent ESG reporting strengthen brand equity and gain competitive advantage in environmentally conscious consumer segments.

- For instance, Eat Smart (a brand of Curation Foods, Inc., which is part of the Landec Corporation) did source an average of over 50% recycled content across its plastic packaging as reported in its 2024 ESG (Environmental, Social, and Governance) report.

- Personalization Through Advanced Consumer Insights

The rise of first-party data ecosystems and AI-powered analytics creates significant opportunities for hyper-personalized product development and targeted marketing. CPG brands deploy digital loyalty platforms, smart packaging, and connected devices to gather consumption insights and tailor recommendations. Dynamic segmentation enables precise product positioning across demographic clusters and lifestyle cohorts. As consumers demand individualized experiences, customized formulations, personalized bundles, and adaptive promotions emerge as high-value growth avenues for leading CPG manufacturers.

- For instance, BrightFarms has made remarkable advances in controlled-environment agriculture its new 1.5 million-sq-ft greenhouse in Lorena, Texas, is projected to produce 25 million salad servings annually using Kubo’s Ultra-Clima climate technology.

- Expansion of Direct-to-Consumer (D2C) Ecosystems

CPG companies increasingly develop D2C channels to build stronger consumer relationships, collect real-time behavioral data, and improve margins by bypassing intermediaries. Dedicated e-stores, social commerce integrations, and influencer-driven campaigns enhance brand visibility and control over consumer experience. Customizable ordering options, subscription services, and exclusive online product launches strengthen engagement and retention. This shift enables CPG brands to quickly test innovations, reduce reliance on traditional retail networks, and accelerate market responsiveness.

Key Challenges

- Volatile Raw Material Prices and Cost Pressures

Fluctuations in raw-material prices—driven by geopolitical uncertainties, climate-related supply disruptions, and global logistics constraints—create persistent margin challenges for CPG manufacturers. High costs of packaging materials, agricultural commodities, and energy services pressure production budgets. Companies struggle to balance price increases with consumer affordability expectations, particularly in highly commoditized categories. Managing this volatility requires strategic sourcing, long-term supplier agreements, and continuous cost-optimization initiatives across manufacturing and distribution networks.

- Intensifying Competition and Private-Label Growth

Rising competition from established brands, agile digital-native entrants, and expanding private-label portfolios complicates differentiation in the CPG market. Private-label products increasingly match national brands in quality while offering lower price points, attracting value-conscious consumers. This trend pressures brand loyalty and forces companies to accelerate innovation cycles, strengthen marketing investments, and enhance consumer engagement. Maintaining market share requires sustained brand-building efforts, targeted product innovation, and agility in responding to fast-evolving consumer demands.

Regional Analysis

North America

North America holds roughly 28% of the global CPG market, supported by high per-capita spending, mature retail networks, and strong penetration of premium and convenience-driven product categories. Major brands leverage advanced e-commerce channels, data-driven personalization, and rapid-delivery partnerships to sustain competitive advantage. Growth remains strong in health-focused foods, functional beverages, and sustainable household products. The region also benefits from steady adoption of automation and digital supply-chain technologies, enabling faster replenishment cycles. Rising demand for clean-label and eco-friendly packaging continues to shape product innovation across the U.S. and Canada.

Europe

Europe accounts for approximately 26% of global CPG market share, driven by a well-established retail infrastructure, high regulatory standards, and sustained consumer interest in sustainable, traceable, and ethically sourced products. The region demonstrates strong demand for organic foods, premium beauty, and wellness-oriented personal care items, supported by strict labeling and environmental compliance requirements. E-commerce adoption continues to accelerate, especially in Western Europe, enabling brands to expand D2C models. Economic stability in key markets—Germany, France, and the UK—supports steady product diversification, while private-label competition remains a defining trend within major supermarket chains.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing region, capturing nearly 32% of the global CPG market, supported by rapid urbanization, expanding middle-class consumption, and strong penetration of mobile-first commerce. China, India, Japan, and Southeast Asia serve as high-volume growth hubs, especially across packaged foods, personal care, and household cleaning categories. Companies benefit from massive digital retail ecosystems, social-commerce adoption, and the rising influence of local and regional brands. Premiumization, health-oriented products, and sustainable packaging trends continue to accelerate as consumers increasingly shift toward higher-quality, branded alternatives.

Latin America

Latin America holds approximately 8% of the global CPG market, with growth concentrated in Brazil, Mexico, Argentina, and Colombia. Demand increases for affordable packaged foods, hygiene products, and value-oriented household goods due to rising inflationary pressures and evolving urban lifestyles. E-commerce adoption expands steadily, enabling small and mid-sized brands to reach consumers beyond major cities. Despite macroeconomic volatility, the region benefits from strong brand loyalty and ongoing investments in localized production to manage import costs. Sustainability investments and premium product portfolios gain traction among higher-income consumer segments across key markets.

Middle East & Africa

Middle East & Africa (MEA) accounts for nearly 6% of the global CPG market, supported by expanding retail modernization, rising disposable incomes in urban centers, and increasing demand for packaged foods, personal care, and hygiene products. Gulf countries drive premium consumption trends, while African markets record strong demand for affordable, mass-market brands. E-commerce penetration rises gradually, particularly in the UAE, Saudi Arabia, South Africa, and Kenya. Supply-chain improvements, regional manufacturing expansion, and growing youth populations create long-term growth opportunities, although challenges persist around logistics costs and uneven retail infrastructure.

Market Segmentations:

By Product Type:

- Bakery & Confectionery

- Dairy Products

By Packaging:

- Cans & Tins

- Bottles & Jars

By Distribution Channel:

- Convenience Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Consumer Packaged Goods (CPG) market features a diverse mix of players including Gotham Greens, Mann Packing Co., Inc., organicgirl, Dolle Food Company Inc., Misionero, Fresh Express, Incorporated, Eat Smart, Bondvelle, BrightFarms, Inc., and Earthbound Farm. the Consumer Packaged Goods (CPG) market remains highly dynamic, shaped by continuous innovation, evolving consumer preferences, and intensifying pressure to enhance operational efficiency. Companies prioritize product differentiation through premium formulations, sustainable packaging, and health-focused variants to strengthen brand loyalty in crowded categories. Digital transformation plays a central role, with firms leveraging AI-driven demand forecasting, optimized supply chains, and omnichannel retail strategies to improve responsiveness and reduce stockouts. Strong investments in e-commerce capabilities, data analytics, and personalized marketing enable brands to expand consumer reach and refine targeting. Additionally, rising sustainability expectations push manufacturers to adopt greener materials, reduce emissions, and implement transparent sourcing practices. Overall, the market remains fragmented, with success driven by agility, brand equity, and the ability to adapt quickly to regulatory and consumer shifts.

Key Player Analysis

- Gotham Greens

- Mann Packing Co., Inc.

- organicgirl

- Dolle Food Company Inc.

- Misionero

- Fresh Express, Incorporated

- Eat Smart

- Bondvelle

- BrightFarms, Inc.

- Earthbound Farm

Recent Developments

- In September 2025, Unilever’s brand Dove launched a limited-edition, cookie-scented body care line with Crumbl Cookies, sold at Walmart and heavily promoted on TikTok and Instagram. The campaign was a significant success.

- In August 2025, Bloom Nutrition launched Crisp Apple Sparkling Energy at Target for a limited time. It combines fresh apple flavor with 180mg of caffeine from green coffee bean extract, L-theanine, ginseng, and prebiotics for gut health.

- In May 2025, Clean Cult launched its refillable cleaning system nationwide at Target, offering 17 sustainable products-including hand soap, dish soap, laundry detergent, and all-purpose cleaner-in paper-based cartons and aluminum bottles.

- In December 2024, Conagra Brands, an American food manufacturer marketed its Healthy Choice frozen meals as ‘GLP-1 friendly’ to cash in on weight-loss drug users. These meals are designed for this balanced nutrition because they are high in protein, fiber and low calories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue advancing digital commerce adoption, with brands strengthening omnichannel strategies to reach broader consumer segments.

- AI-driven analytics will increasingly guide product innovation, demand forecasting, and personalized marketing.

- Sustainability will remain central as companies expand recyclable packaging and reduce environmental footprints.

- Premiumization will accelerate, driven by rising demand for health-focused, clean-label, and functional products.

- Automation and smart manufacturing will enhance supply-chain resilience and operational efficiency.

- Direct-to-consumer models will expand further, enabling brands to capture richer consumer data and improve margins.

- Private-label competition will intensify, pushing brands to differentiate through quality and innovation.

- Retail partnerships will become more data-centric, emphasizing collaborative planning and real-time inventory visibility.

- Consumer expectations for transparency and traceability will drive adoption of advanced labeling and sourcing technologies.

- Emerging markets will contribute significant growth as urbanization, digitalization, and disposable incomes rise.